Key Insights

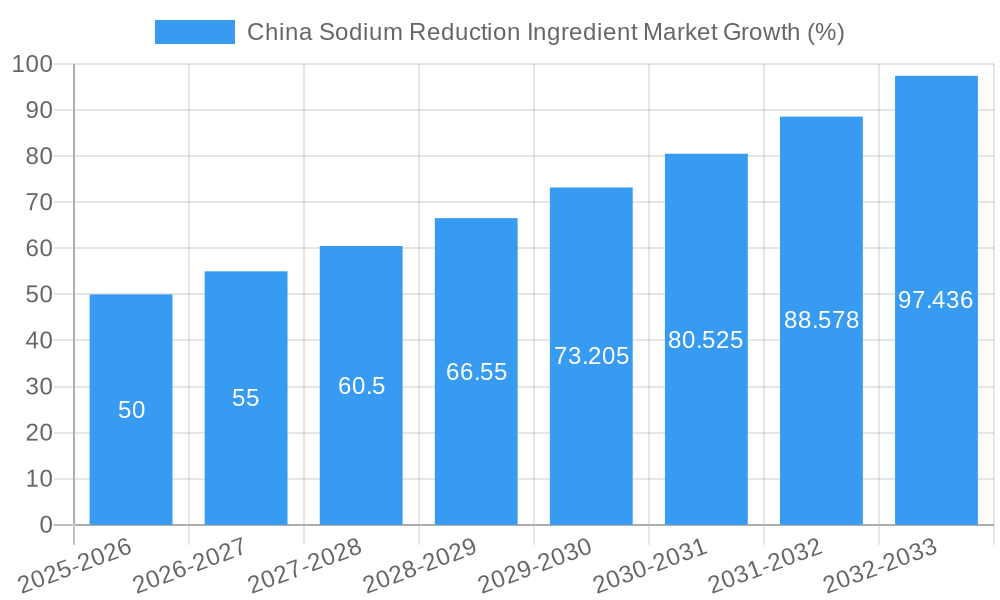

The China sodium reduction ingredient market is experiencing robust growth, driven by increasing consumer awareness of health and wellness, coupled with stricter government regulations aimed at curbing sodium intake. The market, currently valued at approximately $XX million (assuming a reasonable market size based on global trends and China's significant food processing sector), is projected to achieve a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is fueled by the rising prevalence of diet-related diseases and a consequent shift towards healthier food choices. Key application segments include bakery and confectionery, condiments, seasonings and sauces, dairy and frozen foods, meat and meat products, and snacks. The demand for sodium reduction ingredients is further propelled by innovative product development within these sectors, as manufacturers strive to meet evolving consumer preferences and regulatory compliance. Leading players like Givaudan, Tate & Lyle, Innophos, and others are actively investing in research and development to introduce novel, effective, and palatable sodium reduction solutions.

The market's growth trajectory is significantly impacted by several factors. Consumer preference for clean-label products and a growing interest in natural sodium substitutes present considerable opportunities. Technological advancements in ingredient formulation contribute to the development of more effective solutions while mitigating potential compromises in taste and texture. However, challenges remain, including the potential for higher costs associated with some sodium reduction ingredients compared to conventional salt and the need for robust consumer education regarding the benefits of reduced-sodium diets. The market segmentation, encompassing amino acids and glutamates, mineral salts (including calcium chloride), yeast extracts, and other product types, indicates a diverse range of ingredient options, creating avenues for specialization and innovation. This diversity, coupled with the robust growth forecast, positions the China sodium reduction ingredient market as an attractive sector for investment and expansion.

China Sodium Reduction Ingredient Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the burgeoning China Sodium Reduction Ingredient Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, competitive landscapes, and future growth trajectories, incorporating robust data and forecasts.

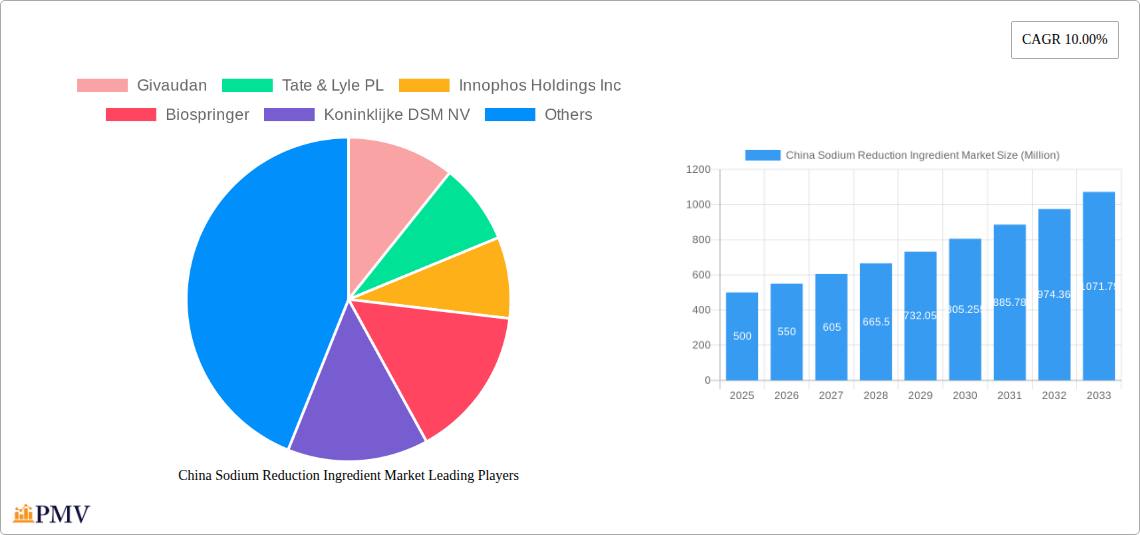

China Sodium Reduction Ingredient Market Market Structure & Competitive Dynamics

The China sodium reduction ingredient market exhibits a moderately concentrated structure, with key players like Givaudan, Tate & Lyle PL, Innophos Holdings Inc, Biospringer, Koninklijke DSM NV, Corbion NV, Angel Yeast Co Ltd, Ohly Americas, Cargill, Inc., and Archer Daniels Midland Company (ADM) holding significant market share. The combined market share of the top five players is estimated at 55% in 2025. The market is characterized by intense competition, driven by continuous product innovation and strategic acquisitions.

Innovation ecosystems are thriving, with companies investing heavily in R&D to develop novel sodium reduction solutions. Regulatory frameworks, particularly those focusing on public health and food safety, significantly influence market dynamics. The increasing consumer preference for healthier food options fuels the demand for sodium reduction ingredients. Significant M&A activity has been observed in the recent past, with deal values exceeding xx Million in the last five years. These acquisitions primarily aim to expand product portfolios, strengthen market presence, and access new technologies. The market also faces competition from emerging substitutes like natural flavor enhancers and alternative food processing technologies. End-user trends are shifting towards clean-label and functional food ingredients, further shaping the market landscape.

China Sodium Reduction Ingredient Market Industry Trends & Insights

The China sodium reduction ingredient market is experiencing robust growth, driven primarily by increasing health consciousness among consumers and stringent government regulations aimed at reducing sodium intake. The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements in ingredient development, particularly in the areas of taste masking and functionality, are boosting market expansion. Consumer preferences are steadily shifting towards healthier food options, with a greater emphasis on natural and clean-label ingredients. This trend directly benefits the sodium reduction ingredient market, which offers solutions that enhance the palatability and nutritional value of products while reducing sodium content. The increasing penetration of processed foods in the Chinese market further fuels demand, creating opportunities for sodium reduction solutions to address health concerns associated with high-sodium diets. Competitive dynamics remain intense, with companies continually investing in product innovation, marketing, and strategic partnerships to gain a competitive edge.

Dominant Markets & Segments in China Sodium Reduction Ingredient Market

Leading Region/Segment: The Eastern region of China dominates the market, driven by high population density, greater awareness of health and wellness, and a well-established food processing industry.

Product Type: Amino acids and glutamates hold the largest market share, primarily due to their effective taste-enhancing properties and widespread applications across various food categories. Mineral salts, particularly calcium chloride, are also significant contributors, offering cost-effective sodium reduction solutions. Yeast extracts are gaining popularity due to their natural origin and enhanced flavor profiles. Other product types, including specialized enzymes and hydrolysates, are expected to witness significant growth.

Application: The bakery and confectionery segment is a major application area, with manufacturers increasingly adopting sodium reduction strategies to cater to health-conscious consumers. Condiments, seasonings, and sauces also represent a significant market segment, driven by the increasing demand for low-sodium alternatives to traditional flavoring agents. Dairy and frozen foods, meat and meat products, and snack food categories are also witnessing increased adoption of sodium reduction ingredients, propelled by consumer demand and regulatory pressures.

Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting healthier lifestyles and reducing sodium intake are key growth catalysts.

- Infrastructure: A well-developed food processing and distribution infrastructure supports market expansion.

- Consumer Awareness: Growing awareness of the health risks associated with high sodium consumption drives demand.

The growth of each segment is influenced by factors such as consumer preferences, technological advancements, and regulatory changes.

China Sodium Reduction Ingredient Market Product Innovations

Recent product innovations focus on developing natural, clean-label sodium reduction ingredients that effectively mask the salty taste while enhancing flavor profiles. This includes using advanced fermentation techniques, enzymatic hydrolysis, and novel extraction methods to create functional ingredients. These innovations cater to the growing consumer demand for healthier and more natural food products, which aligns perfectly with the overall market trend towards clean-label products. Companies are competing on the basis of ingredient efficacy, cost-effectiveness, and ease of incorporation into food products.

Report Segmentation & Scope

The report segments the China sodium reduction ingredient market based on product type (Amino Acids and Glutamates, Mineral Salts, Calcium Chloride, Yeast Extracts, Other Product Types) and application (Bakery and Confectionery, Condiments, Seasonings and Sauces, Dairy and Frozen Foods, Meat and Meat Products, Snacks, Other Applications). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The report also provides insights into regional variations in market growth and consumption patterns. Growth projections for each segment vary, with amino acids and glutamates anticipated to experience the highest growth, followed by yeast extracts. Competitive dynamics within each segment are shaped by factors like ingredient functionality, cost, and brand reputation.

Key Drivers of China Sodium Reduction Ingredient Market Growth

The market's growth is primarily driven by rising consumer awareness of health risks associated with high sodium intake, stringent government regulations promoting sodium reduction, and increasing demand for healthier and more natural food products. Technological advancements leading to the development of improved taste-masking and functional ingredients further accelerate market growth. The expansion of the processed food industry in China also presents significant growth opportunities for sodium reduction ingredient providers. These factors collectively contribute to the significant and sustained growth projected for the market.

Challenges in the China Sodium Reduction Ingredient Market Sector

The China sodium reduction ingredient market faces challenges like the high cost of some advanced sodium reduction ingredients, fluctuating raw material prices, and stringent regulatory approvals required for new product introductions. Maintaining consistent product quality and supply chain efficiency also present operational hurdles. Furthermore, the competition from existing flavor enhancers and traditional sodium-based ingredients poses a challenge to market penetration. The combined impact of these factors can hinder market growth if not adequately addressed.

Leading Players in the China Sodium Reduction Ingredient Market Market

- Givaudan

- Tate & Lyle PL

- Innophos Holdings Inc

- Biospringer

- Koninklijke DSM NV

- Corbion NV

- Angel Yeast Co Ltd

- Ohly Americas

- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

Key Developments in China Sodium Reduction Ingredient Market Sector

- Jan 2023: Givaudan launches a new range of natural sodium reduction solutions for the Chinese market.

- Mar 2024: Tate & Lyle PL announces a strategic partnership with a local Chinese food manufacturer to expand its market reach.

- Oct 2024: Innophos Holdings Inc. secures regulatory approval for a new sodium reduction ingredient in China.

- (Further developments to be added based on market updates)

Strategic China Sodium Reduction Ingredient Market Market Outlook

The China sodium reduction ingredient market is poised for continued robust growth, driven by sustained consumer preference for healthier options, ongoing government initiatives supporting sodium reduction, and the expansion of the food processing industry. Strategic opportunities exist for companies to develop innovative, cost-effective, and clean-label sodium reduction ingredients. Investing in research and development, strategic partnerships, and robust distribution networks will be crucial for success in this competitive and rapidly evolving market. The market shows high potential for companies leveraging technological advancements to cater to the growing demand for functional and healthier food ingredients.

China Sodium Reduction Ingredient Market Segmentation

-

1. Product Type

- 1.1. Amino Acids and Glutamates

-

1.2. Mineral Salts

- 1.2.1. Potassium Chloride

- 1.2.2. Magnesium Sulphate

- 1.2.3. Potassium Lactate

- 1.2.4. Calcium Chloride

- 1.3. Yeast Extracts

- 1.4. Other Product Types

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Condiments, Seasonings and Sauces

- 2.3. Dairy and Frozen Foods

- 2.4. Meat and Meat Products

- 2.5. Snacks

- 2.6. Other Applications

China Sodium Reduction Ingredient Market Segmentation By Geography

- 1. China

China Sodium Reduction Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Yeast Extracts are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sodium Reduction Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids and Glutamates

- 5.1.2. Mineral Salts

- 5.1.2.1. Potassium Chloride

- 5.1.2.2. Magnesium Sulphate

- 5.1.2.3. Potassium Lactate

- 5.1.2.4. Calcium Chloride

- 5.1.3. Yeast Extracts

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Condiments, Seasonings and Sauces

- 5.2.3. Dairy and Frozen Foods

- 5.2.4. Meat and Meat Products

- 5.2.5. Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Givaudan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tate & Lyle PL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innophos Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Biospringer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke DSM NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corbion NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Angel Yeast Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ohly Americas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cargill Inc.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Archer Daniels Midland Company (ADM)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Givaudan

List of Figures

- Figure 1: China Sodium Reduction Ingredient Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Sodium Reduction Ingredient Market Share (%) by Company 2024

List of Tables

- Table 1: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Region 2019 & 2032

- Table 3: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Product Type 2019 & 2032

- Table 5: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Application 2019 & 2032

- Table 7: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Region 2019 & 2032

- Table 9: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Country 2019 & 2032

- Table 11: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Product Type 2019 & 2032

- Table 13: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Application 2019 & 2032

- Table 15: China Sodium Reduction Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Sodium Reduction Ingredient Market Volume k Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sodium Reduction Ingredient Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the China Sodium Reduction Ingredient Market?

Key companies in the market include Givaudan, Tate & Lyle PL, Innophos Holdings Inc, Biospringer, Koninklijke DSM NV, Corbion NV, Angel Yeast Co Ltd, Ohly Americas, Cargill, Inc., Archer Daniels Midland Company (ADM).

3. What are the main segments of the China Sodium Reduction Ingredient Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Yeast Extracts are Driving the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in k Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sodium Reduction Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sodium Reduction Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sodium Reduction Ingredient Market?

To stay informed about further developments, trends, and reports in the China Sodium Reduction Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence