Key Insights

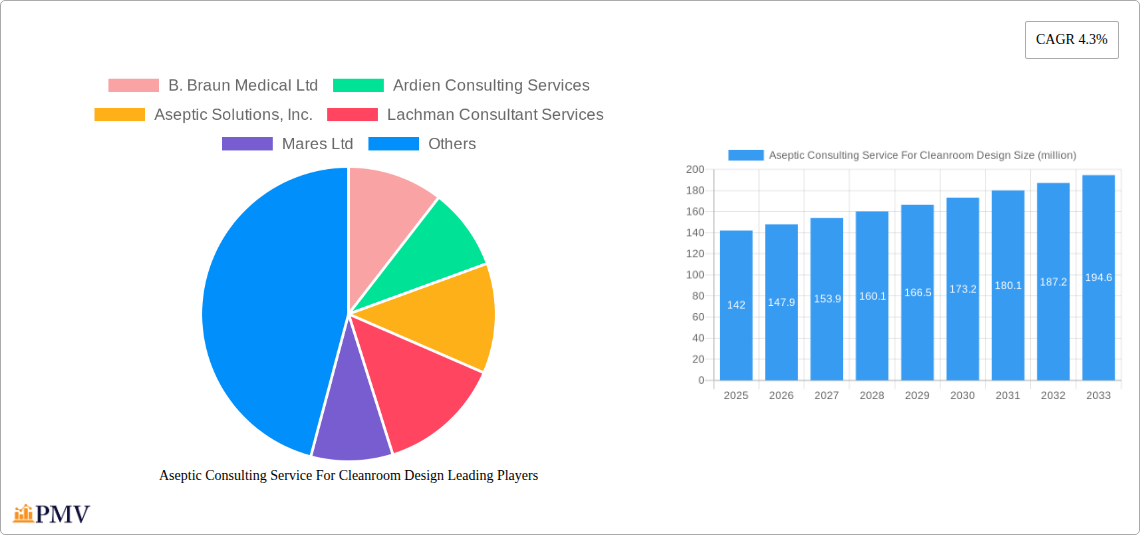

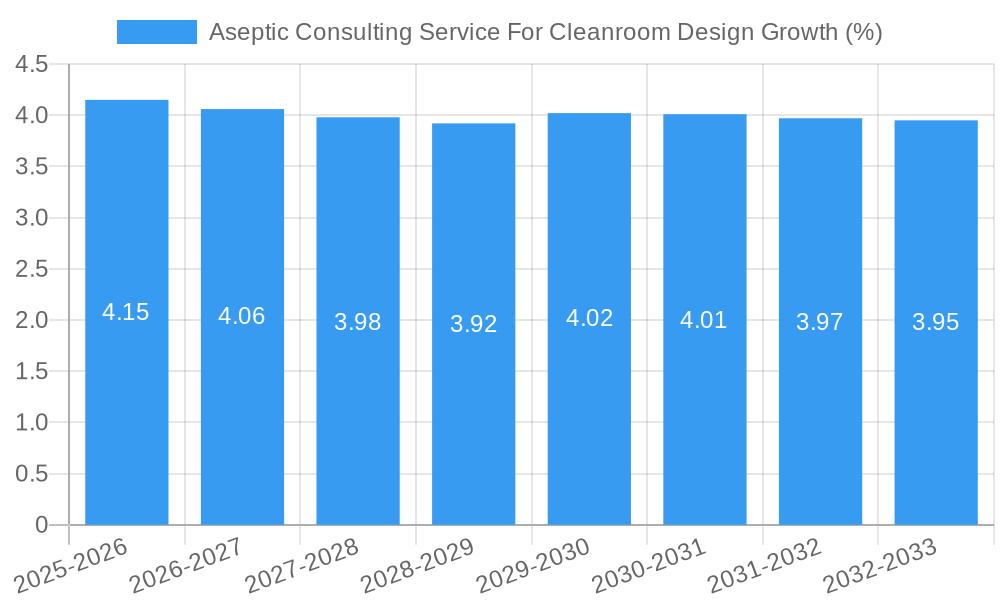

The Aseptic Consulting Service for Cleanroom Design market is poised for significant expansion, projected to reach an estimated USD 142 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.3% anticipated throughout the forecast period of 2025-2033. A primary driver for this burgeoning market is the increasing stringent regulatory compliance demands across critical sectors such as pharmaceuticals, food and beverage, and healthcare. Companies are recognizing the indispensable role of expertly designed aseptic cleanrooms in ensuring product integrity, patient safety, and preventing contamination. The need for specialized knowledge in creating and maintaining sterile environments is paramount, driving demand for specialized consulting services. Furthermore, the continuous innovation in pharmaceutical research and development, particularly in biologics and advanced therapies, necessitates highly controlled and sophisticated cleanroom infrastructure. This, coupled with the growing global population and rising healthcare expenditure, further fuels the demand for aseptic consulting to meet evolving industry standards and production capacities.

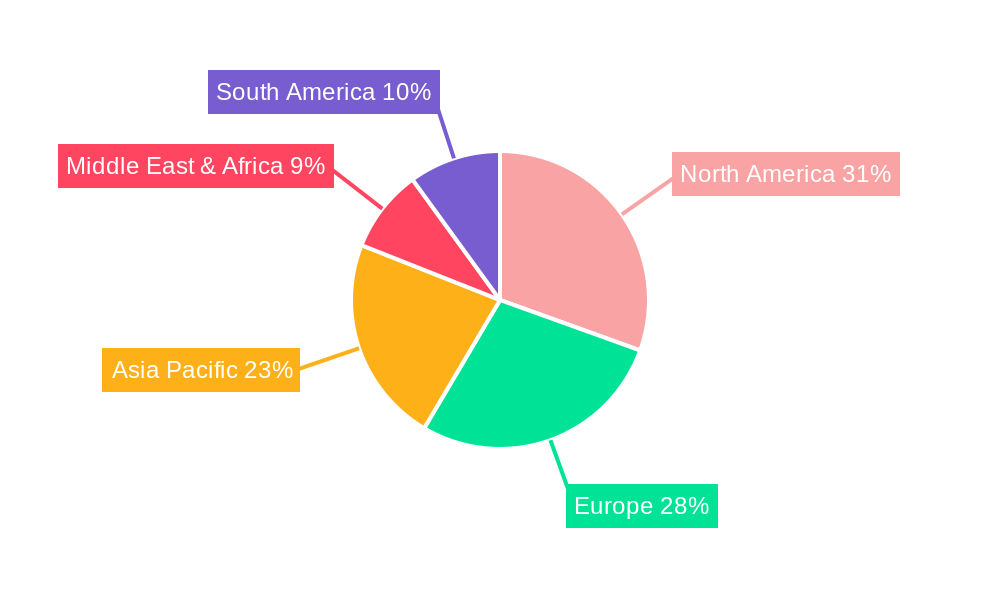

The market landscape is characterized by a dynamic interplay of new construction and existing facility upgrades. The "Design of New Aseptic Cleanroom" segment is expected to witness substantial investment as new healthcare facilities and pharmaceutical manufacturing plants are established globally. Simultaneously, the "Refurbishment of Existing Cleanroom" segment will see sustained activity as older facilities are retrofitted to meet current Good Manufacturing Practices (cGMP) and evolving technological requirements. Key industry players like B. Braun Medical Ltd, Steris Corporation, and Sotera Health are actively engaged in providing these critical services, indicating a competitive yet expanding market. Geographically, North America and Europe are anticipated to lead market share due to established pharmaceutical and biotechnology hubs and stringent regulatory frameworks. However, the Asia Pacific region, driven by rapid industrialization and growing healthcare infrastructure, is expected to emerge as a high-growth market. Emerging challenges such as the high initial cost of implementing advanced cleanroom technologies and a shortage of skilled aseptic consulting professionals could moderate growth, but the overall trajectory remains strongly positive due to the non-negotiable nature of aseptic control in these vital industries.

This comprehensive report provides an in-depth analysis of the global Aseptic Consulting Service for Cleanroom Design market. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this research offers critical insights into market dynamics, growth drivers, challenges, and competitive landscapes. Essential for stakeholders in the pharmaceutical industry, hospital applications, food and beverage production, and other critical sectors requiring sterile environments, this report details market segmentation, emerging trends, and strategic opportunities.

The pharmaceutical industry remains a dominant force, driven by stringent regulatory requirements and the continuous need for sterile drug manufacturing. Likewise, the hospital sector increasingly relies on aseptic cleanrooms for sterile processing and patient safety. The food and beverage production segment is also expanding its adoption of advanced cleanroom technologies to ensure product integrity and consumer safety. The report meticulously examines both the design of new aseptic cleanrooms and the refurbishment of existing cleanrooms, providing a holistic view of the market's evolution.

This report is an indispensable resource for aseptic consulting firms, cleanroom design specialists, pharmaceutical manufacturers, healthcare providers, food and beverage companies, regulatory bodies, and investors seeking to understand and capitalize on the burgeoning aseptic cleanroom consulting market. We analyze key players such as B. Braun Medical Ltd, Ardien Consulting Services, Aseptic Solutions, Inc., Lachman Consultant Services, Mares Ltd, Gapp Quality GmbH, Sotera Health, tri-consulting, AXYS-NETWORK, Integrated Project Services, LLC, Steris Corporation, Veltek Associates, Inc., Hoefliger, Ruland Engineering & Consulting GmbH, Microrite, Inc., i-Pharm, and Galenisys.

Aseptic Consulting Service For Cleanroom Design Market Structure & Competitive Dynamics

The aseptic consulting service for cleanroom design market exhibits a moderate to high level of concentration, with several key players dominating specific regional or application segments. Innovation ecosystems are driven by advancements in sterile manufacturing technologies, automation, and containment strategies. Regulatory frameworks, particularly those set by the FDA and EMA, significantly shape market entry and operational standards, acting as both a driver for specialized consulting services and a potential barrier. Product substitutes, while limited for true aseptic environments, include less stringent controlled environments that may cater to specific niche applications. End-user trends point towards an increasing demand for integrated solutions encompassing design, validation, and ongoing monitoring services. Mergers and acquisitions (M&A) activities are prevalent as larger firms aim to expand their service portfolios and geographical reach, with estimated M&A deal values in the hundreds of millions. For instance, a major acquisition in this space could represent an estimated 500 million in deal value, consolidating market share and expertise. The market share of leading consultants can range from an estimated 10% to 25% in their specialized areas.

Aseptic Consulting Service For Cleanroom Design Industry Trends & Insights

The global aseptic consulting service for cleanroom design market is poised for robust growth, driven by an estimated Compound Annual Growth Rate (CAGR) of xx% over the forecast period (2025-2033). This expansion is fueled by escalating global demand for sterile products, particularly in the pharmaceutical and healthcare sectors, necessitating stringent environmental controls. Technological disruptions, including the adoption of advanced air filtration systems, real-time environmental monitoring solutions, and AI-driven design optimization tools, are reshaping the industry. Consumer preferences are increasingly focused on product safety and efficacy, pushing manufacturers to invest in superior cleanroom standards. Competitive dynamics are characterized by a blend of established consulting giants and specialized niche providers, each vying for market share through expertise, innovative service offerings, and strong client relationships. The market penetration of specialized aseptic consulting services is expected to rise from an estimated xx% in the base year to an anticipated yy% by the end of the forecast period, indicating a growing recognition of the value these services bring. The increasing complexity of drug manufacturing, including biologics and personalized medicine, further propels the demand for sophisticated aseptic cleanroom designs and validation services, contributing significantly to market expansion. The growing emphasis on Good Manufacturing Practices (GMP) compliance across all regulated industries underscores the critical role of expert consulting in achieving and maintaining these standards, thereby driving market growth.

Dominant Markets & Segments in Aseptic Consulting Service For Cleanroom Design

The Pharmaceutical Industry segment stands out as the dominant force within the aseptic consulting service for cleanroom design market, accounting for an estimated 60% of the global market share. This dominance is primarily driven by the intrinsic requirements of drug manufacturing, where sterility is paramount to patient safety and product efficacy. Regulatory mandates from bodies like the FDA and EMA enforce rigorous standards for aseptic processing, creating a continuous need for expert design and validation services. Key drivers within this segment include:

- Stringent Regulatory Compliance: The ever-evolving GMP guidelines and regulatory inspections necessitate specialized expertise to ensure compliance, driving demand for consulting services.

- New Drug Development & Expansion: The continuous pipeline of new pharmaceutical products, especially complex biologics and sterile injectables, requires the design and implementation of state-of-the-art aseptic facilities.

- Quality Assurance & Risk Mitigation: Aseptic environments are critical for minimizing contamination risks, directly impacting product quality and patient outcomes, making investment in expert consulting a strategic imperative.

- Technological Advancements: The integration of advanced technologies like isolators, single-use systems, and sophisticated HVAC systems requires specialized knowledge for effective design and implementation.

Geographically, North America and Europe represent the leading regions, largely due to the high concentration of pharmaceutical manufacturing facilities and robust regulatory oversight. Within these regions, the Design of New Aseptic Cleanroom type commands a significant market share, estimated at approximately 70% of all new cleanroom projects, as companies invest in greenfield facilities to meet growing production demands and leverage the latest technologies. However, the Refurbishment of Existing Cleanroom segment is also experiencing substantial growth, driven by the need to upgrade older facilities to meet current regulatory standards and incorporate new technologies, representing an estimated 30% of the market.

Aseptic Consulting Service For Cleanroom Design Product Innovations

Product innovations in aseptic consulting services are centered around enhancing efficiency, ensuring compliance, and reducing contamination risks. This includes the development of sophisticated simulation software for predicting airflow patterns and contamination spread, advanced cleanroom monitoring systems utilizing IoT technology for real-time data acquisition, and the integration of single-use technologies in cleanroom design. Competitive advantages are gained by firms offering end-to-end solutions, from initial design and validation to ongoing operational support and training, thereby maximizing market fit and client value.

Report Segmentation & Scope

This report segments the Aseptic Consulting Service for Cleanroom Design market across key applications and service types.

Application Segments:

- Hospital: This segment focuses on consulting services for hospital pharmacies, operating theaters, and sterile processing departments, ensuring patient safety and adherence to healthcare regulations. Estimated market size: xx million.

- Food and Beverage Production: This segment addresses the needs of food and beverage manufacturers requiring sterile environments for sensitive product lines, ensuring product shelf-life and consumer safety. Estimated market size: yy million.

- Pharmaceutical Industry: This remains the largest segment, encompassing all aspects of sterile drug manufacturing, from API production to finished dosage forms. Estimated market size: zz million.

- Others: This includes niche applications such as cosmetic manufacturing, advanced materials production, and research laboratories requiring controlled sterile environments. Estimated market size: aa million.

Type Segments:

- Design of New Aseptic Cleanroom: This segment covers the complete design process for greenfield aseptic facilities, including conceptualization, detailed engineering, and validation planning. Projected growth: bb% CAGR.

- Refurbishment of Existing Cleanroom: This segment focuses on upgrading and modernizing existing cleanroom facilities to meet current standards, improve performance, and incorporate new technologies. Projected growth: cc% CAGR.

Key Drivers of Aseptic Consulting Service For Cleanroom Design Growth

The growth of the aseptic consulting service for cleanroom design market is propelled by several key factors. The ever-increasing stringency of regulatory requirements across the pharmaceutical, healthcare, and food industries mandates expert guidance for compliance. Technological advancements in sterile manufacturing, such as isolator technology and advanced air handling systems, necessitate specialized consulting expertise for effective implementation. Furthermore, the growing global demand for sterile pharmaceutical products and safe food supplies fuels the need for new and upgraded aseptic facilities. The increasing complexity of drug formulations, including biologics and gene therapies, also drives the demand for highly specialized cleanroom designs and validation.

Challenges in the Aseptic Consulting Service For Cleanroom Design Sector

Despite significant growth, the aseptic consulting service for cleanroom design sector faces several challenges. High upfront investment costs for designing and building aseptic facilities can be a barrier for some companies. Navigating complex and evolving regulatory landscapes requires continuous adaptation and deep expertise, posing a constant challenge for consultants and clients alike. Supply chain disruptions for critical components and materials can impact project timelines and budgets. Additionally, a shortage of highly skilled aseptic design and validation professionals can limit the availability of expert services. Competitive pressures from both established players and emerging consultancies also contribute to market dynamics.

Leading Players in the Aseptic Consulting Service For Cleanroom Design Market

- B. Braun Medical Ltd

- Ardien Consulting Services

- Aseptic Solutions, Inc.

- Lachman Consultant Services

- Mares Ltd

- Gapp Quality GmbH

- Sotera Health

- tri-consulting

- AXYS-NETWORK

- Integrated Project Services, LLC

- Steris Corporation

- Veltek Associates, Inc.

- Hoefliger

- Ruland Engineering & Consulting GmbH

- Microrite, Inc.

- i-Pharm

- Galenisys

Key Developments in Aseptic Consulting Service For Cleanroom Design Sector

- 2023: Launch of advanced simulation software for aseptic cleanroom design, improving predictive accuracy and reducing design iterations.

- 2023: Increased adoption of AI-driven solutions for real-time environmental monitoring and predictive maintenance in cleanrooms.

- 2023: Strategic partnerships formed between specialized cleanroom technology providers and global consulting firms to offer integrated solutions.

- 2023: Expansion of consulting services to include expertise in single-use cleanroom technologies for biopharmaceutical manufacturing.

- 2022: Significant M&A activity, with larger firms acquiring niche consultancies to broaden their service offerings and market reach.

- 2022: Increased focus on sustainable cleanroom design principles and energy-efficient HVAC systems.

- 2021: Enhanced focus on cybersecurity for integrated cleanroom control systems to protect sensitive manufacturing data.

Strategic Aseptic Consulting Service For Cleanroom Design Market Outlook

- 2023: Launch of advanced simulation software for aseptic cleanroom design, improving predictive accuracy and reducing design iterations.

- 2023: Increased adoption of AI-driven solutions for real-time environmental monitoring and predictive maintenance in cleanrooms.

- 2023: Strategic partnerships formed between specialized cleanroom technology providers and global consulting firms to offer integrated solutions.

- 2023: Expansion of consulting services to include expertise in single-use cleanroom technologies for biopharmaceutical manufacturing.

- 2022: Significant M&A activity, with larger firms acquiring niche consultancies to broaden their service offerings and market reach.

- 2022: Increased focus on sustainable cleanroom design principles and energy-efficient HVAC systems.

- 2021: Enhanced focus on cybersecurity for integrated cleanroom control systems to protect sensitive manufacturing data.

Strategic Aseptic Consulting Service For Cleanroom Design Market Outlook

The strategic outlook for the aseptic consulting service for cleanroom design market is exceptionally positive, driven by ongoing global health imperatives and the relentless pursuit of product quality. Growth accelerators include the increasing demand for sterile injectables, the rise of personalized medicine, and the continuous expansion of the biopharmaceutical sector. Emerging markets present significant untapped potential as they adopt more stringent manufacturing standards. Strategic opportunities lie in offering comprehensive, lifecycle management solutions that extend beyond initial design to include ongoing validation, monitoring, and optimization services. Furthermore, leveraging digital technologies for remote consulting, data analytics, and augmented reality-assisted validation will be crucial for maintaining a competitive edge and capturing future market growth.

Aseptic Consulting Service For Cleanroom Design Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Food and Beverage Production

- 1.3. Pharmaceutical Industry

- 1.4. Others

-

2. Type

- 2.1. Design of New Aseptic Cleanroom

- 2.2. Refurbishment of Existing Cleanroom

Aseptic Consulting Service For Cleanroom Design Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aseptic Consulting Service For Cleanroom Design REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aseptic Consulting Service For Cleanroom Design Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Food and Beverage Production

- 5.1.3. Pharmaceutical Industry

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Design of New Aseptic Cleanroom

- 5.2.2. Refurbishment of Existing Cleanroom

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aseptic Consulting Service For Cleanroom Design Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Food and Beverage Production

- 6.1.3. Pharmaceutical Industry

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Design of New Aseptic Cleanroom

- 6.2.2. Refurbishment of Existing Cleanroom

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aseptic Consulting Service For Cleanroom Design Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Food and Beverage Production

- 7.1.3. Pharmaceutical Industry

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Design of New Aseptic Cleanroom

- 7.2.2. Refurbishment of Existing Cleanroom

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aseptic Consulting Service For Cleanroom Design Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Food and Beverage Production

- 8.1.3. Pharmaceutical Industry

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Design of New Aseptic Cleanroom

- 8.2.2. Refurbishment of Existing Cleanroom

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aseptic Consulting Service For Cleanroom Design Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Food and Beverage Production

- 9.1.3. Pharmaceutical Industry

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Design of New Aseptic Cleanroom

- 9.2.2. Refurbishment of Existing Cleanroom

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aseptic Consulting Service For Cleanroom Design Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Food and Beverage Production

- 10.1.3. Pharmaceutical Industry

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Design of New Aseptic Cleanroom

- 10.2.2. Refurbishment of Existing Cleanroom

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 B. Braun Medical Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ardien Consulting Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aseptic Solutions Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lachman Consultant Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mares Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gapp Quality GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sotera Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 tri-consulting

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AXYS-NETWORK

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Integrated Project Services LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Steris Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Veltek Associates Inc.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hoefliger

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ruland Engineering & Consulting GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Microrite Inc.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 i-Pharm

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Galenisys

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 B. Braun Medical Ltd

List of Figures

- Figure 1: Global Aseptic Consulting Service For Cleanroom Design Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Aseptic Consulting Service For Cleanroom Design Revenue (million), by Application 2024 & 2032

- Figure 3: North America Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Aseptic Consulting Service For Cleanroom Design Revenue (million), by Type 2024 & 2032

- Figure 5: North America Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Aseptic Consulting Service For Cleanroom Design Revenue (million), by Country 2024 & 2032

- Figure 7: North America Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Aseptic Consulting Service For Cleanroom Design Revenue (million), by Application 2024 & 2032

- Figure 9: South America Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Aseptic Consulting Service For Cleanroom Design Revenue (million), by Type 2024 & 2032

- Figure 11: South America Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Aseptic Consulting Service For Cleanroom Design Revenue (million), by Country 2024 & 2032

- Figure 13: South America Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Aseptic Consulting Service For Cleanroom Design Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Aseptic Consulting Service For Cleanroom Design Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Aseptic Consulting Service For Cleanroom Design Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Aseptic Consulting Service For Cleanroom Design Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Aseptic Consulting Service For Cleanroom Design Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aseptic Consulting Service For Cleanroom Design?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Aseptic Consulting Service For Cleanroom Design?

Key companies in the market include B. Braun Medical Ltd, Ardien Consulting Services, Aseptic Solutions, Inc., Lachman Consultant Services, Mares Ltd, Gapp Quality GmbH, Sotera Health, tri-consulting, AXYS-NETWORK, Integrated Project Services, LLC, Steris Corporation, Veltek Associates, Inc., Hoefliger, Ruland Engineering & Consulting GmbH, Microrite, Inc., i-Pharm, Galenisys.

3. What are the main segments of the Aseptic Consulting Service For Cleanroom Design?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 142 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aseptic Consulting Service For Cleanroom Design," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aseptic Consulting Service For Cleanroom Design report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aseptic Consulting Service For Cleanroom Design?

To stay informed about further developments, trends, and reports in the Aseptic Consulting Service For Cleanroom Design, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence