Key Insights

The North American strategic consulting market, encompassing the United States and Canada, is a dynamic and rapidly evolving sector. Driven by increasing business complexity, the need for digital transformation, and a growing emphasis on data-driven decision-making, the market experienced robust growth between 2019 and 2024. With a Compound Annual Growth Rate (CAGR) of 7.20%, the market's value reached an estimated $XX million in 2025. This growth is fueled by several key factors. Firstly, the financial services sector, facing regulatory changes and competitive pressures, is heavily investing in strategic consulting to optimize operations and navigate the evolving landscape. Secondly, the life sciences and healthcare industry is leveraging consulting expertise to manage complex regulatory environments, improve operational efficiency, and accelerate innovation. Retail companies, facing disruptions from e-commerce and shifting consumer preferences, are also seeking strategic guidance to refine their business models and enhance customer experiences. Government agencies, too, are increasingly relying on consultants to address challenges in areas like infrastructure development and public policy. The significant presence of major consulting firms like Deloitte, Bain, McKinsey, and Accenture in North America underlines the region's importance and the high level of competition in this market.

Looking forward, the forecast period of 2025-2033 is expected to witness continued growth, albeit potentially at a slightly moderated pace. While the overall positive outlook persists, several factors could influence the market's trajectory. The intensifying competition among established players and the emergence of niche consulting firms might lead to price pressures. Economic downturns or geopolitical instability could also dampen demand. However, the ongoing technological advancements, the growing adoption of AI and data analytics in strategic decision-making, and the persistent need for expert guidance across diverse industries are expected to outweigh these potential challenges and sustain market expansion in the long term. The sustained growth in the financial services, healthcare, and technology sectors will continue to fuel demand for strategic consulting services in the North American market.

North America Strategic Consulting Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the North America strategic consulting industry, offering valuable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers actionable intelligence on market size, segmentation, competitive dynamics, and future growth prospects. The study period is 2019–2033, the base year is 2025, the estimated year is 2025, and the forecast period is 2025–2033, with the historical period being 2019–2024.

North America Strategic Consulting Industry Market Structure & Competitive Dynamics

The North American strategic consulting market is highly concentrated, with a few major players dominating the landscape. Key players include Deloitte Touche Tohmatsu Limited, Roland Berger LLC, Bain & Company, Ernst & Young Global Limited, Accenture plc, Marsh & McLennan Companies Inc, PricewaterhouseCoopers International Limited, KPMG International Limited, The Boston Consulting Group, McKinsey & Company, and A T Kearney. These firms compete fiercely based on their expertise, brand reputation, global reach, and client relationships. Market share is estimated at xx Million for the top 5 players in 2025, indicating a highly consolidated market structure.

The industry's innovation ecosystem is dynamic, with continuous advancements in data analytics, artificial intelligence, and digital transformation driving new service offerings. Regulatory frameworks, particularly concerning data privacy and cybersecurity, significantly impact operations. The market sees increasing pressure from alternative service providers and technological advancements, creating a need for ongoing innovation. Mergers and acquisitions (M&A) activities are frequent, with deal values exceeding xx Million annually in recent years. These activities often involve the acquisition of smaller specialized firms by larger players looking to expand their capabilities and market share.

- Market Concentration: High, dominated by top 10 firms.

- Innovation: Rapid advancements in data analytics and AI.

- Regulatory Framework: Stringent data privacy and cybersecurity regulations.

- M&A Activity: Significant, driving market consolidation.

- Market Share (Top 5 firms, 2025): xx Million

North America Strategic Consulting Industry Industry Trends & Insights

The North American strategic consulting market is experiencing robust growth, driven by increasing demand for data-driven decision-making across various industries. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, fueled by factors such as digital transformation initiatives, globalization, and rising competition. Market penetration is currently estimated at xx%, with significant untapped potential remaining. Technological disruptions, such as the rise of AI-powered analytics and cloud-based solutions, are transforming the industry's service delivery models. Consumer preferences are shifting towards more agile, outcome-based consulting services. Competitive dynamics are marked by intense rivalry among established firms and the emergence of niche players. The industry demonstrates substantial growth, primarily due to escalating demand for specialized consulting services, particularly in response to market volatility and the need to adapt rapidly to evolving technologies. This underscores the crucial role of strategic consulting in achieving sustainable growth and navigating dynamic competitive landscapes. Further analysis is needed to identify and quantify the impact of each driver and disruptor accurately.

Dominant Markets & Segments in North America Strategic Consulting Industry

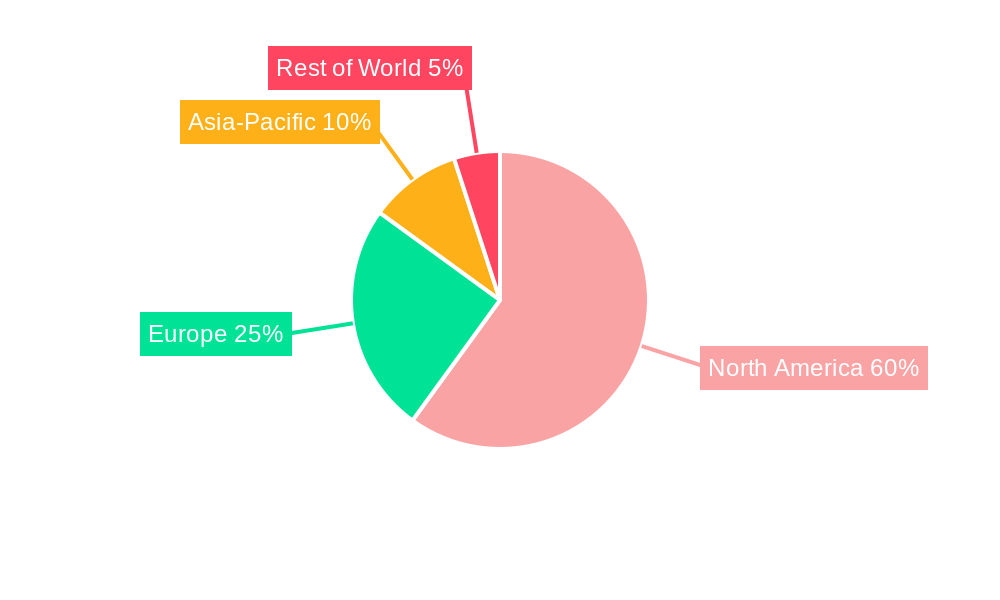

The United States represents the largest market segment, driven by a robust economy, strong regulatory frameworks, and a large base of corporations across diverse industries. Canada also demonstrates significant growth, with a focus on specific sectors such as resources and technology.

By End-User Industry:

- Financial Services: Remains a dominant segment due to high regulatory complexities and the need for digital transformation.

- Life Sciences and Healthcare: Experiencing rapid growth due to innovative drug development and increasing healthcare expenditures.

- Retail: Significant demand for strategic advice on e-commerce strategies and omnichannel operations.

- Government: Consistent demand for policy advice and operational efficiency improvements.

- Energy: Significant consulting needs arise from the transition to renewable energy sources.

Key Drivers (United States):

- Strong economic growth.

- Advanced technological infrastructure.

- Large and diverse corporate sector.

Key Drivers (Canada):

- Robust resource sector.

- Growing technology sector.

- Government investments in infrastructure.

North America Strategic Consulting Industry Product Innovations

The strategic consulting industry is undergoing rapid product innovation, characterized by the integration of advanced analytics, AI, and data visualization tools into service offerings. These innovations enable more effective problem-solving and predictive capabilities, providing clients with actionable insights and competitive advantages. The market is witnessing a shift towards customized, outcome-driven solutions. Cloud-based platforms and digital transformation initiatives are key technology trends facilitating innovative service delivery. The adoption of Agile methodologies and design thinking enhances the efficiency and impact of consulting projects.

Report Segmentation & Scope

This report segments the North America strategic consulting market by end-user industry (Financial Services, Life Sciences and Healthcare, Retail, Government, Energy, Other End-User Industries) and by country (United States, Canada). Growth projections vary significantly across these segments based on several factors, including economic conditions and specific industry dynamics. Market sizes are projected based on historical data, current trends, and future forecasts. Competitive dynamics vary between segments, with some exhibiting higher levels of concentration than others.

- By End-User Industry: Each segment shows unique growth projections depending on industry-specific dynamics and trends.

- By Country: The United States dominates the market, with Canada demonstrating consistent growth.

Key Drivers of North America Strategic Consulting Industry Growth

The growth of the North American strategic consulting industry is driven by several key factors: increasing demand for data-driven decision-making amidst complex market conditions, the accelerating pace of technological change and digital transformation, and the need for organizational agility and resilience. Government initiatives fostering innovation and economic growth create a favorable environment for consulting services. Furthermore, regulatory changes and increasing global competition necessitate strategic guidance for businesses.

Challenges in the North America Strategic Consulting Industry Sector

The North American strategic consulting industry faces several challenges. Intense competition from established players and emerging firms puts pressure on pricing and profitability. Attracting and retaining top talent is crucial given the skills shortage in data science and digital transformation. Client expectations for measurable outcomes and faster service delivery place further pressure on consulting firms. Maintaining high ethical standards and managing reputational risks are also significant challenges.

Leading Players in the North America Strategic Consulting Industry Market

- Deloitte Touche Tohmatsu Limited

- Roland Berger LLC

- Bain & Company

- Ernst & Young Global Limited

- Accenture plc

- Marsh & McLennan Companies Inc

- PricewaterhouseCoopers International Limited

- KPMG International Limited

- The Boston Consulting Group

- McKinsey & Company

- A T Kearney

Key Developments in North America Strategic Consulting Industry Sector

- April 2022: CGI's acquisition of Harwell Management expands its presence in the French financial services consulting market.

- October 2021: Yes&'s acquisition of Boldr Strategic Consulting strengthens its digital strategy and consulting capabilities.

Strategic North America Strategic Consulting Industry Market Outlook

The North American strategic consulting market is poised for continued growth, driven by ongoing technological advancements, increasing globalization, and the rising complexity of business environments. Strategic opportunities lie in specialized consulting services, leveraging AI and data analytics, and focusing on sustainable and ESG (environmental, social, and governance) related consulting. Firms focusing on digital transformation, data-driven decision making, and adapting to evolving regulatory landscapes will likely experience the most success.

North America Strategic Consulting Industry Segmentation

-

1. End-User Industry

- 1.1. Financial Services

- 1.2. Life Sciences and Healthcare

- 1.3. Retail

- 1.4. Government

- 1.5. Energy

- 1.6. Other End-User Industries

North America Strategic Consulting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Strategic Consulting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategy and Operations to Drive the market; SMEs to Exhibit a Strong Growth Rate

- 3.3. Market Restrains

- 3.3.1. Issues Related to Transformation and Integration of Processes by Organization

- 3.4. Market Trends

- 3.4.1. Healthcare Industry to drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Financial Services

- 5.1.2. Life Sciences and Healthcare

- 5.1.3. Retail

- 5.1.4. Government

- 5.1.5. Energy

- 5.1.6. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. United States North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Strategic Consulting Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Deloitte Touche Tohmatsu Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Roland Berger LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bain & Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ernst & Young Global Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Accenture plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Marsh & McLennan Companies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PricewaterhouseCoopers International Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KPMG International Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 The Boston Consulting Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 McKinsey & Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 A T Kearney

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: North America Strategic Consulting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Strategic Consulting Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Strategic Consulting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Strategic Consulting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Strategic Consulting Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: North America Strategic Consulting Industry Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Strategic Consulting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Strategic Consulting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: North America Strategic Consulting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North America Strategic Consulting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United States North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Canada North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Rest of North America North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of North America North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: North America Strategic Consulting Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 18: North America Strategic Consulting Industry Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 19: North America Strategic Consulting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: North America Strategic Consulting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United States North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Canada North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Mexico North America Strategic Consulting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mexico North America Strategic Consulting Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Strategic Consulting Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Strategic Consulting Industry?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Roland Berger LLC, Bain & Company, Ernst & Young Global Limited, Accenture plc, Marsh & McLennan Companies Inc, PricewaterhouseCoopers International Limited, KPMG International Limited, The Boston Consulting Group, McKinsey & Company, A T Kearney.

3. What are the main segments of the North America Strategic Consulting Industry?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strategy and Operations to Drive the market; SMEs to Exhibit a Strong Growth Rate.

6. What are the notable trends driving market growth?

Healthcare Industry to drive the Market.

7. Are there any restraints impacting market growth?

Issues Related to Transformation and Integration of Processes by Organization.

8. Can you provide examples of recent developments in the market?

April 2022 - CGI disclosed that it had reached an agreement to purchase all of the shares of Harwell Management holding and its affiliates through its subsidiary CGI France SAS. A management consulting company called Harwell Management primarily serves the French market and has a focus on the financial services sector. With the help of about 150 consultants, Harwell Management helps major financial organizations, such as banks and insurers, define and carry out mission-driven strategies, abide by constantly changing rules, create competitive advantage, and promote the sustainable value and long-term growth. In order to support clients along the whole financial services value chain, the company anticipates a need for business and strategic IT consulting skills, regulatory know-how, and end-to-end creative digital services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Strategic Consulting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Strategic Consulting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Strategic Consulting Industry?

To stay informed about further developments, trends, and reports in the North America Strategic Consulting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence