Key Insights

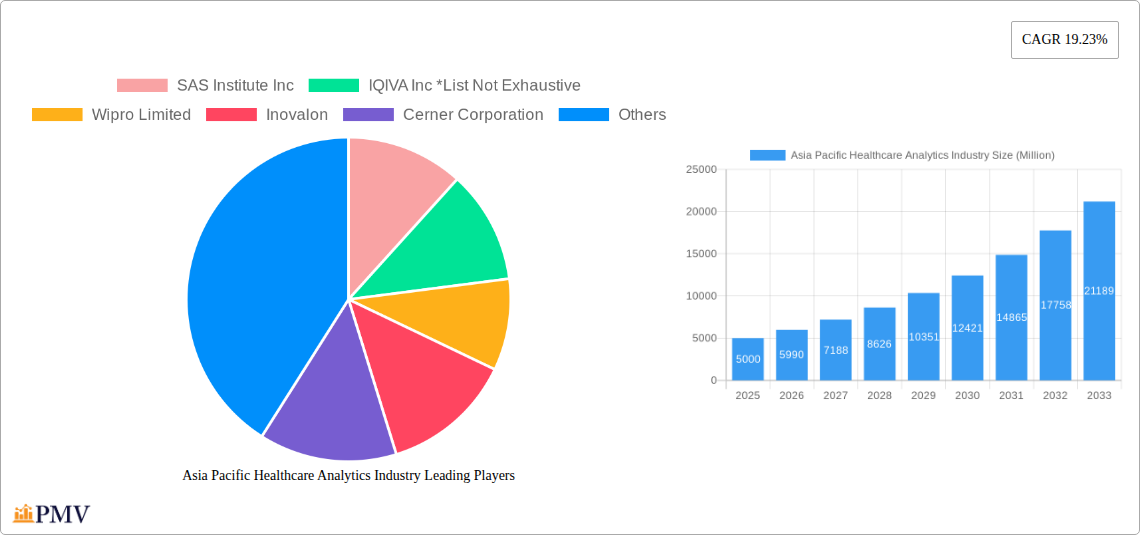

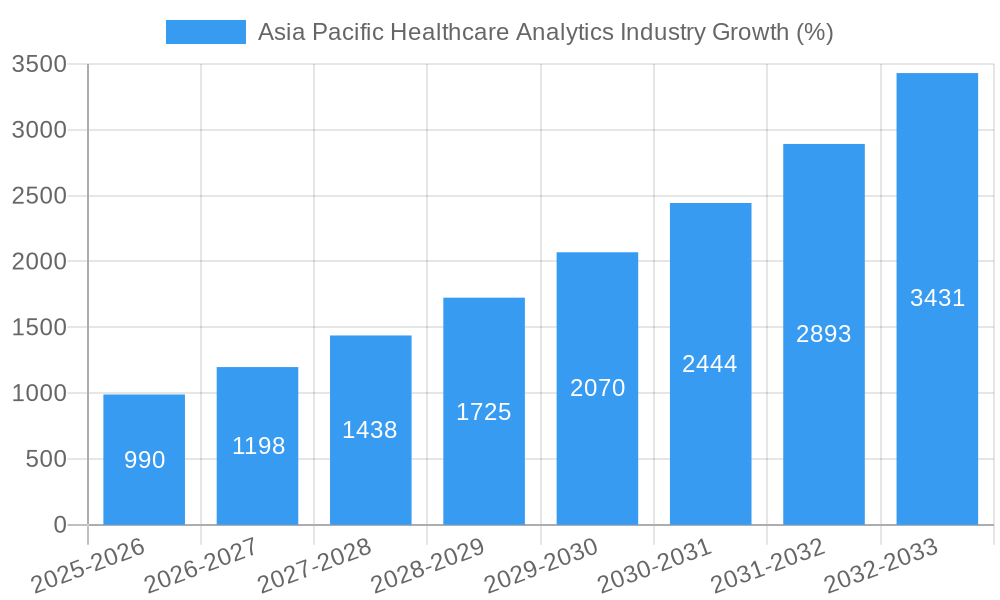

The Asia-Pacific healthcare analytics market is experiencing robust growth, fueled by a confluence of factors. The region's expanding healthcare infrastructure, increasing prevalence of chronic diseases, rising adoption of electronic health records (EHRs), and government initiatives promoting digital health are key drivers. A compound annual growth rate (CAGR) of 19.23% from 2019-2024 suggests a significant market expansion, likely exceeding several billion USD in 2025. This growth is particularly strong in countries like China, India, and Japan, which are investing heavily in healthcare IT and data analytics solutions to improve efficiency and quality of care. The market is segmented by deployment (on-premise and cloud), application (clinical, financial, and operational data analytics), and end-user (healthcare providers, pharmaceutical companies, and research institutions). Cloud-based solutions are gaining traction due to their scalability, cost-effectiveness, and accessibility. Clinical data analytics dominates the application segment, driven by the need for improved diagnosis, treatment, and disease management. While data privacy and security concerns represent a significant restraint, the overall market outlook remains positive, with substantial growth projected through 2033. The increasing adoption of AI and machine learning in healthcare analytics is expected to further accelerate market expansion in the coming years. Leading players like SAS Institute, IQVIA, Wipro, and Cerner are actively competing in this dynamic market, constantly innovating to provide advanced solutions to healthcare providers and organizations.

The rapid expansion of the Asia-Pacific healthcare analytics market reflects a growing recognition of the value of data-driven insights in improving healthcare outcomes. The market's diverse segments present significant opportunities for both established players and emerging companies. The increasing availability of big data, coupled with advancements in analytical technologies, is driving the demand for sophisticated solutions capable of handling and analyzing large volumes of complex healthcare data. Furthermore, government regulations aimed at improving healthcare data interoperability are facilitating data sharing and collaborative analysis, leading to more efficient and effective healthcare delivery. While challenges remain, such as addressing data security concerns and bridging the digital divide, the long-term prospects for the Asia-Pacific healthcare analytics market remain exceptionally strong, promising significant advancements in healthcare quality, efficiency, and patient care.

Asia Pacific Healthcare Analytics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Asia Pacific healthcare analytics market, offering valuable insights for businesses, investors, and stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by deployment (on-premise, cloud), application (clinical, financial, operational/administrative data analytics), end-user (healthcare providers, pharmaceutical, biotech, academic), and country (China, Japan, India, South Korea, Australia, Indonesia, Rest of Asia Pacific). The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia Pacific Healthcare Analytics Industry Market Structure & Competitive Dynamics

The Asia Pacific healthcare analytics market exhibits a moderately concentrated structure, with several major players commanding significant market share. Key players like SAS Institute Inc, IQIVA Inc, Wipro Limited, Inovalon, Cerner Corporation, Optum Inc, Health Catalyst, and McKesson Corporation compete intensely, driving innovation and shaping market dynamics. Market share is dynamic, with ongoing M&A activity influencing the competitive landscape. Deal values in recent years have averaged xx Million, with a notable increase in cross-border acquisitions. The regulatory framework varies across countries, influencing data privacy and security regulations and impacting market growth. The increasing adoption of cloud-based solutions and the rising demand for advanced analytics are major factors shaping the market. The innovation ecosystem is vibrant, fueled by government initiatives, academic research, and venture capital investments. Substitute products like traditional data management systems pose some competition, but the increasing complexity of healthcare data and the need for actionable insights favor the growth of sophisticated analytics platforms. End-user trends indicate a strong preference for cloud-based solutions offering scalability and cost-effectiveness.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Innovation Ecosystem: Active, driven by government funding, academic research, and private investment.

- Regulatory Framework: Varies across countries, influencing data privacy and security.

- M&A Activity: Significant, with deal values averaging xx Million in recent years.

- Product Substitutes: Traditional data management systems.

- End-User Trends: Shifting towards cloud-based solutions.

Asia Pacific Healthcare Analytics Industry Industry Trends & Insights

The Asia Pacific healthcare analytics market is experiencing robust growth, driven by several factors. The rising prevalence of chronic diseases, increasing healthcare expenditure, and the growing adoption of electronic health records (EHRs) are fueling the demand for advanced analytics solutions. Technological advancements like AI, machine learning, and big data analytics are revolutionizing healthcare data management and analysis, enabling better patient care and operational efficiency. Consumer preferences are shifting towards personalized healthcare, creating a demand for tailored treatment plans and proactive healthcare management strategies. These factors, along with increasing government initiatives promoting digital healthcare, contribute significantly to market expansion. The market exhibits high growth potential in emerging economies like India and Indonesia, driven by increasing healthcare investment and a burgeoning middle class. Competitive dynamics are characterized by fierce competition among established players and the emergence of innovative start-ups, leading to continuous product innovation and improved solutions.

Dominant Markets & Segments in Asia Pacific Healthcare Analytics Industry

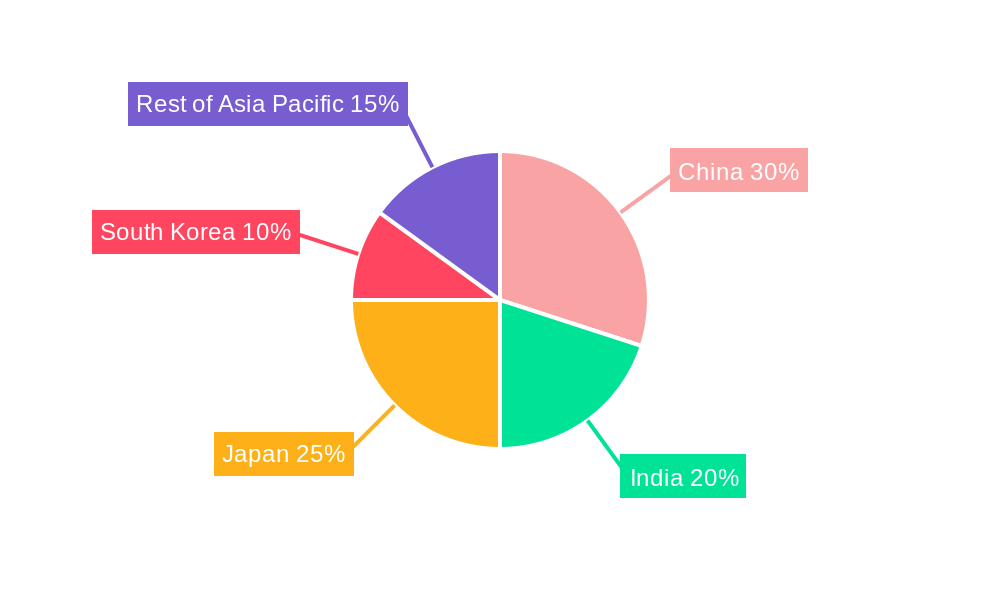

- Leading Region: China, due to its large population, expanding healthcare infrastructure, and government support for digital healthcare initiatives.

- Leading Country: China, driven by significant investments in healthcare IT and increasing adoption of advanced analytics.

- Leading Segment (Deployment): Cloud, due to its scalability, cost-effectiveness, and accessibility.

- Leading Segment (Application): Clinical Data Analytics, driven by the need for improved diagnosis, treatment planning, and patient outcomes.

- Leading Segment (End-User): Healthcare providers, owing to the increasing need for efficient data management and improved operational efficiency.

Key Drivers for Dominance:

- China: Government investments in digital healthcare, growing healthcare expenditure, and expanding EHR adoption.

- Cloud Deployment: Cost-effectiveness, scalability, and ease of access.

- Clinical Data Analytics: Critical for improved patient care, diagnosis, and treatment planning.

- Healthcare Providers: Need for improved efficiency, reduced costs, and better patient outcomes.

Asia Pacific Healthcare Analytics Industry Product Innovations

Recent product innovations focus on AI-powered diagnostic tools, predictive analytics for disease outbreaks, and personalized medicine solutions. Cloud-based platforms offering enhanced security and scalability are gaining popularity. The integration of blockchain technology for secure data sharing is also emerging as a significant trend. These innovations aim to improve the accuracy and efficiency of healthcare analytics, leading to better patient care, reduced costs, and improved operational efficiency. The market is witnessing the introduction of innovative solutions catering to specific healthcare challenges like managing chronic diseases and improving public health.

Report Segmentation & Scope

The report segments the market by deployment (on-premise, cloud), application (clinical, financial, operational/administrative data analytics), end-user (healthcare provider, pharmaceutical, biotechnology, academic), and country (China, Japan, India, South Korea, Australia, Indonesia, Rest of Asia Pacific). Each segment includes detailed analysis of market size, growth projections, and competitive dynamics. The cloud deployment segment is expected to show the highest growth rate due to its inherent scalability and cost benefits. Clinical data analytics is expected to remain the largest application segment, while healthcare providers are anticipated to be the dominant end-user group. China is projected to be the largest national market in the region.

Key Drivers of Asia Pacific Healthcare Analytics Industry Growth

Several key factors drive growth in the Asia Pacific healthcare analytics market. Rising healthcare expenditure, coupled with the increasing prevalence of chronic diseases, creates a significant demand for efficient data management and analysis. Technological advancements such as AI and machine learning are revolutionizing healthcare data analysis, leading to improved diagnostic tools and personalized treatment plans. Government initiatives promoting digital healthcare transformation in various countries contribute significantly to market expansion. Furthermore, the increasing adoption of EHRs and the growing focus on value-based care models are further accelerating market growth.

Challenges in the Asia Pacific Healthcare Analytics Industry Sector

Despite the significant growth potential, several challenges hinder the expansion of the Asia Pacific healthcare analytics market. Data security and privacy concerns remain paramount, particularly with the increasing use of cloud-based solutions. Interoperability issues between different healthcare systems hinder seamless data exchange and analysis. The high cost of implementing and maintaining advanced analytics systems, coupled with a shortage of skilled professionals, poses a significant obstacle to market growth. Regulatory complexities and varying data privacy regulations across different countries also pose challenges to market expansion. Finally, concerns about the ethical implications of AI and machine learning in healthcare need careful consideration.

Leading Players in the Asia Pacific Healthcare Analytics Industry Market

- SAS Institute Inc

- IQIVA Inc

- Wipro Limited

- Inovalon

- Cerner Corporation

- Optum Inc

- Health Catalyst

- McKesson Corporation

Key Developments in Asia Pacific Healthcare Analytics Industry Sector

- March 2022: Optum, Inc. launched Optum Specialty Fusion, a specialty drug management solution projected to achieve 17% overall cost reductions in health plans.

- March 2022: Microsoft launched Azure Health Data Services, a cloud-based platform for managing protected health information (PHI).

Strategic Asia Pacific Healthcare Analytics Industry Market Outlook

The Asia Pacific healthcare analytics market presents significant growth opportunities. The increasing focus on preventive care, personalized medicine, and value-based healthcare will fuel demand for advanced analytics solutions. Technological innovations like AI and machine learning will continue to transform healthcare data management, creating new market opportunities for providers of analytics platforms and services. Strategic partnerships between technology companies and healthcare providers will play a crucial role in driving market expansion. Investing in infrastructure development and workforce training will be critical for realizing the full potential of the market.

Asia Pacific Healthcare Analytics Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. Application

- 2.1. Clinical Data Analytics

- 2.2. Financial Data Analytics

- 2.3. Operational/Administrative Data Analytics

-

3. End-User

- 3.1. Healthcare Provider

- 3.2. Pharmaceutical Industry

- 3.3. Biotechnology Industry

- 3.4. Academic Organization

Asia Pacific Healthcare Analytics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Healthcare Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements and Favorable Governemnt Initiatives; Emergence of Big Data in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Cost and Complexity of Software; Data Integrity and Privacy Concerns; Lack of Proper Skilled Labors

- 3.4. Market Trends

- 3.4.1. Expanding IT sector and demand for improved medical services to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Clinical Data Analytics

- 5.2.2. Financial Data Analytics

- 5.2.3. Operational/Administrative Data Analytics

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Healthcare Provider

- 5.3.2. Pharmaceutical Industry

- 5.3.3. Biotechnology Industry

- 5.3.4. Academic Organization

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. China Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Healthcare Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SAS Institute Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IQIVA Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Wipro Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Inovalon

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cerner Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Optum Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Health Catalyst

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 McKesson Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 SAS Institute Inc

List of Figures

- Figure 1: Asia Pacific Healthcare Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Healthcare Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 15: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Asia Pacific Healthcare Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia Pacific Healthcare Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Healthcare Analytics Industry?

The projected CAGR is approximately 19.23%.

2. Which companies are prominent players in the Asia Pacific Healthcare Analytics Industry?

Key companies in the market include SAS Institute Inc, IQIVA Inc *List Not Exhaustive, Wipro Limited, Inovalon, Cerner Corporation, Optum Inc, Health Catalyst, McKesson Corporation.

3. What are the main segments of the Asia Pacific Healthcare Analytics Industry?

The market segments include Deployment, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements and Favorable Governemnt Initiatives; Emergence of Big Data in the Healthcare Industry.

6. What are the notable trends driving market growth?

Expanding IT sector and demand for improved medical services to drive the market.

7. Are there any restraints impacting market growth?

Cost and Complexity of Software; Data Integrity and Privacy Concerns; Lack of Proper Skilled Labors.

8. Can you provide examples of recent developments in the market?

March 2022: Optum, Inc. has introduced Optum Specialty Fusion, a specialty drug management solution that simplifies treatment for those using certain medications and minimizes pharmaceutical expenditures. According to the company, which is part of UnitedHealth Group, the method has the potential to achieve 17% overall cost reductions in health plans' medical and pharmaceutical costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Healthcare Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Healthcare Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Healthcare Analytics Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Healthcare Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence