Key Insights

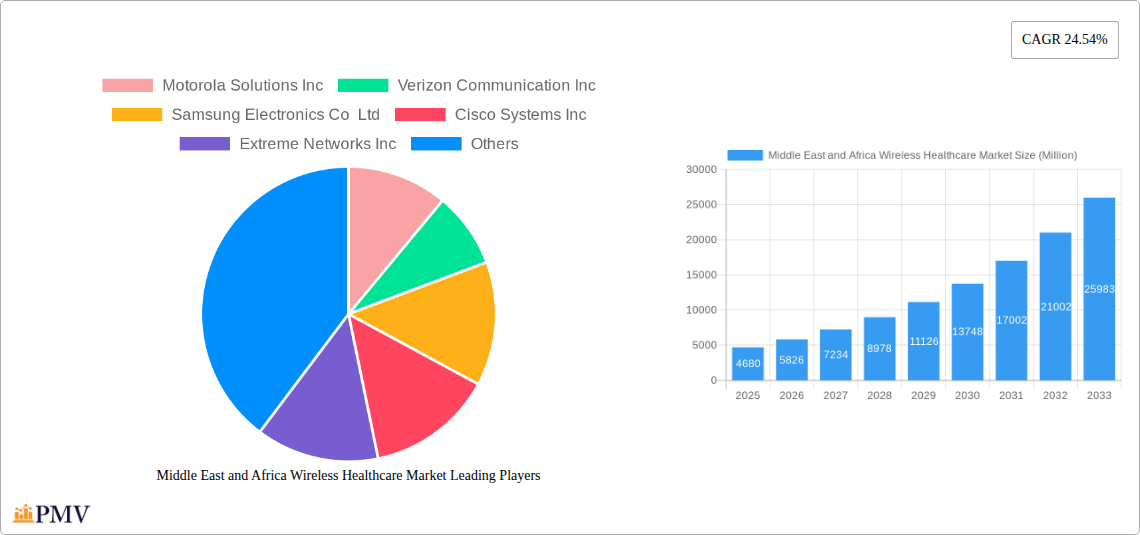

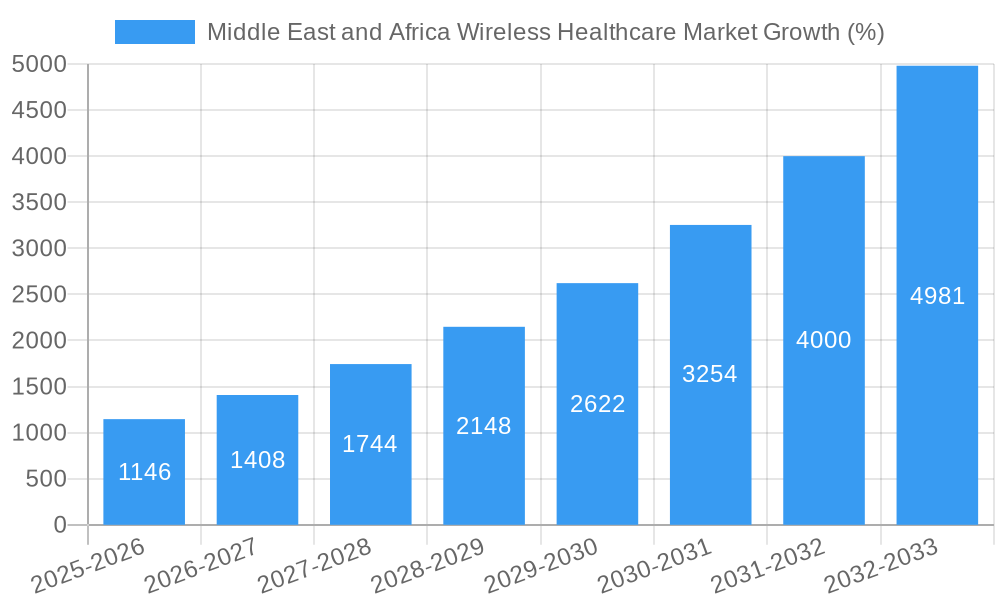

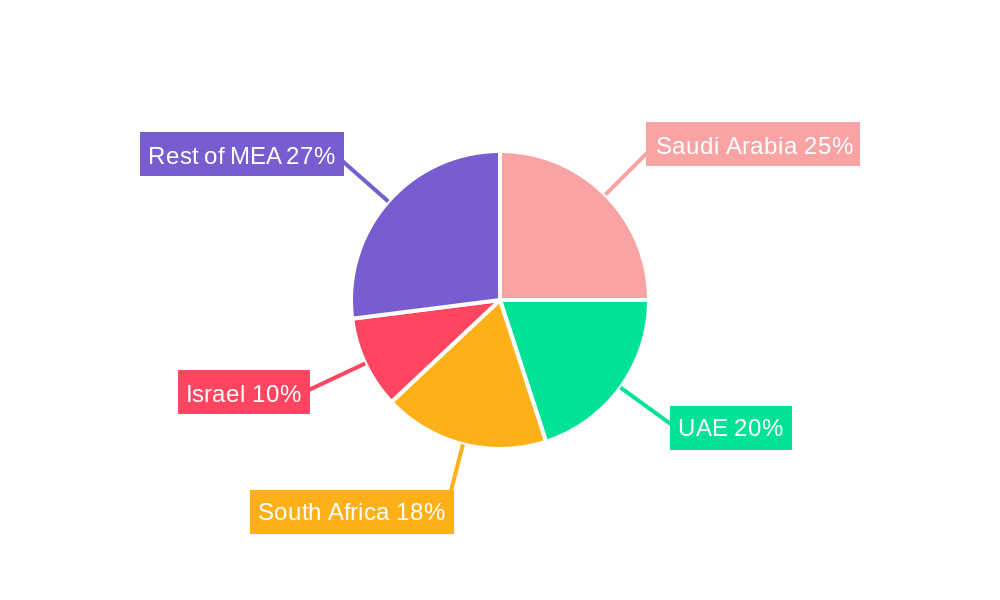

The Middle East and Africa (MEA) wireless healthcare market is experiencing robust growth, projected to reach $4.68 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 24.54% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing smartphone penetration and improved internet connectivity across the region are making telehealth services more accessible, particularly in remote areas with limited healthcare infrastructure. Governments in many MEA countries are actively investing in digital health initiatives, aiming to improve healthcare efficiency and access. The rising prevalence of chronic diseases, coupled with a growing elderly population, necessitates more efficient and convenient healthcare delivery models, further bolstering the demand for wireless healthcare solutions. Furthermore, the integration of advanced technologies such as IoT (Internet of Things) devices and AI-powered diagnostics is enhancing the capabilities of wireless healthcare platforms, improving patient outcomes and operational efficiencies. Key market segments include hardware (wearable devices, remote patient monitoring equipment), software (telehealth platforms, electronic health records), and services (technical support, data analytics). Hospitals and nursing homes, home care providers, and pharmaceutical companies represent the major application areas. South Africa, the UAE, and Saudi Arabia are currently the leading markets within the region. However, considerable growth potential exists in other nations as infrastructure development and technological adoption continue.

The competitive landscape includes both established technology providers like Motorola Solutions, Verizon, and Samsung, and healthcare-focused companies such as Allscripts and Philips. These companies are actively expanding their offerings and partnerships to capitalize on the growing market opportunities. Challenges remain, however, including ensuring data security and privacy, addressing the digital divide, and navigating regulatory complexities across different countries. The ongoing development of 5G networks and further advancements in AI and machine learning are expected to significantly shape the future of the MEA wireless healthcare market, propelling further expansion and innovation in the years to come. The market's growth trajectory is strongly influenced by factors such as government healthcare policies, technological advancements, and the increasing affordability of wireless technologies.

Middle East & Africa Wireless Healthcare Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Middle East and Africa Wireless Healthcare Market, offering invaluable insights for stakeholders across the healthcare technology ecosystem. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The market is segmented by component (Hardware, Software, Services), application (Hospitals and Nursing Homes, Home Care, Pharmaceuticals), and country (Saudi Arabia, United Arab Emirates, South Africa, Israel, Rest of Middle East and Africa). Key players analyzed include Motorola Solutions Inc, Verizon Communication Inc, Samsung Electronics Co Ltd, Cisco Systems Inc, Extreme Networks Inc, Qualcomm Technologies Inc, Koninklijke Philips NV, Allscripts Healthcare Solutions Inc, Apple Inc, and AT&T Inc. The report projects a market size of xx Million by 2033.

Middle East and Africa Wireless Healthcare Market Market Structure & Competitive Dynamics

The Middle East and Africa wireless healthcare market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The market is characterized by a dynamic innovation ecosystem driven by increasing investment in digital health technologies and a supportive regulatory environment in several key countries. However, regulatory inconsistencies across the region pose a challenge. Product substitution is a growing factor, with new technologies continually emerging. End-user trends show a strong preference for user-friendly, integrated solutions that enhance efficiency and improve patient outcomes. M&A activity is expected to increase, fueled by the desire of established players to expand their market reach and acquire innovative technologies. Market share data from 2024 shows that the top three players combined held approximately xx% of the market, while numerous smaller players compete for the remaining share. The total value of M&A deals in the sector during 2024 was estimated at xx Million.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Innovation Ecosystems: Active and growing, driven by increasing investment in digital health.

- Regulatory Frameworks: Varied across countries, posing challenges for consistent market growth.

- Product Substitutes: Increasing, with newer, more advanced technologies constantly emerging.

- End-User Trends: Preference for user-friendly, integrated solutions focusing on patient outcomes.

- M&A Activity: Expected to increase, driven by expansion and technology acquisition strategies.

Middle East and Africa Wireless Healthcare Market Industry Trends & Insights

The Middle East and Africa wireless healthcare market is experiencing significant growth, driven by factors such as increasing smartphone penetration, rising government initiatives promoting digital healthcare, and growing awareness of the benefits of telehealth. The market is characterized by rapid technological advancements, including the adoption of 5G technology, AI-powered diagnostics, and the Internet of Medical Things (IoMT). Consumer preferences are shifting towards personalized, convenient, and remote healthcare solutions. The competitive landscape is dynamic, with both established players and new entrants vying for market share. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Middle East and Africa Wireless Healthcare Market

The Saudi Arabia and the United Arab Emirates represent the most dominant national markets, driven by robust healthcare infrastructure investments, favorable government policies, and a high concentration of technologically advanced healthcare providers. The hardware segment currently holds the largest market share among the components, while hospitals and nursing homes constitute the largest application segment.

- Leading Region: Middle East (Saudi Arabia, UAE)

- Key Country Drivers:

- Saudi Arabia: Significant government investment in healthcare infrastructure and digital transformation.

- United Arab Emirates: Strong focus on smart city initiatives and adoption of advanced technologies.

- South Africa: Growing adoption of telehealth and mobile health solutions in underserved areas.

- Dominant Segment (Component): Hardware – driven by increased demand for connected medical devices.

- Dominant Segment (Application): Hospitals and Nursing Homes – due to high adoption rates and technological capabilities.

Middle East and Africa Wireless Healthcare Market Product Innovations

Recent innovations include the integration of AI for improved diagnostic accuracy and personalized treatment plans. Wearable sensors for remote patient monitoring and telemedicine platforms are gaining traction, enhancing accessibility and efficiency of care. These technologies address the need for better healthcare access, particularly in remote areas, and improve the efficiency of existing healthcare systems. The focus is on developing interoperable solutions, improving data security, and creating user-friendly interfaces to maximize market penetration.

Report Segmentation & Scope

This report segments the Middle East and Africa Wireless Healthcare Market by component (Hardware, Software, Services), application (Hospitals and Nursing Homes, Home Care, Pharmaceuticals), and country (Saudi Arabia, United Arab Emirates, South Africa, Israel, Rest of Middle East and Africa). Each segment is analyzed in detail, providing market size estimations, growth projections, and competitive landscapes. The report offers insights into the drivers and challenges faced by each segment and identifies key opportunities for growth.

Key Drivers of Middle East and Africa Wireless Healthcare Market Growth

The market's growth is propelled by several factors: increasing smartphone and internet penetration; rising government investments in digital healthcare infrastructure; a growing prevalence of chronic diseases necessitating remote patient monitoring; the adoption of telemedicine solutions to bridge geographic disparities in healthcare access; and the burgeoning demand for cost-effective and accessible healthcare solutions. Further, supportive regulatory frameworks in several countries are encouraging innovation and market expansion.

Challenges in the Middle East and Africa Wireless Healthcare Market Sector

Significant challenges include uneven internet access across the region, particularly in remote areas; concerns over data privacy and security; the high cost of implementing and maintaining advanced technologies; the need for skilled professionals to manage and utilize these technologies; and regulatory complexities that vary across different countries. These factors can hinder widespread adoption and impact market growth.

Leading Players in the Middle East and Africa Wireless Healthcare Market Market

- Motorola Solutions Inc

- Verizon Communication Inc

- Samsung Electronics Co Ltd

- Cisco Systems Inc

- Extreme Networks Inc

- Qualcomm Technologies Inc

- Koninklijke Philips NV

- Allscripts Healthcare Solutions Inc

- Apple Inc

- AT&T Inc

Key Developments in Middle East and Africa Wireless Healthcare Market Sector

- February 2023: Digital Diagnostics partners with Tamer Healthcare in Saudi Arabia to market AI-powered diabetic retinopathy diagnostic system, signifying increased adoption of AI in healthcare.

- January 2023: Abu Dhabi Public Health Centre launches the UAE's first mobile BSL-3 laboratory, enhancing infectious disease preparedness and response capabilities.

Strategic Middle East and Africa Wireless Healthcare Market Market Outlook

The Middle East and Africa wireless healthcare market presents significant growth potential driven by continued technological advancements, increasing government support, and growing awareness of the benefits of remote patient monitoring and telemedicine. Strategic opportunities exist for companies that focus on developing user-friendly, affordable, and interoperable solutions that address the unique needs of the region. Investing in infrastructure development, particularly in underserved areas, and addressing concerns surrounding data privacy and security are crucial for unlocking the market's full potential.

Middle East and Africa Wireless Healthcare Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Application

- 2.1. Hospitals and Nursing Homes

- 2.2. Home Care

- 2.3. Pharmaceuticals

Middle East and Africa Wireless Healthcare Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Wireless Healthcare Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Connected Devices in Healthcare; Growing Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Lack of Networking Infrastructure

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Connected Devices in Healthcare

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hospitals and Nursing Homes

- 5.2.2. Home Care

- 5.2.3. Pharmaceuticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. South Africa Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Wireless Healthcare Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Motorola Solutions Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Verizon Communication Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cisco Systems Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Extreme Networks Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Qualcomm Technologies Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Koninklijke Philips NV

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Allscripts Healthcare Solutions Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Apple Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AT&T Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Middle East and Africa Wireless Healthcare Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Wireless Healthcare Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Middle East and Africa Wireless Healthcare Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Qatar Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Kuwait Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Oman Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bahrain Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Jordan Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Lebanon Middle East and Africa Wireless Healthcare Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Wireless Healthcare Market?

The projected CAGR is approximately 24.54%.

2. Which companies are prominent players in the Middle East and Africa Wireless Healthcare Market?

Key companies in the market include Motorola Solutions Inc, Verizon Communication Inc, Samsung Electronics Co Ltd, Cisco Systems Inc, Extreme Networks Inc, Qualcomm Technologies Inc, Koninklijke Philips NV, Allscripts Healthcare Solutions Inc, Apple Inc, AT&T Inc.

3. What are the main segments of the Middle East and Africa Wireless Healthcare Market?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Connected Devices in Healthcare; Growing Technological Advancements.

6. What are the notable trends driving market growth?

Increasing Adoption of Connected Devices in Healthcare.

7. Are there any restraints impacting market growth?

Lack of Networking Infrastructure.

8. Can you provide examples of recent developments in the market?

February 2023: Digital Diagnostics, the creator of the first-ever FDA-cleared, fully autonomous AI system for the diagnosis of diabetic retinopathy, announced a strategic partnership with Tamer Healthcare, an integrated healthcare and wellness firm with over 100 years of established business in the Kingdom of Saudi Arabia, to enhance further healthcare and innovation in the Kingdom of Saudi Arabia. The strategic agreement will first focus on marketing Digital Diagnostics' flagship product, IDx-DR, for detecting diabetic retinopathy (including macular edema), with future AI technology research and extension planned.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Wireless Healthcare Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Wireless Healthcare Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Wireless Healthcare Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Wireless Healthcare Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence