Key Insights

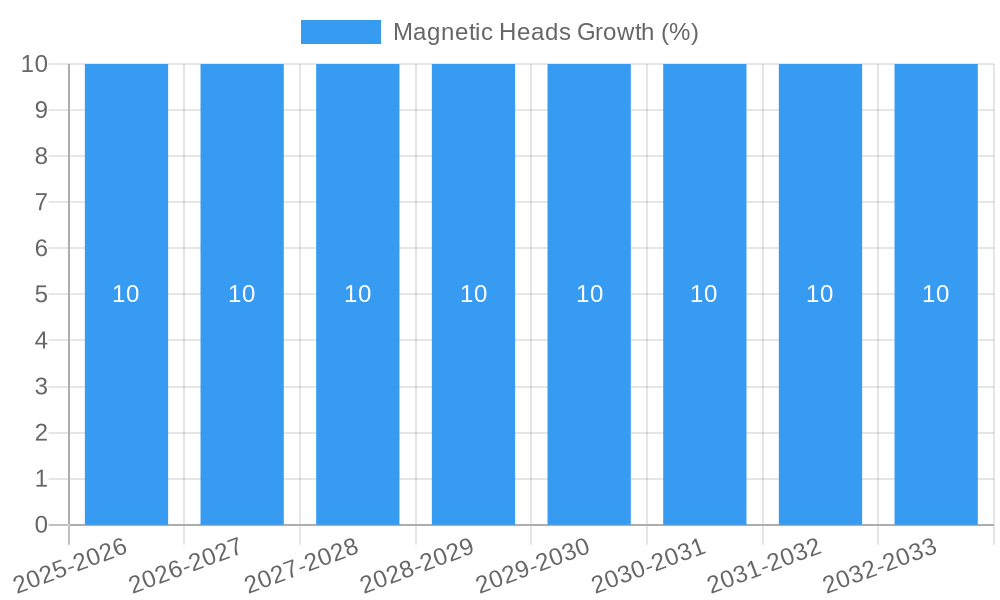

The global Magnetic Heads market is poised for significant expansion, projected to reach an estimated value of USD XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% throughout the forecast period of 2025-2033. This growth trajectory is primarily fueled by the increasing demand for advanced data storage solutions across various industries, including ticketing, credit card processing, and other consumer electronics. The pervasive integration of magnetic stripe technology in payment systems and access control mechanisms continues to drive the need for reliable and high-performance magnetic heads. Furthermore, the ongoing innovation in miniaturization and enhanced read/write capabilities is expanding the application scope for these critical components. The market's expansion is further supported by the ongoing digital transformation initiatives globally, leading to a surge in the deployment of point-of-sale (POS) systems and smart card technologies, all of which rely on sophisticated magnetic head technology.

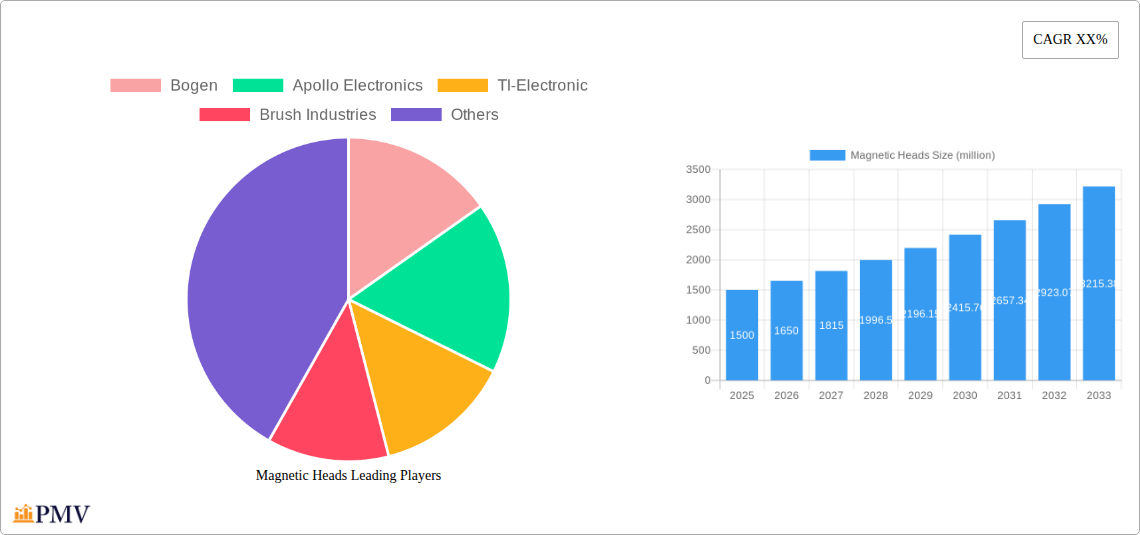

Despite the overarching growth, certain factors present challenges to the market's unhindered progress. The increasing adoption of contactless payment technologies and advanced semiconductor-based storage solutions, while creating new opportunities, also poses a restraint by gradually displacing traditional magnetic stripe-based systems in certain segments. However, the persistent cost-effectiveness and proven reliability of magnetic stripe technology, particularly in developing economies and niche applications, ensure its continued relevance and demand. Key market players like Bogen, Apollo Electronics, TI-Electronic, and Brush Industries are actively investing in research and development to enhance product performance, reduce manufacturing costs, and explore new application areas to maintain their competitive edge and capitalize on emerging market opportunities. The market segmentation, based on applications like Tickets, Credit Cards, and Other Products, alongside types such as 0.5 mm and 1 mm, indicates a diverse demand landscape that requires tailored solutions.

Magnetic Heads Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a detailed examination of the global Magnetic Heads market, covering historical trends, current dynamics, and future projections. The study encompasses the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. We delve into market structure, key trends, dominant segments, product innovations, and the strategic outlook for this vital industry. The report is meticulously crafted for industry professionals, investors, and researchers seeking actionable insights into the magnetic heads industry, leveraging high-ranking SEO keywords such as "magnetic heads market," "magnetic stripe technology," "credit card readers," "ticket validators," "magnetic sensor," and "data storage heads."

Magnetic Heads Market Structure & Competitive Dynamics

The global Magnetic Heads market, projected to reach several million dollars by 2033, exhibits a moderately concentrated structure. Key players like Bogen, Apollo Electronics, TI-Electronic, and Brush Industries are actively shaping the competitive landscape through ongoing innovation and strategic alliances. The innovation ecosystem thrives on advancements in miniaturization, enhanced read/write speeds, and improved durability for magnetic heads used in diverse applications. Regulatory frameworks, primarily focused on data security and device certification, play a crucial role in market entry and product development.

- Market Concentration: While a few major players hold significant market share, opportunities exist for niche providers specializing in high-performance or custom magnetic heads.

- Innovation Ecosystem: Continuous R&D in materials science and electromagnetic engineering is driving the development of next-generation magnetic heads.

- Regulatory Frameworks: Compliance with standards like PCI DSS for payment card applications is paramount.

- Product Substitutes: While emerging technologies like NFC and QR codes are impacting some segments, magnetic stripe technology continues to dominate due to its cost-effectiveness and established infrastructure.

- End-User Trends: Increasing demand for secure and efficient data capture in ticketing, payment processing, and access control systems fuels market growth.

- M&A Activities: Mergers and acquisitions are expected to continue as larger companies seek to consolidate market share and acquire specialized technologies. M&A deal values are projected to reach hundreds of millions of dollars over the forecast period.

Magnetic Heads Industry Trends & Insights

The Magnetic Heads industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and persistent demand across various sectors. The compound annual growth rate (CAGR) is estimated to be in the mid-single digits, indicating a healthy expansion trajectory. Market penetration is deep within established industries, with new applications continuously emerging, particularly in the realm of secure data storage and retrieval.

Technological disruptions are a constant theme, with manufacturers focusing on improving the sensitivity, reliability, and form factor of magnetic heads. This includes the development of higher-density recording media and more sophisticated read/write circuitry, enabling faster data transfer rates and greater data storage capacity. The evolution of materials science is also playing a significant role, with new magnetic alloys and nanostructured materials contributing to enhanced performance characteristics.

Consumer preferences are increasingly leaning towards convenience and security. In the payment card segment, for instance, while EMV chip technology has gained prominence, magnetic stripes remain a critical fallback and are still widely used in many regions. The seamless integration of magnetic card readers into point-of-sale (POS) systems, loyalty programs, and access control devices underscores their continued relevance. Similarly, in the ticketing sector, magnetic heads are integral to the efficient processing of transit cards, event tickets, and other forms of secure credentials. The ongoing digitization of various industries, from retail to transportation, further amplifies the need for reliable and cost-effective data capture solutions like magnetic heads. Competitive dynamics are characterized by a focus on cost optimization, product differentiation through advanced features, and strategic partnerships to expand market reach.

Dominant Markets & Segments in Magnetic Heads

The Magnetic Heads market’s dominance is clearly visible across several key applications and product types, driven by robust economic policies, evolving infrastructure, and consistent consumer adoption. The Credit Cards segment stands out as a significant revenue generator, propelled by the sheer volume of transactions globally and the established infrastructure of financial institutions. The ongoing reliance on magnetic stripe technology for backup and compatibility, even with the rise of chip and contactless payments, ensures sustained demand.

Application: Credit Cards:

- Key Drivers: Ubiquitous use of credit cards for daily transactions, need for backward compatibility in POS systems, secure data encoding requirements, and the vast global financial infrastructure. Economic policies favoring digital payments and credit accessibility further bolster this segment.

- Dominance Analysis: The credit card industry represents the largest market for magnetic heads due to its sheer scale. The continued need for magnetic stripe readers in ATMs, POS terminals, and hotel key card systems solidifies its leading position. Market size in this segment is projected to reach several hundred million dollars.

Application: Tickets:

- Key Drivers: Growth in public transportation, event ticketing, and access control systems. The cost-effectiveness and reliability of magnetic tickets for mass transit and limited-use applications are key factors. Infrastructure development in urban areas and increased tourism contribute to this segment's growth.

- Dominance Analysis: While newer technologies are emerging, magnetic stripe tickets remain prevalent in many transit systems worldwide due to their established infrastructure and lower per-unit cost compared to some advanced alternatives. The market size is estimated to be in the tens of millions of dollars.

Application: Other Products:

- Key Drivers: This broad category includes applications like ID cards, loyalty cards, gift cards, employee badges, and magnetic encoders for various industrial and consumer electronics. Increasing adoption of smart cards with magnetic stripes for access control and identification purposes is a significant driver.

- Dominance Analysis: This segment, while fragmented, collectively represents a substantial market. The versatility of magnetic stripe technology for diverse identification and authentication purposes ensures its continued relevance across numerous industries. Market size is projected to be in the tens of millions of dollars.

Type: 0.5 mm:

- Key Drivers: Miniaturization trends in electronic devices, demand for compact magnetic heads in portable payment terminals, mobile POS devices, and smaller access control systems.

- Dominance Analysis: The 0.5 mm type is crucial for applications where space is a premium. Its widespread adoption in newer, more compact devices contributes to its significant market share, estimated to be in the hundreds of millions of dollars.

Type: 1 mm:

- Key Drivers: Traditional applications in larger POS systems, industrial equipment, and bulk data storage devices where size is less of a constraint, and robustness and compatibility with existing infrastructure are prioritized.

- Dominance Analysis: The 1 mm type continues to hold a strong position in legacy systems and industrial applications that have not yet been upgraded. It serves as a reliable and cost-effective solution for many established use cases, contributing a market share in the tens of millions of dollars.

Magnetic Heads Product Innovations

Product innovations in the magnetic heads sector are primarily focused on enhancing read accuracy, improving data density, and extending the operational lifespan of the heads. Manufacturers are developing smaller, more sensitive magnetic heads that can read lower-coercivity magnetic stripes with greater reliability, even in challenging environmental conditions. Advancements in read head technology, including magneto-resistive (MR) and giant magneto-resistive (GMR) sensors, are enabling faster and more precise data retrieval. Furthermore, efforts are underway to integrate magnetic head technology with other sensor types for multi-functional devices. These innovations offer competitive advantages by enabling more secure transactions, faster data processing, and the development of more compact and integrated electronic devices.

Report Segmentation & Scope

This report meticulously segments the Magnetic Heads market based on key Application and Type categories. The scope includes a comprehensive analysis of each segment's current market size, projected growth, and competitive dynamics.

- Application: Tickets: This segment encompasses magnetic heads used in transit passes, event tickets, and access control systems. It is projected to grow steadily, driven by public transportation expansion and event industry dynamics.

- Application: Credit Cards: This segment covers magnetic heads utilized in payment processing systems for credit and debit cards. It remains a dominant segment due to the global reliance on card-based transactions.

- Application: Other Products: This broad category includes magnetic heads for ID badges, loyalty cards, gift cards, and various industrial applications requiring magnetic data storage and retrieval. Its growth is linked to the proliferation of personalized identification and access control solutions.

- Type: 0.5 mm: This segmentation focuses on compact magnetic heads, crucial for portable and space-constrained devices such as mobile POS terminals and small access readers.

- Type: 1 mm: This segmentation addresses standard-sized magnetic heads, prevalent in traditional POS systems, industrial equipment, and larger data storage solutions.

Key Drivers of Magnetic Heads Growth

Several key factors are driving the continued growth of the Magnetic Heads market. Technological advancements in sensor technology and materials science are leading to more efficient and reliable magnetic read/write capabilities. The ever-increasing volume of financial transactions globally, particularly in emerging economies, sustains the demand for credit card readers. Furthermore, the persistent need for secure and cost-effective ticketing solutions in public transportation and entertainment industries, coupled with the expanding applications in access control and identification cards, are significant growth accelerators. Regulatory mandates for data security and interoperability also indirectly support the market by ensuring standardized compatibility.

Challenges in the Magnetic Heads Sector

Despite robust growth drivers, the Magnetic Heads sector faces several challenges. The primary restraint is the increasing adoption of contactless payment technologies like NFC and EMV chip cards, which offer enhanced security and convenience, potentially reducing reliance on magnetic stripes in some applications. Intense price competition among manufacturers, especially for standard magnetic heads, can impact profit margins. Additionally, evolving data security regulations, while driving innovation, also necessitate significant investment in compliance and R&D, posing a barrier for smaller players. Supply chain disruptions and the fluctuating costs of raw materials can also pose challenges to consistent production and pricing.

Leading Players in the Magnetic Heads Market

- Bogen

- Apollo Electronics

- TI-Electronic

- Brush Industries

Key Developments in Magnetic Heads Sector

- 2023 Q4: Introduction of next-generation high-coercivity magnetic read heads for enhanced data security in payment applications.

- 2024 Q1: Brush Industries announces strategic partnership to expand magnetic head integration into access control systems in Asia-Pacific.

- 2024 Q2: TI-Electronic showcases miniaturized magnetic heads for portable POS devices at industry expo.

- 2024 Q3: Apollo Electronics expands manufacturing capacity for magnetic heads to meet rising demand in emerging markets.

- 2024 Q4: Bogen develops advanced magnetic encoders for industrial asset tracking solutions.

Strategic Magnetic Heads Market Outlook

The strategic outlook for the Magnetic Heads market remains positive, characterized by sustained demand in core applications and emergent opportunities. The continued global reliance on credit and debit card transactions, coupled with the essential role of magnetic stripes in legacy systems and as a fallback, will ensure ongoing market relevance. The expansion of public transportation networks and the growing entertainment industry will continue to drive demand for magnetic ticketing solutions. Furthermore, the increasing focus on secure identification and access control in both corporate and consumer environments presents a significant growth avenue. Companies that can offer innovative, cost-effective, and highly reliable magnetic head solutions, while adapting to evolving security standards, are well-positioned for future success in this dynamic market.

Magnetic Heads Segmentation

-

1. Application

- 1.1. Tickets

- 1.2. Credit Cards

- 1.3. Other Products

-

2. Types

- 2.1. 0.5 mm

- 2.2. 1 mm

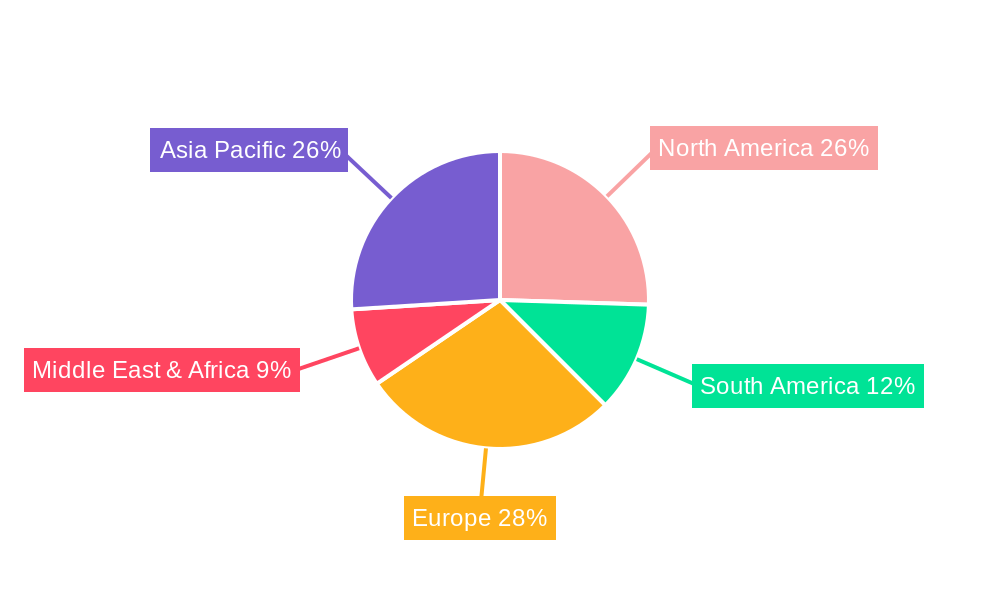

Magnetic Heads Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Magnetic Heads REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnetic Heads Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Tickets

- 5.1.2. Credit Cards

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 0.5 mm

- 5.2.2. 1 mm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Magnetic Heads Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Tickets

- 6.1.2. Credit Cards

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 0.5 mm

- 6.2.2. 1 mm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Magnetic Heads Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Tickets

- 7.1.2. Credit Cards

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 0.5 mm

- 7.2.2. 1 mm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Magnetic Heads Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Tickets

- 8.1.2. Credit Cards

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 0.5 mm

- 8.2.2. 1 mm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Magnetic Heads Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Tickets

- 9.1.2. Credit Cards

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 0.5 mm

- 9.2.2. 1 mm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Magnetic Heads Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Tickets

- 10.1.2. Credit Cards

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 0.5 mm

- 10.2.2. 1 mm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bogen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apollo Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TI-Electronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brush Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Bogen

List of Figures

- Figure 1: Global Magnetic Heads Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Magnetic Heads Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Magnetic Heads Revenue (million), by Application 2024 & 2032

- Figure 4: North America Magnetic Heads Volume (K), by Application 2024 & 2032

- Figure 5: North America Magnetic Heads Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Magnetic Heads Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Magnetic Heads Revenue (million), by Types 2024 & 2032

- Figure 8: North America Magnetic Heads Volume (K), by Types 2024 & 2032

- Figure 9: North America Magnetic Heads Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Magnetic Heads Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Magnetic Heads Revenue (million), by Country 2024 & 2032

- Figure 12: North America Magnetic Heads Volume (K), by Country 2024 & 2032

- Figure 13: North America Magnetic Heads Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Magnetic Heads Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Magnetic Heads Revenue (million), by Application 2024 & 2032

- Figure 16: South America Magnetic Heads Volume (K), by Application 2024 & 2032

- Figure 17: South America Magnetic Heads Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Magnetic Heads Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Magnetic Heads Revenue (million), by Types 2024 & 2032

- Figure 20: South America Magnetic Heads Volume (K), by Types 2024 & 2032

- Figure 21: South America Magnetic Heads Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Magnetic Heads Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Magnetic Heads Revenue (million), by Country 2024 & 2032

- Figure 24: South America Magnetic Heads Volume (K), by Country 2024 & 2032

- Figure 25: South America Magnetic Heads Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Magnetic Heads Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Magnetic Heads Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Magnetic Heads Volume (K), by Application 2024 & 2032

- Figure 29: Europe Magnetic Heads Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Magnetic Heads Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Magnetic Heads Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Magnetic Heads Volume (K), by Types 2024 & 2032

- Figure 33: Europe Magnetic Heads Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Magnetic Heads Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Magnetic Heads Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Magnetic Heads Volume (K), by Country 2024 & 2032

- Figure 37: Europe Magnetic Heads Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Magnetic Heads Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Magnetic Heads Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Magnetic Heads Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Magnetic Heads Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Magnetic Heads Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Magnetic Heads Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Magnetic Heads Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Magnetic Heads Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Magnetic Heads Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Magnetic Heads Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Magnetic Heads Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Magnetic Heads Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Magnetic Heads Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Magnetic Heads Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Magnetic Heads Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Magnetic Heads Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Magnetic Heads Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Magnetic Heads Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Magnetic Heads Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Magnetic Heads Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Magnetic Heads Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Magnetic Heads Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Magnetic Heads Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Magnetic Heads Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Magnetic Heads Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Magnetic Heads Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Magnetic Heads Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Magnetic Heads Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Magnetic Heads Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Magnetic Heads Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Magnetic Heads Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Magnetic Heads Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Magnetic Heads Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Magnetic Heads Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Magnetic Heads Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Magnetic Heads Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Magnetic Heads Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Magnetic Heads Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Magnetic Heads Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Magnetic Heads Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Magnetic Heads Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Magnetic Heads Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Magnetic Heads Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Magnetic Heads Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Magnetic Heads Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Magnetic Heads Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Magnetic Heads Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Magnetic Heads Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Magnetic Heads Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Magnetic Heads Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Magnetic Heads Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Magnetic Heads Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Magnetic Heads Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Magnetic Heads Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Magnetic Heads Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Magnetic Heads Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Magnetic Heads Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Magnetic Heads Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Magnetic Heads Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Magnetic Heads Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Magnetic Heads Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Magnetic Heads Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Magnetic Heads Volume K Forecast, by Country 2019 & 2032

- Table 81: China Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Magnetic Heads Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Magnetic Heads Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnetic Heads?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Magnetic Heads?

Key companies in the market include Bogen, Apollo Electronics, TI-Electronic, Brush Industries.

3. What are the main segments of the Magnetic Heads?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnetic Heads," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnetic Heads report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnetic Heads?

To stay informed about further developments, trends, and reports in the Magnetic Heads, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence