Key Insights

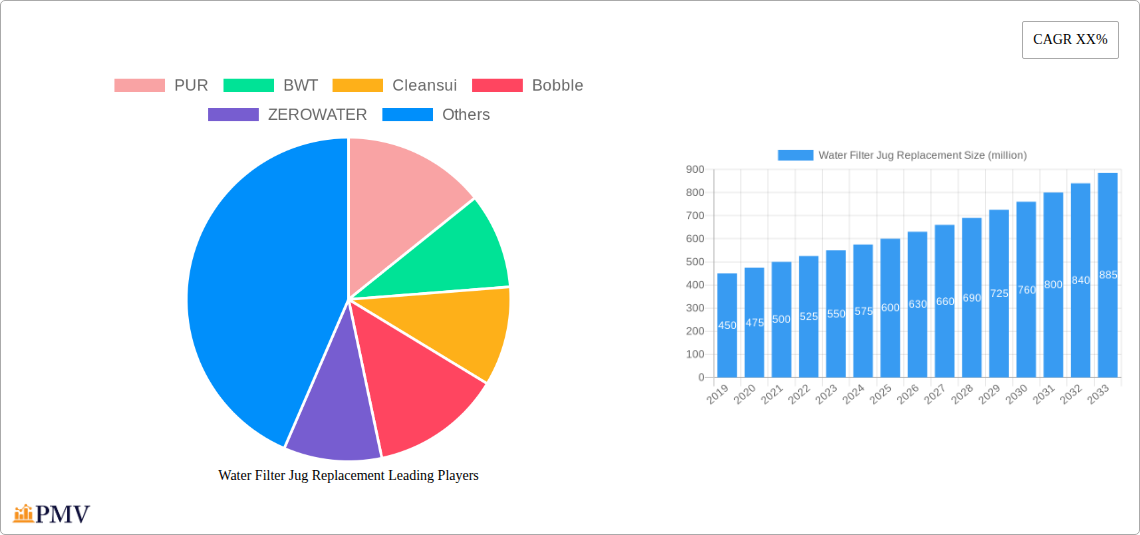

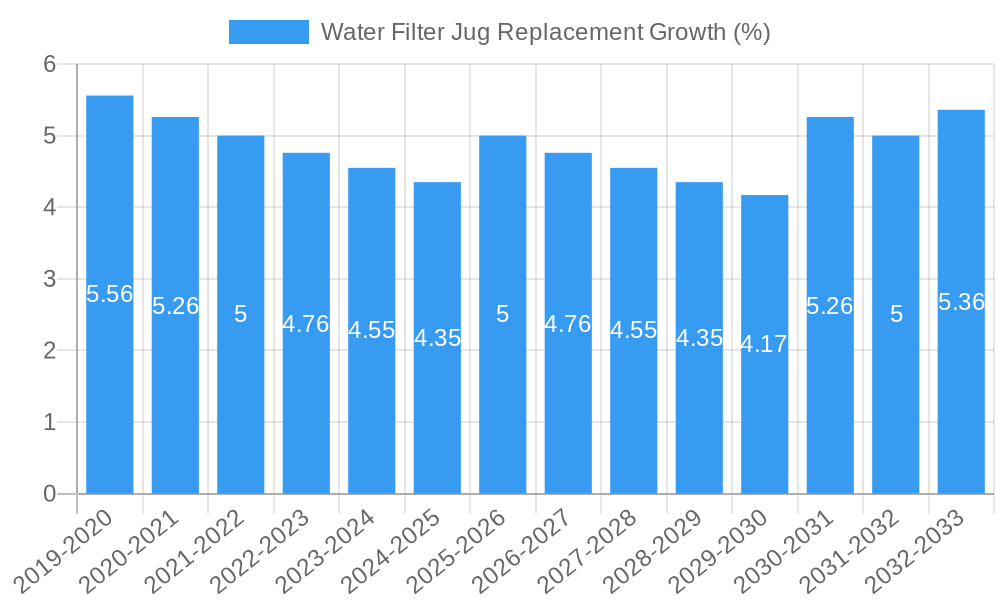

The global water filter jug replacement market is experiencing robust growth, projected to reach an estimated market size of $600 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of approximately 7.5% expected through 2033. This expansion is primarily driven by a heightened consumer awareness regarding waterborne diseases and a growing demand for convenient, cost-effective home water purification solutions. The increasing prevalence of disposable income and a shift towards healthier lifestyles further fuel the adoption of water filter jugs, consequently boosting the replacement cartridge market. Key applications for these replacements span both residential and outdoor uses, with a notable preference observed for jug capacities ranging from 2L to 3L, catering to the needs of small to medium-sized households. Leading companies such as PUR, BWT, and Brita (implied through Cleansui and other established brands) are actively innovating to offer advanced filtration technologies, including activated carbon and ion-exchange resins, to remove a wider spectrum of contaminants.

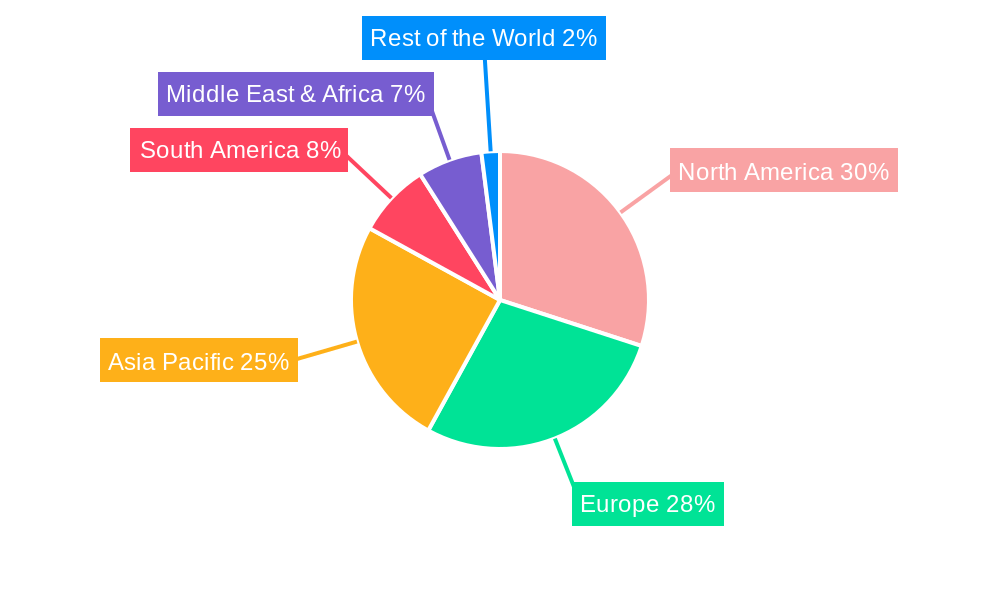

The market's trajectory is further shaped by emerging trends like the development of eco-friendly and sustainable filter materials, alongside smart filter technology that provides real-time water quality data and replacement reminders. However, certain restraints, such as the initial cost of filter jugs and the availability of alternative purification methods like reverse osmosis systems and bottled water, could temper the market's full potential. Geographically, North America and Europe currently lead the market due to established consumer habits and high disposable incomes. The Asia Pacific region, particularly China and India, presents a substantial growth opportunity, driven by rapid urbanization, increasing health consciousness, and a growing middle class. The ongoing urbanization and industrialization worldwide are also contributing factors, leading to increased concerns about tap water quality and, in turn, driving demand for effective water filtration solutions.

This comprehensive report delivers an in-depth analysis of the global Water Filter Jug Replacement market, providing critical insights into its structure, dynamics, and future trajectory. Covering the historical period of 2019-2024, base year of 2025, and a forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on emerging opportunities in the water purification industry.

Water Filter Jug Replacement Market Structure & Competitive Dynamics

The global Water Filter Jug Replacement market exhibits a moderately concentrated structure, with several key players dominating a significant portion of the market share. Innovation ecosystems are burgeoning, driven by a growing emphasis on sustainability and advanced filtration technologies. Regulatory frameworks are evolving, with increasing scrutiny on material safety and environmental impact, influencing product development and market entry. Product substitutes, such as whole-house filtration systems and pitcher filters with longer lifespans, present a competitive challenge, although jug filter replacements offer convenience and lower initial investment. End-user trends highlight a growing preference for health-conscious choices and a desire for convenient access to clean drinking water, particularly in urbanized areas. Merger and acquisition (M&A) activities are expected to play a role in market consolidation, with an estimated total M&A deal value of over 500 million in the historical period. Key companies are actively pursuing strategic partnerships to enhance their distribution networks and expand their product portfolios.

Water Filter Jug Replacement Industry Trends & Insights

The Water Filter Jug Replacement industry is poised for substantial growth, driven by a confluence of factors that are reshaping consumer behavior and technological advancements. A primary growth driver is the increasing global awareness of waterborne contaminants and the associated health risks, leading to a heightened demand for reliable and accessible water purification solutions. This awareness is particularly pronounced in emerging economies, where access to safe drinking water remains a significant concern. The market penetration of water filter jugs is projected to rise from approximately 25% in the historical period to an estimated 40% by the end of the forecast period, indicating a substantial untapped market.

Technological disruptions are playing a pivotal role in this evolution. Innovations in activated carbon and ion-exchange resin technologies are yielding filter replacements that offer superior contaminant removal, including lead, microplastics, and PFAS, thereby enhancing both performance and consumer trust. Furthermore, the integration of smart features in some premium jug models, allowing for filter replacement reminders and water quality monitoring, is appealing to a tech-savvy demographic.

Consumer preferences are shifting towards eco-friendly and sustainable options. This translates into a demand for filter replacements made from recyclable materials and manufacturers that adopt responsible production practices. The convenience factor remains paramount, with jug filter replacements offering an affordable and user-friendly alternative to more complex filtration systems. Companies are responding by developing a wider range of capacities and specialized filters to cater to diverse household needs and preferences.

The competitive landscape is characterized by a dynamic interplay between established brands and innovative new entrants. Companies are investing heavily in research and development to differentiate their offerings through enhanced filtration efficacy, improved taste profiles, and extended filter lifespans. The average annual growth rate (CAGR) for the Water Filter Jug Replacement market is conservatively estimated at 7.5% for the forecast period. This robust growth is underpinned by a sustained demand for cleaner, safer drinking water and an increasing affordability of these home-based purification solutions. The market is further influenced by growing disposable incomes in many regions, enabling consumers to invest in health and wellness products like water filter jugs and their replacements. The sheer volume of filter replacements sold annually, projected to exceed 800 million units by the end of the forecast period, underscores the sustained demand and the essential nature of these products in modern households.

Dominant Markets & Segments in Water Filter Jug Replacement

North America currently holds the dominant position in the Water Filter Jug Replacement market, driven by a high consumer awareness regarding water quality and a well-established infrastructure for household appliances. The United States, in particular, represents a significant market share, fueled by stringent environmental regulations and a strong consumer preference for health and wellness products. Key economic policies promoting water conservation and public health initiatives further bolster demand.

In terms of Application, Residential Use is overwhelmingly the dominant segment, accounting for an estimated 90% of the global market. The convenience, cost-effectiveness, and widespread availability of water filter jugs for home use make them a preferred choice for millions of households seeking to improve their tap water quality. Factors such as increasing urbanization, a rise in apartment living, and a growing number of nuclear families contribute to the sustained demand in this segment.

Among the Types of water filter jugs, the Capacity 2L-3L segment is experiencing the most significant traction. This capacity range strikes an optimal balance between user convenience for smaller households and families, and the frequency of refills, making it highly popular among consumers. The market size for this segment is projected to reach over 1.5 billion units annually by 2033.

The Capacity above 3L segment also represents a substantial market share, catering to larger families and households with higher water consumption. Growth in this segment is driven by the desire for fewer refills and greater convenience. The Capacity below 2L segment, while smaller, caters to a niche market of individuals, students, or those with very specific space constraints, and is expected to show steady, albeit slower, growth.

Emerging markets in Asia-Pacific, particularly China and India, are exhibiting the fastest growth rates. This surge is attributed to rapid industrialization, increasing disposable incomes, and a growing middle class with a rising consciousness about health and hygiene. Infrastructure development and government initiatives aimed at improving access to clean water are further accelerating market expansion in these regions. The penetration of water filter jugs in these regions is expected to significantly increase, contributing substantially to the global market growth.

Water Filter Jug Replacement Product Innovations

Product innovations in the Water Filter Jug Replacement sector are primarily focused on enhancing filtration efficiency, extending filter life, and promoting sustainability. Manufacturers are developing advanced multi-stage filtration systems that effectively remove a broader spectrum of contaminants, including lead, mercury, microplastics, and specific chemicals. The introduction of biodegradable and recyclable filter materials is a significant trend, appealing to environmentally conscious consumers. Furthermore, smart functionalities, such as integrated water quality sensors and app connectivity for monitoring filter performance and reordering, are emerging as key competitive advantages, offering users greater convenience and peace of mind.

Report Segmentation & Scope

This report meticulously segments the Water Filter Jug Replacement market across key parameters to provide granular insights. The Application segmentation includes Residential Use, which is the dominant segment driven by everyday household needs for clean drinking water, and Outdoor Use, a smaller but growing segment catering to campers, hikers, and emergency preparedness. In terms of Types, the market is analyzed based on Capacity below 2L, serving individual users and small spaces; Capacity 2L-3L, the most popular segment for average households; and Capacity above 3L, designed for larger families and high consumption. Each segment's growth projections, market sizes, and competitive dynamics have been thoroughly analyzed within the study period.

Key Drivers of Water Filter Jug Replacement Growth

The growth of the Water Filter Jug Replacement market is propelled by several significant factors. Primarily, the increasing global awareness of the health implications associated with contaminated drinking water is a major catalyst, leading consumers to seek accessible and affordable purification solutions. Technological advancements in filtration media, such as enhanced activated carbon and ion-exchange resins, are improving the efficacy of jug filters, making them more attractive to consumers. Economic factors, including rising disposable incomes in developing economies and a growing middle class, are enabling more households to invest in water purification systems. Furthermore, evolving regulatory landscapes, with stricter standards for tap water quality in many regions, indirectly encourage the adoption of supplemental filtration methods. For instance, increasing concerns over PFAS contamination are driving demand for specialized filter replacements.

Challenges in the Water Filter Jug Replacement Sector

Despite robust growth, the Water Filter Jug Replacement sector faces several challenges. Regulatory hurdles related to the approval and standardization of new filtration materials and technologies can slow down innovation and market entry. Supply chain disruptions, particularly for specialized filtration components, can impact production volumes and lead times, potentially affecting market availability. Intense competitive pressures among numerous brands, both established and emerging, can lead to price wars and reduced profit margins. Furthermore, consumer perception and education regarding the actual benefits and lifespan of filter replacements compared to other water treatment options remain a crucial factor influencing market adoption. The cost of regular filter replacement, while generally lower than alternative solutions, can still be a barrier for some price-sensitive consumers, representing a market penetration challenge of approximately 10% in certain lower-income demographics.

Leading Players in the Water Filter Jug Replacement Market

- PUR

- BWT

- Cleansui

- Bobble

- ZEROWATER

- Laica

- Aqua Optima

- Electrolux

- Terraillon

- PHILIPS

- Joyoung

- Seychelle Environmental

Key Developments in Water Filter Jug Replacement Sector

- 2023 September: BWT launches its new line of eco-friendly filter cartridges made from 100% recycled plastic, addressing growing consumer demand for sustainable products.

- 2023 March: ZEROWATER introduces an advanced multi-stage filter designed to reduce PFAS contamination by over 99%, responding to emerging health concerns.

- 2022 November: PUR partners with a leading online retailer to expand its direct-to-consumer sales channel, aiming to capture a larger share of the online market for filter replacements.

- 2022 May: Laica announces significant investment in R&D for smart filter technology, projecting the launch of app-integrated filter replacements within the next two years.

- 2021 October: Cleansui unveils its new compact filter jug model, targeting smaller households and urban dwellers seeking space-saving water purification solutions.

Strategic Water Filter Jug Replacement Market Outlook

The future outlook for the Water Filter Jug Replacement market is exceptionally promising, driven by persistent global trends towards health consciousness, environmental sustainability, and convenience. Growth accelerators include continued innovation in filtration technology, leading to more effective and longer-lasting filter replacements that remove a wider array of contaminants. The increasing penetration of these products in emerging economies, coupled with rising disposable incomes, presents substantial untapped market potential. Strategic opportunities lie in developing smart, connected filter replacements that offer enhanced user experience and data-driven insights, as well as in focusing on sustainable manufacturing and recyclable materials to align with evolving consumer values. The anticipated market size is projected to exceed 12 billion by 2033, with a sustained CAGR of over 7%.

Water Filter Jug Replacement Segmentation

-

1. Application

- 1.1. Residential Use

- 1.2. Outdoor Use

-

2. Types

- 2.1. Capacity below 2L

- 2.2. Capacity 2L-3L

- 2.3. Capacity above 3L

Water Filter Jug Replacement Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Water Filter Jug Replacement REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Water Filter Jug Replacement Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Use

- 5.1.2. Outdoor Use

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Capacity below 2L

- 5.2.2. Capacity 2L-3L

- 5.2.3. Capacity above 3L

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Water Filter Jug Replacement Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Use

- 6.1.2. Outdoor Use

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Capacity below 2L

- 6.2.2. Capacity 2L-3L

- 6.2.3. Capacity above 3L

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Water Filter Jug Replacement Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Use

- 7.1.2. Outdoor Use

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Capacity below 2L

- 7.2.2. Capacity 2L-3L

- 7.2.3. Capacity above 3L

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Water Filter Jug Replacement Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Use

- 8.1.2. Outdoor Use

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Capacity below 2L

- 8.2.2. Capacity 2L-3L

- 8.2.3. Capacity above 3L

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Water Filter Jug Replacement Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Use

- 9.1.2. Outdoor Use

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Capacity below 2L

- 9.2.2. Capacity 2L-3L

- 9.2.3. Capacity above 3L

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Water Filter Jug Replacement Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Use

- 10.1.2. Outdoor Use

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Capacity below 2L

- 10.2.2. Capacity 2L-3L

- 10.2.3. Capacity above 3L

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PUR

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BWT

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cleansui

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bobble

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZEROWATER

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Laica

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aqua Optima

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Electrolux

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terraillon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PHILIPS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Joyoung

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Seychelle Environmental

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 PUR

List of Figures

- Figure 1: Global Water Filter Jug Replacement Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Water Filter Jug Replacement Revenue (million), by Application 2024 & 2032

- Figure 3: North America Water Filter Jug Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Water Filter Jug Replacement Revenue (million), by Types 2024 & 2032

- Figure 5: North America Water Filter Jug Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Water Filter Jug Replacement Revenue (million), by Country 2024 & 2032

- Figure 7: North America Water Filter Jug Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Water Filter Jug Replacement Revenue (million), by Application 2024 & 2032

- Figure 9: South America Water Filter Jug Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Water Filter Jug Replacement Revenue (million), by Types 2024 & 2032

- Figure 11: South America Water Filter Jug Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Water Filter Jug Replacement Revenue (million), by Country 2024 & 2032

- Figure 13: South America Water Filter Jug Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Water Filter Jug Replacement Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Water Filter Jug Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Water Filter Jug Replacement Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Water Filter Jug Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Water Filter Jug Replacement Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Water Filter Jug Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Water Filter Jug Replacement Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Water Filter Jug Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Water Filter Jug Replacement Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Water Filter Jug Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Water Filter Jug Replacement Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Water Filter Jug Replacement Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Water Filter Jug Replacement Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Water Filter Jug Replacement Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Water Filter Jug Replacement Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Water Filter Jug Replacement Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Water Filter Jug Replacement Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Water Filter Jug Replacement Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Water Filter Jug Replacement Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Water Filter Jug Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Water Filter Jug Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Water Filter Jug Replacement Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Water Filter Jug Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Water Filter Jug Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Water Filter Jug Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Water Filter Jug Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Water Filter Jug Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Water Filter Jug Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Water Filter Jug Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Water Filter Jug Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Water Filter Jug Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Water Filter Jug Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Water Filter Jug Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Water Filter Jug Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Water Filter Jug Replacement Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Water Filter Jug Replacement Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Water Filter Jug Replacement Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Water Filter Jug Replacement Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Water Filter Jug Replacement?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Water Filter Jug Replacement?

Key companies in the market include PUR, BWT, Cleansui, Bobble, ZEROWATER, Laica, Aqua Optima, Electrolux, Terraillon, PHILIPS, Joyoung, Seychelle Environmental.

3. What are the main segments of the Water Filter Jug Replacement?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Water Filter Jug Replacement," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Water Filter Jug Replacement report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Water Filter Jug Replacement?

To stay informed about further developments, trends, and reports in the Water Filter Jug Replacement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence