Key Insights

The European waterborne polyurethane coatings market is projected for significant growth, with a Compound Annual Growth Rate (CAGR) of 12.82%. The market size was valued at $9.79 billion in the base year of 2025 and is expected to continue expanding. This growth is fueled by the increasing demand for environmentally friendly, low-VOC coating solutions across major industries. European environmental regulations are a primary driver, compelling manufacturers and consumers to adopt sustainable waterborne polyurethane coatings over traditional solvent-based options due to their reduced environmental impact. The inherent benefits of waterborne PU coatings, including superior durability, flexibility, abrasion resistance, and diverse aesthetic finishes, are also promoting their use in high-performance applications. The automotive and transportation sectors, with their focus on innovation and lightweight materials, are major adopters, seeking coatings that offer excellent protection and aesthetics while adhering to environmental standards. The building and construction industry, driven by sustainable building trends and the need for durable protective finishes, also presents substantial growth opportunities.

Europe Waterborne Polyurethane Coatings Market Market Size (In Billion)

Key trends indicate a rising preference for two-component (2K) waterborne polyurethane coatings, which provide enhanced performance, including faster curing and superior chemical resistance, making them suitable for demanding industrial applications. The electricals & electronics and wood & furniture sectors are also increasing their adoption, benefiting from the versatility and low-VOC attributes of these coatings. However, market restraints include the potentially higher initial cost of some waterborne formulations and perceived application complexities compared to solvent-borne alternatives, which may necessitate investment in new equipment and training for end-users. Despite these challenges, the substantial environmental advantages and ongoing technological advancements in formulation and application are anticipated to ensure sustained market expansion. Leading companies, including Akzo Nobel N.V., BASF SE, PPG Industries Inc., and The Sherwin-Williams Company, are actively investing in research and development to improve product performance and broaden their European market presence.

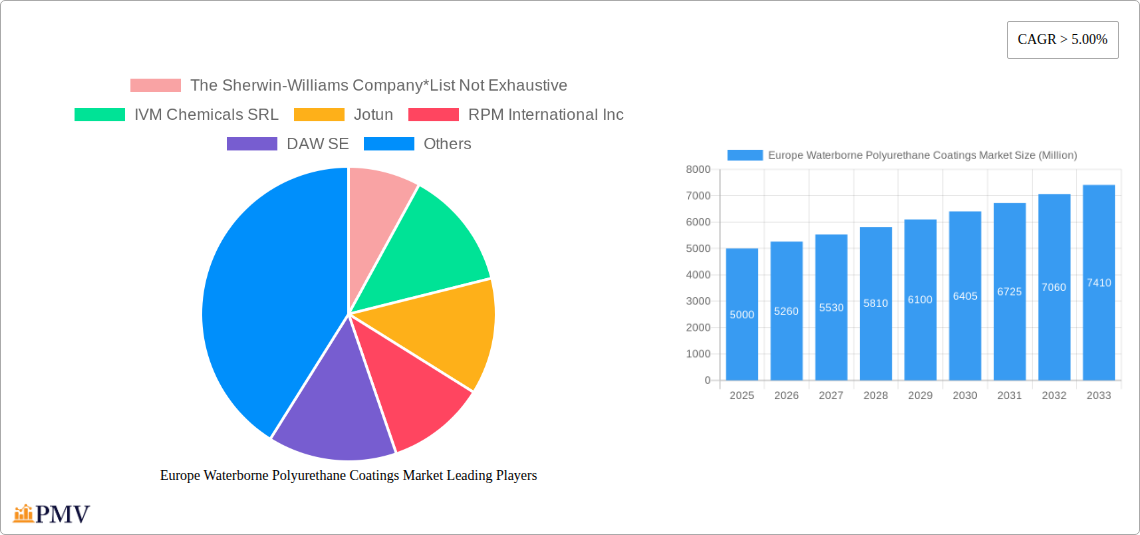

Europe Waterborne Polyurethane Coatings Market Company Market Share

Europe Waterborne Polyurethane Coatings Market: Comprehensive Analysis & Growth Forecast (2019–2033)

This in-depth report provides a detailed examination of the Europe Waterborne Polyurethane Coatings Market, a rapidly expanding sector driven by increasing environmental consciousness, stringent regulations, and evolving end-user demands. Covering the historical period from 2019 to 2024, with the base year at 2025, and projecting growth through 2033, this study offers critical insights into market dynamics, competitive landscapes, and future opportunities. Our analysis incorporates key segments including Form (One Component (1K), Two Component (2K)) and End-user Industries (Automotive, Transportation, Building & Construction, Electricals & Electronics, Wood & Furniture, Other End-user Industries).

Europe Waterborne Polyurethane Coatings Market Market Structure & Competitive Dynamics

The Europe Waterborne Polyurethane Coatings Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized regional players. Innovation ecosystems are thriving, fueled by significant R&D investments aimed at developing low-VOC (Volatile Organic Compound) formulations and enhanced performance characteristics. Regulatory frameworks, particularly those from the European Union concerning environmental protection and chemical safety, are instrumental in shaping market dynamics and driving the adoption of waterborne technologies over traditional solvent-based alternatives. Product substitutes, while present, are increasingly losing ground to the superior environmental profile and performance advancements of waterborne polyurethane coatings. End-user trends, such as the demand for sustainable building materials and eco-friendly automotive finishes, are profoundly influencing product development and market penetration. Mergers and Acquisitions (M&A) activities are sporadic but strategic, focusing on expanding product portfolios, gaining market access, and consolidating technological capabilities. For instance, recent M&A deals have been valued in the range of $50 Million to $300 Million, aiming to enhance competitive positioning within key segments like building & construction and wood & furniture. Market share for leading players often ranges from 5% to 15%, with smaller, specialized companies occupying niche segments.

Europe Waterborne Polyurethane Coatings Market Industry Trends & Insights

The Europe Waterborne Polyurethane Coatings Market is poised for significant expansion, driven by a confluence of compelling factors and evolving industry trends. The overarching trend of sustainability continues to be the primary growth catalyst. Stricter environmental regulations across Europe, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and various national VOC emission standards, are compelling manufacturers and end-users alike to transition away from solvent-borne coatings. This regulatory push, coupled with a growing consumer preference for eco-friendly products, creates a fertile ground for the adoption of waterborne polyurethane coatings. The technological advancements in waterborne polyurethane dispersions (PUDs) are a key enabler. Innovations in resin chemistry, crosslinking technologies, and additive formulations are continuously improving the performance characteristics of waterborne coatings, bridging the gap with their solvent-borne counterparts in terms of durability, chemical resistance, adhesion, and aesthetic appeal. This includes developments in self-crosslinking systems and low-temperature curing technologies.

The automotive and transportation sectors are witnessing a substantial uptake of waterborne polyurethane coatings due to their lower environmental impact during application and their contribution to achieving stringent OEM (Original Equipment Manufacturer) sustainability targets. The building and construction industry is another major consumer, driven by demand for low-VOC architectural coatings, wood finishes, and protective coatings for infrastructure. The increasing emphasis on interior air quality and occupant health further amplifies the appeal of waterborne solutions. In the wood and furniture segment, waterborne polyurethane coatings offer excellent aesthetic finishes with reduced hazardous emissions, aligning with the growing trend of sustainable furniture production and the demand for healthier indoor environments. While electricals & electronics applications might represent a smaller segment, the need for protective and insulating coatings with low VOCs is creating niche opportunities.

The competitive dynamics are characterized by intense innovation and strategic partnerships. Companies are investing heavily in R&D to enhance product performance, reduce application costs, and develop specialized formulations for diverse end-use applications. The market penetration of waterborne polyurethane coatings is projected to reach approximately 70% by 2033, up from an estimated 55% in the base year 2025. The overall market size is estimated to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period. The increasing focus on lifecycle assessment and the circular economy further bolsters the position of waterborne polyurethane coatings as a preferred choice for environmentally conscious industries.

Dominant Markets & Segments in Europe Waterborne Polyurethane Coatings Market

The Europe Waterborne Polyurethane Coatings Market is characterized by distinct regional and segment-level dominance, driven by a combination of economic factors, regulatory landscapes, and specific end-user industry demands.

Dominant Region/Country: Germany currently leads the European market for waterborne polyurethane coatings. This dominance is attributed to its robust industrial base, particularly in automotive manufacturing and construction, coupled with its stringent environmental regulations and strong emphasis on research and development. The country’s commitment to sustainability and innovation in chemical manufacturing provides a significant advantage. Other key markets include France, the United Kingdom, Italy, and Spain, each contributing significantly due to their respective industrial strengths and growing environmental awareness.

Dominant Segments:

Form:

- Two Component (2K) Waterborne Polyurethane Coatings: This segment holds a dominant position due to its superior performance characteristics, including enhanced durability, chemical resistance, and faster drying times, making it ideal for demanding applications in automotive, industrial, and high-performance wood coatings. The ability of 2K systems to achieve crosslinking at ambient temperatures further enhances their appeal. The market share for 2K is approximately 60% of the total waterborne polyurethane coatings market in Europe.

- One Component (1K) Waterborne Polyurethane Coatings: While 1K coatings offer ease of application and are cost-effective, their performance is generally lower compared to 2K systems. However, they are gaining traction in less demanding applications such as DIY wood finishes and certain architectural coatings due to their convenience. Their market share is around 40%.

End-user Industry:

- Building & Construction: This segment represents the largest share of the waterborne polyurethane coatings market in Europe, estimated at around 35%. The increasing demand for sustainable and low-VOC building materials, coupled with extensive infrastructure development and renovation projects across the continent, fuels this growth. Protective coatings for exteriors, interior wood finishes, and floor coatings are key application areas. Economic policies supporting green building initiatives and energy efficiency improvements further bolster this segment.

- Automotive: The automotive sector is a significant and growing consumer, accounting for approximately 30% of the market. Stringent OEM requirements for low-VOC emissions, coupled with the pursuit of lighter and more environmentally friendly vehicle designs, drive the adoption of waterborne polyurethane coatings for both interior and exterior applications. The high volume of automotive production in countries like Germany and its focus on advanced manufacturing techniques are key drivers.

- Wood & Furniture: This segment is steadily growing, capturing an estimated 20% of the market. The demand for aesthetically pleasing, durable, and environmentally friendly finishes for furniture, cabinetry, and flooring is increasing. Growing consumer awareness about indoor air quality and the demand for sustainable furniture further accelerate this trend.

- Transportation (excluding Automotive): This segment, including coatings for trains, buses, and marine applications, represents about 10% of the market. The need for corrosion resistance, durability, and adherence to environmental regulations in these sectors drives the adoption of waterborne polyurethane coatings.

- Electricals & Electronics: While a smaller segment, approximately 5%, it is experiencing growth due to the requirement for insulating, protective, and aesthetically pleasing coatings with low environmental impact for electronic components and devices.

Europe Waterborne Polyurethane Coatings Market Product Innovations

Product innovation in the Europe Waterborne Polyurethane Coatings Market is primarily focused on enhancing performance while adhering to strict environmental regulations. Key developments include advancements in polyurethane dispersions (PUDs) offering superior scratch resistance, UV stability, and chemical resistance, closely mimicking solvent-borne counterparts. Technologies for faster curing times, even at ambient temperatures, are crucial for improving application efficiency. Novel formulations are also emerging for specific niche applications, such as highly flexible coatings for textiles and advanced protective coatings for industrial equipment. The competitive advantage lies in offering a complete eco-friendly solution without compromising on the quality and longevity of the finished product.

Report Segmentation & Scope

This report meticulously segments the Europe Waterborne Polyurethane Coatings Market based on critical parameters to provide a granular understanding of market dynamics. The segmentation encompasses:

- Form: The market is analyzed across One Component (1K) Waterborne Polyurethane Coatings and Two Component (2K) Waterborne Polyurethane Coatings. The 1K segment is expected to grow steadily due to its ease of application and cost-effectiveness, while the 2K segment will continue to dominate due to its superior performance characteristics, particularly in demanding industrial and automotive applications. Growth projections for the 1K segment are around 5.8% CAGR, while the 2K segment is anticipated to grow at approximately 7.0% CAGR.

- End-user Industry: The analysis covers the Automotive, Transportation, Building & Construction, Electricals & Electronics, Wood & Furniture, and Other End-user Industries. The Building & Construction segment is projected to maintain its leading position with a CAGR of around 6.7%, driven by sustainable construction initiatives. The Automotive segment is expected to witness a CAGR of approximately 6.5%, fueled by OEM sustainability targets. The Wood & Furniture segment is anticipated to grow at about 6.2% CAGR, while the Transportation and Electricals & Electronics segments are projected to grow at 6.0% and 6.3% CAGR respectively. Other End-user Industries, encompassing sectors like aerospace, marine, and general industrial coatings, are also analyzed for their specific growth trajectories.

Key Drivers of Europe Waterborne Polyurethane Coatings Market Growth

Several powerful drivers are propelling the growth of the Europe Waterborne Polyurethane Coatings Market. Stringent environmental regulations, particularly those related to Volatile Organic Compound (VOC) emissions, are paramount. The European Union’s commitment to reducing industrial pollution and promoting sustainable practices mandates the shift towards low-VOC alternatives like waterborne coatings. Secondly, growing consumer and industry awareness regarding the health and environmental impacts of traditional solvent-based coatings is a significant factor. This heightened consciousness translates into increased demand for eco-friendly products across various sectors. Technological advancements in waterborne polyurethane chemistry are continuously improving performance attributes, such as durability, scratch resistance, and drying times, making them increasingly competitive with solvent-borne counterparts. Finally, growth in key end-user industries like building & construction and automotive, driven by economic recovery and infrastructure development, directly translates into increased demand for coatings solutions.

Challenges in the Europe Waterborne Polyurethane Coatings Market Sector

Despite the robust growth trajectory, the Europe Waterborne Polyurethane Coatings Market faces several challenges. Higher initial costs compared to some solvent-based alternatives can be a barrier for price-sensitive applications, although this is often offset by lifecycle benefits. Slower drying times and application complexities in certain waterborne formulations, though improving with technology, can still pose challenges for manufacturers accustomed to faster solvent-based processes. Performance limitations in extremely harsh environments for certain waterborne systems are also a consideration, although ongoing R&D is actively addressing these gaps. Furthermore, supply chain disruptions and the availability of key raw materials can impact production and pricing. Intense competition from established solvent-based coatings and emerging alternative eco-friendly technologies also presents a constant challenge.

Leading Players in the Europe Waterborne Polyurethane Coatings Market Market

The Europe Waterborne Polyurethane Coatings Market is characterized by the presence of several leading global and regional manufacturers. Key players include:

- The Sherwin-Williams Company

- IVM Chemicals SRL

- Jotun

- RPM International Inc

- DAW SE

- Hempel

- PPG Industries Inc

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N V

- Polycoat Products

Key Developments in Europe Waterborne Polyurethane Coatings Market Sector

- 2023: AkzoNobel launched a new range of sustainable waterborne coatings for the furniture industry, focusing on reduced VOC emissions and enhanced durability.

- 2023: BASF SE expanded its portfolio of waterborne polyurethane dispersions, offering improved performance for automotive clear coats and industrial applications.

- 2022: PPG Industries Inc acquired a specialized manufacturer of bio-based coatings, signaling a growing trend towards sustainable raw material sourcing in the waterborne segment.

- 2022: Jotun introduced innovative waterborne coatings for the marine sector, meeting stringent environmental regulations and offering superior anti-corrosion properties.

- 2021: Axalta Coating Systems enhanced its waterborne refinish coatings for the automotive aftermarket, emphasizing faster application and improved aesthetics.

- 2020: RPM International Inc strengthened its presence in the wood coatings market with strategic product development in waterborne polyurethane technologies.

Strategic Europe Waterborne Polyurethane Coatings Market Market Outlook

The strategic outlook for the Europe Waterborne Polyurethane Coatings Market is exceptionally positive, driven by an unwavering commitment to sustainability and continuous technological innovation. Growth accelerators include the ongoing tightening of environmental regulations, which will further marginalize solvent-based alternatives, and the increasing demand for healthier indoor environments, particularly in residential and commercial buildings. The automotive industry's transition towards electric vehicles also presents opportunities, as these new platforms often prioritize lightweight and sustainable materials. Manufacturers focusing on R&D for high-performance, easy-to-apply, and cost-competitive waterborne polyurethane coatings will gain a significant competitive edge. Strategic opportunities lie in expanding market reach into emerging economies within Europe, forging partnerships for raw material sourcing, and developing customized solutions for specialized industrial applications. The future market will be defined by companies that can effectively balance performance, sustainability, and cost.

Europe Waterborne Polyurethane Coatings Market Segmentation

-

1. Form

- 1.1. One Component (1K)

- 1.2. Two Component (2K)

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Transportation

- 2.3. Buiding & Construction

- 2.4. Electricals & Electronics

- 2.5. Wood & furniture

- 2.6. Other End-user Industries

Europe Waterborne Polyurethane Coatings Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Waterborne Polyurethane Coatings Market Regional Market Share

Geographic Coverage of Europe Waterborne Polyurethane Coatings Market

Europe Waterborne Polyurethane Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Consistent Growth Registered by the European Wood Furniture Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Declining Automotive Industry; Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Consistent Growth of European Wood Furniture Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Waterborne Polyurethane Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. One Component (1K)

- 5.1.2. Two Component (2K)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Transportation

- 5.2.3. Buiding & Construction

- 5.2.4. Electricals & Electronics

- 5.2.5. Wood & furniture

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IVM Chemicals SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RPM International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DAW SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hempel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PPG Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axalta Coating Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Akzo Nobel N V

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Polycoat Products

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: Europe Waterborne Polyurethane Coatings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Waterborne Polyurethane Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Waterborne Polyurethane Coatings Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Europe Waterborne Polyurethane Coatings Market Volume liter per unit Forecast, by Form 2020 & 2033

- Table 3: Europe Waterborne Polyurethane Coatings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Waterborne Polyurethane Coatings Market Volume liter per unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Waterborne Polyurethane Coatings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Waterborne Polyurethane Coatings Market Volume liter per unit Forecast, by Region 2020 & 2033

- Table 7: Europe Waterborne Polyurethane Coatings Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: Europe Waterborne Polyurethane Coatings Market Volume liter per unit Forecast, by Form 2020 & 2033

- Table 9: Europe Waterborne Polyurethane Coatings Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Waterborne Polyurethane Coatings Market Volume liter per unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Waterborne Polyurethane Coatings Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Waterborne Polyurethane Coatings Market Volume liter per unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Waterborne Polyurethane Coatings Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Waterborne Polyurethane Coatings Market Volume (liter per unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Waterborne Polyurethane Coatings Market?

The projected CAGR is approximately 12.82%.

2. Which companies are prominent players in the Europe Waterborne Polyurethane Coatings Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, IVM Chemicals SRL, Jotun, RPM International Inc, DAW SE, Hempel, PPG Industries Inc, BASF SE, Axalta Coating Systems, Akzo Nobel N V, Polycoat Products.

3. What are the main segments of the Europe Waterborne Polyurethane Coatings Market?

The market segments include Form, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.79 billion as of 2022.

5. What are some drivers contributing to market growth?

; Consistent Growth Registered by the European Wood Furniture Industry; Other Drivers.

6. What are the notable trends driving market growth?

Consistent Growth of European Wood Furniture Industry.

7. Are there any restraints impacting market growth?

; Declining Automotive Industry; Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter per unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Waterborne Polyurethane Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Waterborne Polyurethane Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Waterborne Polyurethane Coatings Market?

To stay informed about further developments, trends, and reports in the Europe Waterborne Polyurethane Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence