Key Insights

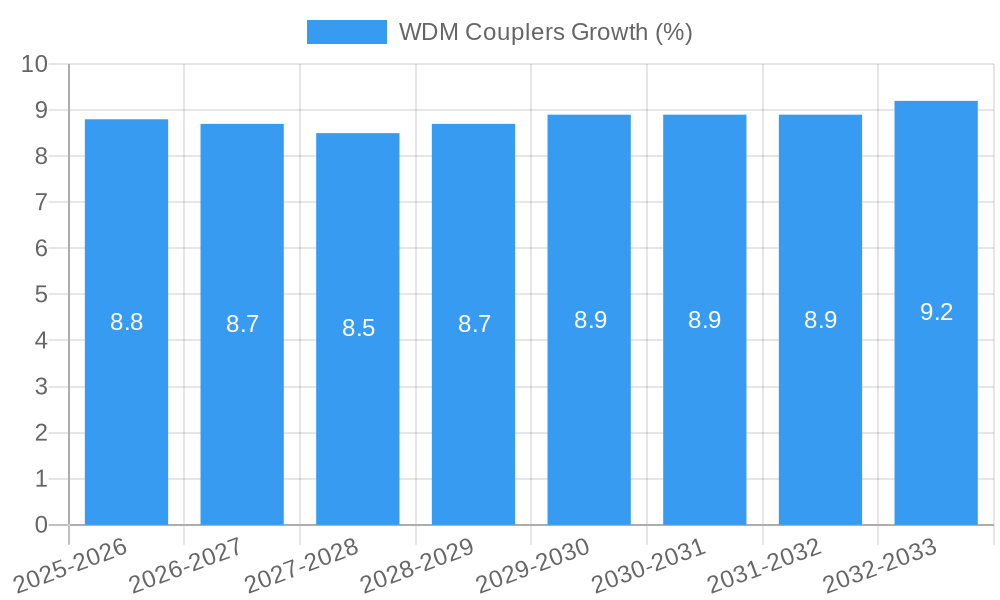

The global WDM Couplers market is poised for significant expansion, driven by the ever-increasing demand for higher bandwidth and efficient data transmission across telecommunications, data centers, and enterprise networks. With an estimated market size of approximately $850 million in 2025, the sector is projected to experience a robust Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This growth is fundamentally fueled by the ongoing deployment of next-generation optical networks, including 5G infrastructure, fiber-to-the-home (FTTH) initiatives, and the burgeoning cloud computing ecosystem, all of which necessitate sophisticated wavelength division multiplexing technologies for effective signal management. The ability of WDM couplers to combine and separate optical signals at different wavelengths onto a single fiber is critical for maximizing spectral efficiency and reducing the need for extensive cabling, making them an indispensable component in modern optical communication systems.

However, the market faces certain restraints, primarily related to the initial capital expenditure required for advanced WDM coupler technologies and the ongoing challenges in standardization across different network architectures. Despite these hurdles, the market is characterized by strong trends favoring miniaturization, increased integration, and the development of more cost-effective manufacturing processes. Key players such as Corning, OZ Optics, and Fujikura are actively investing in research and development to introduce innovative solutions that enhance performance, reduce insertion loss, and improve power handling capabilities. The competitive landscape is dynamic, with companies focusing on product differentiation and strategic partnerships to capture market share. Emerging applications in areas like optical sensing, medical diagnostics, and high-performance computing are also expected to contribute to sustained market growth, further solidifying the importance of WDM couplers in the telecommunications and broader technology sectors.

Comprehensive WDM Couplers Market Analysis: Unlocking Opportunities in Next-Generation Optical Networks (2019-2033)

This in-depth market research report provides a granular analysis of the global WDM (Wavelength Division Multiplexing) couplers market, covering historical data from 2019 to 2024, a base year of 2025, and an extensive forecast period extending to 2033. The study meticulously examines market structures, competitive dynamics, critical industry trends, dominant market segments, groundbreaking product innovations, key growth drivers, significant challenges, leading market players, crucial developments, and a strategic market outlook for WDM couplers. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the rapidly evolving landscape of optical communication technologies.

WDM Couplers Market Structure & Competitive Dynamics

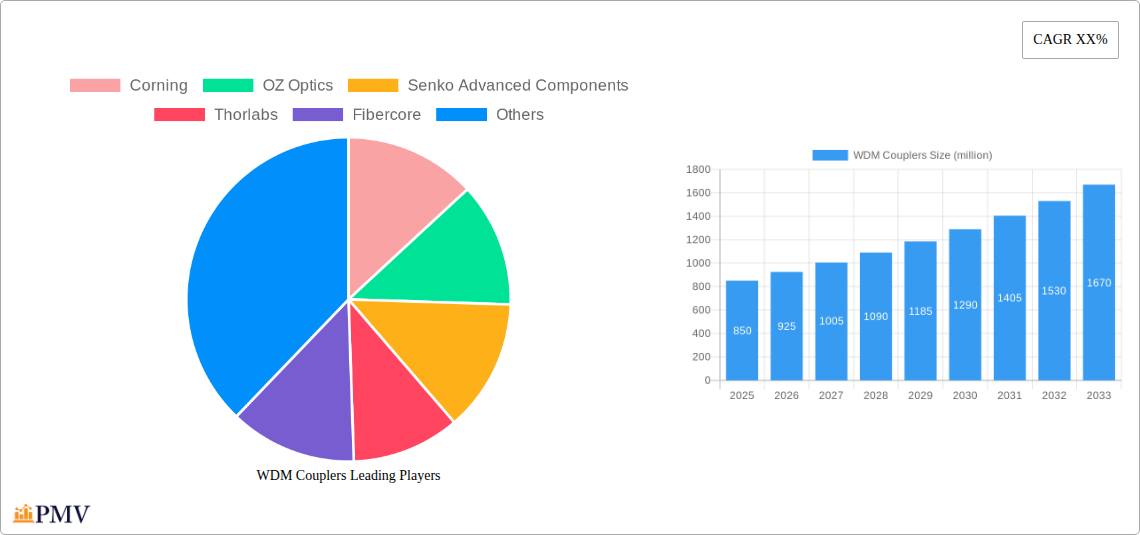

The WDM couplers market exhibits a moderately fragmented structure, with a blend of established industry giants and emerging specialized players. Key companies like Corning, OZ Optics, Senko Advanced Components, Thorlabs, Fibercore, Fujikura, AC Photonics, Go!Foton, Lightel Technologies, OptoTest, Timbercon, Cube Optics, WaveSplitter Technologies, Fibertronics, Alliance Fiber Optic Products, LightComm Technology, Gould Fiber Optics, and OptiWorks are actively shaping the market. Market concentration is influenced by intellectual property, manufacturing capabilities, and strategic partnerships. The innovation ecosystem is robust, driven by continuous research and development in optical technologies, fiber optics, and passive optical components. Regulatory frameworks are generally supportive of technological advancement, with a focus on standardization and interoperability. Product substitutes, while present in broader optical connectivity, are less direct for specialized WDM coupler functionalities. End-user trends lean towards higher bandwidth requirements, miniaturization, and increased integration. Merger and acquisition activities are observed as companies seek to expand their product portfolios, gain market share, and acquire specialized expertise. We anticipate a total addressable market size of approximately $2,000 million by the end of the forecast period. The M&A deal value is estimated to be in the range of $50 million to $200 million annually during the forecast period, indicating strategic consolidation efforts.

WDM Couplers Industry Trends & Insights

The WDM couplers market is poised for significant growth, driven by the insatiable demand for higher data transmission capacities across various sectors, including telecommunications, data centers, and broadband access. The Compound Annual Growth Rate (CAGR) for the WDM couplers market is projected to be approximately 8.5% over the forecast period (2025-2033). Technological disruptions, particularly the evolution of denser WDM (DWDM) systems and the increasing adoption of fiber-to-the-home (FTTH) deployments, are key growth catalysts. Consumer preferences are increasingly skewed towards cost-effective, high-performance, and compact optical solutions. The competitive landscape is characterized by intense product innovation, price competitiveness, and a strong emphasis on customer service and technical support. Market penetration is steadily increasing as more networks upgrade to support higher speeds and more channels. The integration of WDM couplers with other optical components to create more complex passive optical modules presents a significant market opportunity. The adoption of advanced manufacturing techniques, such as automated fiber alignment and precision molding, is further optimizing production efficiency and product quality. The burgeoning growth of cloud computing and the exponential increase in data traffic generated by IoT devices are creating a sustained demand for high-capacity optical networking solutions, directly benefiting the WDM couplers market.

Dominant Markets & Segments in WDM Couplers

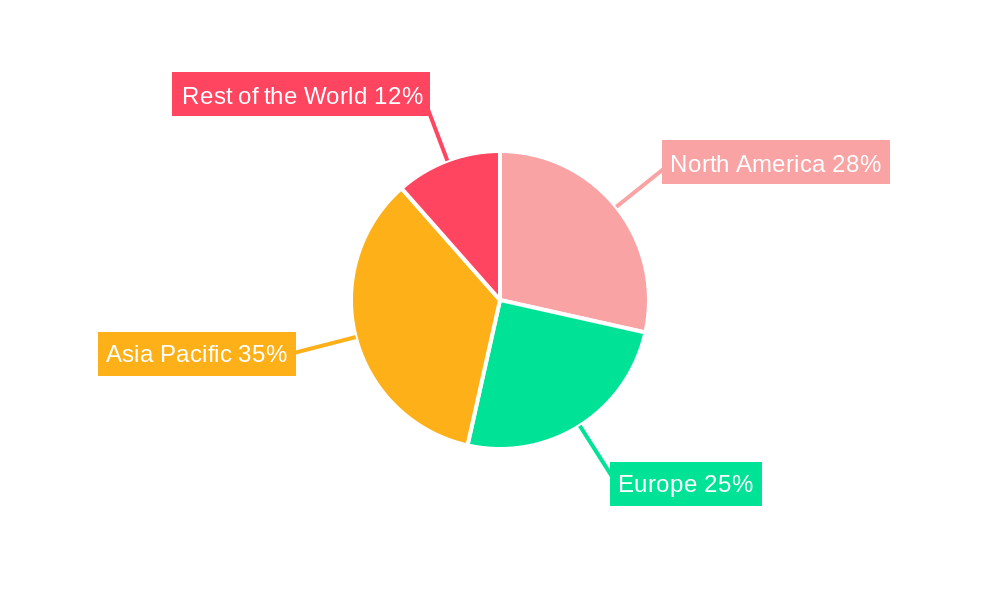

The Telecommunications segment, particularly within the Asia-Pacific region, is currently the dominant market for WDM couplers. This dominance is driven by substantial investments in 5G infrastructure, the expansion of fiber optic networks, and the rapid adoption of broadband services across countries like China, Japan, and South Korea. Economic policies encouraging digital transformation and government initiatives to enhance telecommunications infrastructure play a pivotal role in this regional leadership.

Within Application:

- Telecommunications: This is the largest application segment, accounting for over 50% of the market share.

- Drivers: Expansion of 5G networks, increased data traffic, FTTH deployments.

- Market Size: Estimated to be $1,200 million by 2025.

- Data Centers: Experiencing rapid growth due to the demand for high-speed interconnections and increased server density.

- Drivers: Cloud computing growth, AI workloads, data center interconnectivity (DCI).

- Market Size: Estimated to be $500 million by 2025.

- Broadcast and Cable Networks: A steady segment driven by the need for efficient signal distribution.

- Drivers: HD broadcasting, increased channel capacity.

- Market Size: Estimated to be $150 million by 2025.

- Industrial and Military Applications: Smaller but growing segments, driven by specialized high-reliability requirements.

- Drivers: Robustness, performance in harsh environments.

- Market Size: Estimated to be $150 million by 2025.

Within Types:

- 1x2 WDM Couplers: The most prevalent type, offering fundamental wavelength splitting capabilities.

- Drivers: Ubiquitous use in basic optical network configurations.

- Market Size: Estimated to be $800 million by 2025.

- 1x4 WDM Couplers: Increasingly adopted for higher channel density in specific network designs.

- Drivers: Growing demand for more WDM channels in compact solutions.

- Market Size: Estimated to be $500 million by 2025.

- 1x8 and Higher WDM Couplers: Specialized solutions for advanced WDM systems.

- Drivers: Requirement for very high channel counts in DWDM.

- Market Size: Estimated to be $700 million by 2025.

WDM Couplers Product Innovations

Product innovations in WDM couplers are primarily focused on enhancing performance, miniaturization, and cost-effectiveness. Companies are developing couplers with lower insertion loss, improved isolation between channels, and broader operating wavelength ranges to support evolving network demands. Advancements in manufacturing techniques allow for more compact and robust designs, suitable for integration into complex optical modules. Key innovations include the development of planar lightwave circuit (PLC) based couplers for higher integration and reduced footprint, as well as advanced packaging solutions that improve environmental resilience. The competitive advantage lies in offering superior optical performance, higher channel counts in smaller form factors, and cost-efficient manufacturing processes that meet the stringent requirements of next-generation optical networks.

Report Segmentation & Scope

This report segments the global WDM couplers market based on Application and Types.

- Application Segments: The Telecommunications segment, projected to reach approximately $2,000 million by 2033, is the largest, driven by 5G and FTTH. Data Centers, estimated to reach $1,000 million by 2033, are a rapidly growing segment due to cloud infrastructure expansion and AI demands. Broadcast and Cable Networks are expected to reach $300 million by 2033, and Industrial and Military Applications are projected to reach $300 million by 2033, showcasing niche but important growth.

- Types Segments: 1x2 WDM Couplers are expected to reach $1,600 million by 2033, remaining a foundational product. 1x4 WDM Couplers are projected to reach $1,000 million by 2033, driven by increased channel density needs. 1x8 and Higher WDM Couplers are anticipated to reach $1,400 million by 2033, catering to advanced DWDM systems. The competitive dynamics within each segment vary, with some types experiencing faster innovation and market adoption than others.

Key Drivers of WDM Couplers Growth

Several key factors are propelling the growth of the WDM couplers market.

- Technological Advancement: The continuous evolution of fiber optic technology, including denser WDM (DWDM) systems and advancements in optical amplifier technologies, necessitates efficient and high-performance WDM couplers.

- Increasing Data Demand: The exponential growth in global data traffic, driven by cloud computing, streaming services, social media, and the Internet of Things (IoT), requires higher bandwidth optical networks, directly benefiting WDM coupler adoption.

- 5G Network Rollout: The widespread deployment of 5G infrastructure requires increased fiber density and higher capacity backhaul and fronthaul networks, creating substantial demand for WDM couplers.

- Data Center Expansion: The burgeoning growth of data centers, fueled by cloud services and big data analytics, necessitates high-speed, high-density optical interconnections, where WDM couplers play a crucial role.

- Broadband Penetration: Government initiatives and consumer demand for faster internet speeds are driving the expansion of fiber-to-the-home (FTTH) networks, which utilize WDM couplers for efficient wavelength management.

Challenges in the WDM Couplers Sector

Despite the robust growth trajectory, the WDM couplers sector faces certain challenges.

- Cost Sensitivity: While performance is critical, there is significant price pressure in many segments, particularly in high-volume telecommunications deployments.

- Technical Expertise Requirements: The installation and maintenance of complex WDM systems, including the proper integration of WDM couplers, can require specialized technical expertise, potentially limiting widespread adoption in less developed markets.

- Supply Chain Volatility: Global supply chain disruptions, geopolitical factors, and the availability of raw materials can impact production costs and lead times for WDM coupler components.

- Competition from Integrated Solutions: The development of highly integrated optical transceivers and modules that incorporate WDM functionalities could potentially impact the standalone market for certain types of WDM couplers.

- Standardization and Interoperability: While efforts are underway, ensuring seamless interoperability between WDM couplers from different manufacturers within complex optical networks remains an ongoing challenge. The market size impacted by supply chain issues is estimated to be between $100 million and $300 million annually in terms of delayed revenue.

Leading Players in the WDM Couplers Market

- Corning

- OZ Optics

- Senko Advanced Components

- Thorlabs

- Fibercore

- Fujikura

- AC Photonics

- Go!Foton

- Lightel Technologies

- OptoTest

- Timbercon

- Cube Optics

- WaveSplitter Technologies

- Fibertronics

- Alliance Fiber Optic Products

- LightComm Technology

- Gould Fiber Optics

- OptiWorks

Key Developments in WDM Couplers Sector

- 2023: Launch of ultra-low loss 1x4 WDM couplers by Corning, enhancing transmission efficiency for high-density networks.

- 2023: OZ Optics introduced compact, high-isolation WDM modules for 5G small cell deployments.

- 2024: Senko Advanced Components unveiled new robust, environmentally sealed WDM couplers designed for harsh outdoor telecommunication environments.

- 2024: Thorlabs expanded its portfolio with high-power WDM couplers catering to laser-based applications.

- 2024: Fujikura showcased advanced PLC-based WDM couplers with improved integration capabilities for next-generation optical networking equipment.

- 2025: Fibercore announced the development of specialized WDM couplers for industrial IoT applications requiring extreme reliability.

- 2025: AC Photonics launched a new series of cost-effective 1x8 WDM couplers for broadband access networks.

Strategic WDM Couplers Market Outlook

The strategic outlook for the WDM couplers market remains exceptionally positive, driven by the sustained global demand for higher bandwidth and more efficient optical networks. Future growth accelerators include the ongoing expansion of 5G networks, the relentless demand for data center capacity, and the increasing adoption of FTTH services worldwide. Strategic opportunities lie in developing highly integrated WDM solutions, offering specialized couplers for niche applications like data center interconnectivity (DCI) and industrial automation, and focusing on cost-effective manufacturing processes. Companies that can innovate in terms of miniaturization, performance enhancements, and supply chain resilience will be well-positioned to capture significant market share. The increasing complexity and channel count in future optical networks will continue to fuel the demand for advanced WDM coupler technologies.

WDM Couplers Segmentation

- 1. Application

- 2. Types

WDM Couplers Segmentation By Geography

- 1. CA

WDM Couplers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. WDM Couplers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Corning

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OZ Optics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Senko Advanced Components

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thorlabs

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fibercore

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujikura

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AC Photonics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Go!Foton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lightel Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OptoTest

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Timbercon

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cube Optics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 WaveSplitter Technologies

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Fibertronics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Alliance Fiber Optic Products

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 LightComm Technology

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Gould Fiber Optics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 OptiWorks

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Corning

List of Figures

- Figure 1: WDM Couplers Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: WDM Couplers Share (%) by Company 2024

List of Tables

- Table 1: WDM Couplers Revenue million Forecast, by Region 2019 & 2032

- Table 2: WDM Couplers Revenue million Forecast, by Application 2019 & 2032

- Table 3: WDM Couplers Revenue million Forecast, by Types 2019 & 2032

- Table 4: WDM Couplers Revenue million Forecast, by Region 2019 & 2032

- Table 5: WDM Couplers Revenue million Forecast, by Application 2019 & 2032

- Table 6: WDM Couplers Revenue million Forecast, by Types 2019 & 2032

- Table 7: WDM Couplers Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the WDM Couplers?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the WDM Couplers?

Key companies in the market include Corning, OZ Optics, Senko Advanced Components, Thorlabs, Fibercore, Fujikura, AC Photonics, Go!Foton, Lightel Technologies, OptoTest, Timbercon, Cube Optics, WaveSplitter Technologies, Fibertronics, Alliance Fiber Optic Products, LightComm Technology, Gould Fiber Optics, OptiWorks.

3. What are the main segments of the WDM Couplers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "WDM Couplers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the WDM Couplers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the WDM Couplers?

To stay informed about further developments, trends, and reports in the WDM Couplers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence