Key Insights

The Saudi Arabia microwave oven market, valued at $158.9 million in 2025, is poised for robust expansion with a projected compound annual growth rate (CAGR) of 3.71% from 2025 to 2033. This growth is propelled by increasing urbanization, evolving lifestyles, and a rising demand for convenient kitchen solutions. The integration of modern kitchens and a preference for rapid meal preparation among busy households significantly fuels this market dynamic. Enhanced product accessibility through expanding online retail channels further stimulates sales. Convection microwave ovens lead consumer preference, indicating a demand for versatile and advanced cooking functionalities. While the residential sector is the primary driver, the commercial segment, including hospitality and food service, presents substantial growth opportunities driven by the adoption of efficient kitchen appliances. Market expansion may face headwinds from energy price volatility and potential economic fluctuations impacting discretionary spending. The competitive arena features prominent global brands alongside local and regional manufacturers. Future success will depend on innovation, energy-efficient offerings, and adaptation to evolving consumer preferences, such as the demand for smart appliances. Regional distribution across Central, Eastern, Western, and Southern Saudi Arabia highlights varying demand patterns influenced by demographic and economic activity levels, with urban hubs exhibiting the highest consumption.

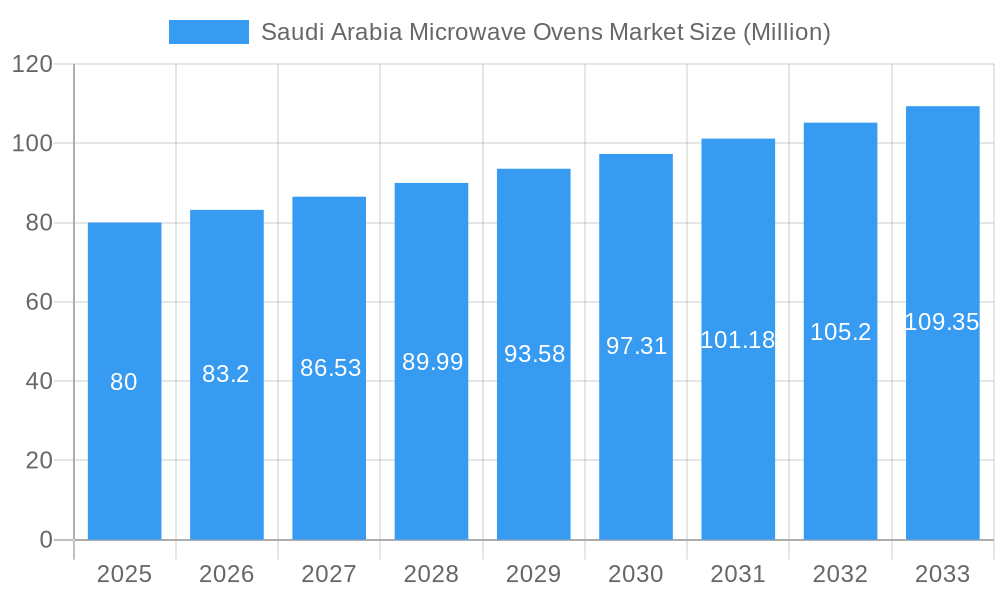

Saudi Arabia Microwave Ovens Market Market Size (In Million)

The Saudi Arabia microwave oven market forecast indicates sustained growth over the next decade, supported by ongoing economic development and infrastructure advancements. Manufacturers can capitalize on this momentum by implementing targeted marketing strategies that highlight convenience, value, and advanced features. A potential shift towards healthier cooking methods may influence product innovation, favoring models with steam or other health-conscious functionalities. Saudi Arabia's economic diversification initiatives and increased consumer spending will contribute to a stronger market performance. Establishing robust distribution networks and prioritizing exceptional after-sales service will be critical for sustained competitive advantage.

Saudi Arabia Microwave Ovens Market Company Market Share

Saudi Arabia Microwave Ovens Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia microwave ovens market, offering valuable insights for businesses, investors, and industry stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report segments the market by type (Grill, Solo, Convection), distribution channel (Offline, Online), and end-user (Residential, Commercial). Key players analyzed include Panasonic, Zhongshan Donlim Weili Electrical Appliances Co Ltd, AB Electrolux, White-Westinghouse, Hommer, Samsung Electronics, Geepas, ZAGZOOG FOR HOME APPLIANCES, Black & Decker, and LG Electronics. The report is meticulously crafted to provide actionable intelligence, facilitating informed decision-making within this dynamic market. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Saudi Arabia Microwave Ovens Market Structure & Competitive Dynamics

The Saudi Arabia microwave ovens market exhibits a moderately concentrated structure, with several international and domestic players vying for market share. The market's competitive landscape is characterized by intense price competition, particularly in the solo microwave oven segment. Innovation is driven by advancements in technology, focusing on energy efficiency, enhanced cooking features, and aesthetically pleasing designs. The regulatory framework in Saudi Arabia generally promotes fair competition, with certain standards related to safety and energy consumption. Product substitutes, such as conventional ovens and other cooking appliances, pose a competitive challenge, although the convenience and speed offered by microwave ovens continue to drive demand. End-user trends, especially among younger demographics, show a preference for smart and connected appliances, influencing the growth of smart microwave ovens. M&A activities in the Saudi Arabian home appliance sector have been relatively modest in recent years, with deal values averaging around xx Million. Market share data reveals that Samsung Electronics holds approximately xx% of the market, followed by LG Electronics at xx%, while Panasonic and other players share the remaining market.

Saudi Arabia Microwave Ovens Market Industry Trends & Insights

The Saudi Arabia microwave ovens market is witnessing robust growth, driven by several factors. The rising disposable incomes of the Saudi population, coupled with increasing urbanization and nuclear family sizes, are fueling demand. Technological disruptions, particularly the introduction of smart microwaves with Wi-Fi connectivity and advanced cooking functions, are attracting tech-savvy consumers. Changing consumer preferences are pushing the market toward more energy-efficient and health-conscious models. The CAGR of the market during the forecast period (2025-2033) is projected to be xx%, exceeding the historical CAGR (2019-2024) of xx%. Market penetration is steadily increasing, driven by growing awareness of microwave oven benefits. Furthermore, the government's focus on infrastructure development and economic diversification strategies enhances market growth potential. Intensifying competition among key players is leading to innovative product offerings and competitive pricing strategies.

Dominant Markets & Segments in Saudi Arabia Microwave Ovens Market

- By Type: The convection microwave oven segment dominates the Saudi Arabia market due to its versatility and capability to offer multiple cooking functions. This dominance is attributed to increased consumer preference for multi-functional appliances that save both space and time in kitchens.

- By Distribution Channel: The offline channel currently holds the major share, driven by established retail networks and consumer preference for hands-on product experience before purchase. However, online channels are steadily gaining traction driven by increasing internet and smartphone penetration.

- By End-User: The residential segment accounts for the largest share, reflecting the widespread adoption of microwave ovens in households. The commercial sector exhibits moderate growth, with increasing demand from restaurants, cafes, and hotels.

Key drivers for this dominance include rising disposable incomes, increasing urbanization leading to smaller kitchen spaces, and the escalating popularity of ready-to-cook meals that require quick and convenient heating. The expanding food service industry in Saudi Arabia further propels the commercial segment's growth.

Saudi Arabia Microwave Ovens Market Product Innovations

Recent product developments in the Saudi Arabia microwave ovens market are focused on incorporating smart features like Wi-Fi connectivity, voice control, and pre-programmed recipes. Manufacturers are also emphasizing energy efficiency and health-conscious designs, including features like steam cooking and crisping options. These innovations target consumer preferences for convenience, healthy cooking, and technological advancements, thereby enhancing the competitive advantage of manufacturers offering these features.

Report Segmentation & Scope

This report segments the Saudi Arabia microwave ovens market across several key parameters:

- By Type: Grill, Solo, Convection microwaves. Each segment presents unique growth prospects; for example, the convection segment is expected to exhibit higher growth due to its added functionality.

- By Distribution Channel: Offline (retail stores, supermarkets) and Online (e-commerce platforms). This segmentation highlights the evolving consumer behavior and the increasing influence of online sales.

- By End-User: Residential, Commercial. The residential segment comprises the majority of the market, while the commercial segment displays significant potential for future growth.

Each segment’s growth projections, market size, and competitive dynamics are thoroughly analyzed within the report.

Key Drivers of Saudi Arabia Microwave Ovens Market Growth

Several factors are propelling the growth of the Saudi Arabia microwave ovens market:

- Rising Disposable Incomes: Increased purchasing power allows more households to afford microwave ovens.

- Urbanization: Smaller living spaces increase the demand for space-saving appliances like microwave ovens.

- Changing Lifestyles: Busy schedules lead to increased demand for quick and convenient cooking solutions.

- Technological Advancements: Smart features and improved cooking capabilities make microwave ovens more appealing.

Challenges in the Saudi Arabia Microwave Ovens Market Sector

Challenges facing the Saudi Arabia microwave oven market include:

- Price Sensitivity: Consumers are highly price-sensitive, especially in the budget segment.

- Competition: Intense competition from established and new players creates pricing pressure.

- Economic Fluctuations: Economic downturns can impact consumer spending on non-essential appliances. These factors could negatively impact market growth by xx% in adverse economic conditions.

Leading Players in the Saudi Arabia Microwave Ovens Market Market

- Panasonic

- Zhongshan Donlim Weili Electrical Appliances Co Ltd

- AB Electrolux

- White-Westinghouse

- Hommer

- Samsung Electronics

- Geepas

- ZAGZOOG FOR HOME APPLIANCES

- Black & Decker

- LG Electronics

Key Developments in Saudi Arabia Microwave Ovens Market Sector

- June 2022: LG Electronics launched a 56-liter microwave oven with healthcare features, impacting the high-capacity segment.

- May 2021: LG's "The Spot" online campaign targeted Gen Z consumers in Saudi Arabia, boosting brand awareness and potentially influencing purchasing decisions.

Strategic Saudi Arabia Microwave Ovens Market Outlook

The Saudi Arabia microwave ovens market presents significant growth potential, driven by sustained economic growth, evolving consumer preferences, and technological advancements. Strategic opportunities exist for players focusing on energy-efficient, smart, and health-conscious products. Companies can leverage online channels to expand reach and target specific demographics. Furthermore, partnerships with local distributors and retailers are crucial for effective market penetration. The long-term outlook for the market is highly positive, with continued expansion expected across all segments.

Saudi Arabia Microwave Ovens Market Segmentation

-

1. Type

- 1.1. Grill

- 1.2. Solo

- 1.3. Convection

-

2. Dsitribution Channel

- 2.1. Offline

- 2.2. Online

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

Saudi Arabia Microwave Ovens Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Microwave Ovens Market Regional Market Share

Geographic Coverage of Saudi Arabia Microwave Ovens Market

Saudi Arabia Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Rising competition among the players

- 3.4. Market Trends

- 3.4.1. Increasing Population and the Rising Number of Households is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Microwave Ovens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Grill

- 5.1.2. Solo

- 5.1.3. Convection

- 5.2. Market Analysis, Insights and Forecast - by Dsitribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zhongshan Donlim Weili Electrical Appliances CoLtd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AB Electrolux

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 White-Westinghouse**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hommer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Geepas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ZAGZOOG FOR HOME APPLIANCES

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Black & Deckar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Saudi Arabia Microwave Ovens Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Microwave Ovens Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by Dsitribution Channel 2020 & 2033

- Table 3: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by Dsitribution Channel 2020 & 2033

- Table 7: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Saudi Arabia Microwave Ovens Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Microwave Ovens Market?

The projected CAGR is approximately 3.71%.

2. Which companies are prominent players in the Saudi Arabia Microwave Ovens Market?

Key companies in the market include Panasonic, Zhongshan Donlim Weili Electrical Appliances CoLtd, AB Electrolux, White-Westinghouse**List Not Exhaustive, Hommer, Samsung Electronics, Geepas, ZAGZOOG FOR HOME APPLIANCES, Black & Deckar, LG Electronics.

3. What are the main segments of the Saudi Arabia Microwave Ovens Market?

The market segments include Type, Dsitribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 158.9 million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector.

6. What are the notable trends driving market growth?

Increasing Population and the Rising Number of Households is Driving the Market.

7. Are there any restraints impacting market growth?

Rising competition among the players.

8. Can you provide examples of recent developments in the market?

June 2022 - LG Electronics (LG), a global leader and technology innovator in home appliances, and United Yousuf Mohammed Naghi Ltd. announced the launch of its new biggest capacity microwave oven for the Saudi market. The biggest capacity is defined as 56 litres with health care features, streamlined design and innovative technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence