Key Insights

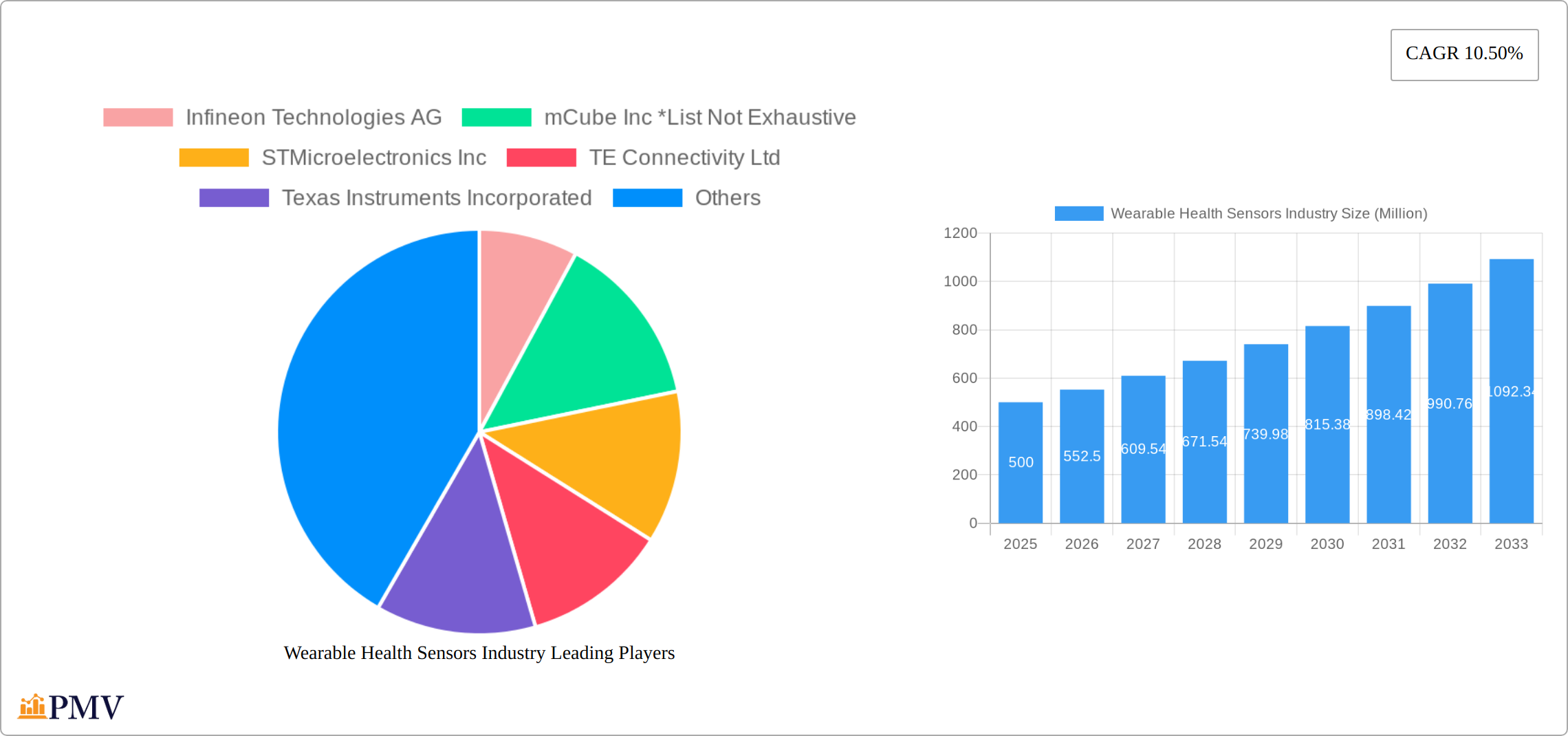

The Wearable Health Sensors Industry is poised for significant growth, projected to reach a market size of $XX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This expansion is driven by increasing consumer demand for health monitoring devices and technological advancements in sensor technology. Key drivers include the rising prevalence of chronic diseases, the growing popularity of fitness and wellness tracking, and innovations in miniaturization and connectivity of sensors. The market is segmented by type, including pressure, temperature, and position sensors, with pressure sensors leading due to their widespread use in monitoring vital signs like blood pressure. By end-user industry, healthcare and consumer electronics are the dominant segments, reflecting the integration of health monitoring into everyday devices.

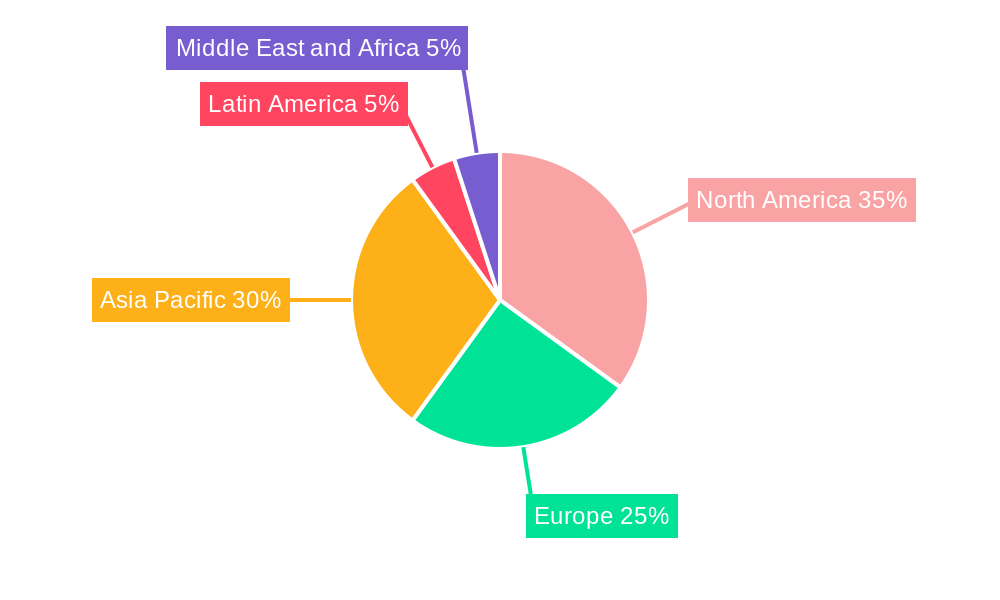

Regionally, North America holds the largest market share due to high healthcare expenditure and the presence of major industry players like Infineon Technologies AG, Texas Instruments Incorporated, and Analog Devices Inc. Europe and Asia Pacific are also significant markets, with Asia Pacific showing the fastest growth rate, attributed to increasing health awareness and rising disposable incomes. Despite the promising growth, the industry faces restraints such as high development costs and data privacy concerns. However, trends towards personalized medicine and the integration of AI and IoT in wearable devices present new opportunities for market expansion and innovation.

Wearable Health Sensors Industry Market Structure & Competitive Dynamics

The Wearable Health Sensors Industry is characterized by a mix of established players and emerging innovators, with a market concentration that varies by segment. Key companies like Infineon Technologies AG, STMicroelectronics Inc, and Texas Instruments Incorporated hold significant market shares, driving the industry forward through their robust product portfolios and technological advancements. The innovation ecosystem is vibrant, with research institutions like Fraunhofer IIS playing a pivotal role in developing next-generation sensor technologies. Regulatory frameworks are stringent, especially in healthcare applications, where compliance with standards such as FDA approval is crucial. Product substitutes, such as traditional health monitoring devices, pose a challenge, but wearable sensors gain traction due to their convenience and real-time data capabilities.

End-user trends show a growing preference for integrated health monitoring in consumer electronics and sports/fitness devices. Mergers and acquisitions are pivotal in shaping market dynamics, with notable deals like Nitto Denko Corporation's acquisition of Bend Labs, Inc. for an estimated value of xx Million USD in June 2022, aimed at enhancing sensor technology portfolios. This M&A activity not only consolidates market shares but also fosters innovation by combining different technological strengths. The competitive landscape is further intensified by the entry of new players, which often focus on niche markets or specific sensor types, thereby increasing competition and driving down prices.

- Market Share: Leading companies like Texas Instruments Incorporated and STMicroelectronics Inc hold approximately 20% and 15% of the market, respectively.

- M&A Deal Values: The acquisition of Bend Labs, Inc. by Nitto Denko Corporation was valued at around xx Million USD.

Wearable Health Sensors Industry Industry Trends & Insights

The Wearable Health Sensors Industry is experiencing robust growth, driven by a confluence of factors. Market projections indicate a CAGR of 12.5% from 2025 to 2033, fueled by escalating health consciousness, the proliferation of interconnected IoT devices, and a rapidly aging global population demanding proactive healthcare solutions. Technological advancements are pivotal, with miniaturization and enhanced power efficiency enabling increasingly sophisticated sensors within smaller, more comfortable form factors. This facilitates real-time health monitoring and advanced data analytics, significantly enhancing the functionality and appeal of wearable health technologies.

Consumer preferences are evolving towards seamless integration with smartphones and other smart devices, along with a strong demand for actionable, personalized health insights. This trend is especially pronounced within the healthcare sector, where continuous vital signs monitoring via wearable sensors improves patient outcomes and reduces healthcare costs. The sports and fitness sector witnesses parallel growth, driven by a desire for precise performance tracking and personalized training recommendations. This demand is further amplified by the rise of telehealth and remote patient monitoring, underscoring the industry's crucial role in modern healthcare delivery.

Competitive intensity remains high, with industry leaders like Infineon Technologies AG and Analog Devices Inc. constantly innovating to maintain their market share. Market penetration is robust in North America and Europe, regions with high health and fitness awareness. However, the Asia-Pacific region presents a rapidly expanding growth market, driven by rapid urbanization, rising disposable incomes, and a burgeoning middle class with increased access to technology and healthcare.

Challenges remain, including data privacy concerns and the need for standardization across diverse devices. These challenges, however, also present opportunities for differentiation through robust data security measures, improved interoperability, and the development of industry-wide data sharing protocols. The Wearable Health Sensors Industry is poised for sustained growth, propelled by technological innovation, evolving consumer preferences, and expanding applications across diverse sectors.

Dominant Markets & Segments in Wearable Health Sensors Industry

The Wearable Health Sensors Industry is dominated by several key segments and regions. In terms of sensor types, pressure sensors lead the market due to their widespread use in monitoring blood pressure and other vital signs. Temperature sensors are also significant, particularly in healthcare applications for fever monitoring. Position sensors, used in tracking movements and posture, are gaining traction in sports and fitness devices.

Key Drivers for Pressure Sensors:

Increasing prevalence of hypertension and cardiovascular diseases.

Technological advancements in sensor accuracy and miniaturization.

Key Drivers for Temperature Sensors:

Rising demand for non-invasive health monitoring solutions.

Integration into smart home and IoT ecosystems.

Key Drivers for Position Sensors:

Growing interest in fitness and sports analytics.

Development of ergonomic wearables for posture correction.

In terms of end-user industries, healthcare is the dominant segment, driven by the need for continuous monitoring and early diagnosis of health conditions. Consumer electronics are also a significant segment, with wearable sensors being integrated into smartwatches and fitness trackers. The sports and fitness industry is witnessing rapid growth, fueled by the demand for performance-enhancing devices.

North America is the leading region in the Wearable Health Sensors Industry, attributed to high healthcare expenditure and a strong presence of key market players. However, Asia-Pacific is expected to witness the highest growth rate during the forecast period, driven by increasing health awareness and technological adoption. Europe remains a mature market with a focus on innovation and regulatory compliance.

The dominance of these segments and regions is influenced by a combination of economic policies, infrastructure development, and consumer behavior. For instance, supportive government policies in North America, such as subsidies for healthcare technology, have boosted the adoption of wearable sensors. In Asia-Pacific, the rapid development of healthcare infrastructure and the rise of tech-savvy consumers are key drivers of market growth.

Wearable Health Sensors Industry Product Innovations

Innovation in the Wearable Health Sensors Industry centers on creating more accurate, user-friendly, and seamlessly integrated solutions. Recent advancements include flexible and stretchable sensors effortlessly incorporated into clothing and accessories, enhancing comfort and promoting wider adoption. Simultaneously, breakthroughs in data analytics and artificial intelligence (AI) empower sensors to provide more personalized and predictive health insights, further strengthening their market competitiveness. The ongoing emphasis on miniaturization and power efficiency is crucial, extending battery life and reducing device size – key factors impacting consumer acceptance and market penetration.

Report Segmentation & Scope

The Wearable Health Sensors Industry report is segmented by type and end-user industry. By type, the market is divided into Pressure Sensors, Temperature Sensors, Position Sensors, and Other Types. Pressure sensors are expected to grow at a CAGR of 13.2% from 2025 to 2033, driven by their critical role in monitoring vital signs. Temperature sensors will see a steady growth of 10.5% over the same period, fueled by their use in non-invasive health monitoring. Position sensors are projected to grow at 11.8%, as they gain popularity in sports and fitness applications. Other types of sensors are expected to grow at 9.5%, driven by emerging applications.

By end-user industry, the market is segmented into Healthcare, Consumer Electronics, Sports/Fitness, and Other End User Industries. The healthcare segment is expected to grow at a CAGR of 14.0%, with a market size of xx Million USD by 2033, driven by the need for continuous monitoring. Consumer electronics will grow at 11.5%, reaching a market size of xx Million USD, due to integration into smart devices. Sports and fitness will see a growth rate of 12.8%, with a market size of xx Million USD, fueled by performance tracking. Other end-user industries are projected to grow at 10.0%, with a market size of xx Million USD, driven by diverse applications.

Key Drivers of Wearable Health Sensors Industry Growth

The Wearable Health Sensors Industry's growth trajectory is fueled by several key drivers. Technological advancements in sensor miniaturization and sophisticated data analytics significantly enhance the functionality and desirability of wearable devices. Economically, rising disposable incomes and a heightened consumer focus on preventative health care significantly drive market demand. Regulatory approvals, particularly from bodies like the FDA, build consumer confidence and facilitate market entry. For instance, the FDA's expanded indication approval for Abbott's Cardio MEMS HF System in February 2022 substantially broadened the addressable market for heart failure monitoring, demonstrating the critical influence of regulatory factors.

Challenges in the Wearable Health Sensors Industry Sector

The Wearable Health Sensors Industry faces several challenges that could impede growth. Regulatory hurdles, such as stringent data privacy laws, require significant investment in compliance. Supply chain issues, including component shortages, can delay product launches and increase costs. Competitive pressures are intense, with companies like Infineon Technologies AG and Texas Instruments Incorporated vying for market share. These challenges result in a quantifiable impact, such as a potential 5% reduction in market growth rate due to regulatory delays and a 3% increase in costs due to supply chain disruptions.

Leading Players in the Wearable Health Sensors Industry Market

- Infineon Technologies AG

- mCube Inc *List Not Exhaustive

- STMicroelectronics Inc

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Arm Limited

- TDK Corporation

- Fraunhofer IIS

- Analog Devices Inc

- Maxim Integrated Products Inc

Key Developments in Wearable Health Sensors Industry Sector

- June 2022: Nitto Denko Corporation's acquisition of Bend Labs, Inc., forming Nitto Bend Technologies, combined Bend's sensor device expertise with Nitto's strengths. This merger is projected to bolster Nitto's market position by accelerating the development and launch of next-generation wearable health sensor technologies and related products, leveraging data-driven insights for enhanced healthcare solutions.

- February 2022: Abbott received FDA approval for an expanded indication for its Cardio MEMS HF System, extending its application to a significantly larger patient population. This approval added 1.2 million US patients to the addressable market, providing an early warning system for worsening heart failure and significantly expanding the market for wearable cardiac health sensors.

Strategic Wearable Health Sensors Industry Market Outlook

The strategic outlook for the Wearable Health Sensors Industry remains exceptionally positive, with several significant growth catalysts on the horizon. The integration of AI and machine learning into sensor technology will enable highly personalized and predictive health monitoring solutions, unlocking new market opportunities. Expansion into emerging markets, particularly within Asia-Pacific, presents substantial growth potential due to rising health awareness, increased technological adoption, and the expanding availability of affordable healthcare solutions. Strategic partnerships and collaborations between technology companies and healthcare providers will further stimulate innovation and accelerate market penetration. The industry is poised for robust growth, underpinned by a commitment to enhancing user experience, bolstering data security, and ensuring stringent regulatory compliance.

Wearable Health Sensors Industry Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Position Sensor

- 1.4. Other Types

-

2. End User Industry

- 2.1. Healthcare

- 2.2. Consumer Electronic

- 2.3. Sports/Fitness

- 2.4. Other End User Industries

Wearable Health Sensors Industry Segmentation By Geography

- 1. Asia Pacific

- 2. Europe

- 3. Latin America

- 4. Middle East and Africa

- 5. North America

Wearable Health Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Continuous Monitoring In Healthcare Services; Rising Growth toward Advanced Functions Sensors in Smart Gadgets; Miniaturization of Physiological Sensors

- 3.3. Market Restrains

- 3.3.1. Dearth of Common Standards and Interoperability Issues

- 3.4. Market Trends

- 3.4.1. Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Position Sensor

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Healthcare

- 5.2.2. Consumer Electronic

- 5.2.3. Sports/Fitness

- 5.2.4. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Middle East and Africa

- 5.3.5. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure Sensor

- 6.1.2. Temperature Sensor

- 6.1.3. Position Sensor

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Healthcare

- 6.2.2. Consumer Electronic

- 6.2.3. Sports/Fitness

- 6.2.4. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure Sensor

- 7.1.2. Temperature Sensor

- 7.1.3. Position Sensor

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Healthcare

- 7.2.2. Consumer Electronic

- 7.2.3. Sports/Fitness

- 7.2.4. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Latin America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure Sensor

- 8.1.2. Temperature Sensor

- 8.1.3. Position Sensor

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Healthcare

- 8.2.2. Consumer Electronic

- 8.2.3. Sports/Fitness

- 8.2.4. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure Sensor

- 9.1.2. Temperature Sensor

- 9.1.3. Position Sensor

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Healthcare

- 9.2.2. Consumer Electronic

- 9.2.3. Sports/Fitness

- 9.2.4. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pressure Sensor

- 10.1.2. Temperature Sensor

- 10.1.3. Position Sensor

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Healthcare

- 10.2.2. Consumer Electronic

- 10.2.3. Sports/Fitness

- 10.2.4. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Asia Pacific Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Latin America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East and Africa Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. North America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Infineon Technologies AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 mCube Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 STMicroelectronics Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 TE Connectivity Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Texas Instruments Incorporated

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Arm Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 TDK Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Fraunhofer IIS

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Analog Devices Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Maxim Integrated Products Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Wearable Health Sensors Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Latin America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Latin America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: Europe Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Europe Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Latin America Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Latin America Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: Latin America Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: Latin America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Latin America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 33: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 34: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: North America Wearable Health Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: North America Wearable Health Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: North America Wearable Health Sensors Industry Revenue (Million), by End User Industry 2024 & 2032

- Figure 39: North America Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2024 & 2032

- Figure 40: North America Wearable Health Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: North America Wearable Health Sensors Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wearable Health Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: Global Wearable Health Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Wearable Health Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 17: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 20: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 23: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 26: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 29: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Health Sensors Industry?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Wearable Health Sensors Industry?

Key companies in the market include Infineon Technologies AG, mCube Inc *List Not Exhaustive, STMicroelectronics Inc, TE Connectivity Ltd, Texas Instruments Incorporated, Arm Limited, TDK Corporation, Fraunhofer IIS, Analog Devices Inc, Maxim Integrated Products Inc.

3. What are the main segments of the Wearable Health Sensors Industry?

The market segments include Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Continuous Monitoring In Healthcare Services; Rising Growth toward Advanced Functions Sensors in Smart Gadgets; Miniaturization of Physiological Sensors.

6. What are the notable trends driving market growth?

Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market.

7. Are there any restraints impacting market growth?

Dearth of Common Standards and Interoperability Issues.

8. Can you provide examples of recent developments in the market?

June 2022 : Nitto Denko Corporation agreed to acquire Bend Labs, Inc. In line with this acquisition, Bend merged into the Nitto Group from June 1, 2022 to continue its business operations as Nitto Bend Technologies. As a result of this merger agreement, Bend's sensor device technologies were combined with Nitto's strengths for developing a next-generation technologies and products portfolio and new businesses utilizing sensor-acquired data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Health Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Health Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Health Sensors Industry?

To stay informed about further developments, trends, and reports in the Wearable Health Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence