Key Insights

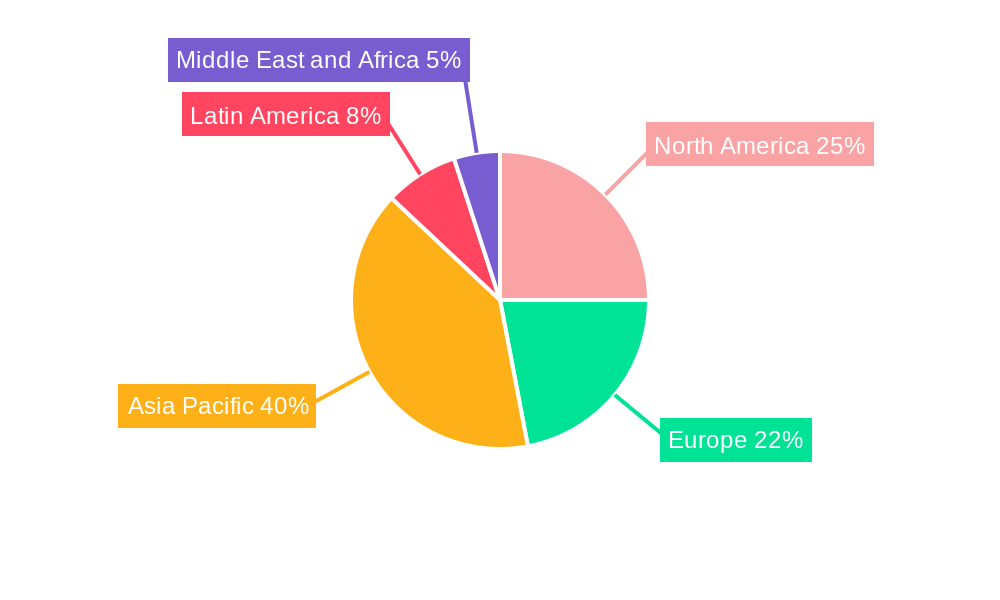

The global Telecom Power Systems market, valued at approximately $5.69 billion in 2024, is poised for significant expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% from 2024 to 2033, this growth is underpinned by the continuous expansion of global telecommunications infrastructure and the escalating demand for dependable power solutions. Key growth drivers include the widespread adoption of 5G networks, the increasing reliance on cloud services, and the proliferation of data centers. The telecom sector's growing commitment to renewable energy sources is also fostering innovation in hybrid power systems, integrating solar and battery storage. While high-power segments and core network applications currently lead, access and metro network segments are anticipated to surge due to network densification and expansion into new regions. Intense competition exists among established leaders such as Alpha Technologies, Delta Group, and ABB Group, alongside emerging players focused on technological advancements and strategic alliances. Geographically, the Asia-Pacific region is expected to maintain its leading position owing to rapid infrastructure development, with North America and Europe remaining substantial markets. Challenges include volatile raw material costs, stringent regulations, and potential supply chain disruptions.

Telecom Power Systems Industry Market Size (In Billion)

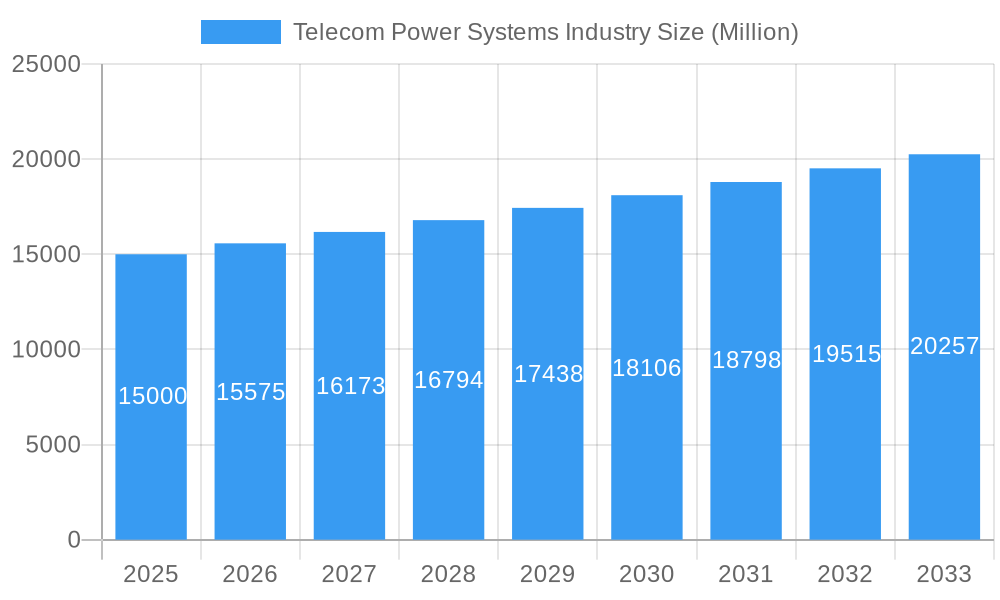

The forecast period (2024-2033) indicates sustained market growth. The high-power segment will be bolstered by the substantial energy requirements of large data centers and 5G base stations. Advancements in smart grid technologies and a strong emphasis on energy efficiency will propel innovation in power management solutions. The ongoing expansion of telecommunication networks in emerging economies, particularly across Asia-Pacific, Africa, and Latin America, presents considerable opportunities. To maintain a competitive advantage, companies must prioritize delivering reliable, efficient, and cost-effective solutions that align with the evolving needs of the telecommunications industry, emphasizing sustainable practices and cutting-edge technologies.

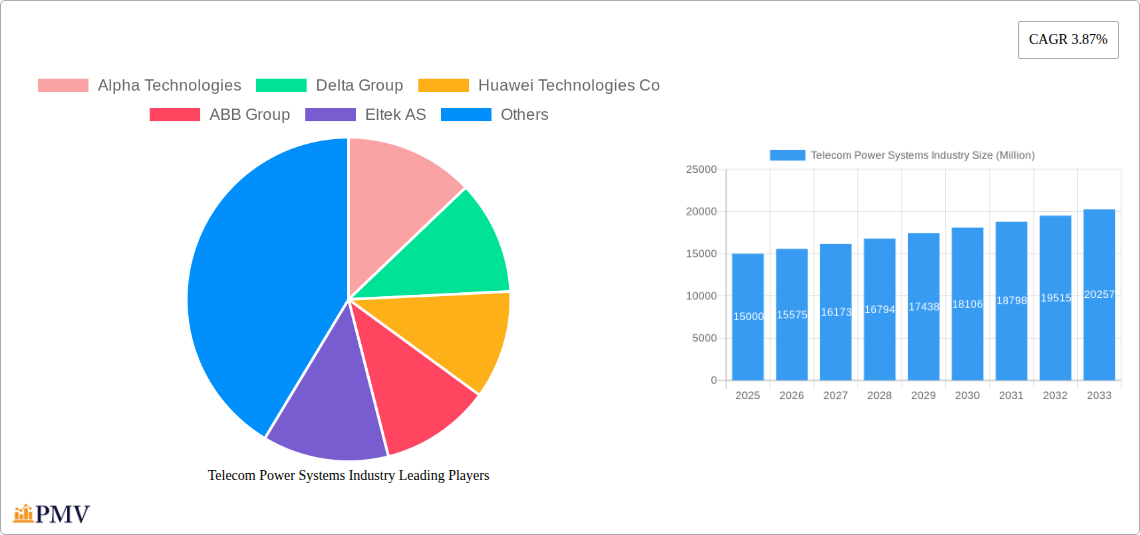

Telecom Power Systems Industry Company Market Share

Telecom Power Systems Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Telecom Power Systems industry, offering invaluable insights for businesses, investors, and stakeholders seeking to understand and capitalize on market opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete historical and future perspective. The report incorporates data from the historical period (2019-2024) and presents a robust forecast for the coming years. The market is segmented by power range (Low, Medium, High) and end-user application (Access, Core, Metro), providing granular analysis of key market trends and dynamics. Leading players such as Alpha Technologies, Delta Group, Huawei Technologies Co, ABB Group, Eltek AS, Cummins Inc, ZTE Corporation, Schneider Electric, Efore Group, and Eaton Corporation are profiled, offering a competitive landscape overview. The total market size is projected to reach xx Million by 2033.

Telecom Power Systems Industry Market Structure & Competitive Dynamics

The Telecom Power Systems market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. Alpha Technologies, Delta Group, and Huawei Technologies Co. are among the leading companies, each commanding a substantial portion of the global market. Market share figures for 2024 are estimated as follows: Alpha Technologies (15%), Delta Group (12%), Huawei Technologies Co. (18%), ABB Group (10%), with the remaining share distributed amongst other players. Innovation ecosystems are crucial, with companies investing heavily in R&D to develop more efficient and reliable power solutions. Regulatory frameworks vary across different regions, impacting market access and operations. Product substitutes, like alternative energy sources, are emerging but currently pose a limited threat to the established market. End-user trends favor increased capacity and reliability, driving demand for high-power systems in core and metro networks. M&A activity has been moderate in recent years, with deal values averaging xx Million per transaction. Key M&A activities include [Insert specific examples of M&A if available, with deal value details]. This competitive landscape is further shaped by increasing demand for 5G infrastructure and the expansion of data centers, creating opportunities for growth and consolidation.

Telecom Power Systems Industry Industry Trends & Insights

The Telecom Power Systems industry is experiencing robust growth, driven by the global expansion of telecommunications infrastructure and the increasing adoption of 5G technology. The market is projected to achieve a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the surging demand for high-bandwidth applications, the proliferation of connected devices, and government initiatives aimed at improving telecommunications infrastructure globally. Technological disruptions, such as the adoption of advanced power electronics and energy storage systems, are enhancing the efficiency and reliability of telecom power systems. Consumer preferences are shifting towards energy-efficient and environmentally friendly solutions, pushing manufacturers to adopt sustainable practices and develop green technologies. Market penetration of advanced power solutions remains relatively low in certain regions, presenting substantial growth potential. The competitive dynamics are characterized by intense competition, particularly among the leading players, who are constantly innovating and expanding their product portfolios.

Dominant Markets & Segments in Telecom Power Systems Industry

The Asia-Pacific region is currently the dominant market for telecom power systems, driven by rapid economic growth, substantial investments in telecom infrastructure, and the increasing adoption of 5G technology. China and India are significant contributors to this regional dominance.

- Key Drivers in Asia-Pacific:

- Rapid economic growth and rising disposable incomes.

- Massive investments in 5G network rollout and expansion.

- Government initiatives promoting digitalization and infrastructure development.

- Increasing demand for high-bandwidth applications and connected devices.

Within the segment breakdown:

- Power Range: The High power range segment is expected to witness significant growth, driven by the demand for increased power capacity in core and metro networks supporting high data traffic.

- End-user Application: The Core segment dominates the market due to the concentration of critical infrastructure and the need for high reliability and redundancy in this network segment.

Telecom Power Systems Industry Product Innovations

Recent product innovations focus on improving efficiency, reliability, and reducing environmental impact. This includes advancements in power conversion technologies, energy storage solutions (e.g., lithium-ion batteries), and intelligent monitoring systems. The adoption of modular designs allows for greater flexibility and scalability, catering to varying network requirements. These innovative products offer superior performance, lower operating costs, and a reduced carbon footprint, gaining significant traction among telecom operators.

Report Segmentation & Scope

This report segments the Telecom Power Systems market by power range (Low, Medium, High) and end-user application (Access, Core, Metro).

- Power Range: The Low power range caters to smaller access networks, with xx Million market size in 2025 and a projected CAGR of xx%. The Medium power range serves mid-sized networks, with a 2025 market size of xx Million and a projected CAGR of xx%. The High power range is crucial for core and metro networks, holding the largest market share in 2025 (xx Million) and a projected CAGR of xx%.

- End-user Application: The Access segment focuses on the last mile connectivity, while Core and Metro cater to larger network areas with high data traffic needs. Each segment shows robust growth projections, with the Core segment currently dominant. Competitive dynamics differ across segments, reflecting the specific needs of each application area.

Key Drivers of Telecom Power Systems Industry Growth

Several factors drive growth within the Telecom Power Systems industry:

- Expanding Telecommunications Infrastructure: The global rollout of 5G networks and the continued expansion of broadband access are major drivers.

- Technological Advancements: Innovations in power electronics and energy storage solutions improve system efficiency and reliability.

- Government Regulations: Supportive policies and regulations promote investment in telecom infrastructure.

Challenges in the Telecom Power Systems Industry Sector

The Telecom Power Systems industry faces several challenges:

- Supply Chain Disruptions: Global supply chain vulnerabilities impact the availability and cost of components.

- Regulatory Hurdles: Varying regulations across different regions create complexities in market entry and operations.

- Competitive Pressures: Intense competition from established and emerging players puts pressure on profit margins.

Leading Players in the Telecom Power Systems Industry Market

Key Developments in Telecom Power Systems Industry Sector

- December 2022: Telecom Egypt and Grid Telecom announced a collaboration to build a subsea system connecting Egypt and Greece, signifying investment in cross-border infrastructure and expanding network reach.

- May 2022: The launch of the GatiShakti Sanchar portal in India streamlines right-of-way approvals for telecom infrastructure, potentially accelerating network deployment and market expansion.

Strategic Telecom Power Systems Industry Market Outlook

The Telecom Power Systems industry presents significant growth potential, driven by the continued expansion of 5G networks, increased data traffic, and rising demand for reliable power solutions. Strategic opportunities exist for companies that focus on innovation, sustainability, and efficient supply chain management. The increasing adoption of renewable energy sources and smart grid technologies will further shape the industry's future. Players who can leverage these trends and deliver cost-effective, reliable solutions will be well-positioned for success.

Telecom Power Systems Industry Segmentation

-

1. Power Range

- 1.1. Low

- 1.2. Medium

- 1.3. High

-

2. End-user Application

- 2.1. Access

- 2.2. Core

- 2.3. Metro

Telecom Power Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Telecom Power Systems Industry Regional Market Share

Geographic Coverage of Telecom Power Systems Industry

Telecom Power Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Tower Installations; Adoption of Hybrid Power System in Telecom

- 3.3. Market Restrains

- 3.3.1. High Deployment and Operational Cost

- 3.4. Market Trends

- 3.4.1. Access Application in 5G Holds the Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Power Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Range

- 5.1.1. Low

- 5.1.2. Medium

- 5.1.3. High

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Access

- 5.2.2. Core

- 5.2.3. Metro

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Power Range

- 6. North America Telecom Power Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Power Range

- 6.1.1. Low

- 6.1.2. Medium

- 6.1.3. High

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Access

- 6.2.2. Core

- 6.2.3. Metro

- 6.1. Market Analysis, Insights and Forecast - by Power Range

- 7. Europe Telecom Power Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Power Range

- 7.1.1. Low

- 7.1.2. Medium

- 7.1.3. High

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Access

- 7.2.2. Core

- 7.2.3. Metro

- 7.1. Market Analysis, Insights and Forecast - by Power Range

- 8. Asia Pacific Telecom Power Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Power Range

- 8.1.1. Low

- 8.1.2. Medium

- 8.1.3. High

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Access

- 8.2.2. Core

- 8.2.3. Metro

- 8.1. Market Analysis, Insights and Forecast - by Power Range

- 9. Latin America Telecom Power Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Power Range

- 9.1.1. Low

- 9.1.2. Medium

- 9.1.3. High

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Access

- 9.2.2. Core

- 9.2.3. Metro

- 9.1. Market Analysis, Insights and Forecast - by Power Range

- 10. Middle East and Africa Telecom Power Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Power Range

- 10.1.1. Low

- 10.1.2. Medium

- 10.1.3. High

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. Access

- 10.2.2. Core

- 10.2.3. Metro

- 10.1. Market Analysis, Insights and Forecast - by Power Range

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alpha Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Delta Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Huawei Technologies Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ABB Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eltek AS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cummins Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZTE Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Efore Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eaton Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Alpha Technologies

List of Figures

- Figure 1: Global Telecom Power Systems Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Telecom Power Systems Industry Revenue (billion), by Power Range 2025 & 2033

- Figure 3: North America Telecom Power Systems Industry Revenue Share (%), by Power Range 2025 & 2033

- Figure 4: North America Telecom Power Systems Industry Revenue (billion), by End-user Application 2025 & 2033

- Figure 5: North America Telecom Power Systems Industry Revenue Share (%), by End-user Application 2025 & 2033

- Figure 6: North America Telecom Power Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Telecom Power Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Telecom Power Systems Industry Revenue (billion), by Power Range 2025 & 2033

- Figure 9: Europe Telecom Power Systems Industry Revenue Share (%), by Power Range 2025 & 2033

- Figure 10: Europe Telecom Power Systems Industry Revenue (billion), by End-user Application 2025 & 2033

- Figure 11: Europe Telecom Power Systems Industry Revenue Share (%), by End-user Application 2025 & 2033

- Figure 12: Europe Telecom Power Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Telecom Power Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Telecom Power Systems Industry Revenue (billion), by Power Range 2025 & 2033

- Figure 15: Asia Pacific Telecom Power Systems Industry Revenue Share (%), by Power Range 2025 & 2033

- Figure 16: Asia Pacific Telecom Power Systems Industry Revenue (billion), by End-user Application 2025 & 2033

- Figure 17: Asia Pacific Telecom Power Systems Industry Revenue Share (%), by End-user Application 2025 & 2033

- Figure 18: Asia Pacific Telecom Power Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Telecom Power Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Telecom Power Systems Industry Revenue (billion), by Power Range 2025 & 2033

- Figure 21: Latin America Telecom Power Systems Industry Revenue Share (%), by Power Range 2025 & 2033

- Figure 22: Latin America Telecom Power Systems Industry Revenue (billion), by End-user Application 2025 & 2033

- Figure 23: Latin America Telecom Power Systems Industry Revenue Share (%), by End-user Application 2025 & 2033

- Figure 24: Latin America Telecom Power Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Telecom Power Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Telecom Power Systems Industry Revenue (billion), by Power Range 2025 & 2033

- Figure 27: Middle East and Africa Telecom Power Systems Industry Revenue Share (%), by Power Range 2025 & 2033

- Figure 28: Middle East and Africa Telecom Power Systems Industry Revenue (billion), by End-user Application 2025 & 2033

- Figure 29: Middle East and Africa Telecom Power Systems Industry Revenue Share (%), by End-user Application 2025 & 2033

- Figure 30: Middle East and Africa Telecom Power Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Telecom Power Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecom Power Systems Industry Revenue billion Forecast, by Power Range 2020 & 2033

- Table 2: Global Telecom Power Systems Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 3: Global Telecom Power Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Telecom Power Systems Industry Revenue billion Forecast, by Power Range 2020 & 2033

- Table 5: Global Telecom Power Systems Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 6: Global Telecom Power Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Telecom Power Systems Industry Revenue billion Forecast, by Power Range 2020 & 2033

- Table 8: Global Telecom Power Systems Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 9: Global Telecom Power Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Telecom Power Systems Industry Revenue billion Forecast, by Power Range 2020 & 2033

- Table 11: Global Telecom Power Systems Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 12: Global Telecom Power Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Telecom Power Systems Industry Revenue billion Forecast, by Power Range 2020 & 2033

- Table 14: Global Telecom Power Systems Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 15: Global Telecom Power Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Telecom Power Systems Industry Revenue billion Forecast, by Power Range 2020 & 2033

- Table 17: Global Telecom Power Systems Industry Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 18: Global Telecom Power Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Power Systems Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Telecom Power Systems Industry?

Key companies in the market include Alpha Technologies, Delta Group, Huawei Technologies Co, ABB Group, Eltek AS, Cummins Inc, ZTE Corporation, Schneider Electric, Efore Group, Eaton Corporation.

3. What are the main segments of the Telecom Power Systems Industry?

The market segments include Power Range, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.69 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Tower Installations; Adoption of Hybrid Power System in Telecom.

6. What are the notable trends driving market growth?

Access Application in 5G Holds the Significant Share in the Market.

7. Are there any restraints impacting market growth?

High Deployment and Operational Cost.

8. Can you provide examples of recent developments in the market?

December 2022: Telecom Egypt, Egypt's first integrated telecom operator, and Grid Telecom, a wholly-owned subsidiary of the Independent Power Transmission Operator (IPTO) in Greece, announced a collaboration agreement to build a subsea system connecting Egypt and Greece.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Power Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Power Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Power Systems Industry?

To stay informed about further developments, trends, and reports in the Telecom Power Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence