Key Insights

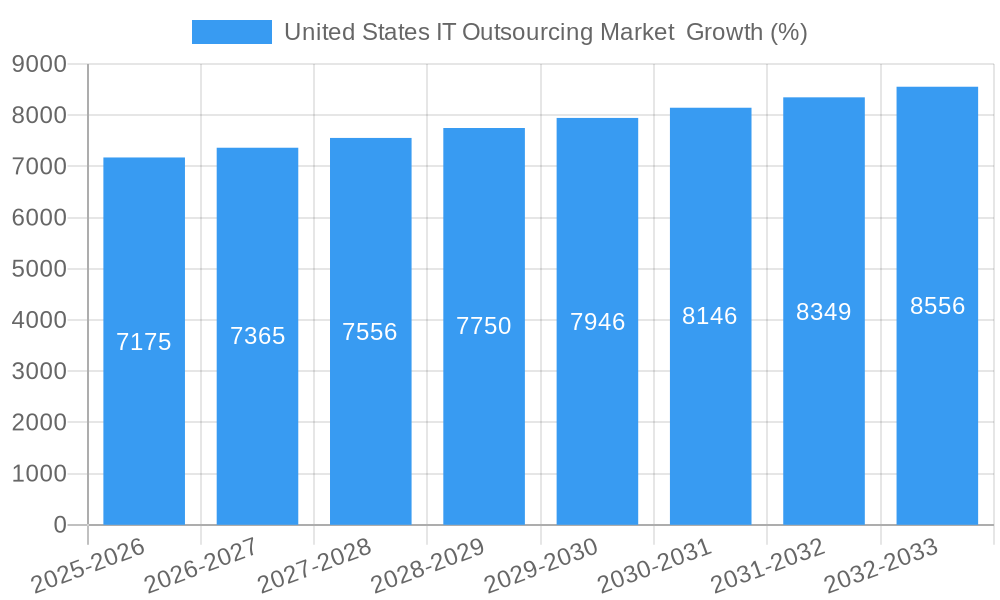

The United States IT outsourcing market, a significant segment of the global IT services landscape, is experiencing steady growth, driven by several key factors. The increasing adoption of cloud computing, the need for enhanced cybersecurity measures, and the growing demand for digital transformation initiatives across various industries are major catalysts. Businesses are increasingly outsourcing IT functions like application development and maintenance, infrastructure management, and data analytics to specialized providers, allowing them to focus on core competencies and reduce operational costs. This trend is particularly pronounced among large enterprises, which have the resources and need for sophisticated IT solutions. While the SME segment also contributes, the larger enterprises significantly impact overall market size and growth. The projected CAGR of 2.87% suggests a consistent, albeit moderate, expansion over the forecast period (2025-2033). However, this growth is likely influenced by economic conditions and fluctuations in the technology sector. Specific industry segments like Banking, Financial Services, and Insurance (BFSI) and IT and Telecom are driving the market significantly due to their high reliance on robust and secure IT infrastructure. The increasing prevalence of data privacy regulations also creates a demand for specialized outsourcing services that ensure compliance.

Geographic distribution within the US market likely shows concentration in key technology hubs such as California, Texas, and New York, reflecting a higher concentration of large enterprises and tech companies. While precise regional breakdowns for the US market are unavailable in the provided data, it is reasonable to assume a substantial portion of the market share resides in these states. Potential restraints on market growth could include economic downturns impacting IT budgets, competition among numerous providers, and concerns surrounding data security and intellectual property protection. Despite these challenges, the long-term outlook for the US IT outsourcing market remains positive, fueled by ongoing technological advancements and the increasing reliance on IT infrastructure across all sectors of the economy. The market is expected to reach significant value by 2033, showcasing robust growth despite moderate CAGR.

United States IT Outsourcing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States IT Outsourcing market, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period of 2025-2033, this study offers invaluable insights into market size, segmentation, growth drivers, challenges, and key players. The report incorporates data from the historical period (2019-2024) to provide a robust foundation for future projections. The total market value in 2025 is estimated at xx Million.

United States IT Outsourcing Market Structure & Competitive Dynamics

The US IT outsourcing market exhibits a moderately consolidated structure, with a few large players holding significant market share. However, the presence of numerous smaller and specialized firms fosters competition and innovation. The market is characterized by intense rivalry based on pricing, service quality, technological capabilities, and geographical reach. Key aspects influencing market structure include:

Market Concentration: While precise market share data for individual companies isn't readily available, giants like IBM, Microsoft, and NTT Corporation hold substantial shares. Smaller players often focus on niche segments or geographic areas. The Herfindahl-Hirschman Index (HHI) is predicted to be around xx, indicating a moderately concentrated market.

Innovation Ecosystems: Robust innovation ecosystems exist, driven by investments in R&D, strategic partnerships, and acquisitions. The market is witnessing rapid advancements in cloud computing, AI, and cybersecurity, influencing service offerings and competitive landscapes.

Regulatory Frameworks: Regulations such as data privacy laws (e.g., CCPA, GDPR implications) significantly impact outsourcing strategies and service offerings. Compliance costs and requirements affect the operating costs and competitiveness of various players.

Product Substitutes: The increasing availability of in-house IT capabilities and cloud-based solutions presents some degree of substitution for certain outsourcing services. However, the complexity and specialized nature of many IT functions often necessitate external expertise.

End-User Trends: End-user preferences are shifting towards cloud-based solutions, agile methodologies, and outcome-based outsourcing contracts. This necessitates continuous adaptation from IT outsourcing providers.

Mergers & Acquisitions (M&A): The market has witnessed significant M&A activity in recent years, with deal values ranging from xx Million to xx Million. These transactions often involve consolidation of capabilities, expansion into new markets, or acquisition of specialized technology. The number of M&A deals in 2024 was estimated to be xx, showcasing a high rate of market consolidation.

United States IT Outsourcing Market Industry Trends & Insights

The US IT outsourcing market is experiencing robust growth, fueled by several key trends:

The market is witnessing a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025-2033). This growth is primarily driven by the increasing adoption of cloud computing, the rising demand for digital transformation services, and the growing need for specialized IT skills, often lacking in-house. Technological disruptions, such as the increasing adoption of artificial intelligence (AI) and machine learning (ML) in IT services, are transforming how IT outsourcing is delivered and consumed. Consumer preference is leaning towards flexible, scalable, and cost-effective solutions, leading providers to offer customized services through various engagement models. The market penetration of cloud-based IT outsourcing solutions is expected to reach approximately xx% by 2033. Furthermore, competitive dynamics involve constant innovation in service delivery models, pricing strategies, and strategic partnerships to gain a competitive edge.

Dominant Markets & Segments in United States IT Outsourcing Market

The US IT outsourcing market shows considerable diversity across segments.

By Service Type: Infrastructure outsourcing holds a significant market share, driven by the increasing need for robust and scalable IT infrastructure. Application outsourcing is also a substantial segment, with strong demand for customized software solutions and application development. Other services, such as cybersecurity and data analytics, are experiencing rapid growth.

By Organization Size: Large enterprises represent a major share of the market due to their higher IT budgets and complex IT needs. However, SMEs are increasingly adopting outsourcing solutions to leverage cost-effectiveness and access specialized expertise.

By Industry: The Banking, Financial Services, and Insurance (BFSI) sector, IT and Telecom, and Healthcare sectors are dominant segments due to their high IT spending and stringent regulatory compliance requirements. Other industries like Manufacturing, Government, Retail, and Energy are showing significant growth in outsourcing adoption.

Key Drivers for Dominant Segments:

- BFSI: Stringent regulatory compliance and data security needs drive outsourcing.

- IT & Telecom: Need for advanced infrastructure and specialized expertise.

- Healthcare: Compliance needs, data security, and electronic health records (EHR) management.

- Large Enterprises: Higher IT spending and complex IT needs.

The dominance of these segments stems from factors such as robust digital infrastructure, favorable economic policies promoting technology adoption, and substantial investments in IT modernization. The growth of specific segments is highly influenced by industry-specific regulations, technological advancements, and competitive dynamics within each sector.

United States IT Outsourcing Market Product Innovations

Recent product innovations focus on AI-powered solutions, advanced cybersecurity offerings, and cloud-native applications. Providers are increasingly adopting agile methodologies and DevOps practices to improve service delivery and customer satisfaction. These innovations provide enhanced scalability, flexibility, and cost optimization for clients. The integration of AI and ML is driving automation of routine tasks, improving efficiency, and enhancing the accuracy of IT operations. This strong focus on technological advancements ensures market fit by addressing the evolving needs of businesses.

Report Segmentation & Scope

This report provides a granular segmentation of the US IT outsourcing market:

By Service Type: Application Outsourcing (Market Size: xx Million in 2025, Projected CAGR: xx%), Infrastructure Outsourcing (Market Size: xx Million in 2025, Projected CAGR: xx%), Other Services (Market Size: xx Million in 2025, Projected CAGR: xx%).

By Organization Size: SMEs (Market Size: xx Million in 2025, Projected CAGR: xx%), Large Enterprises (Market Size: xx Million in 2025, Projected CAGR: xx%).

By Industry: Detailed breakdowns of each industry sector mentioned previously are provided, including market size projections and CAGR for each.

Key Drivers of United States IT Outsourcing Market Growth

Several key factors are driving the expansion of the US IT outsourcing market:

- Rising demand for digital transformation: Businesses are increasingly seeking IT outsourcing services to support their digital transformation initiatives.

- Cost optimization: Outsourcing helps organizations reduce IT infrastructure and personnel costs.

- Access to specialized skills: Outsourcing provides access to specialized IT expertise that might be difficult or expensive to hire internally.

- Scalability and flexibility: Outsourcing allows organizations to scale their IT resources up or down as needed.

- Focus on core competencies: Outsourcing frees up internal resources to focus on core business activities.

Challenges in the United States IT Outsourcing Market Sector

The US IT outsourcing market faces several challenges:

- Data security and privacy concerns: Ensuring data security and complying with data privacy regulations remains a significant challenge.

- Vendor management complexities: Managing multiple vendors can be complex and time-consuming.

- Communication and collaboration challenges: Effective communication and collaboration between outsourcing providers and clients are crucial.

- Geopolitical risks: Political instability or trade conflicts could impact IT outsourcing operations. The risk of supply chain disruptions also contributes to market uncertainty.

Leading Players in the United States IT Outsourcing Market Market

- NTT Corporation

- Infinitely Virtual

- IBM Corporation

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- DXC Technology Company

- CDW Corporation

- *List Not Exhaustive

Key Developments in United States IT Outsourcing Market Sector

- July 2023: Leidos and Microsoft announced a strategic collaboration to accelerate AI transformation in the public sector, boosting AI-based IT outsourcing.

- June 2023: Nokia and DXC Technology partnered to expand DXC Signal Private LTE and 5G services, enhancing IT infrastructure outsourcing capabilities for industrial enterprises.

Strategic United States IT Outsourcing Market Outlook

The US IT outsourcing market is poised for continued growth, driven by increasing digitalization, cloud adoption, and demand for specialized IT skills. Strategic opportunities exist for providers to focus on AI-powered solutions, cybersecurity services, and cloud-native applications. Furthermore, building robust partnerships and addressing data security concerns will be critical for long-term success. The market's future growth will be heavily influenced by technological advancements, regulatory changes, and the evolving needs of businesses across various sectors.

United States IT Outsourcing Market Segmentation

-

1. Service Type

- 1.1. Application Outsourcing

- 1.2. Infrastructure Outsourcing

- 1.3. Other Services

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. Industry

- 3.1. Banking, Financial Services, and Insurance

- 3.2. IT and Telecom

- 3.3. Manufacturing

- 3.4. Healthcare

- 3.5. Government and Public Sector

- 3.6. Retail and E-commerce

- 3.7. Energy, Utilities, and Mining

- 3.8. Others

United States IT Outsourcing Market Segmentation By Geography

- 1. United States

United States IT Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations; Organizations are Increasingly Focusing on IT as a Means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration toward the Cloud and Adoption of Virtualized Infrastructure

- 3.3. Market Restrains

- 3.3.1. Initial High Cost of Adoption; Lack of Skilled Professionals in the Oil and Gas Industry

- 3.4. Market Trends

- 3.4.1. Ongoing Migration Toward Cloud and the Adoption of Virtualized Infrastructure to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Application Outsourcing

- 5.1.2. Infrastructure Outsourcing

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. Banking, Financial Services, and Insurance

- 5.3.2. IT and Telecom

- 5.3.3. Manufacturing

- 5.3.4. Healthcare

- 5.3.5. Government and Public Sector

- 5.3.6. Retail and E-commerce

- 5.3.7. Energy, Utilities, and Mining

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service Type

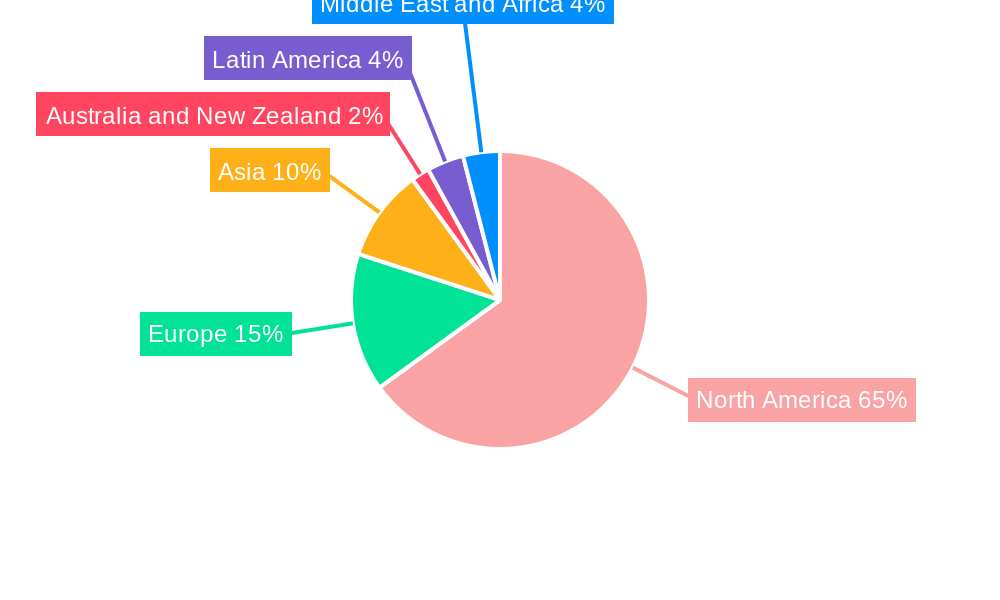

- 6. North America United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa United States IT Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 NTT Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Infinitely Virtual

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hewlett Packard Enterprise Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Microsoft Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DXC Technology Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CDW Corporation*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 NTT Corporation

List of Figures

- Figure 1: United States IT Outsourcing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States IT Outsourcing Market Share (%) by Company 2024

List of Tables

- Table 1: United States IT Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States IT Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: United States IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: United States IT Outsourcing Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 5: United States IT Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States IT Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States IT Outsourcing Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 19: United States IT Outsourcing Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 20: United States IT Outsourcing Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 21: United States IT Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States IT Outsourcing Market ?

The projected CAGR is approximately 2.87%.

2. Which companies are prominent players in the United States IT Outsourcing Market ?

Key companies in the market include NTT Corporation, Infinitely Virtual, IBM Corporation, Hewlett Packard Enterprise Company, Microsoft Corporation, DXC Technology Company, CDW Corporation*List Not Exhaustive.

3. What are the main segments of the United States IT Outsourcing Market ?

The market segments include Service Type, Organization Size, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations; Organizations are Increasingly Focusing on IT as a Means to Gain Differentiation by Relying on Outsourced Vendors; Ongoing Migration toward the Cloud and Adoption of Virtualized Infrastructure.

6. What are the notable trends driving market growth?

Ongoing Migration Toward Cloud and the Adoption of Virtualized Infrastructure to Drive the Market.

7. Are there any restraints impacting market growth?

Initial High Cost of Adoption; Lack of Skilled Professionals in the Oil and Gas Industry.

8. Can you provide examples of recent developments in the market?

July 2023 - Leidos, an American science and technology player, announced that it entered into a strategic collaboration agreement with Microsoft to leverage the company's unique strengths in the market to accelerate artificial intelligence (AI) transformation for new and existing customers in the public sector, showing the growth of company's AI-based IT outsourcing services in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States IT Outsourcing Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States IT Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States IT Outsourcing Market ?

To stay informed about further developments, trends, and reports in the United States IT Outsourcing Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence