Key Insights

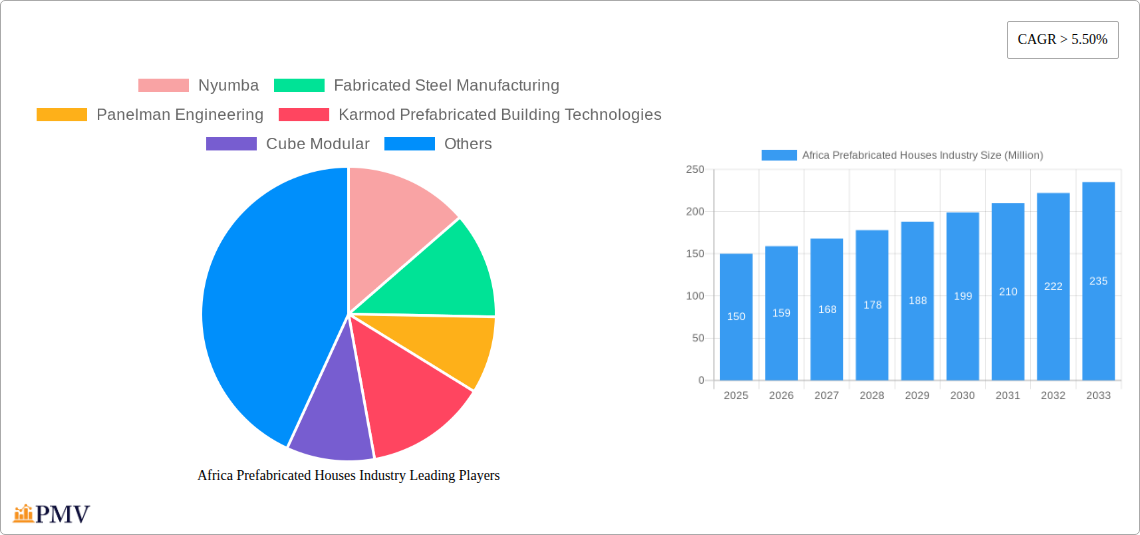

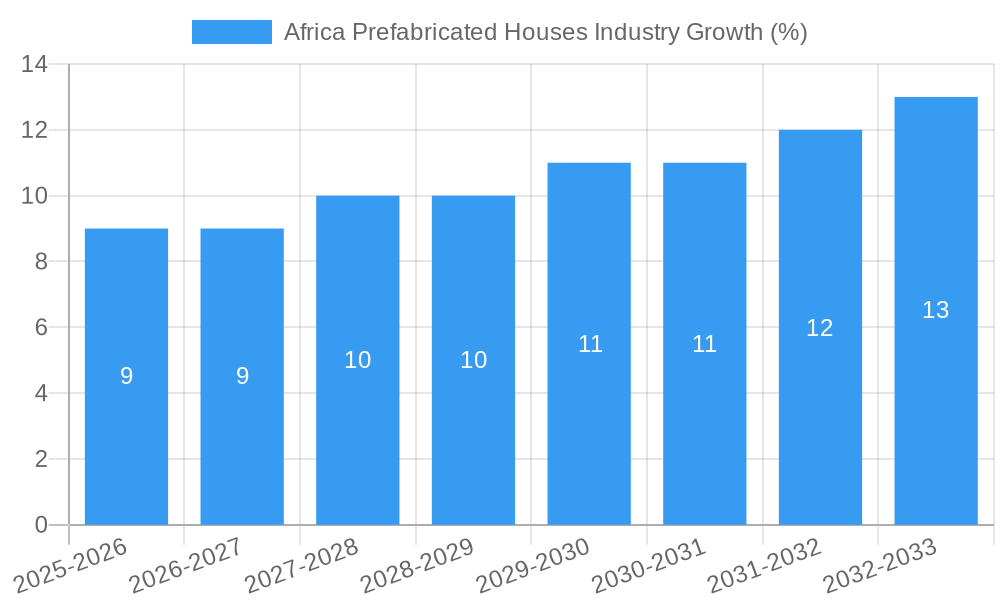

The African prefabricated houses market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 5.5% from 2025 to 2033. Several factors fuel this expansion. Rapid urbanization across Africa, particularly in burgeoning cities within Nigeria, Egypt, and South Africa, creates a significant demand for affordable and quickly deployable housing solutions. Prefabricated construction offers a compelling alternative to traditional methods, addressing the region's housing shortage while minimizing construction time and costs. Government initiatives promoting affordable housing and infrastructure development further stimulate market growth. The increasing adoption of sustainable building practices and the availability of innovative, eco-friendly materials within the prefabricated building sector also contribute to the market's positive trajectory. Key players like Nyumba, Karmod, and Cube Modular are driving innovation and expanding their market presence, leveraging technological advancements to improve efficiency and product quality. However, challenges remain, including inconsistent infrastructure in certain regions, fluctuating raw material prices, and a potential skills gap in the prefabricated construction workforce. Overcoming these hurdles will be crucial to sustaining the market's predicted growth.

Despite these challenges, the long-term outlook remains positive. The increasing adoption of modular and sustainable construction techniques will likely drive further growth. The market segmentation by house type (single-family vs. multi-family) presents opportunities for targeted marketing strategies. Focusing on specific regional needs, especially in countries like Nigeria, Egypt, and South Africa where demand is highest, will be key to maximizing market penetration. Furthermore, collaborations between prefabricated building companies and government agencies will be instrumental in overcoming infrastructural limitations and promoting wider market adoption. This dynamic market offers significant potential for both established players and new entrants, provided they can adapt to the specific needs and conditions of the African market.

Africa Prefabricated Houses Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the rapidly expanding Africa Prefabricated Houses industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, competitive dynamics, and future growth potential. The report leverages extensive data analysis to project a market value of xx Million by 2033, highlighting significant growth opportunities across various segments and geographies.

Africa Prefabricated Houses Industry Market Structure & Competitive Dynamics

The African prefabricated houses market exhibits a moderately fragmented structure, with several key players competing for market share. Market concentration is relatively low, though larger players like Karmod Prefabricated Building Technologies and Cube Modular hold a significant presence. Innovation is driven by the need for cost-effective and rapid housing solutions, fostering the development of new materials, designs, and construction techniques. Regulatory frameworks vary across African nations, impacting market access and standardization. Product substitutes, such as traditional brick-and-mortar construction, face increasing competition from the cost-effectiveness and speed of prefab solutions. End-user trends lean towards eco-friendly and customizable options, influencing product development. M&A activity remains moderate, with deal values averaging around xx Million in recent years. Notable mergers and acquisitions include [Insert specific examples of M&A activity with deal values, if available. If not available, state "Data unavailable"]. Market share data indicates that the top 5 players collectively hold approximately xx% of the market share, highlighting the competitive landscape.

Africa Prefabricated Houses Industry Industry Trends & Insights

The African prefabricated houses market is experiencing robust growth, driven by rapid urbanization, increasing population density, and a significant housing deficit across the continent. This surge is further fueled by government initiatives promoting affordable housing solutions and infrastructure development. The market is witnessing technological disruptions, with advancements in modular construction, 3D printing, and sustainable building materials. Consumer preferences are shifting towards energy-efficient, aesthetically pleasing, and customizable prefab homes. The competitive landscape remains dynamic, with new entrants and existing players constantly innovating to improve product offerings and expand market reach. The Compound Annual Growth Rate (CAGR) is estimated at xx% for the forecast period (2025-2033). Market penetration is increasing steadily, with prefab houses gaining traction in both urban and rural areas. Factors such as improved transportation networks, and reduced labor costs contribute to the market expansion.

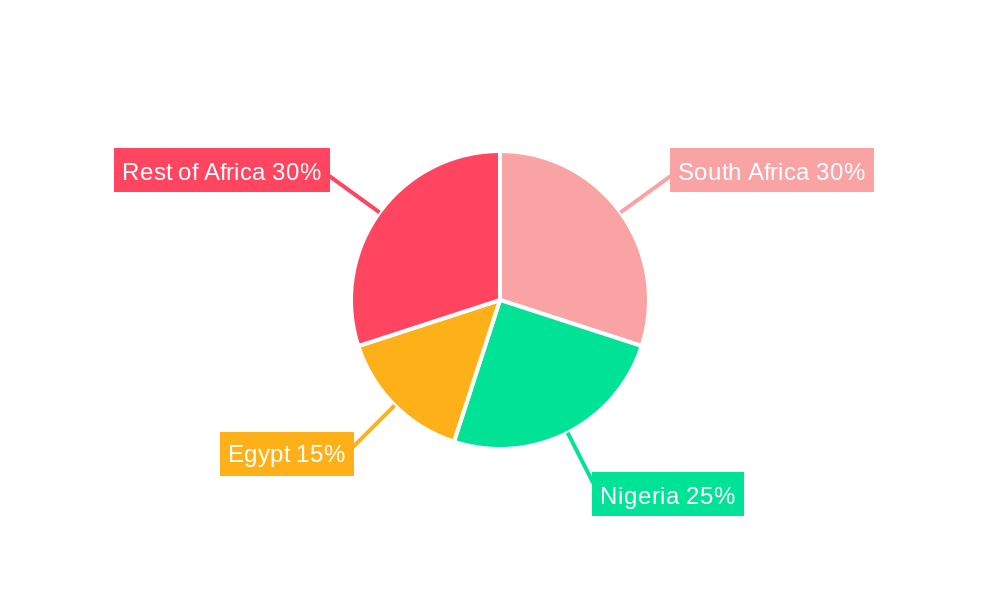

Dominant Markets & Segments in Africa Prefabricated Houses Industry

- By Country: Nigeria, Egypt, and South Africa represent the dominant markets, collectively accounting for approximately xx% of the total market value. This dominance is attributed to their large populations, burgeoning economies, and relatively developed infrastructure.

- Nigeria: Booming population, government initiatives towards affordable housing, and robust private sector involvement are major growth drivers.

- Egypt: Significant government investments in infrastructure and large-scale housing projects fuel market expansion.

- South Africa: A more mature market with a well-established construction industry, supporting growth in prefab adoption.

- By Type: The Multi-Family segment holds a larger market share than the Single-Family segment, primarily driven by large-scale housing projects undertaken by governments and private developers. Single-family homes are also showing increased demand and are projected to have a faster growth rate in the forecast period.

Africa Prefabricated Houses Industry Product Innovations

Recent innovations in the African prefabricated houses market encompass advanced modular designs, sustainable materials (like bamboo and recycled materials), and the incorporation of smart home technologies. These innovations enhance the aesthetic appeal, durability, energy efficiency, and overall value proposition of prefab homes, making them increasingly competitive with traditional construction methods. The integration of 3D printing technology is emerging as a potential game-changer, promising faster construction times and reduced costs. This fits the market's need for rapid and cost-effective housing solutions.

Report Segmentation & Scope

This report segments the African prefabricated houses market by:

By Type: Single Family and Multi-Family. The single-family segment is projected to grow at a CAGR of xx%, driven by increasing disposable incomes and a preference for individual homeownership. The multi-family segment is projected to grow at a CAGR of xx%, primarily driven by government-led affordable housing projects. Competitive dynamics in both segments are marked by a mix of established players and emerging innovators.

By Country: Nigeria, Egypt, South Africa, and Rest of Africa. Each country presents unique market dynamics influenced by economic conditions, regulatory frameworks, and infrastructural development. Growth projections vary significantly across these countries, with Nigeria and Egypt exhibiting particularly strong potential.

Key Drivers of Africa Prefabricated Houses Industry Growth

Several factors propel the growth of the African prefabricated houses industry:

- Rapid Urbanization: The rapid migration from rural areas to cities is creating a massive demand for affordable housing.

- Government Initiatives: Many African governments are implementing policies and initiatives to promote affordable housing and improve infrastructure.

- Technological Advancements: Innovations in construction techniques, materials, and designs are driving efficiency and affordability.

- Economic Growth: Rising incomes and improved living standards in several African countries are fueling demand for better housing.

Challenges in the Africa Prefabricated Houses Industry Sector

Despite the positive outlook, several challenges hinder the industry’s growth:

- High Initial Investment Costs: Setting up prefab manufacturing facilities requires significant capital investment, creating a barrier to entry for smaller players.

- Supply Chain Constraints: Reliable and efficient supply chains are crucial for timely project delivery; disruptions can significantly impact project timelines and profitability. The lack of reliable local suppliers for certain materials often requires expensive imports.

- Regulatory Hurdles: Inconsistent and sometimes complex building codes and regulations across different African nations create challenges for standardization and market access. This leads to project delays and increased administrative costs.

Leading Players in the Africa Prefabricated Houses Industry Market

- Nyumba

- Fabricated Steel Manufacturing

- Panelman Engineering

- Karmod Prefabricated Building Technologies

- Cube Modular

- Concretex

- Kwikspace Modular Buildings Ltd

- M Projects

- House-it Building

- Global Africa Prefabricated Building Solutions Ltd

Key Developments in Africa Prefabricated Houses Industry Sector

- May 2023: Amsterdam-based architecture firm NLE develops a new floating prefab housing structure, testing a model in Cape Verde to assess its viability as a cost-effective solution addressing high land prices.

- January 2022: Addis Ababa City Administration initiates a project to construct 5,000 prefabricated houses, with plans to build 2 Million more within a decade, highlighting the significant scale of government-backed prefab housing initiatives.

Strategic Africa Prefabricated Houses Industry Market Outlook

The future of the African prefabricated houses industry appears bright. Continued urbanization, supportive government policies, technological advancements, and increasing private sector investment will drive significant market expansion. Strategic opportunities exist for companies focusing on sustainable, customizable, and technologically advanced prefab housing solutions. The market presents excellent potential for companies specializing in providing integrated solutions, encompassing design, manufacturing, and construction services. The increasing adoption of technology in the industry, like 3D printing and automation, will further enhance efficiency and affordability, fueling market growth.

Africa Prefabricated Houses Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Africa Prefabricated Houses Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Prefabricated Houses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Shift Towards Prefab Housing due to High Pricing in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nyumba

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fabricated Steel Manufacturing

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Panelman Engineering

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Karmod Prefabricated Building Technologies

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cube Modular

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Concretex

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Kwikspace Modular Buildings Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 M Projects**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 House-it Building

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Global Africa Prefabricated Building Solutions Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nyumba

List of Figures

- Figure 1: Africa Prefabricated Houses Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Prefabricated Houses Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Africa Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Prefabricated Houses Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Africa Prefabricated Houses Industry?

Key companies in the market include Nyumba, Fabricated Steel Manufacturing, Panelman Engineering, Karmod Prefabricated Building Technologies, Cube Modular, Concretex, Kwikspace Modular Buildings Ltd, M Projects**List Not Exhaustive, House-it Building, Global Africa Prefabricated Building Solutions Ltd.

3. What are the main segments of the Africa Prefabricated Houses Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Shift Towards Prefab Housing due to High Pricing in Egypt.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023: A new prefab housing structure is under development by Amsterdam-based architecture firm NLE. They installed a model in Africa's Cape Verde to understand its viability's various aspects as floating houses. The idea is to reduce the overall cost emanating from land prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Prefabricated Houses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Prefabricated Houses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Prefabricated Houses Industry?

To stay informed about further developments, trends, and reports in the Africa Prefabricated Houses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence