Key Insights

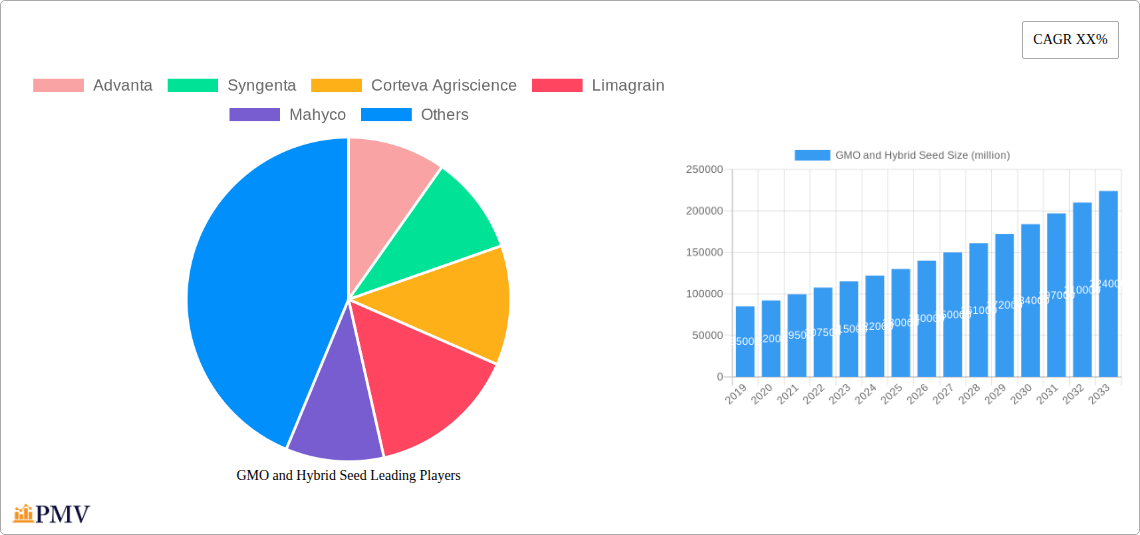

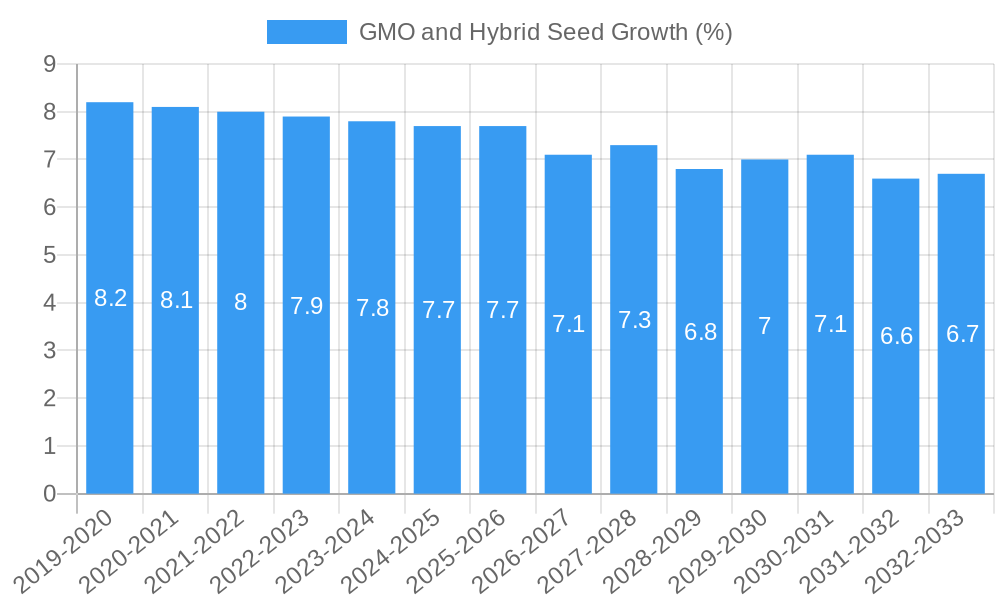

The global GMO and Hybrid Seed market is experiencing robust expansion, projected to reach an estimated market size of USD 120 billion by 2025. This significant growth is fueled by a compound annual growth rate (CAGR) of approximately 8%, indicating a dynamic and expanding industry. Key drivers include the escalating demand for enhanced crop yields to meet the needs of a growing global population, coupled with the increasing adoption of advanced agricultural technologies. Farmers are increasingly recognizing the benefits of hybrid seeds for their superior vigor, adaptability, and disease resistance, while genetically modified (GM) seeds offer advantages like pest resistance, herbicide tolerance, and improved nutritional content, all contributing to greater agricultural efficiency and sustainability. The market is further propelled by government initiatives promoting agricultural modernization and research and development in seed technology.

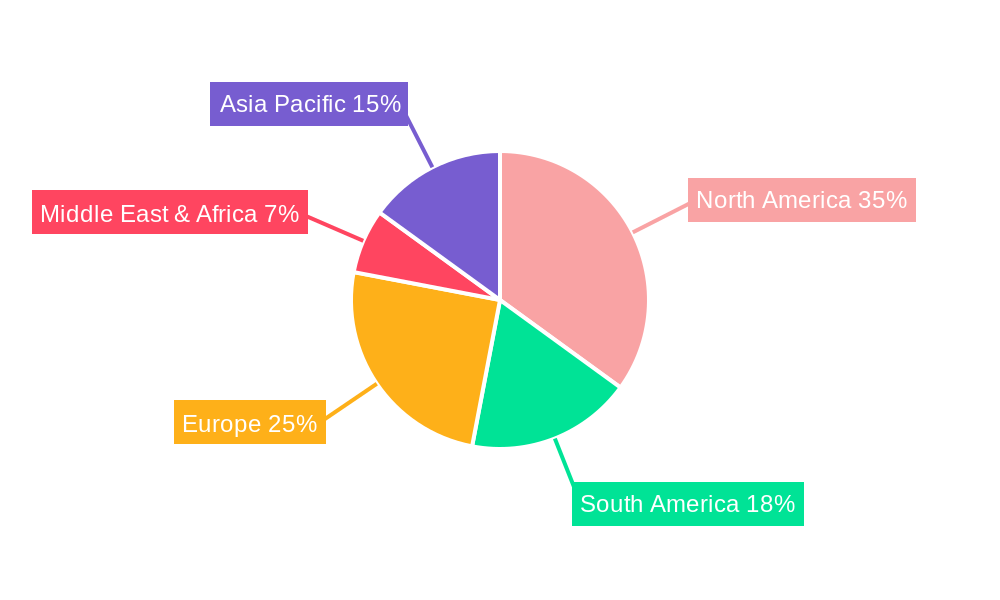

The market's trajectory is marked by several prominent trends, including the rise of climate-resilient seed varieties designed to withstand adverse weather conditions and the growing interest in seeds with enhanced nutritional profiles to combat malnutrition. Biotechnology advancements are continuously introducing novel traits, expanding the application scope of these seeds beyond traditional crops. However, the market also faces certain restraints, such as stringent regulatory frameworks and public perception concerns surrounding genetically modified organisms, particularly in certain regions. Despite these challenges, the pervasive need for food security and increased agricultural productivity ensures a strong underlying demand. The market is segmented by application, with Farmland holding the dominant share, and by type, with Vegetable seeds showing significant traction alongside Fruit and Flower seeds. Geographically, Asia Pacific, driven by large agricultural economies like China and India, is expected to be a major growth engine, while North America and Europe remain crucial markets with high adoption rates of advanced seed technologies.

SEO-Optimized Report Description: Global GMO and Hybrid Seed Market Analysis 2019-2033

Gain unparalleled insights into the global GMO and hybrid seed market with this comprehensive report, covering a study period from 2019 to 2033, with a base year of 2025 and a robust forecast period from 2025 to 2033. Our analysis delves deep into the intricate landscape of genetically modified seeds and hybrid crop varieties, providing actionable intelligence for stakeholders across the agricultural technology sector. This report is essential for understanding market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. Discover growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the future of seed technology.

We meticulously segment the market by application, including Farmland, Greenhouse, and Other, and by product type, such as Vegetable seeds, Fruit seeds, Flower seeds, and Other seed types. This report highlights dominant markets and segments, offering detailed analysis of regional and country-specific growth, supported by economic policies and infrastructure development. Uncover groundbreaking product innovations, emerging applications, and competitive advantages in the biotechnology seed space. Furthermore, we pinpoint the key drivers of agriculture seed growth, including technological advancements, economic factors, and evolving regulatory landscapes, alongside critical challenges such as regulatory hurdles, supply chain complexities, and intense competitive pressures.

This in-depth market intelligence report features insights from leading players like Advanta, Syngenta, Corteva Agriscience, Limagrain, Mahyco, Brightseed, Pairwise, Inari, Nuziveedu Seeds, and Biome Makers. We track significant seed industry developments, including product launches, R&D breakthroughs, and strategic partnerships. Our strategic market outlook provides a clear roadmap for navigating the evolving seed market, identifying growth accelerators and future opportunities in advanced seed technology. With millions of dollars in market valuations and projected growth, this report is your definitive guide to the GMO and hybrid seed industry.

GMO and Hybrid Seed Market Structure & Competitive Dynamics

The global GMO and hybrid seed market exhibits a dynamic structure characterized by moderate to high concentration among established multinational corporations, alongside a growing number of innovative startups. Key players like Syngenta and Corteva Agriscience command significant market share, estimated at over 15% each, driven by extensive R&D investments and broad product portfolios. Advanta and Limagrain also hold substantial positions, contributing to an innovation ecosystem that constantly pushes the boundaries of seed technology. Regulatory frameworks, particularly concerning gene editing and trait approvals, significantly influence market entry and product development, creating both opportunities and barriers. Product substitutes, such as conventional seeds with improved breeding techniques and organic alternatives, are present but often struggle to match the yield and resilience benefits offered by advanced GMO and hybrid varieties. End-user trends indicate a growing demand for seeds with enhanced nutritional profiles, pest resistance, and climate adaptability, particularly in large-scale Farmland applications. M&A activities are prevalent, with multi-million dollar deals focused on acquiring novel traits and expanding geographic reach. For instance, recent acquisitions have focused on gene-editing technologies, with deal values reaching hundreds of millions of dollars, consolidating market power and fostering specialized innovation.

- Market Concentration: Dominated by a few key players, but with increasing influence from specialized biotech firms.

- Innovation Ecosystems: Driven by significant R&D spending on traits like herbicide tolerance and disease resistance.

- Regulatory Frameworks: Varying by region, impacting the speed of new product introductions and market access.

- Product Substitutes: Conventional seeds and organic farming practices offer alternatives, albeit with differing yield expectations.

- End-User Trends: Growing demand for seeds that improve farm efficiency, reduce crop loss, and offer enhanced consumer benefits.

- M&A Activities: Strategic acquisitions and partnerships are common to secure intellectual property and market access, with deal values often in the millions.

GMO and Hybrid Seed Industry Trends & Insights

The GMO and hybrid seed industry is on a robust growth trajectory, driven by a confluence of factors including the increasing global population, the need for enhanced food security, and the imperative to improve agricultural productivity in the face of climate change. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% from 2025 to 2033. Technological disruptions are at the forefront, with advancements in gene editing technologies like CRISPR-Cas9 enabling the development of crops with precise traits, such as drought tolerance, improved nutrient content, and enhanced pest resistance, at an unprecedented pace. This has led to a significant increase in the market penetration of genetically modified seeds and hybrid seed varieties in key agricultural regions. Consumer preferences are evolving, with a growing interest in seeds that contribute to healthier diets and more sustainable farming practices. While concerns about GMOs persist in certain demographics, there is a growing acceptance of crops engineered for specific benefits. Competitive dynamics are characterized by intense R&D investment, strategic alliances, and a focus on intellectual property protection. Companies are investing heavily in digital agriculture solutions that integrate seed technology with precision farming tools, further optimizing crop yields and resource management. The expansion of Greenhouse agriculture, demanding specialized seeds for controlled environments, is also a significant growth driver, offering higher value opportunities. The development of non-browning fruits and vegetables, and seeds engineered for increased shelf-life, are also gaining traction, catering to a desire for reduced food waste and improved convenience. Furthermore, the ongoing development of biofortified crops, designed to address micronutrient deficiencies in populations, represents a substantial social and economic opportunity, driving adoption of specific seed types. The increasing adoption of these advanced seeds in staple crops like corn, soybeans, and cotton is a testament to their proven efficacy in boosting yields and farmer profitability. This, coupled with favorable government policies in several emerging economies, is accelerating market expansion. The competitive landscape is also seeing increased activity from biotechnology startups focusing on niche applications and novel gene-editing techniques, challenging established players and driving further innovation. The overall outlook for the seed technology market remains highly positive, underpinned by sustained demand for agricultural efficiency and innovation.

Dominant Markets & Segments in GMO and Hybrid Seed

The GMO and hybrid seed market demonstrates clear dominance in specific regions and application segments, largely influenced by economic policies, robust agricultural infrastructure, and established farming practices. The Farmland application segment overwhelmingly leads the market, accounting for an estimated 85% of the total market value. This dominance is driven by the scale of global agricultural operations, particularly in major crop producing nations. Key drivers within this segment include government subsidies for adopting advanced agricultural technologies, the need for high-yield crops to meet global food demand, and the proven economic benefits of using genetically modified seeds and hybrid seed varieties for large-scale cultivation. Countries like the United States, Brazil, Argentina, and China are major contributors to this dominance, boasting extensive land under cultivation and significant investment in agricultural R&D.

In terms of crop types, Vegetable seeds represent the second-largest segment, holding approximately 10% of the market, with significant growth potential driven by urbanization and a rising demand for diverse and nutritious food options. Fruit seeds, though smaller in market share (around 3%), are experiencing rapid growth, particularly in regions with a strong horticulture sector and increasing export markets. The Flower seeds segment, while niche, is also experiencing steady growth, driven by the ornamental horticulture industry and increased consumer spending on home gardening.

The Greenhouse application segment, though smaller in overall market share, is a high-growth area, expected to expand at a CAGR of over 7% in the forecast period. This growth is fueled by increasing adoption of protected agriculture techniques to ensure consistent yields and quality, especially in regions with challenging climatic conditions or limited arable land. Economic policies that support the development of modern agricultural infrastructure, including advanced irrigation systems and controlled environment agriculture facilities, are crucial for the expansion of this segment. The development of specialized hybrid seed varieties tailored for greenhouse cultivation, offering specific growth characteristics and disease resistance, is a key factor. For instance, seed companies are developing varieties that are optimized for vertical farming systems, further diversifying the market. The overall dominance of the Farmland segment is expected to continue, but the rapid expansion of Greenhouse applications and the increasing demand for specialty fruit seeds and vegetable seeds with enhanced traits are diversifying the market's growth drivers.

GMO and Hybrid Seed Product Innovations

The GMO and hybrid seed market is characterized by continuous product innovation, driven by the need to enhance crop yields, improve nutritional content, and develop resistance to environmental stresses and pests. Companies are investing heavily in traits such as herbicide tolerance, insect resistance (e.g., Bt crops), and enhanced drought and salt tolerance, directly impacting agricultural productivity. Recent breakthroughs in gene editing technologies like CRISPR-Cas9 are enabling faster and more precise development of these traits, leading to the introduction of novel vegetable seeds and fruit seeds with extended shelf-life and improved flavor profiles. These advancements not only offer competitive advantages to seed producers but also contribute to reduced pesticide usage and improved food quality, aligning with growing consumer and regulatory demands for sustainable agriculture.

Report Segmentation & Scope

This comprehensive report segments the global GMO and hybrid seed market across key applications and product types, providing granular insights into each segment's growth dynamics and market size.

Application Segments:

- Farmland: This segment is the largest, encompassing large-scale agricultural operations. It is projected to reach a market size of over $25 million by 2025, with a steady CAGR of approximately 6.2%. Key drivers include the demand for high yields and efficient crop management.

- Greenhouse: This segment focuses on seeds for controlled environment agriculture. It is a high-growth area, estimated to reach over $3 million by 2025, with a projected CAGR of 7.5%. Innovations in seeds optimized for greenhouse conditions are fueling this growth.

- Other: This segment includes seeds for non-agricultural uses or niche applications, estimated at under $1 million, with modest growth projections.

Type Segments:

- Vegetable Seeds: A significant segment, projected to reach over $2 million by 2025, driven by increasing consumer demand for diverse and nutritious produce.

- Fruit Seeds: Experiencing robust growth, projected to reach over $1.5 million by 2025, with a CAGR of 7.0%, driven by demand for specialty fruits and improved cultivation techniques.

- Flower Seeds: A smaller but steady segment, estimated at under $0.5 million, catering to the ornamental horticulture and home gardening markets.

- Other: This category includes oilseeds, fiber crops, and forage seeds, contributing significantly to the overall market value, estimated at over $22 million by 2025.

Key Drivers of GMO and Hybrid Seed Growth

The GMO and hybrid seed market growth is propelled by several pivotal factors, ensuring sustained expansion and innovation within the agricultural technology sector. The relentless increase in global population necessitates higher crop yields and improved agricultural productivity, making genetically modified seeds and hybrid seed varieties essential for food security. Technological advancements, particularly in gene editing and marker-assisted selection, are continuously enabling the development of seeds with enhanced traits such as pest resistance, herbicide tolerance, and improved nutritional profiles, thereby boosting efficiency and reducing crop losses. Favorable government policies and initiatives in many countries, aimed at promoting modern agricultural practices and food production, further accelerate market adoption. Economic factors, including rising disposable incomes in emerging markets, have led to increased consumer demand for a wider variety of high-quality produce, driving the market for specialty vegetable seeds and fruit seeds. Additionally, the growing awareness and adoption of precision agriculture techniques, which are often integrated with advanced seed technologies, contribute to optimizing resource utilization and maximizing farm output.

Challenges in the GMO and Hybrid Seed Sector

Despite the robust growth, the GMO and hybrid seed sector faces several significant challenges that can impede market expansion and require strategic mitigation. Stringent and varying regulatory frameworks across different countries pose a substantial hurdle for the commercialization of new GMO traits and hybrid varieties, often leading to lengthy approval processes and increased R&D costs. Public perception and consumer acceptance of genetically modified organisms (GMOs) remain a concern in certain regions, necessitating extensive consumer education campaigns and transparent communication about the benefits and safety of these technologies. Supply chain disruptions, though less common for seeds, can arise from extreme weather events or global logistical challenges, impacting the availability and distribution of specialized seed types. Intense competition among major players and emerging startups also pressures profit margins and necessitates continuous innovation and cost-efficiency. Furthermore, intellectual property protection for novel traits and breeding techniques is critical, but enforcement can be challenging, potentially limiting investment in future research and development.

Leading Players in the GMO and Hybrid Seed Market

- Advanta

- Syngenta

- Corteva Agriscience

- Limagrain

- Mahyco

- Brightseed

- Pairwise

- Inari

- Nuziveedu Seeds

- Biome Makers

Key Developments in GMO and Hybrid Seed Sector

- 2023 September: Syngenta launched new vegetable seeds with enhanced disease resistance, targeting the European greenhouse market.

- 2023 August: Corteva Agriscience announced a strategic partnership with a leading agricultural research institute to accelerate the development of drought-tolerant corn seeds.

- 2023 July: Advanta expanded its portfolio of hybrid seed varieties for oilseeds in the South Asian market.

- 2023 May: Limagrain invested heavily in R&D for gene-edited fruit seeds with improved shelf-life and nutritional value.

- 2023 April: Mahyco received regulatory approval for a new GMO trait in staple crops in an emerging market.

- 2023 March: Brightseed utilized AI to identify novel traits for flower seeds with unique color patterns.

- 2023 February: Pairwise showcased progress in developing gene-edited leafy green vegetables for controlled environments.

- 2023 January: Inari secured significant funding to advance its platform for accelerating hybrid seed development.

- 2022 December: Nuziveedu Seeds reported strong sales for its advanced cotton seeds in the Indian subcontinent.

- 2022 November: Biome Makers launched a new microbial solution to enhance nutrient uptake for Farmland crops, complementing seed performance.

Strategic GMO and Hybrid Seed Market Outlook

The strategic outlook for the GMO and hybrid seed market is overwhelmingly positive, driven by innovation and increasing global demand for efficient and sustainable agriculture. Growth accelerators include the continued adoption of gene editing technologies for faster trait development, the expansion of Greenhouse and vertical farming applications requiring specialized seeds, and the rising consumer preference for healthier and more resilient crops. Companies focusing on biofortification and climate-resilient traits are poised for significant growth, aligning with global food security and sustainability agendas. Strategic opportunities lie in expanding into emerging markets with favorable regulatory environments, forming strategic alliances to leverage complementary technologies, and investing in digital agriculture platforms that integrate advanced seed solutions. The market's trajectory suggests a future where biotechnology seed innovation plays an even more critical role in meeting the world's agricultural needs.

GMO and Hybrid Seed Segmentation

-

1. Application

- 1.1. Farmland

- 1.2. Greenhouse

- 1.3. Other

-

2. Types

- 2.1. Vegetable

- 2.2. Fruit

- 2.3. Flowers

- 2.4. Other

GMO and Hybrid Seed Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GMO and Hybrid Seed REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GMO and Hybrid Seed Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Farmland

- 5.1.2. Greenhouse

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Vegetable

- 5.2.2. Fruit

- 5.2.3. Flowers

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America GMO and Hybrid Seed Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Farmland

- 6.1.2. Greenhouse

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Vegetable

- 6.2.2. Fruit

- 6.2.3. Flowers

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America GMO and Hybrid Seed Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Farmland

- 7.1.2. Greenhouse

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Vegetable

- 7.2.2. Fruit

- 7.2.3. Flowers

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe GMO and Hybrid Seed Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Farmland

- 8.1.2. Greenhouse

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Vegetable

- 8.2.2. Fruit

- 8.2.3. Flowers

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa GMO and Hybrid Seed Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Farmland

- 9.1.2. Greenhouse

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Vegetable

- 9.2.2. Fruit

- 9.2.3. Flowers

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific GMO and Hybrid Seed Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Farmland

- 10.1.2. Greenhouse

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Vegetable

- 10.2.2. Fruit

- 10.2.3. Flowers

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Advanta

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Syngenta

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Corteva Agriscience

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Limagrain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mahyco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brightseed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pairwise

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inari

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nuziveedu Seeds

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biome Makers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Advanta

List of Figures

- Figure 1: Global GMO and Hybrid Seed Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America GMO and Hybrid Seed Revenue (million), by Application 2024 & 2032

- Figure 3: North America GMO and Hybrid Seed Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America GMO and Hybrid Seed Revenue (million), by Types 2024 & 2032

- Figure 5: North America GMO and Hybrid Seed Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America GMO and Hybrid Seed Revenue (million), by Country 2024 & 2032

- Figure 7: North America GMO and Hybrid Seed Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America GMO and Hybrid Seed Revenue (million), by Application 2024 & 2032

- Figure 9: South America GMO and Hybrid Seed Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America GMO and Hybrid Seed Revenue (million), by Types 2024 & 2032

- Figure 11: South America GMO and Hybrid Seed Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America GMO and Hybrid Seed Revenue (million), by Country 2024 & 2032

- Figure 13: South America GMO and Hybrid Seed Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe GMO and Hybrid Seed Revenue (million), by Application 2024 & 2032

- Figure 15: Europe GMO and Hybrid Seed Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe GMO and Hybrid Seed Revenue (million), by Types 2024 & 2032

- Figure 17: Europe GMO and Hybrid Seed Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe GMO and Hybrid Seed Revenue (million), by Country 2024 & 2032

- Figure 19: Europe GMO and Hybrid Seed Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa GMO and Hybrid Seed Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa GMO and Hybrid Seed Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa GMO and Hybrid Seed Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa GMO and Hybrid Seed Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa GMO and Hybrid Seed Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa GMO and Hybrid Seed Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific GMO and Hybrid Seed Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific GMO and Hybrid Seed Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific GMO and Hybrid Seed Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific GMO and Hybrid Seed Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific GMO and Hybrid Seed Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific GMO and Hybrid Seed Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GMO and Hybrid Seed Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global GMO and Hybrid Seed Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global GMO and Hybrid Seed Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global GMO and Hybrid Seed Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global GMO and Hybrid Seed Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global GMO and Hybrid Seed Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global GMO and Hybrid Seed Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global GMO and Hybrid Seed Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global GMO and Hybrid Seed Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global GMO and Hybrid Seed Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global GMO and Hybrid Seed Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global GMO and Hybrid Seed Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global GMO and Hybrid Seed Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global GMO and Hybrid Seed Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global GMO and Hybrid Seed Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global GMO and Hybrid Seed Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global GMO and Hybrid Seed Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global GMO and Hybrid Seed Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global GMO and Hybrid Seed Revenue million Forecast, by Country 2019 & 2032

- Table 41: China GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific GMO and Hybrid Seed Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GMO and Hybrid Seed?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the GMO and Hybrid Seed?

Key companies in the market include Advanta, Syngenta, Corteva Agriscience, Limagrain, Mahyco, Brightseed, Pairwise, Inari, Nuziveedu Seeds, Biome Makers.

3. What are the main segments of the GMO and Hybrid Seed?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GMO and Hybrid Seed," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GMO and Hybrid Seed report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GMO and Hybrid Seed?

To stay informed about further developments, trends, and reports in the GMO and Hybrid Seed, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence