Key Insights

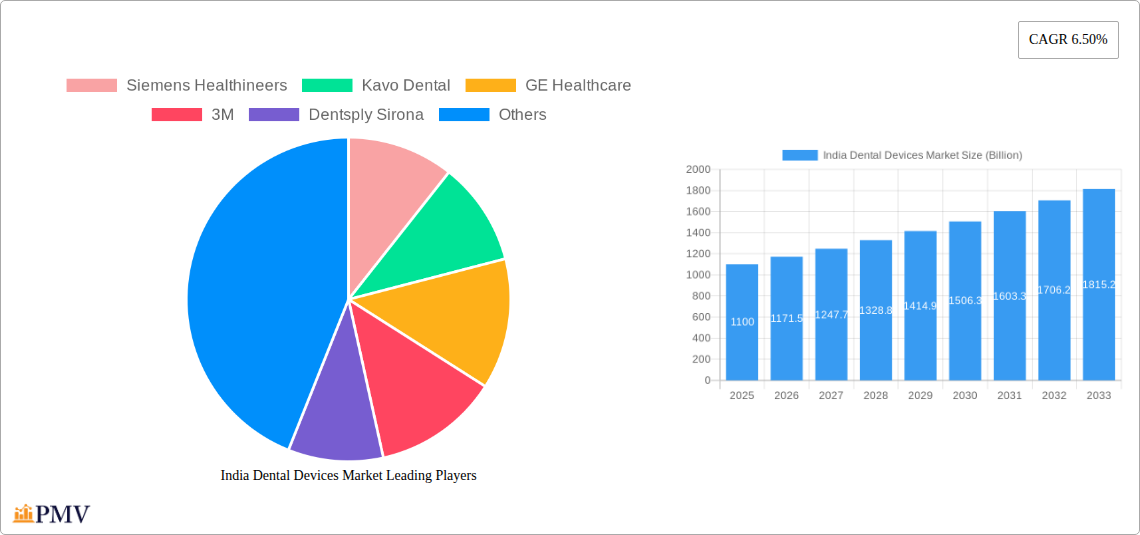

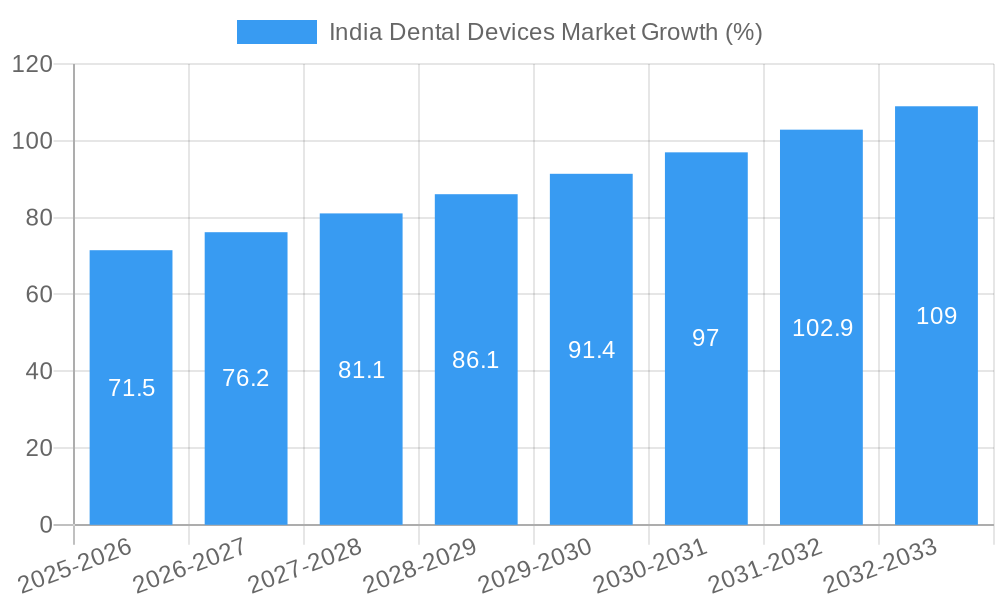

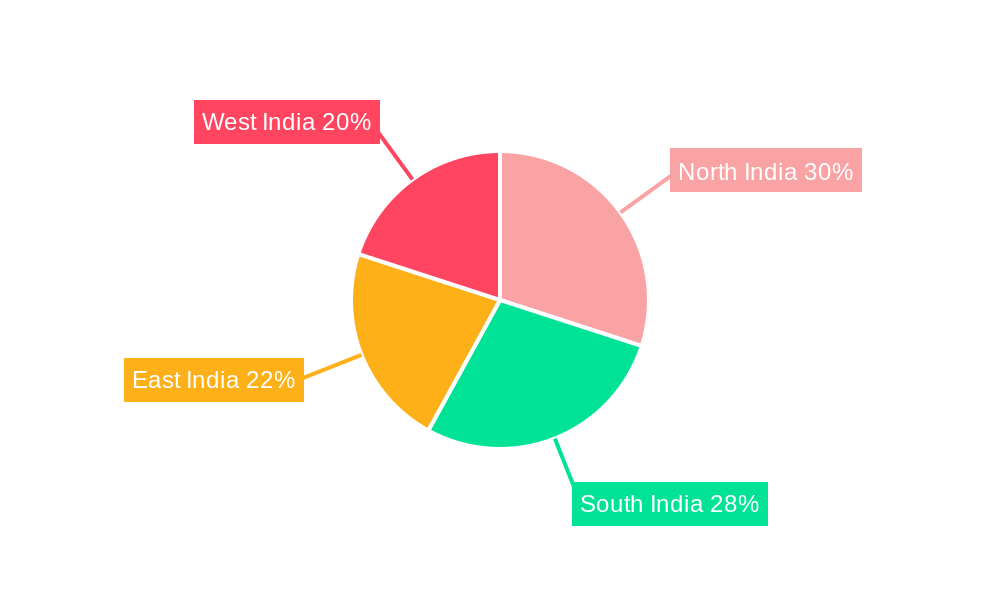

The India dental devices market is experiencing robust growth, projected to reach \$1.1 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes and increasing awareness of oral hygiene are driving demand for advanced dental treatments and technologies. Furthermore, the growing prevalence of dental diseases, coupled with a burgeoning middle class seeking better healthcare, significantly contributes to market growth. The government's initiatives to improve healthcare infrastructure and affordability also play a crucial role. The market is segmented by product type (dental lasers, general and diagnostic equipment, consumables, and other devices), treatment (orthodontic, endodontic, periodontic, and prosthodontic), and end-user (hospitals, clinics, and other). The segment of dental consumables is likely to show strong growth due to the increasing number of dental procedures. Key players like Siemens Healthineers, Dentsply Sirona, and 3M are leveraging technological advancements and strategic partnerships to consolidate their market share. Regional variations exist, with potentially faster growth in urban areas and states with higher healthcare spending compared to rural regions. However, challenges remain such as uneven distribution of dental professionals across the country and the high cost of advanced equipment limiting accessibility in certain regions.

The competitive landscape is characterized by the presence of both multinational corporations and domestic players. Multinational companies leverage their advanced technology and brand recognition, while domestic companies benefit from understanding local market dynamics and affordability concerns. Future growth is expected to be driven by technological advancements such as minimally invasive procedures, AI-powered diagnostic tools, and the integration of digital technologies into dental practices. The increasing adoption of dental insurance schemes could also contribute to market expansion by making dental care more accessible and affordable to a wider population. However, regulatory hurdles and pricing pressures could pose challenges for market participants. A deeper understanding of regional variations, coupled with innovative product development and strategic collaborations, will be crucial for success in this dynamic market.

This in-depth report provides a comprehensive analysis of the India dental devices market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a detailed view of market trends, competitive dynamics, and future growth potential. The market is estimated to be worth XX Billion in 2025 and is projected to experience significant growth over the forecast period.

India Dental Devices Market Market Structure & Competitive Dynamics

The Indian dental devices market is characterized by a moderately concentrated structure, with a few multinational corporations (MNCs) and several domestic players vying for market share. Key players include Siemens Healthineers, Kavo Dental, GE Healthcare, 3M, Dentsply Sirona, Philips Healthcare, Danaher Corporation, Osstem, Carestream Health, and Canon. Market share is currently dominated by MNCs, but domestic companies are increasingly gaining traction.

The regulatory framework, primarily governed by the Central Drugs Standard Control Organisation (CDSCO), plays a significant role in shaping the market. Innovation ecosystems are evolving, with a growing number of startups and research institutions contributing to new product development. Product substitutes, such as traditional dental practices, exist but are gradually being replaced by advanced technologies. End-user trends favor minimally invasive procedures and digital dentistry, while M&A activity in the market has been moderate, with deal values typically ranging from xx Billion to xx Billion.

- Market Concentration: Moderately concentrated, with MNCs holding a significant share.

- Innovation Ecosystem: Growing, driven by startups and research institutions.

- Regulatory Framework: Primarily governed by CDSCO.

- Product Substitutes: Traditional dental practices.

- End-User Trends: Preference for minimally invasive procedures and digital dentistry.

- M&A Activity: Moderate activity, with deal values ranging from xx Billion to xx Billion.

India Dental Devices Market Industry Trends & Insights

The India dental devices market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing awareness of oral hygiene, an expanding middle class, and the growing prevalence of dental diseases. Technological advancements, including the adoption of digital dentistry, CAD/CAM technology, and minimally invasive techniques, are also significantly impacting market growth. Consumer preferences are shifting towards advanced and aesthetically pleasing treatment options.

The market's competitive landscape is intense, with companies focusing on product innovation, strategic partnerships, and expansion into underserved regions to gain a competitive edge. The CAGR (Compound Annual Growth Rate) for the period 2019-2024 is estimated to be xx%, while market penetration is steadily increasing due to improved healthcare infrastructure and greater access to dental care. The forecast period (2025-2033) predicts even greater expansion, driven by sustained economic growth and continued advancements in dental technology.

Dominant Markets & Segments in India Dental Devices Market

By Product Type: General and diagnostic equipment dominates the market, driven by the increasing demand for advanced imaging systems, such as CBCT scanners and intraoral cameras. Dental consumables constitute a significant segment due to their recurring nature. The dental lasers segment is witnessing growth due to their minimally invasive nature and precise application. Other dental devices, including implants and orthodontic appliances, also show promising growth prospects.

By Treatment: Endodontic and restorative procedures comprise a substantial part of the market. The growing prevalence of dental caries and periodontal diseases drives demand for related products and services. Orthodontic treatments are witnessing a surge in demand among young adults, leading to significant market growth in this segment. Prosthodontic treatments, including the use of dental implants, are also increasingly popular.

By End User: Private dental clinics represent the largest end-user segment, given the higher concentration of dental practices in urban and semi-urban areas. Hospitals play a secondary role, primarily serving patients requiring complex dental procedures. Other end-users, such as dental labs and government healthcare institutions, contribute to overall market growth.

- Key Drivers: Rising disposable incomes, increasing dental awareness, expanding middle class, improved healthcare infrastructure, and technological advancements.

India Dental Devices Market Product Innovations

Recent innovations include the introduction of advanced dental lasers with improved precision and versatility, the development of sophisticated CAD/CAM systems for faster and more efficient restorations, and the introduction of biocompatible dental materials. These innovations enhance treatment efficacy, patient comfort, and aesthetic outcomes, driving market growth and shaping competitive dynamics. Technological trends such as AI-powered diagnostics and telehealth solutions are also gaining traction, improving accessibility and efficiency.

Report Segmentation & Scope

The report segments the India dental devices market based on product type (dental lasers, general & diagnostic equipment, dental consumables, other dental devices), treatment type (orthodontic, endodontic, periodontic, prosthodontic), and end-user (hospitals, clinics, other end users). Each segment's growth projections, market sizes (in Billion), and competitive dynamics are analyzed in detail. The report offers a granular view of the market's structure, providing insights into growth opportunities and potential challenges for each segment. For example, the dental consumables segment is expected to demonstrate steady growth due to recurring demand, while the dental lasers segment is projected to show rapid expansion due to technological advancements and growing preference for minimally invasive procedures. The competitive landscape varies across segments, reflecting the presence of both large multinational players and niche domestic manufacturers.

Key Drivers of India Dental Devices Market Growth

Several factors drive the growth of the India dental devices market. The rising prevalence of dental diseases coupled with increased awareness of oral hygiene among the population are key drivers. The expanding middle class with increasing disposable incomes fuels demand for advanced dental care. Technological advancements, such as the adoption of digital dentistry and minimally invasive procedures, further contribute to the market's expansion. Supportive government policies and initiatives promoting healthcare infrastructure development also play a crucial role in boosting market growth.

Challenges in the India Dental Devices Market Sector

Despite its growth potential, the India dental devices market faces several challenges. High import duties on certain dental devices increase costs for consumers and hinder market penetration. A shortage of skilled dental professionals in certain regions limits access to advanced treatments. Supply chain disruptions, especially in the wake of global events, can impact product availability and pricing. Intense competition from established players and new entrants also presents a challenge for market participants. The regulatory landscape, while evolving, can sometimes present hurdles for new product launches. Finally, affordability remains a significant barrier for a substantial portion of the population. These factors collectively contribute to the market's dynamic and evolving nature.

Leading Players in the India Dental Devices Market Market

- Siemens Healthineers

- Kavo Dental

- GE Healthcare

- 3M

- Dentsply Sirona

- Philips Healthcare

- Danaher Corporation

- Osstem

- Carestream Health

- Canon

Key Developments in India Dental Devices Market Sector

- November 2021: Prevest DenPro Limited launched three innovative biomaterials in the dental healthcare sector. This expands the availability of domestically produced, high-quality dental materials, reducing reliance on imports.

- August 2021: Vatech launched an e-commerce platform for selling and distributing dental supplies in India. This significantly enhances distribution channels and market accessibility, boosting overall market growth.

Strategic India Dental Devices Market Market Outlook

The India dental devices market presents significant growth opportunities for both domestic and international players. Continued investments in research and development, strategic partnerships, and expansion into underserved regions will be crucial for success. Focus on digital dentistry, minimally invasive procedures, and affordable solutions tailored to the specific needs of the Indian market will be key growth accelerators. The market's future trajectory is projected to be robust, driven by sustained economic growth, increasing healthcare spending, and ongoing technological advancements.

India Dental Devices Market Segmentation

-

1. Product

-

1.1. General and Diagnostic Equipment

-

1.1.1. Dental Lasers

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. All Tissue Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.1.1. Dental Lasers

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostic Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Periodontic

- 2.4. Prosthodontic

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

India Dental Devices Market Segmentation By Geography

- 1. India

India Dental Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Oral Diseases and Ageing Population; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. Excessive Costs of Treatment; Lack of Awareness Regarding Oral Health in Developing Countries like India

- 3.4. Market Trends

- 3.4.1. Radiology Equipment Segment Expected to Register High Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. All Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostic Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Periodontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North India India Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Siemens Healthineers

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kavo Dental

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GE Healthcare

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 3M

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dentsply Sirona

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Philips Healthcare

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Danaher Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Osstem

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Carestream Health

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Canon

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Siemens Healthineers

List of Figures

- Figure 1: India Dental Devices Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: India Dental Devices Market Share (%) by Company 2024

List of Tables

- Table 1: India Dental Devices Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: India Dental Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Dental Devices Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 4: India Dental Devices Market Volume K Units Forecast, by Product 2019 & 2032

- Table 5: India Dental Devices Market Revenue Billion Forecast, by Treatment 2019 & 2032

- Table 6: India Dental Devices Market Volume K Units Forecast, by Treatment 2019 & 2032

- Table 7: India Dental Devices Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 8: India Dental Devices Market Volume K Units Forecast, by End User 2019 & 2032

- Table 9: India Dental Devices Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 10: India Dental Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: India Dental Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 12: India Dental Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: North India India Dental Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: North India India Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: South India India Dental Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: South India India Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: East India India Dental Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: East India India Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: West India India Dental Devices Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: West India India Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: India Dental Devices Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 22: India Dental Devices Market Volume K Units Forecast, by Product 2019 & 2032

- Table 23: India Dental Devices Market Revenue Billion Forecast, by Treatment 2019 & 2032

- Table 24: India Dental Devices Market Volume K Units Forecast, by Treatment 2019 & 2032

- Table 25: India Dental Devices Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 26: India Dental Devices Market Volume K Units Forecast, by End User 2019 & 2032

- Table 27: India Dental Devices Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 28: India Dental Devices Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Dental Devices Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the India Dental Devices Market?

Key companies in the market include Siemens Healthineers, Kavo Dental, GE Healthcare, 3M, Dentsply Sirona, Philips Healthcare, Danaher Corporation, Osstem, Carestream Health, Canon.

3. What are the main segments of the India Dental Devices Market?

The market segments include Product, Treatment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.1 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Oral Diseases and Ageing Population; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

Radiology Equipment Segment Expected to Register High Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Excessive Costs of Treatment; Lack of Awareness Regarding Oral Health in Developing Countries like India.

8. Can you provide examples of recent developments in the market?

In November 2021, Jammu-based dental materials manufacturer Prevest DenPro Limited launched three innovative biomaterials in the dental health care sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Dental Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Dental Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Dental Devices Market?

To stay informed about further developments, trends, and reports in the India Dental Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence