Key Insights

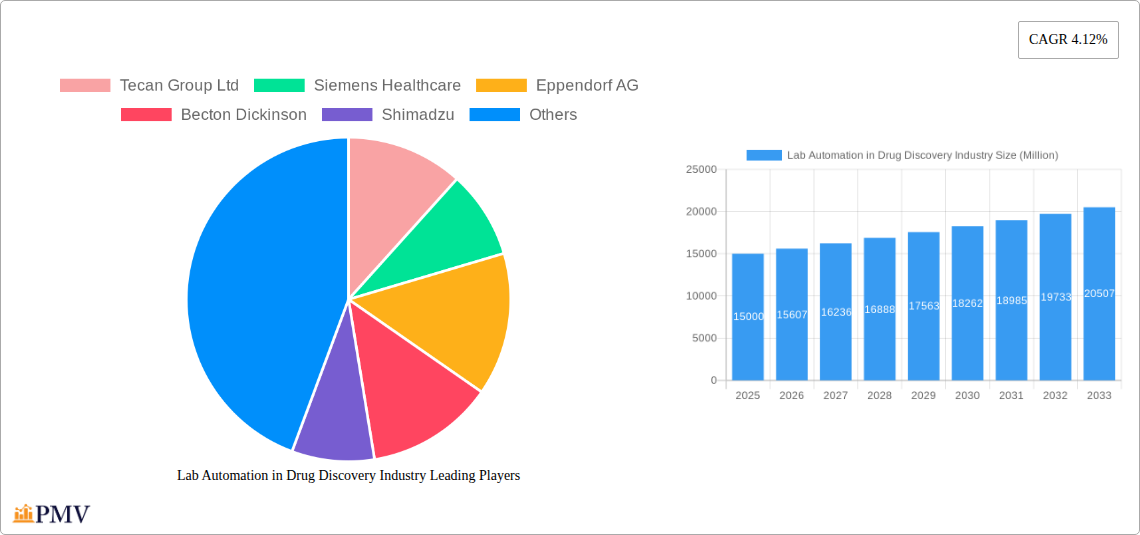

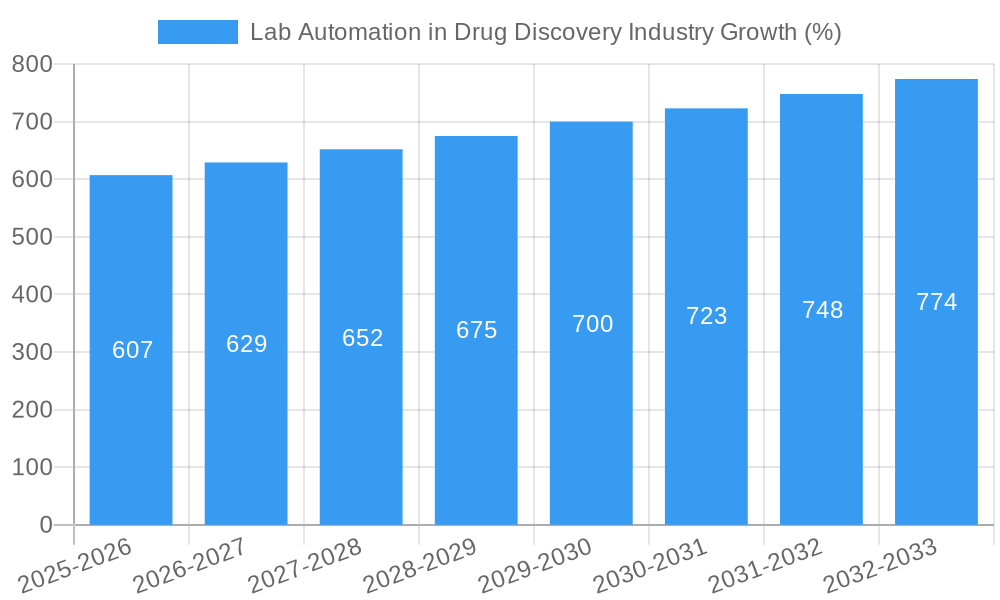

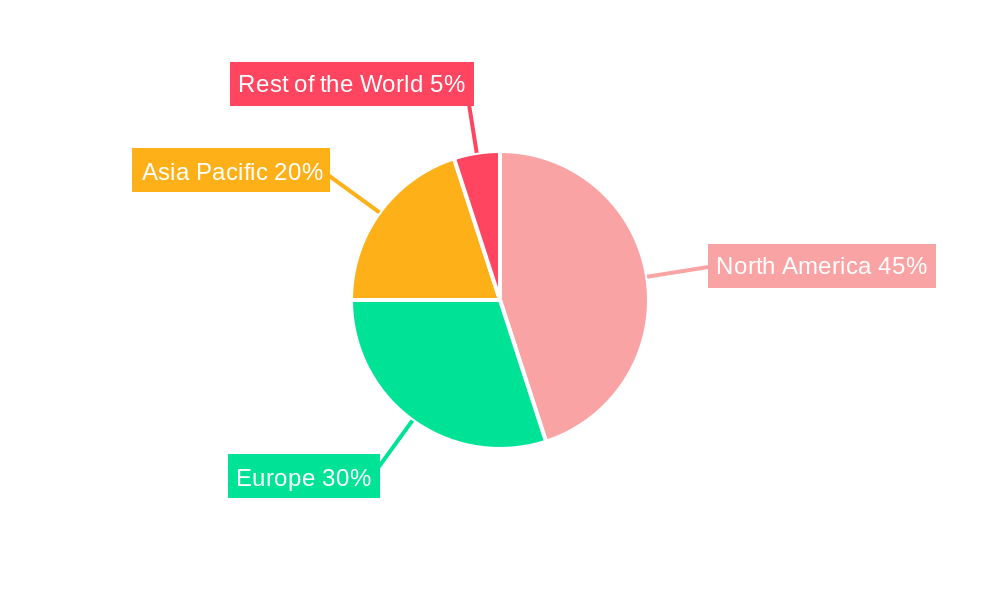

The lab automation market within the drug discovery industry is experiencing robust growth, driven by the increasing demand for high-throughput screening, reduced manual errors, and accelerated drug development timelines. The market, currently estimated at $XX billion in 2025 (assuming a reasonable market size based on typical values for this sector given the provided CAGR), is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the rising prevalence of chronic diseases globally is increasing the need for novel therapeutics, pushing pharmaceutical companies to adopt automation technologies for improved efficiency and cost-effectiveness. Secondly, advancements in technologies such as artificial intelligence (AI) and machine learning (ML) are being integrated into lab automation systems, enhancing their capabilities and enabling more sophisticated drug discovery processes. Finally, the ongoing focus on personalized medicine necessitates high-throughput screening and analysis capabilities, further driving the demand for automated solutions. Significant market segments include automated liquid handlers, automated plate handlers, robotic arms, and automated storage and retrieval systems (AS/RS), each contributing to the overall market expansion. North America currently holds a substantial share of the market, benefiting from strong research infrastructure and high pharmaceutical industry investments, followed by Europe and the Asia Pacific region.

Despite significant growth potential, the market faces certain restraints. High initial investment costs for advanced automation systems can be a barrier to entry for smaller companies. Furthermore, the complexity of integrating various automated systems and the need for specialized expertise can hinder wider adoption. However, the long-term benefits of improved efficiency, reduced errors, and faster drug development are expected to outweigh these challenges, ensuring continued growth in the coming years. Key players like Tecan, Siemens, Eppendorf, and Thermo Fisher are actively investing in R&D and strategic partnerships to solidify their market positions and capitalize on the growing demand for advanced lab automation technologies in drug discovery. The increasing adoption of cloud-based solutions and data analytics is also expected to accelerate market penetration and expand the scope of applications for lab automation in the future.

Lab Automation in Drug Discovery Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lab Automation in Drug Discovery Industry market, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Lab Automation in Drug Discovery Industry Market Structure & Competitive Dynamics

The global lab automation in drug discovery market is characterized by a moderately concentrated structure with several major players commanding significant market share. Key players such as Tecan Group Ltd, Siemens Healthcare, Eppendorf AG, Becton Dickinson, Shimadzu, Perkinelmer, Beckman Coulter, Synchron Lab Automation (MolGen), Thermo Fisher Scientific, Roche Holding AG, Agilent Technologies, Aurora Biome, Bio-Rad, and Hudson Robotics contribute to a competitive landscape marked by continuous innovation and strategic acquisitions.

The market's innovation ecosystem is robust, with significant R&D investments driving advancements in areas like artificial intelligence (AI)-powered automation, miniaturization, and integration of various analytical techniques. Regulatory frameworks, particularly those concerning data security and compliance, heavily influence market dynamics. Product substitutes, such as manual processes, pose a limited threat given the increasing demand for higher throughput and reduced human error. End-user trends, notably a shift towards personalized medicine and increasing outsourcing of laboratory services, are driving market expansion.

M&A activity in the sector has been significant, with several multi-million-dollar deals reported in recent years. For instance, in 2022, xx Million were invested in acquisitions, resulting in xx% increase in market concentration. Further analysis reveals that the top 5 players collectively hold an estimated xx% market share in 2025. This consolidation trend is expected to continue, driven by the need to expand product portfolios and gain access to new technologies. The report delves deeper into specific M&A activities, providing deal values and analyzing their impact on market competition.

Lab Automation in Drug Discovery Industry Industry Trends & Insights

The lab automation market in drug discovery is experiencing substantial growth driven by several key factors. The increasing demand for high-throughput screening (HTS) and automation in drug development pipelines is a major catalyst. The rising prevalence of chronic diseases globally is fueling the need for efficient drug discovery processes, further boosting market expansion. The market is witnessing a significant shift towards advanced automation technologies such as AI-driven systems and robotic process automation (RPA), which is revolutionizing the sector with increased efficiency and accuracy. This adoption is resulting in improved productivity, reduced operational costs, and accelerated time-to-market for new drugs.

Technological disruptions, including the integration of cloud computing and big data analytics, are enabling better data management and insights, allowing researchers to make more informed decisions in drug discovery. Furthermore, the growing emphasis on personalized medicine is driving the demand for customized automation solutions that can handle diverse sample types and assays, contributing to market expansion. The market's competitive dynamics are shaped by the ongoing introduction of innovative products, strategic partnerships, and aggressive expansion by key players. The report forecasts a CAGR of xx% between 2025 and 2033, reflecting the robust growth potential of this market. Market penetration of automated liquid handlers is estimated to be xx% in 2025, poised for further growth as the adoption of automated systems accelerates.

Dominant Markets & Segments in Lab Automation in Drug Discovery Industry

The North American region currently dominates the lab automation market in drug discovery, driven by robust R&D spending, a large pharmaceutical industry, and a supportive regulatory environment. However, Asia-Pacific is expected to exhibit significant growth in the coming years due to the expanding pharmaceutical and biotechnology sectors in countries like China and India.

Dominant Segments (By Equipment):

- Automated Liquid Handlers: This segment holds the largest market share, driven by the widespread use of liquid handling in various drug discovery stages. Key drivers include increasing demand for high-throughput screening (HTS) and the need for precision and accuracy in liquid handling procedures.

- Automated Plate Handlers: High demand for efficient handling and processing of microplates in high-throughput screening processes fuels this segment's growth. The automation improves workflow efficiency and minimizes the risk of human error.

- Robotic Arms: The versatility and adaptability of robotic arms in automating complex laboratory procedures are driving the segment's growth. Flexibility in tasks and integration capabilities are significant advantages.

- Automated Storage & Retrieval Systems (AS/RS): Growing data storage needs and the necessity for efficient sample management are driving the expansion of this segment. Automated systems enhance sample traceability and reduce storage space.

- Software: Advanced software solutions for lab automation are essential for controlling automated systems, data analysis, and workflow management. Demand for improved data integration and analysis capabilities drives segment growth.

- Analyzers: Increased demand for high-throughput analysis and improved efficiency in drug discovery pipelines is driving significant growth in this segment. Automated analyzers significantly improve speed and accuracy of results.

Key Drivers:

- Robust government funding for R&D: Significant investments in life sciences research drive market growth.

- Developed healthcare infrastructure: The availability of advanced technologies and skilled professionals contributes significantly to sector expansion.

- Stringent regulations ensuring quality and safety: Regulations drive the need for reliable and high-quality automation systems.

Lab Automation in Drug Discovery Industry Product Innovations

Recent years have witnessed significant advancements in lab automation technologies. The integration of AI and machine learning is enabling the development of intelligent automation systems capable of self-optimization and adaptive control. Miniaturization technologies have led to the development of smaller, more efficient lab automation systems, reducing costs and space requirements. The focus on user-friendliness has resulted in intuitive interfaces and customizable protocols, making the technology more accessible to a broader range of users. The development of modular and easily integrated systems allows for greater flexibility and scalability in automation solutions. These innovations are enhancing the speed, accuracy, and efficiency of drug discovery processes, significantly improving market competitiveness.

Report Segmentation & Scope

This report segments the lab automation in drug discovery market by equipment type: Automated Liquid Handlers, Automated Plate Handlers, Robotic Arms, Automated Storage & Retrieval Systems (AS/RS), Software, and Analyzers. Each segment is analyzed based on its market size, growth projections, competitive dynamics, and key drivers. For instance, the automated liquid handler segment is projected to grow at a CAGR of xx% during the forecast period, driven by increasing demand for high-throughput screening in drug discovery. Similarly, the software segment is experiencing significant growth due to the rising adoption of data analytics and workflow management tools. The report provides granular detail on each segment’s market share, competitive landscape, and growth potential.

Key Drivers of Lab Automation in Drug Discovery Industry Growth

Several factors propel the growth of the lab automation market in drug discovery. Technological advancements, such as AI-powered automation and miniaturization, are significantly improving the efficiency and accuracy of drug discovery processes. Economic factors, including increased R&D investments and the rising cost of manual labor, are driving the adoption of automation solutions. Moreover, stringent regulatory requirements and increasing pressure to accelerate drug development timelines are pushing companies to embrace lab automation technologies for improved quality control and faster time-to-market.

Challenges in the Lab Automation in Drug Discovery Industry Sector

Despite the significant growth potential, the lab automation market faces certain challenges. High initial investment costs can be a barrier for smaller companies, and the complexity of integrating various automation systems can pose implementation challenges. Regulatory hurdles in different regions can also impact market expansion. Furthermore, the sector faces competitive pressures from established players and new entrants, necessitating continuous innovation and adaptation. These factors, although presenting challenges, ultimately drive improvements and advancements in the industry. For example, the high upfront cost of AS/RS has resulted in a slower adoption rate compared to other segments.

Leading Players in the Lab Automation in Drug Discovery Industry Market

- Tecan Group Ltd

- Siemens Healthcare

- Eppendorf AG

- Becton Dickinson

- Shimadzu

- Perkinelmer

- Beckman Coulter

- Synchron Lab Automation (MolGen)

- Thermo Fisher Scientific

- Roche Holding AG

- Agilent Technologies

- Aurora Biome

- Bio-Rad

- Hudson Robotics

Key Developments in Lab Automation in Drug Discovery Industry Sector

March 2023: Eppendorf launched the new generation epMotion automated liquid handler, showcasing enhanced precision, user-friendly interface, and improved ergonomics. This launch strengthens Eppendorf's position in the automated liquid handling segment, driving competition and market innovation.

February 2023: Automata's launch of the LINQ integrated laboratory automation platform introduces a novel approach to lab automation with its robotic benchtop system. This integrated platform increases lab throughput and efficiency, shaping future trends in laboratory automation.

Strategic Lab Automation in Drug Discovery Industry Market Outlook

The future of lab automation in drug discovery is bright. The convergence of AI, big data, and robotics promises to further revolutionize drug discovery processes, leading to faster development times, reduced costs, and more effective therapies. The market is expected to witness continuous innovation in areas such as miniaturization, high-throughput screening, and personalized medicine. Strategic partnerships and collaborations among pharmaceutical companies, technology providers, and research institutions will play a crucial role in shaping the future of this market. The increasing adoption of cloud-based solutions and the development of sophisticated analytical tools will further enhance data management and analysis capabilities, resulting in more efficient and informed decision-making. This translates to substantial growth opportunities for companies operating in this dynamic market.

Lab Automation in Drug Discovery Industry Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage & Retrieval Systems (AS/RS)

- 1.5. Software

- 1.6. Analyzers

Lab Automation in Drug Discovery Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Drug Discovery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovations Leading to Device Miniaturization and Increased Throughput

- 3.3. Market Restrains

- 3.3.1. High Capital Requirements for Setup

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers are Expected to Account for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 5.1.5. Software

- 5.1.6. Analyzers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 6.1.5. Software

- 6.1.6. Analyzers

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 7.1.5. Software

- 7.1.6. Analyzers

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 8.1.5. Software

- 8.1.6. Analyzers

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage & Retrieval Systems (AS/RS)

- 9.1.5. Software

- 9.1.6. Analyzers

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. North America Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Lab Automation in Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Tecan Group Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Siemens Healthcare

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Eppendorf AG

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Becton Dickinson

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Shimadzu

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Perkinelmer

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Beckman Coulter

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Synchron Lab Automation (MolGen)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Thermo Fisher Scientific

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Roche Holding AG

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Agilent Technologies

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Aurora Biome

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Bio-Rad

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Hudson Robotics

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Tecan Group Ltd

List of Figures

- Figure 1: Global Lab Automation in Drug Discovery Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Pacific Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Pacific Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Lab Automation in Drug Discovery Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Rest of the World Lab Automation in Drug Discovery Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Rest of the World Lab Automation in Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Lab Automation in Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Drug Discovery Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Lab Automation in Drug Discovery Industry?

Key companies in the market include Tecan Group Ltd, Siemens Healthcare, Eppendorf AG, Becton Dickinson, Shimadzu, Perkinelmer, Beckman Coulter, Synchron Lab Automation (MolGen), Thermo Fisher Scientific, Roche Holding AG, Agilent Technologies, Aurora Biome, Bio-Rad, Hudson Robotics.

3. What are the main segments of the Lab Automation in Drug Discovery Industry?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations Leading to Device Miniaturization and Increased Throughput.

6. What are the notable trends driving market growth?

Automated Liquid Handlers are Expected to Account for the Largest Market Share.

7. Are there any restraints impacting market growth?

High Capital Requirements for Setup.

8. Can you provide examples of recent developments in the market?

March 2023: Eppendorf announced the release of the new generation of the epMotion automated liquid handler at the 2023 SLAS conference in San Diego, CA, USA. The epMotion offers unparalleled precision and accuracy in liquid handling, with a user-friendly interface and customizable protocols. The new design includes a sleek, compact form and improved ergonomics for comfortable and efficient use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Drug Discovery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Drug Discovery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Drug Discovery Industry?

To stay informed about further developments, trends, and reports in the Lab Automation in Drug Discovery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence