Key Insights

The North American handbags market is projected for significant expansion, estimated at $14.91 billion by 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.4% from 2025 to 2033. This growth is propelled by rising disposable incomes among young professionals and millennials, alongside an increasing demand for luxury and designer accessories. The proliferation of e-commerce platforms provides convenient access to a broad spectrum of styles and brands, further stimulating market expansion. Evolving fashion trends and the introduction of innovative materials and designs consistently refresh the market, appealing to a varied consumer base. Online channels are a dominant segment, reflecting a clear shift towards digital purchasing habits. Satchels, clutches, tote bags, and sling bags are leading product categories, indicating diverse consumer preferences driven by functionality and style. Major brands such as LVMH, Kering, Tapestry, and others are leveraging these trends through strategic marketing, product diversification, and collaborations to maintain market leadership.

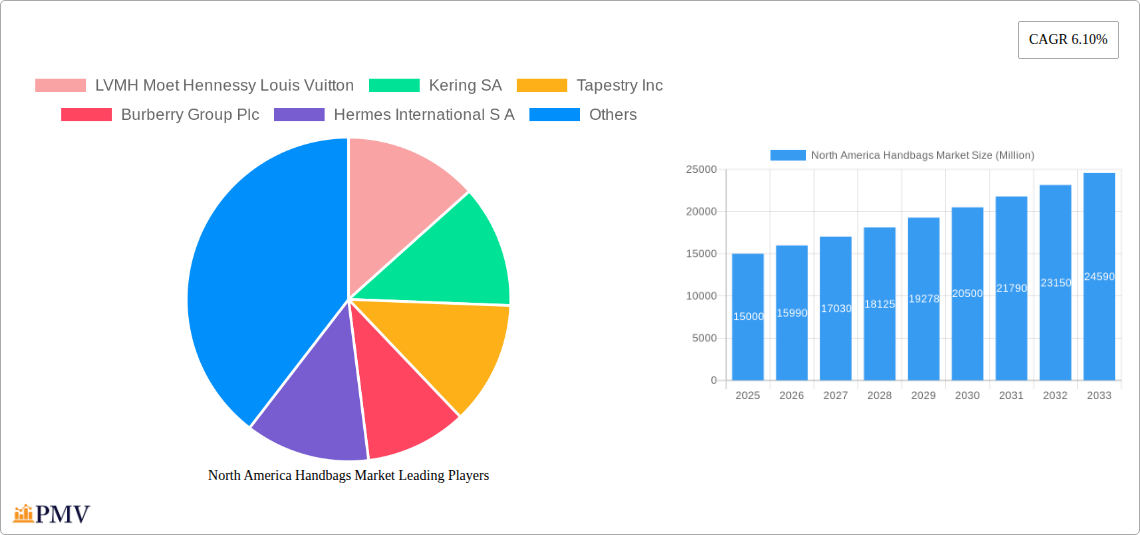

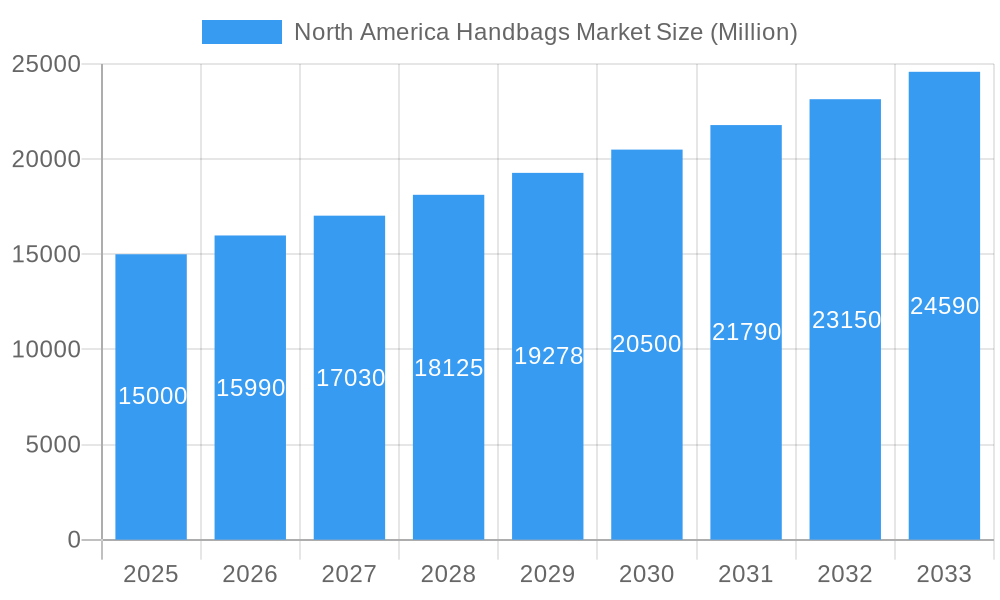

North America Handbags Market Market Size (In Billion)

However, the market confronts certain challenges, including economic volatility and inflation, which can affect consumer expenditure on discretionary items. The presence of counterfeit products and intense competition from both established and emerging brands also present hurdles. Despite these restraints, the long-term outlook for the North American handbags market remains optimistic, supported by ongoing product innovation, expanding online retail footprints, and the persistent appeal of handbags as essential fashion accessories. Regional variations across the US, Canada, and Mexico, influenced by differing economic landscapes and consumer tastes, offer opportunities for targeted strategic market entry and expansion.

North America Handbags Market Company Market Share

North America Handbags Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America handbags market, covering the period from 2019 to 2033. With a focus on market structure, competitive dynamics, industry trends, and future outlook, this report is an essential resource for businesses, investors, and anyone seeking to understand this dynamic market. The report's base year is 2025, with estimates for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024. The market is segmented by distribution channel (online stores, offline stores) and handbag type (satchel, clutch, tote bag, sling bag, others). Key players analyzed include LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, Hermes International S A, Tory Burch LLC, Pixie Mood, Michael Kors (USA) Inc, Fossil Group Inc, and Prada Holding SpA.

North America Handbags Market Structure & Competitive Dynamics

The North America handbags market exhibits a moderately concentrated structure, dominated by established luxury and accessible brands. Key players such as LVMH, Kering, and Tapestry control a significant market share, estimated at xx% collectively in 2025. However, the market also includes numerous smaller players and emerging brands, particularly in the online and vegan leather segments. The competitive landscape is characterized by intense innovation, with companies continuously introducing new designs, materials, and technologies. Regulatory frameworks related to product safety and labeling play a role, particularly concerning materials sourcing and ethical manufacturing. Product substitutes, such as backpacks and other carrying solutions, present a level of competition, though the unique fashion and utility of handbags maintain strong demand. End-user trends heavily influence market dynamics, with shifts in style preferences and consumer spending significantly impacting sales. M&A activities have been notable, although deal values vary considerably. For instance, a recent acquisition in the market valued at approximately xx Million dollars reflects the strategic interest in expanding market share and brand portfolios.

North America Handbags Market Industry Trends & Insights

The North America handbags market is poised for substantial growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by several factors: rising disposable incomes, especially amongst millennials and Gen Z; a growing preference for luxury and designer handbags; increasing e-commerce penetration and the rise of online marketplaces; and the burgeoning popularity of sustainable and ethically sourced materials like vegan leather. Technological disruptions, including advanced manufacturing techniques and personalized customization options, are further fueling market expansion. Consumer preferences for unique designs, personalized accessories, and sustainable products are also shaping industry trends. The market penetration of online retail channels continues to grow, exceeding xx% in 2025, suggesting a significant shift towards digital shopping experiences. Competitive dynamics remain intense, with established brands focusing on brand building and innovation, while smaller players leverage online channels and niche market appeal.

Dominant Markets & Segments in North America Handbags Market

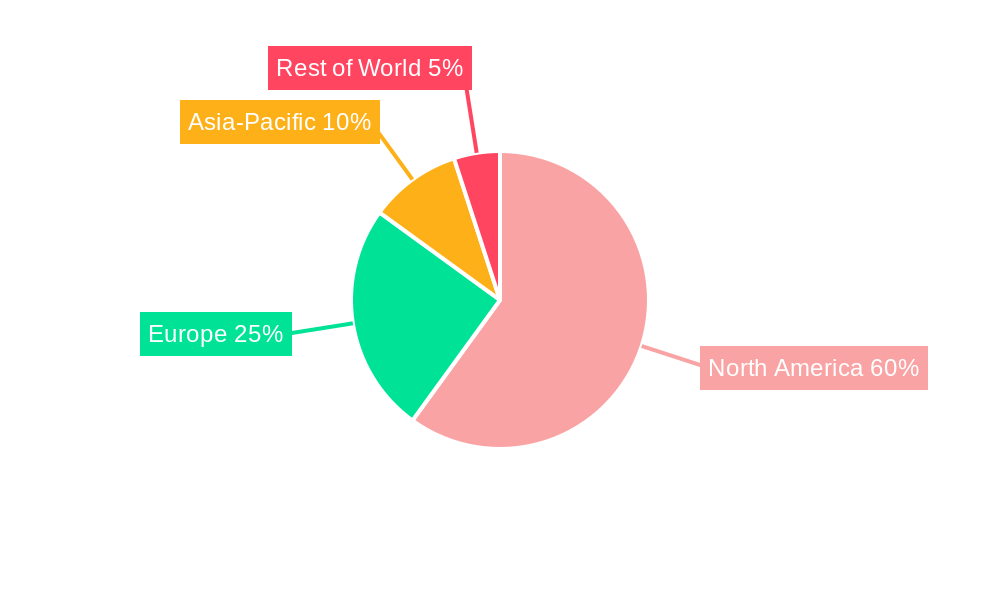

Leading Region/Country: The United States remains the dominant market within North America, owing to its larger population, higher purchasing power, and strong fashion culture. Key growth drivers include favorable economic conditions and a well-developed retail infrastructure. Canada represents a significant, though smaller, market segment.

Dominant Segment (Distribution Channel): Offline stores currently dominate the distribution channel, capturing approximately xx% of the market share in 2025. However, online stores are witnessing rapid growth and are projected to gain significant market share in the coming years. This is driven by the convenience, wider selection, and competitive pricing offered by e-commerce platforms.

Dominant Segment (Handbag Type): Tote bags and Satchels collectively hold the largest market share among different handbag types, driven by their versatility and functional appeal. Clutch bags and sling bags cater to specific fashion trends and user preferences, while the ‘Others’ segment includes a wide variety of styles and contributes significantly to the market's overall diversity.

North America Handbags Market Product Innovations

Recent product innovations focus on sustainable and ethical materials, including vegan leather and recycled fabrics, reflecting growing consumer demand for environmentally friendly options. Technological advancements in manufacturing techniques have enabled the creation of lighter, more durable, and stylish handbags. Smart features are increasingly integrated into certain handbags, such as RFID blocking and Bluetooth connectivity. These innovations cater to the evolving needs and preferences of consumers, driving further market growth and shaping competitive advantages.

Report Segmentation & Scope

This report comprehensively segments the North America handbags market by distribution channel (online stores and offline stores) and handbag type (satchel, clutch, tote bag, sling bag, and others). Growth projections for each segment are provided, highlighting the market size and competitive dynamics within each. The online store segment is expected to show faster growth than the offline store segment due to increased e-commerce adoption. Among handbag types, the satchel and tote bag segments are projected to maintain their dominance, while other types, like sling bags and clutches, will exhibit moderate growth. The ‘Others’ category showcases diversity and ongoing trend-driven changes.

Key Drivers of North America Handbags Market Growth

The growth of the North America handbags market is propelled by several factors. Rising disposable incomes, particularly among younger demographics, fuel demand for both luxury and affordable handbags. The strong fashion industry in North America generates continuous demand for new designs and trends. Technological innovations in materials and manufacturing processes are improving the quality, functionality, and sustainability of handbags. Favorable government policies promoting domestic manufacturing in some cases also play a positive role in market growth.

Challenges in the North America Handbags Market Sector

The North America handbags market faces challenges including fluctuations in raw material prices, impacting production costs and profitability. Increasing competition from both established brands and new entrants necessitates constant innovation and brand building. Supply chain disruptions can cause delays and shortages, affecting market availability. Furthermore, concerns about counterfeit products and intellectual property rights protection pose significant challenges. These factors can impact market stability and growth.

Leading Players in the North America Handbags Market Market

Key Developments in North America Handbags Market Sector

- March 2022: Aranyani, an Indian luxury handbag brand, expands into the US market, launching products in New York.

- September 2021: Pixie Mood redesigns its website and launches its Fall/Winter '21 collection of vegan leather handbags.

- October 2020: Schutz, a Brazilian brand, launches its handbag line in the US, featuring new collections with croc-embossed leathers and chains.

Strategic North America Handbags Market Outlook

The North America handbags market presents significant growth potential, driven by ongoing consumer demand, technological innovation, and the expansion of e-commerce. Strategic opportunities exist in sustainable and ethical product development, personalized customization options, and leveraging digital marketing to reach targeted consumer segments. Companies that effectively adapt to changing consumer preferences, embrace sustainable practices, and innovate their product offerings will be best positioned for success in this dynamic market.

North America Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Clutch

- 1.3. Tote Bag

- 1.4. Sling Bag

- 1.5. Others

-

2. Distibution Channel

- 2.1. Online Stores

- 2.2. Offline Stores

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Handbags Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Handbags Market Regional Market Share

Geographic Coverage of North America Handbags Market

North America Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Luxury Handbags

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Clutch

- 5.1.3. Tote Bag

- 5.1.4. Sling Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Online Stores

- 5.2.2. Offline Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Clutch

- 6.1.3. Tote Bag

- 6.1.4. Sling Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Online Stores

- 6.2.2. Offline Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Clutch

- 7.1.3. Tote Bag

- 7.1.4. Sling Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Online Stores

- 7.2.2. Offline Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Clutch

- 8.1.3. Tote Bag

- 8.1.4. Sling Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Online Stores

- 8.2.2. Offline Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Handbags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Satchel

- 9.1.2. Clutch

- 9.1.3. Tote Bag

- 9.1.4. Sling Bag

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Online Stores

- 9.2.2. Offline Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kering SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tapestry Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Burberry Group Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hermes International S A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tory Burch LLC*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pixie Mood

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Michael Kors (USA) Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fossil Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prada Holding SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: North America Handbags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Handbags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 7: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 11: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 15: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Handbags Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: North America Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Handbags Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Handbags Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the North America Handbags Market?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Kering SA, Tapestry Inc, Burberry Group Plc, Hermes International S A, Tory Burch LLC*List Not Exhaustive, Pixie Mood, Michael Kors (USA) Inc, Fossil Group Inc, Prada Holding SpA.

3. What are the main segments of the North America Handbags Market?

The market segments include Type, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Increase in Demand for Luxury Handbags.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In March 2022, Aranyani, an Indian luxury handbag brand expanded its presence in the United States and launched its products in New York at the Consulate General of India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Handbags Market?

To stay informed about further developments, trends, and reports in the North America Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence