Key Insights

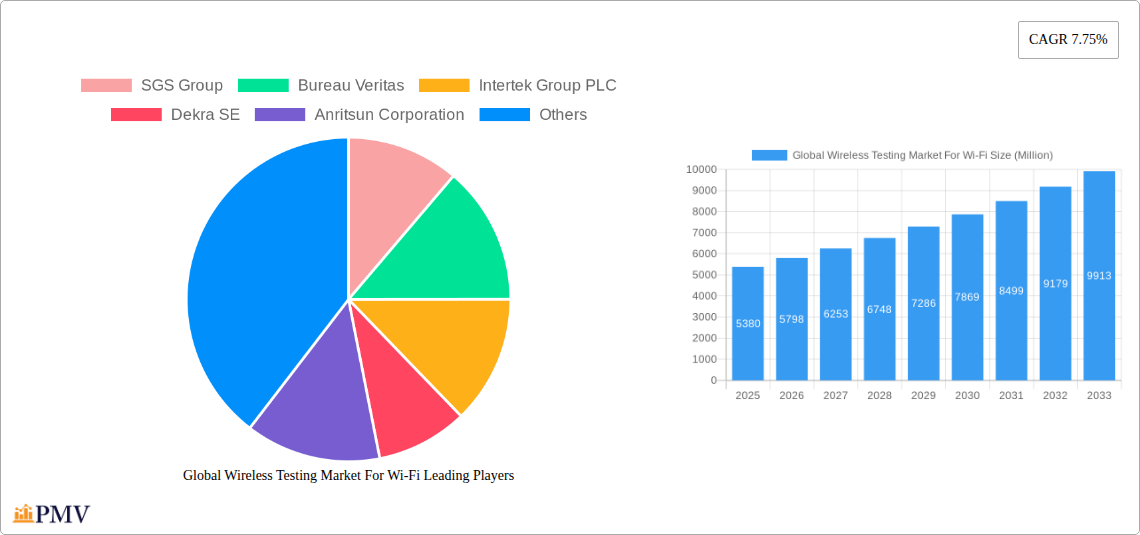

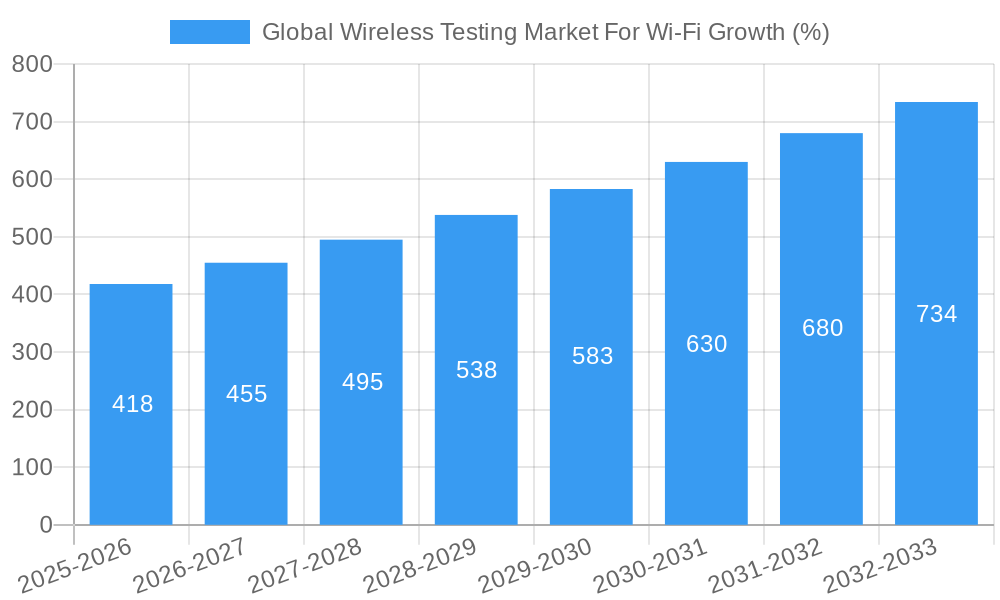

The global wireless testing market for Wi-Fi, valued at $5.38 billion in 2025, is projected to experience robust growth, driven by the expanding adoption of Wi-Fi 6 and 6E technologies, the proliferation of IoT devices, and increasing demand for high-speed, reliable wireless connectivity across various sectors. The market's Compound Annual Growth Rate (CAGR) of 7.75% from 2025 to 2033 indicates a significant expansion, fueled by continuous technological advancements and the growing need for rigorous testing to ensure the performance and security of Wi-Fi networks. Key players like SGS Group, Bureau Veritas, and Intertek Group PLC are leveraging their expertise in testing and certification to cater to this rising demand. Furthermore, the increasing complexity of Wi-Fi networks, particularly in enterprise and industrial settings, is driving the demand for sophisticated testing solutions. This includes comprehensive testing for throughput, latency, security vulnerabilities, and interoperability across diverse devices and environments.

The market segmentation is likely diversified across various testing types (e.g., conformance, performance, security), deployment models (on-premise, cloud-based), and end-user industries (telecom, consumer electronics, enterprise). Geographic expansion is also expected, with developing economies showing strong growth potential due to rising smartphone and internet penetration. However, challenges remain, including the high cost of advanced testing equipment and the need for skilled professionals to operate these technologies. Nevertheless, the overall market outlook remains positive, with significant growth opportunities for companies offering innovative and comprehensive Wi-Fi testing solutions. The ongoing development of new Wi-Fi standards and the expanding applications of wireless technologies will further contribute to the market's expansion in the coming years.

Global Wireless Testing Market for Wi-Fi: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Global Wireless Testing Market for Wi-Fi, covering market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages data from the historical period (2019-2024) to forecast market trends from 2025-2033. This report is designed for industry professionals, investors, and researchers seeking actionable insights into this rapidly evolving market.

Global Wireless Testing Market For Wi-Fi Market Structure & Competitive Dynamics

The global wireless testing market for Wi-Fi is characterized by a moderately concentrated landscape with several key players vying for market share. Market concentration is influenced by factors such as economies of scale, technological expertise, and global reach. The market witnesses continuous innovation, driven by advancements in Wi-Fi technologies (like Wi-Fi 6E and Wi-Fi 7) and the growing demand for high-speed, reliable wireless connectivity across various sectors. Stringent regulatory frameworks, particularly concerning spectrum allocation and device certification, shape market dynamics. Product substitutes, such as wired Ethernet connections, exist but are often limited by practical constraints in several applications. End-user trends, focusing on increased device interconnectivity and reliance on wireless technologies, significantly drive market growth. Mergers and acquisitions (M&A) activities play a significant role in shaping the market structure, with larger players often acquiring smaller firms to enhance their technological capabilities and market reach. Deal values vary widely, with some exceeding xx Million, representing significant investments in market expansion.

- Market Share: Key players such as SGS Group, Bureau Veritas, and Intertek Group PLC hold substantial market shares, estimated to range from xx% to xx% in 2025. Smaller players like Anritsu Corporation and Keysight Technologies also contribute significantly.

- M&A Activity: The past five years have witnessed an average of xx M&A deals annually in this sector, with total deal values fluctuating between xx Million and xx Million, showcasing industry consolidation.

Global Wireless Testing Market For Wi-Fi Industry Trends & Insights

The global wireless testing market for Wi-Fi is experiencing robust growth, driven primarily by the escalating adoption of smart devices, the proliferation of the Internet of Things (IoT), and the increasing demand for high-bandwidth applications. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, indicating significant market expansion. Technological disruptions, particularly the emergence of Wi-Fi 6E and Wi-Fi 7, are key growth drivers, pushing the need for updated testing solutions. Consumer preferences are shifting towards faster, more reliable, and secure wireless connections, creating a strong impetus for robust testing methodologies. Competitive dynamics are marked by ongoing innovation, strategic partnerships, and M&A activity, further intensifying the market's growth trajectory. Market penetration of Wi-Fi testing solutions is expected to reach xx% by 2033, reflecting the widespread adoption across diverse sectors.

Dominant Markets & Segments in Global Wireless Testing Market For Wi-Fi

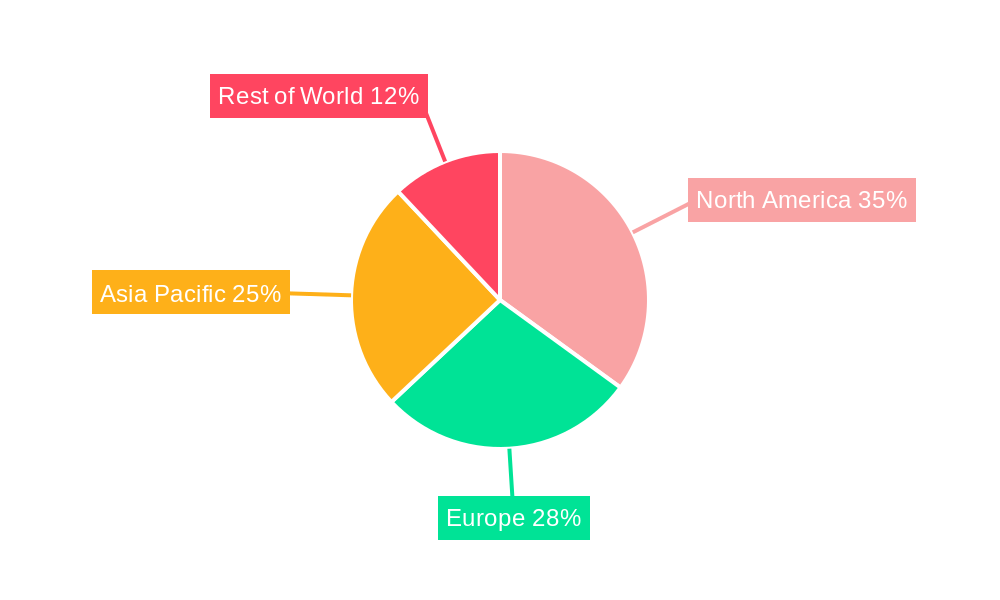

North America currently holds a dominant position in the global wireless testing market for Wi-Fi. This dominance can be attributed to several key factors:

- Strong Technological Innovation: The region is a hub for technological advancements in wireless communication, driving the demand for sophisticated testing solutions.

- High Adoption of Wireless Technologies: The extensive use of Wi-Fi across various sectors, including residential, commercial, and industrial applications, creates a large market for testing services.

- Favorable Regulatory Environment: A supportive regulatory framework fosters innovation and investment in the sector.

- Robust Infrastructure: The region boasts well-developed infrastructure, facilitating the deployment and testing of wireless technologies.

Detailed dominance analysis indicates a significant market share for North America, with a projected xx% of the global market in 2025, expected to maintain its leadership in the coming years.

Global Wireless Testing Market For Wi-Fi Product Innovations

Recent product developments showcase a strong focus on high-throughput testing solutions tailored for advanced Wi-Fi standards like Wi-Fi 7. The introduction of advanced network emulators and protocol analyzers with support for multiple communication technologies highlights a key trend towards integrated, versatile testing platforms. These innovations address the challenges of testing complex Wi-Fi networks while providing detailed insights into network performance and security. The market fit for these advanced solutions is strong, driven by the growing complexity of modern wireless networks.

Report Segmentation & Scope

The report segments the market by several parameters, including technology (Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7, and others), application (consumer electronics, enterprise networks, industrial IoT), service type (conformance testing, interoperability testing, performance testing, security testing), and region (North America, Europe, Asia Pacific, Middle East & Africa, South America). Each segment offers unique growth projections, with the Wi-Fi 7 segment anticipated to exhibit the fastest growth due to increasing adoption and the associated need for comprehensive testing. Competitive dynamics within each segment vary, with some characterized by intense competition and others by niche players. Market sizes for each segment are provided in the complete report.

Key Drivers of Global Wireless Testing Market For Wi-Fi Growth

Several key factors are propelling the growth of the global wireless testing market for Wi-Fi. Firstly, the continuous evolution of Wi-Fi standards, introducing higher speeds and functionalities (like Wi-Fi 6E and Wi-Fi 7), necessitates advanced testing solutions. Secondly, the exponential growth of the IoT and the increasing reliance on wireless communication across various sectors (consumer electronics, automotive, healthcare) are boosting the demand for rigorous testing procedures. Lastly, stringent regulatory requirements for device certification and network compliance further drive market growth.

Challenges in the Global Wireless Testing Market For Wi-Fi Sector

The global wireless testing market for Wi-Fi faces several challenges. Regulatory complexities and evolving compliance standards across different regions add to the cost and complexity of testing. Supply chain disruptions can impact the availability of testing equipment and services. Furthermore, intense competition among established players and the emergence of new entrants pose a challenge to market participants. These challenges, if not properly managed, could potentially reduce the market CAGR by xx% over the forecast period.

Leading Players in the Global Wireless Testing Market For Wi-Fi Market

- SGS Group

- Bureau Veritas

- Intertek Group PLC

- Dekra SE

- Anritsu Corporation

- Keysight Technologies

- eInfochips (Arrow Electronics)

- Rohde & Schwarz GmbH & Co KG

- VIAVI Solutions Inc

- *List Not Exhaustive

Key Developments in Global Wireless Testing Market For Wi-Fi Sector

- May 2024: Teledyne LeCroy launches the Frontline X500e wireless protocol analyzer with Wi-Fi 7 capabilities, expanding testing options for network professionals.

- May 2024: Northeastern University's Open6G OTIC provides comprehensive testing and integration solutions for Open RAN, supporting the growth of open-source wireless technologies.

- April 2024: The U.S. National Science Foundation allocates USD 7 Million to enhance PAWR testbeds for O-RAN testing, boosting open-source innovation.

- February 2024: Keysight Technologies launches the E7515W UXM Wireless Connectivity Test Platform for Wi-Fi 7, providing a streamlined approach to testing this advanced standard.

Strategic Global Wireless Testing Market For Wi-Fi Market Outlook

The global wireless testing market for Wi-Fi is poised for continued growth, driven by technological advancements, the expansion of the IoT, and increasing demand for high-speed wireless connectivity. Strategic opportunities exist for companies that can adapt to evolving standards, offer comprehensive testing solutions, and leverage partnerships to expand their reach. Focus on integrating Artificial Intelligence (AI) and Machine Learning (ML) into testing platforms will be crucial for improved efficiency and accuracy. The market's future potential is significant, with substantial opportunities for innovation and expansion across various sectors.

Global Wireless Testing Market For Wi-Fi Segmentation

-

1. Offering

-

1.1. Equipment

- 1.1.1. Wireless Device Testing

- 1.1.2. Wireless Network Testing

- 1.2. Services

-

1.1. Equipment

-

2. Application Area

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunication

- 2.4. Energy & Power

- 2.5. Other Ap

Global Wireless Testing Market For Wi-Fi Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia

- 5. New Zealand

- 6. Latin America

- 7. Middle East and Africa

Global Wireless Testing Market For Wi-Fi REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Proliferation of wireless devices; Advancements in wireless technology (including Wi-Fi 5

- 3.2.2 6 & 7); Rising demand for high-speed connectivity

- 3.3. Market Restrains

- 3.3.1 Proliferation of wireless devices; Advancements in wireless technology (including Wi-Fi 5

- 3.3.2 6 & 7); Rising demand for high-speed connectivity

- 3.4. Market Trends

- 3.4.1. Rising demand for high-speed connectivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Equipment

- 5.1.1.1. Wireless Device Testing

- 5.1.1.2. Wireless Network Testing

- 5.1.2. Services

- 5.1.1. Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application Area

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunication

- 5.2.4. Energy & Power

- 5.2.5. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia

- 5.3.5. New Zealand

- 5.3.6. Latin America

- 5.3.7. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Equipment

- 6.1.1.1. Wireless Device Testing

- 6.1.1.2. Wireless Network Testing

- 6.1.2. Services

- 6.1.1. Equipment

- 6.2. Market Analysis, Insights and Forecast - by Application Area

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. IT & Telecommunication

- 6.2.4. Energy & Power

- 6.2.5. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Equipment

- 7.1.1.1. Wireless Device Testing

- 7.1.1.2. Wireless Network Testing

- 7.1.2. Services

- 7.1.1. Equipment

- 7.2. Market Analysis, Insights and Forecast - by Application Area

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. IT & Telecommunication

- 7.2.4. Energy & Power

- 7.2.5. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Equipment

- 8.1.1.1. Wireless Device Testing

- 8.1.1.2. Wireless Network Testing

- 8.1.2. Services

- 8.1.1. Equipment

- 8.2. Market Analysis, Insights and Forecast - by Application Area

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. IT & Telecommunication

- 8.2.4. Energy & Power

- 8.2.5. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Australia Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Equipment

- 9.1.1.1. Wireless Device Testing

- 9.1.1.2. Wireless Network Testing

- 9.1.2. Services

- 9.1.1. Equipment

- 9.2. Market Analysis, Insights and Forecast - by Application Area

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. IT & Telecommunication

- 9.2.4. Energy & Power

- 9.2.5. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. New Zealand Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Equipment

- 10.1.1.1. Wireless Device Testing

- 10.1.1.2. Wireless Network Testing

- 10.1.2. Services

- 10.1.1. Equipment

- 10.2. Market Analysis, Insights and Forecast - by Application Area

- 10.2.1. Consumer Electronics

- 10.2.2. Automotive

- 10.2.3. IT & Telecommunication

- 10.2.4. Energy & Power

- 10.2.5. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Latin America Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Offering

- 11.1.1. Equipment

- 11.1.1.1. Wireless Device Testing

- 11.1.1.2. Wireless Network Testing

- 11.1.2. Services

- 11.1.1. Equipment

- 11.2. Market Analysis, Insights and Forecast - by Application Area

- 11.2.1. Consumer Electronics

- 11.2.2. Automotive

- 11.2.3. IT & Telecommunication

- 11.2.4. Energy & Power

- 11.2.5. Other Ap

- 11.1. Market Analysis, Insights and Forecast - by Offering

- 12. Middle East and Africa Global Wireless Testing Market For Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Offering

- 12.1.1. Equipment

- 12.1.1.1. Wireless Device Testing

- 12.1.1.2. Wireless Network Testing

- 12.1.2. Services

- 12.1.1. Equipment

- 12.2. Market Analysis, Insights and Forecast - by Application Area

- 12.2.1. Consumer Electronics

- 12.2.2. Automotive

- 12.2.3. IT & Telecommunication

- 12.2.4. Energy & Power

- 12.2.5. Other Ap

- 12.1. Market Analysis, Insights and Forecast - by Offering

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SGS Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bureau Veritas

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Intertek Group PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Dekra SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Anritsun Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Keysight Technologies

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 eInfochips (Arrow Electronics)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rohde & Schwarz GmbH & Co KG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 VIAVI Solutions Inc *List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 SGS Group

List of Figures

- Figure 1: Global Global Wireless Testing Market For Wi-Fi Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Global Wireless Testing Market For Wi-Fi Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 4: North America Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 5: North America Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 6: North America Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 7: North America Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 8: North America Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 9: North America Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 10: North America Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 11: North America Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 16: Europe Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 17: Europe Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 18: Europe Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 19: Europe Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 20: Europe Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 21: Europe Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 22: Europe Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 23: Europe Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 28: Asia Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 29: Asia Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 30: Asia Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 31: Asia Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 32: Asia Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 33: Asia Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 34: Asia Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 35: Asia Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 40: Australia Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 41: Australia Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 42: Australia Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 43: Australia Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 44: Australia Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 45: Australia Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 46: Australia Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 47: Australia Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 49: Australia Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

- Figure 51: New Zealand Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 52: New Zealand Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 53: New Zealand Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 54: New Zealand Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 55: New Zealand Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 56: New Zealand Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 57: New Zealand Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 58: New Zealand Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 59: New Zealand Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 60: New Zealand Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 61: New Zealand Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 62: New Zealand Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

- Figure 63: Latin America Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 64: Latin America Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 65: Latin America Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 66: Latin America Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 67: Latin America Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 68: Latin America Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 69: Latin America Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 70: Latin America Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 71: Latin America Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 72: Latin America Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 73: Latin America Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 74: Latin America Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

- Figure 75: Middle East and Africa Global Wireless Testing Market For Wi-Fi Revenue (Million), by Offering 2024 & 2032

- Figure 76: Middle East and Africa Global Wireless Testing Market For Wi-Fi Volume (Billion), by Offering 2024 & 2032

- Figure 77: Middle East and Africa Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Offering 2024 & 2032

- Figure 78: Middle East and Africa Global Wireless Testing Market For Wi-Fi Volume Share (%), by Offering 2024 & 2032

- Figure 79: Middle East and Africa Global Wireless Testing Market For Wi-Fi Revenue (Million), by Application Area 2024 & 2032

- Figure 80: Middle East and Africa Global Wireless Testing Market For Wi-Fi Volume (Billion), by Application Area 2024 & 2032

- Figure 81: Middle East and Africa Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Application Area 2024 & 2032

- Figure 82: Middle East and Africa Global Wireless Testing Market For Wi-Fi Volume Share (%), by Application Area 2024 & 2032

- Figure 83: Middle East and Africa Global Wireless Testing Market For Wi-Fi Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Global Wireless Testing Market For Wi-Fi Volume (Billion), by Country 2024 & 2032

- Figure 85: Middle East and Africa Global Wireless Testing Market For Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Global Wireless Testing Market For Wi-Fi Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 5: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 6: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 7: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 10: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 11: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 12: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 13: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 16: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 17: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 18: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 19: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 22: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 23: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 24: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 25: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 28: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 29: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 30: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 31: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 34: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 35: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 36: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 37: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 40: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 41: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 42: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 43: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

- Table 45: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Offering 2019 & 2032

- Table 46: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Offering 2019 & 2032

- Table 47: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Application Area 2019 & 2032

- Table 48: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Application Area 2019 & 2032

- Table 49: Global Wireless Testing Market For Wi-Fi Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Wireless Testing Market For Wi-Fi Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Wireless Testing Market For Wi-Fi?

The projected CAGR is approximately 7.75%.

2. Which companies are prominent players in the Global Wireless Testing Market For Wi-Fi?

Key companies in the market include SGS Group, Bureau Veritas, Intertek Group PLC, Dekra SE, Anritsun Corporation, Keysight Technologies, eInfochips (Arrow Electronics), Rohde & Schwarz GmbH & Co KG, VIAVI Solutions Inc *List Not Exhaustive.

3. What are the main segments of the Global Wireless Testing Market For Wi-Fi?

The market segments include Offering, Application Area.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of wireless devices; Advancements in wireless technology (including Wi-Fi 5. 6 & 7); Rising demand for high-speed connectivity.

6. What are the notable trends driving market growth?

Rising demand for high-speed connectivity.

7. Are there any restraints impacting market growth?

Proliferation of wireless devices; Advancements in wireless technology (including Wi-Fi 5. 6 & 7); Rising demand for high-speed connectivity.

8. Can you provide examples of recent developments in the market?

May 2024: Teledyne LeCroy, a global provider of advanced protocol test solutions, has unveiled the Frontline X500e wireless protocol analyzer, now equipped with Wi-Fi 7. The X500e, an evolution of its predecessor, the Frontline X500, offers an all-in-one solution adept at capturing and correlating data across diverse communication technologies. The X500e provides accurate insights for network professionals, whether they're working with Bluetooth, Wi-Fi, 802.15.4-based technologies (like Matter, Thread, and Zigbee), or wired interfaces such as HCI-UART, USB, SPI, and Audio I2S.May 2024: Northeastern University's Institute for the Wireless Internet of Things (WIoT) has unveiled the Open6G Open Testing and Integration Center (OTIC). The center now offers comprehensive testing and integration solutions for Open RAN, encompassing conformance, interoperability, and end-to-end testing, all adhering to O-RAN ALLIANCE specifications. The Open6G OTIC facilitates testing to meet the performance and interoperability standards prioritized by the National Telecommunications and Information Administration (NTIA) in the Public Wireless Supply Chain Innovation Fund (PWSCIF) NOFO 2, focusing on Open Radio Commercialization and Innovation.April 2024: The U.S. National Science Foundation has allocated an additional USD 7 million to the Platforms for Advanced Wireless Research program. This funding aims to enhance the capacities of PAWR testbeds, specifically for the testing and validation of Open Radio Access Network (O-RAN) systems and subsystems. NSF's new investment acts as seed funding, empowering PAWR platforms to enhance their testing capabilities.February 2024: Keysight Technologies, Inc. has launched the E7515W UXM Wireless Connectivity Test Platform, tailored for Wi-Fi. This network emulation solution offers signalling radio frequency (RF) and throughput testing specifically for devices utilizing Wi-Fi 7, featuring 4x4 MIMO with a 320 MHz bandwidth. Keysight's latest UXM Wireless Connectivity Test Solution tackles this challenge, offering RF engineers a streamlined, turnkey approach to Wi-Fi 7 testing while delivering exclusive insights into both the physical (PHY) and media access control (MAC) layers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Wireless Testing Market For Wi-Fi," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Wireless Testing Market For Wi-Fi report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Wireless Testing Market For Wi-Fi?

To stay informed about further developments, trends, and reports in the Global Wireless Testing Market For Wi-Fi, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence