Key Insights

The North America Online Gambling Market is poised for substantial growth, projected to reach an estimated market size of approximately USD 30,000 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 11.78% throughout the forecast period (2025-2033). This robust expansion is primarily fueled by a confluence of factors, including the increasing adoption of mobile devices for gaming, the continuous innovation in game development, and the progressive legalization and regulation of online gambling across various North American jurisdictions. The convenience and accessibility offered by online platforms, coupled with sophisticated marketing strategies and lucrative bonuses, are attracting a broader demographic of players. Furthermore, the integration of advanced technologies like AI and blockchain is enhancing player experience through personalized offerings and secure transaction systems, acting as significant growth catalysts. The market is experiencing a notable shift towards live casino games and sports betting, driven by their interactive nature and the engagement they foster.

North America Online Gambling Market Market Size (In Billion)

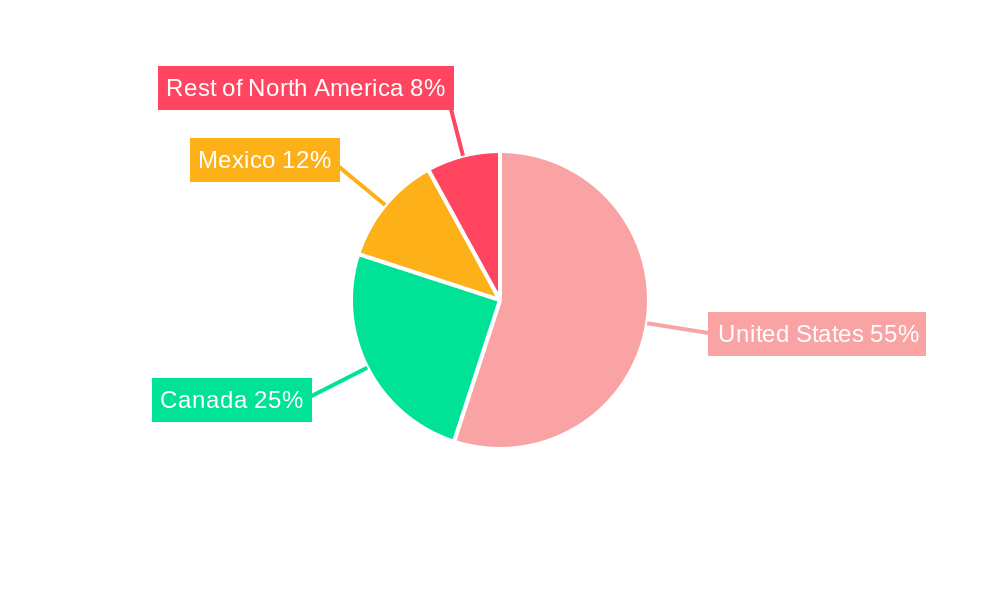

Key restraints that could potentially temper this growth include evolving regulatory landscapes, concerns surrounding problem gambling and the need for robust responsible gaming measures, and intense competition among established and emerging players. However, the overall sentiment remains overwhelmingly positive, with significant investment flowing into the sector. Mobile devices are emerging as the dominant platform, accounting for a substantial portion of revenue, underscoring the importance of mobile-first strategies for market participants. The market is segmented across various game types, with sports betting and a diverse array of casino games, including live casino, slots, and table games, holding significant shares. Geographically, the United States currently leads the market, followed by Canada and Mexico, with the "Rest of North America" also contributing to the overall expansion. Companies such as Caesars Entertainment, Flutter Entertainment, and DraftKings are at the forefront, driving innovation and market penetration.

North America Online Gambling Market Company Market Share

This in-depth report provides a definitive analysis of the North America online gambling market, offering critical insights into its dynamic growth trajectory and evolving landscape. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report delves into the historical performance (2019–2024) and future potential of online betting and gaming across the continent. We analyze key segments including Sports Betting, Casino Games (Live Casino, Slots, Baccarat, Blackjack, Poker, Other Casino Games), and Other Game Types, across Desktop and Mobile devices, within major geographies: United States, Canada, and Mexico, along with Rest of North America.

The North America online gambling market is experiencing unprecedented expansion, driven by technological advancements, evolving consumer preferences, and favorable regulatory shifts. This report equips industry stakeholders with actionable intelligence to navigate the competitive environment and capitalize on emerging opportunities.

North America Online Gambling Market Market Structure & Competitive Dynamics

The North America online gambling market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, particularly in the United States. Innovation ecosystems are thriving, fueled by significant investments in technology, particularly in areas like live casino and mobile gaming. Regulatory frameworks are evolving, with more states and provinces legalizing and regulating online gambling, which in turn, is driving market growth. Product substitutes are largely limited to traditional land-based casinos, though the convenience and accessibility of online platforms continue to erode their dominance. End-user trends indicate a strong preference for mobile-first experiences, personalized offers, and secure, seamless payment solutions. Mergers and acquisitions (M&A) activities are a prominent feature, shaping the competitive landscape. For instance, the acquisition of William Hill's non-US business by 888 Holdings PLC from Caesars Entertainment Corporation in July 2022, and DraftKings' acquisition of Golden Nugget Online Gaming (GNOG) in May 2022, highlight the industry's consolidation drive. These strategic moves aim to expand market reach, enhance product portfolios, and gain a competitive edge. Market share is increasingly being defined by user acquisition and retention strategies, with significant marketing spend dedicated to attracting new players and fostering loyalty.

North America Online Gambling Market Industry Trends & Insights

The North America online gambling market is propelled by a confluence of powerful growth drivers, technological disruptions, and evolving consumer preferences. The legalization and expansion of regulated online sports betting across the United States has been a paramount catalyst, unlocking significant revenue streams and attracting major operators. This trend is complemented by the increasing maturity of online casino offerings, with slots, live dealer games, and poker experiencing robust demand. Technological advancements, particularly in mobile gaming, are revolutionizing accessibility and user experience. The ubiquitous nature of smartphones and tablets ensures that a vast majority of online gambling activity occurs on mobile devices, necessitating operators to prioritize responsive design and dedicated applications. Artificial intelligence (AI) and machine learning (ML) are being leveraged for personalized player experiences, fraud detection, and responsible gambling initiatives. The integration of live casino features, replicating the immersive atmosphere of brick-and-mortar establishments, has significantly boosted player engagement. Consumer preferences are shifting towards convenience, variety, and secure transactions. Players demand a wide array of game options, from classic blackjack and baccarat to innovative slot machines and competitive poker tournaments. The competitive dynamics are intense, with established players like Flutter Entertainment PLC and MGM Resorts International (Borgata Hotel Casino & Spa) vying for market share against agile newcomers and established sports betting platforms like DraftKings. The Stars Group Inc and 888 Holding PLC continue to be significant players. The CAGR for the North America online gambling market is projected to be substantial, indicating a period of sustained, rapid growth. Market penetration is expected to deepen as more jurisdictions embrace regulation and as operators refine their strategies to reach a wider demographic. The adoption of cryptocurrencies for transactions is also an emerging trend, offering potential for faster, more secure payments, though regulatory clarity remains a factor. The continuous innovation in game design, including the incorporation of social features and virtual reality elements, further fuels player interest and retention.

Dominant Markets & Segments in North America Online Gambling Market

The United States stands as the dominant market within the North America online gambling market, driven by its large population, significant disposable income, and the progressive legalization of sports betting and online casino gaming across numerous states. The economic policies supporting regulated gambling, coupled with substantial investments in digital infrastructure, have created a fertile ground for operators.

Key Drivers of Dominance in the United States:

- Regulatory Landscape: The phased legalization of online sports betting and casino games in states like New Jersey, Pennsylvania, Michigan, and New York has been the primary driver, creating vast new markets.

- Consumer Adoption: A large, tech-savvy population readily embraces online entertainment and betting.

- Operator Investment: Significant capital infusion by major players like DraftKings, Flutter Entertainment PLC (FanDuel Group), and Caesars Entertainment Corporation has fueled market growth through aggressive marketing and product development.

Within game types, Sports Betting currently commands a significant share, fueled by major sporting events and the widespread availability of betting platforms. However, Casino Games are rapidly gaining ground, with Slots being the most popular category due to their accessibility and diverse themes. Live Casino experiences are increasingly sought after, offering an immersive and interactive environment for blackjack, baccarat, poker, and other table games.

Device segmentation clearly favors Mobile devices, accounting for the lion's share of wagers and gameplay. The convenience of placing bets and playing casino games on the go has made mobile the primary platform for most users. The development of user-friendly mobile applications by operators like Slots Empire Casino, El Royale Casino, and Wild Casino has been crucial in capturing this market segment.

Canada represents the second-largest market, with provinces like Ontario leading the way in establishing regulated online gambling frameworks. While progress has been slower than in the US, the long-term potential is substantial. Mexico and the Rest of North America are emerging markets, with nascent regulatory developments and a growing interest in online entertainment.

North America Online Gambling Market Product Innovations

Product innovation in the North America online gambling market is primarily focused on enhancing user experience and engagement. The rise of live dealer casino games, offering real-time interaction with professional croupiers, has transformed the online casino segment, bringing the thrill of a physical casino directly to players' screens. Advancements in mobile gaming technology ensure seamless gameplay and intuitive interfaces across all devices. Operators are also investing in personalized gaming experiences through AI-driven recommendations and tailored promotions. The integration of social features and gamification elements in slot games and poker platforms is fostering community and increasing player retention. Furthermore, the exploration of virtual reality (VR) and augmented reality (AR) in online gambling promises even more immersive future experiences, offering a competitive advantage to early adopters.

Report Segmentation & Scope

This report meticulously segments the North America online gambling market across critical dimensions for comprehensive analysis.

- Game Type: The market is analyzed by Sports Betting, encompassing pre-match and in-play wagers; Casino Games, further broken down into Live Casino, Slots, Baccarat, Blackjack, Poker, and Other Casino Games; and Other Game Types such as lottery and bingo.

- Device: We evaluate the market's performance across Desktop and Mobile platforms, recognizing the dominance of mobile accessibility.

- Geography: The report covers the United States, Canada, Mexico, and the Rest of North America, providing granular insights into regional variations and growth opportunities. Projections and market sizes are estimated for each segment, with a keen focus on the competitive dynamics shaping their evolution.

Key Drivers of North America Online Gambling Market Growth

The North America online gambling market is experiencing robust growth fueled by several key factors. The legalization and expansion of regulated online sports betting and casino gaming across US states and Canadian provinces is a primary driver, opening up substantial new markets and revenue streams. Technological advancements, particularly in mobile technology and live dealer streaming, are enhancing player engagement and accessibility, making online gambling more convenient and immersive than ever before. Evolving consumer preferences for instant gratification, a wide variety of entertainment options, and secure online transactions are also propelling demand. Furthermore, increasing disposable income and the growing acceptance of online gambling as a form of entertainment contribute significantly to market expansion.

Challenges in the North America Online Gambling Market Sector

Despite its rapid growth, the North America online gambling market faces several challenges. The complex and fragmented regulatory landscape across different states and provinces can create operational hurdles and increase compliance costs. Intense competition among a growing number of operators leads to higher customer acquisition costs and pressure on profit margins. Responsible gambling concerns and the need for robust player protection measures require significant investment in monitoring and intervention systems. Cybersecurity threats and the risk of data breaches necessitate constant vigilance and investment in advanced security protocols. Furthermore, establishing and maintaining trust with consumers regarding the fairness and security of online platforms remains an ongoing challenge, particularly in newer markets.

Leading Players in the North America Online Gambling Market Market

- Slots Empire Casino

- El Royale Casino

- Caesars Entertainment Corporation

- Flutter Entertainment PLC

- The Stars Group Inc

- BoVegas

- 888 Holding PLC

- Cherry Gold Casino

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Wild Casino

- DraftKings

Key Developments in North America Online Gambling Market Sector

- July 2022: 888 Holdings PLC acquired William Hill's non-US business from Caesars Entertainment Corporation. William Hill is a popular online gambling platform brand, indicating strategic consolidation and market expansion.

- May 2022: DraftKings acquired Golden Nugget Online Gaming (GNOG). This acquisition enhances DraftKings' reach into new client demographics by leveraging the Golden Nugget brand and strengthens its gaming product offerings through GNOG's unique capabilities like Live Dealer, integrated with DraftKings' technology stack.

- July 2021: The Flutter Entertainment subsidiary FanDuel Group expanded its FanDuel Casino offers in New Jersey and Michigan. The official launch of FanDuel Group's standalone, FanDuel-branded FanDuel Casino product in New Jersey on iOS, Android, and desktop was announced. Customers of Michigan's FanDuel Casino can now play Evolution's live dealer games, signifying expansion and enhancement of casino offerings.

Strategic North America Online Gambling Market Market Outlook

The strategic outlook for the North America online gambling market is exceptionally positive, driven by ongoing regulatory expansion and a sustained increase in consumer adoption. Growth accelerators include further state-level legalization of online casino games and the continuous innovation in mobile gambling and live dealer experiences. The market will witness increased M&A activity as larger entities seek to consolidate market share and acquire emerging technologies. Investments in responsible gambling frameworks and advanced cybersecurity will be crucial for long-term sustainability and player trust. The focus will increasingly shift towards personalized player journeys, loyalty programs, and the integration of emerging technologies like AI to enhance engagement and retention. Opportunities abound for operators who can effectively navigate the regulatory complexities and deliver compelling, secure, and entertaining online gambling products.

North America Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Slots

- 1.2.3. Baccarat

- 1.2.4. Blackjack

- 1.2.5. Poker

- 1.2.6. Other Casino Games

- 1.3. Other Game Types

-

2. Device

- 2.1. Desktop

- 2.2. Mobile

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of the North America

North America Online Gambling Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of the North America

North America Online Gambling Market Regional Market Share

Geographic Coverage of North America Online Gambling Market

North America Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Slots

- 5.1.2.3. Baccarat

- 5.1.2.4. Blackjack

- 5.1.2.5. Poker

- 5.1.2.6. Other Casino Games

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. United States North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Slots

- 6.1.2.3. Baccarat

- 6.1.2.4. Blackjack

- 6.1.2.5. Poker

- 6.1.2.6. Other Casino Games

- 6.1.3. Other Game Types

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. Canada North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Slots

- 7.1.2.3. Baccarat

- 7.1.2.4. Blackjack

- 7.1.2.5. Poker

- 7.1.2.6. Other Casino Games

- 7.1.3. Other Game Types

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Mexico North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Slots

- 8.1.2.3. Baccarat

- 8.1.2.4. Blackjack

- 8.1.2.5. Poker

- 8.1.2.6. Other Casino Games

- 8.1.3. Other Game Types

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. Rest of the North America North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Slots

- 9.1.2.3. Baccarat

- 9.1.2.4. Blackjack

- 9.1.2.5. Poker

- 9.1.2.6. Other Casino Games

- 9.1.3. Other Game Types

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of the North America

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Slots Empire Casino

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 El Royale Casino

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Caesars Entertainment Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutter Entertainment PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Stars Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BoVegas

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 888 Holding PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cherry Gold Casino*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MGM Resorts International (Borgata Hotel Casino & Spa)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wild Casino

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DraftKings (Golden Nugget

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Slots Empire Casino

List of Figures

- Figure 1: North America Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 3: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 6: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 7: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 10: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 11: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 15: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 18: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 19: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Gambling Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the North America Online Gambling Market?

Key companies in the market include Slots Empire Casino, El Royale Casino, Caesars Entertainment Corporation, Flutter Entertainment PLC, The Stars Group Inc, BoVegas, 888 Holding PLC, Cherry Gold Casino*List Not Exhaustive, MGM Resorts International (Borgata Hotel Casino & Spa), Wild Casino, DraftKings (Golden Nugget.

3. What are the main segments of the North America Online Gambling Market?

The market segments include Game Type, Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth..

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment. William Hill is a popular online gambling platform brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Gambling Market?

To stay informed about further developments, trends, and reports in the North America Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence