Key Insights

The Global Automotive Selective Catalytic Reduction (SCR) Market is projected for substantial growth, with an estimated market size of 13.22 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 11.8%. This upward trend is primarily driven by increasingly stringent global emission regulations aimed at reducing NOx pollutants from diesel and gasoline engines. Governments worldwide are prioritizing air quality, fueling demand for advanced SCR systems, including catalysts and components. Key regulatory drivers include Euro 7 standards in Europe and EPA regulations in North America, alongside evolving norms in Asia Pacific and emerging markets. Innovation in catalyst technology, focusing on enhanced efficiency, durability, and cost reduction, is a significant market factor. The expanding adoption of SCR technology across various vehicle types, from heavy-duty trucks and buses to passenger cars and off-road machinery, further supports this positive market trajectory.

Automotive Selective Catalytic Reduction Market Market Size (In Billion)

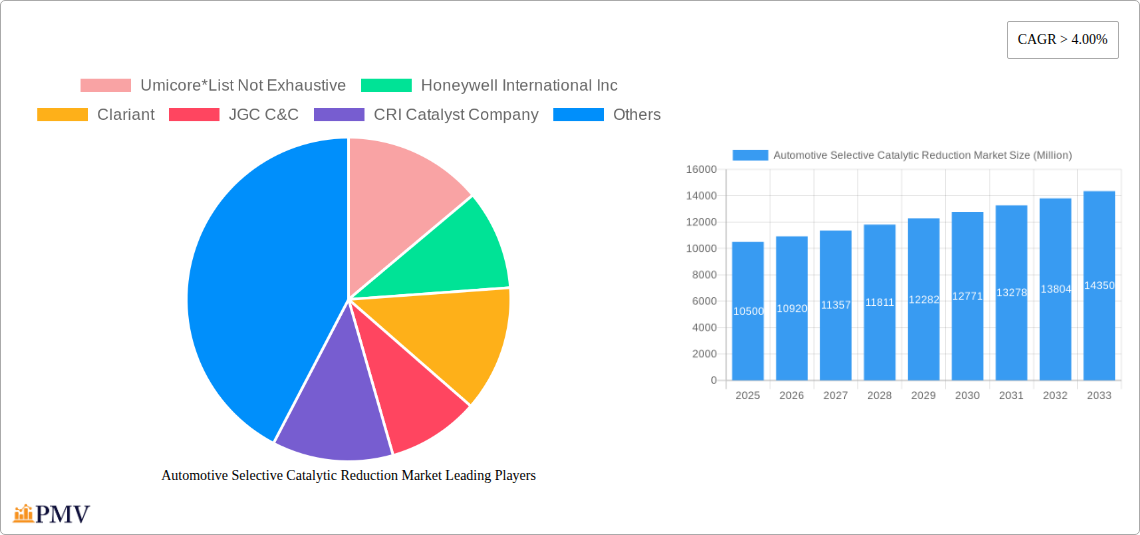

The SCR market features a dynamic competitive landscape and evolving technological trends. The Honeycomb Catalyst segment is anticipated to lead due to its superior surface area and catalytic efficiency. While Selective Catalytic Reduction remains the core process, advancements in Diesel Particulate Filters (DPFs) and Catalytic Oxidation are enhancing comprehensive emissions control solutions. Although the power generation sector contributes, automotive applications are the primary growth engine for the SCR market. Leading companies such as Umicore, Honeywell International Inc., and BASF SE are actively investing in R&D for next-generation SCR solutions. Market challenges include the complexity and cost of SCR systems, the requirement for specific urea-based reductants (DEF/AdBlue), and potential retrofitting difficulties for older vehicles. Nevertheless, strong regulatory mandates and growing environmental awareness ensure sustained growth for the Automotive SCR market.

Automotive Selective Catalytic Reduction Market Company Market Share

Automotive Selective Catalytic Reduction Market: Comprehensive Report Description

This in-depth market research report delves into the Automotive Selective Catalytic Reduction (SCR) Market, providing an exhaustive analysis of its current landscape, future trajectory, and key influencing factors. The report is meticulously crafted for industry professionals, investors, and stakeholders seeking actionable insights into the global SCR market, automotive emissions control solutions, and NOx reduction technologies.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

The report covers a wide array of critical segments including Catalyst Type (Honeycomb Catalyst, Plate Catalyst, Corrugated Catalyst), Process Type (Selective Catalytic Reduction, Non-selective Catalytic Reduction, Diesel Particulate Filters, Catalytic Oxidation), and Application (Power Generation (Excluding Coal based), Coal-based Thermal Power Generation, Industrial). We also highlight advancements from leading companies such as Umicore, Honeywell International Inc, Clariant, JGC C&C, CRI Catalyst Company, DCL International Inc, CDTi Advanced Materials Inc, Hitachi Zosen Corporation, CORMETECH, BASF SE, Cataler Corporation, Johnson Matthey, IBIDEN Porzellanfabrik Frauenthal, and Corning Incorporated.

This detailed analysis will equip you with a strategic advantage in navigating the dynamic automotive aftertreatment market and understanding the crucial role of SCR systems in achieving stringent environmental regulations and sustainable mobility.

Automotive Selective Catalytic Reduction Market Market Structure & Competitive Dynamics

The Automotive Selective Catalytic Reduction Market is characterized by a moderately concentrated structure, with a blend of established global players and emerging regional manufacturers vying for market share. Key industry dynamics are shaped by intense competition, a strong emphasis on research and development for high-performance catalysts, and a growing focus on cost-effectiveness. The innovation ecosystem thrives on partnerships between catalyst developers, automotive OEMs, and research institutions to create advanced SCR systems that meet evolving emission standards. Regulatory frameworks, particularly stringent Euro standards and EPA regulations, act as significant market drivers, compelling manufacturers to invest in cleaner technologies. Product substitutes, such as other NOx abatement technologies, are present but SCR currently holds a dominant position due to its efficiency and cost-effectiveness in many applications. End-user trends highlight a growing demand for durable, low-maintenance SCR systems and a preference for integrated exhaust aftertreatment solutions. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate their market position, expand their product portfolios, and gain access to new technologies and geographical markets. For instance, M&A deals in the broader automotive emissions control market have previously ranged from tens to hundreds of millions, indicating significant strategic investment. Market share analysis reveals that major players like Johnson Matthey and BASF SE hold substantial portions of the automotive catalyst market, particularly in SCR technologies.

Automotive Selective Catalytic Reduction Market Industry Trends & Insights

The Automotive Selective Catalytic Reduction Market is experiencing robust growth, driven by a confluence of factors including escalating global demand for cleaner transportation and industrial processes, and increasingly stringent environmental regulations worldwide. A significant CAGR of approximately 7.5% is projected over the forecast period, indicating substantial expansion. The market penetration of SCR technology is steadily increasing, especially within the heavy-duty vehicle sector and industrial applications. Technological disruptions are playing a pivotal role, with ongoing advancements in catalyst formulations, urea injection systems, and integrated aftertreatment solutions aimed at enhancing SCR efficiency, reducing ammonia slip, and improving durability. The development of more compact and lightweight SCR systems is a key trend, facilitating their integration into a wider range of vehicles and machinery. Consumer preferences are shifting towards vehicles and industrial equipment that demonstrably meet or exceed environmental standards, thereby boosting demand for SCR-equipped products. Competitive dynamics are characterized by fierce price competition and a relentless pursuit of innovation, with companies investing heavily in R&D to develop next-generation SCR catalysts with superior performance and longevity. The rising adoption of electric vehicles presents a long-term consideration, but the sheer volume of existing and new internal combustion engine vehicles, particularly in commercial and industrial sectors, ensures continued demand for SCR systems for the foreseeable future. The integration of advanced diagnostics and monitoring systems within SCR units is also gaining traction, offering end-users real-time performance data and predictive maintenance capabilities. The trend towards stricter NOx emission limits for both on-road and off-road vehicles, alongside industrial boilers and power plants, is a primary growth accelerator for the SCR market. The increasing focus on decarbonization and sustainability in the global automotive industry further underscores the importance of efficient emission control technologies like SCR.

Dominant Markets & Segments in Automotive Selective Catalytic Reduction Market

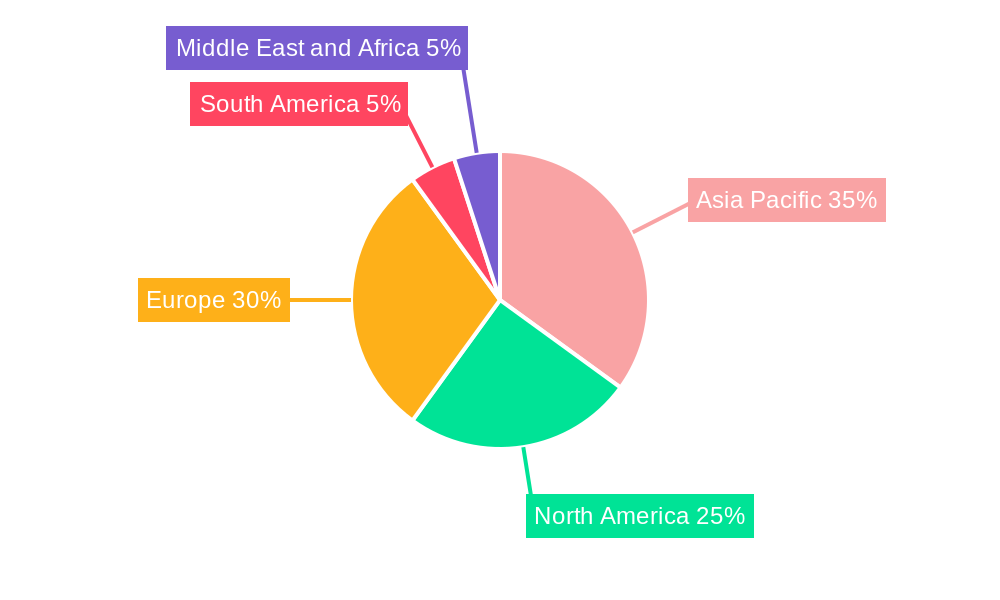

The Automotive Selective Catalytic Reduction Market is witnessing significant dominance from specific regions and segments, largely dictated by regulatory pressures and industrial activity.

- Leading Region: North America and Europe currently lead the market due to their stringent emission standards, such as EPA Tier 4 and Euro VI, which have mandated the widespread adoption of SCR technology in heavy-duty vehicles and industrial equipment. The presence of major automotive manufacturers and a strong aftermarket for emission control systems further solidifies their dominance. Asia Pacific is rapidly emerging as a key growth region, driven by increasing industrialization and the implementation of stricter emission norms in countries like China and India.

- Dominant Catalyst Type: The Honeycomb Catalyst segment holds the largest market share. This is attributed to its high surface area, excellent flow characteristics, and proven performance in SCR applications, making it ideal for managing large volumes of exhaust gases. Its ability to be formulated with various washcoats and precious metals allows for tailored NOx reduction efficiencies.

- Dominant Process Type: Selective Catalytic Reduction (SCR) itself is the dominant process type within this market, by definition. However, when considering the broader context of exhaust aftertreatment, Diesel Particulate Filters (DPFs) often work in conjunction with SCR systems, forming integrated solutions that collectively address particulate matter and NOx emissions. The demand for SCR is intrinsically linked to the need to meet regulations for NOx, which is a primary pollutant targeted by this technology.

- Dominant Application: Coal-based Thermal Power Generation and Industrial applications represent significant demand drivers for SCR technology, particularly in stationary sources. These sectors have historically been major emitters of NOx, and increasingly stringent environmental regulations are forcing them to adopt advanced abatement solutions. The Power Generation (Excluding Coal based) segment is also a growing area, especially with natural gas-fired power plants and other less carbon-intensive sources investing in emission control.

Key drivers for this dominance include:

- Economic Policies: Government incentives and penalties related to emission compliance significantly influence market adoption.

- Infrastructure Development: Expansion of industries and transportation networks in emerging economies necessitates advanced emission control.

- Technological Advancements: Continuous improvement in SCR catalyst efficiency and system integration enhances its appeal across various applications.

Automotive Selective Catalytic Reduction Market Product Innovations

Product innovations in the Automotive Selective Catalytic Reduction Market are primarily focused on enhancing efficiency, reducing cost, and improving the durability of SCR systems. Companies are developing advanced catalyst formulations, often incorporating novel zeolites and precious metal combinations, to achieve higher NOx conversion rates at lower temperatures and minimize ammonia slip. Innovations also extend to urea injection systems, aiming for more precise dosing and better atomization to optimize the SCR reaction. The integration of SCR with other exhaust aftertreatment components, such as Diesel Particulate Filters (DPFs) and Catalytic Oxidizers, into compact, modular units is another significant trend, simplifying installation and reducing overall system weight. These advancements are crucial for meeting increasingly stringent emission standards and offering competitive advantages to manufacturers.

Report Segmentation & Scope

This report segments the Automotive Selective Catalytic Reduction Market comprehensively across several key dimensions. The Catalyst Type is analyzed through Honeycomb Catalyst, Plate Catalyst, and Corrugated Catalyst, with Honeycomb catalysts projected to maintain the largest market share due to their established performance and cost-effectiveness. Under Process Type, the report details the Selective Catalytic Reduction process, along with related technologies like Non-selective Catalytic Reduction, Diesel Particulate Filters, and Catalytic Oxidation, focusing on their interplay and market evolution. The Application segment is divided into Power Generation (Excluding Coal based), Coal-based Thermal Power Generation, and Industrial applications, with industrial and coal-based power generation currently representing the largest demand, though non-coal power generation is a significant growth area. Each segment's market size, growth projections, and competitive dynamics are thoroughly examined.

Key Drivers of Automotive Selective Catalytic Reduction Market Growth

The Automotive Selective Catalytic Reduction Market is propelled by several potent growth drivers. Foremost among these are increasingly stringent global emission regulations, such as Euro 7 and EPA standards, which mandate significant reductions in NOx emissions from vehicles and industrial sources. The growing automotive fleet, particularly in emerging economies, coupled with the continued prevalence of internal combustion engines, fuels demand for aftertreatment systems. Technological advancements in catalyst design and system integration are enhancing SCR efficiency and cost-effectiveness, making them more attractive. Furthermore, a rising global awareness of environmental pollution and a push towards sustainable practices are encouraging the adoption of cleaner technologies across all sectors, including transportation and power generation.

Challenges in the Automotive Selective Catalytic Reduction Market Sector

Despite its growth, the Automotive Selective Catalytic Reduction Market faces several challenges. The high initial cost of SCR systems can be a barrier, particularly for smaller enterprises or in price-sensitive markets. Ensuring the long-term durability and reliability of SCR components, especially in harsh operating conditions, remains a focus. Supply chain disruptions for critical raw materials, such as precious metals used in catalysts, can impact production and pricing. Furthermore, the evolving landscape of vehicle powertrains, with the rise of electric vehicles, poses a long-term challenge to the market for internal combustion engine aftertreatment solutions. The need for effective urea (AdBlue) supply and infrastructure for refilling also presents logistical hurdles in certain regions.

Leading Players in the Automotive Selective Catalytic Reduction Market Market

- Umicore

- Honeywell International Inc

- Clariant

- JGC C&C

- CRI Catalyst Company

- DCL International Inc

- CDTi Advanced Materials Inc

- Hitachi Zosen Corporation

- CORMETECH

- BASF SE

- Cataler Corporation

- Johnson Matthey

- IBIDEN Porzellanfabrik Frauenthal

- Corning Incorporated

Key Developments in Automotive Selective Catalytic Reduction Market Sector

- 2023: Johnson Matthey launches a new generation of SCR catalysts offering improved thermal durability and reduced NOx emissions, aiming to meet future Euro 7 standards.

- 2023: BASF SE expands its catalyst manufacturing capacity to meet the growing global demand for SCR solutions in both automotive and industrial sectors.

- 2022: Umicore announces R&D initiatives focused on developing next-generation SCR catalysts with enhanced performance at lower operating temperatures, targeting improved fuel efficiency.

- 2021: Honeywell International Inc introduces an advanced SCR system with integrated diagnostic capabilities, providing real-time performance monitoring for enhanced reliability.

- 2020: Clariant develops a new SCR catalyst formulation that demonstrates significant reduction in ammonia slip, improving overall system efficiency and environmental compliance.

Strategic Automotive Selective Catalytic Reduction Market Market Outlook

The Automotive Selective Catalytic Reduction Market is poised for continued growth, driven by relentless regulatory pressure for cleaner air and the ongoing need for efficient NOx abatement in combustion engines. Strategic opportunities lie in the development of advanced, more compact, and cost-effective SCR systems that can be seamlessly integrated into a wider range of vehicles and industrial machinery. Collaboration between catalyst manufacturers, automotive OEMs, and technology providers will be crucial for accelerating innovation and market penetration. The increasing focus on sustainability and the circular economy also presents opportunities for developing SCR catalysts with longer lifespans and improved recyclability. Addressing the challenges of urea supply and infrastructure will further unlock market potential, particularly in developing regions. The transition to alternative fuels and powertrains will necessitate adaptive strategies, potentially involving hybrid SCR solutions or focus on specific niche applications where combustion engines remain dominant.

Automotive Selective Catalytic Reduction Market Segmentation

-

1. Catalyst Type

- 1.1. Honeycomb Catalyst

- 1.2. Plate Catalyst

- 1.3. Corrugated Catalyst

-

2. Process Type

- 2.1. Selective Catalytic Reduction

- 2.2. Non-selective Catalytic Reduction

- 2.3. Diesel Particulate Filters

- 2.4. Catalytic Oxidation

-

3. Application

- 3.1. Power Generation (Excluding Coal based)

- 3.2. Coal-based Thermal Power Generation

- 3.3. Industrial

Automotive Selective Catalytic Reduction Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. Russia

- 3.5. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Automotive Selective Catalytic Reduction Market Regional Market Share

Geographic Coverage of Automotive Selective Catalytic Reduction Market

Automotive Selective Catalytic Reduction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand due to Stringent Emission Standards of Developed Countries; Increasing Thermal Power Production Capacity in China and India

- 3.3. Market Restrains

- 3.3.1. Decline in Coal Based Thermal Power Generation in Western European Countries

- 3.4. Market Trends

- 3.4.1. Power Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Selective Catalytic Reduction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 5.1.1. Honeycomb Catalyst

- 5.1.2. Plate Catalyst

- 5.1.3. Corrugated Catalyst

- 5.2. Market Analysis, Insights and Forecast - by Process Type

- 5.2.1. Selective Catalytic Reduction

- 5.2.2. Non-selective Catalytic Reduction

- 5.2.3. Diesel Particulate Filters

- 5.2.4. Catalytic Oxidation

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Power Generation (Excluding Coal based)

- 5.3.2. Coal-based Thermal Power Generation

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 6. Asia Pacific Automotive Selective Catalytic Reduction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 6.1.1. Honeycomb Catalyst

- 6.1.2. Plate Catalyst

- 6.1.3. Corrugated Catalyst

- 6.2. Market Analysis, Insights and Forecast - by Process Type

- 6.2.1. Selective Catalytic Reduction

- 6.2.2. Non-selective Catalytic Reduction

- 6.2.3. Diesel Particulate Filters

- 6.2.4. Catalytic Oxidation

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Power Generation (Excluding Coal based)

- 6.3.2. Coal-based Thermal Power Generation

- 6.3.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 7. North America Automotive Selective Catalytic Reduction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 7.1.1. Honeycomb Catalyst

- 7.1.2. Plate Catalyst

- 7.1.3. Corrugated Catalyst

- 7.2. Market Analysis, Insights and Forecast - by Process Type

- 7.2.1. Selective Catalytic Reduction

- 7.2.2. Non-selective Catalytic Reduction

- 7.2.3. Diesel Particulate Filters

- 7.2.4. Catalytic Oxidation

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Power Generation (Excluding Coal based)

- 7.3.2. Coal-based Thermal Power Generation

- 7.3.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 8. Europe Automotive Selective Catalytic Reduction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 8.1.1. Honeycomb Catalyst

- 8.1.2. Plate Catalyst

- 8.1.3. Corrugated Catalyst

- 8.2. Market Analysis, Insights and Forecast - by Process Type

- 8.2.1. Selective Catalytic Reduction

- 8.2.2. Non-selective Catalytic Reduction

- 8.2.3. Diesel Particulate Filters

- 8.2.4. Catalytic Oxidation

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Power Generation (Excluding Coal based)

- 8.3.2. Coal-based Thermal Power Generation

- 8.3.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 9. South America Automotive Selective Catalytic Reduction Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 9.1.1. Honeycomb Catalyst

- 9.1.2. Plate Catalyst

- 9.1.3. Corrugated Catalyst

- 9.2. Market Analysis, Insights and Forecast - by Process Type

- 9.2.1. Selective Catalytic Reduction

- 9.2.2. Non-selective Catalytic Reduction

- 9.2.3. Diesel Particulate Filters

- 9.2.4. Catalytic Oxidation

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Power Generation (Excluding Coal based)

- 9.3.2. Coal-based Thermal Power Generation

- 9.3.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 10. Middle East and Africa Automotive Selective Catalytic Reduction Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 10.1.1. Honeycomb Catalyst

- 10.1.2. Plate Catalyst

- 10.1.3. Corrugated Catalyst

- 10.2. Market Analysis, Insights and Forecast - by Process Type

- 10.2.1. Selective Catalytic Reduction

- 10.2.2. Non-selective Catalytic Reduction

- 10.2.3. Diesel Particulate Filters

- 10.2.4. Catalytic Oxidation

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Power Generation (Excluding Coal based)

- 10.3.2. Coal-based Thermal Power Generation

- 10.3.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Catalyst Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Umicore*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clariant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JGC C&C

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CRI Catalyst Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DCL International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CDTi Advanced Materials Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Zosen Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CORMETECH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BASF SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cataler Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Johnson Matthey

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IBIDEN Porzellanfabrik Frauenthal

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Corning Incorporated

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Umicore*List Not Exhaustive

List of Figures

- Figure 1: Global Automotive Selective Catalytic Reduction Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue (billion), by Catalyst Type 2025 & 2033

- Figure 3: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue Share (%), by Catalyst Type 2025 & 2033

- Figure 4: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue (billion), by Process Type 2025 & 2033

- Figure 5: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 6: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Automotive Selective Catalytic Reduction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Automotive Selective Catalytic Reduction Market Revenue (billion), by Catalyst Type 2025 & 2033

- Figure 11: North America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Catalyst Type 2025 & 2033

- Figure 12: North America Automotive Selective Catalytic Reduction Market Revenue (billion), by Process Type 2025 & 2033

- Figure 13: North America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 14: North America Automotive Selective Catalytic Reduction Market Revenue (billion), by Application 2025 & 2033

- Figure 15: North America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Automotive Selective Catalytic Reduction Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Automotive Selective Catalytic Reduction Market Revenue (billion), by Catalyst Type 2025 & 2033

- Figure 19: Europe Automotive Selective Catalytic Reduction Market Revenue Share (%), by Catalyst Type 2025 & 2033

- Figure 20: Europe Automotive Selective Catalytic Reduction Market Revenue (billion), by Process Type 2025 & 2033

- Figure 21: Europe Automotive Selective Catalytic Reduction Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 22: Europe Automotive Selective Catalytic Reduction Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe Automotive Selective Catalytic Reduction Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Automotive Selective Catalytic Reduction Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Automotive Selective Catalytic Reduction Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Selective Catalytic Reduction Market Revenue (billion), by Catalyst Type 2025 & 2033

- Figure 27: South America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Catalyst Type 2025 & 2033

- Figure 28: South America Automotive Selective Catalytic Reduction Market Revenue (billion), by Process Type 2025 & 2033

- Figure 29: South America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 30: South America Automotive Selective Catalytic Reduction Market Revenue (billion), by Application 2025 & 2033

- Figure 31: South America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Automotive Selective Catalytic Reduction Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Automotive Selective Catalytic Reduction Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue (billion), by Catalyst Type 2025 & 2033

- Figure 35: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue Share (%), by Catalyst Type 2025 & 2033

- Figure 36: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue (billion), by Process Type 2025 & 2033

- Figure 37: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue Share (%), by Process Type 2025 & 2033

- Figure 38: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Catalyst Type 2020 & 2033

- Table 2: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 3: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Catalyst Type 2020 & 2033

- Table 6: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 7: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: ASEAN Countries Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Catalyst Type 2020 & 2033

- Table 16: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 17: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Catalyst Type 2020 & 2033

- Table 23: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 24: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Germany Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of the Europe Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Catalyst Type 2020 & 2033

- Table 32: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 33: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Brazil Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Argentina Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Catalyst Type 2020 & 2033

- Table 39: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Process Type 2020 & 2033

- Table 40: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Automotive Selective Catalytic Reduction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Africa Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Automotive Selective Catalytic Reduction Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Selective Catalytic Reduction Market?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the Automotive Selective Catalytic Reduction Market?

Key companies in the market include Umicore*List Not Exhaustive, Honeywell International Inc, Clariant, JGC C&C, CRI Catalyst Company, DCL International Inc, CDTi Advanced Materials Inc, Hitachi Zosen Corporation, CORMETECH, BASF SE, Cataler Corporation, Johnson Matthey, IBIDEN Porzellanfabrik Frauenthal, Corning Incorporated.

3. What are the main segments of the Automotive Selective Catalytic Reduction Market?

The market segments include Catalyst Type, Process Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand due to Stringent Emission Standards of Developed Countries; Increasing Thermal Power Production Capacity in China and India.

6. What are the notable trends driving market growth?

Power Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Decline in Coal Based Thermal Power Generation in Western European Countries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Selective Catalytic Reduction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Selective Catalytic Reduction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Selective Catalytic Reduction Market?

To stay informed about further developments, trends, and reports in the Automotive Selective Catalytic Reduction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence