Key Insights

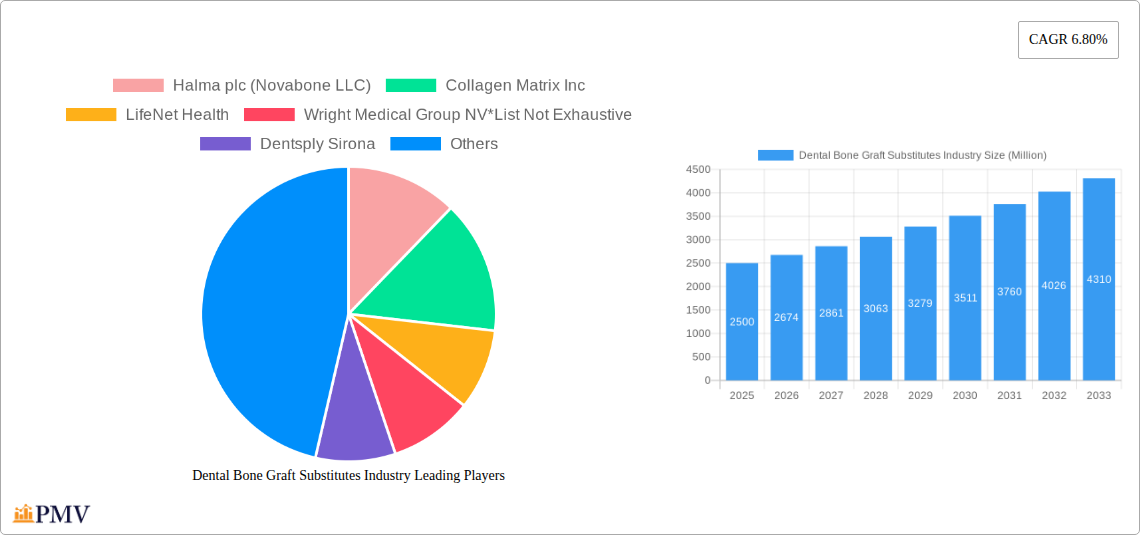

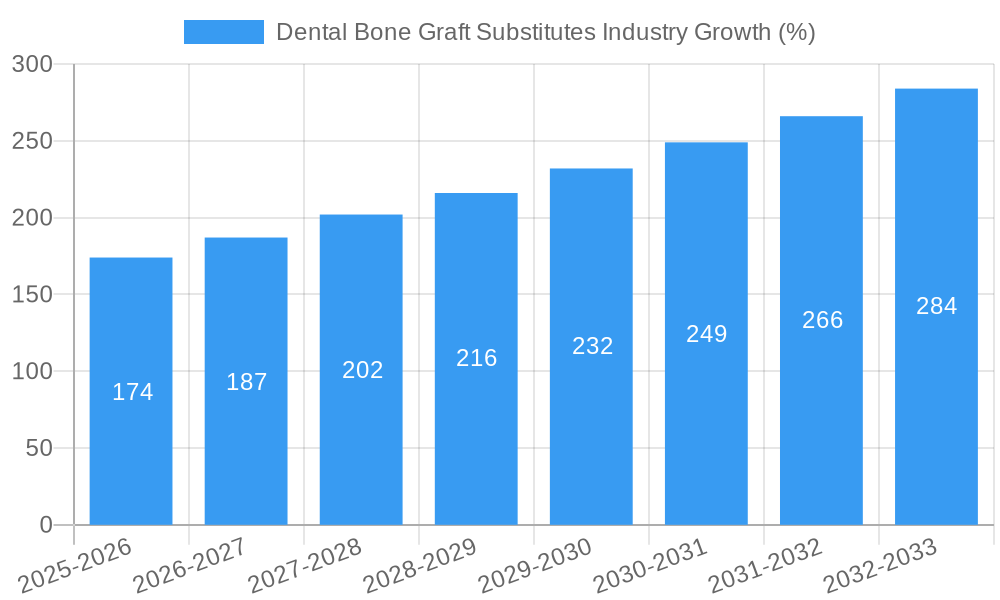

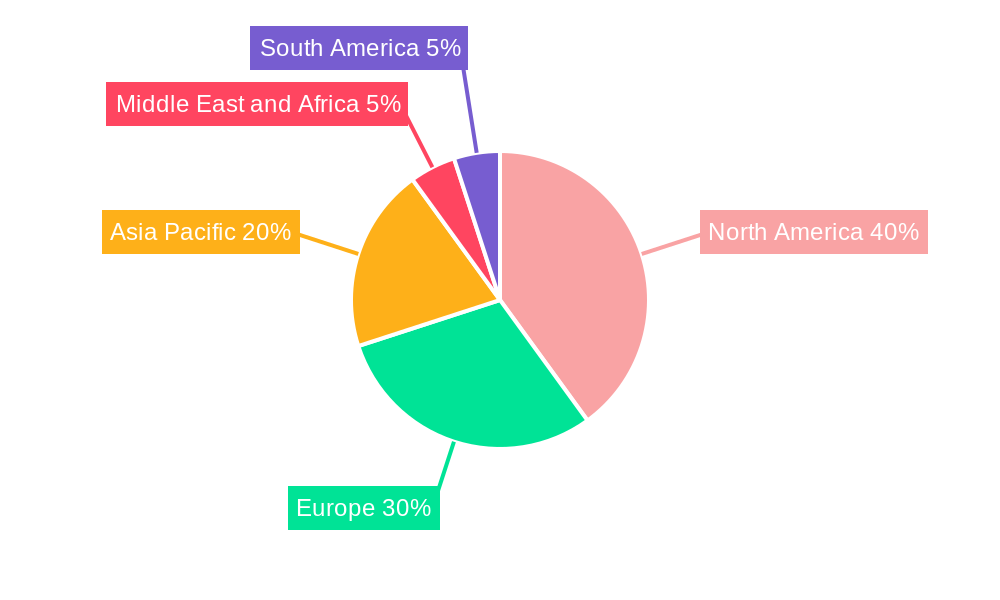

The global dental bone graft substitutes market is experiencing robust growth, projected to reach a significant value by 2033, driven by a 6.80% CAGR. This expansion is fueled by several key factors. The rising prevalence of periodontal disease and tooth loss, coupled with an aging global population requiring more extensive dental procedures, are significantly increasing demand. Technological advancements in biomaterial science are leading to the development of innovative, more biocompatible and effective graft substitutes, improving patient outcomes and driving market adoption. Furthermore, the increasing adoption of minimally invasive surgical techniques and a growing preference for aesthetically pleasing dental restorations are further contributing to market growth. The market is segmented by mechanism (osteoconduction, osteoinduction, osteogenesis, osteopromotion), end-users (hospitals, dental clinics, others), and type (xenograft, allograft, autograft, others). While autografts currently dominate due to their superior biological properties, the increasing demand for readily available and cost-effective alternatives is driving the growth of allografts and xenografts. The North American market currently holds a substantial share, attributed to advanced healthcare infrastructure and high disposable income, but regions like Asia-Pacific are expected to witness rapid growth due to increasing dental awareness and rising healthcare expenditure. Competitive intensity is high, with major players such as Zimmer Biomet, Dentsply Sirona, and Medtronic, along with several specialized companies, continually innovating to maintain market share.

Despite the significant growth opportunities, the market faces certain challenges. The high cost associated with some graft substitutes and the potential for complications such as infection or rejection can limit their widespread adoption, particularly in developing economies. Stringent regulatory approvals and the need for skilled professionals for the procedures also present hurdles. However, ongoing research and development efforts focused on improving the efficacy, safety, and affordability of these substitutes are expected to mitigate these challenges and contribute to sustained market growth. The future of this market is bright, with continued innovation and expanding applications promising sustained expansion throughout the forecast period.

This comprehensive report provides a detailed analysis of the global Dental Bone Graft Substitutes industry, offering invaluable insights for businesses, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete overview of past performance, current trends, and future projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Dental Bone Graft Substitutes Industry Market Structure & Competitive Dynamics

The global dental bone graft substitutes market is characterized by a moderately concentrated structure, with several key players holding significant market share. Major players such as Halma plc (Novabone LLC), Collagen Matrix Inc, LifeNet Health, Wright Medical Group NV, Dentsply Sirona, Dentium, Medtronic PLC, Johnson & Johnson, ZIMMER BIOMET, Institut Straumann AG, Botiss biomaterials GmbH, and Geistlich Pharm compete intensely, driving innovation and shaping market dynamics. Market share fluctuates based on product innovation, regulatory approvals, and strategic partnerships.

The industry’s innovation ecosystem is dynamic, fueled by ongoing research into biocompatible materials and advanced manufacturing techniques. Regulatory frameworks vary across geographies, influencing product approvals and market access. Substitutes, including autografts and allografts, exert competitive pressure on synthetic bone graft substitutes. End-user trends, particularly the increasing preference for minimally invasive procedures and improved patient outcomes, are shaping product development. M&A activities have been observed, though deal values are not publicly available in many cases. For instance, the partnership between Biocomposites and Zimmer Biomet demonstrates the strategic importance of collaborations.

Dental Bone Graft Substitutes Industry Industry Trends & Insights

The dental bone graft substitutes market is experiencing robust growth, driven by several factors. The rising prevalence of periodontal diseases and tooth loss, coupled with an aging global population requiring more restorative dental procedures, is fueling demand. Technological advancements, such as the development of biocompatible and osteoconductive materials, are improving the efficacy and safety of bone graft substitutes. Consumer preferences are shifting towards minimally invasive procedures and faster healing times, further boosting the market. The market is witnessing increased competition, with companies focusing on product differentiation and innovation to gain a competitive edge. The CAGR for the forecast period is expected to be xx%, with market penetration increasing in developing economies due to rising disposable incomes and improved healthcare infrastructure.

Dominant Markets & Segments in Dental Bone Graft Substitutes Industry

- By Mechanism: Osteoconduction is currently the dominant segment, driven by its proven efficacy and wide acceptance among dental professionals. Osteoinduction and Osteogenesis segments are also showing significant growth, driven by advancements in biomaterial science. The Osteopromotion segment is expected to witness significant growth due to innovative material development in the coming years.

- By End Users: Hospitals and dental clinics constitute the major end-users of dental bone graft substitutes. Hospitals, particularly those specializing in oral and maxillofacial surgery, contribute significantly due to complex procedures requiring larger volumes of bone graft materials. The 'Other End Users' segment represents smaller clinics and private practices and is expected to grow steadily as dental services become more accessible.

- By Type: Allografts currently hold a significant market share due to their proven safety and efficacy. However, Xenografts are gaining traction, driven by factors like readily available sources and cost-effectiveness. Autografts remain a significant option, while 'Other Types' represent newer materials in development and early adoption phases. The dominance of each type varies geographically based on factors like regulatory approvals and healthcare infrastructure. North America, particularly the United States, is currently the leading market, driven by high healthcare expenditure, advanced dental infrastructure, and a large geriatric population. Europe and Asia-Pacific are also experiencing substantial growth, fueled by increasing awareness of dental health and improving healthcare standards.

Dental Bone Graft Substitutes Industry Product Innovations

Recent innovations focus on developing biocompatible and resorbable materials with enhanced osteoinductive and osteoconductive properties. These innovations aim to minimize the risk of infection and improve bone regeneration, leading to better patient outcomes. The introduction of novel delivery systems, such as injectable bone graft substitutes, simplifies the surgical procedure and reduces recovery time. The market is seeing growth in the use of 3D-printed bone grafts, offering customized solutions for complex defects, driving the adoption of personalized medicine in dental surgery. This aligns with market demands for faster integration, improved biocompatibility, and minimally invasive applications.

Report Segmentation & Scope

This report comprehensively segments the dental bone graft substitutes market across several parameters:

- By Mechanism: Osteoconduction, Osteoinduction, Osteogenesis, Osteopromotion. Each segment's growth projections and competitive dynamics are analyzed separately, taking into account their individual market sizes and evolving trends.

- By End Users: Hospitals, Dental Clinics, Other End Users. This segmentation allows for a detailed understanding of consumption patterns and growth potential among different end-users. Market size estimates and growth projections are offered for each end-user category.

- By Type: Xenograft, Allograft, Autograft, Other Types. The report evaluates the unique attributes, market share, and growth prospects for each type of bone graft substitute. Competitive dynamics are examined in relation to the type of substitute.

Key Drivers of Dental Bone Graft Substitutes Industry Growth

Technological advancements in biomaterials science and manufacturing techniques are driving market growth. The increasing prevalence of periodontal diseases and the rise in demand for dental implants are significant factors. Favorable regulatory environments in some regions facilitate product approvals and market penetration. Growing awareness among the public of the importance of dental health, coupled with rising disposable incomes in developing economies, are fueling the expansion of the market.

Challenges in the Dental Bone Graft Substitutes Industry Sector

Stringent regulatory requirements for medical devices can pose hurdles for new product approvals and market entry. Supply chain disruptions can impact the availability of raw materials and finished products. Intense competition among established players and the emergence of new entrants create pressure on pricing and profitability. The high cost of some advanced bone graft substitutes can limit accessibility in certain regions, especially in low- and middle-income countries. This results in approximately xx Million in lost revenue annually.

Leading Players in the Dental Bone Graft Substitutes Industry Market

- Halma plc (Novabone LLC)

- Collagen Matrix Inc

- LifeNet Health

- Wright Medical Group NV

- Dentsply Sirona

- Dentium

- Medtronic PLC

- Johnson & Johnson

- ZIMMER BIOMET

- Institut Straumann AG

- Botiss biomaterials GmbH

- Geistlich Pharma

Key Developments in Dental Bone Graft Substitutes Industry Sector

- March 2022: Biocomposites signed an agreement with Zimmer Biomet to distribute the new Genex Bone Graft Substitute, a biphasic composite designed for optimal bone remodeling. This significantly enhances Zimmer Biomet's product portfolio and market reach.

- March 2022: CGbio signed a five-year contract with Kerunxi Medical for the export of Bongros Dental, a bone graft material, marking a significant expansion into the Chinese market. This represents a substantial increase in international market penetration for CGbio.

Strategic Dental Bone Graft Substitutes Industry Market Outlook

The future of the dental bone graft substitutes market appears bright, driven by continued innovation in biomaterials, increasing demand for dental implants, and expanding access to dental care globally. Strategic opportunities lie in developing cost-effective solutions for emerging markets, focusing on personalized medicine approaches, and exploring new applications of bone graft substitutes beyond traditional dental procedures. The market is ripe for investment in research and development, particularly in areas such as 3D-printed bone grafts and novel biocompatible materials. Focusing on partnerships and collaborations will be crucial for navigating the competitive landscape and achieving sustainable growth.

Dental Bone Graft Substitutes Industry Segmentation

-

1. Type

- 1.1. Xenograft

- 1.2. Allograft

- 1.3. Autograft

- 1.4. Other Types

-

2. Mechanism

- 2.1. Osteoconduction

- 2.2. Osteoinduction

- 2.3. Osteogenesis

- 2.4. Osteopromotion

-

3. End Users

- 3.1. Hospitals

- 3.2. Dental Clinics

- 3.3. Other End Users

Dental Bone Graft Substitutes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Dental Bone Graft Substitutes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Medical and Dental Tourism; Rising Burden of Dental Diseases; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Expensive Dental Procedures; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. The Xenogaft Segment is Expected to Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Xenograft

- 5.1.2. Allograft

- 5.1.3. Autograft

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Mechanism

- 5.2.1. Osteoconduction

- 5.2.2. Osteoinduction

- 5.2.3. Osteogenesis

- 5.2.4. Osteopromotion

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Hospitals

- 5.3.2. Dental Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Xenograft

- 6.1.2. Allograft

- 6.1.3. Autograft

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Mechanism

- 6.2.1. Osteoconduction

- 6.2.2. Osteoinduction

- 6.2.3. Osteogenesis

- 6.2.4. Osteopromotion

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Hospitals

- 6.3.2. Dental Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Xenograft

- 7.1.2. Allograft

- 7.1.3. Autograft

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Mechanism

- 7.2.1. Osteoconduction

- 7.2.2. Osteoinduction

- 7.2.3. Osteogenesis

- 7.2.4. Osteopromotion

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Hospitals

- 7.3.2. Dental Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Xenograft

- 8.1.2. Allograft

- 8.1.3. Autograft

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Mechanism

- 8.2.1. Osteoconduction

- 8.2.2. Osteoinduction

- 8.2.3. Osteogenesis

- 8.2.4. Osteopromotion

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Hospitals

- 8.3.2. Dental Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Xenograft

- 9.1.2. Allograft

- 9.1.3. Autograft

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Mechanism

- 9.2.1. Osteoconduction

- 9.2.2. Osteoinduction

- 9.2.3. Osteogenesis

- 9.2.4. Osteopromotion

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Hospitals

- 9.3.2. Dental Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Xenograft

- 10.1.2. Allograft

- 10.1.3. Autograft

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Mechanism

- 10.2.1. Osteoconduction

- 10.2.2. Osteoinduction

- 10.2.3. Osteogenesis

- 10.2.4. Osteopromotion

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Hospitals

- 10.3.2. Dental Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Halma plc (Novabone LLC)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Collagen Matrix Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 LifeNet Health

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Wright Medical Group NV*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Dentsply Sirona

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dentium

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Medtronic PLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Johnson & Johnson

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 ZIMMER BIOMET

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Institut Straumann AG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Botiss biomaterials GmbH

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Geistlich Pharm

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Halma plc (Novabone LLC)

List of Figures

- Figure 1: Global Dental Bone Graft Substitutes Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 15: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 16: North America Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2024 & 2032

- Figure 17: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2024 & 2032

- Figure 18: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 23: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 24: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2024 & 2032

- Figure 25: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2024 & 2032

- Figure 26: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 31: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 32: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2024 & 2032

- Figure 33: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2024 & 2032

- Figure 34: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 39: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 40: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2024 & 2032

- Figure 41: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2024 & 2032

- Figure 42: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2024 & 2032

- Figure 47: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2024 & 2032

- Figure 48: South America Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2024 & 2032

- Figure 49: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2024 & 2032

- Figure 50: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 4: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 5: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 34: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 35: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 41: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 42: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 51: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 52: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 61: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 62: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 67: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2019 & 2032

- Table 68: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 69: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Bone Graft Substitutes Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Dental Bone Graft Substitutes Industry?

Key companies in the market include Halma plc (Novabone LLC), Collagen Matrix Inc, LifeNet Health, Wright Medical Group NV*List Not Exhaustive, Dentsply Sirona, Dentium, Medtronic PLC, Johnson & Johnson, ZIMMER BIOMET, Institut Straumann AG, Botiss biomaterials GmbH, Geistlich Pharm.

3. What are the main segments of the Dental Bone Graft Substitutes Industry?

The market segments include Type, Mechanism, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Medical and Dental Tourism; Rising Burden of Dental Diseases; Technological Advancements.

6. What are the notable trends driving market growth?

The Xenogaft Segment is Expected to Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Dental Procedures; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

In March 2022, Biocomposites signed an agreement with Zimmer Biomet to distribute the new genex Bone Graft Substitute. Genex Bone Graft Substitute is a biphasic composite of exceptional purity specifically formulated to balance osteoconductive scaffold strength and persistence in the body to enable the optimal remodeling of bone architecture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Bone Graft Substitutes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Bone Graft Substitutes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Bone Graft Substitutes Industry?

To stay informed about further developments, trends, and reports in the Dental Bone Graft Substitutes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence