Key Insights

The European paints and coatings market is projected to expand to approximately 39.63 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.07% from a 2025 base year. This growth trajectory is primarily driven by escalating demand for high-performance coatings across architectural, automotive, and protective applications. A significant trend is the industry's pivot towards sustainable solutions, with a marked preference for water-borne and UV-cured coatings over traditional solvent-borne alternatives, aligning with stringent European environmental regulations and growing eco-conscious consumer preferences.

Europe Paints And Coatings Market Market Size (In Billion)

Technological advancements are further enhancing the market's dynamism, delivering coatings with superior durability, aesthetic appeal, and functional properties. Key contributing sectors include automotive, propelled by innovation in electric vehicles and specialized finishes, and architectural, influenced by new construction and renovation initiatives. While robust growth drivers are evident, market players must strategically navigate challenges such as volatile raw material costs and intense competition. Prominent global and regional companies, including PPG Industries, Akzo Nobel NV, Sherwin-Williams, Cromology, and Jotun, are actively engaged in product innovation and strategic alliances to secure market share.

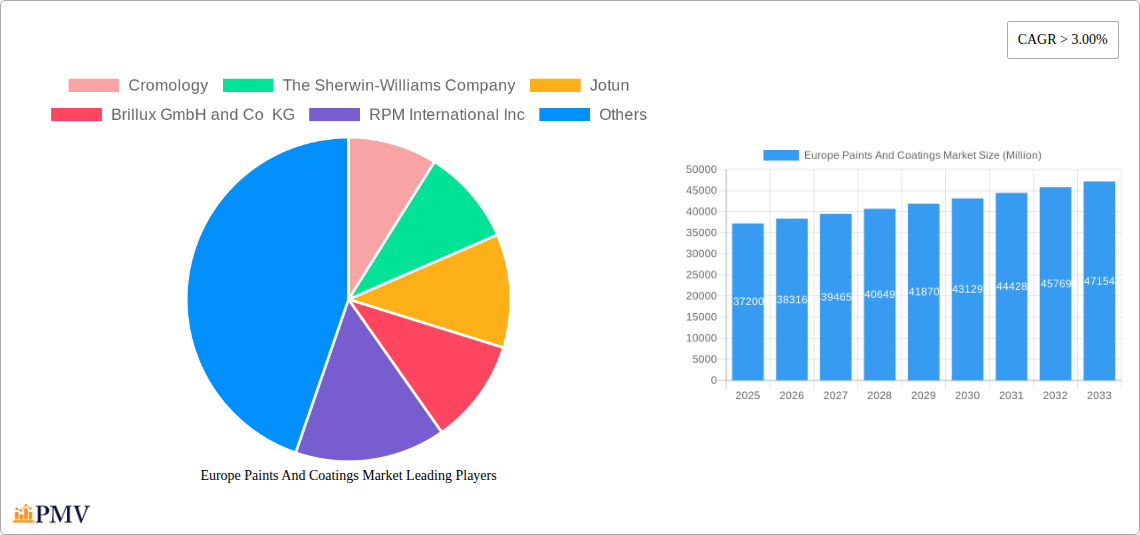

Europe Paints And Coatings Market Company Market Share

Explore the detailed analysis of the Europe Paints and Coatings Market, including market size, growth, and forecasts.

Europe Paints And Coatings Market Market Structure & Competitive Dynamics

The Europe paints and coatings market is characterized by a moderately concentrated structure, with several multinational corporations holding significant market share. Innovation ecosystems are thriving, driven by increasing demand for sustainable solutions and high-performance coatings. Regulatory frameworks, particularly stringent environmental directives like REACH, are shaping product development and manufacturing processes. Substitute products, such as alternative surface treatments and materials, pose a continuous challenge, necessitating ongoing innovation and value proposition enhancement. End-user trends indicate a strong preference for eco-friendly, durable, and aesthetically pleasing coatings across various applications. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with companies strategically acquiring smaller players or complementary businesses to expand their product portfolios and geographical reach. For instance, PPG Industries Inc.'s acquisition of Worwag in May 2021, valued at an estimated 200 Million, exemplifies this trend, significantly boosting PPG's sustainable liquid, powder, and film coatings offerings. Market share analysis reveals a competitive landscape where established players like Akzo Nobel NV, PPG Industries Inc., and The Sherwin-Williams Company consistently vie for dominance. The impact of M&A activity is substantial, leading to market consolidation and the emergence of larger, more integrated entities within the European coatings sector.

Europe Paints And Coatings Market Industry Trends & Insights

The Europe paints and coatings market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.5% between 2025 and 2033. This upward trajectory is primarily fueled by the escalating demand for sustainable and eco-friendly coatings. The strong emphasis on volatile organic compound (VOC)-free formulations and the increasing adoption of water-borne coatings are significant trends, aligning with stringent environmental regulations across the continent. Technological disruptions are playing a pivotal role, with advancements in powder coatings and UV-cured coatings offering superior performance, reduced environmental impact, and enhanced application efficiency. Consumer preferences are evolving, with a growing demand for aesthetically pleasing finishes, enhanced durability, and easy-to-apply solutions. The automotive sector, for example, is witnessing a surge in demand for scratch-resistant and self-healing coatings, driving innovation in this segment. The architectural segment, a cornerstone of the European coatings market, is benefiting from increased construction and renovation activities, particularly in the residential and commercial sectors. The protective coatings segment, vital for infrastructure development and industrial maintenance, is also witnessing steady growth, driven by the need for corrosion resistance and extended asset lifespan. Competitive dynamics are intensifying, with key players investing heavily in research and development to introduce novel products and expand their market presence. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage each other's expertise and resources. The overall market penetration of advanced coating technologies is on the rise, indicating a shift towards higher-value and more specialized products. The European paints and coatings industry is poised for continued expansion, driven by a confluence of economic recovery, technological innovation, and a strong societal push towards sustainability. The market value is estimated to reach 150 Billion Euros by 2033, up from an estimated 100 Billion Euros in 2025.

Dominant Markets & Segments in Europe Paints And Coatings Market

The architectural segment stands as a dominant force within the Europe paints and coatings market, consistently driving market value and volume. This dominance is propelled by a confluence of factors, including robust urban development, increasing renovation and refurbishment activities across residential and commercial properties, and a growing emphasis on aesthetic appeal and interior design. Economic policies promoting construction and housing initiatives in key European nations further bolster this segment's growth.

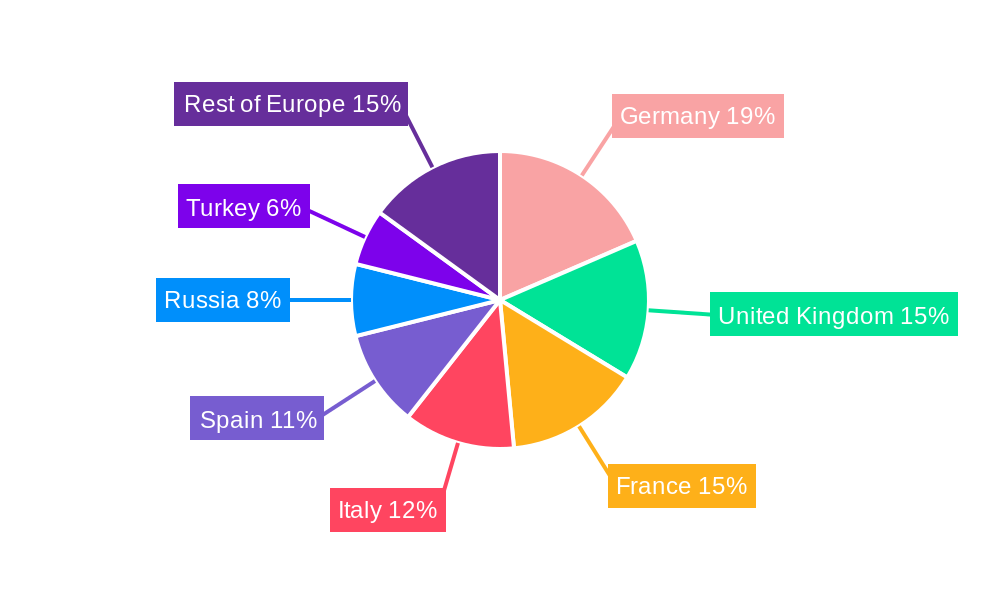

- Leading Region: Western Europe, particularly Germany, the UK, France, and Italy, commands the largest market share due to its mature economies, high disposable incomes, and a strong preference for high-quality and sustainable building materials.

- Key Countries: Germany, with its robust construction industry and stringent environmental regulations encouraging the adoption of advanced coatings, leads the market. The UK follows closely, driven by ongoing infrastructure projects and a thriving housing market.

- Dominant Resin Type: Acrylic resins dominate the architectural coatings segment owing to their excellent weather resistance, durability, low VOC content, and versatility in formulations, offering a wide range of finishes and colors. Their market share is estimated at 35% within this segment.

- Dominant Technology: Water-borne coatings are the undisputed leaders in the architectural segment, accounting for over 70% of the market share. Their low VOC emissions and ease of application align perfectly with environmental regulations and consumer demand for healthier indoor air quality.

- Dominant End User: The residential sector represents the largest sub-segment within architectural coatings, driven by new construction and homeowner renovations. Commercial buildings, including offices, retail spaces, and hospitality venues, also contribute significantly to demand.

The automotive segment is another high-growth area, driven by the increasing production of vehicles and the demand for advanced protective and aesthetic coatings. The protective coatings segment, crucial for infrastructure, marine, and oil & gas industries, exhibits steady growth due to the need for corrosion resistance and asset protection. The general industrial segment, encompassing coatings for machinery, appliances, and metal fabrication, also contributes significantly to the overall market, spurred by manufacturing output and industrial upgrades. Technological advancements, such as the development of low-VOC and high-solids coatings, are increasingly influencing product selection across all segments.

Europe Paints And Coatings Market Product Innovations

Product innovation in the Europe paints and coatings market is intensely focused on sustainability and enhanced performance. Companies are actively developing and launching advanced formulations that minimize environmental impact while maximizing durability and functionality. PPG Industries Inc.'s recent powder coatings developments, including PPG ENVIROCRON Extreme Protection Edge, PPG Envirocorn, and PPG Envirocorn LUM, exemplify this trend, targeting metal fabrication industries with improved edge protection and performance. Similarly, Hempel's launch of Hempaprime CUI 275, a fast-drying CUI coating, addresses the critical need for enhanced corrosion protection in energy generation and oil and gas facilities, improving productivity for end-users. These innovations underscore the market's commitment to delivering solutions that are both environmentally responsible and operationally superior, strengthening competitive advantages and expanding market reach.

Report Segmentation & Scope

This report meticulously segments the Europe paints and coatings market across crucial parameters to provide comprehensive insights. The Resin Type segmentation includes Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Other Resin Types, each offering distinct properties catering to specialized applications and market needs. The Technology segmentation breaks down the market into Water-borne, Solvent-borne, Powder Coatings, and UV Cured Coatings, reflecting the diverse technological advancements and their respective market penetrations. The End User segmentation is analyzed through Architectural, Automotive, Wood, Protective Coatings, General Industrial, Transportation, and Packaging sectors, highlighting the varied demands and growth drivers within each application area. For example, the Architectural segment is projected to witness a CAGR of 5.2% through 2033, with an estimated market size of 45 Billion Euros in 2025. Protective Coatings are expected to grow at a CAGR of 5.8%, reaching 25 Billion Euros by 2033.

Key Drivers of Europe Paints And Coatings Market Growth

Several interconnected factors are driving the Europe paints and coatings market growth. Stringent environmental regulations, such as the EU's directives on VOC emissions, are a significant catalyst, pushing manufacturers towards developing and adopting sustainable coating technologies like water-borne and powder coatings. Economic recovery and growth in key European countries stimulate demand from end-user industries such as construction, automotive, and manufacturing, directly boosting paint and coatings consumption. Increased infrastructure development projects across the continent, particularly in renewable energy and transportation, necessitate the use of high-performance protective coatings. Furthermore, a growing consumer preference for aesthetically pleasing and durable finishes in architectural and automotive applications fuels innovation and market expansion for specialized coatings.

Challenges in the Europe Paints And Coatings Market Sector

Despite robust growth, the Europe paints and coatings market faces several challenges. Fluctuations in raw material prices, particularly for key ingredients like titanium dioxide, resins, and solvents, can impact profit margins and lead to price volatility. Increasingly stringent environmental and health regulations, while driving innovation, also impose higher compliance costs and require significant investment in research and development for new formulations. The competitive pressure from both established global players and emerging regional manufacturers leads to pricing challenges and the need for continuous differentiation through product quality and innovation. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can affect the availability of raw materials and the timely delivery of finished products, potentially impacting market stability.

Leading Players in the Europe Paints And Coatings Market Market

- Cromology

- The Sherwin-Williams Company

- Jotun

- Brillux GmbH and Co KG

- RPM International Inc

- DAW SE

- Akzo Nobel NV

- PPG Industries Inc

- Beckers Group

- BASF SE

- Axalta Coating Systems

- Teknos Group

- Hempel A/S

- TIKKURILA OYJ

- Metlac SpA

- Kansai Paints Co Ltd

- Mankiewicz Gebr and Co

- SHAWCOR

- Śnieżka SA

- TIGER Coatings GmbH and Co KG

Key Developments in Europe Paints And Coatings Market Sector

- November 2022: PPG launched its latest powder coatings developments, including PPG ENVIROCRON Extreme Protection Edge, PPG Envirocorn, and PPG Envirocorn LUM, which finds its major application in the metal fabrication industries. Through the product launch, the company has strengthened its product portfolio.

- June 2022: Hempel launched a new fast-drying CUI coating (CUI 275), Hempaprime CUI 275, designed to increase productivity and improve corrosion protection at energy generation and oil and gas facilities.

- May 2021: PPG announced the successful acquisition of Worwag, strengthening its product portfolio with specialized sustainable liquid, powder, and film coatings products.

Strategic Europe Paints And Coatings Market Market Outlook

The strategic outlook for the Europe paints and coatings market is characterized by continued innovation in sustainable solutions and advanced performance coatings. Growth accelerators include the increasing demand for eco-friendly architectural paints, high-durability automotive finishes, and specialized protective coatings for infrastructure and industrial applications. The push towards a circular economy will drive the development of recyclable and bio-based coatings. Strategic opportunities lie in expanding market presence in emerging economies within Europe and capitalizing on government initiatives promoting green building and sustainable manufacturing. Companies that invest in digital transformation and advanced manufacturing techniques will gain a competitive edge. The forecast period is set to witness significant market expansion, driven by technological advancements, evolving consumer preferences, and a strong commitment to environmental stewardship within the European coatings industry.

Europe Paints And Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Powder Coatings

- 2.4. UV Cured Coatings

-

3. End User

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Protective Coatings

- 3.5. General Industrial

- 3.6. Transportation

- 3.7. Packaging

Europe Paints And Coatings Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Turkey

- 8. Rest of Europe

Europe Paints And Coatings Market Regional Market Share

Geographic Coverage of Europe Paints And Coatings Market

Europe Paints And Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Growth Registered by the European Construction Industry; Rising Demand From Wind Turbine Industry; Growth in Packaging Industry

- 3.3. Market Restrains

- 3.3.1. Rise in the Prices of Raw Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Architectural Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Powder Coatings

- 5.2.4. UV Cured Coatings

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Protective Coatings

- 5.3.5. General Industrial

- 5.3.6. Transportation

- 5.3.7. Packaging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Russia

- 5.4.7. Turkey

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Germany Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Acrylic

- 6.1.2. Alkyd

- 6.1.3. Polyurethane

- 6.1.4. Epoxy

- 6.1.5. Polyester

- 6.1.6. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water-borne

- 6.2.2. Solvent-borne

- 6.2.3. Powder Coatings

- 6.2.4. UV Cured Coatings

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Architectural

- 6.3.2. Automotive

- 6.3.3. Wood

- 6.3.4. Protective Coatings

- 6.3.5. General Industrial

- 6.3.6. Transportation

- 6.3.7. Packaging

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. United Kingdom Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Acrylic

- 7.1.2. Alkyd

- 7.1.3. Polyurethane

- 7.1.4. Epoxy

- 7.1.5. Polyester

- 7.1.6. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water-borne

- 7.2.2. Solvent-borne

- 7.2.3. Powder Coatings

- 7.2.4. UV Cured Coatings

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Architectural

- 7.3.2. Automotive

- 7.3.3. Wood

- 7.3.4. Protective Coatings

- 7.3.5. General Industrial

- 7.3.6. Transportation

- 7.3.7. Packaging

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. France Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Acrylic

- 8.1.2. Alkyd

- 8.1.3. Polyurethane

- 8.1.4. Epoxy

- 8.1.5. Polyester

- 8.1.6. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water-borne

- 8.2.2. Solvent-borne

- 8.2.3. Powder Coatings

- 8.2.4. UV Cured Coatings

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Architectural

- 8.3.2. Automotive

- 8.3.3. Wood

- 8.3.4. Protective Coatings

- 8.3.5. General Industrial

- 8.3.6. Transportation

- 8.3.7. Packaging

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Italy Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Acrylic

- 9.1.2. Alkyd

- 9.1.3. Polyurethane

- 9.1.4. Epoxy

- 9.1.5. Polyester

- 9.1.6. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Water-borne

- 9.2.2. Solvent-borne

- 9.2.3. Powder Coatings

- 9.2.4. UV Cured Coatings

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Architectural

- 9.3.2. Automotive

- 9.3.3. Wood

- 9.3.4. Protective Coatings

- 9.3.5. General Industrial

- 9.3.6. Transportation

- 9.3.7. Packaging

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Spain Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Acrylic

- 10.1.2. Alkyd

- 10.1.3. Polyurethane

- 10.1.4. Epoxy

- 10.1.5. Polyester

- 10.1.6. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Water-borne

- 10.2.2. Solvent-borne

- 10.2.3. Powder Coatings

- 10.2.4. UV Cured Coatings

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Architectural

- 10.3.2. Automotive

- 10.3.3. Wood

- 10.3.4. Protective Coatings

- 10.3.5. General Industrial

- 10.3.6. Transportation

- 10.3.7. Packaging

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Russia Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 11.1.1. Acrylic

- 11.1.2. Alkyd

- 11.1.3. Polyurethane

- 11.1.4. Epoxy

- 11.1.5. Polyester

- 11.1.6. Other Resin Types

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Water-borne

- 11.2.2. Solvent-borne

- 11.2.3. Powder Coatings

- 11.2.4. UV Cured Coatings

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Architectural

- 11.3.2. Automotive

- 11.3.3. Wood

- 11.3.4. Protective Coatings

- 11.3.5. General Industrial

- 11.3.6. Transportation

- 11.3.7. Packaging

- 11.1. Market Analysis, Insights and Forecast - by Resin Type

- 12. Turkey Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 12.1.1. Acrylic

- 12.1.2. Alkyd

- 12.1.3. Polyurethane

- 12.1.4. Epoxy

- 12.1.5. Polyester

- 12.1.6. Other Resin Types

- 12.2. Market Analysis, Insights and Forecast - by Technology

- 12.2.1. Water-borne

- 12.2.2. Solvent-borne

- 12.2.3. Powder Coatings

- 12.2.4. UV Cured Coatings

- 12.3. Market Analysis, Insights and Forecast - by End User

- 12.3.1. Architectural

- 12.3.2. Automotive

- 12.3.3. Wood

- 12.3.4. Protective Coatings

- 12.3.5. General Industrial

- 12.3.6. Transportation

- 12.3.7. Packaging

- 12.1. Market Analysis, Insights and Forecast - by Resin Type

- 13. Rest of Europe Europe Paints And Coatings Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Resin Type

- 13.1.1. Acrylic

- 13.1.2. Alkyd

- 13.1.3. Polyurethane

- 13.1.4. Epoxy

- 13.1.5. Polyester

- 13.1.6. Other Resin Types

- 13.2. Market Analysis, Insights and Forecast - by Technology

- 13.2.1. Water-borne

- 13.2.2. Solvent-borne

- 13.2.3. Powder Coatings

- 13.2.4. UV Cured Coatings

- 13.3. Market Analysis, Insights and Forecast - by End User

- 13.3.1. Architectural

- 13.3.2. Automotive

- 13.3.3. Wood

- 13.3.4. Protective Coatings

- 13.3.5. General Industrial

- 13.3.6. Transportation

- 13.3.7. Packaging

- 13.1. Market Analysis, Insights and Forecast - by Resin Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Cromology

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 The Sherwin-Williams Company

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Jotun

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Brillux GmbH and Co KG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 RPM International Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 DAW SE

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Akzo Nobel NV

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 PPG Industries Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Beckers Group

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 BASF SE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Axalta Coating Systems

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Teknos Group

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Hempel A/S

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 TIKKURILA OYJ

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Metlac SpA

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 Kansai Paints Co Ltd

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.17 Mankiewicz Gebr and Co

- 14.2.17.1. Overview

- 14.2.17.2. Products

- 14.2.17.3. SWOT Analysis

- 14.2.17.4. Recent Developments

- 14.2.17.5. Financials (Based on Availability)

- 14.2.18 SHAWCOR*List Not Exhaustive

- 14.2.18.1. Overview

- 14.2.18.2. Products

- 14.2.18.3. SWOT Analysis

- 14.2.18.4. Recent Developments

- 14.2.18.5. Financials (Based on Availability)

- 14.2.19 Śnieżka SA

- 14.2.19.1. Overview

- 14.2.19.2. Products

- 14.2.19.3. SWOT Analysis

- 14.2.19.4. Recent Developments

- 14.2.19.5. Financials (Based on Availability)

- 14.2.20 TIGER Coatings GmbH and Co KG

- 14.2.20.1. Overview

- 14.2.20.2. Products

- 14.2.20.3. SWOT Analysis

- 14.2.20.4. Recent Developments

- 14.2.20.5. Financials (Based on Availability)

- 14.2.1 Cromology

List of Figures

- Figure 1: Europe Paints And Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Paints And Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 3: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 7: Europe Paints And Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Paints And Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 10: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 11: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 15: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 17: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 18: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 19: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 21: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 23: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 25: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 26: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 27: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 29: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 30: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 31: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 33: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 34: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 35: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 36: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 37: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 38: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 39: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 41: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 42: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 43: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 44: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 45: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 46: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 47: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 49: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 50: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 51: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 52: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 53: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 54: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 55: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 57: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 58: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 59: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 60: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 61: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 62: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 63: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

- Table 65: Europe Paints And Coatings Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 66: Europe Paints And Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 67: Europe Paints And Coatings Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 68: Europe Paints And Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 69: Europe Paints And Coatings Market Revenue billion Forecast, by End User 2020 & 2033

- Table 70: Europe Paints And Coatings Market Volume liter Forecast, by End User 2020 & 2033

- Table 71: Europe Paints And Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Europe Paints And Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Paints And Coatings Market?

The projected CAGR is approximately 2.07%.

2. Which companies are prominent players in the Europe Paints And Coatings Market?

Key companies in the market include Cromology, The Sherwin-Williams Company, Jotun, Brillux GmbH and Co KG, RPM International Inc, DAW SE, Akzo Nobel NV, PPG Industries Inc, Beckers Group, BASF SE, Axalta Coating Systems, Teknos Group, Hempel A/S, TIKKURILA OYJ, Metlac SpA, Kansai Paints Co Ltd, Mankiewicz Gebr and Co, SHAWCOR*List Not Exhaustive, Śnieżka SA, TIGER Coatings GmbH and Co KG.

3. What are the main segments of the Europe Paints And Coatings Market?

The market segments include Resin Type, Technology, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Consistent Growth Registered by the European Construction Industry; Rising Demand From Wind Turbine Industry; Growth in Packaging Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Architectural Industry.

7. Are there any restraints impacting market growth?

Rise in the Prices of Raw Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

In November 2022, PPG launched its latest powder coatings developments, including PPG ENVIROCRON Extreme Protection Edge, PPG Envirocorn, and PPG Envirocorn LUM, which finds its major application in the metal fabrication industries. Through the product launch, the company has strengthened its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Paints And Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Paints And Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Paints And Coatings Market?

To stay informed about further developments, trends, and reports in the Europe Paints And Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence