Key Insights

The North America Siding and Decking Market is projected to experience robust growth, driven by increasing demand for durable, low-maintenance, and aesthetically appealing building materials. The market is estimated to reach $20.7 million by 2024, expanding at a Compound Annual Growth Rate (CAGR) of 4.3%. Key growth catalysts include surging new residential construction and extensive renovation projects across the region. Homeowners and commercial developers are increasingly adopting advanced materials like composite decking and modern siding options such as vinyl and fiber cement, favored for their superior longevity and environmental resistance over traditional wood. Growing disposable incomes and a trend towards enhancing outdoor living spaces also contribute to this positive market outlook.

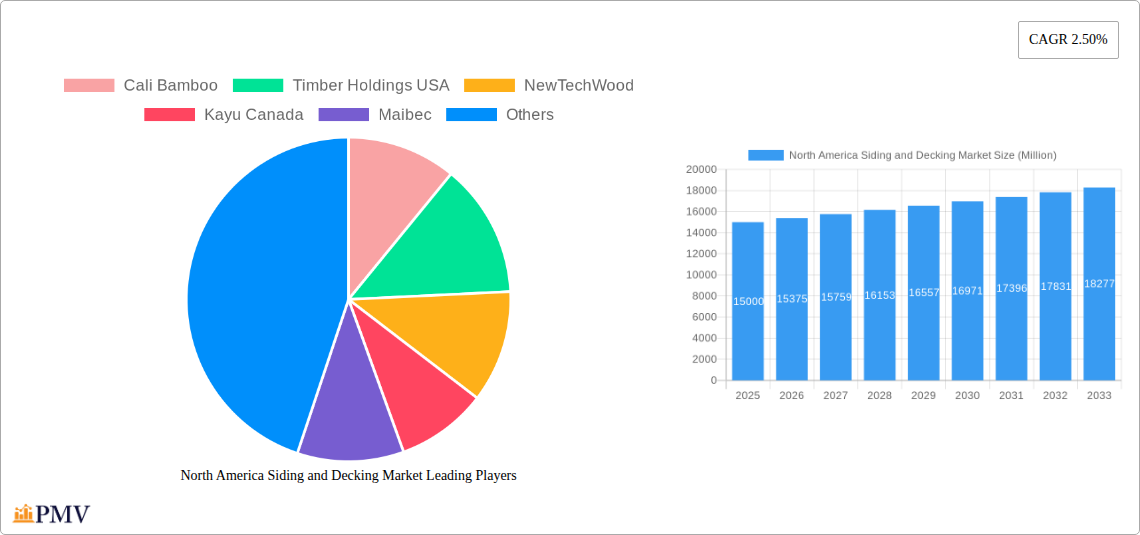

North America Siding and Decking Market Market Size (In Million)

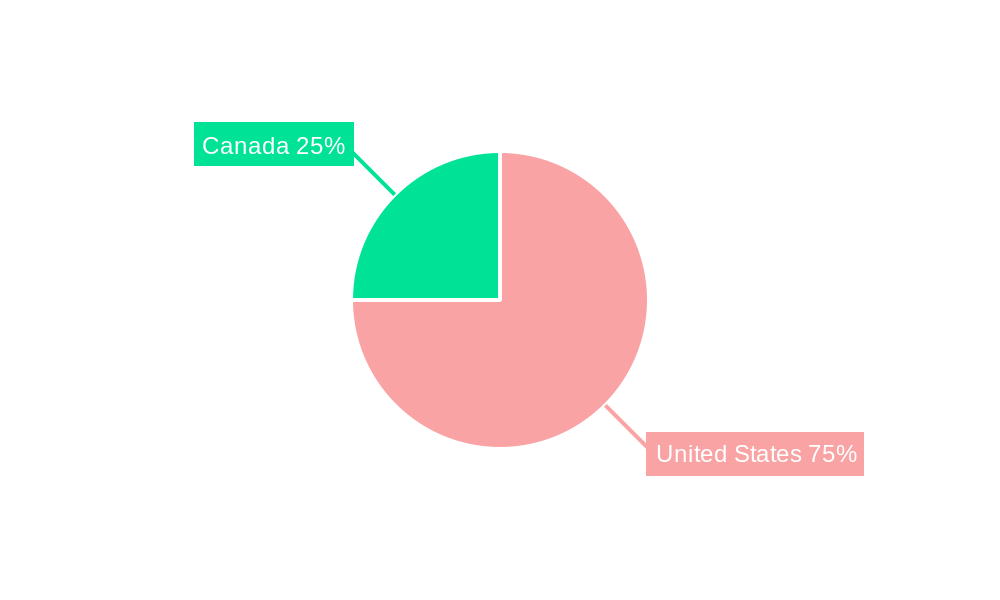

Market evolution is marked by a pronounced shift towards sustainable and technologically advanced materials. Composite decking, a blend of wood fibers and plastics, leads the market due to its eco-friendly nature and minimal maintenance. Vinyl and fiber cement siding are also gaining significant traction for their durability, fire resistance, and diverse design choices. While the residential sector remains the primary consumer, commercial applications are steadily rising as businesses recognize the long-term cost savings and aesthetic benefits of these materials. However, the higher initial cost of some premium composite and advanced siding options may present a challenge for price-sensitive buyers. The United States dominates the market, with Canada following closely, both demonstrating consistent growth.

North America Siding and Decking Market Company Market Share

North America Siding and Decking Market Market Structure & Competitive Dynamics

The North America siding and decking market exhibits a moderately concentrated structure, with a mix of large, established players and smaller, niche manufacturers. Key companies like Trex Company Inc., Fiberon, AZEK Building Products, and Louisiana Pacific Corporation hold significant market shares, particularly in the composite and engineered wood segments. The innovation ecosystem is robust, driven by advancements in material science, sustainability, and design aesthetics. Regulatory frameworks, particularly concerning building codes, fire safety, and environmental impact (e.g., FSC certification for wood), play a crucial role in shaping product development and market access. Product substitutes, such as traditional wood, brick, and stucco for siding, and various wood treatments for decking, continually challenge market dominance, requiring manufacturers to emphasize durability, low maintenance, and aesthetic appeal. End-user trends are increasingly leaning towards sustainable, low-maintenance, and aesthetically pleasing solutions, influencing product innovation and marketing strategies. Mergers and acquisitions (M&A) activity is present, albeit not at an extremely high pace, with deal values often linked to strategic expansion, technology acquisition, or consolidation of market share. For instance, a significant M&A deal in the past could have been in the range of hundreds of millions of dollars, aimed at integrating complementary product lines or expanding geographical reach. Market concentration varies by segment, with composite decking and vinyl siding being relatively more consolidated due to high R&D investment and economies of scale. The competitive landscape is characterized by intense price competition in commodity segments, while premium and innovative products command higher margins.

North America Siding and Decking Market Industry Trends & Insights

The North America siding and decking market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025-2033). This expansion is fueled by several intertwined trends. A primary market driver is the sustained demand for home improvement and renovation projects, particularly in the residential sector. As homeowners invest more in their properties, the demand for durable, low-maintenance, and aesthetically appealing siding and decking solutions escalates. Furthermore, the increasing urbanization and subsequent construction of new residential and commercial spaces contribute significantly to market penetration. Technological disruptions are a key theme, with advancements in composite materials offering enhanced durability, weather resistance, and a wider range of design options, closely mimicking natural wood grains and colors. The development of advanced manufacturing techniques also contributes to cost efficiencies and improved product quality. Consumer preferences are evolving; there's a growing emphasis on sustainability and eco-friendly materials. This has led to a surge in demand for recycled and responsibly sourced wood products, as well as low-VOC (Volatile Organic Compound) siding and decking solutions. The "smart home" trend is also influencing product development, with integrated lighting and heating features becoming more sought after in decking products. The competitive dynamics are intensifying as manufacturers strive to differentiate themselves through unique product features, sustainability certifications, and superior customer service. The market penetration of composite decking, for example, has grown substantially, displacing traditional wood decking in many applications due to its longevity and reduced upkeep. The shift towards fiber cement siding, driven by its fire resistance and durability, also represents a significant trend impacting market share dynamics. The market is also experiencing a growing demand for aesthetically versatile products that can cater to diverse architectural styles, from modern minimalist to traditional rustic. This necessitates continuous innovation in color palettes, textures, and profiles across both siding and decking categories. The increasing awareness of the environmental impact of construction materials further drives the adoption of sustainable alternatives, creating opportunities for manufacturers prioritizing green building practices.

Dominant Markets & Segments in North America Siding and Decking Market

The United States stands as the dominant market within the North America siding and decking sector, accounting for an estimated 75% of the total market value in 2025. This dominance is attributed to its larger population, higher disposable incomes, and a more active housing construction and renovation market compared to Canada. Within the United States, key drivers for this dominance include robust economic policies supporting construction, significant investment in infrastructure projects, and a well-established housing market with a continuous cycle of new builds and upgrades.

Dominant Segments:

Type: Composite Decking

- Key Drivers: Growing preference for low-maintenance, high-durability alternatives to traditional wood. Increasing awareness of composite decking's resistance to rot, insect infestation, and fading. Aesthetic advancements offering realistic wood grain textures and diverse color options.

- Dominance Analysis: Composite decking is projected to capture over 40% of the total decking market value in North America by 2025. This growth is further propelled by government incentives promoting sustainable building materials and increasing homeowner investment in outdoor living spaces. Companies like Trex Company Inc. and Fiberon have been instrumental in popularizing composite decking through continuous innovation and extensive distribution networks. The segment's dominance is also influenced by its superior lifespan and reduced environmental impact compared to treated wood, aligning with evolving consumer values.

Siding Material: Vinyl

- Key Drivers: Cost-effectiveness, ease of installation, and wide availability. Excellent resistance to moisture and pests. A broad spectrum of colors and styles catering to various architectural needs.

- Dominance Analysis: Vinyl siding continues to hold a significant market share, particularly in the residential construction sector, estimated at around 35% of the total siding market. Its affordability makes it a preferred choice for budget-conscious builders and homeowners. The segment's dominance is further reinforced by ongoing product improvements, such as enhanced impact resistance and energy efficiency features. Companies like CertainTeed and Royal Building Products are key players in this segment, offering extensive product lines and distribution.

End User: Residential

- Key Drivers: Strong demand for home improvement and renovation. Increasing investment in outdoor living spaces (decks, patios). New home construction trends.

- Dominance Analysis: The residential sector represents the largest end-user segment, accounting for an estimated 70% of the North America siding and decking market revenue in 2025. This is driven by a consistent desire among homeowners to enhance their property value, comfort, and aesthetic appeal. The growth in the "aging-in-place" trend also fuels renovations, further boosting demand for durable and low-maintenance siding and decking. The increasing popularity of outdoor entertainment spaces has significantly contributed to the growth of the decking segment within the residential market.

Geography: United States

- Key Drivers: Larger housing market and construction activity. Higher disposable incomes for renovation projects. Favorable economic conditions supporting new builds and infrastructure development.

- Dominance Analysis: As mentioned earlier, the United States is the leading geography. Its dominance is sustained by a proactive construction industry, a strong consumer appetite for home upgrades, and a significant volume of both new residential and commercial projects. The sheer scale of the US market provides ample opportunities for manufacturers to achieve economies of scale and drive significant revenue.

North America Siding and Decking Market Product Innovations

Product innovation in the North America siding and decking market is largely centered on enhancing durability, sustainability, and aesthetic appeal. Manufacturers are developing advanced composite materials with improved UV resistance, scratch resistance, and fade warranties, often mimicking natural wood textures with remarkable fidelity. There's a growing trend towards embracing recycled and reclaimed materials, with companies like Cali Bamboo pioneering sustainable bamboo-based decking and siding solutions. MoistureShield and Trex Company Inc. are at the forefront of developing low-maintenance, high-performance composite decking that offers superior fade and stain resistance. In the siding segment, innovations include advanced fiber cement formulations offering enhanced fire resistance and impact durability, as well as vinyl siding with improved insulation properties and a wider range of sophisticated color palettes. The development of integrated systems, such as pre-finished siding and decking, also streamlines installation and reduces project timelines, offering a competitive advantage.

Report Segmentation & Scope

This comprehensive report segments the North America siding and decking market by Type, Siding Material, End User, and Geography.

Type Segmentation: This section analyzes Wooden Decking, Plastic Decking, Aluminium Decking, and Composite Decking. The composite decking segment is expected to show the highest growth, driven by its durability and low maintenance. Wooden decking, though a traditional segment, continues to hold a significant share, especially in custom builds.

Siding Material Segmentation: The market is analyzed across Vinyl, Fibre Cement, Wood, Stone, Metal, and Others. Vinyl siding is projected to maintain its leading position due to its cost-effectiveness, while fibre cement is gaining traction for its durability and fire resistance.

End User Segmentation: This report categorizes the market into Residential, Commercial, and Non-Building / Non-Residential sectors. The residential segment is anticipated to dominate, fueled by renovation and new construction activities.

Geographic Segmentation: The market is studied across the United States and Canada. The United States is expected to remain the larger market, driven by its robust construction industry and consumer spending on home improvements.

Key Drivers of North America Siding and Decking Market Growth

The growth of the North America siding and decking market is propelled by several key drivers. Firstly, the persistent demand for home improvement and renovation activities, particularly driven by homeowners seeking to enhance their property value and outdoor living spaces, is a significant economic factor. Secondly, technological advancements in material science are leading to the development of more durable, sustainable, and aesthetically pleasing siding and decking products, such as advanced composites and engineered wood, which offer superior performance and lower maintenance. Thirdly, increasing urbanization and population growth in North America necessitate new construction of residential and commercial buildings, directly boosting the demand for these building materials. Finally, a growing consumer preference for low-maintenance, weather-resistant, and eco-friendly building solutions aligns perfectly with the product offerings of many leading manufacturers, further accelerating market adoption.

Challenges in the North America Siding and Decking Market Sector

Despite the positive growth trajectory, the North America siding and decking market faces several challenges. Fluctuations in raw material prices, such as lumber, plastic resins, and aluminum, can impact manufacturing costs and profit margins, leading to price volatility for end-users. Stringent environmental regulations and building codes, while promoting sustainability, can also increase compliance costs and necessitate significant R&D investment for manufacturers to meet evolving standards. Supply chain disruptions, exacerbated by global events, can lead to material shortages and delivery delays, impacting project timelines and customer satisfaction. Moreover, intense competition among established players and the emergence of new entrants can lead to price wars, particularly in commoditized segments, and pressure profit margins. The initial higher cost of premium composite and engineered wood products compared to traditional materials can also be a barrier to adoption for some consumer segments.

Leading Players in the North America Siding and Decking Market Market

- Trex Company Inc

- Fiberon

- Louisiana Pacific Corporation

- AZEK Building Products

- Westlake Chemical

- Timber Holdings USA

- NewTechWood

- Kayu Canada

- Maibec

- Fortune Brands

- MoistureShield

- Cali Bamboo

- Woodguard

Key Developments in North America Siding and Decking Market Sector

- 2023: Trex Company Inc. launched new lines of composite decking with enhanced fade and stain warranties, reflecting a focus on product longevity.

- 2023: Fiberon introduced innovative composite decking profiles featuring improved slip resistance and a wider range of color options to cater to evolving design trends.

- 2022: AZEK Building Products acquired a company specializing in composite railing systems, expanding its integrated outdoor living solutions.

- 2022: Westlake Chemical expanded its production capacity for PVC-based building products, anticipating increased demand for vinyl siding.

- 2021: MoistureShield announced significant advancements in its proprietary Capped Polymer technology, offering superior performance against moisture and staining.

- 2021: Cali Bamboo released a new range of sustainable bamboo siding products, emphasizing eco-friendly construction alternatives.

- 2020: Timber Holdings USA focused on expanding its distribution network for sustainably sourced hardwood decking in key US markets.

Strategic North America Siding and Decking Market Market Outlook

The strategic outlook for the North America siding and decking market is highly positive, driven by a confluence of evolving consumer demands and technological advancements. The market is characterized by a strong growth accelerator in the residential renovation and remodeling sector, where homeowners are increasingly prioritizing outdoor living spaces and seeking durable, low-maintenance, and aesthetically pleasing solutions. Furthermore, the continued emphasis on sustainability and eco-friendly building materials presents a significant opportunity for manufacturers investing in recycled content and responsible sourcing. Innovations in composite and engineered wood technologies, offering enhanced performance and design flexibility, will continue to drive market penetration. The commercial sector, while smaller, is also showing promising growth, particularly in multi-family housing and hospitality projects. Strategic opportunities lie in product differentiation through advanced materials, unique design offerings, and strong branding that emphasizes sustainability and longevity. Expanding distribution channels and offering integrated solutions for both siding and decking can further enhance market reach and customer value.

North America Siding and Decking Market Segmentation

-

1. Type

- 1.1. Wooden Decking

- 1.2. Plastic Decking

- 1.3. Aluminium Decking

- 1.4. Composite Decking

-

2. Siding Material

- 2.1. Vinyl

- 2.2. Fibre Cement

- 2.3. Wood

- 2.4. Stone

- 2.5. Metal

- 2.6. Others

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Non-Building / Non-Residential

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Siding and Decking Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Siding and Decking Market Regional Market Share

Geographic Coverage of North America Siding and Decking Market

North America Siding and Decking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth in the Hospitality Sector is Shifting to Commercial Smart Kitchen Appliances; Surge in Urban Population and Rise in Expenditure on Home Renovations Driving Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns About Data Privacy Among End Users Can Impedes Market Growth; High Cost of Maintenance and Upkeep

- 3.4. Market Trends

- 3.4.1. United States is one of the most Expanding Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Siding and Decking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wooden Decking

- 5.1.2. Plastic Decking

- 5.1.3. Aluminium Decking

- 5.1.4. Composite Decking

- 5.2. Market Analysis, Insights and Forecast - by Siding Material

- 5.2.1. Vinyl

- 5.2.2. Fibre Cement

- 5.2.3. Wood

- 5.2.4. Stone

- 5.2.5. Metal

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Non-Building / Non-Residential

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Siding and Decking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wooden Decking

- 6.1.2. Plastic Decking

- 6.1.3. Aluminium Decking

- 6.1.4. Composite Decking

- 6.2. Market Analysis, Insights and Forecast - by Siding Material

- 6.2.1. Vinyl

- 6.2.2. Fibre Cement

- 6.2.3. Wood

- 6.2.4. Stone

- 6.2.5. Metal

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Non-Building / Non-Residential

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Siding and Decking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wooden Decking

- 7.1.2. Plastic Decking

- 7.1.3. Aluminium Decking

- 7.1.4. Composite Decking

- 7.2. Market Analysis, Insights and Forecast - by Siding Material

- 7.2.1. Vinyl

- 7.2.2. Fibre Cement

- 7.2.3. Wood

- 7.2.4. Stone

- 7.2.5. Metal

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Non-Building / Non-Residential

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Cali Bamboo

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Timber Holdings USA

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 NewTechWood

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Kayu Canada

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Maibec

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Trex Company Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Fiberon

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Louisiana Pacific Corporation

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Fortune Brands

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 MoistureShield

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 AZEK Building Products

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Westlake Chemical

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Woodguard

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Cali Bamboo

List of Figures

- Figure 1: North America Siding and Decking Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Siding and Decking Market Share (%) by Company 2025

List of Tables

- Table 1: North America Siding and Decking Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America Siding and Decking Market Volume Squar foot Forecast, by Type 2020 & 2033

- Table 3: North America Siding and Decking Market Revenue million Forecast, by Siding Material 2020 & 2033

- Table 4: North America Siding and Decking Market Volume Squar foot Forecast, by Siding Material 2020 & 2033

- Table 5: North America Siding and Decking Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: North America Siding and Decking Market Volume Squar foot Forecast, by End User 2020 & 2033

- Table 7: North America Siding and Decking Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Siding and Decking Market Volume Squar foot Forecast, by Geography 2020 & 2033

- Table 9: North America Siding and Decking Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: North America Siding and Decking Market Volume Squar foot Forecast, by Region 2020 & 2033

- Table 11: North America Siding and Decking Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: North America Siding and Decking Market Volume Squar foot Forecast, by Type 2020 & 2033

- Table 13: North America Siding and Decking Market Revenue million Forecast, by Siding Material 2020 & 2033

- Table 14: North America Siding and Decking Market Volume Squar foot Forecast, by Siding Material 2020 & 2033

- Table 15: North America Siding and Decking Market Revenue million Forecast, by End User 2020 & 2033

- Table 16: North America Siding and Decking Market Volume Squar foot Forecast, by End User 2020 & 2033

- Table 17: North America Siding and Decking Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: North America Siding and Decking Market Volume Squar foot Forecast, by Geography 2020 & 2033

- Table 19: North America Siding and Decking Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: North America Siding and Decking Market Volume Squar foot Forecast, by Country 2020 & 2033

- Table 21: North America Siding and Decking Market Revenue million Forecast, by Type 2020 & 2033

- Table 22: North America Siding and Decking Market Volume Squar foot Forecast, by Type 2020 & 2033

- Table 23: North America Siding and Decking Market Revenue million Forecast, by Siding Material 2020 & 2033

- Table 24: North America Siding and Decking Market Volume Squar foot Forecast, by Siding Material 2020 & 2033

- Table 25: North America Siding and Decking Market Revenue million Forecast, by End User 2020 & 2033

- Table 26: North America Siding and Decking Market Volume Squar foot Forecast, by End User 2020 & 2033

- Table 27: North America Siding and Decking Market Revenue million Forecast, by Geography 2020 & 2033

- Table 28: North America Siding and Decking Market Volume Squar foot Forecast, by Geography 2020 & 2033

- Table 29: North America Siding and Decking Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: North America Siding and Decking Market Volume Squar foot Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Siding and Decking Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the North America Siding and Decking Market?

Key companies in the market include Cali Bamboo, Timber Holdings USA, NewTechWood, Kayu Canada, Maibec, Trex Company Inc, Fiberon, Louisiana Pacific Corporation, Fortune Brands, MoistureShield, AZEK Building Products, Westlake Chemical, Woodguard.

3. What are the main segments of the North America Siding and Decking Market?

The market segments include Type, Siding Material, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.7 million as of 2022.

5. What are some drivers contributing to market growth?

The Growth in the Hospitality Sector is Shifting to Commercial Smart Kitchen Appliances; Surge in Urban Population and Rise in Expenditure on Home Renovations Driving Market Growth.

6. What are the notable trends driving market growth?

United States is one of the most Expanding Markets.

7. Are there any restraints impacting market growth?

Concerns About Data Privacy Among End Users Can Impedes Market Growth; High Cost of Maintenance and Upkeep.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Squar foot.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Siding and Decking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Siding and Decking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Siding and Decking Market?

To stay informed about further developments, trends, and reports in the North America Siding and Decking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence