Key Insights

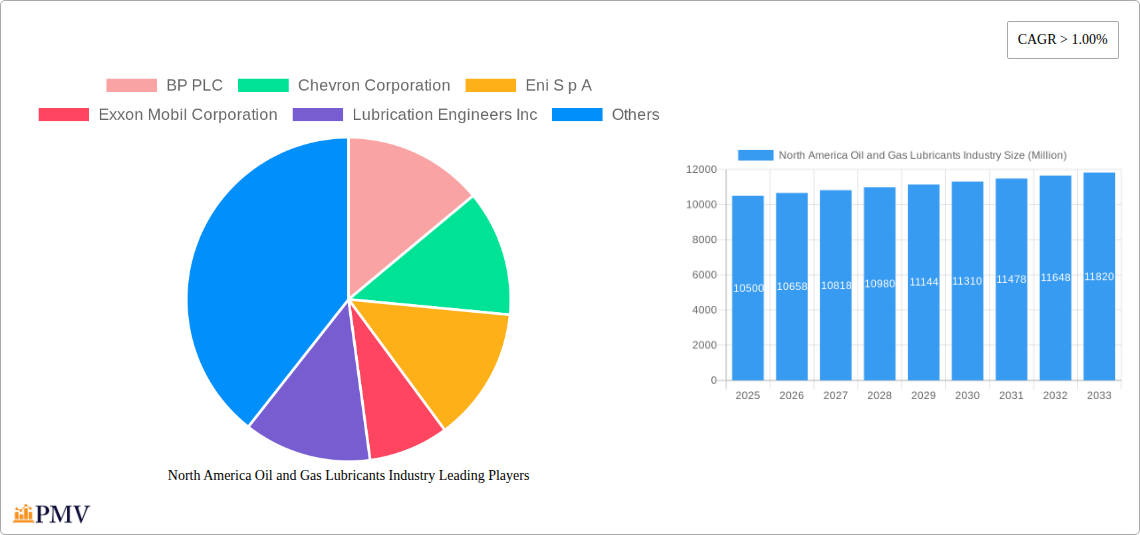

The North America Oil and Gas Lubricants Market is projected for robust expansion, reaching an estimated size of USD 7.29 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 0.16% through 2033. This growth is driven by consistent demand across upstream, midstream, and downstream oil and gas operations, fueled by exploration, production, pipeline integrity, and refining needs. Advanced lubricants are crucial for machinery longevity and operational efficiency. Technological innovations are yielding specialized lubricants designed for extreme temperature and pressure resistance, vital for the sector.

North America Oil and Gas Lubricants Industry Market Size (In Billion)

Key market trends include the rising adoption of synthetic lubricants for superior performance and extended drain intervals. Growing environmental consciousness and regulatory pressures are accelerating the development and use of biodegradable and eco-friendly lubricant formulations, especially for offshore applications. Market challenges include crude oil price volatility impacting exploration budgets and subsequent lubricant demand, as well as fluctuating raw material costs. Despite these factors, diverse product segments, including greases, coolants, engine oils, and hydraulic fluids, serve a broad spectrum of onshore and offshore applications, ensuring sustained market relevance and growth potential across North America.

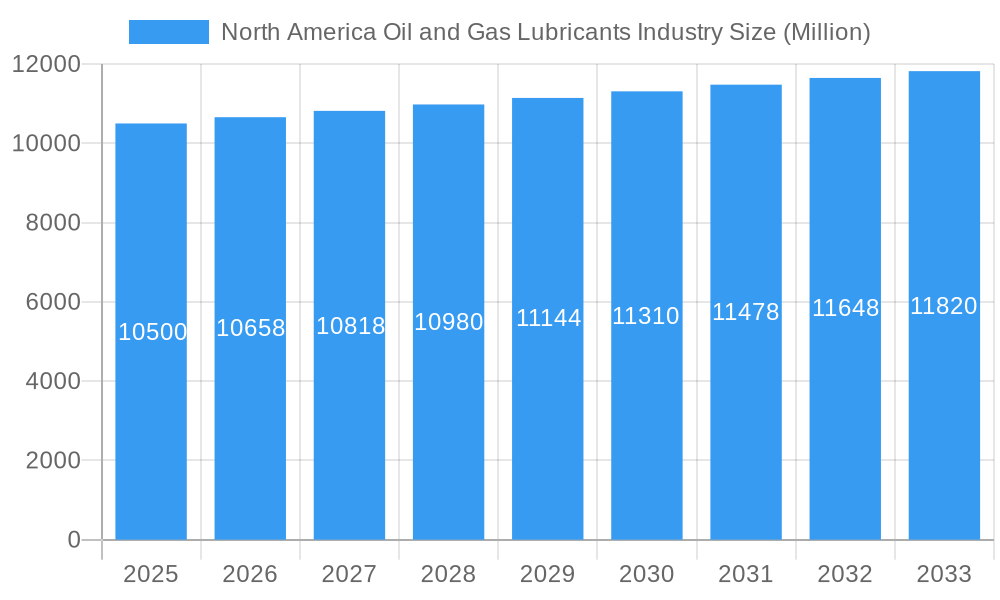

North America Oil and Gas Lubricants Industry Company Market Share

Report Title: North America Oil and Gas Lubricants Market Analysis: Size, Share, Trends, Growth & Forecast 2025-2033

Report Description: This comprehensive analysis delves into the North America Oil and Gas Lubricants Market, covering 2019-2033 with a base year of 2025. It offers in-depth insights into market structure, competitive landscapes, emerging trends, dominant segments, and future projections. Examine key growth drivers, challenges, product innovations, and strategic developments shaping the North American lubricants sector for oil and gas. Understand market segmentation by onshore/offshore locations, product types (greases, coolants, engine oils, hydraulic fluids, etc.), and industry sectors (upstream, midstream, downstream). Key geographies include the United States, Canada, and Mexico. This report is an essential resource for lubricant manufacturers, oilfield service providers, and investors seeking to navigate the evolving oil and gas lubricants market.

North America Oil and Gas Lubricants Industry Market Structure & Competitive Dynamics

The North America Oil and Gas Lubricants Industry is characterized by a moderate to high degree of market concentration, with major players like Exxon Mobil Corporation, Shell PLC, and Chevron Corporation holding significant market shares. The competitive landscape is shaped by continuous innovation in lubricant formulations to meet stringent environmental regulations and optimize equipment performance across upstream, midstream, and downstream operations. Key metrics like market share will be detailed, showing the dominance of established entities. The innovation ecosystem thrives on partnerships between lubricant producers and equipment manufacturers to develop specialized lubricants for demanding applications such as deep-sea drilling and high-temperature processing. Regulatory frameworks, including EPA standards and regional environmental policies, significantly influence product development and market entry strategies. Product substitutes, such as synthetic alternatives and bio-based lubricants, are gaining traction, pushing traditional players to enhance their offerings. End-user trends point towards a demand for longer drain intervals, improved fuel efficiency, and lubricants that reduce operational downtime. Mergers and acquisitions (M&A) activities are crucial for consolidating market presence and expanding product portfolios. Recent notable M&A deals, such as Shell's acquisition of Allied Reliability and Saudi Aramco's acquisition of Valvoline's global products business for approximately USD 2.65 Billion, highlight the ongoing consolidation and strategic realignment within the industry.

North America Oil and Gas Lubricants Industry Industry Trends & Insights

The North America Oil and Gas Lubricants Industry is poised for significant growth driven by robust exploration and production activities, particularly in the United States and Canada. The increasing demand for high-performance lubricants that enhance equipment efficiency, extend service life, and reduce maintenance costs is a primary growth driver. Technological advancements are at the forefront, with a focus on developing advanced synthetic and semi-synthetic formulations that can withstand extreme temperatures, pressures, and corrosive environments encountered in both onshore and offshore oil and gas operations. The shift towards digitalization and automation in the oil and gas sector also influences lubricant demand, requiring lubricants that are compatible with advanced machinery and monitoring systems. Consumer preferences are increasingly leaning towards environmentally friendly and sustainable lubricant solutions, pushing manufacturers to invest in bio-lubricants and products with lower environmental impact. The competitive dynamics are intense, with key players continuously investing in research and development to differentiate their product offerings and secure market share. The CAGR for the North American oil and gas lubricants market is projected to be robust, reflecting sustained demand from all sectors of the oil and gas value chain. Market penetration of specialized lubricants for complex applications, such as those used in hydraulic fracturing and deep-sea exploration, is on the rise. The ongoing energy transition, while potentially impacting overall fossil fuel demand in the long term, is also creating opportunities for specialized lubricants used in the maintenance and operation of existing infrastructure. The increasing complexity of oilfield equipment necessitates lubricants that offer superior protection against wear, corrosion, and oxidation, leading to a sustained demand for premium lubricant products. This trend is further amplified by the industry's focus on operational efficiency and cost optimization, where effective lubrication plays a critical role in preventing breakdowns and minimizing downtime. The integration of smart technologies for predictive maintenance also influences lubricant selection, with a growing demand for lubricants that can provide data on equipment health and performance.

Dominant Markets & Segments in North America Oil and Gas Lubricants Industry

The United States stands as the dominant market within the North America Oil and Gas Lubricants Industry, driven by its extensive oil and gas reserves, significant refining capacity, and vast network of exploration and production activities. This dominance is further reinforced by substantial investments in both onshore and offshore exploration.

Location: Onshore Dominance: The onshore segment is the largest contributor to the North American lubricants market. Key drivers include:

- Shale Oil and Gas Revolution: Continuous advancements in hydraulic fracturing and horizontal drilling technologies in regions like the Permian Basin necessitate a high volume of specialized lubricants for extraction equipment.

- Extensive Infrastructure: A well-established network of pipelines, refineries, and processing plants requires continuous lubrication for a wide array of machinery, from drilling rigs to pumps and compressors.

- Economic Policies: Favorable government policies and incentives supporting domestic energy production fuel onshore activities and, consequently, lubricant demand.

Product Type: Engine Oils Lead: Engine oils represent the largest product segment. This is due to:

- Heavy-Duty Vehicles: The vast fleet of trucks and specialized vehicles used in transportation and oilfield operations requires robust engine oil formulations.

- Industrial Machinery: Engines powering various industrial equipment across upstream, midstream, and downstream operations are a significant consumer.

- Performance Demands: Increasing demands for fuel efficiency and extended drain intervals drive innovation in high-performance engine oils.

Sector: Upstream and Downstream Powerhouses: Both the upstream and downstream sectors are major consumers of oil and gas lubricants.

- Upstream: Focuses on exploration and production, requiring lubricants for drilling rigs, pumps, compressors, and extraction machinery, often operating under extreme conditions.

- Downstream: Encompasses refining and petrochemical processing, utilizing lubricants for complex machinery in refineries, chemical plants, and transportation logistics, where high temperatures and pressures are common. The midstream sector, focused on transportation and storage, also contributes significantly, requiring lubricants for pipelines, pumping stations, and storage facilities.

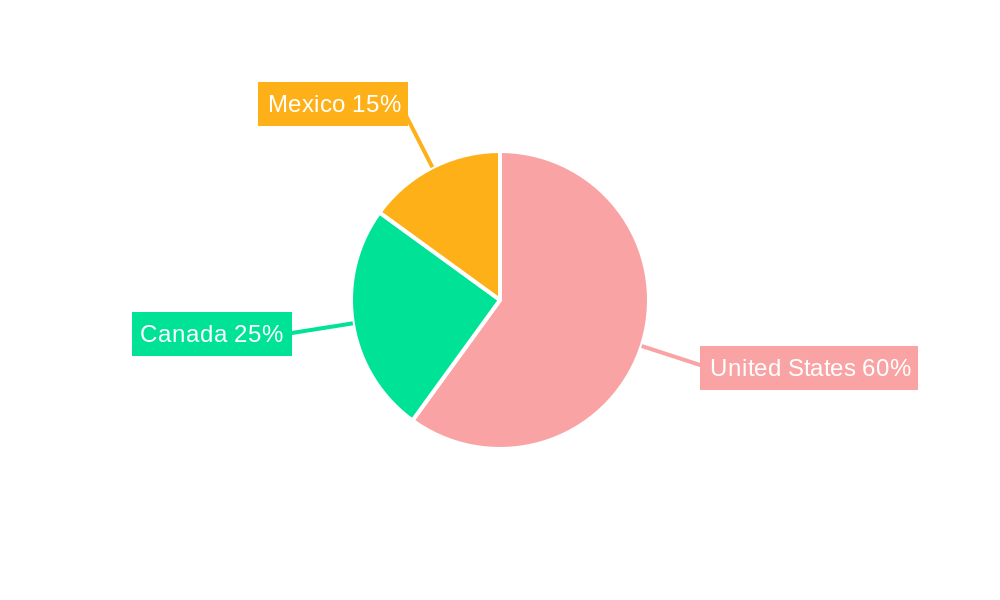

Geography: United States, Canada, Mexico: While the United States leads, Canada's oil sands and ongoing exploration efforts, along with Mexico's established oil industry, contribute significantly to the regional market dynamics. The integration of these geographies creates a complex yet unified North American lubricants market.

North America Oil and Gas Lubricants Industry Product Innovations

Product innovation in the North America Oil and Gas Lubricants Industry is primarily focused on enhancing performance under extreme conditions and meeting stringent environmental standards. Advancements include the development of high-viscosity index (HVI) synthetic engine oils for extended drain intervals and improved fuel efficiency, alongside specialized hydraulic fluids formulated for low-temperature operability in Arctic regions and high-temperature resistance in deep-well drilling. Grease formulations are evolving to offer superior load-carrying capacity and extended wear protection for critical components like bearings and gears. Lubricants with improved biodegradability and lower toxicity are also gaining traction, aligning with the industry's sustainability goals. These innovations provide competitive advantages by reducing operational costs, minimizing environmental impact, and extending the lifespan of vital oil and gas equipment.

Report Segmentation & Scope

This report meticulously segments the North America Oil and Gas Lubricants Industry across multiple dimensions to provide a granular market view.

- Location: The market is analyzed based on Onshore and Offshore applications, each presenting unique lubrication challenges and demands. Onshore operations are expected to command a larger market share due to extensive land-based extraction and processing activities. Offshore, while smaller in volume, often requires highly specialized and premium-priced lubricants.

- Product Type: Segmentation includes Grease, Coolant/Anti-freezer, Engine Oils, Hydraulic Fluids, and Other Product Types (e.g., gear oils, turbine oils, compressor oils). Engine Oils and Hydraulic Fluids are projected to be leading segments due to their widespread use across all sectors of the oil and gas industry.

- Sector: The analysis covers the Upstream (exploration and production), Midstream (transportation and storage), and Downstream (refining and petrochemicals) sectors. Each sector's distinct operational requirements drive specific lubricant demands, with upstream and downstream segments expected to exhibit the highest growth.

- Geography: The report focuses on United States, Canada, and Mexico. The United States is anticipated to maintain its leading position due to its significant oil and gas production volumes and sophisticated industrial infrastructure.

Key Drivers of North America Oil and Gas Lubricants Industry Growth

Several key factors are driving growth in the North America Oil and Gas Lubricants Industry. The continuous exploration and production activities, particularly in unconventional reserves like shale oil and gas, necessitate high volumes of specialized lubricants. Technological advancements in equipment, demanding higher performance and efficiency, are pushing the development and adoption of advanced synthetic and semi-synthetic lubricants. Furthermore, stringent environmental regulations are promoting the use of eco-friendly and sustainable lubricant solutions. The ongoing need to maintain and optimize existing infrastructure, coupled with significant investments in new energy projects, also contributes to sustained demand.

Challenges in the North America Oil and Gas Lubricants Industry Sector

Despite robust growth, the North America Oil and Gas Lubricants Industry faces several challenges. The increasing price volatility of crude oil and refined products can impact upstream and downstream operational budgets, indirectly affecting lubricant procurement. Intense competition among numerous global and regional lubricant manufacturers leads to price pressures and necessitates continuous innovation to maintain market share. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to material shortages and increased lead times for raw materials used in lubricant production. Furthermore, the evolving energy landscape and the global push towards renewable energy sources could potentially alter the long-term demand for traditional lubricants, requiring strategic adaptation and diversification.

Leading Players in the North America Oil and Gas Lubricants Industry Market

- BP PLC

- Chevron Corporation

- Eni S p A

- Exxon Mobil Corporation

- Lubrication Engineers Inc

- LUKOIL

- Petro-Canada Lubricants Inc

- Shell PLC

- Schlumberger Limited

- SKF

- TotalEnergies SE

- Valvoline Inc

Key Developments in North America Oil and Gas Lubricants Industry Sector

- December 2022: Shell acquired Allied Reliability, significantly expanding its North American lubricants business. This strategic move aligns with Shell's global lubricants strategy, aiming to broaden its premium product offerings, strengthen its industrial sector presence, and deliver comprehensive services, thereby enhancing its value proposition to customers.

- August 2022: Valvoline Inc. announced the sale of its global products business, which includes its lubricant portfolio, to Saudi Aramco for USD 2.65 Billion in cash. This divestiture allowed Valvoline to sharpen its focus on its rapidly growing retail services unit.

Strategic North America Oil and Gas Lubricants Industry Market Outlook

The strategic outlook for the North America Oil and Gas Lubricants Industry is characterized by sustained growth driven by innovation and increasing demand for high-performance, specialized lubricants. Opportunities lie in the development of environmentally sustainable products, including bio-lubricants, and lubricants tailored for emerging technologies in the energy sector. Increased focus on digitalization and predictive maintenance within the oil and gas industry presents avenues for lubricants that offer enhanced monitoring and diagnostic capabilities. Furthermore, strategic collaborations and potential M&A activities will continue to shape the competitive landscape, offering pathways for market expansion and portfolio enhancement. The industry is well-positioned to capitalize on the ongoing need for efficient and reliable lubrication solutions across all facets of oil and gas operations.

North America Oil and Gas Lubricants Industry Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

-

2. Product Type

- 2.1. Grease

- 2.2. Coolant/Anti-freezer

- 2.3. Engine Oils

- 2.4. Hydraulic Fluids

- 2.5. Other Product Types

-

3. Sector

- 3.1. Upstream

- 3.2. Midstream

- 3.3. Downstream

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Oil and Gas Lubricants Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Oil and Gas Lubricants Industry Regional Market Share

Geographic Coverage of North America Oil and Gas Lubricants Industry

North America Oil and Gas Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Interest towards Unconventional Reserves; Technological Advancement Leading to Higher Well Production Rates

- 3.3. Market Restrains

- 3.3.1. Growing Interest towards Unconventional Reserves; Technological Advancement Leading to Higher Well Production Rates

- 3.4. Market Trends

- 3.4.1. Offshore Exploration is Expected to Experience the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Oil and Gas Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Grease

- 5.2.2. Coolant/Anti-freezer

- 5.2.3. Engine Oils

- 5.2.4. Hydraulic Fluids

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Sector

- 5.3.1. Upstream

- 5.3.2. Midstream

- 5.3.3. Downstream

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. United States North America Oil and Gas Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Grease

- 6.2.2. Coolant/Anti-freezer

- 6.2.3. Engine Oils

- 6.2.4. Hydraulic Fluids

- 6.2.5. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Sector

- 6.3.1. Upstream

- 6.3.2. Midstream

- 6.3.3. Downstream

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. Canada North America Oil and Gas Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Grease

- 7.2.2. Coolant/Anti-freezer

- 7.2.3. Engine Oils

- 7.2.4. Hydraulic Fluids

- 7.2.5. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Sector

- 7.3.1. Upstream

- 7.3.2. Midstream

- 7.3.3. Downstream

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Mexico North America Oil and Gas Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Grease

- 8.2.2. Coolant/Anti-freezer

- 8.2.3. Engine Oils

- 8.2.4. Hydraulic Fluids

- 8.2.5. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Sector

- 8.3.1. Upstream

- 8.3.2. Midstream

- 8.3.3. Downstream

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BP PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Eni S p A

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Exxon Mobil Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Lubrication Engineers Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 LUKOIL

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Petro-Canada Lubricants Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Shell PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Schlumberger Limited

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SKF

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 TotalEnergies SE

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Valvoline Inc *List Not Exhaustive

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 BP PLC

List of Figures

- Figure 1: Global North America Oil and Gas Lubricants Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United States North America Oil and Gas Lubricants Industry Revenue (billion), by Location 2025 & 2033

- Figure 3: United States North America Oil and Gas Lubricants Industry Revenue Share (%), by Location 2025 & 2033

- Figure 4: United States North America Oil and Gas Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: United States North America Oil and Gas Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: United States North America Oil and Gas Lubricants Industry Revenue (billion), by Sector 2025 & 2033

- Figure 7: United States North America Oil and Gas Lubricants Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 8: United States North America Oil and Gas Lubricants Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: United States North America Oil and Gas Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: United States North America Oil and Gas Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: United States North America Oil and Gas Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Canada North America Oil and Gas Lubricants Industry Revenue (billion), by Location 2025 & 2033

- Figure 13: Canada North America Oil and Gas Lubricants Industry Revenue Share (%), by Location 2025 & 2033

- Figure 14: Canada North America Oil and Gas Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Canada North America Oil and Gas Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Canada North America Oil and Gas Lubricants Industry Revenue (billion), by Sector 2025 & 2033

- Figure 17: Canada North America Oil and Gas Lubricants Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 18: Canada North America Oil and Gas Lubricants Industry Revenue (billion), by Geography 2025 & 2033

- Figure 19: Canada North America Oil and Gas Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Canada North America Oil and Gas Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Canada North America Oil and Gas Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Mexico North America Oil and Gas Lubricants Industry Revenue (billion), by Location 2025 & 2033

- Figure 23: Mexico North America Oil and Gas Lubricants Industry Revenue Share (%), by Location 2025 & 2033

- Figure 24: Mexico North America Oil and Gas Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 25: Mexico North America Oil and Gas Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Mexico North America Oil and Gas Lubricants Industry Revenue (billion), by Sector 2025 & 2033

- Figure 27: Mexico North America Oil and Gas Lubricants Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 28: Mexico North America Oil and Gas Lubricants Industry Revenue (billion), by Geography 2025 & 2033

- Figure 29: Mexico North America Oil and Gas Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Mexico North America Oil and Gas Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Mexico North America Oil and Gas Lubricants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 2: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 4: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 7: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 9: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 12: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 14: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Location 2020 & 2033

- Table 17: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 19: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global North America Oil and Gas Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oil and Gas Lubricants Industry?

The projected CAGR is approximately 0.16%.

2. Which companies are prominent players in the North America Oil and Gas Lubricants Industry?

Key companies in the market include BP PLC, Chevron Corporation, Eni S p A, Exxon Mobil Corporation, Lubrication Engineers Inc, LUKOIL, Petro-Canada Lubricants Inc, Shell PLC, Schlumberger Limited, SKF, TotalEnergies SE, Valvoline Inc *List Not Exhaustive.

3. What are the main segments of the North America Oil and Gas Lubricants Industry?

The market segments include Location, Product Type, Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Interest towards Unconventional Reserves; Technological Advancement Leading to Higher Well Production Rates.

6. What are the notable trends driving market growth?

Offshore Exploration is Expected to Experience the Highest Growth.

7. Are there any restraints impacting market growth?

Growing Interest towards Unconventional Reserves; Technological Advancement Leading to Higher Well Production Rates.

8. Can you provide examples of recent developments in the market?

In December 2022, Shell acquired Allied Reliability, expanding its North American lubricants business. This is in line with its global lubricants strategy of expanding its premium product offering and presence in the industrial sector and providing complementary services to provide a strong value proposition to its customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oil and Gas Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oil and Gas Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oil and Gas Lubricants Industry?

To stay informed about further developments, trends, and reports in the North America Oil and Gas Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence