Key Insights

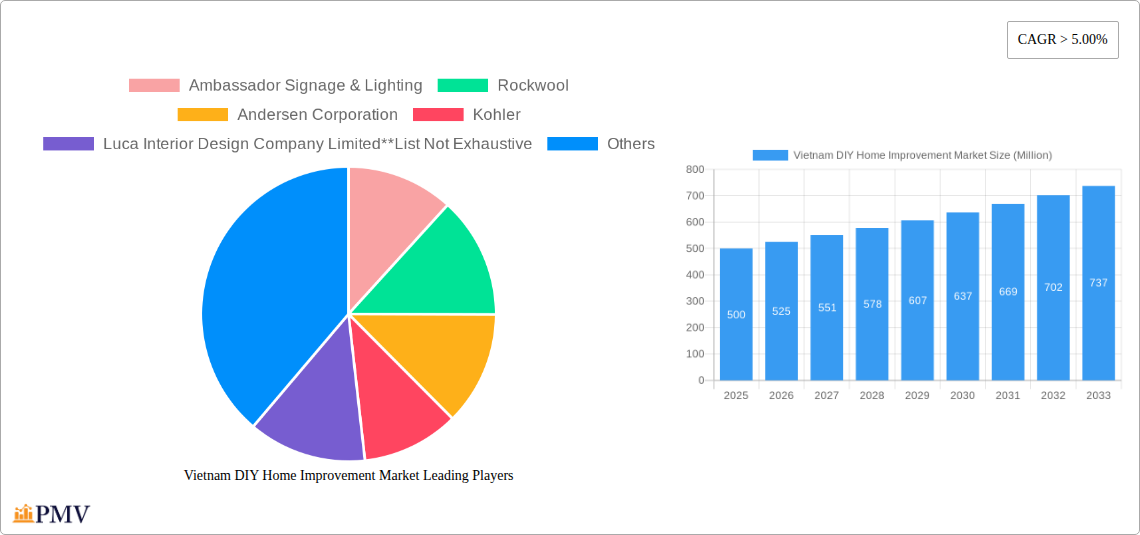

The Vietnam DIY home improvement market is experiencing robust growth, fueled by a rising middle class with increased disposable income and a preference for homeownership. The market, estimated at [Let's assume a market size of $500 million in 2025 based on a moderately sized developing economy and a 5%+ CAGR] in 2025, is projected to expand significantly over the forecast period (2025-2033). This growth is driven by several key factors, including increasing urbanization, a burgeoning construction sector, and a growing awareness of home improvement's value in enhancing living spaces. Popular segments include building materials (cement, lumber), kitchen renovations, and electrical work, reflecting Vietnam's ongoing infrastructure development and homeowners' focus on functional upgrades. The distribution channel is diversified, encompassing DIY stores, specialty retailers, and a rapidly expanding online presence. While challenges such as fluctuating material costs and skilled labor shortages exist, the long-term outlook remains positive, supported by government initiatives promoting sustainable housing and improved living standards. The growing popularity of online platforms for purchasing home improvement products and accessing design inspiration further boosts market dynamism.

Vietnam DIY Home Improvement Market Market Size (In Million)

The competitive landscape is characterized by a mix of international players like Kohler and 3M, alongside domestic companies like Truong Thanh and Innoci Viet Nam. These companies are strategically focusing on product innovation, expanding distribution networks, and providing value-added services to cater to the evolving needs of Vietnamese consumers. The increasing adoption of sustainable and eco-friendly building materials presents a significant opportunity for companies to differentiate themselves and attract environmentally conscious customers. The market is segmented by type of product (lumber, décor, kitchen fittings, tools, etc.) and distribution channels, offering various strategic entry points for both established and emerging players. Future growth hinges on addressing supply chain resilience, fostering skilled labor, and aligning offerings with the unique preferences and needs of the Vietnamese DIY market.

Vietnam DIY Home Improvement Market Company Market Share

Vietnam DIY Home Improvement Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Vietnam DIY home improvement market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is segmented by type and distribution channel, offering a granular understanding of its structure and growth potential. The total market size is projected to reach xx Million USD by 2033, showcasing significant growth opportunities.

Vietnam DIY Home Improvement Market Market Structure & Competitive Dynamics

The Vietnam DIY home improvement market exhibits a moderately fragmented structure with a mix of both international and domestic players. Market concentration is relatively low, with no single company holding a dominant share. However, established international brands exert significant influence, particularly in specialized segments like high-end kitchen appliances or premium building materials. The innovation ecosystem is developing, with a growing number of startups and smaller companies offering innovative products and services. Regulatory frameworks, while evolving, generally support market growth. Product substitution is a factor, particularly in basic building materials, where price competition is intense. End-user trends are shifting towards more sustainable and technologically advanced products, driving innovation in smart home technology integration. M&A activity is moderate, with a few significant deals impacting the market landscape in recent years. Deal values have ranged from xx Million USD to xx Million USD, signaling consolidation trends.

- Market Share: The top 5 players collectively hold an estimated xx% market share.

- M&A Activity: Significant deals include [mention specific deals with values if available, otherwise indicate "Data unavailable"].

- Regulatory Landscape: The Vietnamese government's focus on infrastructure development and housing projects significantly impacts the market.

Vietnam DIY Home Improvement Market Industry Trends & Insights

The Vietnam DIY home improvement market is experiencing robust and sustained growth, propelled by a confluence of powerful economic and social forces. A burgeoning middle class, coupled with increasing urbanization, is significantly driving demand for home renovation and enhancement projects. Furthermore, evolving lifestyle aspirations and a greater emphasis on creating comfortable and aesthetically pleasing living spaces are fueling consumer interest in DIY solutions. The digital revolution is profoundly impacting the landscape, with e-commerce platforms rapidly gaining traction, offering unparalleled convenience and access to a diverse array of products. Simultaneously, there's a discernible and growing consumer consciousness towards environmentally responsible choices, leading to a surge in demand for sustainable and energy-efficient building materials and home solutions. This trend is further amplified by technological advancements, including the integration of smart home devices that enhance convenience and efficiency. For the period 2025-2033, the market is projected to witness a Compound Annual Growth Rate (CAGR) of **xx%**, a figure that impressively outpaces the global average, underscoring Vietnam's burgeoning potential. The increasing adoption of premium products, reflecting a shift in consumer priorities towards quality and advanced features, presents a substantial avenue for market expansion. Competition within this vibrant market is multifaceted, characterized by a strategic blend of price-sensitive offerings and a strong emphasis on product innovation and differentiation. International enterprises are strategically leveraging their established brand recognition and cutting-edge technologies to solidify their market presence, while agile local businesses are capitalizing on their understanding of local needs and cost-effectiveness to deliver tailored solutions.

Dominant Markets & Segments in Vietnam DIY Home Improvement Market

Within the Vietnam DIY home improvement market, the Kitchen segment stands out as the current leader, driven by the ongoing wave of urbanization and a pronounced consumer preference for contemporary and functional kitchen designs. The Building Materials segment also holds significant weight, mirroring the sustained activity in both new construction and extensive renovation projects across the nation. In terms of distribution, DIY home improvement stores currently dominate, offering a comprehensive shopping experience. However, specialty stores also play a crucial role, and the online retail segment is experiencing exceptionally rapid expansion, indicating a significant shift in consumer purchasing habits.

Key Drivers by Segment:

- Kitchen: A confluence of factors, including rising disposable incomes, a strong aspiration for modern kitchen aesthetics, and heightened awareness of global design trends, are propelling this segment forward.

- Building Materials: Government-backed infrastructure development, a consistent surge in construction activities, and robust growth in both residential and commercial real estate sectors are the primary catalysts.

- DIY Home Improvement Stores: Consumers are drawn to these outlets for their extensive product assortments, the convenience of one-stop shopping, and the availability of expert advice and customer support.

- Online: The digital marketplace offers unmatched convenience, competitive pricing structures, and access to an exceptionally broad spectrum of products, making it increasingly attractive to consumers.

Vietnam DIY Home Improvement Market Product Innovations

Recent innovations focus on eco-friendly, energy-efficient, and technologically advanced products. Smart home integration features are increasingly popular in lighting, appliances, and security systems. The market is also witnessing the rise of modular and prefabricated solutions, reducing installation time and costs. These innovations are enhancing customer convenience and aligning with consumer demand for sustainable and smart home solutions.

Report Segmentation & Scope

This comprehensive report meticulously segments the Vietnam DIY home improvement market across two primary dimensions: Type and Distribution Channel. Under the 'Type' category, the market is analyzed by: Lumber and Landscape Management, Décor and Indoor Garden, Kitchen, Painting and Wallpaper, Tools and Hardware, Building Materials, Lighting, Plumbing and Equipment, Flooring, Repair, and Replacement, and Electrical Work. The 'Distribution Channel' segmentation includes: DIY Home Improvement Stores, Specialty Stores, Online, and Other Physical Stores. For each identified segment, the report provides an in-depth analysis of its market size, projected growth trajectories, and the prevailing competitive dynamics. The outlook consistently indicates sustained growth across all analyzed segments, with certain segments poised for even more accelerated expansion than others.

Key Drivers of Vietnam DIY Home Improvement Market Growth

Several factors drive the Vietnam DIY home improvement market's growth. A rising middle class with increased disposable income fuels demand for home improvements. Government initiatives promoting infrastructure development and affordable housing also contribute. Technological advancements, such as the introduction of smart home technologies and eco-friendly products, are reshaping consumer preferences and driving innovation.

Challenges in the Vietnam DIY Home Improvement Market Sector

Challenges include supply chain disruptions, particularly for imported materials, and potential regulatory hurdles. Competition from both established international brands and local players puts pressure on margins. Furthermore, fluctuations in raw material prices and macroeconomic factors can impact market stability.

Leading Players in the Vietnam DIY Home Improvement Market Market

- Ambassador Signage & Lighting

- Rockwool

- Andersen Corporation

- Kohler

- Luca Interior Design Company Limited

- DuPont Building Innovations

- Truong Thanh

- 3M Vietnam Co Ltd

- Innoci Viet Nam Co Ltd

- Caesar

Key Developments in Vietnam DIY Home Improvement Market Sector

- September 2022: Kohnan Japan Long Bien opens its 10th store in Hanoi, expanding the DIY retail presence.

- November 2021: Andersen Corporation publishes its first Environmental Product Declaration (EPD), signaling a focus on sustainability.

Strategic Vietnam DIY Home Improvement Market Market Outlook

The Vietnam DIY home improvement market is strategically positioned for substantial and enduring growth, underpinned by Vietnam's continued economic dynamism, ongoing urbanization, and the ever-evolving preferences of its consumer base. Key strategic avenues for future success include the adept integration of emerging technologies, a dedicated focus on promoting and offering sustainable and eco-friendly solutions, and the agile capitalization of the burgeoning online retail sector. Enterprises that demonstrate a keen ability to anticipate and respond to shifting consumer demands, while consistently delivering innovative and value-added products and services, will undoubtedly be the frontrunners in navigating and thriving within this dynamic and promising market landscape.

Vietnam DIY Home Improvement Market Segmentation

-

1. Type

- 1.1. Lumber and Landscape Management

- 1.2. Décor and Indoor Garden

- 1.3. Kitchen

- 1.4. Painting and Wallpaper

- 1.5. Tools and Hardware

- 1.6. Building Materials

- 1.7. Lighting

- 1.8. Plumbing and Equipment

- 1.9. Flooring, Repair, and Replacement

- 1.10. Electrical Work

-

2. Distribution Channel

- 2.1. DIY Home Improvement Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Physical Stores

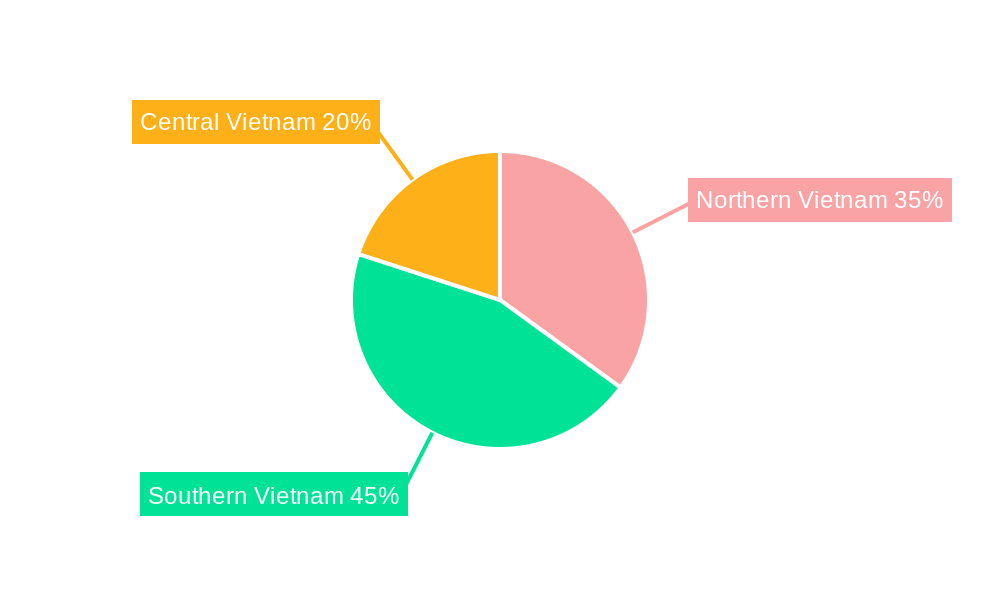

Vietnam DIY Home Improvement Market Segmentation By Geography

- 1. Vietnam

Vietnam DIY Home Improvement Market Regional Market Share

Geographic Coverage of Vietnam DIY Home Improvement Market

Vietnam DIY Home Improvement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure

- 3.3. Market Restrains

- 3.3.1. Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Online Retailing of DIY Products is Driving the Market in Vietnam

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam DIY Home Improvement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lumber and Landscape Management

- 5.1.2. Décor and Indoor Garden

- 5.1.3. Kitchen

- 5.1.4. Painting and Wallpaper

- 5.1.5. Tools and Hardware

- 5.1.6. Building Materials

- 5.1.7. Lighting

- 5.1.8. Plumbing and Equipment

- 5.1.9. Flooring, Repair, and Replacement

- 5.1.10. Electrical Work

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. DIY Home Improvement Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Physical Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ambassador Signage & Lighting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rockwool

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Andersen Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Luca Interior Design Company Limited**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont Building Innovations

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Truong Thanh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3M Vietnam Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Innoci Viet Nam Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Caeser

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ambassador Signage & Lighting

List of Figures

- Figure 1: Vietnam DIY Home Improvement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam DIY Home Improvement Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam DIY Home Improvement Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Vietnam DIY Home Improvement Market?

Key companies in the market include Ambassador Signage & Lighting, Rockwool, Andersen Corporation, Kohler, Luca Interior Design Company Limited**List Not Exhaustive, DuPont Building Innovations, Truong Thanh, 3M Vietnam Co Ltd, Innoci Viet Nam Co Ltd, Caeser.

3. What are the main segments of the Vietnam DIY Home Improvement Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure.

6. What are the notable trends driving market growth?

Increasing Focus on Online Retailing of DIY Products is Driving the Market in Vietnam.

7. Are there any restraints impacting market growth?

Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid.

8. Can you provide examples of recent developments in the market?

In September 2022, the Japan-based DIY retailer Kohnan Japan Long Bien opened its 10th store in the Aeon Mall in Hanoi City, Vietnam. The store provides products such as outdoor goods, miscellaneous indoor goods, and tableware. Kohnan also has its own brands - Southernport and Lifelex. It is planning to manufacture unique products in collaboration with local Vietnamese companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam DIY Home Improvement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam DIY Home Improvement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam DIY Home Improvement Market?

To stay informed about further developments, trends, and reports in the Vietnam DIY Home Improvement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence