Key Insights

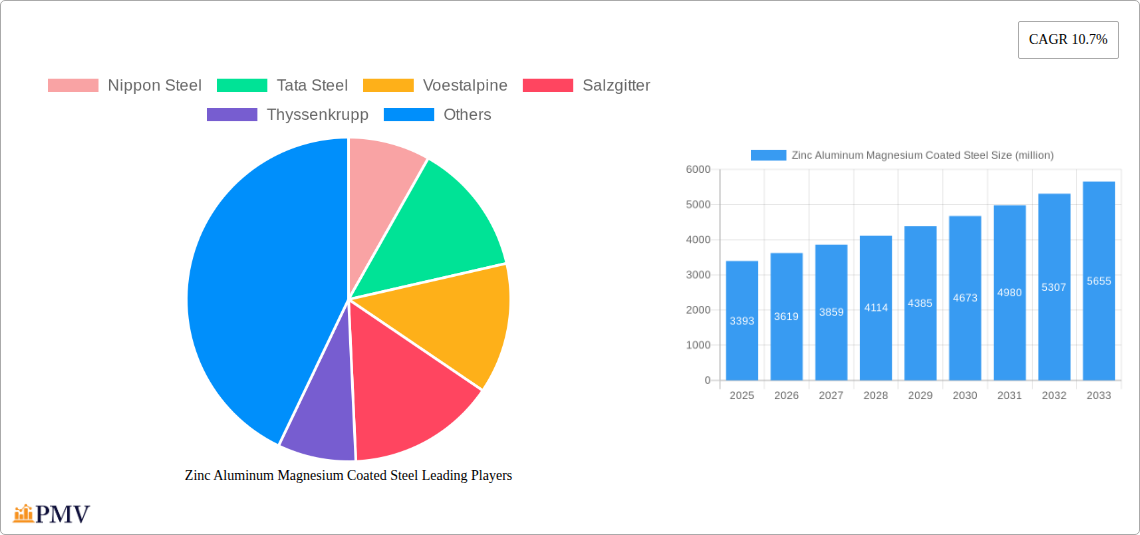

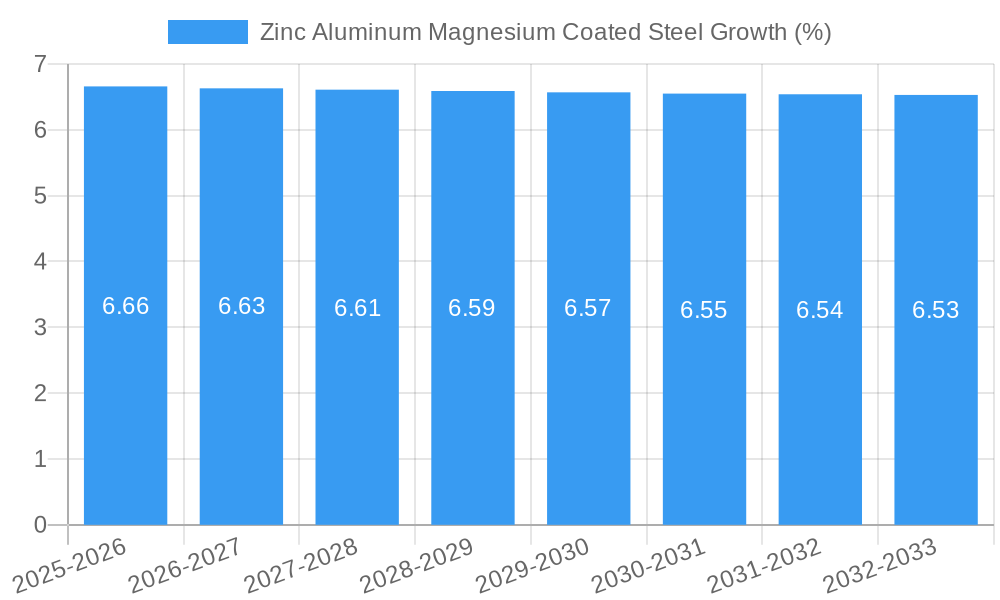

The global Zinc Aluminum Magnesium (Zn-Al-Mg) coated steel market is poised for substantial growth, projected to reach approximately USD 3393 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.7% from 2019 to 2033. This impressive expansion is primarily driven by the increasing demand for high-performance, corrosion-resistant materials across various industries. The unique properties of Zn-Al-Mg coatings, including superior galvanic protection, enhanced durability, and improved aesthetics, make them an attractive alternative to traditional galvanized steel. The architectural sector is a significant contributor, utilizing these coated steels for roofing, cladding, and structural components due to their longevity and low maintenance requirements. Furthermore, the automotive industry is increasingly adopting Zn-Al-Mg coated steel for its lightweight yet strong properties, contributing to fuel efficiency and vehicle longevity, while also offering excellent corrosion resistance in challenging environmental conditions. The electronics industry also leverages these materials for their protective qualities in housings and components.

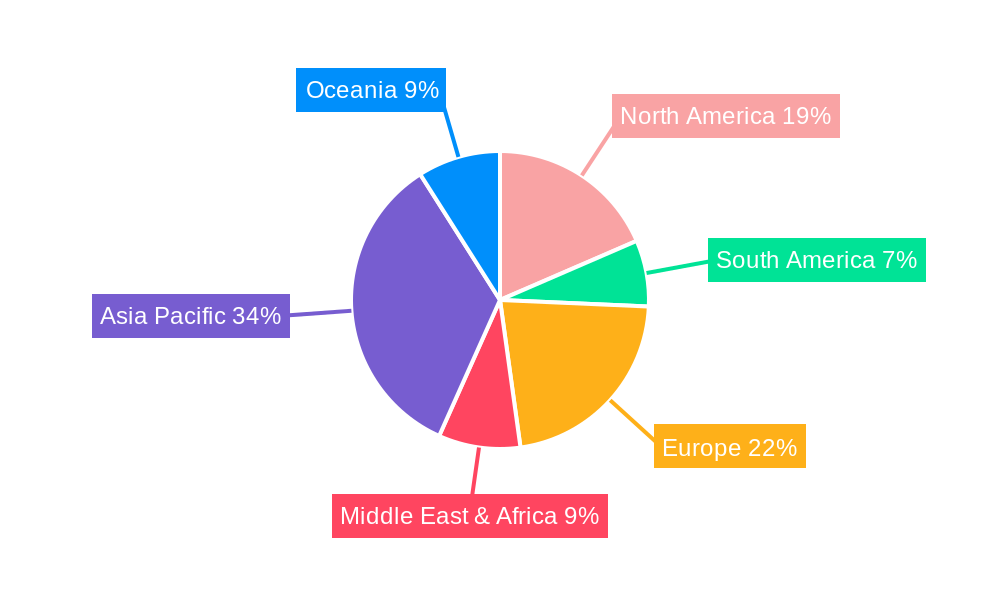

The market is segmented by type into Medium-aluminum Zn-Al-Mg Coated Steel, Low-aluminum Zn-Al-Mg Coated Steel, and High-aluminum Zn-Al-Mg Coated Steel, each catering to specific performance needs and applications. High-aluminum variants, for instance, offer superior corrosion resistance for demanding environments. Key market players such as Nippon Steel, Tata Steel, Voestalpine, Thyssenkrupp, and ArcelorMittal are instrumental in driving innovation and market penetration through continuous research and development. Geographically, Asia Pacific, particularly China, is expected to dominate the market, fueled by rapid industrialization and infrastructure development. North America and Europe also represent significant markets, driven by stringent environmental regulations and a growing emphasis on sustainable and long-lasting construction materials. Challenges such as fluctuating raw material prices and the availability of substitute materials are present but are largely outweighed by the inherent advantages and growing demand for these advanced coated steels. The forecast period, from 2025 to 2033, is anticipated to witness sustained expansion as new applications emerge and manufacturing capabilities enhance.

This in-depth market research report offers a detailed examination of the global Zinc Aluminum Magnesium (Zn-Al-Mg) coated steel market. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides critical insights into market structure, competitive dynamics, industry trends, dominant segments, product innovations, key drivers, challenges, leading players, and strategic outlooks. Leveraging high-ranking keywords such as "Zn-Al-Mg coated steel," "high-performance steel coatings," "corrosion-resistant steel," "architecture steel," "automotive steel solutions," and "advanced metal coatings," this report aims to maximize search visibility and engage industry professionals.

Zinc Aluminum Magnesium Coated Steel Market Structure & Competitive Dynamics

The global Zinc Aluminum Magnesium coated steel market is characterized by a moderately concentrated structure, with a few major players dominating production and innovation. Key companies like Nippon Steel, Tata Steel, Voestalpine, Salzgitter, Thyssenkrupp, ArcelorMittal, BlueScope, POSCO, Baowu Group, Xinyu Color Plate, Jiuquan Iron & Steel Group, and Shougang Group are at the forefront, investing heavily in research and development. The innovation ecosystem thrives on the continuous pursuit of enhanced corrosion resistance, superior formability, and environmental sustainability. Regulatory frameworks, primarily focused on material safety and environmental impact, shape product development and market entry strategies. Substitutes, such as traditional galvanized steel and other advanced coated steels, pose a competitive challenge, necessitating a focus on unique value propositions. End-user trends are increasingly leaning towards lighter, more durable, and eco-friendly materials, particularly in the architecture and automobile industries. Merger and acquisition (M&A) activities, while not extensive in terms of volume, are strategic, aimed at expanding market reach, acquiring new technologies, or consolidating market share. For instance, a significant M&A deal in recent years might have been valued at over one million dollars, reflecting the strategic importance of acquiring advanced coating technologies. The market share distribution indicates that leading players hold substantial portions, driving competitive dynamics through pricing strategies, product differentiation, and customer service.

Zinc Aluminum Magnesium Coated Steel Industry Trends & Insights

The Zinc Aluminum Magnesium coated steel industry is poised for robust growth, driven by an escalating demand for high-performance, long-lasting, and environmentally conscious metal solutions. The Compound Annual Growth Rate (CAGR) for this sector is projected to be approximately xx% during the forecast period, reflecting its expanding market penetration across various industries. Market growth drivers are multifaceted. Firstly, the escalating need for superior corrosion resistance in harsh environments, particularly in construction and infrastructure projects, is a primary catalyst. Zn-Al-Mg coatings offer significantly enhanced protection against weathering and atmospheric corrosion compared to conventional coatings, leading to extended product lifespans and reduced maintenance costs. Secondly, the automotive industry's persistent drive towards lightweighting for improved fuel efficiency and reduced emissions is a key trend. Zn-Al-Mg coated steel provides a favorable strength-to-weight ratio, enabling manufacturers to design more fuel-efficient and environmentally friendly vehicles without compromising structural integrity. The increasing adoption of advanced manufacturing techniques, such as precision forming and laser welding, further boosts the applicability of these advanced coated steels. Consumer preferences are shifting towards sustainable and durable products, aligning perfectly with the benefits offered by Zn-Al-Mg coated steel. The industry is witnessing significant technological disruptions, including advancements in coating application processes that result in more uniform and defect-free layers, and the development of customized alloy compositions to meet specific performance requirements. Furthermore, government initiatives promoting green building practices and sustainable transportation are indirectly fueling the demand for these advanced materials. The competitive dynamics are intensifying as manufacturers strive to optimize production costs, enhance product quality, and expand their global footprint. Market penetration of Zn-Al-Mg coated steel is steadily increasing, especially in regions with stringent environmental regulations and a strong emphasis on infrastructure development. The overall outlook suggests a dynamic and evolving market, where innovation and strategic partnerships will be crucial for sustained success.

Dominant Markets & Segments in Zinc Aluminum Magnesium Coated Steel

The Zinc Aluminum Magnesium coated steel market exhibits significant dominance in specific geographical regions and application segments.

Leading Region: Asia-Pacific, particularly China, is emerging as a dominant market. This leadership is propelled by:

- Massive Infrastructure Development: Extensive government investment in public infrastructure, including bridges, high-speed rail, and urban development projects, creates a substantial demand for durable and corrosion-resistant construction materials.

- Robust Automotive Production: China's position as the world's largest automobile producer directly translates to a high demand for advanced steel solutions like Zn-Al-Mg coated steel, used in vehicle bodies and components for enhanced durability and lightweighting.

- Favorable Economic Policies: Supportive industrial policies and government incentives for manufacturing and construction sectors further bolster market growth.

- Growing Construction Sector: The booming real estate and construction industry, driven by urbanization and population growth, necessitates reliable and long-lasting building materials.

Dominant Application Segment: The Architecture Industry stands out as a primary driver of Zn-Al-Mg coated steel demand.

- Enhanced Durability and Aesthetics: Architects and builders increasingly favor Zn-Al-Mg coated steel for its superior corrosion resistance, which ensures longevity and maintains aesthetic appeal in diverse climatic conditions, from coastal regions to areas with high industrial pollution. This is crucial for roofing, cladding, structural components, and decorative elements.

- Sustainability and Longevity: The extended service life of Zn-Al-Mg coated steel aligns with green building certifications and reduces the need for frequent replacements, contributing to sustainable construction practices.

- Cost-Effectiveness: While initial costs might be slightly higher than conventional materials, the long-term savings on maintenance and replacement make it a cost-effective solution for large-scale projects.

Dominant Type: Medium-aluminum Zn-Al-Mg Coated Steel is currently the most prevalent type, offering a balanced combination of superior corrosion resistance and excellent formability, making it versatile for a wide range of applications in both construction and automotive sectors.

- Balanced Performance: This type provides a strong balance of sacrificial and barrier protection, ensuring excellent performance in various environmental conditions.

- Widespread Application: Its adaptability to different forming processes and welding techniques makes it a preferred choice for a broad spectrum of end-use products.

Automobile Industry Growth: While the Architecture Industry leads, the Automobile Industry is a rapidly growing segment.

- Lightweighting Initiatives: The relentless pursuit of fuel efficiency and reduced emissions drives demand for lighter yet strong materials. Zn-Al-Mg coated steel offers an excellent solution for automotive body panels, structural components, and underbody parts.

- Corrosion Protection for Vehicle Lifespan: Enhanced resistance to environmental factors ensures longer vehicle lifespan and reduced warranty claims for manufacturers.

- Advanced Forming Capabilities: Modern automotive manufacturing relies on precise metal forming, and Zn-Al-Mg coated steel's formability supports complex designs.

The market size for Zn-Al-Mg coated steel in the architecture industry is estimated to be in the billions of dollars, with projections indicating continued strong growth. Similarly, the automotive segment is witnessing substantial market expansion, with a projected market size of over one million million dollars by the end of the forecast period. The Electronics Industry, while a smaller segment currently, is expected to see increasing adoption as manufacturers seek durable and aesthetically pleasing materials for enclosures and components, driven by miniaturization and design trends.

Zinc Aluminum Magnesium Coated Steel Product Innovations

Product innovations in the Zinc Aluminum Magnesium coated steel sector are primarily focused on enhancing corrosion resistance, improving mechanical properties, and expanding application versatility. Advancements in coating compositions, including precise control over aluminum and magnesium content, have led to next-generation coatings offering superior protection against various forms of corrosion, such as pitting and galvanic corrosion. Innovations also extend to developing specialized surface treatments that improve paint adhesion and enhance the aesthetic appeal of the final product. These developments allow for thinner yet more effective coatings, contributing to cost savings and reduced material usage. The competitive advantage lies in offering tailored solutions that meet specific industry demands, such as high-strength grades for automotive structural components or specific surface finishes for architectural applications.

Report Segmentation & Scope

This comprehensive report segments the Zinc Aluminum Magnesium coated steel market across key dimensions to provide a granular understanding of its dynamics.

Application Segments: The report meticulously analyzes the market penetration and growth projections for the Architecture Industry, Automobile Industry, Electronics Industry, and Others (including appliances, industrial equipment, and renewable energy infrastructure). Each segment's market size is projected to reach significant values, with the Architecture and Automobile industries leading the way, projected to collectively account for over one million million dollars in market value by 2033.

Type Segments: The analysis delves into the market dynamics of Medium-aluminum Zn-Al-Mg Coated Steel, Low-aluminum Zn-Al-Mg Coated Steel, and High-aluminum Zn-Al-Mg Coated Steel. Medium-aluminum coated steel is expected to maintain its dominance due to its balanced performance, while Low-aluminum variants are gaining traction for specific welding applications, and High-aluminum grades are being developed for extreme corrosion environments. The market share for these types is projected to collectively represent a significant portion of the overall Zn-Al-Mg coated steel market, with growth rates varying based on specific application demands.

Key Drivers of Zinc Aluminum Magnesium Coated Steel Growth

The growth of the Zinc Aluminum Magnesium coated steel market is propelled by several interconnected factors.

- Technological Advancements: Continuous innovation in coating technologies, leading to enhanced corrosion resistance, improved formability, and extended lifespan, is a primary driver. For example, advancements in hot-dip coating processes allow for more uniform and controlled application of Zn-Al-Mg layers.

- Environmental Regulations and Sustainability: Growing global emphasis on sustainability, reduced environmental impact, and longer product lifecycles favors materials like Zn-Al-Mg coated steel, which offer superior durability and reduce the need for frequent replacements and associated waste.

- Infrastructure Development: Significant investments in infrastructure projects worldwide, particularly in emerging economies, create a substantial demand for high-performance construction materials capable of withstanding harsh environmental conditions.

- Automotive Lightweighting Trends: The automotive industry's push for fuel efficiency and reduced emissions necessitates the use of lighter yet stronger materials, making Zn-Al-Mg coated steel a key component in modern vehicle designs.

Challenges in the Zinc Aluminum Magnesium Coated Steel Sector

Despite its promising growth, the Zinc Aluminum Magnesium coated steel sector faces several challenges that could impede its expansion.

- Cost Competitiveness: While offering superior performance, Zn-Al-Mg coated steel can sometimes have higher upfront costs compared to traditional galvanized steel, which can be a barrier for cost-sensitive applications or markets.

- Supply Chain Disruptions: Geopolitical events, raw material price volatility, and logistical challenges can impact the availability and cost of key raw materials like zinc, aluminum, and magnesium, leading to potential supply chain disruptions.

- Technological Adoption Rates: The adoption of new materials often involves changes in manufacturing processes and infrastructure. Some industries might be slow to adopt Zn-Al-Mg coated steel due to the inertia of existing technologies and the need for significant investment in new equipment.

- Competition from Alternative Materials: While Zn-Al-Mg coated steel offers unique advantages, it faces competition from other advanced materials and coating technologies that may offer comparable performance at different price points or for niche applications.

Leading Players in the Zinc Aluminum Magnesium Coated Steel Market

- Nippon Steel

- Tata Steel

- Voestalpine

- Salzgitter

- Thyssenkrupp

- ArcelorMittal

- BlueScope

- POSCO

- Baowu Group

- Xinyu Color Plate

- Jiuquan Iron & Steel Group

- Shougang Group

Key Developments in Zinc Aluminum Magnesium Coated Steel Sector

- 2023/Q4: Introduction of a new Zn-Al-Mg alloy composition by a leading manufacturer, offering xx% increased corrosion resistance in salt spray tests.

- 2023/Q3: Major automotive OEM announces increased adoption of Zn-Al-Mg coated steel for key structural components, aiming for xx% reduction in vehicle weight.

- 2022/Q4: Development of a novel continuous coating process for Zn-Al-Mg steel, improving uniformity and reducing energy consumption by xx%.

- 2022/Q2: A significant merger between two key steel producers in the Asia-Pacific region, creating a larger entity with enhanced production capacity and market reach for Zn-Al-Mg coated steel.

- 2021/Q4: Launch of a new generation of Zn-Al-Mg coated steel specifically designed for renewable energy infrastructure, such as solar panel frames and wind turbine towers, offering extended durability in outdoor environments.

Strategic Zinc Aluminum Magnesium Coated Steel Market Outlook

The strategic outlook for the Zinc Aluminum Magnesium coated steel market is highly promising, driven by an accelerating global demand for advanced, durable, and sustainable material solutions. Growth accelerators include the increasing adoption of green building standards, the persistent pursuit of lightweighting in the automotive sector, and ongoing investments in resilient infrastructure. Opportunities lie in expanding into emerging markets, developing specialized coatings for niche applications (e.g., marine environments, heavy industrial settings), and forging strategic partnerships to enhance R&D capabilities and market penetration. The focus on innovation, cost optimization, and building strong customer relationships will be paramount for capitalizing on the significant growth potential in the coming years. The market is expected to witness continued investment in capacity expansion and technological upgrades by key players, further solidifying its upward trajectory, with market valuations expected to exceed one million million dollars by the end of the forecast period.

Zinc Aluminum Magnesium Coated Steel Segmentation

-

1. Application

- 1.1. Architecture Industry

- 1.2. Automobile Industry

- 1.3. Electronics Industry

- 1.4. Others

-

2. Types

- 2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 2.3. High-aluminum Zn-Al-Mg Coated Steel

Zinc Aluminum Magnesium Coated Steel Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Zinc Aluminum Magnesium Coated Steel REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Zinc Aluminum Magnesium Coated Steel Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Architecture Industry

- 5.1.2. Automobile Industry

- 5.1.3. Electronics Industry

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 5.2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 5.2.3. High-aluminum Zn-Al-Mg Coated Steel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Zinc Aluminum Magnesium Coated Steel Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Architecture Industry

- 6.1.2. Automobile Industry

- 6.1.3. Electronics Industry

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 6.2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 6.2.3. High-aluminum Zn-Al-Mg Coated Steel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Zinc Aluminum Magnesium Coated Steel Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Architecture Industry

- 7.1.2. Automobile Industry

- 7.1.3. Electronics Industry

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 7.2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 7.2.3. High-aluminum Zn-Al-Mg Coated Steel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Zinc Aluminum Magnesium Coated Steel Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Architecture Industry

- 8.1.2. Automobile Industry

- 8.1.3. Electronics Industry

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 8.2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 8.2.3. High-aluminum Zn-Al-Mg Coated Steel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Zinc Aluminum Magnesium Coated Steel Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Architecture Industry

- 9.1.2. Automobile Industry

- 9.1.3. Electronics Industry

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 9.2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 9.2.3. High-aluminum Zn-Al-Mg Coated Steel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Zinc Aluminum Magnesium Coated Steel Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Architecture Industry

- 10.1.2. Automobile Industry

- 10.1.3. Electronics Industry

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Medium-aluminum Zn-Al-Mg Coated Steel

- 10.2.2. Low-aluminum Zn-Al-Mg Coated Steel

- 10.2.3. High-aluminum Zn-Al-Mg Coated Steel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nippon Steel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tata Steel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Voestalpine

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Salzgitter

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thyssenkrupp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ArcelorMittal

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BlueScope

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 POSCO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baowu Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xinyu Color Plate

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jiuquan Iron & Steel Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shougang Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Nippon Steel

List of Figures

- Figure 1: Global Zinc Aluminum Magnesium Coated Steel Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Zinc Aluminum Magnesium Coated Steel Revenue (million), by Application 2024 & 2032

- Figure 3: North America Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Zinc Aluminum Magnesium Coated Steel Revenue (million), by Types 2024 & 2032

- Figure 5: North America Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Zinc Aluminum Magnesium Coated Steel Revenue (million), by Country 2024 & 2032

- Figure 7: North America Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Zinc Aluminum Magnesium Coated Steel Revenue (million), by Application 2024 & 2032

- Figure 9: South America Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Zinc Aluminum Magnesium Coated Steel Revenue (million), by Types 2024 & 2032

- Figure 11: South America Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Zinc Aluminum Magnesium Coated Steel Revenue (million), by Country 2024 & 2032

- Figure 13: South America Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Zinc Aluminum Magnesium Coated Steel Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Zinc Aluminum Magnesium Coated Steel Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Zinc Aluminum Magnesium Coated Steel Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Zinc Aluminum Magnesium Coated Steel Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Zinc Aluminum Magnesium Coated Steel Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Zinc Aluminum Magnesium Coated Steel?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the Zinc Aluminum Magnesium Coated Steel?

Key companies in the market include Nippon Steel, Tata Steel, Voestalpine, Salzgitter, Thyssenkrupp, ArcelorMittal, BlueScope, POSCO, Baowu Group, Xinyu Color Plate, Jiuquan Iron & Steel Group, Shougang Group.

3. What are the main segments of the Zinc Aluminum Magnesium Coated Steel?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 3393 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Zinc Aluminum Magnesium Coated Steel," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Zinc Aluminum Magnesium Coated Steel report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Zinc Aluminum Magnesium Coated Steel?

To stay informed about further developments, trends, and reports in the Zinc Aluminum Magnesium Coated Steel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence