Key Insights

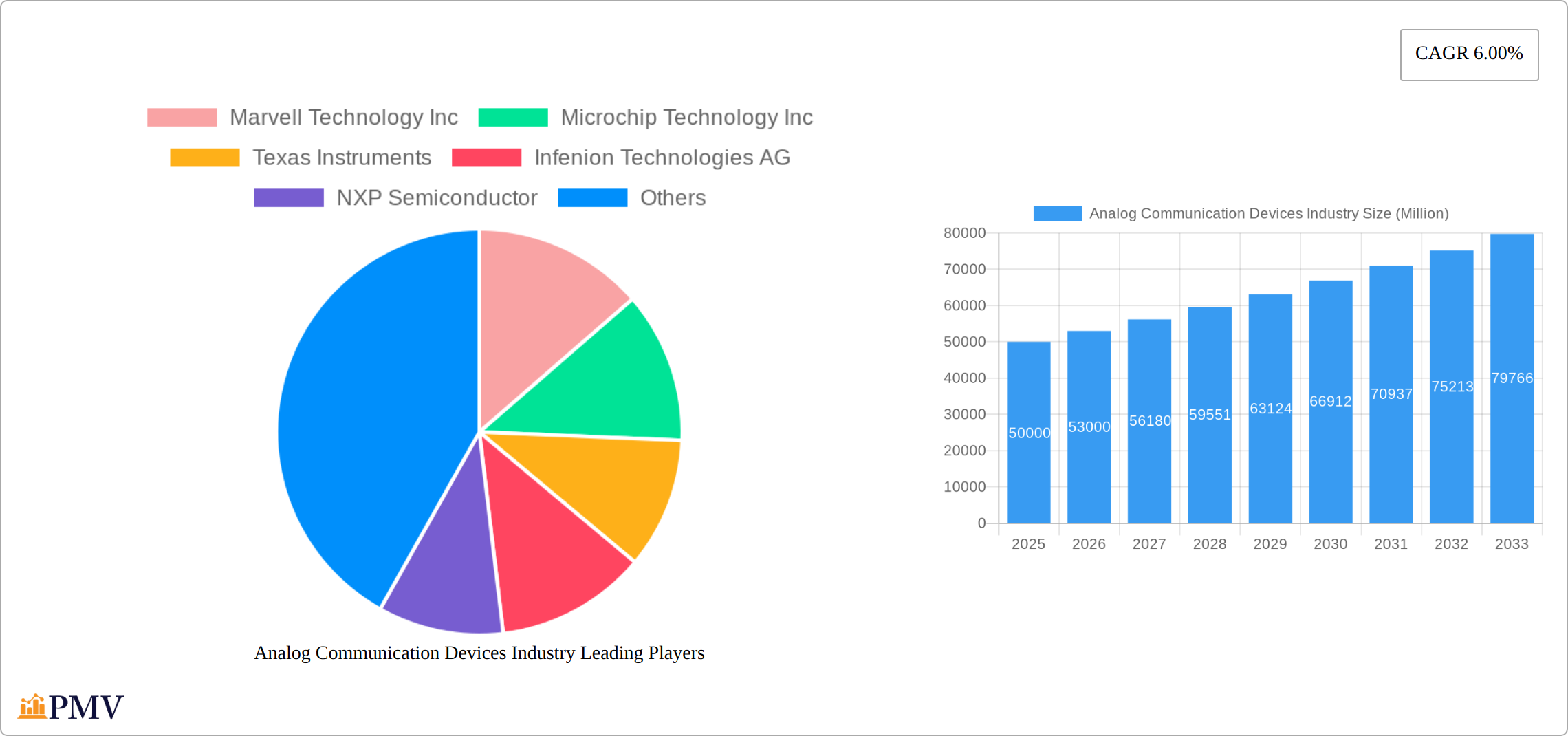

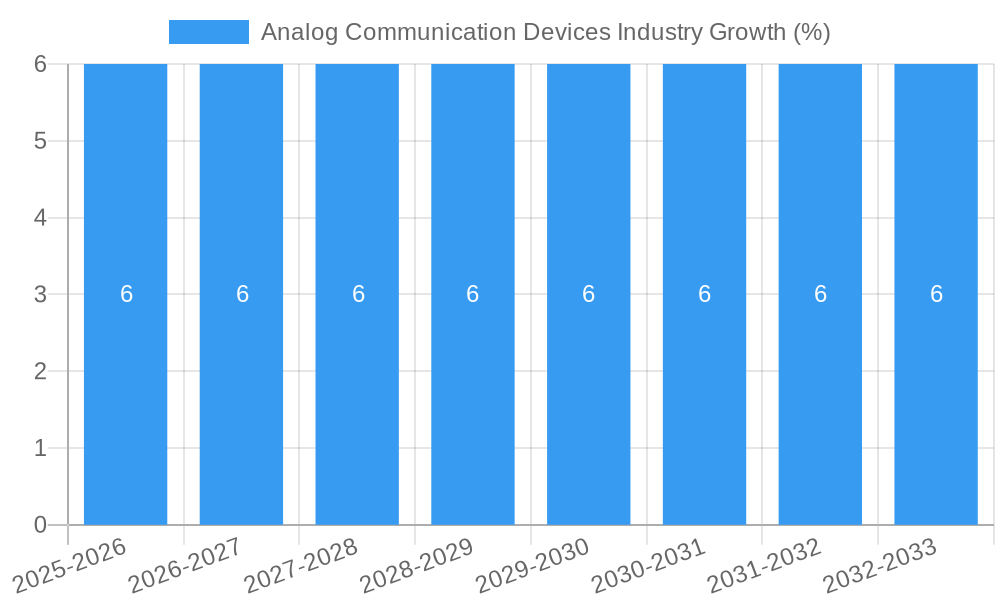

The Analog Communication Devices Industry is projected to witness a robust growth with a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This growth is driven by the increasing demand for high-performance semiconductors and passive components across various applications such as automotive, consumer electronics, industrial, medical, and military sectors. In 2025, the market size is estimated to be around $50,000 million, reflecting the industry's expansion and the rising adoption of advanced analog communication technologies. Key drivers include the proliferation of Internet of Things (IoT) devices, the need for energy-efficient solutions, and the growth of smart vehicles and smart homes. Leading companies such as Marvell Technology Inc, Microchip Technology Inc, and Texas Instruments are at the forefront, innovating and expanding their product portfolios to meet the evolving market demands.

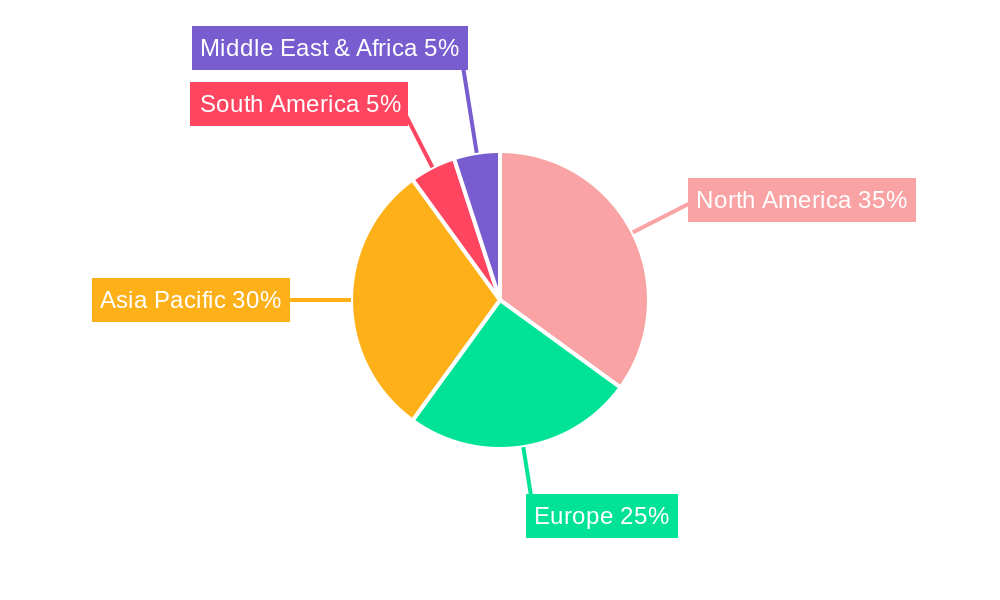

Trends shaping the Analog Communication Devices Industry include the miniaturization of components, integration of analog and digital technologies, and the shift towards 5G networks. These trends are counterbalanced by restraints such as high development costs and the complexity of integrating new technologies. The market is segmented by product type into semiconductors, passive components, and electromechanical devices, each catering to specific application needs. Geographically, North America, particularly the United States, holds a significant market share due to its advanced technological infrastructure and presence of major industry players. However, the Asia Pacific region, led by China and Japan, is expected to experience the fastest growth, driven by rapid industrialization and increasing investments in technology. As the industry evolves, stakeholders are focusing on strategic collaborations and R&D to harness the potential of emerging markets and technologies.

Analog Communication Devices Industry Market Structure & Competitive Dynamics

The Analog Communication Devices Industry is characterized by a complex market structure driven by rapid technological advancements and strategic consolidations. Market concentration within this sector is moderate, with a few dominant players like Texas Instruments and Infineon Technologies AG holding significant market shares, estimated at 15% and 12% respectively. The innovation ecosystem thrives on continuous R&D investments, with companies like Marvell Technology Inc and Microchip Technology Inc focusing on developing advanced semiconductor solutions to cater to the growing demand in 5G and IoT applications.

Regulatory frameworks play a pivotal role in shaping the industry dynamics, particularly in regions like North America and Europe, where stringent standards for electromagnetic compatibility and environmental compliance are enforced. Product substitutes, such as digital communication devices, pose a threat to market growth, although analog devices continue to be preferred in niche applications such as automotive and military sectors due to their reliability and cost-effectiveness.

End-user trends indicate a shift towards integrated solutions, prompting companies to expand their product portfolios. For instance, Renesas Electronics Corporation has been actively acquiring smaller firms to enhance its offerings in the automotive sector. M&A activities have been robust, with deal values reaching over $500 Million in the last year, reflecting the industry's aggressive growth strategy. Key mergers include the acquisition of Maxim Integrated by Analog Devices for $21 Billion in 2021, aimed at strengthening their position in the analog and mixed-signal markets.

Analog Communication Devices Industry Industry Trends & Insights

The Analog Communication Devices Industry is witnessing significant growth driven by the increasing adoption of 5G technology and the proliferation of IoT devices. The market is projected to grow at a CAGR of 5.5% from 2025 to 2033, with the base year 2025 estimated at $50 Billion. Technological disruptions, such as the development of advanced ASICs and the integration of AI in analog systems, are key growth catalysts. Consumer preferences are shifting towards devices that offer higher performance and energy efficiency, prompting manufacturers to innovate continually.

Competitive dynamics are intense, with major players like Texas Instruments and Infineon Technologies AG vying for market leadership through product differentiation and strategic partnerships. The penetration of analog devices in the automotive sector is particularly high, with an estimated market share of 30%, driven by the demand for advanced driver assistance systems (ADAS) and electric vehicles (EVs). In the consumer electronics segment, the market is witnessing a surge in demand for smart home devices and wearable technology, which is expected to boost the segment's growth at a CAGR of 6.2% over the forecast period.

The industrial sector is another significant driver, with analog devices being integral to automation and control systems. The medical and military applications are also on the rise, with the former driven by the need for reliable and precise medical equipment, and the latter by the demand for secure and robust communication systems. Regulatory changes, such as the push for greener technologies, are influencing the industry's direction, encouraging the development of eco-friendly analog solutions.

Dominant Markets & Segments in Analog Communication Devices Industry

The Analog Communication Devices Industry is dominated by the Asia-Pacific region, particularly China and Japan, due to their robust manufacturing capabilities and high demand for consumer electronics and automotive applications. Within product types, semiconductors lead the market, driven by their critical role in modern electronics and communication systems. The segment is expected to reach a market size of $30 Billion by 2033, fueled by advancements in 5G and IoT technologies.

- Economic Policies: Government incentives and subsidies in countries like South Korea and Taiwan are boosting the semiconductor industry.

- Infrastructure: The presence of advanced manufacturing facilities and R&D centers in Asia-Pacific supports the dominance of this region.

In terms of applications, the automotive sector is a key driver, with analog devices being essential for engine control units, infotainment systems, and ADAS. The demand for electric vehicles is particularly high in Europe, where stringent emission norms are accelerating the adoption of EVs, thereby increasing the need for analog components.

- Economic Policies: The European Union's Green Deal is promoting the shift to sustainable transportation, boosting the automotive segment.

- Infrastructure: The development of EV charging networks across Europe is supporting the growth of analog devices in this sector.

The consumer electronics segment is another dominant force, with North America leading due to high consumer spending and the presence of major tech companies. The integration of smart home devices and wearable technology is driving the segment's growth.

- Economic Policies: Tax incentives for tech companies in the U.S. are encouraging innovation and investment in consumer electronics.

- Infrastructure: The widespread availability of high-speed internet and smart home infrastructure in North America supports this dominance.

Analog Communication Devices Industry Product Innovations

Recent product innovations in the Analog Communication Devices Industry have focused on enhancing performance and meeting the evolving needs of 5G and IoT applications. Analog Devices' introduction of an ASIC-based radio platform for O-RAN-compliant 5G radio units in March 2021 exemplifies this trend. This platform, which includes software-defined transceivers and a baseband ASIC, significantly improves performance and reduces time to market. Similarly, IQ-Analog Corporation's F1000 Antenna Processor Unit (APU), integrated into Lockheed Martin's next-generation AESA sensor in January 2021, showcases the industry's move towards full-spectrum conversion wideband transceivers for communication, radar, and electronic warfare systems. These innovations highlight the industry's commitment to technological advancement and market fit.

Report Segmentation & Scope

The Analog Communication Devices Industry report covers comprehensive segmentation based on product types and applications, providing insights into growth projections, market sizes, and competitive dynamics.

- Semiconductors: This segment is poised for significant growth, projected to reach $30 Billion by 2033, driven by the demand for advanced communication systems.

- Passive Components: Expected to grow at a steady pace, with a market size of $10 Billion by 2033, as they remain essential in various applications.

- Electromechanical Devices: Anticipated to reach $5 Billion by 2033, with increasing demand in industrial and automotive sectors.

- Automotive: The largest application segment, expected to grow at a CAGR of 6.0% over the forecast period, driven by the rise in electric vehicles and ADAS.

- Consumer Electronics: Projected to grow at a CAGR of 6.2%, fueled by the proliferation of smart devices and wearables.

- Industrial: Expected to reach a market size of $8 Billion by 2033, with growth driven by automation and control systems.

- Medical: Anticipated to grow at a CAGR of 5.8%, due to the demand for precise medical equipment.

- Military: Projected to reach $3 Billion by 2033, driven by the need for secure and robust communication systems.

Key Drivers of Analog Communication Devices Industry Growth

The growth of the Analog Communication Devices Industry is propelled by several key drivers. Technological advancements, particularly in 5G and IoT, are at the forefront, enabling the development of more efficient and powerful devices. Economic factors, such as increased consumer spending on electronics and automotive products, also play a significant role. Regulatory frameworks, including those promoting sustainable technologies and 5G infrastructure, further support industry growth. For example, the European Union's Green Deal is driving the demand for eco-friendly analog components in electric vehicles, while government incentives in Asia-Pacific are boosting semiconductor production.

Challenges in the Analog Communication Devices Industry Sector

The Analog Communication Devices Industry faces several challenges that could impede growth. Regulatory hurdles, such as compliance with stringent environmental and safety standards, can increase production costs and delay product launches. Supply chain disruptions, particularly those affecting semiconductor availability, pose significant risks, with recent shortages leading to production delays and increased prices. Competitive pressures are intense, with companies like Texas Instruments and Infineon Technologies AG constantly innovating to maintain market share. These challenges have quantifiable impacts, with supply chain issues alone estimated to have reduced industry growth by 2% in 2022.

Leading Players in the Analog Communication Devices Industry Market

- Marvell Technology Inc

- Microchip Technology Inc

- Texas Instruments

- Infenion Technologies AG

- NXP Semiconductor

- Maxim Integrated

- EnSilica Ltd

- Renesas Electronics Corporation

- AnSem NV

- Diode Incorporated

- Viasat Inc

Key Developments in Analog Communication Devices Industry Sector

- March 2021: Analog Devices introduced a new ASIC-based radio platform for O-RAN-compliant 5G radio units, designed to meet the evolving needs of 5G networks and shorten the time to market. This development has significantly enhanced performance and form factor, impacting the 5G market dynamics.

- January 2021: IQ-Analog Corporation announced the integration of its F1000 Antenna Processor Unit (APU) into Lockheed Martin's next-generation digital prototype active electronically scanned phased array (AESA) sensor. This move addresses next-generation communication, radar, and electronic warfare systems, influencing market trends in these sectors.

Strategic Analog Communication Devices Industry Market Outlook

The future outlook for the Analog Communication Devices Industry is promising, with growth accelerators such as the continued expansion of 5G networks and the increasing adoption of IoT devices. Strategic opportunities lie in the development of eco-friendly and energy-efficient solutions, driven by regulatory demands and consumer preferences. The industry is expected to capitalize on the growing demand for electric vehicles and smart home technologies, offering significant potential for market expansion. Companies that focus on innovation and strategic partnerships will be well-positioned to leverage these opportunities and achieve sustained growth over the forecast period.

Analog Communication Devices Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Analog Communication Devices Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Analog Communication Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Internet and Mobile Telephony Services; Growing Adoption of 5G Technology

- 3.3. Market Restrains

- 3.3.1. Design Complexity

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of Internet and Mobile Telephony Services to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Rest of the World Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. North America Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 10.1.4 Rest of North America

- 11. Europe Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Taiwan

- 12.1.6 Australia

- 12.1.7 Rest of Asia-Pacific

- 13. South America Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Rest of South America

- 14. Middle East & Africa Analog Communication Devices Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 UAE

- 14.1.2 South Africa

- 14.1.3 Saudi Arabia

- 14.1.4 Rest of MEA

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Marvell Technology Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Microchip Technology Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Texas Instruments

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Infenion Technologies AG

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 NXP Semiconductor

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Maxim Integrated

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 EnSilica Ltd

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Renesas Electronics Corporation

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 AnSem NV

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Diode Incorporated

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Viasat Inc *List Not Exhaustive

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Marvell Technology Inc

List of Figures

- Figure 1: Global Analog Communication Devices Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East & Africa Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East & Africa Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Analog Communication Devices Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 13: North America Analog Communication Devices Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 14: North America Analog Communication Devices Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 15: North America Analog Communication Devices Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 16: North America Analog Communication Devices Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America Analog Communication Devices Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America Analog Communication Devices Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America Analog Communication Devices Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America Analog Communication Devices Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 21: North America Analog Communication Devices Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 22: North America Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Analog Communication Devices Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 25: Europe Analog Communication Devices Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 26: Europe Analog Communication Devices Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 27: Europe Analog Communication Devices Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 28: Europe Analog Communication Devices Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: Europe Analog Communication Devices Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: Europe Analog Communication Devices Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: Europe Analog Communication Devices Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: Europe Analog Communication Devices Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 33: Europe Analog Communication Devices Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 34: Europe Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 37: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 38: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 39: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 40: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 45: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 46: Asia Pacific Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 47: Asia Pacific Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

- Figure 48: Rest of the World Analog Communication Devices Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 49: Rest of the World Analog Communication Devices Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 50: Rest of the World Analog Communication Devices Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 51: Rest of the World Analog Communication Devices Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 52: Rest of the World Analog Communication Devices Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: Rest of the World Analog Communication Devices Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: Rest of the World Analog Communication Devices Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Rest of the World Analog Communication Devices Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Rest of the World Analog Communication Devices Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 57: Rest of the World Analog Communication Devices Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 58: Rest of the World Analog Communication Devices Industry Revenue (Million), by Country 2024 & 2032

- Figure 59: Rest of the World Analog Communication Devices Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Analog Communication Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Analog Communication Devices Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Analog Communication Devices Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Analog Communication Devices Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Analog Communication Devices Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Analog Communication Devices Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Analog Communication Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Asia-Pacific Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: UAE Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: South Africa Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Saudi Arabia Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of MEA Analog Communication Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Analog Communication Devices Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 38: Global Analog Communication Devices Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 39: Global Analog Communication Devices Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 40: Global Analog Communication Devices Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 41: Global Analog Communication Devices Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 42: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Global Analog Communication Devices Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 44: Global Analog Communication Devices Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 45: Global Analog Communication Devices Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 46: Global Analog Communication Devices Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 47: Global Analog Communication Devices Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 48: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Analog Communication Devices Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: Global Analog Communication Devices Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 51: Global Analog Communication Devices Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 52: Global Analog Communication Devices Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 53: Global Analog Communication Devices Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 54: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Analog Communication Devices Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 56: Global Analog Communication Devices Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 57: Global Analog Communication Devices Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 58: Global Analog Communication Devices Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 59: Global Analog Communication Devices Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 60: Global Analog Communication Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog Communication Devices Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Analog Communication Devices Industry?

Key companies in the market include Marvell Technology Inc, Microchip Technology Inc, Texas Instruments, Infenion Technologies AG, NXP Semiconductor, Maxim Integrated, EnSilica Ltd, Renesas Electronics Corporation, AnSem NV, Diode Incorporated, Viasat Inc *List Not Exhaustive.

3. What are the main segments of the Analog Communication Devices Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Internet and Mobile Telephony Services; Growing Adoption of 5G Technology.

6. What are the notable trends driving market growth?

Increasing Penetration of Internet and Mobile Telephony Services to Drive the Demand.

7. Are there any restraints impacting market growth?

Design Complexity.

8. Can you provide examples of recent developments in the market?

March 2021 - Analog Devices introduced a new ASIC-based radio platform for O-RAN-compliant 5G radio units, designed to meet the evolving needs of 5G networks and shorten the time to market. This radio platform includes all the core functionality needed in an O-RAN-compliant 5G radio unit, including software-defined transceivers, a baseband ASIC, signal processing, and power to enable significant performance and form factor improvements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analog Communication Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analog Communication Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analog Communication Devices Industry?

To stay informed about further developments, trends, and reports in the Analog Communication Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence