Key Insights

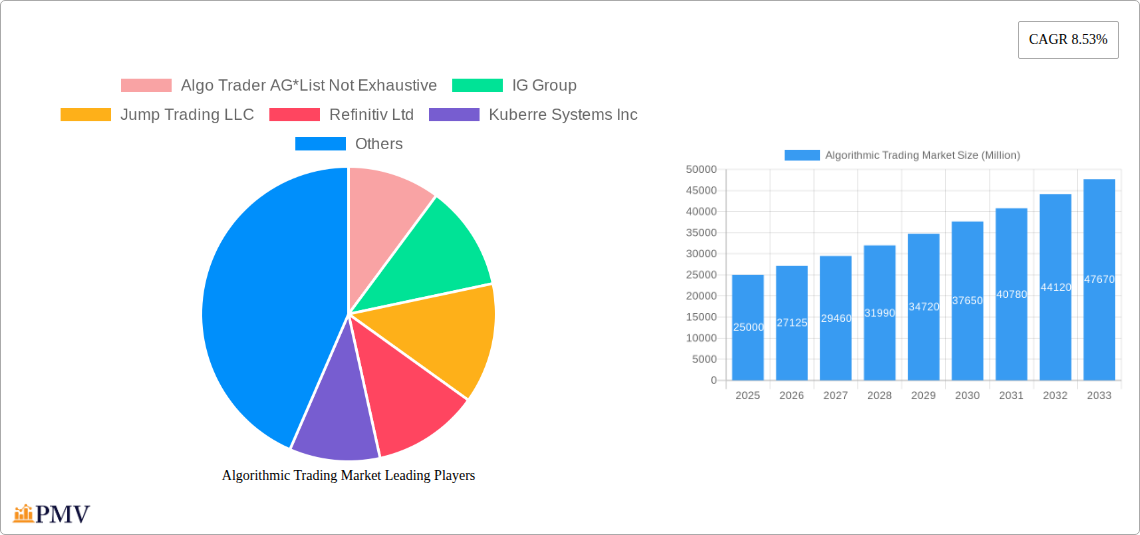

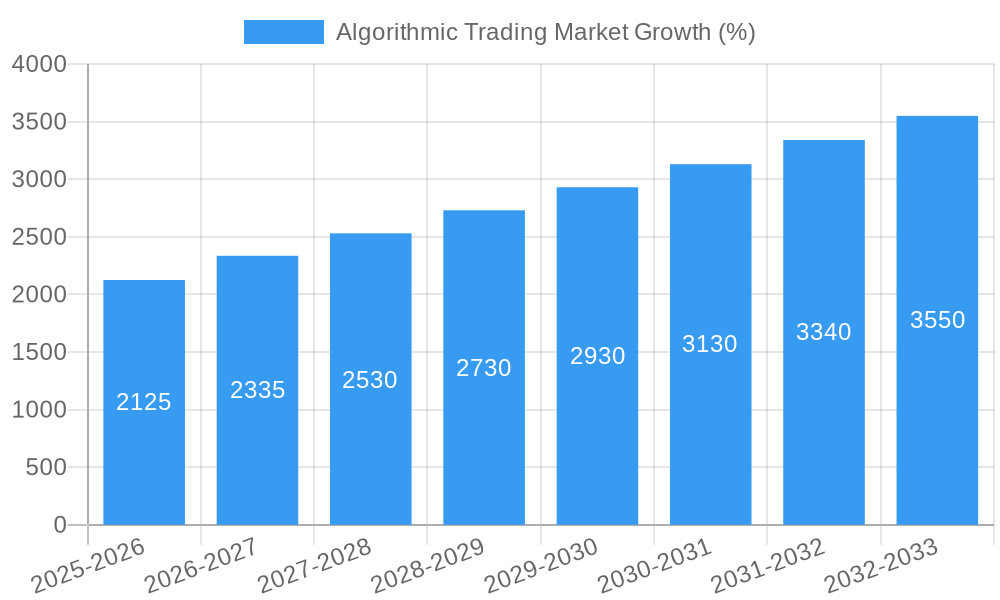

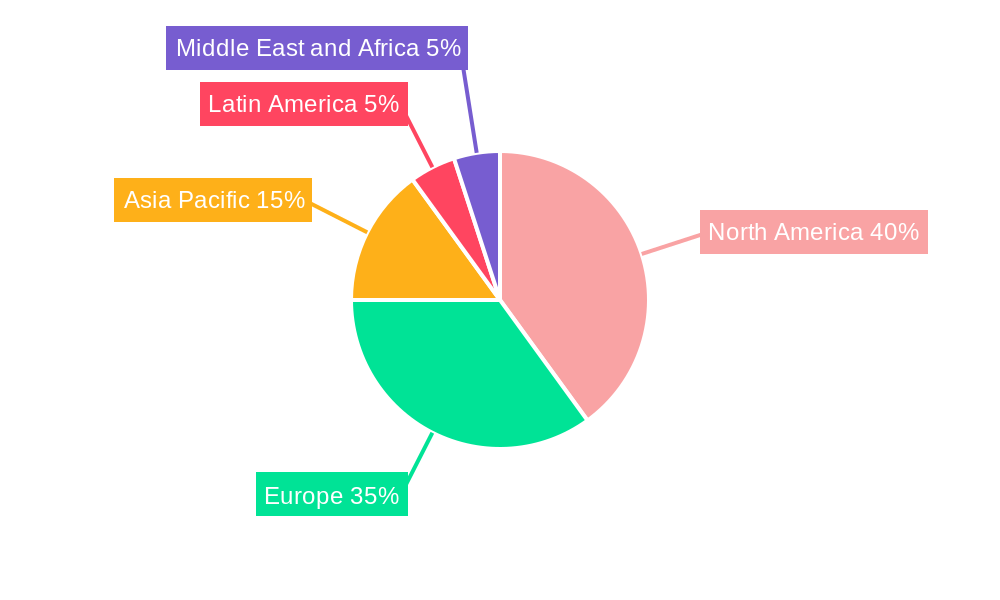

The Algorithmic Trading market is experiencing robust growth, projected to reach a substantial size by 2033. A compound annual growth rate (CAGR) of 8.53% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by several key drivers. The increasing adoption of sophisticated trading strategies by institutional investors seeking enhanced efficiency and reduced risk is a major catalyst. Furthermore, the proliferation of readily available, high-quality data and advanced analytics tools empower both institutional and retail traders to leverage algorithmic strategies effectively. The rise of cloud-based solutions further enhances accessibility and scalability, lowering the barrier to entry for smaller firms. While regulatory scrutiny and concerns about market manipulation pose potential restraints, the overall market trend remains positive, driven by the continuous innovation in trading technology and the ever-increasing demand for speed and precision in financial markets. Segment-wise, the institutional investor segment currently dominates, followed by a rapidly growing retail investor segment fueled by increased accessibility and educational resources. Solution-based offerings hold the largest market share, with a rising demand for integrated software tools and comprehensive services providing seamless trading experiences. The on-cloud deployment model enjoys widespread adoption due to its cost-effectiveness and flexibility. Large enterprises currently lead the market adoption, but SMEs are progressively embracing algorithmic trading, leading to significant future potential in this segment. Geographically, North America and Europe currently hold the largest market share, but the Asia-Pacific region exhibits the highest growth potential, driven by increasing technological advancements and economic expansion.

The forecast period from 2025 to 2033 anticipates continued market expansion, with a potential acceleration in growth due to the expected maturation of technologies and increased adoption across diverse market segments. The ongoing advancements in artificial intelligence (AI) and machine learning (ML) are poised to significantly shape the market's future, enhancing the sophistication and efficiency of algorithmic trading strategies. However, successful navigation of evolving regulatory landscapes and managing cybersecurity risks will be crucial for sustained market growth. The competitive landscape remains dynamic, with established players constantly innovating and new entrants vying for market share, fostering a highly competitive yet innovative ecosystem. This dynamic interplay of drivers, restraints, and technological advancements will continue to define the trajectory of the algorithmic trading market in the coming years.

Algorithmic Trading Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Algorithmic Trading Market, encompassing market size, growth projections, competitive landscape, and key technological advancements. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and researchers. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Algorithmic Trading Market Market Structure & Competitive Dynamics

The Algorithmic Trading market is characterized by a moderately concentrated structure, with a few large players holding significant market share. However, the market also features a vibrant ecosystem of smaller firms and startups driving innovation. Regulatory frameworks, particularly concerning data privacy and security, are constantly evolving, influencing market dynamics. Product substitutes, like traditional manual trading, are gradually losing ground due to the efficiency and speed of algorithmic strategies. End-user trends show a strong preference for sophisticated, customizable solutions capable of handling high-frequency trading and complex strategies. Mergers and acquisitions (M&A) are common, with deal values reaching xx Million in recent years, signifying consolidation and the pursuit of technological advancements. Notable M&A activities include [Insert Specific M&A examples with deal values if available, otherwise state "Data unavailable"]. Key metrics, such as market share, are analyzed within the report, providing a detailed competitive landscape and strategic insights.

Algorithmic Trading Market Industry Trends & Insights

The Algorithmic Trading Market is experiencing exponential growth, driven by factors like increasing automation in finance, the proliferation of high-frequency trading, and the rising adoption of artificial intelligence (AI) and machine learning (ML) in trading strategies. Technological disruptions, including the rise of cloud-based solutions and advancements in data analytics, are reshaping the market landscape. Consumer preferences are shifting towards integrated platforms that offer comprehensive analytics, risk management tools, and seamless integration with existing trading infrastructure. The competitive dynamics are intensified by continuous product innovation, strategic partnerships, and the entry of new players with specialized technological expertise. The market penetration of algorithmic trading is growing rapidly across diverse financial instruments, particularly in equities and derivatives. The overall market exhibits a significant growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033).

Dominant Markets & Segments in Algorithmic Trading Market

By Types of Traders: Institutional investors dominate the market due to their larger capital base and sophisticated trading needs. However, retail investor participation is steadily increasing, driven by the accessibility of algorithmic trading platforms. Long-term traders favor stable, robust algorithms, while short-term traders prioritize speed and responsiveness.

By Component: Solutions (pre-built trading algorithms and platforms) represent a larger segment compared to Software Tools/Services, owing to their convenience and comprehensive functionality.

By Deployment: On-cloud deployment is gaining momentum due to its scalability, cost-effectiveness, and accessibility. On-premise deployment still holds a significant share among large enterprises with stringent security requirements.

By Organization Size: Large enterprises drive the majority of market revenue due to their substantial trading volumes and investments in advanced technology. SMEs are actively adopting algorithmic trading, albeit at a smaller scale, aiming to leverage its advantages in managing their portfolios efficiently.

The North American region currently holds the largest market share, primarily due to the presence of major financial institutions, advanced technological infrastructure, and a supportive regulatory environment. Factors such as robust economic policies, well-developed financial markets, and a high concentration of technology companies contribute to this dominance. Other regions, particularly in Asia and Europe, are witnessing significant growth, driven by the increasing adoption of algorithmic trading across various financial markets.

Algorithmic Trading Market Product Innovations

Recent product innovations focus on integrating AI/ML, advanced analytics capabilities, and enhanced risk management features. Many platforms now incorporate customizable algorithms, allowing traders to tailor their strategies based on specific market conditions and risk tolerance. The market is witnessing a shift towards cloud-native solutions, promoting greater scalability and accessibility for diverse users. These advancements provide competitive advantages by enhancing trading efficiency, improving accuracy, and minimizing risk exposure.

Report Segmentation & Scope

This report segments the Algorithmic Trading Market by:

Types of Traders: Institutional Investors, Retail Investors, Long-term Traders, Short-term Traders. Growth projections vary considerably across these segments, with institutional investors showing the highest growth rate followed by Retail investors.

Component: Solutions, Software Tools, Services. The software tools segment is experiencing faster growth due to increasing demand for customizable trading platforms.

Deployment: On-cloud, On-premise. Cloud deployment is projected to hold a dominant market share over the forecast period.

Organization Size: Small and Medium Enterprises (SMEs), Large Enterprises. Large enterprises currently drive the largest market share due to their greater investment capacity and trading volumes.

Key Drivers of Algorithmic Trading Market Growth

The Algorithmic Trading Market is experiencing rapid growth due to several key factors: The increasing adoption of AI and machine learning technologies for developing sophisticated trading algorithms and improved predictive modeling. The rising demand for high-frequency trading (HFT) and algorithmic trading is fueling the development of faster and more efficient trading platforms. Additionally, supportive regulatory frameworks in various jurisdictions encourage innovation and market development.

Challenges in the Algorithmic Trading Market Sector

Challenges faced by the Algorithmic Trading market include regulatory scrutiny and evolving compliance requirements impacting market expansion. Supply chain disruptions and technology vulnerabilities pose risks to market stability. The intense competition among providers can lead to pricing pressures and margin erosion. The need for robust cybersecurity measures and mitigation of algorithmic biases are also significant challenges that the market must address.

Leading Players in the Algorithmic Trading Market Market

- Algo Trader AG

- IG Group

- Jump Trading LLC

- Refinitiv Ltd

- Kuberre Systems Inc

- MetaQuotes Software Corp

- 63 Moons Technologies Limited

- ARGO SE

- Thomson Reuters

- Symphony Fintech Solutions Pvt Ltd

- Info Reach Inc

- Virtu Financial Inc

Key Developments in Algorithmic Trading Market Sector

- June 2023: DoubleVerify launched DV Algorithmic Optimizer with Scibids, enhancing digital advertising optimization through AI-powered ad decisioning.

- June 2023: KuCoin Futures partnered with Kryll, integrating automated trading bots and TradingView signals into its platform, revolutionizing futures trading.

Strategic Algorithmic Trading Market Market Outlook

The Algorithmic Trading Market is poised for substantial growth, driven by ongoing technological advancements, expanding regulatory acceptance, and the increasing demand for sophisticated trading strategies. Strategic opportunities lie in developing AI-powered solutions, enhancing data analytics capabilities, and fostering partnerships across the financial technology ecosystem. The focus on secure and transparent trading practices will be critical for sustained market growth.

Algorithmic Trading Market Segmentation

-

1. Types of Traders

- 1.1. Institutional Investors

- 1.2. Retail Investors

- 1.3. Long-term Traders

- 1.4. Short-term Traders

-

2. Component

-

2.1. Solutions

- 2.1.1. Platforms

- 2.1.2. Software Tools

- 2.2. Services

-

2.1. Solutions

-

3. Deployment

- 3.1. On-cloud

- 3.2. On-premise

-

4. Organization Size

- 4.1. Small and Medium Enterprises

- 4.2. Large Enterprises

Algorithmic Trading Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Algorithmic Trading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Demand for Fast

- 3.2.2 Reliable

- 3.2.3 and Effective Order Execution; Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs

- 3.3. Market Restrains

- 3.3.1. Instant Loss of Liquidity

- 3.4. Market Trends

- 3.4.1. On-cloud Deployment Segment is expected to drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types of Traders

- 5.1.1. Institutional Investors

- 5.1.2. Retail Investors

- 5.1.3. Long-term Traders

- 5.1.4. Short-term Traders

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Solutions

- 5.2.1.1. Platforms

- 5.2.1.2. Software Tools

- 5.2.2. Services

- 5.2.1. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. On-cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by Organization Size

- 5.4.1. Small and Medium Enterprises

- 5.4.2. Large Enterprises

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Types of Traders

- 6. North America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Types of Traders

- 6.1.1. Institutional Investors

- 6.1.2. Retail Investors

- 6.1.3. Long-term Traders

- 6.1.4. Short-term Traders

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Solutions

- 6.2.1.1. Platforms

- 6.2.1.2. Software Tools

- 6.2.2. Services

- 6.2.1. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. On-cloud

- 6.3.2. On-premise

- 6.4. Market Analysis, Insights and Forecast - by Organization Size

- 6.4.1. Small and Medium Enterprises

- 6.4.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Types of Traders

- 7. Europe Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Types of Traders

- 7.1.1. Institutional Investors

- 7.1.2. Retail Investors

- 7.1.3. Long-term Traders

- 7.1.4. Short-term Traders

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Solutions

- 7.2.1.1. Platforms

- 7.2.1.2. Software Tools

- 7.2.2. Services

- 7.2.1. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. On-cloud

- 7.3.2. On-premise

- 7.4. Market Analysis, Insights and Forecast - by Organization Size

- 7.4.1. Small and Medium Enterprises

- 7.4.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Types of Traders

- 8. Asia Pacific Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Types of Traders

- 8.1.1. Institutional Investors

- 8.1.2. Retail Investors

- 8.1.3. Long-term Traders

- 8.1.4. Short-term Traders

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Solutions

- 8.2.1.1. Platforms

- 8.2.1.2. Software Tools

- 8.2.2. Services

- 8.2.1. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. On-cloud

- 8.3.2. On-premise

- 8.4. Market Analysis, Insights and Forecast - by Organization Size

- 8.4.1. Small and Medium Enterprises

- 8.4.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Types of Traders

- 9. Latin America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Types of Traders

- 9.1.1. Institutional Investors

- 9.1.2. Retail Investors

- 9.1.3. Long-term Traders

- 9.1.4. Short-term Traders

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Solutions

- 9.2.1.1. Platforms

- 9.2.1.2. Software Tools

- 9.2.2. Services

- 9.2.1. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. On-cloud

- 9.3.2. On-premise

- 9.4. Market Analysis, Insights and Forecast - by Organization Size

- 9.4.1. Small and Medium Enterprises

- 9.4.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Types of Traders

- 10. Middle East and Africa Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Types of Traders

- 10.1.1. Institutional Investors

- 10.1.2. Retail Investors

- 10.1.3. Long-term Traders

- 10.1.4. Short-term Traders

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Solutions

- 10.2.1.1. Platforms

- 10.2.1.2. Software Tools

- 10.2.2. Services

- 10.2.1. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment

- 10.3.1. On-cloud

- 10.3.2. On-premise

- 10.4. Market Analysis, Insights and Forecast - by Organization Size

- 10.4.1. Small and Medium Enterprises

- 10.4.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Types of Traders

- 11. North America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Algorithmic Trading Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Algo Trader AG*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IG Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Jump Trading LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Refinitiv Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kuberre Systems Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 MetaQuotes Software Corp

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 63 Moons Technologies Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ARGO SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Thomson Reuters

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Symphony Fintech Solutions Pvt Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Info Reach Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Virtu Financial Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Algo Trader AG*List Not Exhaustive

List of Figures

- Figure 1: Global Algorithmic Trading Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 13: North America Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 14: North America Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 17: North America Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 18: North America Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 19: North America Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 20: North America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 23: Europe Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 24: Europe Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 25: Europe Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 26: Europe Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 29: Europe Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 30: Europe Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 33: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 34: Asia Pacific Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 35: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 36: Asia Pacific Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Asia Pacific Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Asia Pacific Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 43: Latin America Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 44: Latin America Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Latin America Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Latin America Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Latin America Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Latin America Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 49: Latin America Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 50: Latin America Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Types of Traders 2024 & 2032

- Figure 53: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Types of Traders 2024 & 2032

- Figure 54: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Component 2024 & 2032

- Figure 55: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Component 2024 & 2032

- Figure 56: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Deployment 2024 & 2032

- Figure 57: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 58: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 59: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 60: Middle East and Africa Algorithmic Trading Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Algorithmic Trading Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Algorithmic Trading Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 3: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 5: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 6: Global Algorithmic Trading Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Algorithmic Trading Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 18: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 20: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 21: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 23: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 25: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 28: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 30: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 31: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 33: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 34: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 35: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 36: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global Algorithmic Trading Market Revenue Million Forecast, by Types of Traders 2019 & 2032

- Table 38: Global Algorithmic Trading Market Revenue Million Forecast, by Component 2019 & 2032

- Table 39: Global Algorithmic Trading Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 40: Global Algorithmic Trading Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 41: Global Algorithmic Trading Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algorithmic Trading Market?

The projected CAGR is approximately 8.53%.

2. Which companies are prominent players in the Algorithmic Trading Market?

Key companies in the market include Algo Trader AG*List Not Exhaustive, IG Group, Jump Trading LLC, Refinitiv Ltd, Kuberre Systems Inc, MetaQuotes Software Corp, 63 Moons Technologies Limited, ARGO SE, Thomson Reuters, Symphony Fintech Solutions Pvt Ltd, Info Reach Inc, Virtu Financial Inc.

3. What are the main segments of the Algorithmic Trading Market?

The market segments include Types of Traders, Component, Deployment, Organization Size.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Fast. Reliable. and Effective Order Execution; Growing Demand for Market Surveillance Augmented by Reduced Transaction Costs.

6. What are the notable trends driving market growth?

On-cloud Deployment Segment is expected to drive the Market Growth.

7. Are there any restraints impacting market growth?

Instant Loss of Liquidity.

8. Can you provide examples of recent developments in the market?

June 2023: DoubleVerify, one of the leading software platforms for digital media measurement, data, and analytics, announced the launch of DV Algorithmic Optimizer, an advanced measure and optimization offering with Scibids, one of the global leaders in artificial intelligence (AI) for digital marketing. The combination of DV's proprietary attention signals and Scibids' AI-powered ad decisioning enables advertisers to identify the performing inventory that maximizes business outcomes and advertising ROI without sacrificing scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algorithmic Trading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algorithmic Trading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algorithmic Trading Market?

To stay informed about further developments, trends, and reports in the Algorithmic Trading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence