Key Insights

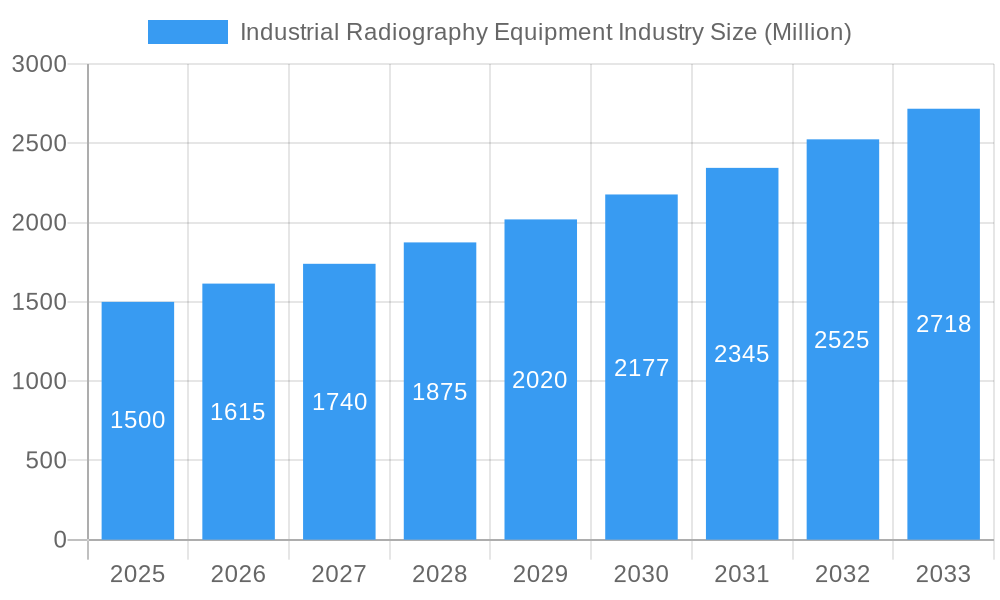

The global Industrial Radiography Equipment market is projected to reach a size of $1.35 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.6% through 2033. This expansion is driven by the increasing demand for non-destructive testing (NDT) solutions across diverse industries. Key growth factors include the imperative for stringent quality control and safety standards in aerospace, automotive, and energy sectors. The widespread adoption of advanced radiography technologies, such as direct radiography (DR) and computed tomography (CT), is enhancing market penetration by offering superior precision, accelerated inspection, and detailed imaging. These advancements are vital for identifying micro-defects and ensuring component integrity, thereby reducing waste and operational risks. Furthermore, increased investments in infrastructure and the growing complexity of manufactured goods necessitate comprehensive material inspection, supporting market growth.

Industrial Radiography Equipment Industry Market Size (In Billion)

The industrial radiography market encompasses equipment and software, with Computed Radiography (CR) and Direct Radiography (DR) technologies showing significant adoption due to their enhanced image quality and efficiency. Major end-user industries include aerospace, automotive, manufacturing, oil & gas, and construction, where safety and reliability are critical. Emerging applications in food inspection and semiconductor quality assurance are also diversifying the market. However, high initial investment costs for advanced systems and the requirement for skilled technicians present challenges. Despite these restraints, the trend towards stricter regulations and greater awareness of NDT benefits are expected to sustain market growth.

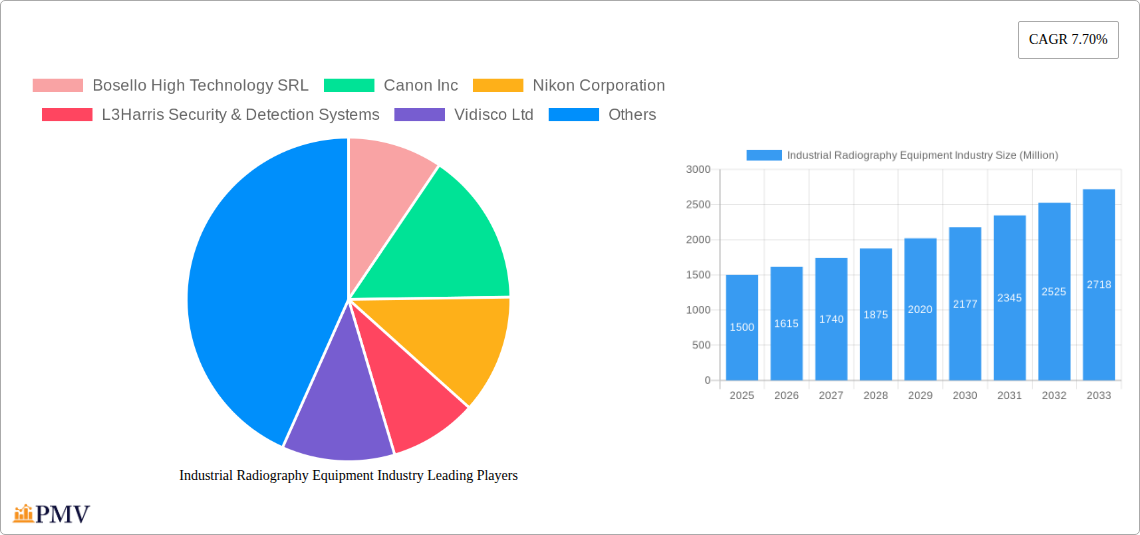

Industrial Radiography Equipment Industry Company Market Share

Industrial Radiography Equipment Industry Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This detailed market research report provides an in-depth analysis of the global Industrial Radiography Equipment Industry, covering market structure, competitive dynamics, key trends, dominant segments, product innovations, and future outlook. Our study spans the Study Period: 2019–2033, with the Base Year: 2025 and Estimated Year: 2025, offering robust insights for stakeholders. We meticulously analyze the Forecast Period: 2025–2033 and draw upon Historical Period: 2019–2024 data. This report is your essential guide to understanding the evolving landscape of NDT equipment, X-ray inspection systems, gamma radiography, industrial CT scanners, and non-destructive testing solutions.

Industrial Radiography Equipment Industry Market Structure & Competitive Dynamics

The Industrial Radiography Equipment Industry exhibits a moderately concentrated market structure. Leading players like General Electric Company, Hitachi Ltd, Canon Inc, and Olympus Corporation hold significant market share, estimated collectively at over 60% for equipment sales. Innovation ecosystems are robust, driven by continuous R&D in digital radiography and computed tomography technologies. Regulatory frameworks, particularly concerning radiation safety and industry-specific standards (e.g., ISO, ASTM), play a crucial role in market entry and product development. Product substitutes, such as ultrasonic testing and eddy current testing, exist but are often complementary rather than direct replacements for radiography's unique capabilities in material penetration and defect visualization.

- Market Concentration: Dominated by a few key players, with significant market share held by major conglomerates.

- Innovation Ecosystems: Thriving with investment in digital imaging, AI integration, and portable solutions.

- Regulatory Frameworks: Stringent safety and quality standards influencing product design and market access.

- Product Substitutes: Ultrasonic testing, eddy current testing, and visual inspection offer alternative NDT methods.

- End-User Trends: Increasing demand for higher resolution, faster inspection times, and automated systems.

- M&A Activities: Limited but significant, with strategic acquisitions aimed at expanding product portfolios or geographic reach. Recent deal values are estimated to be in the range of $50 Million to $200 Million.

Industrial Radiography Equipment Industry Industry Trends & Insights

The Industrial Radiography Equipment Industry is experiencing substantial growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 7.5% through the forecast period. This surge is primarily fueled by the escalating demand for robust quality control and safety assurance across a multitude of end-user industries. The transition from traditional film radiography to advanced computed radiography (CR) and direct radiography (DR) systems is a significant trend, offering enhanced image quality, reduced processing times, and digital archiving capabilities. Furthermore, the adoption of computed tomography (CT) is rapidly expanding, providing detailed 3D volumetric inspection of complex components, especially in the aerospace, automotive, and semiconductor and electronics sectors.

Technological disruptions are continuously reshaping the market. The integration of Artificial Intelligence (AI) and machine learning algorithms is enhancing image analysis, automating defect detection, and improving inspection efficiency. Miniaturization and portability of radiography equipment are also key developments, enabling on-site inspections in challenging environments, particularly within the oil and gas and construction industries. Consumer preferences are leaning towards higher throughput, lower dose solutions, and integrated software platforms that streamline the entire inspection workflow. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on providing comprehensive solutions encompassing hardware, software, and technical support. The market penetration of digital radiography technologies is projected to reach over 70% by 2030, displacing conventional film-based methods. The overall market size is estimated to grow from approximately $2,500 Million in 2024 to over $4,500 Million by 2033.

Dominant Markets & Segments in Industrial Radiography Equipment Industry

The Industrial Radiography Equipment Industry is dominated by North America and Europe in terms of market revenue, primarily driven by their advanced industrial infrastructure and stringent quality control mandates in sectors like aerospace and automotive and manufacturing. Within these regions, the equipment segment is the largest, accounting for an estimated 70% of the total market value, with a projected market size of over $3,000 Million by 2033.

- Dominant Region: North America, followed closely by Europe, due to high industrial activity and stringent quality standards.

- Leading Technology Segment: Computed Radiography (CR) and Direct Radiography (DR) are leading the technological shift, offering superior imaging and efficiency over Film Radiography. The market for Computed Radiography is expected to reach $1,200 Million by 2033.

- Key End-User Industries:

- Aerospace: High demand for precision inspection of critical components, driving the adoption of advanced NDT solutions. This segment alone contributes over $700 Million to the market.

- Automotive and Manufacturing: Significant adoption for quality control of welds, castings, and assembled parts, with an estimated market size of $850 Million.

- Oil and Gas: Essential for pipeline integrity inspection and offshore platform maintenance, contributing approximately $600 Million.

- Economic Policies & Infrastructure: Government investments in infrastructure development and stringent safety regulations in these dominant regions significantly bolster the demand for industrial radiography equipment.

- Technological Advancements: The continuous evolution of digital radiography and CT scanning technologies further solidifies the dominance of these regions and segments.

- Market Penetration of Digital Technologies: High adoption rates of CR and DR systems across manufacturing and inspection facilities.

Industrial Radiography Equipment Industry Product Innovations

Product innovations in the Industrial Radiography Equipment Industry are primarily focused on enhancing image resolution, reducing inspection times, and increasing portability and automation. The development of high-sensitivity detectors, advanced image processing algorithms, and integrated AI for defect analysis are key trends. For instance, new portable digital radiography systems offer field-deployable solutions with immediate image acquisition and analysis, providing a competitive advantage in remote or time-sensitive inspections. The integration of 3D imaging capabilities through computed tomography is also a significant innovation, enabling comprehensive volumetric analysis for complex geometries. These advancements cater to the evolving needs for faster, more accurate, and more efficient non-destructive testing across various industrial applications.

Report Segmentation & Scope

This report segments the Industrial Radiography Equipment Industry across several key dimensions to provide a granular market understanding. The primary segmentation includes:

- Offering: This segment is further divided into Equipment (X-ray generators, detectors, imaging systems) and Software (image processing, analysis, and management solutions). The Equipment segment is projected to hold a market size of over $3,000 Million by 2033.

- Technology: This encompasses Film Radiography, the foundational technology; Computed Radiography (CR), which utilizes digital imaging plates; Direct Radiography (DR), offering real-time digital imaging; and Computed Tomography (CT), providing 3D volumetric data. The Computed Radiography segment is anticipated to reach $1,200 Million by 2033.

- End-user Industry: This covers critical sectors such as Aerospace ($700 Million projected), Food Industry (growing rapidly, projected $250 Million), Construction ($400 Million), Oil and Gas ($600 Million), Automotive and Manufacturing ($850 Million), Energy and Power ($450 Million), Semiconductor and Electronics ($350 Million), and Other End-user Industries (including defense and research, $300 Million).

Key Drivers of Industrial Radiography Equipment Industry Growth

The Industrial Radiography Equipment Industry is propelled by several critical growth drivers. The increasing emphasis on product quality, safety, and reliability across all manufacturing sectors, driven by regulatory mandates and consumer expectations, is paramount. Technological advancements, particularly the shift towards digital radiography (CR and DR) and the increasing adoption of computed tomography (CT), offer enhanced inspection capabilities and efficiency, fueling market expansion. Furthermore, the growing demand for non-destructive testing (NDT) solutions in emerging economies and the expansion of industries like renewable energy and advanced manufacturing are creating significant growth opportunities. The need for efficient inspection of critical infrastructure in the oil and gas and construction sectors also contributes substantially.

Challenges in the Industrial Radiography Equipment Industry Sector

Despite robust growth, the Industrial Radiography Equipment Industry faces several challenges. High initial capital investment for advanced digital radiography and CT systems can be a barrier for smaller enterprises. Stringent radiation safety regulations, while crucial, can add complexity and cost to deployment and operation. The availability of skilled technicians and operators to effectively utilize and interpret complex radiography data is another concern. Furthermore, the market experiences competitive pressures from alternative NDT technologies, although radiography remains indispensable for certain applications. Supply chain disruptions, as experienced recently, can also impact the availability and cost of critical components.

Leading Players in the Industrial Radiography Equipment Industry Market

- Bosello High Technology SRL

- Canon Inc

- Nikon Corporation

- L3Harris Security & Detection Systems

- Vidisco Ltd

- Dürr NDT Gmbh & Co KG

- Teledyne Dalsa Inc

- North Star Imaging Inc

- YXLON International

- Hamamatsu Photonics K K

- Carestream Health Inc

- Hitachi Ltd

- General Electric Company

- Olympus Corporation

- Rigaku Corporation

Key Developments in Industrial Radiography Equipment Industry Sector

- 2023/11: Introduction of AI-powered image analysis software for enhanced defect detection by General Electric Company.

- 2023/09: Nikon Corporation launched a new portable industrial CT scanner with improved resolution and speed.

- 2023/07: Dürr NDT Gmbh & Co KG acquired a smaller competitor to expand its service offerings in Europe.

- 2023/05: Hitachi Ltd announced strategic partnerships to integrate advanced sensors into their radiography systems.

- 2022/12: Carestream Health Inc released a new generation of direct radiography detectors offering faster imaging and higher sensitivity.

Strategic Industrial Radiography Equipment Industry Market Outlook

The Industrial Radiography Equipment Industry is poised for continued strategic growth, driven by ongoing technological advancements and increasing global demand for sophisticated NDT solutions. The strategic focus for market players will be on developing integrated digital inspection platforms, incorporating AI and automation to enhance efficiency and accuracy. Expansion into emerging markets and catering to the specific needs of rapidly growing sectors like electric vehicles and renewable energy will be crucial. Strategic partnerships and potential consolidations will further shape the competitive landscape, creating opportunities for companies that can offer comprehensive, innovative, and cost-effective radiography solutions. The increasing digitalization of manufacturing processes will solidify the indispensable role of industrial radiography for quality assurance and structural integrity.

Industrial Radiography Equipment Industry Segmentation

-

1. Offering

- 1.1. Equipment

- 1.2. Software

-

2. Technology

- 2.1. Film Radiography

- 2.2. Computed Radiography

- 2.3. Direct Radiography

- 2.4. Computed Tomography

-

3. End-user Industry

- 3.1. Aerospace

- 3.2. Food Industry

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Automotive and Manufacturing

- 3.6. Energy and Power

- 3.7. Semiconductor and Electronics

- 3.8. Other End-user Industries

Industrial Radiography Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Industrial Radiography Equipment Industry Regional Market Share

Geographic Coverage of Industrial Radiography Equipment Industry

Industrial Radiography Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Portable and Miniaturized Equipment; Recovering Demand from the Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. Lack in Awareness

- 3.4. Market Trends

- 3.4.1. Recovering Demand from Oil and Gas Industry will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Equipment

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Film Radiography

- 5.2.2. Computed Radiography

- 5.2.3. Direct Radiography

- 5.2.4. Computed Tomography

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace

- 5.3.2. Food Industry

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Automotive and Manufacturing

- 5.3.6. Energy and Power

- 5.3.7. Semiconductor and Electronics

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Equipment

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Film Radiography

- 6.2.2. Computed Radiography

- 6.2.3. Direct Radiography

- 6.2.4. Computed Tomography

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace

- 6.3.2. Food Industry

- 6.3.3. Construction

- 6.3.4. Oil and Gas

- 6.3.5. Automotive and Manufacturing

- 6.3.6. Energy and Power

- 6.3.7. Semiconductor and Electronics

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Equipment

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Film Radiography

- 7.2.2. Computed Radiography

- 7.2.3. Direct Radiography

- 7.2.4. Computed Tomography

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace

- 7.3.2. Food Industry

- 7.3.3. Construction

- 7.3.4. Oil and Gas

- 7.3.5. Automotive and Manufacturing

- 7.3.6. Energy and Power

- 7.3.7. Semiconductor and Electronics

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Equipment

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Film Radiography

- 8.2.2. Computed Radiography

- 8.2.3. Direct Radiography

- 8.2.4. Computed Tomography

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace

- 8.3.2. Food Industry

- 8.3.3. Construction

- 8.3.4. Oil and Gas

- 8.3.5. Automotive and Manufacturing

- 8.3.6. Energy and Power

- 8.3.7. Semiconductor and Electronics

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Equipment

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Film Radiography

- 9.2.2. Computed Radiography

- 9.2.3. Direct Radiography

- 9.2.4. Computed Tomography

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace

- 9.3.2. Food Industry

- 9.3.3. Construction

- 9.3.4. Oil and Gas

- 9.3.5. Automotive and Manufacturing

- 9.3.6. Energy and Power

- 9.3.7. Semiconductor and Electronics

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East and Africa Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Equipment

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Film Radiography

- 10.2.2. Computed Radiography

- 10.2.3. Direct Radiography

- 10.2.4. Computed Tomography

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Aerospace

- 10.3.2. Food Industry

- 10.3.3. Construction

- 10.3.4. Oil and Gas

- 10.3.5. Automotive and Manufacturing

- 10.3.6. Energy and Power

- 10.3.7. Semiconductor and Electronics

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bosello High Technology SRL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Canon Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nikon Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L3Harris Security & Detection Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vidisco Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dürr NDT Gmbh & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Teledyne Dalsa Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 North Star Imaging Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 YXLON International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hamamatsu Photonics K K

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Carestream Health Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hitachi Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 General Electric Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Olympus Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Rigaku Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Bosello High Technology SRL

List of Figures

- Figure 1: Global Industrial Radiography Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Industrial Radiography Equipment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Industrial Radiography Equipment Industry Revenue (billion), by Offering 2025 & 2033

- Figure 4: North America Industrial Radiography Equipment Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 5: North America Industrial Radiography Equipment Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Industrial Radiography Equipment Industry Volume Share (%), by Offering 2025 & 2033

- Figure 7: North America Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 8: North America Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 9: North America Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Industrial Radiography Equipment Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 12: North America Industrial Radiography Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Industrial Radiography Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Industrial Radiography Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Industrial Radiography Equipment Industry Revenue (billion), by Offering 2025 & 2033

- Figure 20: Europe Industrial Radiography Equipment Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 21: Europe Industrial Radiography Equipment Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Europe Industrial Radiography Equipment Industry Volume Share (%), by Offering 2025 & 2033

- Figure 23: Europe Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 24: Europe Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 25: Europe Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Europe Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 27: Europe Industrial Radiography Equipment Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 28: Europe Industrial Radiography Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Industrial Radiography Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Industrial Radiography Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Industrial Radiography Equipment Industry Revenue (billion), by Offering 2025 & 2033

- Figure 36: Asia Pacific Industrial Radiography Equipment Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 37: Asia Pacific Industrial Radiography Equipment Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 38: Asia Pacific Industrial Radiography Equipment Industry Volume Share (%), by Offering 2025 & 2033

- Figure 39: Asia Pacific Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 40: Asia Pacific Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Asia Pacific Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Asia Pacific Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 43: Asia Pacific Industrial Radiography Equipment Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Industrial Radiography Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Industrial Radiography Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Industrial Radiography Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Industrial Radiography Equipment Industry Revenue (billion), by Offering 2025 & 2033

- Figure 52: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 53: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 54: Latin America Industrial Radiography Equipment Industry Volume Share (%), by Offering 2025 & 2033

- Figure 55: Latin America Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 56: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 57: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Latin America Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 59: Latin America Industrial Radiography Equipment Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 60: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Latin America Industrial Radiography Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Latin America Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by Offering 2025 & 2033

- Figure 68: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 69: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 70: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by Offering 2025 & 2033

- Figure 71: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 72: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 73: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 74: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 75: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 3: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 10: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 11: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 18: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 19: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 26: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 27: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 29: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 34: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 35: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 36: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 37: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 42: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 43: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 44: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 45: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Radiography Equipment Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Industrial Radiography Equipment Industry?

Key companies in the market include Bosello High Technology SRL, Canon Inc, Nikon Corporation, L3Harris Security & Detection Systems, Vidisco Ltd, Dürr NDT Gmbh & Co KG, Teledyne Dalsa Inc, North Star Imaging Inc, YXLON International, Hamamatsu Photonics K K, Carestream Health Inc, Hitachi Ltd, General Electric Company, Olympus Corporation, Rigaku Corporation.

3. What are the main segments of the Industrial Radiography Equipment Industry?

The market segments include Offering, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.35 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Portable and Miniaturized Equipment; Recovering Demand from the Oil and Gas Industry.

6. What are the notable trends driving market growth?

Recovering Demand from Oil and Gas Industry will Drive the Market.

7. Are there any restraints impacting market growth?

Lack in Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Radiography Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Radiography Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Radiography Equipment Industry?

To stay informed about further developments, trends, and reports in the Industrial Radiography Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence