Key Insights

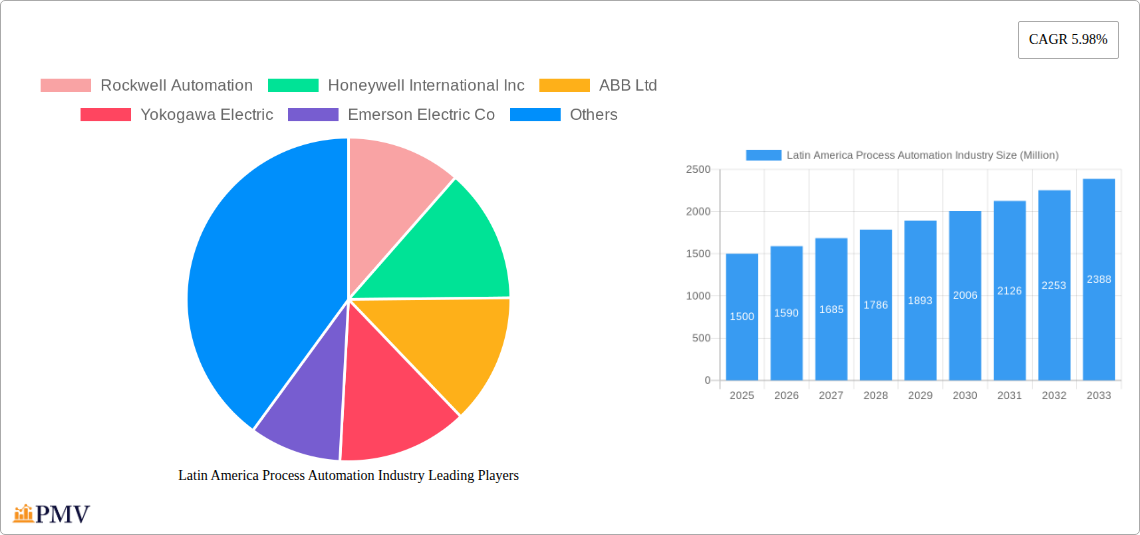

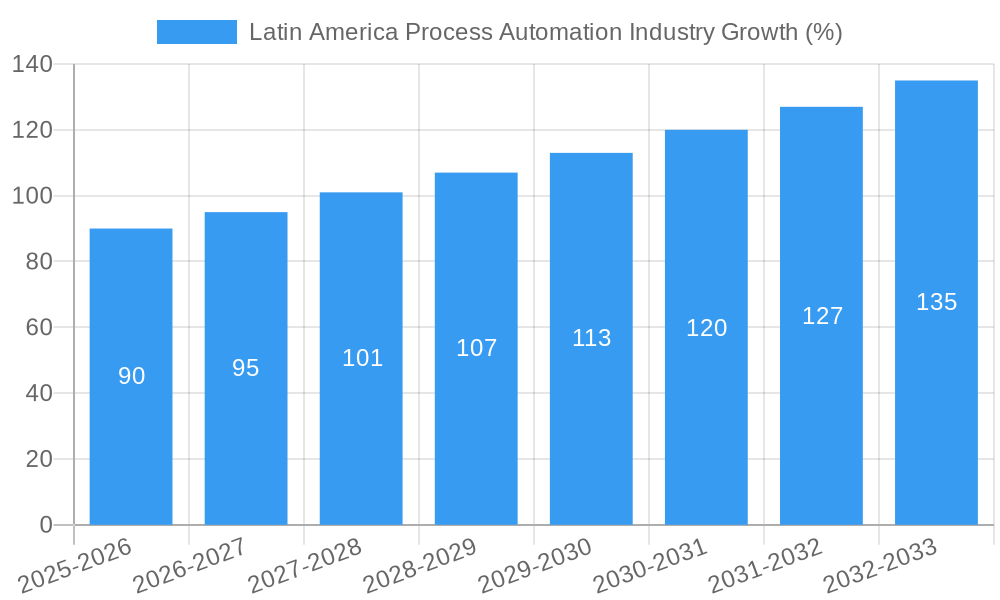

The Latin American process automation market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, driven by increasing industrial automation across key sectors. The 5.98% CAGR suggests a significant expansion through 2033, fueled by the region's burgeoning oil and gas, chemical, and petrochemical industries. Demand for advanced process control (APC) solutions, particularly customized solutions for optimizing production efficiency and reducing operational costs, is a key growth driver. The rising adoption of wireless communication protocols, offering flexibility and cost-effectiveness compared to wired systems, is another significant trend. Furthermore, the increasing focus on sustainable practices within industries like water and wastewater management is boosting demand for sophisticated automation technologies. While challenges like economic volatility and infrastructural limitations might pose restraints, the overall market outlook remains positive. The prevalence of 'System Hardware' and 'Sensors and Transmitters' segments indicates a strong emphasis on physical automation upgrades, while the growth of 'Advanced Process Control' software solutions signifies a shift towards sophisticated process optimization. Major players like Rockwell Automation, Honeywell, and ABB are strategically positioned to capitalize on these trends.

Growth within specific segments is expected to vary. The oil and gas sector is likely to lead the way, given its existing automation infrastructure and continuous investment in operational efficiency improvements. However, substantial growth is anticipated in other sectors such as food and beverage, and pharmaceuticals, driven by increasing demands for quality control and automation driven production lines. The adoption of Industry 4.0 technologies and the increasing need for data-driven decision-making within manufacturing plants will continue to propel market expansion, shaping the competitive landscape and fostering innovation in process automation solutions. The increasing investment in digital transformation initiatives by governments across Latin America will also boost adoption.

Latin America Process Automation Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America process automation industry, offering invaluable insights for businesses, investors, and stakeholders seeking to understand the market's dynamics and future trajectory. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market size for 2025 is estimated at XX Million, with a projected CAGR of XX% during the forecast period.

Latin America Process Automation Industry Market Structure & Competitive Dynamics

The Latin American process automation market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. Key players include Rockwell Automation, Honeywell International Inc, ABB Ltd, Yokogawa Electric, Emerson Electric Co, Siemens AG, General Electric Co, Fuji Electric, Schneider Electric, Delta Electronics Limited, Mitsubishi Electric, and Eaton Corporation. The market share distribution is dynamic, with ongoing M&A activities reshaping the competitive landscape. While precise market share figures for each player are not publicly available, Rockwell Automation, Honeywell, and Siemens are generally considered among the leading players, commanding a combined share estimated at xx%. The total value of M&A deals in the sector during the historical period (2019-2024) is estimated at approximately XX Million.

Innovation ecosystems are developing across the region, with several startups and technology providers emerging to address specific process automation needs. Regulatory frameworks vary across Latin American countries, impacting market access and product compliance. Product substitutes, while limited, include legacy systems and manual processes, which are gradually being replaced by automated solutions. End-user trends reflect a strong push towards digitalization, Industry 4.0 adoption, and improved operational efficiency.

Latin America Process Automation Industry Industry Trends & Insights

The Latin American process automation market exhibits robust growth, driven by increasing industrialization, modernization initiatives across various sectors, and the growing adoption of advanced technologies such as AI and IoT. Key growth drivers include:

- Rising demand for improved operational efficiency and productivity: Businesses across various sectors are increasingly adopting process automation to enhance efficiency, reduce operational costs, and improve overall productivity.

- Government initiatives promoting industrial automation: Several Latin American governments are actively promoting automation to stimulate economic growth and competitiveness, providing financial incentives and support for industrial modernization.

- Technological advancements in process automation: The continuous evolution of process automation technologies, including advancements in AI, machine learning, and cloud computing, is driving market expansion by offering more efficient, intelligent, and cost-effective solutions.

- Increased focus on safety and security: Automation plays a crucial role in ensuring safer and more secure industrial operations, particularly in hazardous environments, further fueling its adoption.

The market penetration of advanced process control (APC) solutions is increasing, while the adoption of wireless communication protocols is gaining traction due to their flexibility and cost-effectiveness. The market experienced a temporary slowdown during the initial phases of the COVID-19 pandemic (2020) but has since shown a strong recovery and is poised for continued expansion.

Dominant Markets & Segments in Latin America Process Automation Industry

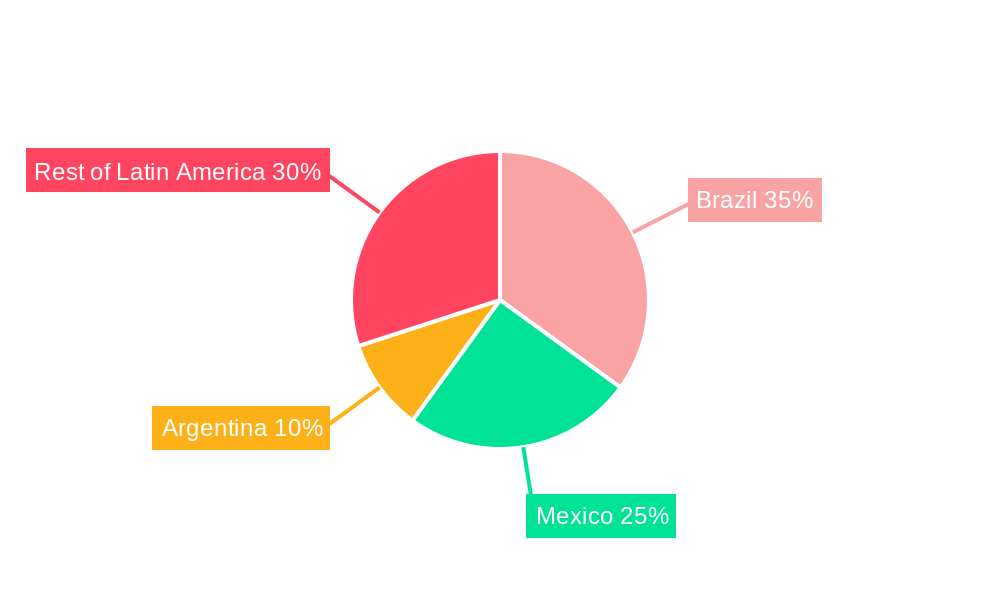

The Brazilian market leads the Latin American process automation sector, followed by Mexico, and several other major economies in the region. Within segments:

- Communication Protocol: Wired protocols currently dominate due to established infrastructure and reliability, however wireless is exhibiting significant growth particularly in remote or challenging-to-access industrial settings.

- System Type: System Hardware (PLCs, HMIs, etc.) holds the largest share, with Sensors and Transmitters witnessing strong growth due to their crucial role in data acquisition.

- Software Type: Basic Process Control software remains dominant, but Advanced Process Control is rapidly gaining traction due to its ability to optimize processes and improve efficiency.

- APC (Standalone & Customized Solutions): Advanced Regulatory Control is the most widely used, though Multivariable Model and Inferential & Sequential solutions are experiencing increased demand in complex applications.

- End-user Industry: The Oil and Gas, Chemical and Petrochemical, and Power and Utilities sectors are the primary drivers of market growth, followed by the Food and Beverage and Pharmaceutical industries.

Key drivers vary by segment and country but often include strong government support, economic development, and a push for improved operational efficiencies and safety. The dominance of specific segments reflects the varying levels of industrial maturity and technological adoption across different sectors.

Latin America Process Automation Industry Product Innovations

Recent product innovations include the introduction of more sophisticated APC solutions integrating AI and machine learning for enhanced process optimization. New sensor technologies enabling real-time data acquisition and improved analytics are also contributing to market growth. The focus is on creating more integrated, scalable, and flexible solutions that address specific needs across different industrial sectors. Companies are emphasizing cloud-based solutions, remote monitoring capabilities, and improved user interfaces to enhance ease of use and operational efficiency.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Latin American process automation market, analyzing various communication protocols (Wired and Wireless), system types (System Hardware and Sensors and Transmitters), software types (Basic Process Control and Advanced Process Control), and APC solutions (Advanced Regulatory Control, Multivariable Model, and Inferential & Sequential). It also examines end-user industries, including Oil and Gas, Chemical and Petrochemical, Power and Utilities, Water and Wastewater, Food and Beverage, Paper and Pulp, Pharmaceutical, and Other End-user Industries. Each segment's market size, growth projections, and competitive dynamics are thoroughly investigated.

Key Drivers of Latin America Process Automation Industry Growth

The growth of the Latin American process automation industry is fueled by several factors including: increasing government investment in infrastructure development, the need for improved operational efficiency across various industries, a rising focus on safety and environmental regulations, and technological advancements leading to the development of more sophisticated automation solutions. Economic growth across several Latin American countries contributes significantly, creating demand for increased industrial production and process optimization.

Challenges in the Latin America Process Automation Industry Sector

Challenges in the sector include inconsistent regulatory frameworks across different countries, which can complicate market entry and product compliance. Supply chain disruptions, particularly related to the procurement of specialized components, also pose a significant obstacle. Intense competition from established multinational players and the emergence of new entrants further presents challenges. These factors can impact project timelines, increase costs, and limit market expansion.

Leading Players in the Latin America Process Automation Industry Market

- Rockwell Automation (Rockwell Automation)

- Honeywell International Inc (Honeywell International Inc)

- ABB Ltd (ABB Ltd)

- Yokogawa Electric (Yokogawa Electric)

- Emerson Electric Co (Emerson Electric Co)

- Siemens AG (Siemens AG)

- General Electric Co (General Electric Co)

- Fuji Electric (Fuji Electric)

- Schneider Electric (Schneider Electric)

- Delta Electronics Limited (Delta Electronics Limited)

- Mitsubishi Electric (Mitsubishi Electric)

- Eaton Corporation (Eaton Corporation)

Key Developments in Latin America Process Automation Industry Sector

- January 2020: Emerson Electronics Co. launched a new portfolio of RXi industrial display and panel PC products to minimize lifecycle costs and improve production processes across various industries. This launch enhanced Emerson's competitiveness and expanded its product offerings in a key market segment.

- May 2020: RoviSys announced its collaboration with VANTIQ to develop applications for detecting and containing COVID-19 in the food and beverage and life sciences sectors. This highlights the industry's adaptability and its responsiveness to emerging challenges and opportunities.

Strategic Latin America Process Automation Industry Market Outlook

The Latin American process automation market presents significant growth potential driven by ongoing industrialization, increasing investments in infrastructure modernization, and the growing adoption of advanced automation technologies. Strategic opportunities exist for companies focusing on providing integrated solutions, leveraging digital technologies, and adapting to the specific needs of different industrial sectors across the region. Continued focus on innovation and addressing the challenges related to regulatory frameworks and supply chain management will be crucial for success.

Latin America Process Automation Industry Segmentation

-

1. Communication Protocol

- 1.1. Wired

- 1.2. Wireless

-

2. System Type

-

2.1. By System Hardware

- 2.1.1. Supervis

- 2.1.2. Distributed Control System (DCS)

- 2.1.3. Programmable Logic Controller (PLC)

- 2.1.4. Manufacturing Execution System (MES)

- 2.1.5. Valves & Actuators

- 2.1.6. Electric Motors

- 2.1.7. Human Machine Interface (HMI)

- 2.1.8. Process Safety Systems

- 2.1.9. Sensors and Transmitters

-

2.2. By Software Type

-

2.2.1. APC (Standalone & Customized Solutions)

- 2.2.1.1. Advanced Regulatory Control

- 2.2.1.2. Multivariable Model

- 2.2.1.3. Inferential & Sequential

- 2.2.2. Data Analytics and Reporting-based Software

- 2.2.3. Other Software and Services

-

2.2.1. APC (Standalone & Customized Solutions)

-

2.1. By System Hardware

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Chemical and Petrochemical

- 3.3. Power and Utilities

- 3.4. Water and Wastewater

- 3.5. Food and Beverage

- 3.6. Paper and Pulp

- 3.7. Pharmaceutical

- 3.8. Other End-user Industries

Latin America Process Automation Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Process Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. Relatively High Deployment Costs; Complex Design compared to Traditional Sensors

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by System Type

- 5.2.1. By System Hardware

- 5.2.1.1. Supervis

- 5.2.1.2. Distributed Control System (DCS)

- 5.2.1.3. Programmable Logic Controller (PLC)

- 5.2.1.4. Manufacturing Execution System (MES)

- 5.2.1.5. Valves & Actuators

- 5.2.1.6. Electric Motors

- 5.2.1.7. Human Machine Interface (HMI)

- 5.2.1.8. Process Safety Systems

- 5.2.1.9. Sensors and Transmitters

- 5.2.2. By Software Type

- 5.2.2.1. APC (Standalone & Customized Solutions)

- 5.2.2.1.1. Advanced Regulatory Control

- 5.2.2.1.2. Multivariable Model

- 5.2.2.1.3. Inferential & Sequential

- 5.2.2.2. Data Analytics and Reporting-based Software

- 5.2.2.3. Other Software and Services

- 5.2.2.1. APC (Standalone & Customized Solutions)

- 5.2.1. By System Hardware

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Power and Utilities

- 5.3.4. Water and Wastewater

- 5.3.5. Food and Beverage

- 5.3.6. Paper and Pulp

- 5.3.7. Pharmaceutical

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Communication Protocol

- 6. Brazil Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Rockwell Automation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ABB Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Yokogawa Electric

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Emerson Electric Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Siemens AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 General Electric Co

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Fuji Electric

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Schneider Electric

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Delta Electronics Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Mitsubishi Electric

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Eaton Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Rockwell Automation

List of Figures

- Figure 1: Latin America Process Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Process Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Process Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Process Automation Industry Revenue Million Forecast, by Communication Protocol 2019 & 2032

- Table 3: Latin America Process Automation Industry Revenue Million Forecast, by System Type 2019 & 2032

- Table 4: Latin America Process Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Latin America Process Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Process Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Process Automation Industry Revenue Million Forecast, by Communication Protocol 2019 & 2032

- Table 14: Latin America Process Automation Industry Revenue Million Forecast, by System Type 2019 & 2032

- Table 15: Latin America Process Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Latin America Process Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Process Automation Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Latin America Process Automation Industry?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Yokogawa Electric, Emerson Electric Co, Siemens AG, General Electric Co, Fuji Electric, Schneider Electric, Delta Electronics Limited, Mitsubishi Electric, Eaton Corporation.

3. What are the main segments of the Latin America Process Automation Industry?

The market segments include Communication Protocol, System Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector.

6. What are the notable trends driving market growth?

Pharmaceutical Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Relatively High Deployment Costs; Complex Design compared to Traditional Sensors.

8. Can you provide examples of recent developments in the market?

May 2020 - RoviSys announced its collaboration with VANTIQ, a developer of next-generation applications, to develop applications that can detect and contain COVID-19 in the food and beverage industry, apart from the critical life science sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Process Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Process Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Process Automation Industry?

To stay informed about further developments, trends, and reports in the Latin America Process Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence