Key Insights

The Latin American travel retail market is poised for significant expansion. While historical data prior to our base year: 2025 is limited, key drivers such as rising disposable incomes, increasing tourism, and a growing middle class are fueling this upward trend. Our analysis projects the market size in base year: 2025 to be approximately market size: 72.57 billion, reflecting a rebound from pandemic-related disruptions and the ongoing development of airport infrastructure and duty-free offerings in major hubs like Mexico City, São Paulo, and Bogotá. The burgeoning e-commerce segment, offering pre-ordering and delivery, is also expected to enhance traveler convenience and drive further market penetration.

Latin America Travel Retail Industry Market Size (In Billion)

Looking ahead, the market is forecast to grow at a Compound Annual Growth Rate (CAGR) of cagr: 5.4% from 2025 to 2033. This expansion will be supported by sustained growth in air travel, enhancements in tourist infrastructure, and a broader availability of luxury and experiential products. Potential challenges include economic volatility and currency fluctuations in certain regional economies. To navigate these risks, market participants should focus on product diversification, adapting to evolving consumer demands, and utilizing data analytics for optimized inventory and targeted marketing. Future market performance will be influenced by political stability, infrastructure investment, and macroeconomic conditions. Detailed country-specific analyses will offer a more nuanced understanding of the market's potential.

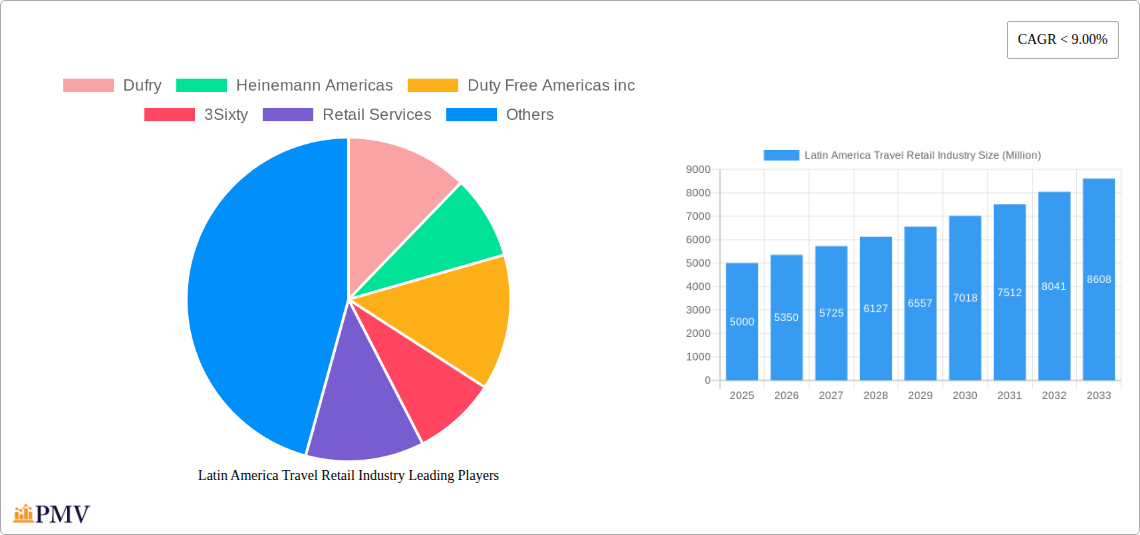

Latin America Travel Retail Industry Company Market Share

Latin America Travel Retail Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America travel retail industry, offering invaluable insights for businesses and investors seeking to navigate this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Historical data from 2019-2024 provides a robust foundation for the projections. The report values are expressed in Millions.

Latin America Travel Retail Industry Market Structure & Competitive Dynamics

The Latin American travel retail market exhibits a moderately concentrated structure, with key players such as Dufry, Heinemann Americas, and Duty Free Americas Inc. holding significant market share. However, a number of smaller, specialized players like 3Sixty, Retail Services, LURYX, Provimex, Sineriz, Monarq Group, and BERNABEL TRADING S A also contribute significantly to the overall market dynamics. The market share of these players varies significantly depending on the specific segment and country. Estimates suggest Dufry holds approximately xx% market share, while Heinemann Americas and Duty Free Americas Inc. each command around xx% and xx% respectively. The remaining share is distributed among smaller players.

Innovation within the industry is driven by both large multinational corporations and smaller, agile companies, focusing on enhanced customer experiences, digitalization, and personalized offerings. The regulatory framework across Latin American countries varies, impacting operational costs and market access. Product substitutes, mainly online retail and local stores, pose a moderate challenge, particularly for less differentiated products. End-user trends favor premium and experiential purchases, influencing product assortment strategies.

Mergers and acquisitions (M&A) activity has been moderate in recent years. Significant deals include (Value in Millions):

- Deal 1: xx between Company A and Company B in 20xx.

- Deal 2: xx between Company C and Company D in 20xx.

- Deal 3: xx between Company E and Company F in 20xx.

These M&A activities demonstrate a trend toward consolidation and expansion within the sector.

Latin America Travel Retail Industry Industry Trends & Insights

The Latin American travel retail market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the rising middle class, increased disposable incomes, and a surge in inbound and outbound tourism. Technological disruptions, such as the rise of mobile payments, omnichannel strategies, and personalized marketing, are transforming the customer experience and creating new opportunities for growth. Consumers in Latin America exhibit a growing preference for premium brands and unique, experiential purchases, driving demand for high-value products and immersive shopping environments.

Market penetration of travel retail remains relatively low compared to other regions, presenting significant potential for future growth. The increasing adoption of digital technologies and omnichannel strategies by major players will accelerate market penetration in the coming years. Intense competitive rivalry among established players and emerging brands also shapes market dynamics. The estimated market size in 2025 is xx Million and is predicted to reach xx Million by 2033.

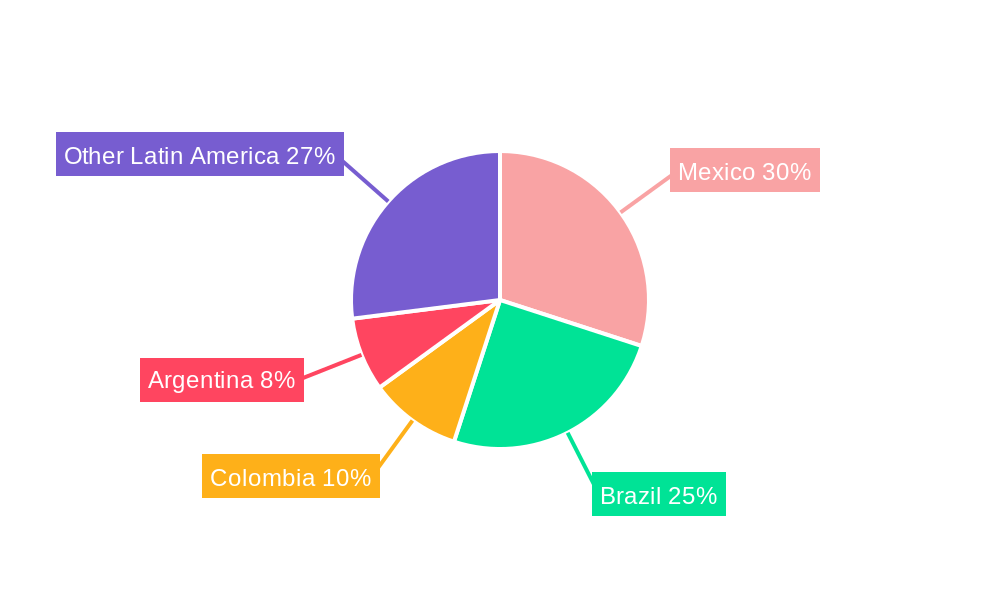

Dominant Markets & Segments in Latin America Travel Retail Industry

Mexico and Brazil represent the dominant markets within the Latin American travel retail industry, accounting for xx% and xx% of the total market value respectively, in 2025. This dominance is driven by:

- Strong Economic Growth: Both countries have experienced relatively robust economic growth in recent years, leading to increased disposable incomes and tourism spending.

- Developed Infrastructure: Major airports and tourism hubs in Mexico and Brazil offer significant opportunities for travel retail development.

- Favorable Government Policies: Supportive government policies toward tourism and retail development have helped to boost the growth of the travel retail sector in these countries.

Other key markets include Colombia, Argentina, and Chile, which are experiencing steadily growing markets. The duty-free segment dominates the overall market, accounting for xx% of the total market value in 2025, driven by favorable government regulations and high demand for imported goods. However, the airport segment also holds significant potential for future expansion and is predicted to grow at a faster CAGR than the duty-free segment. The market dominance of Mexico and Brazil is expected to continue throughout the forecast period, although other markets will experience faster growth rates.

Latin America Travel Retail Industry Product Innovations

Recent product innovations in the Latin American travel retail industry have focused on personalization, convenience, and premium experiences. Companies are leveraging technology to create immersive shopping environments, offering personalized recommendations and seamless payment options. The focus on incorporating local flavors and brands into product offerings is also gaining traction. This strategy allows businesses to cater to the growing demand for authentic and regionally specific products, thus enhancing their competitive advantages.

Report Segmentation & Scope

The report segments the Latin American travel retail market by country (Mexico, Brazil, Colombia, Argentina, Chile, and others), product category (liquor, perfume & cosmetics, confectionery, tobacco, etc.), and distribution channel (airport, cruise, border). Each segment presents unique growth opportunities and competitive dynamics. Growth projections for each segment are provided based on extensive market research and analysis. The report further delves into market size estimations for each segment for the historical period (2019-2024) and forecasts for the period 2025-2033. Competitive dynamics, including key players' market share and strategies within each segment, are also extensively discussed.

Key Drivers of Latin America Travel Retail Industry Growth

The growth of the Latin American travel retail industry is driven by a confluence of factors. The expanding middle class and increasing disposable incomes are fueling higher consumer spending on travel and luxury goods. Furthermore, improvements in airport infrastructure and increased tourism are creating more opportunities for retailers to reach a larger customer base. Government policies promoting tourism and foreign investment further contribute to market expansion. Finally, technological advancements, such as the adoption of omnichannel strategies and personalized marketing, are transforming the customer experience and driving growth.

Challenges in the Latin America Travel Retail Industry Sector

The Latin American travel retail industry faces several challenges. Inconsistent regulatory environments across different countries create operational complexities and increase costs. Supply chain disruptions, particularly in the context of global events, can significantly impact product availability and pricing. Intense competition among established players and emerging brands requires continuous innovation and investment to maintain a competitive edge. Currency fluctuations and macroeconomic instability within certain Latin American countries represent significant financial risks to industry players. These challenges impact profit margins and overall market predictability.

Leading Players in the Latin America Travel Retail Industry Market

- Dufry

- Heinemann Americas

- Duty Free Americas Inc

- 3Sixty

- Retail Services

- LURYX

- Provimex

- Sineriz

- Monarq Group

- BERNABEL TRADING S A

Key Developments in Latin America Travel Retail Industry Sector

- February 2021: Lancôme Travel Retail Americas and Dufry partnered to open Lancôme's largest flagship store in South America, enhancing the luxury shopping experience and demonstrating a commitment to experiential retail.

- April 2021: MONARQ Group shifted its focus to digital marketing, social media, and e-commerce, launching MONARQ's Social Club to engage consumers online and expand its reach during the pandemic. This showcased a successful adaptation to changing consumer behavior and increased digital engagement.

Strategic Latin America Travel Retail Industry Market Outlook

The Latin American travel retail industry holds significant long-term growth potential. Continued economic growth, rising tourism numbers, and the increasing adoption of technology will fuel market expansion. Strategic opportunities exist for companies to capitalize on the growing demand for premium products, personalized experiences, and seamless omnichannel shopping. By adapting to evolving consumer preferences and navigating the challenges presented by regulatory and macroeconomic conditions, businesses can unlock substantial growth within this dynamic sector.

Latin America Travel Retail Industry Segmentation

-

1. Retail Activity Type

- 1.1. Fashion and Accessories

- 1.2. Jewellery and Watches

- 1.3. Wine & Spirits

- 1.4. Food & Confectionary

- 1.5. Fragnances and Cosmetics

- 1.6. Tobacco

- 1.7. Others (Stationery, Electronics, etc.)

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other(Railway Stations, Border, Downtown)

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Rest of Latin America

Latin America Travel Retail Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of Latin America

Latin America Travel Retail Industry Regional Market Share

Geographic Coverage of Latin America Travel Retail Industry

Latin America Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Fragrance & Cosmetics Segment Share is Dominating the Travel Retail Market in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewellery and Watches

- 5.1.3. Wine & Spirits

- 5.1.4. Food & Confectionary

- 5.1.5. Fragnances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others (Stationery, Electronics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other(Railway Stations, Border, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 6. Brazil Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 6.1.1. Fashion and Accessories

- 6.1.2. Jewellery and Watches

- 6.1.3. Wine & Spirits

- 6.1.4. Food & Confectionary

- 6.1.5. Fragnances and Cosmetics

- 6.1.6. Tobacco

- 6.1.7. Others (Stationery, Electronics, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Airports

- 6.2.2. Airlines

- 6.2.3. Ferries

- 6.2.4. Other(Railway Stations, Border, Downtown)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 7. Argentina Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 7.1.1. Fashion and Accessories

- 7.1.2. Jewellery and Watches

- 7.1.3. Wine & Spirits

- 7.1.4. Food & Confectionary

- 7.1.5. Fragnances and Cosmetics

- 7.1.6. Tobacco

- 7.1.7. Others (Stationery, Electronics, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Airports

- 7.2.2. Airlines

- 7.2.3. Ferries

- 7.2.4. Other(Railway Stations, Border, Downtown)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 8. Colombia Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 8.1.1. Fashion and Accessories

- 8.1.2. Jewellery and Watches

- 8.1.3. Wine & Spirits

- 8.1.4. Food & Confectionary

- 8.1.5. Fragnances and Cosmetics

- 8.1.6. Tobacco

- 8.1.7. Others (Stationery, Electronics, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Airports

- 8.2.2. Airlines

- 8.2.3. Ferries

- 8.2.4. Other(Railway Stations, Border, Downtown)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 9. Rest of Latin America Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 9.1.1. Fashion and Accessories

- 9.1.2. Jewellery and Watches

- 9.1.3. Wine & Spirits

- 9.1.4. Food & Confectionary

- 9.1.5. Fragnances and Cosmetics

- 9.1.6. Tobacco

- 9.1.7. Others (Stationery, Electronics, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Airports

- 9.2.2. Airlines

- 9.2.3. Ferries

- 9.2.4. Other(Railway Stations, Border, Downtown)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Dufry

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Heinemann Americas

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Duty Free Americas inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 3Sixty

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Retail Services

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LURYX

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Provimex

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sineriz

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Monarq Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BERNABEL TRADING S A*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Dufry

List of Figures

- Figure 1: Global Latin America Travel Retail Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Brazil Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 3: Brazil Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 4: Brazil Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: Brazil Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: Brazil Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Brazil Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Brazil Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Brazil Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Argentina Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 11: Argentina Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 12: Argentina Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Argentina Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Argentina Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Argentina Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Argentina Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Argentina Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Colombia Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 19: Colombia Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 20: Colombia Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Colombia Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Colombia Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Colombia Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Colombia Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Colombia Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 27: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 28: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 2: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Latin America Travel Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 6: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 10: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 14: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 18: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Travel Retail Industry?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Latin America Travel Retail Industry?

Key companies in the market include Dufry, Heinemann Americas, Duty Free Americas inc, 3Sixty, Retail Services, LURYX, Provimex, Sineriz, Monarq Group, BERNABEL TRADING S A*List Not Exhaustive.

3. What are the main segments of the Latin America Travel Retail Industry?

The market segments include Retail Activity Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.57 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Fragrance & Cosmetics Segment Share is Dominating the Travel Retail Market in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2021- MONARQ Group shifted its focus to digital marketing, social media and e-commerce. To promote its brands on social media, the independent premium wine and spirits distributor launched MONARQ's Social Club early on during the pandemic with overwhelmingly positive feedback from participants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Travel Retail Industry?

To stay informed about further developments, trends, and reports in the Latin America Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence