Key Insights

The Latin American consumer electronics market, encompassing electronic devices and household appliances, is projected for substantial growth. Driven by increasing disposable incomes, e-commerce expansion, and government digitalization initiatives, the market is expected to reach $87.96 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 1.7% from the 2025 base year. Key markets include Brazil, Mexico, and Argentina, with significant potential also identified in Peru and Chile. Segmentation by product type highlights electronic devices as the dominant category, followed by household appliances. Sales channels are experiencing a rapid shift towards online platforms. The competitive landscape features global leaders such as Samsung, LG, Panasonic, and Lenovo, alongside strong regional contenders like Semp TCL and Esmaltec.

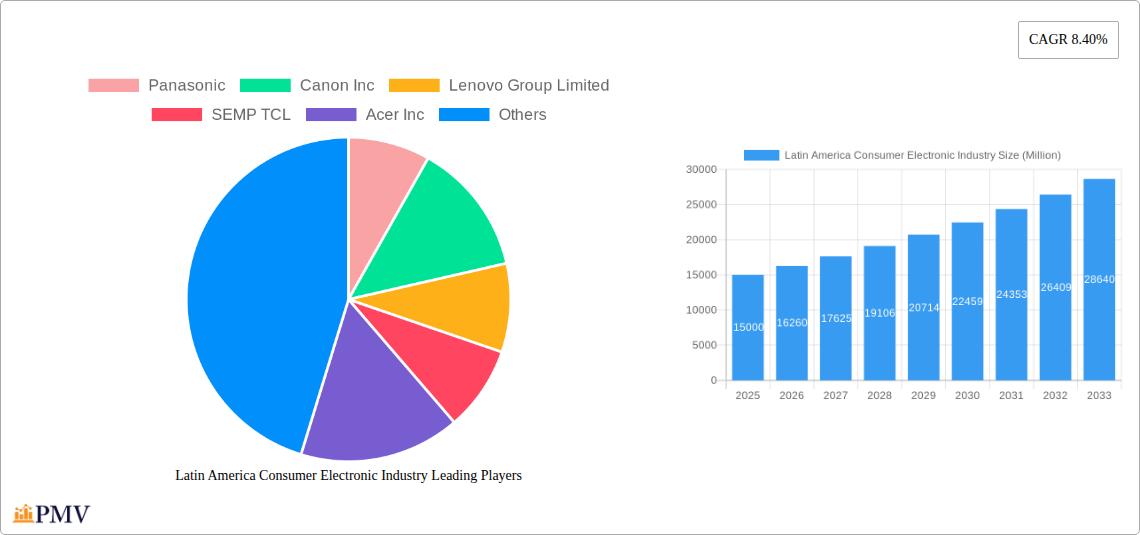

Latin America Consumer Electronic Industry Market Size (In Billion)

Despite a positive long-term outlook, the Latin American consumer electronics market faces challenges. Economic volatility, currency fluctuations, and infrastructure limitations can impact consumer spending and market adoption of advanced technologies. Intense competition from lower-cost imports also presents pricing pressures. Nevertheless, ongoing economic development, widespread digitalization, and sustained demand for advanced products underpin the market's robust trajectory. Successful market entry will necessitate adaptable product portfolios and localized marketing strategies within this dynamic environment.

Latin America Consumer Electronic Industry Company Market Share

Latin America Consumer Electronics Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America consumer electronics industry, covering the period 2019-2033. It offers crucial insights into market dynamics, competitive landscapes, and future growth prospects, making it an indispensable resource for industry stakeholders, investors, and strategic planners. With a focus on key markets like Brazil, Mexico, and Argentina, this report delivers actionable intelligence to navigate the complexities of this dynamic sector. The study includes a detailed segmentation analysis by product type (electronic devices and household appliances), sales channel (online and offline), and country (Brazil, Mexico, Argentina, and Rest of Latin America). The base year is 2025, with estimations for 2025 and forecasts extending to 2033.

Latin America Consumer Electronic Industry Market Structure & Competitive Dynamics

This section analyzes the structure of the Latin American consumer electronics market, focusing on market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and merger & acquisition (M&A) activities. The market is moderately concentrated, with key players holding significant market share. For example, Samsung and LG Electronics collectively hold an estimated xx% market share in the television segment in 2025, while Panasonic, Canon Inc, and Lenovo Group Limited dominate specific niches. Innovation ecosystems vary across countries, with Brazil exhibiting greater activity. Regulatory frameworks concerning electronic waste and data privacy are evolving, impacting market players. The substitution of older technologies with newer, more efficient alternatives, such as smart home appliances, is driving significant change. Consumer preference shifts towards premium features and brands, along with the increasing affordability of electronic devices, are shaping the market. The M&A landscape remains active, with deal values exceeding $xx Million in 2024, primarily focused on expanding market access and product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Innovation Ecosystems: Brazil leads in innovation, followed by Mexico.

- M&A Activity: Deal values exceeded $xx Million in 2024.

Latin America Consumer Electronic Industry Industry Trends & Insights

This section explores the key trends and insights shaping the Latin American consumer electronics industry. The market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and expanding internet penetration. The compound annual growth rate (CAGR) for the overall market is projected to be xx% during the forecast period (2025-2033). Technological disruptions, particularly the rise of smart devices and the Internet of Things (IoT), are transforming consumer preferences. The market penetration of smart TVs and smartphones continues to increase, exceeding xx% in major markets by 2025. Competitive dynamics are intense, with established players facing challenges from both domestic and international competitors. Price competition, coupled with the demand for innovative features, presents a major challenge for companies. Consumer preferences are evolving towards sustainability and energy efficiency, further influencing the market.

Dominant Markets & Segments in Latin America Consumer Electronic Industry

This section identifies the leading regions, countries, and segments within the Latin American consumer electronics market. Brazil remains the largest market, followed by Mexico and Argentina.

- Leading Country: Brazil, driven by a large population and expanding middle class.

- Leading Product Type: Electronic Devices (smartphones, laptops, televisions) dominate the market.

- Leading Sales Channel: Offline channels still hold a larger share, but online sales are experiencing rapid growth.

- Key Drivers (Brazil): Strong domestic demand, robust infrastructure, favorable government policies.

- Key Drivers (Mexico): Proximity to the US market, growing manufacturing base.

- Key Drivers (Argentina): High smartphone penetration, relatively high per capita income.

Latin America Consumer Electronic Industry Product Innovations

The Latin American consumer electronics market witnesses continuous product development, driven by technological advancements and evolving consumer needs. Smart home integration, enhanced connectivity features, and improved energy efficiency are key trends. Products are increasingly designed for affordability and durability to cater to diverse consumer segments. Competitors are focusing on unique value propositions, such as localized content and services, to gain a competitive edge.

Report Segmentation & Scope

This report offers detailed segmentation of the Latin American consumer electronics market by product type, sales channel, and country. The product type segmentation includes Electronic Devices (smartphones, laptops, televisions, etc.) and Household Appliances (refrigerators, washing machines, etc.). Sales channels are categorized into online and offline. Country-wise segmentation covers Brazil, Mexico, Argentina, and the Rest of Latin America. Each segment provides detailed growth projections, market size estimations, and competitive analyses for the period 2019-2033.

Key Drivers of Latin America Consumer Electronic Industry Growth

Several factors are driving the growth of the Latin American consumer electronics market. Rising disposable incomes are enabling consumers to purchase more electronic goods. Expanding internet and mobile penetration fuels demand for smartphones, laptops, and other connected devices. Government initiatives focused on infrastructure development and digital inclusion further enhance market potential. Technological advancements lead to innovative products that cater to evolving consumer needs.

Challenges in the Latin America Consumer Electronic Industry Sector

Despite the significant growth opportunities, the Latin American consumer electronics industry faces several challenges. Economic volatility and currency fluctuations can impact consumer spending and investment decisions. Supply chain disruptions and logistics issues continue to pose significant challenges, impacting production and distribution efficiency. The prevalence of counterfeit products poses threats to both brands and consumers. Stringent regulatory compliance requirements add complexity for businesses.

Leading Players in the Latin America Consumer Electronic Industry Market

Key Developments in Latin America Consumer Electronic Industry Sector

- 2022 Q4: Samsung launches new line of budget smartphones targeting the Brazilian market.

- 2023 Q1: LG Electronics partners with a local retailer to expand its offline distribution network in Mexico.

- 2024 Q2: A major M&A deal involving a leading appliance manufacturer in Argentina is announced.

Strategic Latin America Consumer Electronic Industry Market Outlook

The Latin American consumer electronics market holds significant future potential. Continued economic growth, rising middle class, and expanding digitalization will drive demand for electronic devices and appliances. Strategic opportunities exist for companies focused on innovation, localized product offerings, and efficient supply chain management. Companies that adapt to evolving consumer preferences and address the challenges of the region will be well-positioned for success.

Latin America Consumer Electronic Industry Segmentation

-

1. Product Type

-

1.1. Electronic Devices

- 1.1.1. Smartphones

- 1.1.2. Tablets

- 1.1.3. Desktop PCs

- 1.1.4. Laptops/Notebooks

- 1.1.5. Television

- 1.1.6. Others

-

1.2. Household Appliances

- 1.2.1. Refrigerators

- 1.2.2. Air Conditioners

- 1.2.3. Washing Machines

-

1.1. Electronic Devices

-

2. Sales Channel

- 2.1. Online

- 2.2. Offline

Latin America Consumer Electronic Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Consumer Electronic Industry Regional Market Share

Geographic Coverage of Latin America Consumer Electronic Industry

Latin America Consumer Electronic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased access to the Internet; Growing inclination towards using smart appliances and devices

- 3.3. Market Restrains

- 3.3.1. Security concerns related to smart devices

- 3.4. Market Trends

- 3.4.1. Increasing smart device penetration in Latin America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Consumer Electronic Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electronic Devices

- 5.1.1.1. Smartphones

- 5.1.1.2. Tablets

- 5.1.1.3. Desktop PCs

- 5.1.1.4. Laptops/Notebooks

- 5.1.1.5. Television

- 5.1.1.6. Others

- 5.1.2. Household Appliances

- 5.1.2.1. Refrigerators

- 5.1.2.2. Air Conditioners

- 5.1.2.3. Washing Machines

- 5.1.1. Electronic Devices

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Canon Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SEMP TCL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Acer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Whirlpool Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HP Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dell Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrolux AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Esmaltec*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Apple Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Samsung

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LG Electronics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Latin America Consumer Electronic Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Consumer Electronic Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Consumer Electronic Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Consumer Electronic Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: Latin America Consumer Electronic Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Consumer Electronic Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Latin America Consumer Electronic Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 6: Latin America Consumer Electronic Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Consumer Electronic Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Consumer Electronic Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the Latin America Consumer Electronic Industry?

Key companies in the market include Panasonic, Canon Inc, Lenovo Group Limited, SEMP TCL, Acer Inc, Whirlpool Corp, HP Inc, Dell Inc, Electrolux AB, Esmaltec*List Not Exhaustive, Apple Inc, Samsung, LG Electronics.

3. What are the main segments of the Latin America Consumer Electronic Industry?

The market segments include Product Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased access to the Internet; Growing inclination towards using smart appliances and devices.

6. What are the notable trends driving market growth?

Increasing smart device penetration in Latin America.

7. Are there any restraints impacting market growth?

Security concerns related to smart devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Consumer Electronic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Consumer Electronic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Consumer Electronic Industry?

To stay informed about further developments, trends, and reports in the Latin America Consumer Electronic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence