Key Insights

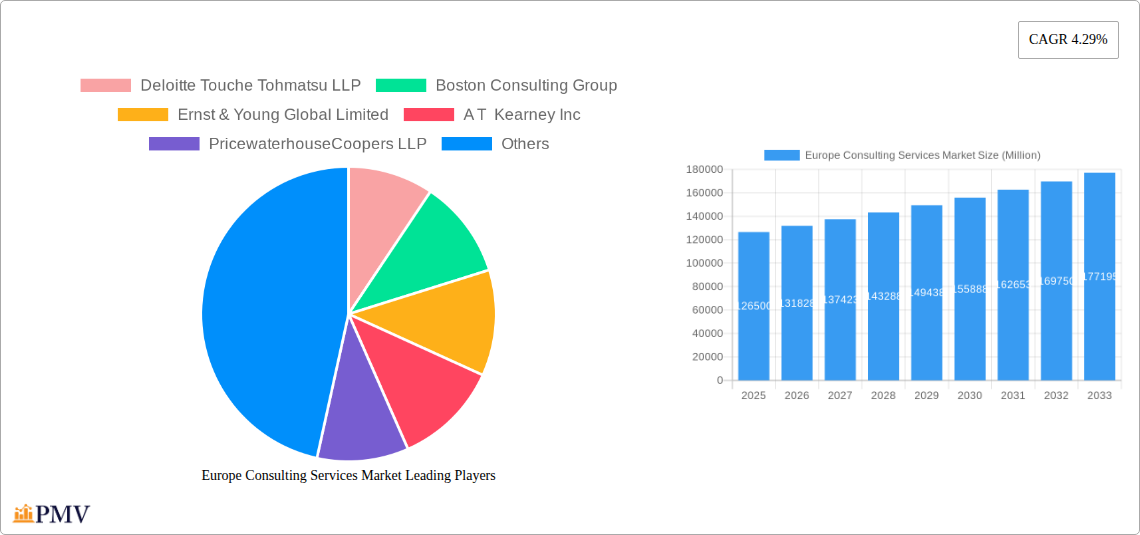

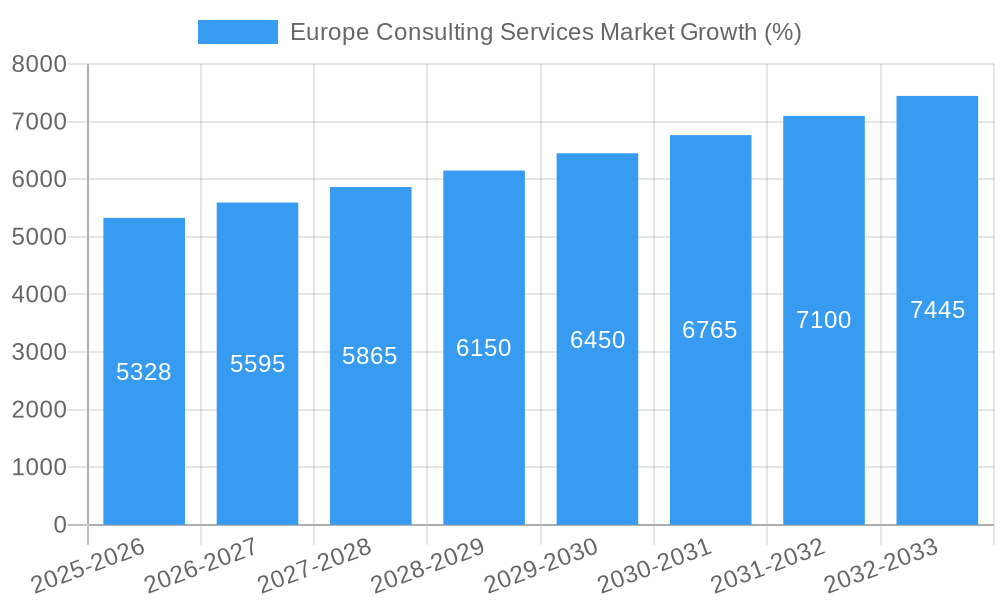

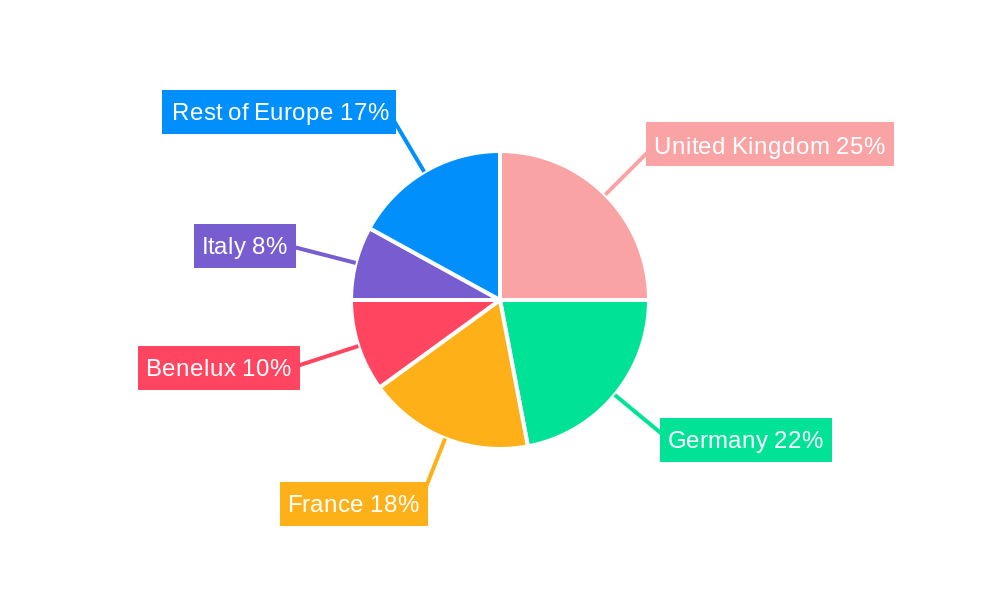

The European consulting services market, valued at €126.5 billion in 2025, is projected to experience steady growth, driven by increasing business complexity, digital transformation initiatives, and the need for strategic guidance across diverse sectors. A Compound Annual Growth Rate (CAGR) of 4.29% from 2025 to 2033 indicates a significant expansion, reaching an estimated value exceeding €180 billion by 2033. This growth is fueled by several key factors. The rise of data analytics and artificial intelligence is transforming business decision-making, creating a demand for specialized consulting expertise. Furthermore, regulatory changes and increasing global competition are forcing businesses to seek external guidance to navigate complex market landscapes and optimize operations. The United Kingdom, Germany, and France represent the largest national markets, though significant growth potential exists within the Benelux region and other smaller European economies. The operational consulting segment currently holds a substantial market share, but technology advisory services are anticipated to witness the fastest growth trajectory due to the escalating digitalization across various industries. Conversely, while the market enjoys overall growth, potential restraints include economic downturns, geopolitical uncertainties and skill shortages within the consulting sector itself.

The market segmentation reveals a dynamic landscape. While operational consulting remains dominant, the increasing complexity of technology and the digital transformation across various sectors are creating a robust demand for technology advisory services. This segment is predicted to outpace the growth of other service types in the forecast period. Geographically, the United Kingdom, Germany, and France remain the largest markets, but the Benelux region and other smaller European economies offer significant untapped potential. Major players like Deloitte, BCG, EY, KPMG, and McKinsey continue to dominate the market, leveraging their established brand recognition and global expertise. However, niche players specializing in specific sectors or technologies are also gaining traction, presenting competitive opportunities. The sustained growth forecast indicates a lucrative and expanding market for consulting services in Europe, emphasizing the need for ongoing innovation and adaptation to remain competitive.

Europe Consulting Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe consulting services market, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on rigorous research and data analysis. The market is segmented by service type (Operations Consulting, Strategy Consulting, Financial Advisory, Technology Advisory, Other Service Types) and by country (United Kingdom, Germany, France, Benelux, Italy, Rest of Europe). Key players such as Deloitte Touche Tohmatsu LLP, Boston Consulting Group, Ernst & Young Global Limited, A T Kearney Inc, PricewaterhouseCoopers LLP, KPMG, Bain & Company Inc, McKinsey & Company, Accenture PL, and Booz Allen Hamilton Inc are thoroughly examined. The report’s estimated market value in 2025 is xx Million.

Europe Consulting Services Market Structure & Competitive Dynamics

The European consulting services market exhibits a moderately concentrated structure, with a few major players holding significant market share. Deloitte, McKinsey, and BCG consistently rank among the top firms, enjoying a combined market share estimated at 35% in 2025. This concentration is partly driven by significant brand recognition, extensive global networks, and substantial investments in talent acquisition and technological innovation. However, a vibrant ecosystem of smaller, specialized consultancies also exists, often focusing on niche sectors or offering innovative service packages. The market’s regulatory framework, while generally supportive of competition, varies across European nations, impacting market entry and operational procedures. M&A activity has been significant, particularly during the historical period (2019-2024), with several large acquisitions valued at over xx Million aimed at expanding service offerings and geographical reach. The average M&A deal value during this period was estimated at xx Million. End-user trends are increasingly focused on digital transformation, sustainability, and data analytics, shaping the demand for specialized consulting services. Substitutes, such as in-house consulting teams or open-source solutions, pose limited threats in most segments due to the complexity and specialized knowledge typically required.

Europe Consulting Services Market Industry Trends & Insights

The European consulting services market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. The increasing adoption of digital technologies across various industries is creating significant demand for technology advisory and digital transformation services. This is further amplified by growing regulatory pressure on data privacy and cybersecurity, forcing businesses to seek external expertise. Furthermore, the ongoing economic recovery across many European nations, coupled with rising investments in infrastructure development, fuels demand for operations consulting and financial advisory services. Market penetration of consulting services varies significantly across industries and countries, with financial services, healthcare, and technology sectors showcasing higher adoption rates. Competitive dynamics are shaped by factors like pricing strategies, service innovation, and brand reputation. The emergence of AI-driven consulting solutions is transforming the market, offering faster turnaround times and improved analytical capabilities. Companies are increasingly investing in AI and machine learning to enhance service delivery and optimize client outcomes.

Dominant Markets & Segments in Europe Consulting Services Market

By Service Type: Strategy consulting consistently holds the largest market share, driven by the increasing need for businesses to navigate complex market dynamics and develop effective long-term strategies. Financial advisory is also a significant segment, especially during periods of economic uncertainty. Technology advisory is witnessing the fastest growth, fueled by the widespread digital transformation efforts.

By Country: The United Kingdom remains the largest national market due to its robust financial sector and significant investments in technology. Germany and France also represent substantial markets due to their diverse industrial bases and strong economic performance. The Benelux region showcases higher per capita spending on consulting services. Italy's market growth is expected to be propelled by post-pandemic recovery and investments in modernization.

The dominance of the UK is largely attributable to London’s status as a major global financial hub, attracting significant investments and resulting in high demand for consulting expertise. Germany's large manufacturing sector, coupled with its robust economic growth, further fuels market demand. France also benefits from its considerable public and private sector investments. While the UK, Germany and France have the highest market shares, the Benelux region demonstrates a strong per capita expenditure that reflects an intense focus on optimization and technological integration.

Europe Consulting Services Market Product Innovations

Recent innovations in the European consulting services market are predominantly centered on leveraging advanced analytics, AI, and machine learning to deliver data-driven insights and solutions. Consultancy firms are increasingly integrating these technologies into their service offerings, enabling them to offer more sophisticated analyses, faster turnaround times, and improved accuracy in forecasting and strategic planning. The enhanced analytical capabilities translate into improved business outcomes for clients. This has led to a competitive advantage for those firms successfully integrating and deploying these new technologies.

Report Segmentation & Scope

This report segments the European consulting services market by service type (Operations Consulting, Strategy Consulting, Financial Advisory, Technology Advisory, Other Service Types) and by country (United Kingdom, Germany, France, Benelux, Italy, Rest of Europe). Each segment's market size is analyzed for the historical period (2019-2024), base year (2025), and forecast period (2025-2033), providing detailed growth projections and competitive dynamics. For example, the Technology Advisory segment shows robust growth projections due to the escalating demand for digital transformation services, while the UK market exhibits consistent high demand across all service types due to its position as a global financial centre.

Key Drivers of Europe Consulting Services Market Growth

The growth of the European consulting services market is driven by several factors. Firstly, the accelerating pace of digital transformation is creating a substantial need for specialized expertise in areas such as cloud computing, cybersecurity, and data analytics. Secondly, the ongoing economic recovery and growth in various European economies are boosting investments in business expansion and modernization, consequently increasing demand for consulting services. Finally, the tightening regulatory environment in numerous sectors is requiring increased compliance efforts, creating an impetus for compliance and risk management consulting. These synergistic factors are collectively shaping the market's growth trajectory.

Challenges in the Europe Consulting Services Market Sector

The European consulting services market faces challenges including intense competition among established players and new entrants, creating price pressures and necessitating continuous service innovation. Furthermore, variations in regulatory landscapes across different European countries introduce complexities for delivering consistent services across the region. Supply chain disruptions and rising operating costs also pose significant hurdles, impacting profitability. These factors influence market dynamics and necessitate strategic adaptation from market participants.

Leading Players in the Europe Consulting Services Market Market

- Deloitte Touche Tohmatsu LLP

- Boston Consulting Group

- Ernst & Young Global Limited

- A T Kearney Inc

- PricewaterhouseCoopers LLP

- KPMG

- Bain & Company Inc

- McKinsey & Company

- Accenture PL

- Booz Allen Hamilton Inc

Key Developments in Europe Consulting Services Market Sector

October 2023: KPMG UK launched "Advisory," a new business unit combining Consulting and Deal Advisory arms. This integration aims to broaden service offerings and cater to a wider client base.

September 2023: BCG partnered with Anthropic to launch an AI consulting initiative. This collaboration allows BCG to better advise clients on integrating AI strategies and deploying Anthropic’s AI models effectively.

Strategic Europe Consulting Services Market Market Outlook

The European consulting services market presents a positive outlook for the forecast period. Sustained economic growth, technological advancements, and increasing regulatory complexity are driving demand for specialized consulting expertise. Firms that successfully integrate AI and other advanced technologies into their service offerings and adapt to evolving client needs will gain a competitive edge. Focus on niche sectors and specialized services, coupled with strategic acquisitions, represents viable growth accelerators within this vibrant market.

Europe Consulting Services Market Segmentation

-

1. Service Type

- 1.1. Operations Consulting

- 1.2. Strategy Consulting

- 1.3. Financial Advisory

- 1.4. Technology Advisory

- 1.5. Other Service Types

Europe Consulting Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Changes; Growing Investment in Emerging Technologies

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Operations Consulting to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Operations Consulting

- 5.1.2. Strategy Consulting

- 5.1.3. Financial Advisory

- 5.1.4. Technology Advisory

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Germany Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Consulting Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Deloitte Touche Tohmatsu LLP

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Boston Consulting Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ernst & Young Global Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 A T Kearney Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PricewaterhouseCoopers LLP

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KPMG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bain & Company Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 McKinsey & Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Accenture PL

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Booz Allen Hamilton Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Deloitte Touche Tohmatsu LLP

List of Figures

- Figure 1: Europe Consulting Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Consulting Services Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Europe Consulting Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Consulting Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 13: Europe Consulting Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Consulting Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Consulting Services Market?

The projected CAGR is approximately 4.29%.

2. Which companies are prominent players in the Europe Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu LLP, Boston Consulting Group, Ernst & Young Global Limited, A T Kearney Inc, PricewaterhouseCoopers LLP, KPMG, Bain & Company Inc, McKinsey & Company, Accenture PL, Booz Allen Hamilton Inc.

3. What are the main segments of the Europe Consulting Services Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Changes; Growing Investment in Emerging Technologies.

6. What are the notable trends driving market growth?

Operations Consulting to Witness Major Growth.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

October 2023 - KPMG UK launched Advisory – a new business that combines its Consulting and Deal Advisory arms to create a new practice called Advisory. This can help the company gain a customer base and cater to a wider range of customers across the UK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Consulting Services Market?

To stay informed about further developments, trends, and reports in the Europe Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence