Key Insights

Switzerland's luxury residential real estate market is projected to reach $10 billion by 2024, with a projected Compound Annual Growth Rate (CAGR) of 4.8% from 2024 to 2033. This growth is underpinned by Switzerland's stable political and economic environment, exceptional quality of life, and its strong appeal to high-net-worth individuals (HNWIs). Limited inventory in prime locations such as Zurich, Geneva, and Bern, coupled with rising demand, is driving price appreciation. Furthermore, a robust tourism sector and a strong Swiss franc enhance the market's attractiveness to both domestic and international investors. While regulatory adjustments and economic uncertainties present challenges, the market's status as a safe-haven asset and desirable residential destination ensures a positive long-term outlook.

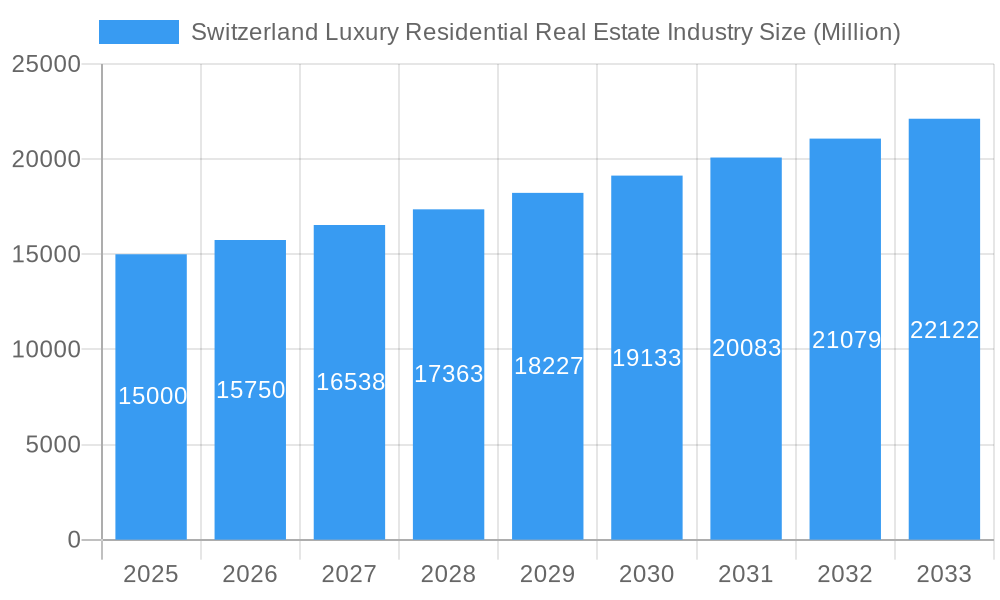

Switzerland Luxury Residential Real Estate Industry Market Size (In Billion)

Within market segments, villas and detached homes are favored by affluent buyers over apartments and condominiums. Zurich, Geneva, and Bern are leading luxury property transaction hubs. Key market participants including UM Real Estate Investment AG, CMG Immobilien, and Sotheby's International Realty offer specialized services to a discerning clientele. Future market expansion will likely be propelled by the development of premium residential projects designed for affluent buyers and reinforced by the presence of established real estate firms. Increased competition for scarce luxury properties is expected to foster innovative marketing approaches and enhanced service offerings to attract HNWIs.

Switzerland Luxury Residential Real Estate Industry Company Market Share

Switzerland Luxury Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Switzerland luxury residential real estate market, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, key trends, and future growth potential, making it an essential resource for investors, developers, and industry professionals. The report utilizes data from the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), with an estimated year of 2025. The total market size is estimated at xx Million in 2025.

Switzerland Luxury Residential Real Estate Industry Market Structure & Competitive Dynamics

The Swiss luxury residential real estate market exhibits a moderately concentrated structure, with several key players commanding significant market share. The top five companies, including UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Realty, Engel & Volkers Zurichsee Region Zimmerberg, and Residence Immobilien, account for an estimated xx% of the market in 2025. However, the market also features a considerable number of smaller, niche players, particularly within specific regions and property types.

Innovation in the sector is primarily driven by technological advancements in marketing, property management, and virtual tours. The regulatory framework is robust, with strict building codes and environmental regulations impacting development costs and timelines. Luxury property buyers are increasingly environmentally conscious, creating demand for sustainable and energy-efficient homes. Substitutes are limited due to the unique characteristics of luxury properties; however, alternative investment options, such as art or private equity, can compete for high-net-worth individual investments.

M&A activity has been relatively moderate over the past few years, with deal values ranging from xx Million to xx Million. Recent mergers and acquisitions have primarily focused on regional expansion and diversification of service offerings. Examples include smaller boutique firms being acquired by larger national or international players to increase market presence. The expected CAGR for M&A activity from 2025-2033 is estimated at xx%. End-user trends show a strong preference for properties in prime locations with exceptional amenities and a focus on sustainability.

Switzerland Luxury Residential Real Estate Industry Industry Trends & Insights

The Swiss luxury residential real estate market is characterized by strong growth drivers, including a stable political and economic environment, high purchasing power among affluent residents and foreign investors, and limited land availability in prime locations. These factors contribute to significant price appreciation and high demand for luxury properties. The market is experiencing technological disruptions through the increased use of virtual tours, online property portals, and data analytics for market forecasting.

Consumer preferences are shifting toward sustainable and energy-efficient properties, smart home technology, and personalized living spaces. Competitive dynamics are intense, with established players vying for market share and emerging businesses seeking to disrupt the traditional model through innovative service offerings. The Compound Annual Growth Rate (CAGR) for the Swiss luxury residential real estate market is projected to be xx% from 2025 to 2033, driven primarily by strong demand in key cities like Zurich and Geneva. The market penetration of international buyers remains significant, particularly from neighboring European countries and countries with political and economic stability.

Dominant Markets & Segments in Switzerland Luxury Residential Real Estate Industry

Zurich consistently ranks as the dominant market for luxury residential real estate in Switzerland, followed by Geneva and Basel. This dominance is driven by several factors:

- Economic Factors: Zurich and Geneva are major financial centers with a high concentration of high-net-worth individuals. Basel's strong pharmaceutical and chemical industries contribute to high disposable income among residents.

- Infrastructure: These cities boast exceptional infrastructure, including top-rated schools, sophisticated transportation systems, and vibrant cultural scenes.

- Lifestyle Factors: The quality of life, safety, and access to amenities attract affluent buyers.

By Type: Villas and landed houses consistently command higher prices due to their exclusivity and spaciousness, representing a larger portion of the market than apartments and condominiums. However, demand for luxury apartments and condominiums, particularly in prime locations within cities, remains strong.

By Cities:

- Zurich: High demand, limited supply, and strong price appreciation.

- Geneva: International appeal, high demand from expatriates, and significant investment in upscale properties.

- Basel: Strong local economy and a growing affluent population drive demand.

- Bern, Lausanne, and Other Cities: Exhibit moderate growth, driven by local demand and investment in upscale properties in specific neighborhoods.

Switzerland Luxury Residential Real Estate Industry Product Innovations

The luxury residential real estate sector is witnessing significant product innovations, emphasizing sustainability and smart home technology. Developments include energy-efficient building materials, smart home integration systems, and personalized design features catering to individual client preferences. These innovations provide competitive advantages by offering buyers a superior living experience and aligning with broader environmental concerns. The increasing adoption of virtual reality and augmented reality technologies for property viewings is enhancing the buyer experience.

Report Segmentation & Scope

This report segments the Swiss luxury residential real estate market by property type (Villas and Landed Houses, Apartments and Condominiums) and by city (Bern, Zurich, Geneva, Basel, Lausanne, Other Cities). Growth projections vary across segments, with villas and landed houses in Zurich and Geneva experiencing the strongest growth. Market size estimations are provided for each segment for the base year and forecast period. Competitive dynamics are analyzed within each segment, highlighting key players and their market strategies.

Key Drivers of Switzerland Luxury Residential Real Estate Industry Growth

Several key factors drive the growth of the Swiss luxury residential real estate market:

- Strong economic fundamentals: The Swiss economy remains stable and prosperous, supporting high disposable income among its residents.

- High net worth individuals: A significant concentration of high net worth individuals fuels demand for luxury properties.

- Political stability: Switzerland's politically stable environment attracts international investors.

- Limited land supply: Scarcity of land in prime locations maintains prices and drives market value upwards.

Challenges in the Switzerland Luxury Residential Real Estate Industry Sector

The Swiss luxury residential real estate market faces several challenges:

- Regulatory hurdles: Strict building codes and environmental regulations can increase development costs and timelines.

- Supply chain issues: Global supply chain disruptions can impact the availability of building materials and increase construction costs.

- Competition: The market is competitive, with both established players and new entrants vying for market share. This impacts pricing strategies and overall profitability.

- Geopolitical Uncertainty: Global economic downturns or political instability can negatively impact investor confidence and luxury real estate investment.

Leading Players in the Switzerland Luxury Residential Real Estate Industry Market

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty

- Engel & Volkers Zurichsee Region Zimmerberg

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury places SA

- La Roche Residential

Key Developments in Switzerland Luxury Residential Real Estate Industry Sector

- January 2022: Engel & Volkers Zurichsee Region Zimmerberg, a top player, announced its expansion to over 50 locations in Switzerland, increasing market presence and brand affinity.

- March 2023: Honeywell Immobilier partnered with the Watershed Organization Trust (WOTR) to focus on soil and water conservation, demonstrating a commitment to environmental sustainability, potentially attracting eco-conscious buyers.

Strategic Switzerland Luxury Residential Real Estate Industry Market Outlook

The Swiss luxury residential real estate market is poised for continued growth, driven by sustained economic strength, high demand from both domestic and international buyers, and limited land availability. Strategic opportunities exist for developers focusing on sustainable and technologically advanced properties, catering to the evolving preferences of high-net-worth individuals. Furthermore, companies focusing on niche markets, such as eco-friendly constructions or specialized concierge services, could gain a competitive edge. The market will continue to see consolidation as larger firms acquire smaller players to gain scale and increase their market share.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Switzerland Luxury Residential Real Estate Industry

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 10 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence