Key Insights

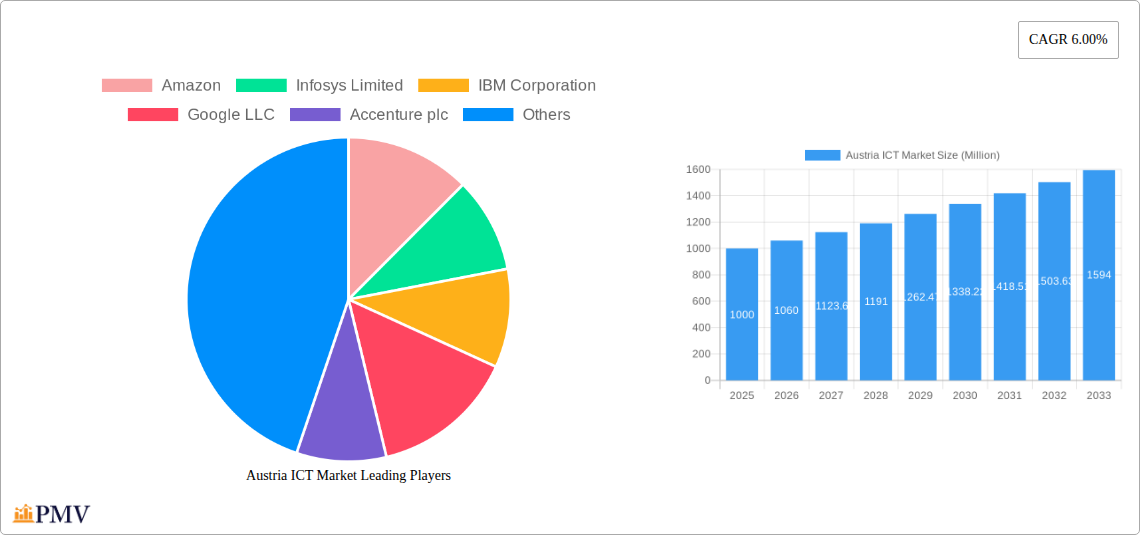

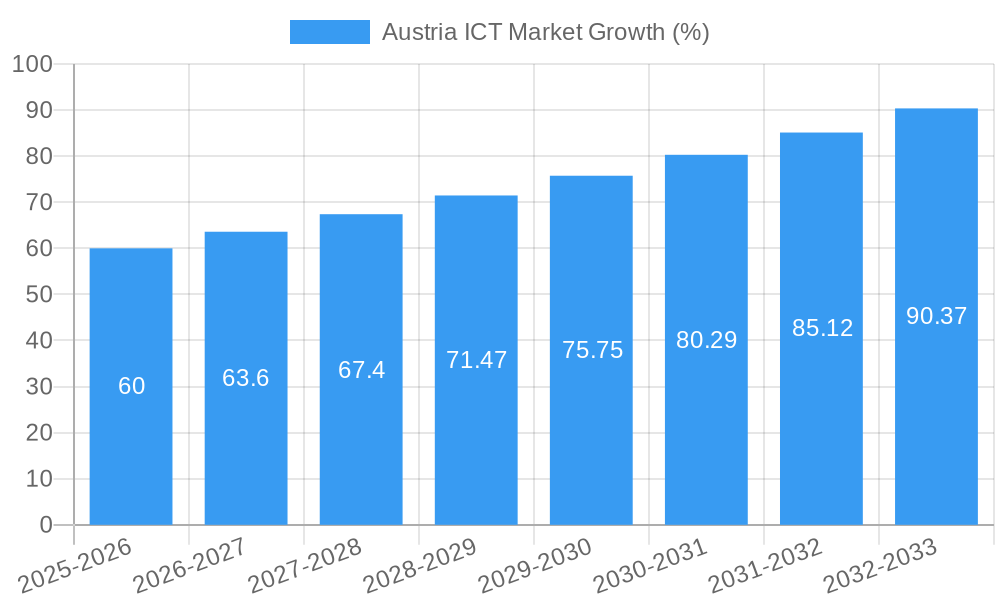

The Austrian ICT market, valued at approximately €X million in 2025 (estimated based on provided CAGR and market trends), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization across various sectors, including BFSI, IT and Telecom, and the public sector, is a primary catalyst. Government initiatives promoting digital infrastructure and e-governance further stimulate market growth. The rising adoption of cloud computing, big data analytics, and artificial intelligence (AI) across enterprises of all sizes (SMEs and large corporations) is also significantly impacting the market's trajectory. Furthermore, the burgeoning e-commerce sector in Austria is driving demand for advanced ICT solutions, particularly in areas like logistics and customer relationship management (CRM). While data privacy concerns and the need for robust cybersecurity measures pose potential restraints, the overall market outlook remains positive. The market is segmented by type (hardware, software, IT services, telecommunication services), enterprise size (SMEs and large enterprises), and industry vertical (BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, and Others). Leading players like Amazon, Infosys, IBM, Google, Accenture, and others are actively competing for market share, driving innovation and competition within the Austrian ICT landscape.

The strong performance of the Austrian ICT market is likely to continue throughout the forecast period. The increasing integration of technology across diverse industries will be a major driver, supported by investments in 5G infrastructure and the expanding adoption of Internet of Things (IoT) technologies. However, the market will also face challenges such as maintaining a skilled workforce to meet the demands of technological advancements and ensuring responsible data handling practices. To effectively capitalize on the growth opportunities, companies will need to prioritize innovation, strategic partnerships, and a customer-centric approach. The increasing emphasis on data security and compliance will also shape the strategies of companies operating in this dynamic market, demanding robust security solutions and compliance strategies. The segment of IT services is expected to show particularly strong growth given the increasing complexity of ICT needs among businesses in Austria.

Austria ICT Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Austria ICT market, covering the period from 2019 to 2033. It offers invaluable insights into market structure, competitive dynamics, industry trends, and future growth prospects, making it an essential resource for businesses, investors, and policymakers operating within or seeking to enter the Austrian ICT sector. The report utilizes data from the base year 2025 and provides estimations for 2025, with a forecast period extending to 2033 and a historical period covering 2019-2024. The market size is expressed in Millions throughout the report.

Austria ICT Market Market Structure & Competitive Dynamics

The Austrian ICT market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share alongside a vibrant ecosystem of smaller, specialized firms. Key players include Amazon, Infosys Limited, IBM Corporation, Google LLC, Accenture plc, Hewlett Packard Enterprise, HCL Technologies, Microsoft Corporation, Dell Inc, Cisco Systems, Capgemini, and Oracle. However, the market is also characterized by a high degree of innovation, driven by both established players and startups.

The regulatory framework in Austria is generally supportive of technological advancement, but ongoing adaptation to EU regulations and digitalization initiatives presents both opportunities and challenges. Product substitution is a constant factor, with new technologies constantly emerging and disrupting existing markets. End-user trends show a strong shift towards cloud-based solutions, mobile technologies, and increased cybersecurity concerns. M&A activity is significant, with deal values reaching xx Million in recent years, demonstrating a trend towards consolidation and expansion of service offerings. For example, Accenture’s acquisition of ARZ in 2022 exemplifies the strategic moves to enhance cloud-based banking services. Market share data for individual players is available within the full report.

Austria ICT Market Industry Trends & Insights

The Austria ICT market is experiencing robust growth, driven by factors such as increasing digitalization across various sectors, rising government investments in infrastructure, and the expanding adoption of cloud computing and 5G technologies. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting a dynamic and expanding market. Market penetration of key technologies like cloud computing and IoT continues to rise, with a significant increase in adoption by both large enterprises and SMEs. The shift towards digital transformation is a primary growth driver, fostering innovation across hardware, software, and service segments. Consumer preferences are increasingly focused on user-friendly, secure, and cost-effective solutions, driving competition and innovation. Competitive dynamics are characterized by strategic alliances, partnerships, and acquisitions, shaping the market landscape. Specific market penetration figures for various technologies are detailed in the full report.

Dominant Markets & Segments in Austria ICT Market

- By Type: The IT Services segment dominates the Austrian ICT market, driven by strong demand for digital transformation initiatives and cloud solutions. Software is also a major segment, experiencing consistent growth fueled by the increasing software-as-a-service (SaaS) model. Telecommunication Services are experiencing significant growth fueled by 5G adoption. Hardware experiences moderate growth driven by consistent upgrades and replacement cycles.

- By Size of Enterprise: Large Enterprises are a primary driver of market growth due to their higher spending capacity on ICT solutions. SMEs also contribute significantly, showing increasing adoption of cloud-based solutions and other cost-effective ICT offerings.

- By Industry Vertical: The BFSI (Banking, Financial Services, and Insurance) sector leads in ICT investment, followed by the IT and Telecom industry itself, and the Government sector. Retail and E-commerce, Manufacturing, and Energy and Utilities sectors exhibit strong growth potential, driving the demand for specific ICT solutions. The strong presence of BFSI sector is driven by governmental policies aimed at strengthening their digital infrastructure. The rapid expansion of the E-commerce sector is also a key driver in this vertical.

Austria ICT Market Product Innovations

The Austrian ICT market is witnessing rapid innovation across various segments. Key trends include the increasing adoption of cloud-based solutions, the expansion of 5G networks, advancements in artificial intelligence (AI) and machine learning (ML) applications, and the growing focus on cybersecurity. These innovations are enhancing efficiency, productivity, and user experiences, driving market growth and competitive advantage. The development and deployment of 5G networks are improving the speed and coverage of mobile networks in the country. The implementation of AI and ML applications continues to drive automation and data analysis capabilities.

Report Segmentation & Scope

This report segments the Austria ICT market across various dimensions:

- By Type: Hardware, Software, IT Services, Telecommunication Services (Growth projections and market sizes for each segment are detailed in the full report).

- By Size of Enterprise: Small and Medium Enterprises (SMEs), Large Enterprises (Competitive dynamics and market size breakdown are provided in the full report).

- By Industry Vertical: BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, Energy and Utilities, Other Industry Verticals (Growth forecasts and market share analysis are presented in the full report).

Key Drivers of Austria ICT Market Growth

The Austria ICT market's growth is driven by several key factors: Government initiatives promoting digitalization, the increasing adoption of cloud-based technologies across various sectors, rising investments in 5G infrastructure, the growing demand for cybersecurity solutions, and a burgeoning startup ecosystem fostering innovation. The strong emphasis on digital transformation in both the public and private sectors is a significant factor in market growth.

Challenges in the Austria ICT Market Sector

Challenges facing the Austria ICT market include the need for skilled workforce development to meet the growing demand for specialized talent, potential cybersecurity threats and data privacy concerns, and the ongoing need for investment in digital infrastructure, particularly in rural areas. Competition from established multinational corporations poses challenges for smaller players. Supply chain disruptions can affect the availability of hardware and components, impacting overall market performance. The quantified impact of these challenges is provided within the full report.

Leading Players in the Austria ICT Market Market

- Amazon

- Infosys Limited

- IBM Corporation

- Google LLC

- Accenture plc

- Hewlett Packard Enterprise

- HCL Technologies

- Microsoft Corporation

- Dell Inc

- Cisco Systems

- Capgemini

- Oracle

Key Developments in Austria ICT Market Sector

- December 2022: Nokia and A1 Austria successfully verified 3CC CA on a 5G SA experimental network, achieving data speeds approaching 2 Gbps, significantly enhancing 5G capabilities.

- October 2022: Google announced plans to open new cloud regions in Austria, expanding cloud computing infrastructure and capacity.

- June 2022: Accenture acquired ARZ, expanding its cloud-based banking platform-as-a-service offerings in the European market.

Strategic Austria ICT Market Market Outlook

The Austria ICT market exhibits strong future growth potential, fueled by continued digital transformation across all sectors, expanding 5G network deployment, and increased adoption of AI and cloud-based services. Strategic opportunities exist for businesses focusing on providing innovative solutions addressing cybersecurity, data analytics, and the specific needs of SMEs. The market presents attractive investment opportunities for both established players and new entrants with innovative offerings.

Austria ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Austria ICT Market Segmentation By Geography

- 1. Austria

Austria ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Telecommunication Network

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. Growing demand for Cloud Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infosys Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HCL Technologies*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Capgemini

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Oracle

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Austria ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Austria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Austria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Austria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Austria ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Austria ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Austria ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Austria ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Austria ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Austria ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria ICT Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Austria ICT Market?

Key companies in the market include Amazon, Infosys Limited, IBM Corporation, Google LLC, Accenture plc, Hewlett Packard Enterprise, HCL Technologies*List Not Exhaustive, Microsoft Corporation, Dell Inc, Cisco Systems, Capgemini, Oracle.

3. What are the main segments of the Austria ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Telecommunication Network.

6. What are the notable trends driving market growth?

Growing demand for Cloud Technology.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

December 2022: Nokia and A1 Austria announced that they successfully verified 3 Component Carrier Aggregation (3CC CA) on a 5G Standalone (SA) experimental network in Austria, with data speeds approaching 2 Gbps. CA (Carrier Aggregation) enables mobile carriers to achieve faster throughputs and improved coverage by combining multiple spectrum frequencies to better use their spectrum assets. It will allow A1 to provide its subscribers with a better 5G experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria ICT Market?

To stay informed about further developments, trends, and reports in the Austria ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence