Key Insights

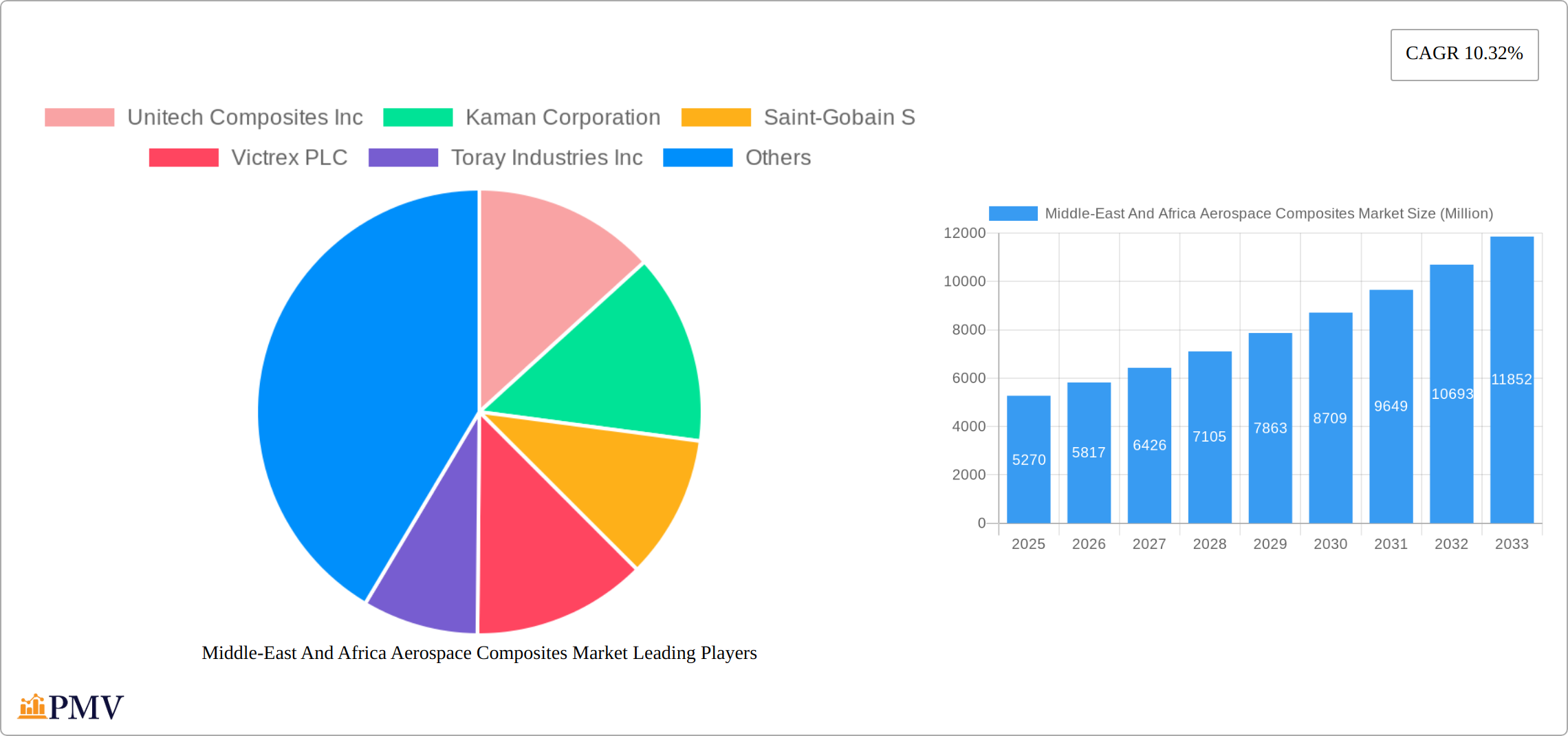

The Middle East and Africa Aerospace Composites Market is poised for significant growth, projected to reach a market size of $5.27 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.32% from 2025 to 2033. This robust expansion is driven by several key factors. Firstly, the increasing demand for lightweight and high-performance aircraft within both commercial and military aviation sectors across the region fuels the need for advanced composite materials. Secondly, the burgeoning space exploration initiatives in countries like the UAE and South Africa are creating a substantial demand for specialized aerospace composites. Thirdly, government investments in defense modernization and infrastructure development further propel market growth. Key players such as Unitech Composites Inc, Kaman Corporation, and Saint-Gobain are strategically positioned to capitalize on these opportunities. While the market faces challenges such as high initial investment costs associated with composite manufacturing and potential supply chain disruptions, the overall long-term outlook remains positive.

The regional distribution of market share reflects the varying levels of aerospace development within the Middle East and Africa. The UAE, Saudi Arabia, and Israel are expected to lead the market due to their established aerospace industries and significant investments in defense and space programs. However, other countries like South Africa and Turkey are also witnessing considerable growth, driven by their expanding aviation sectors and government initiatives promoting technological advancement. The "Rest of Middle East and Africa" segment demonstrates potential for future expansion as these nations increasingly adopt advanced composite technologies. The market segmentation by application type (Commercial and General Aviation, Military Aviation, Space) highlights the diverse applications of aerospace composites and the varied growth potential within each segment. This intricate interplay of factors ensures sustained and diversified growth of the Middle East and Africa Aerospace Composites Market through 2033.

Middle-East & Africa Aerospace Composites Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Middle-East and Africa Aerospace Composites Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and growth drivers to provide a clear understanding of this dynamic sector. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Middle-East And Africa Aerospace Composites Market Market Structure & Competitive Dynamics

The Middle East and Africa aerospace composites market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Unitech Composites Inc, Kaman Corporation, Saint-Gobain S.A., Victrex PLC, Toray Industries Inc, DuPont de Nemours Inc, Notus Composites, Solvay SA, Hexcel Corporation, and Veplas Group are among the key players shaping the competitive landscape. These companies compete based on factors such as product innovation, technological advancements, pricing strategies, and customer relationships. The market exhibits a robust innovation ecosystem, driven by ongoing R&D investments in advanced materials and manufacturing processes.

Regulatory frameworks, including those related to aerospace safety and environmental standards, significantly influence market dynamics. The presence of substitute materials, such as traditional metals, presents a competitive challenge, but the advantages of composites in terms of weight reduction, strength, and durability often outweigh these alternatives. End-user trends, particularly the increasing demand for lightweight and fuel-efficient aircraft, are bolstering market growth. M&A activities have played a limited role in recent years, with deal values averaging xx Million annually during the historical period (2019-2024). Market share distribution among the key players is as follows: Unitech Composites Inc (xx%), Kaman Corporation (xx%), Saint-Gobain S.A (xx%), and others (xx%).

Middle-East And Africa Aerospace Composites Market Industry Trends & Insights

The Middle East and Africa aerospace composites market is experiencing robust growth, driven by a confluence of factors. The surging demand for both commercial and military aircraft, coupled with significant investments in regional space exploration initiatives, is a primary driver. This growth is further accelerated by continuous technological advancements, particularly in high-performance composites exhibiting enhanced strength, durability, and lighter weight. The increasing preference for fuel-efficient aircraft among consumers is also significantly boosting the demand for these advanced materials.

Market competition is fierce, with companies employing diverse strategies including product differentiation, strategic collaborations, and meticulous supply chain optimization to maintain a competitive edge. The commercial aviation segment currently exhibits the highest market penetration, fueled by the region's expanding air travel sector. The market demonstrates a high CAGR ([Insert CAGR percentage here]%), driven by factors such as escalating government investments in defense and aerospace research, fruitful collaborations between international and regional companies, and supportive regulatory frameworks in several countries. The introduction of innovative composite materials boasting superior strength-to-weight ratios further contributes to this robust growth trajectory. Furthermore, the rising focus on sustainability within the aerospace industry is pushing the adoption of composites as a more environmentally friendly alternative to traditional materials.

Dominant Markets & Segments in Middle-East And Africa Aerospace Composites Market

The UAE and Saudi Arabia represent the dominant markets within the Middle East and Africa aerospace composites sector, driven primarily by significant investments in their national aerospace programs. Israel also holds a prominent position due to its advanced technological capabilities and strong aerospace industry.

Key Drivers for UAE and Saudi Arabia:

- Substantial government investments in infrastructure development and modernization of their air forces.

- Growing focus on domestic manufacturing and aerospace technology.

- Strategic partnerships with international aerospace companies.

Key Drivers for Israel:

- Strong domestic aerospace industry with a focus on innovation and technology.

- Growing demand for advanced composite materials in defense applications.

- Export-oriented business model focusing on high-value products.

South Africa and Turkey are also showing considerable growth, driven by expanding domestic air travel and increasing defense spending. The Rest of Middle East and Africa segment displays moderate growth potential, mainly attributed to the increasing adoption of composite materials in various aerospace applications. Within application types, Military Aviation currently leads the market in terms of value and volume owing to the massive defense budgets, followed by Commercial and General Aviation and lastly, the Space sector.

Middle-East And Africa Aerospace Composites Market Product Innovations

Recent years have witnessed a flurry of innovative developments in the Middle East and Africa aerospace composites market, characterized by a focus on creating lighter, stronger, and more durable materials. The introduction of advanced carbon fiber reinforced polymers (CFRP) and other high-performance composites has enabled the production of more fuel-efficient and cost-effective aircraft structures. These advancements offer significant competitive advantages in terms of weight reduction, performance enhancement, and reduced maintenance needs, thereby improving market appeal and adoption rates across various segments. Specific examples include the development of [mention specific examples of innovative composite materials and their applications if available].

Report Segmentation & Scope

This report segments the Middle East and Africa aerospace composites market based on Application Type (Commercial and General Aviation, Military Aviation, Space) and Country (United Arab Emirates, Saudi Arabia, Israel, South Africa, Turkey, Rest of Middle East and Africa). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For example, the Commercial and General Aviation segment is projected to witness substantial growth due to the increasing demand for air travel, while the Military Aviation segment is expected to expand steadily owing to government investments in defense modernization. The Space segment is expected to show slower growth but it represents a rapidly developing market niche. The country-wise analysis highlights the varying market maturity and growth potential across different regions, reflecting the influence of economic and regulatory factors.

Key Drivers of Middle-East And Africa Aerospace Composites Market Growth

The growth of the Middle East and Africa aerospace composites market is propelled by several key factors: the escalating demand for fuel-efficient aircraft, leading to wider adoption of lightweight composites; substantial investments in military aerospace programs by regional governments; continuous technological progress resulting in the development of superior high-performance composite materials; and a growing emphasis on domestic aerospace manufacturing capabilities within several countries. Supportive government policies, encompassing subsidies and incentives for research and development, further contribute to market expansion. The increasing focus on reducing carbon emissions in the aviation sector also presents a significant opportunity for the growth of the aerospace composites market in the region.

Challenges in the Middle-East And Africa Aerospace Composites Market Sector

The Middle East and Africa aerospace composites market faces several challenges, including the high cost of advanced composite materials, supply chain vulnerabilities impacting material availability, and the need for skilled labor to handle specialized manufacturing processes. Stringent regulatory requirements and certifications also add complexity. Competitive pressures from established players and the emergence of new entrants present an ongoing challenge. The reliance on imports of some raw materials leads to price volatility and potential supply disruptions.

Leading Players in the Middle-East And Africa Aerospace Composites Market Market

- Unitech Composites Inc

- Kaman Corporation

- Saint-Gobain S.A.

- Victrex PLC

- Toray Industries Inc

- DuPont de Nemours Inc

- Notus Composites

- Solvay SA

- Hexcel Corporation

- Veplas Group

Key Developments in Middle-East And Africa Aerospace Composites Market Sector

- January 2023: Unitech Composites Inc. announced a new partnership with a Middle Eastern aerospace company to develop advanced composite components for military aircraft.

- June 2022: Toray Industries Inc. opened a new manufacturing facility in the UAE to expand its production capacity for aerospace composites.

- October 2021: A major M&A deal involving two regional composite manufacturers was finalized, leading to increased market consolidation.

Strategic Middle-East And Africa Aerospace Composites Market Market Outlook

The Middle East and Africa aerospace composites market presents significant growth opportunities, driven by ongoing investments in aerospace infrastructure, technological advancements in composite materials, and increasing demand from both commercial and military sectors. Strategic partnerships, focused R&D initiatives, and expansion into new applications and markets will be crucial for success in this dynamic landscape. The long-term outlook for the market remains positive, with continued growth anticipated throughout the forecast period.

Middle-East And Africa Aerospace Composites Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle-East And Africa Aerospace Composites Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East And Africa Aerospace Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle-East And Africa Aerospace Composites Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Unitech Composites Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kaman Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Saint-Gobain S

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Victrex PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Toray Industries Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DuPont de Nemours Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Notus Composites

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Solvay SA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hexcel Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Veplas Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Unitech Composites Inc

List of Figures

- Figure 1: Middle-East And Africa Aerospace Composites Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East And Africa Aerospace Composites Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Middle-East And Africa Aerospace Composites Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Saudi Arabia Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Israel Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Qatar Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Kuwait Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Oman Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Bahrain Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Jordan Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Lebanon Middle-East And Africa Aerospace Composites Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East And Africa Aerospace Composites Market?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the Middle-East And Africa Aerospace Composites Market?

Key companies in the market include Unitech Composites Inc, Kaman Corporation, Saint-Gobain S, Victrex PLC, Toray Industries Inc, DuPont de Nemours Inc, Notus Composites, Solvay SA, Hexcel Corporation, Veplas Group.

3. What are the main segments of the Middle-East And Africa Aerospace Composites Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.27 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East And Africa Aerospace Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East And Africa Aerospace Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East And Africa Aerospace Composites Market?

To stay informed about further developments, trends, and reports in the Middle-East And Africa Aerospace Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence