Key Insights

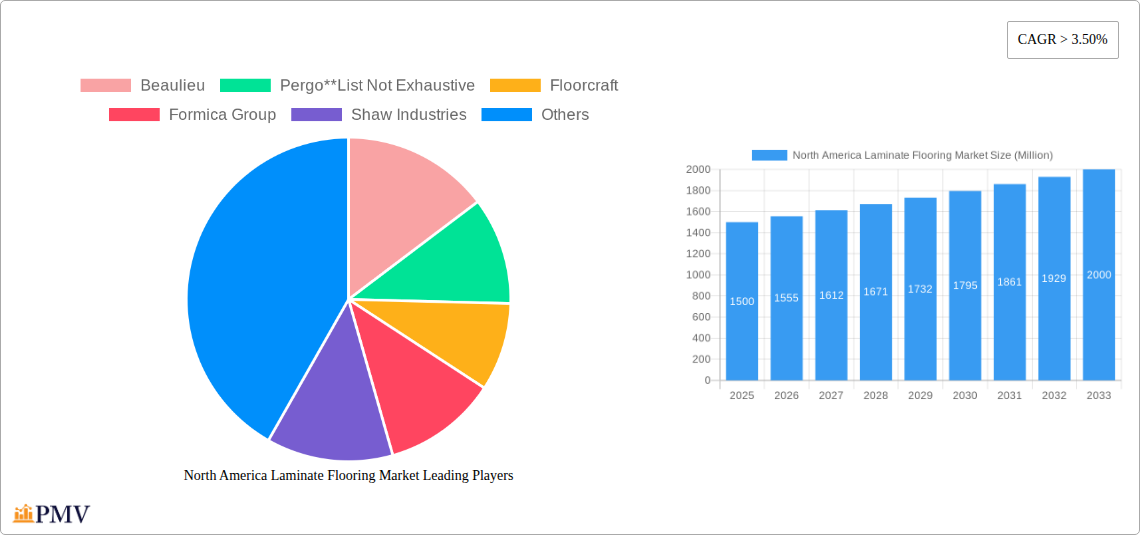

The North America Laminate Flooring Market is poised for steady expansion, projected to grow at a Compound Annual Growth Rate (CAGR) exceeding 3.50% over the forecast period of 2025-2033. The market, currently valued at approximately USD 1,500 million, is being propelled by several key drivers. Increasing consumer preference for durable, aesthetically versatile, and cost-effective flooring solutions continues to fuel demand. Furthermore, the rising trend of home renovation and new construction projects across both residential and commercial sectors in the United States and Canada significantly contributes to market growth. The product segment is dominated by High-density Fiberboard (HDF) laminated flooring due to its enhanced durability and moisture resistance, while Medium-density Fiberboard (MDF) laminated flooring offers a more budget-friendly alternative. The residential sector represents the largest end-user segment, driven by homeowners seeking stylish and practical flooring options. The commercial sector is also witnessing substantial growth, with businesses opting for laminate flooring for its low maintenance and long lifespan in high-traffic areas.

North America Laminate Flooring Market Market Size (In Billion)

The distribution landscape is characterized by a blend of traditional and evolving channels. Offline retail stores, including home improvement centers and specialized flooring retailers, continue to hold a significant market share, providing customers with the opportunity to see and feel the products. However, online stores are rapidly gaining traction, offering convenience and a wider selection, and playing an increasingly important role in reaching a broader customer base. Key players like Mohawk Industries, Shaw Industries, and Tarkett are actively investing in product innovation, sustainability initiatives, and expanding their distribution networks to capture market share. While the market benefits from strong demand drivers, potential restraints such as fluctuations in raw material prices and increasing competition from alternative flooring materials like luxury vinyl tile (LVT) need to be carefully navigated. Nonetheless, the overall outlook for the North America Laminate Flooring Market remains positive, with sustained growth anticipated.

North America Laminate Flooring Market Company Market Share

This in-depth market research report provides an exhaustive analysis of the North America Laminate Flooring Market, covering the study period from 2019 to 2033. With 2025 as the base and estimated year, and a robust forecast period of 2025-2033, this report offers critical insights for stakeholders seeking to understand market dynamics, growth trajectories, and competitive landscapes. The report delves into key segments, including product types (High-density Fiberboard Laminated Flooring, Medium-density Fiberboard Laminated Flooring), end-users (Residential, Commercial), distribution channels (Offline Stores, Online Stores), and geographies (United States, Canada). Leveraging high-ranking keywords such as "laminate flooring market," "North America flooring," "HDF laminate," "MDF laminate," "residential flooring," "commercial flooring," "online flooring sales," and "United States flooring trends," this report aims to maximize search visibility and engage industry professionals.

North America Laminate Flooring Market Market Structure & Competitive Dynamics

The North America Laminate Flooring Market exhibits a moderately concentrated structure, with a blend of established global players and regional manufacturers vying for market share. Key companies like Mohawk Industries, Shaw Industries, and Tarkett hold significant positions, driven by extensive distribution networks and diverse product portfolios. Innovation ecosystems are thriving, particularly in developing more durable, water-resistant, and aesthetically versatile laminate options that mimic natural materials like wood and stone. Regulatory frameworks primarily focus on environmental standards, VOC emissions, and product safety, influencing manufacturing processes and material sourcing. Product substitutes, including vinyl, engineered wood, and tile, present a continuous challenge, pushing laminate manufacturers to enhance performance and value propositions. End-user trends lean towards sustainable materials, ease of installation, and budget-friendly yet stylish flooring solutions. Mergers and acquisitions (M&A) activity has been strategic, with companies aiming to expand their product offerings, geographical reach, or technological capabilities. For instance, acquisitions focused on integrating advanced manufacturing technologies or expanding into emerging distribution channels like e-commerce are noteworthy. The market share distribution reflects the dominance of larger players, though niche manufacturers are carving out success through specialization. M&A deal values vary significantly, often influenced by the strategic importance of the acquired entity's technology or market access. Understanding these dynamics is crucial for navigating the competitive landscape and identifying future growth opportunities.

North America Laminate Flooring Market Industry Trends & Insights

The North America Laminate Flooring Market is experiencing robust growth, fueled by a confluence of evolving consumer preferences, technological advancements, and economic factors. A key driver is the increasing demand for aesthetically pleasing and cost-effective flooring solutions, particularly within the residential sector. Laminate flooring has successfully bridged the gap between affordability and design, offering a wide array of styles that replicate the look and feel of natural hardwood and stone without the associated high costs. The forecast CAGR for this market is estimated to be robust, indicating sustained expansion throughout the forecast period. Technological disruptions are playing a pivotal role, with innovations focusing on enhancing the durability, water resistance, and scratch resistance of laminate products. The development of advanced core materials and wear layers ensures that laminate can withstand heavy foot traffic and moisture, making it a viable option for kitchens, bathrooms, and high-traffic commercial spaces. Furthermore, advancements in printing and embossing technologies allow for incredibly realistic textures and patterns, significantly boosting consumer appeal. Consumer preferences are increasingly aligning with sustainability and ease of maintenance. Manufacturers are responding by developing eco-friendly laminate options with lower VOC emissions and utilizing recycled materials where possible. The convenience of installation and maintenance continues to be a significant selling point for DIY enthusiasts and busy homeowners alike. Competitive dynamics are intensifying as both established players and new entrants strive to capture market share. This competition drives innovation and offers consumers a wider selection of high-quality, affordable products. Market penetration is expected to deepen as laminate flooring continues to gain acceptance as a premium alternative to traditional materials. The interplay between economic recovery, housing market trends, and consumer spending power will continue to shape the trajectory of this dynamic market.

Dominant Markets & Segments in North America Laminate Flooring Market

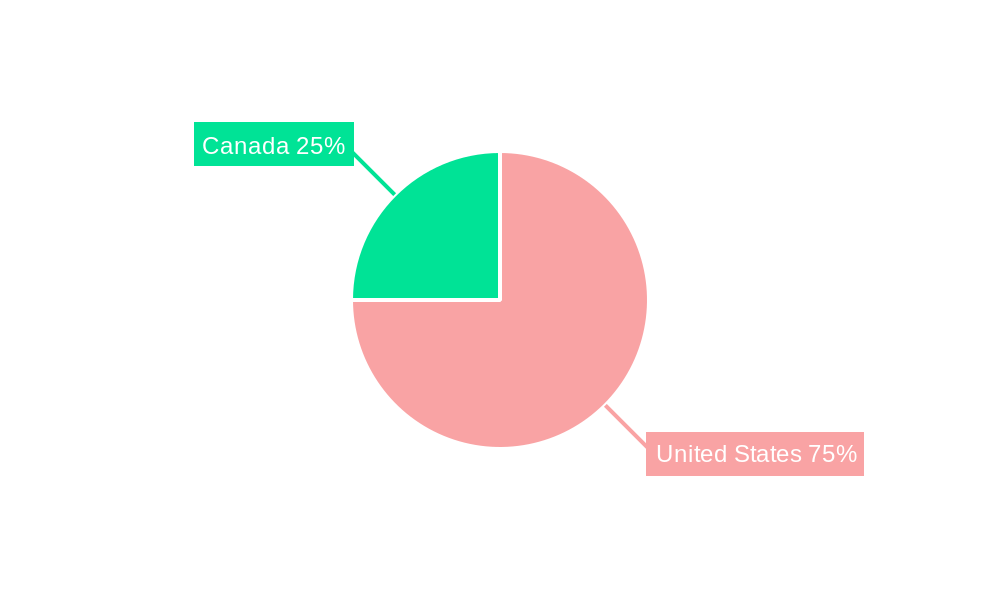

The North America Laminate Flooring Market is characterized by distinct regional dominance and segment preferences, driven by a variety of socio-economic and demographic factors.

Dominant Geography: United States The United States unequivocally holds the position as the largest and most influential market for laminate flooring in North America. This dominance is attributed to several key drivers:

- Economic Policies and Consumer Spending: A generally strong economy and higher disposable incomes in the US translate to greater consumer spending on home renovation and new construction projects, directly benefiting the flooring industry.

- Housing Market Dynamics: The sheer size of the US housing market, encompassing both new builds and a vast existing stock of homes undergoing renovations, provides a substantial and continuous demand for flooring solutions. Government initiatives promoting homeownership and affordable housing further bolster this demand.

- Urbanization and Infrastructure Development: Ongoing urbanization and infrastructure development projects in major US cities create opportunities for both residential and commercial laminate flooring installations.

- Consumer Awareness and Preference: Widespread awareness of laminate flooring's benefits, such as its affordability, durability, and diverse aesthetic options, has solidified its position as a preferred choice for many American households and businesses.

Dominant Product Type: High-density Fiberboard Laminated Flooring High-density fiberboard (HDF) laminated flooring is the leading product type, significantly outperforming its medium-density counterpart.

- Superior Durability and Performance: HDF core provides enhanced resistance to impact, moisture, and wear and tear, making it suitable for high-traffic areas and demanding environments.

- Aesthetic Versatility: The dense core allows for finer detailing in printing and embossing, resulting in more realistic wood and stone textures and patterns, which are highly sought after by consumers.

- Technological Advancements: Manufacturers have invested heavily in improving HDF core technology, making it more dimensionally stable and resistant to swelling, thus addressing a traditional weakness of laminate flooring.

Dominant End User: Residential The residential sector represents the largest end-user segment for laminate flooring.

- Affordability and Aesthetics: Homeowners are attracted to laminate flooring's ability to provide the look of premium materials like hardwood at a significantly lower price point.

- DIY Installation and Renovation Trends: The ease of installation associated with laminate flooring appeals to a large segment of homeowners undertaking DIY renovation projects, a trend that has been amplified in recent years.

- Versatility in Applications: Laminate flooring is suitable for various rooms within a home, including living rooms, bedrooms, hallways, and increasingly, kitchens and bathrooms due to advancements in water-resistant technologies.

Dominant Distribution Channel: Offline Stores Despite the rise of e-commerce, offline retail stores continue to be the primary distribution channel for laminate flooring.

- Tangible Product Experience: Consumers often prefer to see, touch, and feel flooring materials before making a purchase. Offline stores allow for this tactile experience, enabling customers to assess the color, texture, and quality firsthand.

- Expert Advice and Installation Services: Brick-and-mortar retailers offer professional advice from sales associates and provide installation services, which are crucial for many consumers who lack the expertise or time for DIY installation.

- Trust and Brand Building: Established retail chains and independent flooring stores have built trust over years of service, contributing to their continued dominance in product distribution.

North America Laminate Flooring Market Product Innovations

Product innovations in the North America Laminate Flooring Market are primarily focused on enhancing durability, water resistance, and aesthetic realism. Advances in High-Density Fiberboard (HDF) core technology have led to superior dimensional stability and improved resistance to moisture and impact. Wear layers are becoming increasingly robust, offering enhanced scratch and fade resistance, extending the lifespan of the flooring. Furthermore, sophisticated printing and embossing techniques are creating hyper-realistic textures and patterns that closely mimic natural wood grains and stone surfaces, diminishing the distinction between laminate and its premium counterparts. These innovations provide competitive advantages by meeting consumer demand for high-performance, visually appealing, and budget-friendly flooring solutions suitable for diverse applications, from busy homes to commercial spaces.

Report Segmentation & Scope

This report comprehensively segments the North America Laminate Flooring Market across key categories to provide granular insights. The Product Type segmentation includes High-density Fiberboard Laminated Flooring and Medium-density Fiberboard Laminated Flooring, offering analysis of market sizes, growth projections, and competitive dynamics within each. The End User segmentation differentiates between Residential and Commercial applications, detailing their respective market shares, growth drivers, and specific demands. The Distribution Channel analysis covers Offline Stores and Online Stores, examining consumer purchasing habits and the evolving role of e-commerce. Geographically, the report focuses on the United States and Canada, providing in-depth regional market analysis, including economic influences, construction trends, and consumer preferences that shape market penetration and growth.

Key Drivers of North America Laminate Flooring Market Growth

Several key drivers are propelling the growth of the North America Laminate Flooring Market. The rising demand for aesthetically pleasing yet affordable flooring solutions in both residential and commercial sectors is paramount. Advancements in manufacturing technology, leading to enhanced durability, scratch resistance, and water resistance in laminate products, are crucial. Furthermore, the growing trend of home renovation and DIY projects, coupled with the ease of installation characteristic of laminate flooring, significantly contributes to its market penetration. Economic recovery and positive housing market trends in the United States and Canada further stimulate demand. The increasing focus on sustainable building materials and lower VOC emissions in manufacturing also presents an opportunity for laminate producers who adapt their product lines accordingly.

Challenges in the North America Laminate Flooring Market Sector

Despite its growth, the North America Laminate Flooring Market faces several challenges. Intense competition from substitute flooring materials such as luxury vinyl plank (LVP), engineered wood, and tile exerts constant pressure on pricing and market share. Consumer perception regarding the long-term durability and potential for water damage, although diminishing with technological advancements, remains a barrier for some. Regulatory hurdles related to emissions standards and sustainability certifications can increase manufacturing costs and complexity. Supply chain disruptions, influenced by global economic conditions and material availability, can impact production timelines and costs. Additionally, the increasing adoption of online purchasing for home goods necessitates significant investment in e-commerce infrastructure and digital marketing strategies to remain competitive.

Leading Players in the North America Laminate Flooring Market Market

- Beaulieu

- Pergo

- Floorcraft

- Formica Group

- Shaw Industries

- Tarkett

- Armstrong Flooring Inc

- Mannington Mills

- Richmond

- Mohawk Industries

Key Developments in North America Laminate Flooring Market Sector

- February 2023: Shaw Industries Group, Inc. announced the completion of its acquisition of a controlling interest in Watershed Solar LLC, a provider of patented renewable energy solutions. The technology, known as PowerCap, features low-profile, high-output solar arrays installed on landfills, coal ash closures, and rooftops. This innovative approach transforms liabilities or underutilized spaces into valuable renewable energy assets.

- October 2023: Tarkett has complete Collaborative portfolio, featuring eleven designs in total across soft surface and LVT flooring. The collection was first showcased at Design Days this summer and has since become one of Tarkett's most eagerly awaited collections of the year.

Strategic North America Laminate Flooring Market Market Outlook

The strategic outlook for the North America Laminate Flooring Market remains highly positive, driven by continued innovation and evolving consumer demands. Growth accelerators include further advancements in water-resistant and scratch-proof technologies, making laminate suitable for an even wider range of applications, including high-moisture areas. The increasing preference for sustainable and eco-friendly building materials presents a significant opportunity for manufacturers focusing on responsible sourcing and production. The expansion of e-commerce channels, coupled with enhanced digital marketing strategies, will be crucial for reaching a broader consumer base. Strategic partnerships and potential consolidations within the industry can lead to greater market efficiencies and product diversification. The sustained demand for affordable, stylish, and durable flooring solutions in both the residential and commercial sectors positions the laminate flooring market for continued expansion and opportunity throughout the forecast period.

North America Laminate Flooring Market Segmentation

-

1. Product Type

- 1.1. High-density Fiberboard Laminated Flooring

- 1.2. Medium-density Fiberboard Laminated Flooring

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Laminate Flooring Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Laminate Flooring Market Regional Market Share

Geographic Coverage of North America Laminate Flooring Market

North America Laminate Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction

- 3.3. Market Restrains

- 3.3.1. Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring

- 3.4. Market Trends

- 3.4.1. Increase In Use Of Laminated Floor Covering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Fiberboard Laminated Flooring

- 5.1.2. Medium-density Fiberboard Laminated Flooring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-density Fiberboard Laminated Flooring

- 6.1.2. Medium-density Fiberboard Laminated Flooring

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Stores

- 6.3.2. Online Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-density Fiberboard Laminated Flooring

- 7.1.2. Medium-density Fiberboard Laminated Flooring

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Stores

- 7.3.2. Online Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Beaulieu

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Pergo**List Not Exhaustive

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Floorcraft

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Formica Group

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Shaw Industries

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Tarkett

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Armstrong Flooring Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Mannington Mills

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Richmond

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Mohawk Industries

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Beaulieu

List of Figures

- Figure 1: North America Laminate Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Laminate Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Laminate Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Laminate Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Laminate Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Laminate Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Laminate Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Laminate Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Laminate Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Laminate Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Laminate Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Laminate Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Laminate Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North America Laminate Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: North America Laminate Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Laminate Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Laminate Flooring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Laminate Flooring Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the North America Laminate Flooring Market?

Key companies in the market include Beaulieu, Pergo**List Not Exhaustive, Floorcraft, Formica Group, Shaw Industries, Tarkett, Armstrong Flooring Inc, Mannington Mills, Richmond, Mohawk Industries.

3. What are the main segments of the North America Laminate Flooring Market?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction.

6. What are the notable trends driving market growth?

Increase In Use Of Laminated Floor Covering.

7. Are there any restraints impacting market growth?

Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring.

8. Can you provide examples of recent developments in the market?

In February 2023, Shaw Industries Group, Inc. announced the completion of its acquisition of a controlling interest in Watershed Solar LLC, a provider of patented renewable energy solutions. The technology, known as PowerCap, features low-profile, high-output solar arrays installed on landfills, coal ash closures, and rooftops. This innovative approach transforms liabilities or underutilized spaces into valuable renewable energy assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Laminate Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Laminate Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Laminate Flooring Market?

To stay informed about further developments, trends, and reports in the North America Laminate Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence