Key Insights

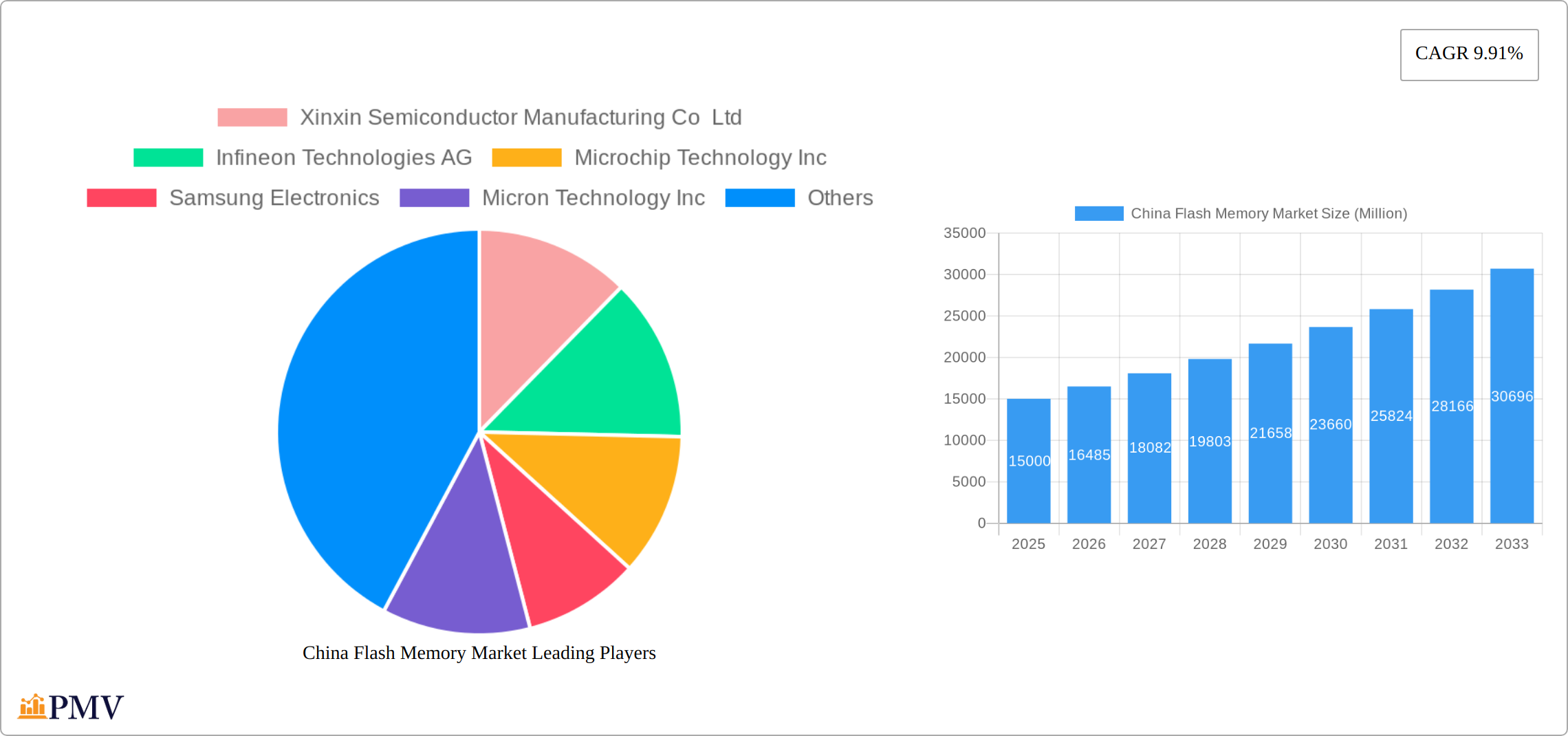

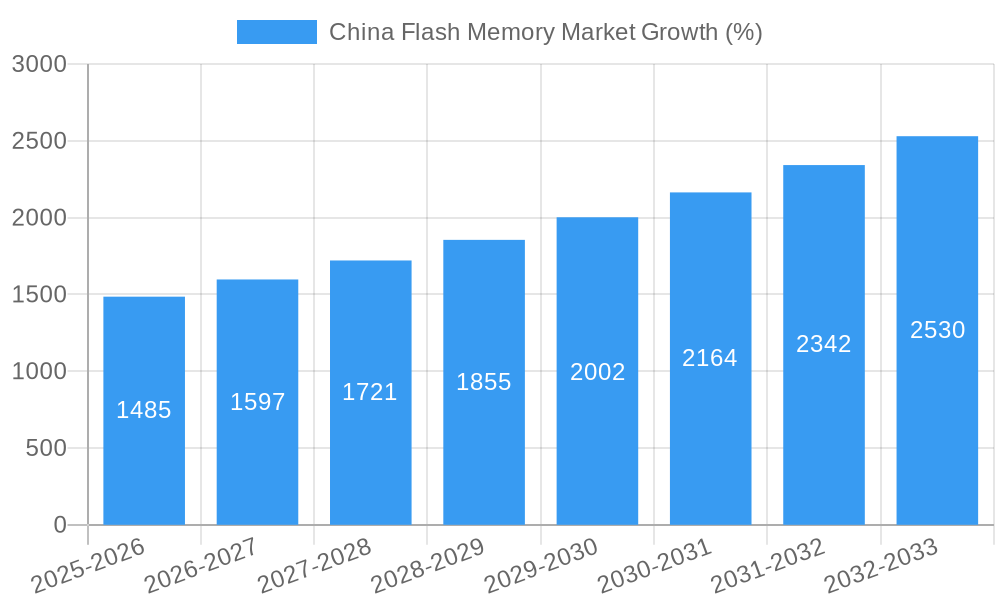

The China flash memory market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.91%, presents a compelling investment landscape. Driven by the nation's burgeoning technological advancements, particularly in data centers, automotive electronics, and the mobile sector, the market is poised for significant expansion. The increasing demand for high-speed data storage and processing capabilities fuels this growth, with NAND flash memory currently dominating the market due to its higher storage density and cost-effectiveness compared to NOR flash memory. Segmentation by density reveals a strong preference for higher density options, reflecting the trend toward larger storage capacities in various applications. Key players like Samsung Electronics, Micron Technology Inc., and Yangtze Memory Technologies Co Ltd. are actively competing to meet this escalating demand, investing heavily in R&D and expanding production capacity to capitalize on the market's potential. The market's growth trajectory suggests a continuing shift toward sophisticated applications requiring extensive storage, driving the adoption of high-density flash memory solutions. This trend is further supported by the rapid expansion of cloud computing services and the pervasive use of connected devices across diverse sectors within China.

Growth in the China flash memory market is also significantly influenced by government initiatives promoting technological self-reliance and the development of domestic semiconductor industries. While challenges remain, including global supply chain disruptions and potential price fluctuations, the long-term outlook remains positive, indicating a sustained period of expansion fueled by continuous technological advancements and increasing digitalization across all sectors of the Chinese economy. The substantial investments by both established international players and emerging Chinese companies suggest a competitive but ultimately robust market environment promising significant returns in the coming years. Further research is needed to quantify the impact of government policy and to predict future market share based on the competitive dynamics among the key players.

China Flash Memory Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the China flash memory market, offering invaluable insights for businesses operating within or considering entry into this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges, providing a 360-degree view of this crucial market. The report includes detailed segmentation by type (NAND and NOR Flash Memory), density (ranging from 128 MB to 4 GIGABIT and beyond), and end-user application (Data Center, Automotive, Mobile & Tablets, Client, and Others). This report is essential for strategic decision-making, investment planning, and competitive benchmarking within the Chinese flash memory landscape.

China Flash Memory Market Market Structure & Competitive Dynamics

The China flash memory market exhibits a complex interplay of established international players and rapidly growing domestic companies. Market concentration is moderate, with several key players holding significant market share, but a fragmented landscape exists among smaller, specialized firms. Innovation ecosystems are vibrant, driven by government initiatives promoting domestic semiconductor development and substantial R&D investments from both domestic and international entities. The regulatory framework, while evolving, plays a significant role in shaping market access and competition, including considerations around data security and national security. Product substitutes, such as other types of non-volatile memory, exist but are not yet widespread threats. M&A activity has been relatively moderate in recent years, with deal values varying significantly based on the size and strategic importance of the acquired companies.

- Key Players & Market Share (Estimated 2025): Samsung Electronics (xx%), Micron Technology Inc (xx%), Yangtze Memory Technologies Co Ltd (xx%), GigaDevice Semiconductor Inc (xx%), Others (xx%). Note that these are estimates based on available data and market trends.

- Recent M&A Activity: While specific deal values are not publicly available for all transactions, there has been a noticeable increase in smaller acquisitions focused on technology integration and expansion of market reach over the last five years.

China Flash Memory Market Industry Trends & Insights

The China flash memory market is characterized by robust growth, driven by increasing demand from various end-user sectors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%, reflecting strong expansion across segments. Technological advancements, such as the development of higher density flash memory and 3D NAND technology, are major growth drivers, enabling increased storage capacity and improved performance. Consumer preferences are shifting toward higher capacity and faster storage solutions, especially in the mobile and data center sectors. Competitive dynamics remain intense, with both domestic and international players vying for market share through price competition, product innovation, and strategic partnerships. Market penetration of high-density flash memory is rapidly increasing, reflecting the adoption of these advanced technologies in mobile devices and data centers. The market is also influenced by significant government investments in infrastructure that necessitates large-scale storage capacity and government initiatives aimed at boosting domestic semiconductor manufacturing capabilities.

Dominant Markets & Segments in China Flash Memory Market

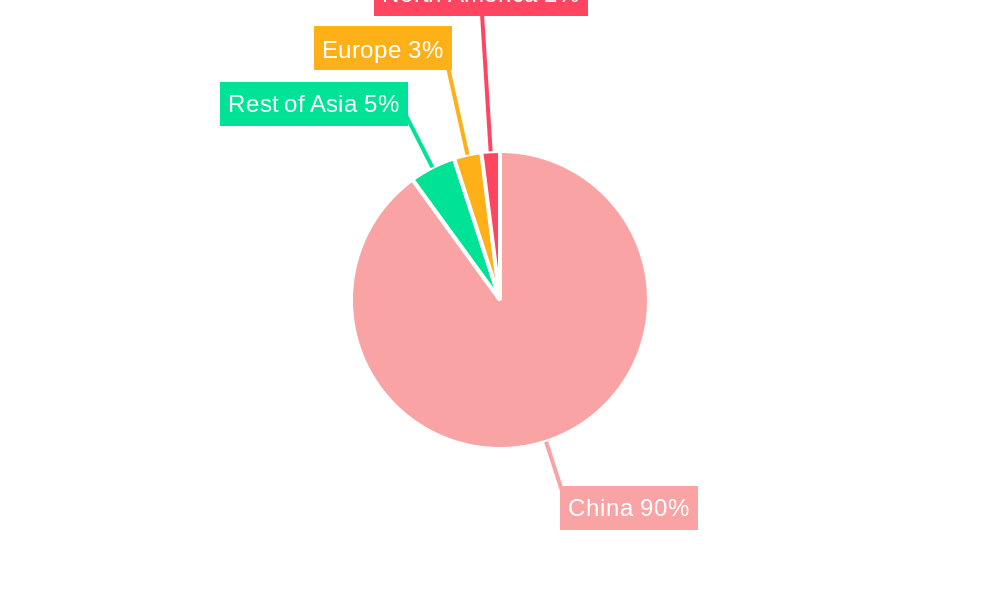

Leading Regions/Segments: The coastal regions of China, specifically those around major technology hubs, demonstrate the highest market penetration and growth in flash memory adoption. Within segments, NAND flash memory dominates due to its higher storage capacity and cost-effectiveness, while the 4 GIGABIT & LESS (greater than 2GB) density segment exhibits the fastest growth. The Data Center and Mobile & Tablets end-user segments show the highest demand, reflecting the widespread adoption of these technologies.

Key Drivers:

- Economic Growth: China’s sustained economic growth fuels demand for electronic devices and data storage solutions across all sectors.

- Government Support: Significant government investments in infrastructure and technological advancement heavily influences the flash memory market, especially towards supporting domestic manufacturing.

- Technological Advancements: Ongoing R&D in higher density and performance flash memory solutions consistently pushes demand.

The dominance of NAND Flash Memory stems from its suitability for large-scale data storage applications. The high growth within the 4 GIGABIT & LESS segment reflects the increasing adoption of higher capacity storage in smartphones, tablets and data centers. The Data Center segment benefits from the booming cloud computing sector and the ever-increasing need for data storage in enterprise servers. The Mobile & Tablets segment exhibits robust demand due to consumer preference for devices with larger storage capacities and higher performance.

China Flash Memory Market Product Innovations

Recent product innovations focus on increasing memory density, improving performance, and reducing power consumption. Companies are aggressively pursuing 3D NAND technology to achieve higher storage capacities at competitive prices. The development of advanced controllers and interface technologies further enhances the overall performance and reliability of flash memory products. These innovations are strategically tailored to meet the diverse demands of various end-user applications, from high-performance data centers to power-constrained mobile devices, emphasizing energy efficiency and speed. This trend continues to shape competitive advantage, making energy efficiency and performance critical differentiators.

Report Segmentation & Scope

This report segments the China flash memory market based on type (NAND and NOR Flash Memory), density (128 MB & LESS, 512 MB & LESS, 2 GIGABIT & LESS, 256 MB & LESS, 1 GIGABIT & LESS, 4 GIGABIT & LESS, 2 MEGABIT & LESS, 4 MEGABIT & LESS, 8 MEGABIT & LESS, 16 MEGABIT & LESS, 32 MEGABIT & LESS, 64 MEGABIT & LESS), and end-user application (Data Center, Automotive, Mobile & Tablets, Client, Other). Each segment's growth projections, market size estimations, and competitive dynamics are analyzed, providing a granular understanding of the market landscape. The overall market size for 2025 is estimated to be xx Million, with significant growth potential across all segments. The competitive intensity varies by segment, with certain segments being more concentrated than others.

Key Drivers of China Flash Memory Market Growth

Several key factors fuel the expansion of the China flash memory market. Technological advancements, particularly in 3D NAND technology, drive increased storage capacity and improved performance. The burgeoning demand from data centers, fueled by the growth of cloud computing and big data analytics, is a significant growth catalyst. The expanding mobile and consumer electronics market contributes significantly to market growth due to higher storage requirements in smartphones and tablets. Government policies supporting domestic semiconductor manufacturing and infrastructure development also play a critical role.

Challenges in the China Flash Memory Market Sector

The China flash memory market faces several challenges. Supply chain disruptions can significantly impact the availability and cost of flash memory products. Intense competition from both domestic and international players exerts downward pressure on pricing. Regulatory hurdles and evolving government policies can create uncertainty for businesses. Intellectual property protection concerns may pose risks to innovation and investment in the sector. The impact of these factors on profitability and overall market growth could be significant, requiring companies to adopt robust strategies for risk mitigation.

Leading Players in the China Flash Memory Market Market

- Xinxin Semiconductor Manufacturing Co Ltd

- Infineon Technologies AG

- Microchip Technology Inc

- Samsung Electronics

- Micron Technology Inc

- GigaDevice Semiconductor Inc

- Yangtze Memory Technologies Co Ltd

- Macronix International Co Ltd

- Winbond Electronics Corporation

- Intel Corporation

Key Developments in China Flash Memory Market Sector

- February 2023: Infineon's announcement that China contributed 36% of its FY2022 revenue highlights the market's importance. The launch of SEMPER Nano NOR Flash memory targets the growing wearable and industrial IoT sectors.

- March 2022: Winbond Electronics' introduction of the W25Q64NE 1.2V SpiFlash NOR flash IC demonstrates advancements in low-power memory solutions for mobile and wearable applications.

- August 2022: Macronix International's octa flash memory's integration into Renesas' development platform showcases collaboration and the strategic importance of high-speed flash memory in cutting-edge product development.

Strategic China Flash Memory Market Market Outlook

The China flash memory market is poised for continued growth, driven by technological innovation, expanding end-user applications, and supportive government policies. Strategic opportunities exist for companies that can leverage technological advancements to deliver high-performance, energy-efficient solutions. Focusing on niche applications, developing strong supply chain relationships, and adapting to evolving regulatory frameworks will be crucial for success. The market presents significant potential for both established players and new entrants capable of navigating the competitive dynamics and capitalizing on the increasing demand for data storage and processing in China.

China Flash Memory Market Segmentation

-

1. Type

-

1.1. NAND Flash Memory

-

1.1.1. By Density

- 1.1.1.1. 128 MB & LESS

- 1.1.1.2. 512 MB & LESS

- 1.1.1.3. 2 GIGABIT & LESS (greater than 1GB)

- 1.1.1.4. 256 MB & LESS

- 1.1.1.5. 1 GIGABIT & LESS

- 1.1.1.6. 4 GIGABIT & LESS (greater than 2GB)

-

1.1.1. By Density

-

1.2. NOR Flash Memory

- 1.2.1. 2 MEGABIT & LESS

- 1.2.2. 4 MEGABIT & LESS (greater than 2MB)

- 1.2.3. 8 MEGABIT & LESS (greater than 4MB)

- 1.2.4. 16 MEGABIT & LESS (greater than 8MB)

- 1.2.5. 32 MEGABIT & LESS (greater than 16MB)

- 1.2.6. 64 MEGABIT & LESS (greater than 32MB)

-

1.1. NAND Flash Memory

-

2. End User

- 2.1. Data Center (Enterprise and Servers)

- 2.2. Automotive

- 2.3. Mobile & Tablets

- 2.4. Client (PC, Client SSD)

- 2.5. Other End-user Applications

China Flash Memory Market Segmentation By Geography

- 1. China

China Flash Memory Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Data Centers in the Region; Growing Applications of IoT

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes and US ban on Chinese Chip Manufacturing

- 3.4. Market Trends

- 3.4.1. NAND Flash to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Flash Memory Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. NAND Flash Memory

- 5.1.1.1. By Density

- 5.1.1.1.1. 128 MB & LESS

- 5.1.1.1.2. 512 MB & LESS

- 5.1.1.1.3. 2 GIGABIT & LESS (greater than 1GB)

- 5.1.1.1.4. 256 MB & LESS

- 5.1.1.1.5. 1 GIGABIT & LESS

- 5.1.1.1.6. 4 GIGABIT & LESS (greater than 2GB)

- 5.1.1.1. By Density

- 5.1.2. NOR Flash Memory

- 5.1.2.1. 2 MEGABIT & LESS

- 5.1.2.2. 4 MEGABIT & LESS (greater than 2MB)

- 5.1.2.3. 8 MEGABIT & LESS (greater than 4MB)

- 5.1.2.4. 16 MEGABIT & LESS (greater than 8MB)

- 5.1.2.5. 32 MEGABIT & LESS (greater than 16MB)

- 5.1.2.6. 64 MEGABIT & LESS (greater than 32MB)

- 5.1.1. NAND Flash Memory

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Data Center (Enterprise and Servers)

- 5.2.2. Automotive

- 5.2.3. Mobile & Tablets

- 5.2.4. Client (PC, Client SSD)

- 5.2.5. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Xinxin Semiconductor Manufacturing Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microchip Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Electronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Micron Technology Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GigaDevice Semiconductor Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yangtze Memory Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Macronix International Co Ltd*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Winbond Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xinxin Semiconductor Manufacturing Co Ltd

List of Figures

- Figure 1: China Flash Memory Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Flash Memory Market Share (%) by Company 2024

List of Tables

- Table 1: China Flash Memory Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Flash Memory Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Flash Memory Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: China Flash Memory Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Flash Memory Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Flash Memory Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Flash Memory Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: China Flash Memory Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Flash Memory Market?

The projected CAGR is approximately 9.91%.

2. Which companies are prominent players in the China Flash Memory Market?

Key companies in the market include Xinxin Semiconductor Manufacturing Co Ltd, Infineon Technologies AG, Microchip Technology Inc, Samsung Electronics, Micron Technology Inc, GigaDevice Semiconductor Inc, Yangtze Memory Technologies Co Ltd, Macronix International Co Ltd*List Not Exhaustive, Winbond Electronics Corporation, Intel Corporation.

3. What are the main segments of the China Flash Memory Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Data Centers in the Region; Growing Applications of IoT.

6. What are the notable trends driving market growth?

NAND Flash to Hold Major Share.

7. Are there any restraints impacting market growth?

Availability of Substitutes and US ban on Chinese Chip Manufacturing.

8. Can you provide examples of recent developments in the market?

February 2023: According to Infineon, China accounted for 36% of the company's revenue in FY2022. The company introduced the SEMPER Nano NOR Flash memory for battery-powered, small-form-factor electronic devices. Wearable and industrial applications, such as hearables, fitness trackers, health monitors, GPS trackers, and drones, enable more precise tracking, critical information logging, noise cancellation, enhanced security, and other benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Flash Memory Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Flash Memory Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Flash Memory Market?

To stay informed about further developments, trends, and reports in the China Flash Memory Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence