Key Insights

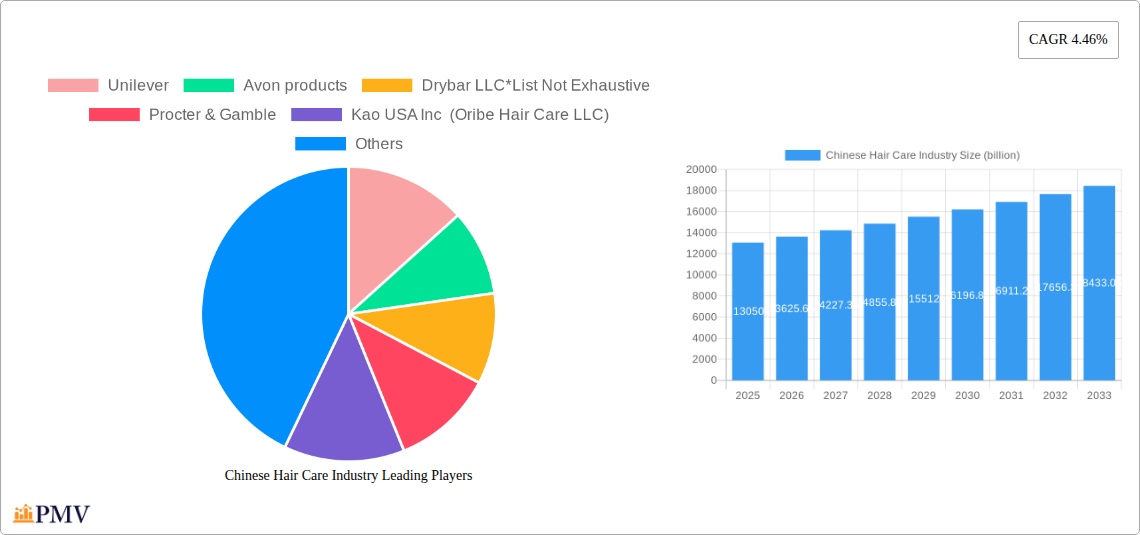

The Chinese Hair Care Industry is poised for significant expansion, projected to reach a substantial market size of $13.05 billion by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.46%, indicating consistent and robust market performance throughout the forecast period of 2025-2033. This upward trajectory is primarily driven by evolving consumer preferences towards premium and specialized hair care products, a growing awareness of hair health and styling, and the increasing disposable income of Chinese consumers. The market is witnessing a pronounced shift towards higher-value segments like specialized conditioners and styling products, reflecting a consumer desire for targeted solutions and enhanced hair aesthetics. Furthermore, the burgeoning e-commerce landscape in China is playing a pivotal role, offering unprecedented accessibility to a wide array of brands and product innovations, thereby fueling market penetration and consumer engagement.

Chinese Hair Care Industry Market Size (In Billion)

The market's expansion is further propelled by innovative product formulations, including those addressing concerns like hair loss, scalp health, and natural ingredients. Key trends observed include a surge in demand for sustainable and organic hair care options, aligning with broader environmental consciousness among Chinese consumers. However, the industry also faces certain restraints, such as intense market competition and the need for continuous product innovation to meet rapidly changing consumer demands. Despite these challenges, the distribution channels are diversifying, with online stores emerging as a dominant force, complemented by traditional hypermarkets, supermarkets, and specialty stores catering to different consumer segments. Major global and local players are actively investing in research and development, strategic partnerships, and aggressive marketing campaigns to capture a significant share of this dynamic and lucrative market.

Chinese Hair Care Industry Company Market Share

Chinese Hair Care Industry Market Structure & Competitive Dynamics

The Chinese hair care market, valued at an estimated 50 billion in the base year 2025, exhibits a moderately concentrated structure with key players like Procter & Gamble, Unilever, and L'Oreal Professionnel holding significant market share. While not entirely dominated by a few giants, the presence of strong international brands, alongside emerging domestic players such as Kaijoe Technology Co Ltd, indicates a dynamic competitive landscape. Innovation ecosystems are flourishing, driven by R&D investments in advanced formulations and sustainable ingredients, with estimated innovation R&D spending reaching 5 billion by 2025. Regulatory frameworks, primarily managed by the National Medical Products Administration (NMPA), are evolving to ensure product safety and efficacy, impacting product development timelines and market entry strategies. Product substitutes, though present in the broader beauty and personal care sector, have a limited direct impact on the core hair care market due to specialized consumer needs and product efficacy demands. End-user trends are increasingly leaning towards personalized solutions, premiumization, and natural ingredients, pushing companies to adapt their product portfolios and marketing approaches. Mergers and acquisitions (M&A) activities, while not yet at the scale of some mature markets, are anticipated to grow, with estimated M&A deal values projected to reach 2 billion by 2033, as larger companies seek to acquire innovative startups or expand their market reach.

Chinese Hair Care Industry Industry Trends & Insights

The Chinese hair care industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is fueled by several key market growth drivers. A rising disposable income among the burgeoning middle class has significantly increased consumer spending on premium and specialized hair care products. Urbanization further contributes to this trend, with greater access to information and retail channels driving demand. Technological disruptions are reshaping the industry, with advancements in ingredient science leading to the development of personalized hair treatments and solutions for specific hair concerns such as hair loss and scalp health. The integration of AI and big data in product development and recommendation engines is also gaining traction, offering consumers tailored product suggestions. Consumer preferences are rapidly evolving, with a strong inclination towards natural, organic, and sustainable ingredients. There's a growing demand for products that address environmental concerns and promote overall hair health beyond basic cleansing. E-commerce platforms have played a pivotal role in accelerating market penetration, making a diverse range of products accessible to consumers across all tiers. The competitive dynamics are intensifying, with both international giants and agile domestic brands vying for market share. Intense promotional activities, influencer marketing, and a focus on experiential retail are becoming commonplace as companies strive to capture consumer attention. The market penetration for specialized hair care treatments, such as anti-hair loss solutions, is estimated to reach 60% by 2033, indicating a significant shift in consumer priorities. The online sales channel is expected to account for over 45% of total market revenue by 2028, highlighting the digital shift in consumer purchasing habits. The increasing adoption of professional salon treatments at home, driven by convenience and cost-effectiveness, also represents a significant growth avenue.

Dominant Markets & Segments in Chinese Hair Care Industry

The Chinese hair care industry's dominance is multifaceted, with distinct leaders across various segments.

Type Segment Dominance

- Shampoo: This segment continues to be the largest and most dominant within the Chinese hair care market. Its sheer volume of sales and widespread consumer adoption, driven by daily necessity and evolving product formulations addressing specific concerns like dandruff, oil control, and hair damage, solidify its leading position. The market size for shampoo is estimated to reach 35 billion by 2025.

- Key Drivers: High consumer frequency of use, broad product availability, and continuous innovation in specialized formulations (e.g., sulfate-free, keratin-infused).

- Conditioner: Experiencing significant growth, conditioners are increasingly viewed as essential companions to shampoos, driven by a growing awareness of the benefits for hair health and styling. The demand for moisturizing, strengthening, and color-protecting conditioners is particularly strong.

- Key Drivers: Rising consumer education on hair care routines, desire for smoother and manageable hair, and the synergistic relationship with shampoo usage.

- Hair Spray: While a smaller segment compared to shampoos and conditioners, hair sprays and other styling products are witnessing growth driven by the increasing influence of fashion trends and social media. Demand for long-lasting hold and heat-protection features is prominent.

- Key Drivers: Influence of celebrity and influencer culture, growing demand for professional styling at home, and innovation in flexible hold and heat-resistant formulas.

- Others: This category, encompassing hair masks, serums, scalp treatments, and hair oils, is the fastest-growing segment. Consumers are increasingly investing in targeted treatments for specific hair and scalp issues, reflecting a move towards a more holistic and personalized approach to hair care.

- Key Drivers: Growing consumer awareness of scalp health, demand for advanced solutions for hair loss and damage, and the availability of premium and specialized treatments.

Distribution Channel Dominance

- Online Stores: This channel has emerged as the undisputed leader in the Chinese hair care market. Its unparalleled reach, convenience, competitive pricing, and vast product selection make it the preferred choice for a majority of consumers. The ease of discovering new brands and reading reviews further bolsters its dominance.

- Key Drivers: Ubiquitous smartphone penetration, robust logistics infrastructure, widespread adoption of e-commerce platforms (e.g., Tmall, JD.com), and the influence of live streaming sales.

- Hypermarket/Supermarket: These traditional retail channels maintain a significant presence, particularly for mass-market brands and staple hair care products. Their convenience for one-stop shopping and visibility to a broad consumer base ensure continued relevance.

- Key Drivers: Broad consumer reach, impulse purchase opportunities, and the availability of everyday essential hair care items.

- Specialty Stores: High-end beauty retailers and brand-specific stores cater to consumers seeking premium and specialized products, often offering personalized consultations and exclusive brands. Their dominance lies in capturing the high-value segment of the market.

- Key Drivers: Demand for premium and niche brands, personalized shopping experiences, and access to expert advice.

- Convenience Stores: While not a primary channel for substantial hair care purchases, convenience stores play a role in offering basic necessities and emergency purchases of essential hair care items.

- Key Drivers: Accessibility and immediate availability for basic needs.

- Other Distribution Channels: This category includes professional salons and direct-to-consumer (DTC) channels, which are gaining traction for premium and customized hair care solutions.

Chinese Hair Care Industry Product Innovations

Product innovation in the Chinese hair care industry is increasingly focused on personalization, efficacy, and sustainability. Advancements in biotechnology are enabling the development of targeted treatments for specific hair and scalp concerns, such as advanced anti-hair loss formulations and personalized scalp care solutions. The integration of natural and organic ingredients, driven by consumer demand for safer and environmentally friendly products, is a key trend. Furthermore, the industry is witnessing the rise of smart beauty devices and at-home treatment kits that mimic professional salon experiences, offering convenience and enhanced results. Competitive advantages are being built on unique ingredient formulations, patented technologies, and strong brand storytelling that resonates with evolving consumer values.

Report Segmentation & Scope

This report meticulously segments the Chinese hair care market to provide actionable insights. The Type segmentation includes Shampoo, Conditioner, Hair Spray, and Others (e.g., hair masks, serums, scalp treatments), each analyzed for market size, growth projections, and competitive dynamics. For instance, the "Others" segment is projected to witness a CAGR of 10% from 2025-2033, reaching an estimated market value of 15 billion by 2033. The Distribution Channel segmentation covers Hypermarket/Supermarket, Convenience Stores, Specialty Stores, Online Stores, and Other Distribution Channels, with online channels expected to dominate, accounting for an estimated 45% of the market by 2028, growing at a CAGR of 9.5%.

Key Drivers of Chinese Hair Care Industry Growth

The growth of the Chinese hair care industry is propelled by a confluence of potent factors. Economically, rising disposable incomes and a growing middle class are fueling increased consumer expenditure on premium and specialized hair care products. Technologically, advancements in ingredient science, biotechnology, and digital platforms are enabling the creation of innovative and personalized solutions. Regulatory support, with evolving standards that prioritize product safety and efficacy, fosters consumer trust and encourages further investment. The increasing adoption of e-commerce and digital marketing strategies allows for wider market reach and targeted consumer engagement.

Challenges in the Chinese Hair Care Industry Sector

Despite its growth trajectory, the Chinese hair care industry faces several challenges. Intense competition, both from established global brands and agile domestic players, necessitates continuous innovation and aggressive marketing strategies. Navigating evolving regulatory frameworks, particularly concerning product claims and ingredient approvals, can pose compliance hurdles and increase time-to-market. Supply chain disruptions, exacerbated by global events and logistics complexities, can impact product availability and cost. Furthermore, counterfeiting and intellectual property infringement remain persistent concerns for brands operating in the Chinese market, requiring robust protective measures and legal recourse.

Leading Players in the Chinese Hair Care Industry Market

- Procter & Gamble

- Unilever

- L'Oreal Professionnel

- Kao USA Inc (Oribe Hair Care LLC)

- Beiersdorf AG

- John Paul Mitchell Systems

- Avon Products

- Drybar LLC

- Kaijoe Technology Co Ltd

Key Developments in Chinese Hair Care Industry Sector

- 2023 Q4: Launch of a new line of sulfate-free shampoos by Unilever, targeting sensitive scalps and catering to the rising demand for natural ingredients.

- 2024 Q1: Procter & Gamble expands its Pantene Pro-V range with advanced anti-hair loss serums, leveraging biotechnology for enhanced efficacy.

- 2024 Q2: L'Oreal Professionnel introduces a subscription-based personalized hair care program through its online channels, enhancing customer loyalty and data collection.

- 2024 Q3: Kaijoe Technology Co Ltd announces a strategic partnership with a leading e-commerce platform to expand its direct-to-consumer reach for innovative hair styling tools.

- 2025 Q1: Kao USA Inc (Oribe Hair Care LLC) focuses on expanding its distribution network within premium specialty stores across major Tier 1 and Tier 2 cities.

Strategic Chinese Hair Care Industry Market Outlook

The Chinese hair care market is poised for sustained growth, driven by evolving consumer preferences for premium, personalized, and sustainable solutions. The increasing emphasis on scalp health and advanced treatment options presents significant opportunities for innovation. Strategic partnerships, the expansion of direct-to-consumer channels, and a continued focus on digital engagement will be crucial for market players. The anticipated M&A activities will likely lead to further market consolidation and the emergence of new market leaders. Embracing technological advancements and responding agilely to changing consumer demands will be paramount for achieving long-term success in this dynamic market.

Chinese Hair Care Industry Segmentation

-

1. Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Spray

- 1.4. Others

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

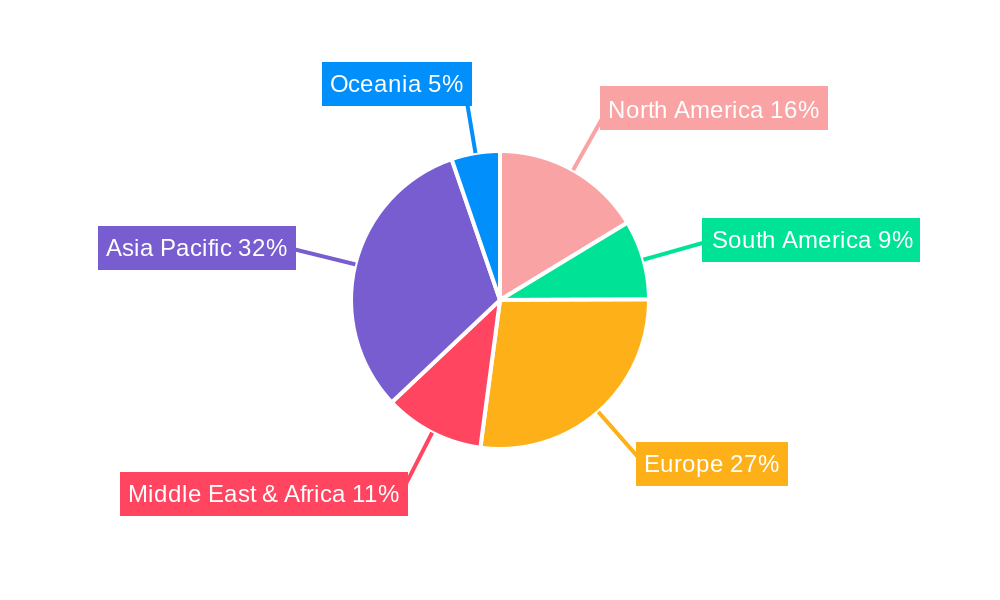

Chinese Hair Care Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Hair Care Industry Regional Market Share

Geographic Coverage of Chinese Hair Care Industry

Chinese Hair Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Skin Concerns Among Consumers; Aggressive Marketing and Advertising by Brands

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Advertisement and Promotional Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Spray

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Chinese Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Shampoo

- 6.1.2. Conditioner

- 6.1.3. Hair Spray

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Chinese Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Shampoo

- 7.1.2. Conditioner

- 7.1.3. Hair Spray

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Chinese Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Shampoo

- 8.1.2. Conditioner

- 8.1.3. Hair Spray

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Chinese Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Shampoo

- 9.1.2. Conditioner

- 9.1.3. Hair Spray

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Chinese Hair Care Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Shampoo

- 10.1.2. Conditioner

- 10.1.3. Hair Spray

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarket/Supermarket

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Unilever

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Avon products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Drybar LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Procter & Gamble

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kao USA Inc (Oribe Hair Care LLC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kaijoe Technology Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 John Paul Mitchell Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beiersdorf AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 L'Oreal Professionnel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Unilever

List of Figures

- Figure 1: Global Chinese Hair Care Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Chinese Hair Care Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Chinese Hair Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Chinese Hair Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Chinese Hair Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Chinese Hair Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Chinese Hair Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Chinese Hair Care Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Chinese Hair Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Chinese Hair Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Chinese Hair Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Chinese Hair Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Chinese Hair Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Chinese Hair Care Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Chinese Hair Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Chinese Hair Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Chinese Hair Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Chinese Hair Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Chinese Hair Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Chinese Hair Care Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Chinese Hair Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Chinese Hair Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Chinese Hair Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Chinese Hair Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Chinese Hair Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Chinese Hair Care Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Chinese Hair Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Chinese Hair Care Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Chinese Hair Care Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Chinese Hair Care Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Chinese Hair Care Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Hair Care Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Chinese Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Chinese Hair Care Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Chinese Hair Care Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Chinese Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Chinese Hair Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Chinese Hair Care Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Chinese Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Chinese Hair Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Chinese Hair Care Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Chinese Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Chinese Hair Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Chinese Hair Care Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Chinese Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Chinese Hair Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Chinese Hair Care Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Chinese Hair Care Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Chinese Hair Care Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Chinese Hair Care Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Hair Care Industry?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the Chinese Hair Care Industry?

Key companies in the market include Unilever, Avon products, Drybar LLC*List Not Exhaustive, Procter & Gamble, Kao USA Inc (Oribe Hair Care LLC), Kaijoe Technology Co Ltd, John Paul Mitchell Systems, Beiersdorf AG, L'Oreal Professionnel.

3. What are the main segments of the Chinese Hair Care Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Skin Concerns Among Consumers; Aggressive Marketing and Advertising by Brands.

6. What are the notable trends driving market growth?

Increasing Expenditure on Advertisement and Promotional Activities.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Hair Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Hair Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Hair Care Industry?

To stay informed about further developments, trends, and reports in the Chinese Hair Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence