Key Insights

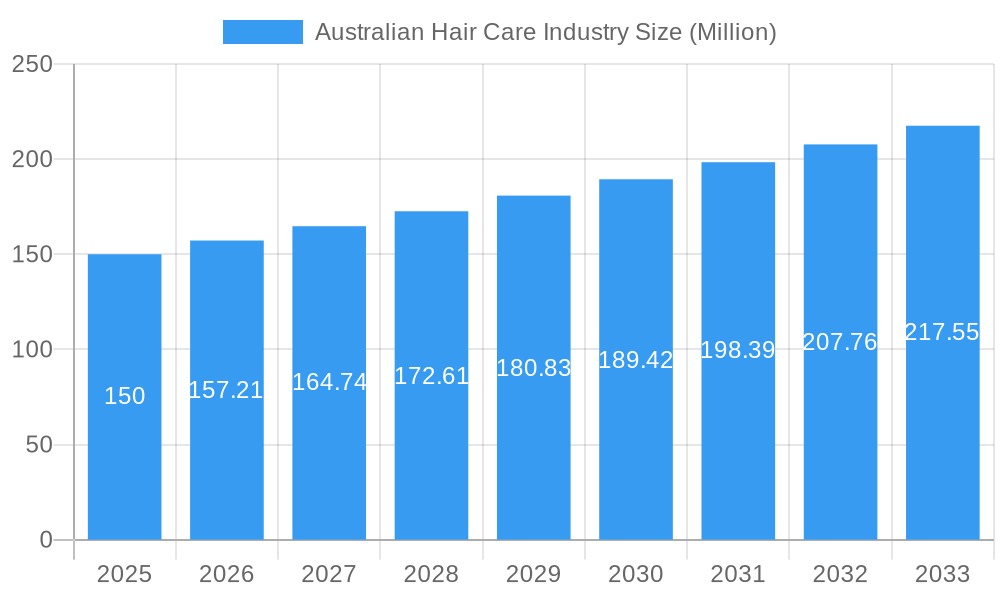

The Australian hair care market, a significant segment of the broader Asia-Pacific region, is experiencing robust growth, projected to reach a substantial market size. While precise figures for Australia are unavailable, leveraging the provided global CAGR of 4.82% and considering Australia's high per capita spending on personal care products, a conservative estimate for the Australian market size in 2025 would be around $150 million. This is based on the assumption that the Australian market is a significant portion of the Asia-Pacific market, given its high standard of living and consumer spending habits. Growth drivers include increasing disposable incomes, rising awareness of hair health and styling trends, and the expanding popularity of natural and organic hair care products. The market is segmented by product type (shampoos, conditioners, hair colorants, and other treatments), and distribution channels (hypermarkets/supermarkets, convenience stores, specialty stores, and online retailers). The dominance of online channels is likely to increase further, mirroring global trends. Key players such as L'Oréal, Unilever, and Procter & Gamble, alongside smaller, niche brands specializing in natural and organic products, compete in this dynamic market.

Australian Hair Care Industry Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, driven by innovation in product formulations, increasing demand for specialized hair care solutions addressing specific hair types and concerns (e.g., hair loss, damage repair), and growing consumer preference for sustainable and ethically sourced products. However, potential restraints include fluctuating raw material costs and the competitive landscape, requiring companies to invest in research and development, brand building, and effective marketing strategies to maintain their market share. Further segmentation analysis would reveal more granular insights into specific product categories and distribution channels within the Australian market. The increasing adoption of e-commerce and the influence of social media marketing are important considerations influencing future growth trajectories.

Australian Hair Care Industry Company Market Share

Australian Hair Care Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Australian hair care industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. This crucial resource is essential for businesses, investors, and stakeholders seeking to understand and navigate this dynamic market. The market is valued at $XX Million in 2025 and is projected to reach $XX Million by 2033.

Australian Hair Care Industry Market Structure & Competitive Dynamics

The Australian hair care market is characterized by a mix of multinational giants and smaller, specialized brands. Market concentration is moderate, with several key players holding significant market share, but numerous smaller businesses also contributing. The industry exhibits a dynamic innovation ecosystem, with continuous launches of new products and technologies focusing on natural ingredients, specialized formulations (like anti-dandruff or volumizing), and sustainable packaging. The regulatory framework, while generally supportive of fair trade practices, is subject to periodic updates and scrutiny. Product substitutes, such as DIY hair care solutions or alternative styling methods, present a level of competition. End-user trends increasingly favor natural and ethically sourced products, personalized hair care regimens, and convenient online purchasing options. M&A activity in the sector has been moderate, with deal values ranging from $XX Million to $XX Million in recent years, reflecting both consolidation and expansion strategies. Key players include Henkel AG & Co KGaA, Amway Corporation, Procter & Gamble, Unilever PLC, Sisley Paris, Nak Hair, L'Oreal SA, Johnson & Johnson Services Inc, Kao Corporation, and OC Naturals. Market share data for these players is detailed within the full report.

- Market Concentration: Moderate, with top 5 players holding approximately XX% market share.

- M&A Activity: Several transactions valued between $XX Million and $XX Million in the past five years.

- Innovation: Strong focus on natural ingredients, specialized formulations, and sustainable practices.

- Regulatory Landscape: Generally supportive, with ongoing updates and scrutiny.

Australian Hair Care Industry Industry Trends & Insights

The Australian hair care market exhibits robust growth, driven by increasing consumer disposable income, rising awareness of hair health, and the growing popularity of personalized hair care. Technological advancements, particularly in formulation and packaging, continue to shape the industry landscape. Consumers display a growing preference for natural, organic, and ethically sourced products, impacting demand for sustainable packaging solutions. The competitive dynamics are intense, with established players constantly innovating and smaller niche brands disrupting the market. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at XX%, indicating strong market expansion. Market penetration of premium hair care products is steadily increasing, driven by growing consumer demand for high-quality, specialized treatments. Online sales channels are experiencing rapid growth, contributing significantly to the overall market expansion.

Dominant Markets & Segments in Australian Hair Care Industry

The Australian hair care market shows significant growth across various segments.

By Type: Shampoos and conditioners continue to be the largest segments, driven by their everyday use and broad appeal. Hair colorants are experiencing steady growth, boosted by evolving consumer preferences for hair coloring and styling. The "Other Types" segment, including hair styling products, treatments, and accessories, demonstrates strong growth, reflecting the diverse needs of consumers.

By Distribution Channel: Hypermarkets and supermarkets remain the dominant distribution channel, benefiting from wide accessibility and established customer bases. Online stores are rapidly gaining market share, driven by increasing online shopping habits and wider product selection. Speciality stores and convenience stores cater to specific customer segments and offer convenience.

Key Drivers:

- Economic factors: Rising disposable incomes and increased spending on personal care products fuel the market.

- Technological advancements: Innovations in formulation, packaging, and distribution channels shape the market.

- Consumer preferences: Growing demand for natural, ethical, and personalized hair care solutions drives expansion.

Australian Hair Care Industry Product Innovations

Recent years have witnessed a surge in innovative hair care products in Australia, driven by technological advancements and evolving consumer needs. Dercos by Vichy's anti-dandruff shampoo, Epres's Biodiffusion technology-based treatments, and David Mallett's natural product lines illustrate the focus on addressing specific hair concerns and delivering effective solutions. These innovations target specific consumer segments, catering to diverse hair types and needs. The market trend is toward science-backed formulations, sustainable ingredients, and convenient application methods.

Report Segmentation & Scope

This report segments the Australian hair care market by product type (Shampoo, Conditioner, Hair Colorants, Other Types) and distribution channel (Hypermarkets/Supermarkets, Convenience Stores, Speciality Stores, Online Stores, Other Distribution Channels). Each segment's market size, growth projections, and competitive landscape are analyzed in detail. The report includes forecasts for each segment over the period 2025-2033, providing insights into market dynamics and future opportunities.

Key Drivers of Australian Hair Care Industry Growth

The Australian hair care market's growth is fueled by a combination of factors: rising disposable incomes enabling increased spending on personal care; consumer preference shifts towards natural and ethical products; continuous innovation in product formulation and packaging; expansion of online retail channels boosting accessibility and convenience; and supportive government regulations promoting fair competition and consumer protection.

Challenges in the Australian Hair Care Industry Sector

The Australian hair care industry faces several challenges: intense competition from both established international brands and emerging niche players; fluctuating raw material costs and supply chain disruptions potentially impacting margins; stringent regulatory requirements necessitate compliance costs; and changing consumer preferences require constant adaptation.

Leading Players in the Australian Hair Care Industry Market

- Henkel AG & Co KGaA

- Amway Corporation

- Procter & Gamble

- Unilever PLC

- Sisley Paris

- Nak Hair

- L'Oreal SA

- Johnson & Johnson Services Inc

- Kao Corporation

- OC Naturals

- *List Not Exhaustive

Key Developments in Australian Hair Care Industry Sector

- September 2022: David Mallett launched new styling products and a "Pure" line.

- October 2022: Epres Brand launched two hair care products using Biodiffusion technology.

- August 2023: Dercos by Vichy launched a dermatological anti-dandruff shampoo line.

Strategic Australian Hair Care Industry Market Outlook

The Australian hair care industry presents significant growth potential, particularly in the segments of natural, sustainable, and personalized products. Strategic opportunities exist for businesses focusing on innovation, effective marketing, and efficient distribution channels. Expanding online presence and catering to diverse consumer needs will be crucial for future success. The market is poised for continued expansion, driven by technological advancements and evolving consumer preferences.

Australian Hair Care Industry Segmentation

-

1. Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Colorants

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Australian Hair Care Industry Segmentation By Geography

- 1. Australia

Australian Hair Care Industry Regional Market Share

Geographic Coverage of Australian Hair Care Industry

Australian Hair Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural and Organic Hare care Products; Increasing Consumption of Shampoos

- 3.3. Market Restrains

- 3.3.1. Problems Associated with the use of Synthetic Products

- 3.4. Market Trends

- 3.4.1. Shampoo Holds a Prominent Share in the Australian Hair Care Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australian Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Colorants

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amway Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Procter & Gamble

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sisley Paris

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nak Hair

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'Oreal SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson & Johnson Services Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kao Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OC Naturals*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Australian Hair Care Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australian Hair Care Industry Share (%) by Company 2025

List of Tables

- Table 1: Australian Hair Care Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australian Hair Care Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australian Hair Care Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australian Hair Care Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Australian Hair Care Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australian Hair Care Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australian Hair Care Industry?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the Australian Hair Care Industry?

Key companies in the market include Henkel AG & Co KGaA, Amway Corporation, Procter & Gamble, Unilever PLC, Sisley Paris, Nak Hair, L'Oreal SA, Johnson & Johnson Services Inc, Kao Corporation, OC Naturals*List Not Exhaustive.

3. What are the main segments of the Australian Hair Care Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural and Organic Hare care Products; Increasing Consumption of Shampoos.

6. What are the notable trends driving market growth?

Shampoo Holds a Prominent Share in the Australian Hair Care Market.

7. Are there any restraints impacting market growth?

Problems Associated with the use of Synthetic Products.

8. Can you provide examples of recent developments in the market?

August 2023: Dercos by Vichy Laboratories launched its dermatological anti-dandruff shampoo line in Australia, targeting the core causes of dandruff with a proven formula. The product is available in different dermatological warehouses across Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australian Hair Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australian Hair Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australian Hair Care Industry?

To stay informed about further developments, trends, and reports in the Australian Hair Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence