Key Insights

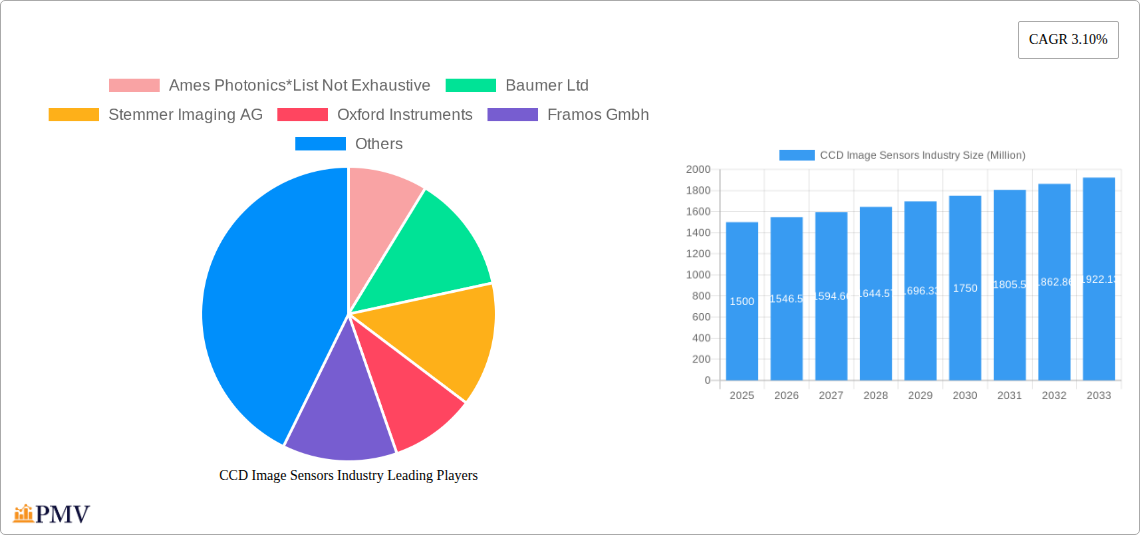

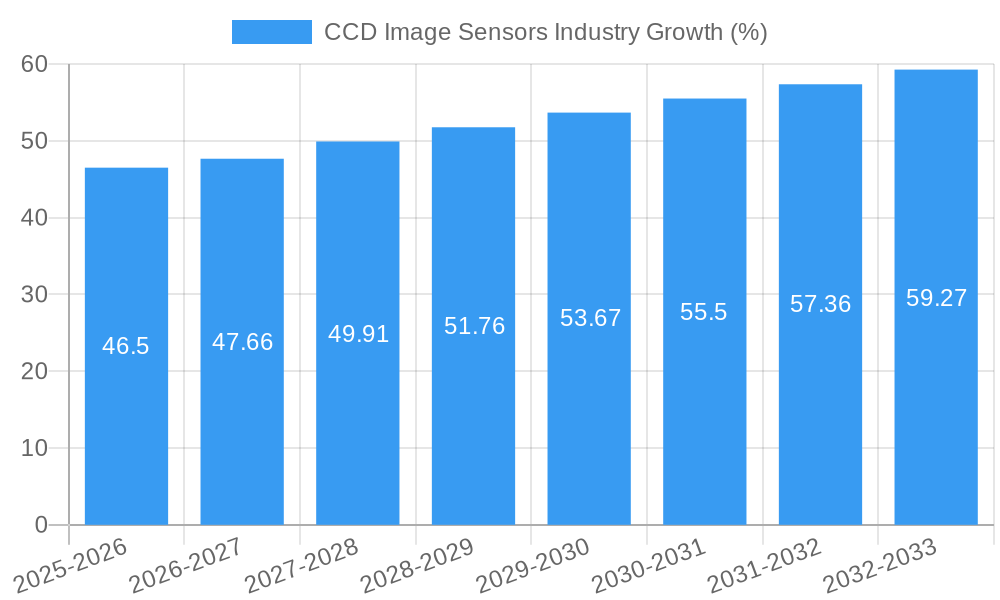

The CCD image sensor market, while facing competition from CMOS technology, maintains a significant presence, particularly in specialized applications demanding high-quality image capture. The market, valued at approximately $XX million in 2025, is projected to experience a compound annual growth rate (CAGR) of 3.10% from 2025 to 2033. This growth is driven by increasing demand from various sectors. The consumer electronics industry continues to be a major driver, with applications in high-end cameras and specialized imaging devices. Furthermore, the healthcare sector's adoption of advanced medical imaging techniques, such as endoscopy and microscopy, fuels demand for high-resolution CCD sensors. Security and surveillance systems, particularly in high-security settings, also contribute to market growth due to the need for reliable and precise image capture in low-light conditions. The automotive and transportation industry is incorporating CCD sensors in advanced driver-assistance systems (ADAS) and autonomous driving technology, further propelling market expansion. While the overall market size might be smaller than the broader image sensor market, the specific needs of these sectors ensure sustained growth and a niche market position for CCD technology.

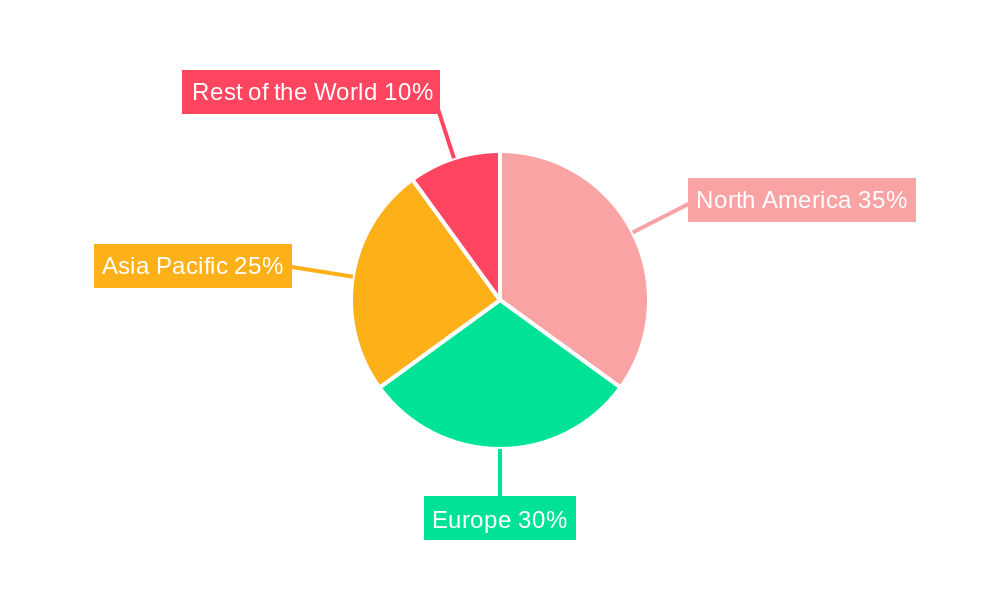

The market segmentation reveals notable trends. Wired CCD sensors remain dominant in applications requiring high data transfer rates and stability, whereas wireless sensors are gaining traction in portable and remote imaging applications. Within end-user applications, consumer electronics currently holds a significant share, but the healthcare and automotive sectors are expected to exhibit faster growth rates over the forecast period. Key players like Ames Photonics, Baumer Ltd., and others are actively involved in technological advancements, fostering innovation and competition. Geographical analysis suggests that North America and Europe currently hold a larger market share due to established technological infrastructure and higher adoption rates, yet the Asia Pacific region is projected to witness the most significant growth in the coming years, driven by increasing industrialization and technological advancements. Regulatory landscapes and advancements in complementary technologies (e.g., image processing software) will continue to shape the market's trajectory.

CCD Image Sensors Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the CCD Image Sensors market, offering crucial insights for businesses and investors navigating this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report forecasts market trends from 2025 to 2033, building upon historical data from 2019 to 2024. The market is segmented by type (Wired, Wireless) and end-user application (Consumer Electronics, Healthcare, Security and Surveillance, Automotive & Transportation, Other End-user Applications). Key players such as Ames Photonics, Baumer Ltd, Stemmer Imaging AG, Oxford Instruments, Framos GmbH, Teledyne e2v (Teledyne Imaging), Toshiba Electronic Devices & Storage Corporation, Sharp Corporation, Hamamatsu Photonics K K, and On Semiconductor Components Industries LLC are analyzed for their market share, strategies, and contributions to industry developments. The report projects a xx Million market value by 2033, with a CAGR of xx% during the forecast period.

CCD Image Sensors Industry Market Structure & Competitive Dynamics

The CCD Image Sensor market exhibits a moderately concentrated structure, with several major players holding significant market share. The competitive landscape is characterized by intense innovation, driven by the need to enhance image quality, speed, and efficiency. Regulatory frameworks, varying by region, influence market access and product standards. Product substitutes, primarily CMOS image sensors, pose a competitive challenge, although CCD sensors retain advantages in specific niche applications. End-user trends, such as the increasing demand for high-resolution imaging in various sectors, are key drivers. M&A activity in the CCD image sensor market has been moderate in recent years, with deal values totaling approximately xx Million in the last five years.

- Market Concentration: The top five players account for approximately xx% of the global market share.

- Innovation Ecosystems: Collaboration between sensor manufacturers and system integrators is vital for product development and market penetration.

- Regulatory Frameworks: Compliance with safety and environmental regulations impacts product design and market entry.

- Product Substitutes: CMOS sensors offer strong competition, especially in cost-sensitive applications.

- End-User Trends: Growth in automotive, medical imaging, and security applications drives market demand.

- M&A Activities: Consolidation is expected to continue, driven by the need for scale and technological expertise.

CCD Image Sensors Industry Industry Trends & Insights

The CCD image sensor market is experiencing a period of steady growth, albeit at a slower pace compared to the CMOS sensor market. Several factors influence this trend: The continued demand for high-quality images in specific applications, such as scientific research and medical imaging, provides a niche market for CCD technology. Technological advancements focus on enhancing sensitivity, speed, and dynamic range. Consumer preference leans towards higher resolution and improved image quality, driving innovation. However, the higher cost and power consumption of CCD sensors compared to CMOS sensors remain a major challenge. The market is expected to grow at a CAGR of xx% between 2025 and 2033, driven by increasing demand in the automotive and medical sectors. Market penetration remains relatively high in niche segments like scientific instrumentation and specialized industrial applications.

Dominant Markets & Segments in CCD Image Sensors Industry

The Asia-Pacific region dominates the CCD image sensor market, driven by robust growth in consumer electronics and automotive manufacturing. Specifically, countries like Japan and South Korea are leading contributors due to the presence of major manufacturers and a strong technological base. Within the market segments:

By Type: Wired CCD image sensors currently hold a larger market share due to their established reliability and performance in demanding applications. However, wireless CCD sensors are experiencing growth due to increasing demand for portable and remote imaging systems.

By End-user Application: The automotive and transportation sector shows strong potential for growth, driven by the increasing use of advanced driver-assistance systems (ADAS) and autonomous vehicles. The healthcare sector also exhibits significant growth, fueled by the demand for high-resolution medical imaging equipment.

Key Drivers (Asia-Pacific):

- Strong economic growth and increasing disposable incomes.

- Rapid advancements in technological infrastructure.

- Favorable government policies promoting technological innovation.

- High demand from the consumer electronics and automotive industries.

CCD Image Sensors Industry Product Innovations

Recent innovations in CCD image sensors focus on improving sensitivity, reducing noise, and increasing speed. New designs incorporate features like back-illuminated technology, higher pixel densities, and on-chip signal processing. These advancements cater to the growing demand for higher-quality images in various applications, enabling new capabilities in scientific research, industrial automation, and medical imaging. The competitive advantage lies in offering superior performance in specific applications where CCD sensors retain advantages over CMOS alternatives, particularly in low-light conditions and applications requiring high dynamic range.

Report Segmentation & Scope

This report segments the CCD image sensor market in two primary ways:

By Type:

Wired: This segment is expected to experience moderate growth due to its established reliability and performance. Market size is projected to reach xx Million by 2033. Competitive dynamics are characterized by established players focusing on performance enhancement.

Wireless: This segment is witnessing rapid expansion, fueled by the demand for portable and remote imaging systems. The market size is projected to reach xx Million by 2033. Competition is increasing with new players entering the market.

By End-user Application:

- Consumer Electronics: This segment is relatively mature, with modest growth expected. The market size is projected to reach xx Million by 2033. Competition is intense, with a focus on cost reduction.

- Healthcare: This segment is experiencing significant growth due to increasing demand for high-resolution medical imaging. The market size is projected to reach xx Million by 2033. Competition is driven by innovation in image quality and speed.

- Security and Surveillance: This segment demonstrates moderate growth, driven by the increasing adoption of advanced security systems. The market size is projected to reach xx Million by 2033. Competitive dynamics focus on features such as low-light performance.

- Automotive & Transportation: This is a high-growth segment, driven by ADAS and autonomous vehicle technologies. The market size is projected to reach xx Million by 2033. Competition is characterized by collaboration between sensor manufacturers and automotive companies.

- Other End-user Applications: This segment includes industrial applications, scientific research, and others, with moderate growth projected. The market size is projected to reach xx Million by 2033. Competitive dynamics are driven by specialized requirements and niche applications.

Key Drivers of CCD Image Sensors Industry Growth

Several factors drive the growth of the CCD image sensor market: Technological advancements, including increased sensitivity and resolution, fuel demand across various applications. The rising adoption of automation in industries like manufacturing and healthcare requires high-precision imaging solutions. Government regulations and safety standards also mandate specific image quality standards in certain sectors. For example, the increasing adoption of advanced driver-assistance systems (ADAS) in the automotive industry is a major driver of demand.

Challenges in the CCD Image Sensors Industry Sector

The CCD image sensor market faces challenges like the intense competition from CMOS sensors, which offer better cost-effectiveness and lower power consumption. Supply chain disruptions and geopolitical uncertainties can impact component availability and pricing. Stringent regulatory requirements and safety standards in various industries increase the cost and complexity of product development. The high initial investment required for advanced CCD sensor production restricts market entry for new players. These factors collectively contribute to xx% of the overall market challenges.

Leading Players in the CCD Image Sensors Industry Market

- Ames Photonics

- Baumer Ltd

- Stemmer Imaging AG

- Oxford Instruments

- Framos GmbH

- Teledyne e2v (Teledyne Imaging)

- Toshiba Electronic Devices & Storage Corporation

- Sharp Corporation

- Hamamatsu Photonics K K

- On Semiconductor Components Industries LLC

Key Developments in CCD Image Sensors Industry Sector

March 2021: Hamamatsu Photonics Inc. launched the S12551 series, a front-illuminated CCD linear image sensor with a high-speed line rate (40 MHz max), designed for applications like sorting machines and foreign object screening. Key features include a pixel size of 14 x 14 μm and high CCD node sensitivity (13 μV/e- typ.).

March 2021: Toshiba Electronic Devices & Storage Corporation launched the TCD2726DGa, a lens reduction type CCD linear image sensor for high-speed scanning in A3 multifunction printers. Key features include a 100MHz (50MHz x 2ch) data rate, built-in timing generator circuit, and CCD driver.

Strategic CCD Image Sensors Industry Market Outlook

The future of the CCD image sensor market is tied to its ability to maintain a competitive edge in niche applications. While CMOS sensors dominate the broader market, continued investment in high-performance CCD technology, especially in areas demanding superior sensitivity, dynamic range, and low noise, will ensure market growth. Strategic partnerships and collaborations will be key to expanding into emerging applications such as advanced medical imaging and scientific research. Focusing on specialized applications and offering customized solutions will help navigate the challenges posed by CMOS technology. The market is projected to see continued growth, driven by sustained demand in specific high-value sectors.

CCD Image Sensors Industry Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. End-user Application

- 2.1. Consumer Electronics

- 2.2. Healthcare

- 2.3. Security and Surveillance

- 2.4. Automotive & Transportation

- 2.5. Other End-user Applications

CCD Image Sensors Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

CCD Image Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for High-quality Images; Increasing Safety Regulations and Adoption of ADAS; Demand from the Professional Imaging in Medical Segments

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Integrated Circuits

- 3.4. Market Trends

- 3.4.1. High Quality Image Cased Inspection Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Consumer Electronics

- 5.2.2. Healthcare

- 5.2.3. Security and Surveillance

- 5.2.4. Automotive & Transportation

- 5.2.5. Other End-user Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Consumer Electronics

- 6.2.2. Healthcare

- 6.2.3. Security and Surveillance

- 6.2.4. Automotive & Transportation

- 6.2.5. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Consumer Electronics

- 7.2.2. Healthcare

- 7.2.3. Security and Surveillance

- 7.2.4. Automotive & Transportation

- 7.2.5. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Consumer Electronics

- 8.2.2. Healthcare

- 8.2.3. Security and Surveillance

- 8.2.4. Automotive & Transportation

- 8.2.5. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Consumer Electronics

- 9.2.2. Healthcare

- 9.2.3. Security and Surveillance

- 9.2.4. Automotive & Transportation

- 9.2.5. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World CCD Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Ames Photonics*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Baumer Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Stemmer Imaging AG

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Oxford Instruments

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Framos Gmbh

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Teledyne e2v (Teledyne Imaging)

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Toshiba Electronic Devices & Storage Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Sharp Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Hamamatsu Photonics K K

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 On Semiconductor Components Industries LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ames Photonics*List Not Exhaustive

List of Figures

- Figure 1: Global CCD Image Sensors Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America CCD Image Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America CCD Image Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America CCD Image Sensors Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 13: North America CCD Image Sensors Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 14: North America CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe CCD Image Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe CCD Image Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe CCD Image Sensors Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 19: Europe CCD Image Sensors Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 20: Europe CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific CCD Image Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific CCD Image Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific CCD Image Sensors Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 25: Asia Pacific CCD Image Sensors Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 26: Asia Pacific CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World CCD Image Sensors Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World CCD Image Sensors Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World CCD Image Sensors Industry Revenue (Million), by End-user Application 2024 & 2032

- Figure 31: Rest of the World CCD Image Sensors Industry Revenue Share (%), by End-user Application 2024 & 2032

- Figure 32: Rest of the World CCD Image Sensors Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World CCD Image Sensors Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CCD Image Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global CCD Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global CCD Image Sensors Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 4: Global CCD Image Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: CCD Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: CCD Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: CCD Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: CCD Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global CCD Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global CCD Image Sensors Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 15: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global CCD Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global CCD Image Sensors Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 18: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global CCD Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global CCD Image Sensors Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 21: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global CCD Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global CCD Image Sensors Industry Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 24: Global CCD Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CCD Image Sensors Industry?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the CCD Image Sensors Industry?

Key companies in the market include Ames Photonics*List Not Exhaustive, Baumer Ltd, Stemmer Imaging AG, Oxford Instruments, Framos Gmbh, Teledyne e2v (Teledyne Imaging), Toshiba Electronic Devices & Storage Corporation, Sharp Corporation, Hamamatsu Photonics K K, On Semiconductor Components Industries LLC.

3. What are the main segments of the CCD Image Sensors Industry?

The market segments include Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for High-quality Images; Increasing Safety Regulations and Adoption of ADAS; Demand from the Professional Imaging in Medical Segments.

6. What are the notable trends driving market growth?

High Quality Image Cased Inspection Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Rising Demand for Integrated Circuits.

8. Can you provide examples of recent developments in the market?

March 2021: Hamamatsu Photonics Inc S12551 series is a front-illuminated type CCD linear image sensor with a high-speed line rate designed for applications such as a sorting machine. The features include pixel size: 14 14 μm, high CCD node sensitivity: 13 μV/e- typ., readout speed: 40 MHz max, anti-blooming function, and built-in electronic shutter. These are used in foreign object screening and high-speed imaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CCD Image Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CCD Image Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CCD Image Sensors Industry?

To stay informed about further developments, trends, and reports in the CCD Image Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence