Key Insights

Qatar's luxury goods market is projected for substantial growth, forecast to reach $563.28 million by 2025. This expansion is fueled by a growing affluent demographic with significant disposable income, coupled with a strong cultural affinity for premium products. The market is expected to experience a Compound Annual Growth Rate (CAGR) of 5.38% through 2033, underscoring sustained consumer demand. Key sectors, including apparel, footwear, and jewelry, are anticipated to drive this growth, supported by new product introductions and exclusive brand collections. The rise of e-commerce, alongside established retail channels, is enhancing market accessibility and offering diverse purchasing options for luxury consumers.

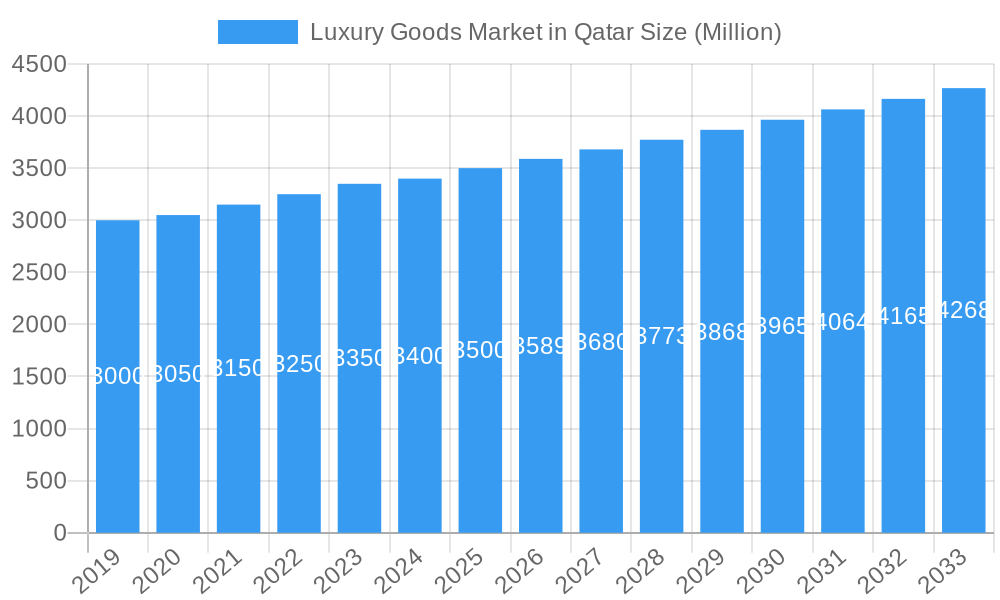

Luxury Goods Market in Qatar Market Size (In Million)

Key trends influencing Qatar's luxury sector include a growing demand for personalized and bespoke experiences, catering to high-net-worth individuals. Furthermore, ethically sourced and sustainable luxury goods are gaining popularity, reflecting heightened consumer consciousness. While robust consumer spending and an improving retail infrastructure support market expansion, global economic volatility and currency fluctuations present potential challenges. Nevertheless, Qatar's strong economic foundation and its status as a regional luxury hub are expected to counterbalance these risks, ensuring continued market development.

Luxury Goods Market in Qatar Company Market Share

Unveiling the Premium Landscape: Qatar Luxury Goods Market Report 2019-2033

Embark on an in-depth exploration of Qatar's dynamic luxury goods market, a burgeoning hub for high-net-worth individuals and discerning consumers. This comprehensive report, spanning the historical period of 2019-2024 and projecting growth through 2033, provides unparalleled insights into the strategies, trends, and opportunities shaping this opulent sector. With a base year of 2025 and an estimated year also of 2025, the analysis delves into market segmentation, competitive landscapes, and future growth trajectories. Discover key market drivers, emerging challenges, and the influential players dominating this lucrative industry. For industry professionals seeking to capitalize on Qatar's affluent consumer base, this report is an indispensable resource for strategic decision-making and market penetration.

Luxury Goods Market in Qatar Market Structure & Competitive Dynamics

The Qatar luxury goods market is characterized by a concentrated yet dynamic competitive environment, driven by a select group of global powerhouses and emerging regional players. Key industry leaders such as LVMH, Kering, Richemont, and Chanel command significant market share, leveraging their extensive brand portfolios and premium retail experiences. Giorgio Armani, Hugo Boss, Prada SpA, PVH, and Puig also contribute to the competitive intensity across various luxury segments. While official market share figures are not publicly disclosed, it is estimated that the top five players hold over 60% of the total market value. Innovation ecosystems are thriving, fueled by significant investments in exclusive product development, bespoke services, and seamless omnichannel strategies. Regulatory frameworks, though generally supportive of foreign investment, necessitate careful navigation regarding import duties and local business practices. Product substitutes, while limited in the ultra-luxury segment, can emerge from highly curated collections of aspirational brands or unique artisanal creations. End-user trends indicate a strong preference for personalized experiences, sustainable luxury, and digital engagement, influencing brand strategies and product offerings. Mergers & Acquisitions (M&A) activities, while less frequent in the direct Qatar market, are indicative of global consolidation trends that indirectly impact the offerings and competitive positioning of brands available in Qatar. Estimated M&A deal values in the global luxury sector regularly exceed several billion dollars, influencing brand valuations and strategic partnerships.

- Market Concentration: Dominated by a few global luxury conglomerates.

- Innovation Ecosystems: Focus on exclusive product development, personalization, and digital integration.

- Regulatory Frameworks: Generally favorable, with attention to import regulations and business compliance.

- Product Substitutes: Primarily high-end artisanal goods and aspirational brands.

- End-User Trends: Growing demand for personalization, sustainability, and digital convenience.

- M&A Activities: Global consolidation impacts brand strategies and market accessibility.

Luxury Goods Market in Qatar Industry Trends & Insights

The Qatar luxury goods market is experiencing robust growth, projected to reach XX Billion by 2033, driven by a confluence of economic prosperity, a young and affluent demographic, and strategic government initiatives aimed at diversifying the economy and boosting tourism. The Compound Annual Growth Rate (CAGR) is estimated to be XX% during the forecast period of 2025–2033. This upward trajectory is underpinned by increasing disposable incomes, a burgeoning high-net-worth individual (HNWI) population, and a strong cultural appreciation for quality, exclusivity, and heritage in luxury products. Technological disruptions are playing a pivotal role, with luxury brands increasingly investing in sophisticated e-commerce platforms, virtual try-on experiences, and personalized digital marketing campaigns to cater to the evolving preferences of Qatari consumers. The seamless integration of online and offline retail channels, known as omnichannel retail, is becoming paramount, offering consumers the flexibility to browse, purchase, and receive luxury items with unparalleled convenience.

Consumer preferences are shifting towards experiential luxury, with an emphasis on unique services, private shopping events, and limited-edition collections. There is also a growing awareness and demand for sustainable luxury, prompting brands to highlight their ethical sourcing, eco-friendly production methods, and social responsibility initiatives. This trend is particularly resonant among the younger generation of luxury consumers in Qatar. Competitive dynamics are intensifying as global luxury houses vie for market dominance, introducing new collections, opening flagship stores, and enhancing their customer engagement strategies. The market penetration of luxury goods remains high, particularly in key segments like jewelry, watches, and high-end fashion, reflecting the strong purchasing power and sophisticated taste of Qatari consumers. The strategic positioning of Qatar as a regional hub for luxury retail, further amplified by major events and ongoing infrastructure development, continues to attract global brands and drive market expansion. The average transaction value for luxury goods in Qatar is estimated to be XX% higher than regional averages, underscoring the premium nature of the market.

Dominant Markets & Segments in Luxury Goods Market in Qatar

The Qatar luxury goods market is characterized by the dominance of specific segments and distribution channels, reflecting deep-seated consumer preferences and strategic brand placements. Among the Types of luxury goods, Jewellery and Watches consistently hold the largest market share, estimated at XX% and XX% respectively, driven by a strong cultural affinity for ornate adornment and the timeless appeal of precision timepieces. These categories benefit from significant demand for both traditional designs and contemporary, avant-garde pieces. Clothing and Apparel follows closely, accounting for approximately XX% of the market, with a strong emphasis on haute couture and designer ready-to-wear. Bags represent another significant segment, with an estimated XX% market share, particularly among women, who seek iconic and functional luxury accessories.

In terms of Distribution Channels, Single Brand Stores are the most dominant, capturing an estimated XX% of the market. These flagship boutiques offer an immersive brand experience, exclusive collections, and personalized service, which are highly valued by Qatari luxury consumers. Multi Brand Stores also play a crucial role, providing a curated selection of various luxury labels and attracting consumers seeking variety and comparison. Their market share is estimated at XX%. The Online Stores segment is rapidly growing, driven by digital advancements and the convenience it offers, with an estimated market share of XX%. This channel is particularly effective for reaching a wider audience and catering to younger demographics. Other Distribution Channels, including duty-free outlets and luxury department store concessions, contribute the remaining XX% of the market.

The Gender segmentation clearly favors Female consumers, who are estimated to account for XX% of the luxury goods market. This dominance is attributed to their higher propensity for purchasing fashion apparel, handbags, jewelry, and beauty products, which are key drivers of luxury spending. The Male segment, while smaller at an estimated XX%, is experiencing significant growth, particularly in watches, high-end apparel, and leather goods, driven by increasing disposable incomes and a growing appreciation for personal style. Economic policies in Qatar, such as tax incentives for foreign businesses and investments in high-end retail infrastructure, have been instrumental in fostering the growth of these dominant segments. The development of luxury shopping destinations and the presence of international airports further bolster the market's appeal and accessibility.

- Dominant Types: Jewellery, Watches, Clothing and Apparel, Bags.

- Key Drivers for Jewellery & Watches: Cultural significance, investment value, desire for exclusivity.

- Dominant Distribution Channels: Single Brand Stores, Multi Brand Stores, Online Stores.

- Key Drivers for Single Brand Stores: Immersive brand experience, personalized service, exclusive offerings.

- Dominant Gender Segment: Female consumers, driven by fashion, accessories, and beauty purchases.

- Growing Gender Segment: Male consumers, with increasing demand for timepieces, apparel, and leather goods.

- Economic Policies: Tax incentives and infrastructure development supporting luxury retail.

Luxury Goods Market in Qatar Product Innovations

Product innovations in Qatar's luxury goods market are increasingly focused on personalization, technological integration, and sustainability. Brands are leveraging advanced manufacturing techniques and bespoke craftsmanship to offer unique, made-to-order items, especially in jewelry and watches, catering to the discerning tastes of Qatari clientele. The integration of smart technology into traditional luxury items, such as smartwatches with exclusive interfaces and high-end fashion accessories with embedded digital features, is gaining traction. Furthermore, there is a growing emphasis on the use of ethically sourced materials and eco-friendly production processes, appealing to the environmentally conscious segment of the market. These innovations not only enhance product desirability but also provide a significant competitive advantage by aligning with evolving consumer values and market demands.

Report Segmentation & Scope

This report provides a granular analysis of the Qatar luxury goods market, segmented across key categories to offer comprehensive insights. The Type segmentation includes: Clothing and Apparel, Footwear, Bags, Jewellery, Watches, and Other Accessories. Each of these categories is analyzed for its market size, growth projections, and competitive dynamics, with Jewellery and Watches projected to lead in market value, while Clothing and Apparel and Bags are expected to exhibit strong growth due to evolving fashion trends. The Distribution Channel segmentation encompasses: Single Brand Stores, Multi Brand Stores, Online Stores, and Other Distribution Channels. Single Brand Stores are expected to maintain their dominance due to the experiential retail preferences of consumers, while Online Stores are poised for significant expansion, driven by digital adoption. The Gender segmentation divides the market into Male and Female segments, with the Female segment currently holding a larger market share, driven by diverse purchasing habits, while the Male segment shows considerable growth potential. The scope of this report covers the historical period of 2019–2024, the base and estimated year of 2025, and projects the market trajectory from 2025 to 2033, offering a complete view of the market's evolution and future potential.

Key Drivers of Luxury Goods Market in Qatar Growth

The growth of the luxury goods market in Qatar is propelled by several key drivers. A primary economic driver is the nation's sustained high per capita income and substantial wealth accumulation, creating a large pool of affluent consumers with significant disposable income for premium purchases. Government initiatives focused on economic diversification and the development of world-class retail infrastructure, including luxury shopping districts and hospitality projects, further stimulate market expansion. Technological advancements are also crucial, with the increasing adoption of e-commerce platforms and digital marketing strategies by luxury brands enhancing accessibility and consumer engagement. Furthermore, Qatar's status as a global tourism and business hub attracts international visitors with a penchant for luxury, contributing to consistent sales growth. The growing influence of social media and digital influencers also plays a role in shaping consumer trends and preferences for luxury products.

Challenges in the Luxury Goods Market in Qatar Sector

Despite its robust growth, the luxury goods market in Qatar faces several challenges. Intense competition from a plethora of global and regional brands necessitates continuous innovation and differentiated offerings to capture and retain market share. Fluctuations in global economic conditions and oil prices, while less impactful due to Qatar's diversified economy, can indirectly influence consumer sentiment and spending patterns. Supply chain disruptions, as evidenced by global events, can impact product availability and lead times, affecting customer satisfaction. Regulatory hurdles, particularly concerning import duties and product authenticity verification, can pose operational complexities for brands. Moreover, the evolving preferences of younger luxury consumers, who increasingly prioritize experiences and sustainability over traditional ownership, require brands to adapt their strategies and product portfolios accordingly.

Leading Players in the Luxury Goods Market in Qatar Market

- Richemont

- Kering

- Giorgio Armani

- Hugo Boss

- LVMH

- Chanel

- Puig

- Joyalukkas

- PVH

- Prada SpA

- Rolex

Key Developments in Luxury Goods Market in Qatar Sector

- November 2022: Ounass, a prominent luxury e-commerce website, launched in Qatar, offering a wide array of luxury brands like Gucci, Saint Laurent, and Balenciaga, covering ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods for men, women, and children. This development significantly enhanced online accessibility to premium products.

- April 2022: Louis Vuitton, a leading global luxury fashion house, inaugurated its first store at Qatar Duty-Free in Hamad International Airport, Doha. This strategic placement provides travelers with convenient access to a comprehensive collection of leather goods, ready-to-wear, textiles, watches, jewelry, accessories, fragrances, and shoes for both men and women, capitalizing on airport traffic.

Strategic Luxury Goods Market in Qatar Market Outlook

The strategic outlook for the Qatar luxury goods market remains exceptionally positive, driven by continued economic prosperity and a growing appetite for premium products. Future growth will be accelerated by the increasing adoption of personalized luxury experiences, where brands will leverage data analytics and AI to curate bespoke offerings for individual clients. The expansion of the e-commerce landscape, coupled with innovative digital engagement strategies, will further solidify online sales channels, making luxury more accessible. Investments in sustainable luxury practices are expected to become a significant differentiator, aligning with global trends and the values of Qatari consumers. Furthermore, the ongoing development of world-class retail destinations and Qatar's ambition to be a global hub for events and tourism will continue to attract premium brands and discerning shoppers, creating sustained opportunities for market players.

Luxury Goods Market in Qatar Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single Brand Stores

- 2.2. Multi Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Gender

- 3.1. Male

- 3.2. Female

Luxury Goods Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Qatar Regional Market Share

Geographic Coverage of Luxury Goods Market in Qatar

Luxury Goods Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar becoming the Luxury Fashion Hub to Support Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Gender

- 5.3.1. Male

- 5.3.2. Female

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single Brand Stores

- 6.2.2. Multi Brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Gender

- 6.3.1. Male

- 6.3.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single Brand Stores

- 7.2.2. Multi Brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Gender

- 7.3.1. Male

- 7.3.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single Brand Stores

- 8.2.2. Multi Brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Gender

- 8.3.1. Male

- 8.3.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single Brand Stores

- 9.2.2. Multi Brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Gender

- 9.3.1. Male

- 9.3.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single Brand Stores

- 10.2.2. Multi Brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Gender

- 10.3.1. Male

- 10.3.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Richemont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hugo boss

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LVMH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puig

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Joyalukkas

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Prada SpA*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rolex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Richemont

List of Figures

- Figure 1: Global Luxury Goods Market in Qatar Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 3: North America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 7: North America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 8: North America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 9: North America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 11: South America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 15: South America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 16: South America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 17: South America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 23: Europe Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 24: Europe Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 31: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 32: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 35: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 39: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 40: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 4: Global Luxury Goods Market in Qatar Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 8: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 15: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 22: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 35: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 45: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Qatar?

The projected CAGR is approximately 5.38%.

2. Which companies are prominent players in the Luxury Goods Market in Qatar?

Key companies in the market include Richemont, Kering, Giorgio Armani, Hugo boss, LVMH, Chanel, Puig, Joyalukkas, PVH, Prada SpA*List Not Exhaustive, Rolex.

3. What are the main segments of the Luxury Goods Market in Qatar?

The market segments include Type, Distribution Channel, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 563.28 million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar becoming the Luxury Fashion Hub to Support Market Growth.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: A luxury e-commerce website, Ounass, was launched in Qatar, where consumers can shop for luxury brands, including Gucci, Saint Laurent, Balenciaga, etc. Consumers can shop for men's, women's, and children's ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Qatar?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence