Key Insights

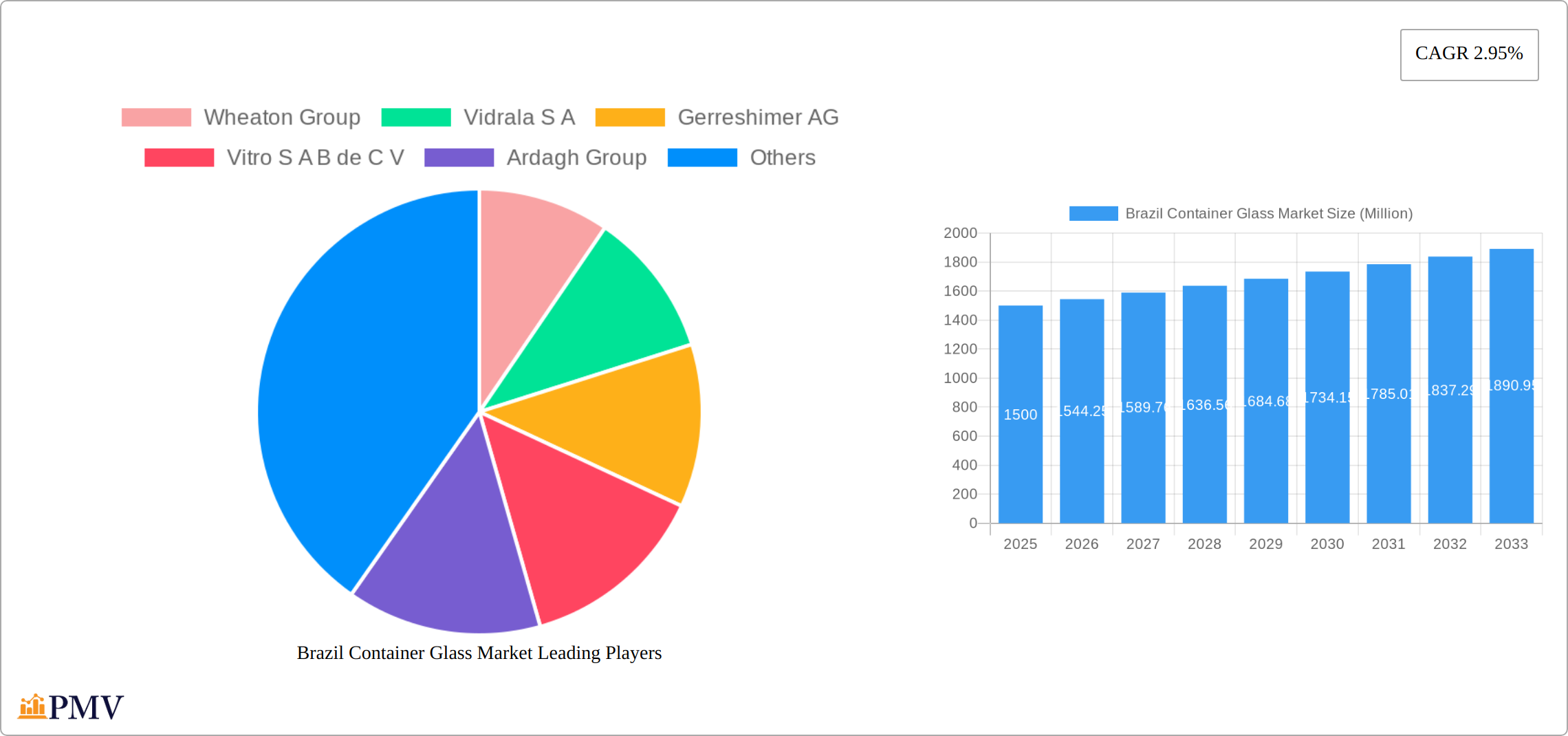

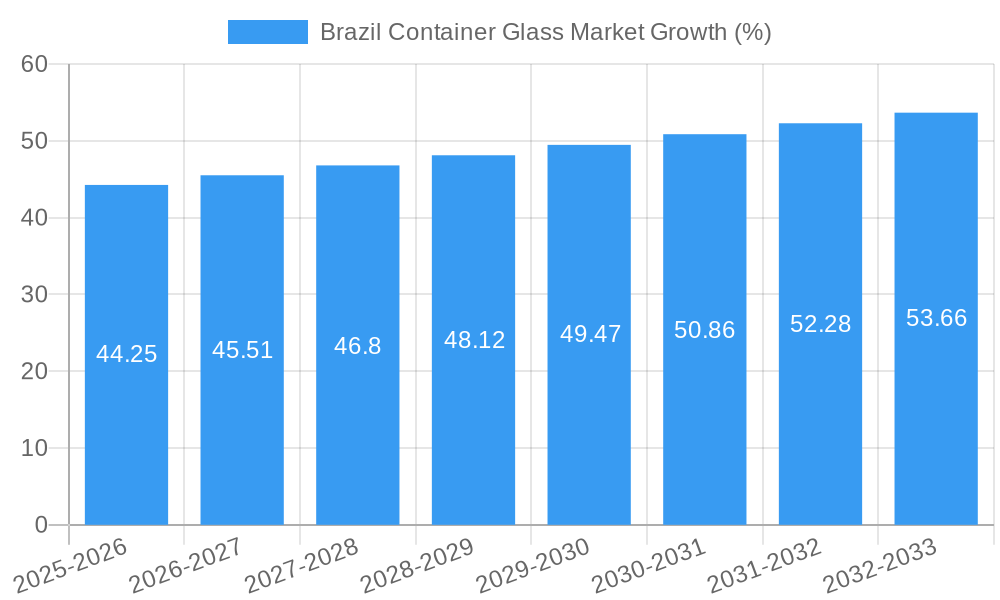

The Brazil container glass market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 2.95% between 2019 and 2024, presents a dynamic landscape influenced by several key factors. The market's growth is propelled by the increasing demand for packaged beverages and food products, particularly within the expanding Brazilian consumer market. This demand is further fueled by the preference for glass packaging due to its perceived quality, recyclability, and inert nature, which safeguards product integrity. However, challenges remain, including fluctuations in raw material prices (like silica sand and soda ash), energy costs, and the competitive pressure from alternative packaging materials such as plastic and aluminum. Furthermore, environmental regulations and concerns regarding carbon emissions associated with glass production could influence the market's trajectory. Leading players such as Wheaton Group, Vidrala S.A., Gerresheimer AG, Vitro S.A.B. de C.V., Ardagh Group, Owens-Illinois Inc., and Verallia Packaging are actively engaged in the market, vying for market share through innovations in production techniques and product offerings. The market segmentation likely includes various types of glass containers (bottles, jars, etc.) and applications across different sectors (beverages, food, pharmaceuticals). Future growth will depend on strategies adopted by these companies to navigate the challenges and capitalize on the opportunities arising from evolving consumer preferences and regulatory landscapes.

The forecast period of 2025-2033 anticipates continued growth, although the exact rate may be influenced by macroeconomic factors and policy changes. To achieve sustainable growth, companies within this market must invest in energy-efficient manufacturing processes, improve recycling infrastructure, and leverage sustainable sourcing of raw materials. This emphasis on sustainability will resonate with environmentally conscious consumers and potentially mitigate regulatory risks. Furthermore, expansion into new segments and exploration of niche applications, such as premium or specialized glass containers, could contribute to substantial growth and diversification within the Brazilian container glass market. This makes strategic partnerships and acquisitions a potentially impactful growth strategy.

Brazil Container Glass Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil container glass market, offering invaluable insights for businesses, investors, and stakeholders seeking to understand this dynamic sector. The study covers the historical period (2019-2024), the base year (2025), and projects the market's trajectory through 2033. We examine market structure, competitive dynamics, industry trends, and key developments, empowering you to make informed decisions in this rapidly evolving landscape. The market size is expected to reach xx Million by 2033.

Brazil Container Glass Market Market Structure & Competitive Dynamics

The Brazilian container glass market exhibits a moderately concentrated structure, with several major players and a number of smaller regional competitors. Market share data reveals that the top five companies control approximately xx% of the market, while the remaining share is distributed amongst a more fragmented landscape. Innovation in the sector is largely driven by efficiency improvements in manufacturing processes and the development of sustainable packaging solutions. Regulatory frameworks, including environmental regulations and import/export policies, significantly influence market dynamics. Product substitutes, such as plastic and aluminum containers, pose a persistent challenge, necessitating continuous innovation in glass packaging technology. End-user trends, including growing demand from the food and beverage industries, are key growth drivers. M&A activity in the Brazilian container glass market has been relatively modest in recent years, with deal values averaging approximately xx Million per transaction. Key trends include:

- High Market Concentration: Top players exert significant influence.

- Focus on Sustainability: Growing demand for eco-friendly packaging.

- Regulatory Scrutiny: Environmental regulations shape business strategies.

- Competitive Pressure from Substitutes: Plastic and aluminum pose a significant threat.

- Moderate M&A Activity: Consolidation potential remains significant.

Brazil Container Glass Market Industry Trends & Insights

The Brazilian container glass market is experiencing steady growth, driven by factors such as increasing domestic consumption, expanding food and beverage sectors, and a growing preference for glass packaging due to its perceived safety and recyclability. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological disruptions, particularly in manufacturing processes and automation, are contributing to improved efficiency and reduced production costs. Consumer preferences are shifting towards sustainable and aesthetically pleasing packaging, pushing manufacturers to innovate in design and material composition. Intense competitive dynamics require companies to constantly enhance their product offerings, optimize production, and explore new market segments to maintain competitiveness. Market penetration of recycled glass in container production is gradually increasing, with a projected xx% by 2033, reflecting rising environmental concerns.

Dominant Markets & Segments in Brazil Container Glass Market

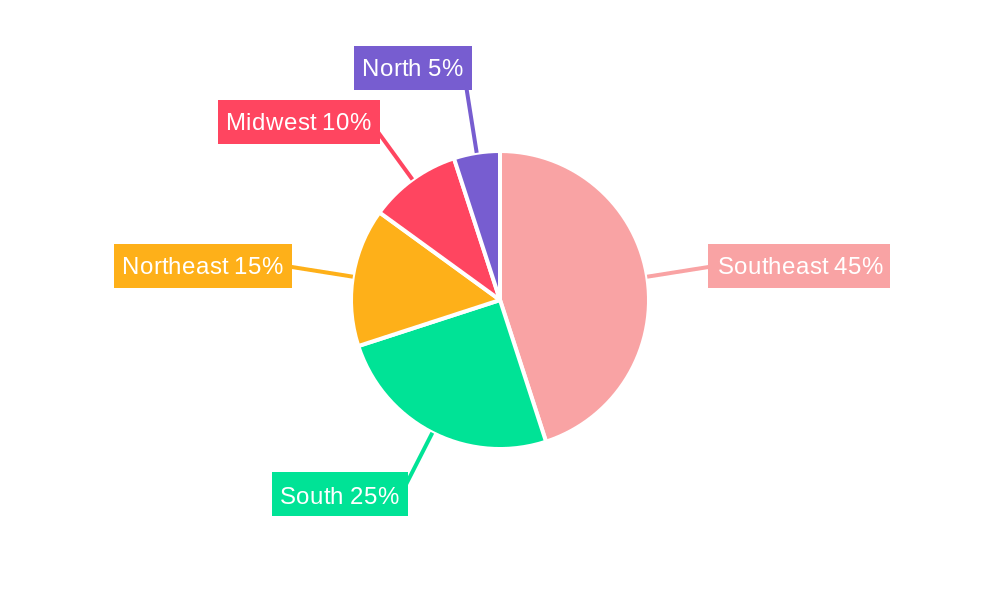

The Southeast region of Brazil is the dominant market for container glass, owing to its high population density, robust industrial base, and significant presence of food and beverage companies. This dominance is further fueled by favorable economic policies that support manufacturing and infrastructure developments within the region. Key drivers for the Southeast region's dominance include:

- High Population Density: Creates significant demand for packaged goods.

- Strong Industrial Base: Supports the manufacturing and distribution of glass containers.

- Concentrated Food & Beverage Sector: Major consumers of container glass products.

- Favourable Infrastructure: Efficient transportation networks facilitate distribution.

- Government Incentives: Policies encourage investment in manufacturing and infrastructure.

Detailed analysis indicates that the Southeast region accounts for approximately xx% of the total market share, significantly exceeding other regions in Brazil. Further segmentation by container type (e.g., bottles, jars) and end-use industry will be provided in the full report.

Brazil Container Glass Market Product Innovations

Recent innovations in the Brazilian container glass market have focused on enhancing production efficiency, improving sustainability, and creating more versatile and aesthetically appealing packaging solutions. Lightweighting techniques reduce material usage, while improved manufacturing processes minimize energy consumption and waste. The use of recycled glass content is increasing, aligning with growing environmental consciousness. New designs and surface treatments cater to evolving consumer preferences and brand differentiation strategies, enabling manufacturers to stand out in a competitive market.

Report Segmentation & Scope

This comprehensive report provides an in-depth segmentation of the Brazilian container glass market, offering granular insights across multiple dimensions. Geographically, the analysis delves into regional trends, with a detailed breakdown by state and key economic regions, highlighting market size, projected growth rates, and the strategic positioning of major players. Product segmentation scrutinizes diverse container types, including bottles and jars, considering material composition such as the increasing incorporation of recycled content, and analyzing the market impact of various color options. Furthermore, end-use segmentation maps the market penetration within primary industries like food and beverage, pharmaceuticals, cosmetics, and home care, detailing specific usage patterns and forecasting future demand for each segment. The competitive landscape for each segment is meticulously evaluated, providing clear market share data and profiling key industry participants.

Key Drivers of Brazil Container Glass Market Growth

The Brazilian container glass market is propelled by a confluence of robust economic and societal factors. A dynamic and expanding food and beverage industry, particularly in segments like craft beers, premium spirits, and artisanal food products, is a primary demand generator, with glass packaging favored for its premium perception, inertness, and aesthetic appeal. Growing consumer consciousness regarding health and sustainability is a significant tailwind, encouraging the adoption of glass as a safe, reusable, and infinitely recyclable material. Favorable government policies and initiatives promoting a circular economy, coupled with evolving environmental regulations that increasingly favor sustainable packaging solutions, further bolster the use of recycled glass content. Investments in infrastructure, coupled with overall economic stability and a burgeoning middle class with increasing disposable income, create an environment conducive to both domestic production expansion and heightened consumer spending on packaged goods. Technological advancements in glass manufacturing, leading to improved efficiency and reduced environmental impact, also contribute to the market's upward trajectory.

Challenges in the Brazil Container Glass Market Sector

Despite its promising outlook, the Brazilian container glass market navigates several significant hurdles. Volatility in the prices of key raw materials, especially energy (natural gas and electricity) which are critical for the energy-intensive melting process, directly impacts production costs and profitability. Intense competition from alternative packaging materials such as PET, aluminum, and flexible packaging, which often offer lower price points or specific performance advantages, poses a constant threat to market share. The implementation of increasingly stringent environmental regulations, while beneficial in the long run, can necessitate substantial capital investments in emission control technologies and waste management, thereby increasing compliance costs for manufacturers. Furthermore, logistical complexities within Brazil, including transportation infrastructure limitations, customs procedures, and regional disparities, can lead to inefficiencies in the supply chain, affecting production timelines and distribution costs. The need for continuous innovation to meet evolving consumer preferences and sustainability demands also presents an ongoing challenge.

Leading Players in the Brazil Container Glass Market Market

- Wheaton Group

- Vidrala S.A.

- Gerresheimer AG

- Vitro S.A.B. de C.V.

- Ardagh Group

- Owens-Illinois Inc.

- Verallia Packaging

Key Developments in Brazil Container Glass Market Sector

- April 2024: Linde Plc's Brazilian subsidiary, White Martins, announced plans to construct a significant green hydrogen electrolyzer facility. This facility will supply Cebrace, a major glass manufacturer, with a sustainable energy source for its Jacareí plant, aiming to drastically reduce its carbon emissions by 2025. This initiative marks a pivotal step towards decarbonizing glass production in the region and sets a benchmark for sustainable manufacturing practices.

- March 2024: O-I Brazil successfully launched its innovative "Recycle and Make a Goal" initiative. This program leveraged the popularity of soccer to promote glass recycling across communities. By integrating recycling efforts with local soccer matches, the campaign not only raised awareness but also actively encouraged increased participation in glass collection and recycling, underscoring O-I's commitment to environmental stewardship and community engagement.

- February 2024: Increased investment in advanced manufacturing technologies has been observed across several Brazilian glass container facilities, focusing on enhancing energy efficiency and reducing waste. This includes the adoption of state-of-the-art furnace designs and automated quality control systems, aiming to boost productivity and competitiveness.

- January 2024: A growing trend of utilizing post-consumer recycled (PCR) glass content in packaging for premium segments, such as craft beverages and high-end cosmetics, has been noted. This development reflects a heightened consumer demand for products with a lower environmental footprint and drives innovation in glass processing and collection methods.

Strategic Brazil Container Glass Market Market Outlook

The outlook for the Brazilian container glass market is exceptionally promising, underpinned by a robust combination of sustained economic expansion, a growing and increasingly discerning consumer base, and a strong societal shift towards sustainable consumption. Strategic opportunities abound for market players who can leverage innovation in production processes, such as investing in energy-efficient technologies and exploring novel material compositions that enhance recyclability and reduce environmental impact. Developing eco-friendly packaging solutions that meet the dual demands of consumers for both aesthetic appeal and environmental responsibility will be paramount. Companies that can effectively optimize their supply chains, enhance logistical efficiency, and foster strong relationships with raw material suppliers and recycling partners will gain a significant competitive advantage. A proactive approach to meeting evolving regulatory landscapes and anticipating consumer preferences for sustainable and premium packaging will be the cornerstones of long-term success and market leadership in this dynamic and competitive sector.

Brazil Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

-

1.1.1. Alcoholi

- 1.1.1.1. Wines and Spirits

- 1.1.1.2. Beer and Cider

- 1.1.1.3. Other Alcoholic Beverages

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy-Based

- 1.1.2.5. Flavored Drinks

- 1.1.2.6. Other Non-Alcoholic Beverages

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Brazil Container Glass Market Segmentation By Geography

- 1. Brazil

Brazil Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector is Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Wines and Spirits

- 5.1.1.1.2. Beer and Cider

- 5.1.1.1.3. Other Alcoholic Beverages

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy-Based

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wheaton Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vidrala S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gerreshimer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vitro S A B de C V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ardagh Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Owens-Illnois Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Verallia Packaging*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Wheaton Group

List of Figures

- Figure 1: Brazil Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Brazil Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Brazil Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Brazil Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Container Glass Market?

The projected CAGR is approximately 2.95%.

2. Which companies are prominent players in the Brazil Container Glass Market?

Key companies in the market include Wheaton Group, Vidrala S A, Gerreshimer AG, Vitro S A B de C V, Ardagh Group, Owens-Illnois Inc, Verallia Packaging*List Not Exhaustive.

3. What are the main segments of the Brazil Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging.

6. What are the notable trends driving market growth?

Pharmaceutical Sector is Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Rising Demand for Sustainable and Consumer Preferences to Drive the Market; Demand for Premium and Recyclable Packaging.

8. Can you provide examples of recent developments in the market?

April 2024: Linde Plc announced that its subsidiary, White Martins, is set to construct and operate a second electrolyzer dedicated to producing green hydrogen for Brazil's southeast region. Upon commencing operations in 2025, White Martins' plant will provide green hydrogen to Cebrace, a glass manufacturer, to reduce emissions from their Jacareí glass melting furnaces. Situated adjacent to White Martins' current air separation facility in Jacareí, São Paulo, the new five-megawatt pressurized alkaline electrolyzer plant will harness renewable energy from nearby solar and wind projects, ensuring the production of independently certified green hydrogen.March 2024: O-I Brazil has launched a new initiative, "Recycle and Make a Goal," to boost glass recycling during soccer matches. This endeavor seeks to curtail waste and diminish emissions in the glass manufacturing process. In collaboration with São Paulo’s Municipal Department of Urban Cleaning, the startup Grupo Seiva, and the "Queen of Recycling" Work Cooperative, O-I Brazil has collected over 8,000 glass bottles for recycling. Further, the company highlighted plans to expand the initiative to cities housing O-I's factories, streamlining project logistics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Container Glass Market?

To stay informed about further developments, trends, and reports in the Brazil Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence