Key Insights

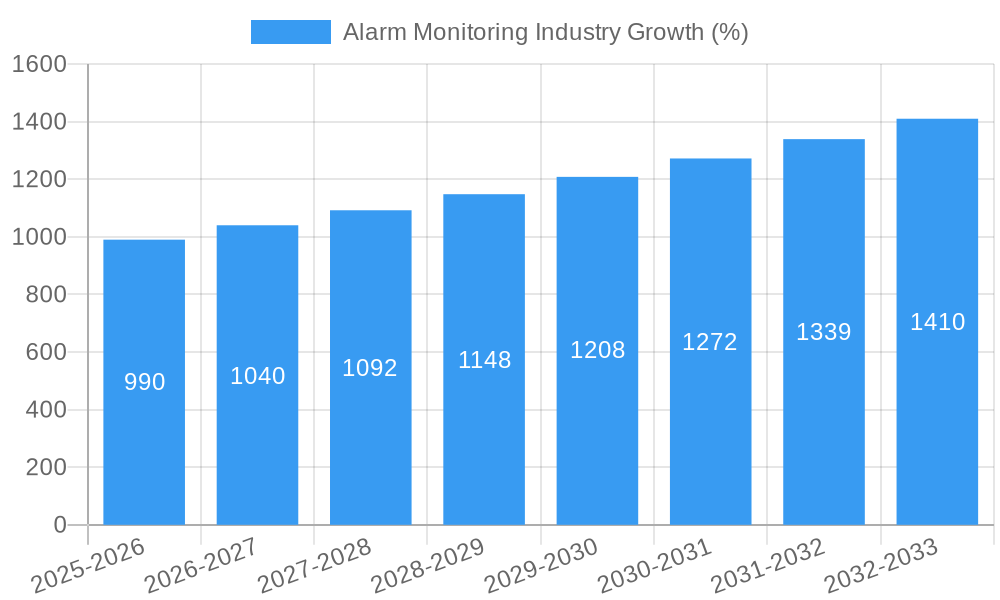

The global alarm monitoring market, currently experiencing robust growth, is projected to reach a substantial size driven by increasing security concerns across residential, commercial, and industrial sectors. The market's Compound Annual Growth Rate (CAGR) of 6.20% from 2019 to 2024 indicates a consistent upward trajectory. This growth is fueled by several key factors. Firstly, the rising adoption of smart home and building technologies, coupled with the increasing availability of advanced, interconnected alarm systems, is a significant driver. Secondly, the growing demand for remote monitoring and management capabilities, facilitated by advancements in cellular and IP network technologies, is boosting market expansion. Furthermore, the increasing prevalence of cyber threats and the need for robust security solutions are compelling organizations and individuals to invest in sophisticated alarm monitoring systems. Finally, government regulations mandating security measures in certain industries further contribute to market growth. The market segmentation reveals a strong demand across various applications, including vehicle alarm monitoring, which is witnessing significant traction due to advancements in telematics and connected car technologies. Building alarm monitoring remains a dominant segment due to the considerable investment in security infrastructure across commercial and residential spaces. The offerings segment is dominated by hardware, followed by software and services, reflecting the integrated nature of modern alarm monitoring solutions. While wired networks still hold a considerable market share, the wireless segment is expanding rapidly, driven by the convenience and flexibility it provides. Key players such as Honeywell, ABB, and Johnson Controls are actively shaping the market landscape through innovation and strategic partnerships.

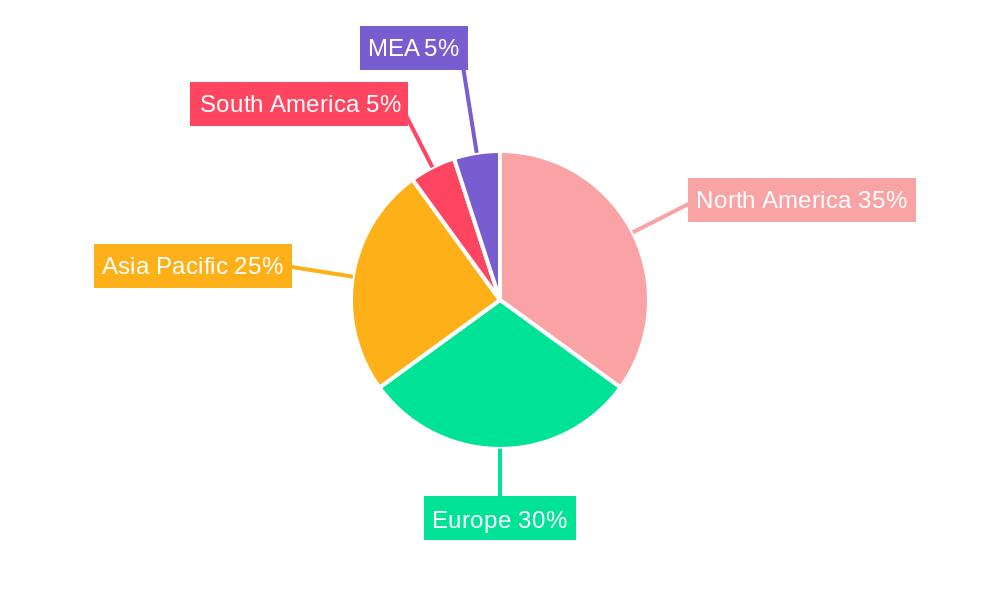

Geographic distribution shows North America and Europe as leading regional markets, attributed to higher disposable incomes, advanced infrastructure, and stringent security regulations. However, the Asia-Pacific region is expected to experience the fastest growth in the forecast period (2025-2033), driven by rapid urbanization, rising middle-class incomes, and increased awareness of security concerns. While challenges such as high initial investment costs and cybersecurity vulnerabilities exist, the overall market outlook remains positive, with continuous technological advancements and increasing demand expected to drive significant growth throughout the forecast period. The market is poised for considerable expansion, with the convergence of IoT, AI, and cloud technologies further enhancing the capabilities and adoption rate of alarm monitoring systems in the coming years.

Alarm Monitoring Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global alarm monitoring industry, offering invaluable insights for businesses, investors, and stakeholders. With a focus on market trends, competitive dynamics, and future growth projections, this report covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report analyzes a market valued at $XX Million in 2025, projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

Alarm Monitoring Industry Market Structure & Competitive Dynamics

The alarm monitoring industry is characterized by a moderately concentrated market structure, with several large multinational corporations holding significant market share. Key players include Honeywell International Inc, ABB Ltd, UTC Fire & Security (Carrier Global Corporation), Samsung Electronics Co Ltd, Johnson Controls International Plc, Siemens AG, Schneider Electric SE, CPI Security System Inc, Rockwell Automation Inc, ADT Corporation, Diebold Nixdorf, and Tyco International Plc. These companies compete intensely based on product innovation, technological advancements, service offerings, and geographic reach.

Market share is distributed across these players, with the top 5 holding approximately XX% of the global market in 2025. The industry witnesses continuous M&A activity, with deal values exceeding $XX Million annually in recent years. These acquisitions often aim to expand product portfolios, enhance technological capabilities, and gain access to new markets. The regulatory landscape varies across geographies, influencing product standardization and compliance requirements. Product substitutes, such as cloud-based security solutions, present a challenge to traditional alarm monitoring systems. End-user trends toward integrated security solutions and smart home technologies are driving demand for advanced alarm monitoring systems.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- M&A Activity: Annual deal values exceeding $XX Million, driven by expansion and technological integration.

- Regulatory Frameworks: Vary by region, impacting compliance and product standardization.

- Product Substitutes: Cloud-based security and smart home solutions pose a competitive challenge.

- End-User Trends: Demand for integrated and smart security systems is steadily increasing.

Alarm Monitoring Industry Industry Trends & Insights

The global alarm monitoring industry is experiencing significant growth driven by factors such as increasing security concerns, rising adoption of smart home technologies, and the proliferation of connected devices. The market penetration of alarm monitoring systems is growing rapidly, particularly in developed economies, and is witnessing a steady increase in developing countries. Technological disruptions, including the integration of IoT, AI, and cloud computing, are transforming the industry, leading to the development of more sophisticated and feature-rich alarm monitoring solutions. Consumer preferences are shifting towards user-friendly, customizable, and remotely accessible systems. Competitive dynamics are characterized by technological innovation, strategic partnerships, and aggressive marketing strategies. The industry is expected to maintain a robust growth trajectory, with a CAGR of XX% over the forecast period (2025-2033).

Dominant Markets & Segments in Alarm Monitoring Industry

Leading Regions/Countries: North America and Europe currently dominate the alarm monitoring market due to high security awareness, advanced infrastructure, and strong economic conditions. However, the Asia-Pacific region is experiencing rapid growth, driven by increasing urbanization and rising disposable incomes.

Dominant Segments:

- Application: Building alarm monitoring holds the largest market share, driven by increasing demand from commercial and residential sectors. Vehicle alarm monitoring is also a significant segment, driven by increasing vehicle ownership and advancements in vehicle security technologies.

- Offering: Services represent the largest share, reflecting the rising preference for managed security services. Hardware continues to be important, with sophisticated and connected devices driving growth. Software solutions are expanding rapidly, fueled by cloud-based platforms and data analytics.

- Communication Technology: Cellular wireless networks are gaining dominance due to their wide coverage and cost-effectiveness. IP networks are also expanding rapidly with the rise of smart homes and businesses.

Key Drivers for Dominant Segments:

- Building Alarm Monitoring: Stringent building codes, rising crime rates, and insurance requirements.

- Vehicle Alarm Monitoring: Increasing vehicle ownership, advancements in vehicle security tech, and insurance mandates.

- Services: Growing preference for managed security services, remote monitoring, and proactive maintenance.

- Cellular Wireless Networks: Wider coverage, cost-effectiveness, and reliable connectivity.

- IP Networks: Integration with smart homes and businesses, advanced analytics capabilities.

Alarm Monitoring Industry Product Innovations

Recent years have witnessed significant advancements in alarm monitoring technology, including the integration of IoT devices, AI-powered analytics, and cloud-based platforms. These innovations have resulted in more sophisticated and user-friendly systems with enhanced features, such as remote access, video surveillance integration, and automated alerts. This has created a competitive landscape where companies continuously strive to offer advanced features, improved reliability, and cost-effective solutions, leading to a wide range of solutions tailored to specific needs.

Report Segmentation & Scope

This report segments the alarm monitoring market across several key parameters:

Application: Vehicle Alarm Monitoring, Building Alarm Monitoring, Other Applications (covering industrial, healthcare, and critical infrastructure). Each segment is analyzed for its market size, growth projections, and competitive dynamics. Building Alarm Monitoring is the largest and fastest-growing segment.

Offering: Hardware (sensors, control panels, etc.), Software (monitoring platforms, analytics tools), and Services (installation, maintenance, monitoring). Software and Services are experiencing rapid growth.

Communication Technology: Wired Telecommunication Network, Cellular Wireless Network, Wireless Radio Network, IP Network. Cellular Wireless Network is the dominant technology, but IP Network is experiencing rapid growth. Each technology segment is examined based on its market share, adoption rate, and future potential.

Key Drivers of Alarm Monitoring Industry Growth

Several factors are driving the growth of the alarm monitoring industry. Firstly, rising security concerns across residential, commercial, and industrial sectors are creating a significant demand for advanced security systems. Secondly, the increasing adoption of smart home technologies and the integration of IoT devices are enhancing the functionalities of alarm systems. Thirdly, favorable government regulations and initiatives promoting enhanced security measures are boosting market growth. Finally, advancements in communication technologies such as 5G and improvements in cloud computing are fostering the development of more reliable and efficient alarm monitoring solutions.

Challenges in the Alarm Monitoring Industry Sector

The alarm monitoring industry faces several challenges. Cybersecurity threats pose a significant risk to the security and reliability of alarm systems. The industry also faces challenges related to high initial investment costs, the need for skilled installation and maintenance personnel, and managing data privacy concerns. Finally, intense competition from existing and emerging players increases the pressure on margins.

Leading Players in the Alarm Monitoring Industry Market

- Honeywell International Inc

- ABB Ltd

- UTC Fire & Security (Carrier Global Corporation)

- Samsung Electronics Co Ltd

- Johnson Controls International Plc

- Siemens AG

- Schneider Electric SE

- CPI Security System Inc

- Rockwell Automation Inc

- ADT Corporation

- Diebold Nixdorf

- Tyco International Plc

Key Developments in Alarm Monitoring Industry Sector

December 2021: Siemens Shooter Detection Systems, an Alarm.com company, integrated technologies to enhance public safety in active shooter situations, leading to increased demand for integrated security solutions.

February 2022: Siemens Building Technologies Division partnered with Skanska Walsh Joint Venture for LaGuardia Airport's Terminal B redevelopment, showcasing the adoption of sophisticated building automation and fire alarm systems in large-scale projects.

Strategic Alarm Monitoring Industry Market Outlook

The future of the alarm monitoring industry appears promising, with continued growth expected across various segments. The integration of cutting-edge technologies such as AI, machine learning, and cloud computing will lead to the development of more intelligent and proactive security solutions. The increasing demand for integrated security systems and smart home automation will fuel further market expansion. Opportunities exist for companies that can provide innovative, user-friendly, and cost-effective solutions that address the evolving security needs of consumers and businesses.

Alarm Monitoring Industry Segmentation

-

1. Offering

-

1.1. Hardware

- 1.1.1. Remote Terminal Units (RTUS)

- 1.1.2. Alarms Sensor

- 1.1.3. Communication Networks and Gateways

- 1.1.4. Other Hardware

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. Communication Technology

- 2.1. Wired Telecommunication Network

- 2.2. Cellular Wireless Network

- 2.3. Wireless Radio Network

- 2.4. IP Network

-

3. Application

- 3.1. Vehicle Alarm Monitoring

- 3.2. Building Alarm Monitoring

- 3.3. Other Applications

Alarm Monitoring Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Alarm Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence for gas sensors in HVAC system; Increasing need for air quality monitoring in smart cities; Growth in government standards and regulations concerning emission control; Rising Demand for Safety Systems in the Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. High initial cost of the device

- 3.4. Market Trends

- 3.4.1. Vehicle Alarm Monitoring Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.1.1. Remote Terminal Units (RTUS)

- 5.1.1.2. Alarms Sensor

- 5.1.1.3. Communication Networks and Gateways

- 5.1.1.4. Other Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Communication Technology

- 5.2.1. Wired Telecommunication Network

- 5.2.2. Cellular Wireless Network

- 5.2.3. Wireless Radio Network

- 5.2.4. IP Network

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Vehicle Alarm Monitoring

- 5.3.2. Building Alarm Monitoring

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.1.1. Remote Terminal Units (RTUS)

- 6.1.1.2. Alarms Sensor

- 6.1.1.3. Communication Networks and Gateways

- 6.1.1.4. Other Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Communication Technology

- 6.2.1. Wired Telecommunication Network

- 6.2.2. Cellular Wireless Network

- 6.2.3. Wireless Radio Network

- 6.2.4. IP Network

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Vehicle Alarm Monitoring

- 6.3.2. Building Alarm Monitoring

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.1.1. Remote Terminal Units (RTUS)

- 7.1.1.2. Alarms Sensor

- 7.1.1.3. Communication Networks and Gateways

- 7.1.1.4. Other Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Communication Technology

- 7.2.1. Wired Telecommunication Network

- 7.2.2. Cellular Wireless Network

- 7.2.3. Wireless Radio Network

- 7.2.4. IP Network

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Vehicle Alarm Monitoring

- 7.3.2. Building Alarm Monitoring

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.1.1. Remote Terminal Units (RTUS)

- 8.1.1.2. Alarms Sensor

- 8.1.1.3. Communication Networks and Gateways

- 8.1.1.4. Other Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Communication Technology

- 8.2.1. Wired Telecommunication Network

- 8.2.2. Cellular Wireless Network

- 8.2.3. Wireless Radio Network

- 8.2.4. IP Network

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Vehicle Alarm Monitoring

- 8.3.2. Building Alarm Monitoring

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East and Africa Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.1.1. Remote Terminal Units (RTUS)

- 9.1.1.2. Alarms Sensor

- 9.1.1.3. Communication Networks and Gateways

- 9.1.1.4. Other Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Communication Technology

- 9.2.1. Wired Telecommunication Network

- 9.2.2. Cellular Wireless Network

- 9.2.3. Wireless Radio Network

- 9.2.4. IP Network

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Vehicle Alarm Monitoring

- 9.3.2. Building Alarm Monitoring

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Latin America Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Hardware

- 10.1.1.1. Remote Terminal Units (RTUS)

- 10.1.1.2. Alarms Sensor

- 10.1.1.3. Communication Networks and Gateways

- 10.1.1.4. Other Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.1.1. Hardware

- 10.2. Market Analysis, Insights and Forecast - by Communication Technology

- 10.2.1. Wired Telecommunication Network

- 10.2.2. Cellular Wireless Network

- 10.2.3. Wireless Radio Network

- 10.2.4. IP Network

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Vehicle Alarm Monitoring

- 10.3.2. Building Alarm Monitoring

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. North America Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. South America Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. North America Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. MEA Alarm Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Honeywell International Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 ABB Ltd

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 UTC Fire & Security (Carrier Global Corporation)

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Samsung Electronics Co Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Johnson Controls International Plc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Siemens AG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Schneider Electric SE

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 CPI Security System Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Rockwell Automation Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 ADT Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Diebold Nixdorf

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Tyco International Plc

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Alarm Monitoring Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Alarm Monitoring Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Alarm Monitoring Industry Revenue (Million), by Offering 2024 & 2032

- Figure 28: North America Alarm Monitoring Industry Volume (K Unit), by Offering 2024 & 2032

- Figure 29: North America Alarm Monitoring Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 30: North America Alarm Monitoring Industry Volume Share (%), by Offering 2024 & 2032

- Figure 31: North America Alarm Monitoring Industry Revenue (Million), by Communication Technology 2024 & 2032

- Figure 32: North America Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2024 & 2032

- Figure 33: North America Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2024 & 2032

- Figure 34: North America Alarm Monitoring Industry Volume Share (%), by Communication Technology 2024 & 2032

- Figure 35: North America Alarm Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 36: North America Alarm Monitoring Industry Volume (K Unit), by Application 2024 & 2032

- Figure 37: North America Alarm Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: North America Alarm Monitoring Industry Volume Share (%), by Application 2024 & 2032

- Figure 39: North America Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 40: North America Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 41: North America Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: North America Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 43: Europe Alarm Monitoring Industry Revenue (Million), by Offering 2024 & 2032

- Figure 44: Europe Alarm Monitoring Industry Volume (K Unit), by Offering 2024 & 2032

- Figure 45: Europe Alarm Monitoring Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 46: Europe Alarm Monitoring Industry Volume Share (%), by Offering 2024 & 2032

- Figure 47: Europe Alarm Monitoring Industry Revenue (Million), by Communication Technology 2024 & 2032

- Figure 48: Europe Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2024 & 2032

- Figure 49: Europe Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2024 & 2032

- Figure 50: Europe Alarm Monitoring Industry Volume Share (%), by Communication Technology 2024 & 2032

- Figure 51: Europe Alarm Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 52: Europe Alarm Monitoring Industry Volume (K Unit), by Application 2024 & 2032

- Figure 53: Europe Alarm Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 54: Europe Alarm Monitoring Industry Volume Share (%), by Application 2024 & 2032

- Figure 55: Europe Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Europe Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Europe Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Europe Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Asia Pacific Alarm Monitoring Industry Revenue (Million), by Offering 2024 & 2032

- Figure 60: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Offering 2024 & 2032

- Figure 61: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 62: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Offering 2024 & 2032

- Figure 63: Asia Pacific Alarm Monitoring Industry Revenue (Million), by Communication Technology 2024 & 2032

- Figure 64: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2024 & 2032

- Figure 65: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2024 & 2032

- Figure 66: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Communication Technology 2024 & 2032

- Figure 67: Asia Pacific Alarm Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 68: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Application 2024 & 2032

- Figure 69: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 70: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Application 2024 & 2032

- Figure 71: Asia Pacific Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 72: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 73: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 75: Middle East and Africa Alarm Monitoring Industry Revenue (Million), by Offering 2024 & 2032

- Figure 76: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Offering 2024 & 2032

- Figure 77: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 78: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Offering 2024 & 2032

- Figure 79: Middle East and Africa Alarm Monitoring Industry Revenue (Million), by Communication Technology 2024 & 2032

- Figure 80: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2024 & 2032

- Figure 81: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2024 & 2032

- Figure 82: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Communication Technology 2024 & 2032

- Figure 83: Middle East and Africa Alarm Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 84: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Application 2024 & 2032

- Figure 85: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 86: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Application 2024 & 2032

- Figure 87: Middle East and Africa Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 88: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 89: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 90: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

- Figure 91: Latin America Alarm Monitoring Industry Revenue (Million), by Offering 2024 & 2032

- Figure 92: Latin America Alarm Monitoring Industry Volume (K Unit), by Offering 2024 & 2032

- Figure 93: Latin America Alarm Monitoring Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 94: Latin America Alarm Monitoring Industry Volume Share (%), by Offering 2024 & 2032

- Figure 95: Latin America Alarm Monitoring Industry Revenue (Million), by Communication Technology 2024 & 2032

- Figure 96: Latin America Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2024 & 2032

- Figure 97: Latin America Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2024 & 2032

- Figure 98: Latin America Alarm Monitoring Industry Volume Share (%), by Communication Technology 2024 & 2032

- Figure 99: Latin America Alarm Monitoring Industry Revenue (Million), by Application 2024 & 2032

- Figure 100: Latin America Alarm Monitoring Industry Volume (K Unit), by Application 2024 & 2032

- Figure 101: Latin America Alarm Monitoring Industry Revenue Share (%), by Application 2024 & 2032

- Figure 102: Latin America Alarm Monitoring Industry Volume Share (%), by Application 2024 & 2032

- Figure 103: Latin America Alarm Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 104: Latin America Alarm Monitoring Industry Volume (K Unit), by Country 2024 & 2032

- Figure 105: Latin America Alarm Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 106: Latin America Alarm Monitoring Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Alarm Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Alarm Monitoring Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Alarm Monitoring Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2019 & 2032

- Table 5: Global Alarm Monitoring Industry Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 6: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2019 & 2032

- Table 7: Global Alarm Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Global Alarm Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Alarm Monitoring Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Global Alarm Monitoring Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 24: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2019 & 2032

- Table 25: Global Alarm Monitoring Industry Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 26: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2019 & 2032

- Table 27: Global Alarm Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Global Alarm Monitoring Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 32: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2019 & 2032

- Table 33: Global Alarm Monitoring Industry Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 34: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2019 & 2032

- Table 35: Global Alarm Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Global Alarm Monitoring Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 40: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2019 & 2032

- Table 41: Global Alarm Monitoring Industry Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 42: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2019 & 2032

- Table 43: Global Alarm Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 45: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Global Alarm Monitoring Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 48: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2019 & 2032

- Table 49: Global Alarm Monitoring Industry Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 50: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2019 & 2032

- Table 51: Global Alarm Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 53: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Global Alarm Monitoring Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 56: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2019 & 2032

- Table 57: Global Alarm Monitoring Industry Revenue Million Forecast, by Communication Technology 2019 & 2032

- Table 58: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2019 & 2032

- Table 59: Global Alarm Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 60: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 61: Global Alarm Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alarm Monitoring Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Alarm Monitoring Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, UTC Fire & Security (Carrier Global Corporation), Samsung Electronics Co Ltd , Johnson Controls International Plc, Siemens AG, Schneider Electric SE, CPI Security System Inc, Rockwell Automation Inc, ADT Corporation, Diebold Nixdorf, Tyco International Plc.

3. What are the main segments of the Alarm Monitoring Industry?

The market segments include Offering, Communication Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence for gas sensors in HVAC system; Increasing need for air quality monitoring in smart cities; Growth in government standards and regulations concerning emission control; Rising Demand for Safety Systems in the Oil and Gas Industry.

6. What are the notable trends driving market growth?

Vehicle Alarm Monitoring Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High initial cost of the device.

8. Can you provide examples of recent developments in the market?

February 2022 - Siemens Building Technologies Division announced a partnership with Skanska Walsh Joint Venture, the design-build contractor for the redevelopment of New York's La Guardia Airport's Central Terminal B, to deploy a Siemens intelligent infrastructure solution that comprises integrated building automation and fire/life safety system for the new central terminal complex. The new Terminal B would be more efficient and safer than its predecessor, built in 1964. Siemens' Desigo CC integrated building management platform would monitor the building automation, facilitating dynamic control of the facility's systems to respond to the changing needs of the terminal's operations. The Desigo Fire XLS-V fire alarm panel with voice capability would be at the heart of the fire alarm system, operating in Terminal B and the central plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alarm Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alarm Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alarm Monitoring Industry?

To stay informed about further developments, trends, and reports in the Alarm Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence