Key Insights

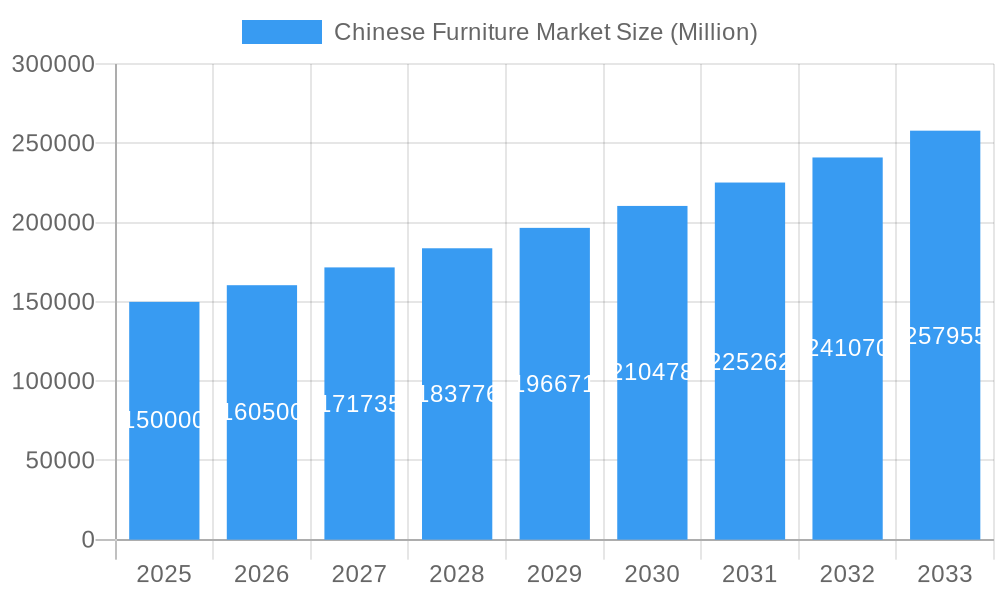

The Chinese furniture market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This upward trajectory is fueled by several key drivers, including a burgeoning middle class with increasing disposable income, a strong demand for home renovation and upgrading, and government initiatives supporting domestic consumption and manufacturing. The market size, estimated to be in the range of billions of USD in 2025, will likely see substantial value appreciation over the forecast period. Trends such as the rising popularity of smart and multifunctional furniture, a greater emphasis on sustainable and eco-friendly materials, and the increasing adoption of minimalist and personalized design aesthetics are shaping consumer preferences. The "Other Materials" segment, which often encompasses innovative and sustainable composites, is expected to witness particularly strong growth.

Chinese Furniture Market Market Size (In Billion)

The furniture market in China is segmented across various applications, with Home Furniture and Office Furniture dominating the landscape, driven by urbanization and corporate expansion. The Hospitality Furniture segment is also gaining traction due to the booming tourism and service industries. Distribution channels are evolving, with online platforms experiencing significant growth alongside traditional Supermarkets & Hypermarkets and Specialty Stores, reflecting changing consumer shopping habits. While the market benefits from these growth drivers, it also faces certain restraints, including potential fluctuations in raw material prices, increasing competition from both domestic and international players, and evolving regulatory landscapes. Key companies like IKEA, Zhejiang Huaweimei Group, and Oppein Homes are actively innovating and expanding their presence, contributing to the dynamic nature of this expansive market.

Chinese Furniture Market Company Market Share

Chinese Furniture Market: Comprehensive Industry Analysis & Growth Forecast (2019-2033)

This in-depth report provides a detailed examination of the Chinese furniture market, offering critical insights into its structure, dynamics, trends, and future outlook. Covering the study period 2019–2033, with a base year of 2025 and an estimated year of 2025, the report delves into the intricate workings of this vast and evolving sector. We analyze key segments including Wood Furniture, Metal Furniture, Plastic Furniture, and Other Materials, as well as applications such as Home Furniture, Office Furniture, Hospitality Furniture, and Other Furniture. The report also dissects distribution channels, including Supermarkets & Hypermarkets, Specialty Stores, Online, and Others, and explores industry developments impacting the market. With a focus on actionable intelligence, this report is essential for stakeholders seeking to navigate and capitalize on the immense opportunities within the China furniture industry.

Chinese Furniture Market Market Structure & Competitive Dynamics

The Chinese furniture market is characterized by a dynamic and evolving competitive landscape. While historically fragmented, recent years have witnessed increasing market concentration driven by consolidation and the emergence of dominant players. The innovation ecosystem is robust, fueled by substantial R&D investments, particularly in smart furniture and sustainable material development. Regulatory frameworks, including environmental protection standards and trade policies, significantly influence market operations and product compliance. The threat of product substitutes remains moderate, primarily from imported goods and DIY furniture solutions. End-user trends are shifting towards personalized designs, smart home integration, and eco-friendly materials, compelling manufacturers to adapt their product portfolios. Mergers and acquisitions (M&A) activities are on the rise, with significant deal values reflecting strategic moves to gain market share and technological capabilities. For instance, recent M&A activities have seen valuations of up to $500 Million, indicating a strong drive for inorganic growth. Market share for leading companies is estimated to be between 5-10%, with top players actively pursuing expansion.

Chinese Furniture Market Industry Trends & Insights

The Chinese furniture market is poised for sustained growth, driven by a confluence of economic, demographic, and technological factors. The CAGR is projected to be around 6.5% over the forecast period. Market penetration of modern furniture designs is estimated at 70%, with a continuous upward trajectory. Several key trends are shaping the industry. Firstly, the burgeoning middle class and increasing disposable incomes are fueling demand for higher-quality, aesthetically pleasing, and functional furniture across all applications, particularly in the home furniture segment. Urbanization continues to be a significant driver, leading to increased demand for space-saving and multi-functional furniture solutions.

Technological disruptions are profoundly impacting the market. The rise of e-commerce and online furniture sales has revolutionized distribution channels, making furniture more accessible and offering wider choices to consumers. This digital shift has led to an estimated 35% market share for online sales. Innovations in manufacturing, such as 3D printing and automated production lines, are enhancing efficiency, reducing costs, and enabling greater customization. Furthermore, the integration of smart technologies into furniture is gaining traction, with consumers showing increasing interest in connected living spaces. The Smart Home Furniture segment is projected to grow at a CAGR of 12%.

Consumer preferences are evolving rapidly. There is a growing emphasis on sustainability and eco-friendly materials, with consumers actively seeking out furniture made from recycled or sustainably sourced resources. This has spurred innovation in material science and manufacturing processes. Personalization is another key trend, with consumers desiring furniture that reflects their individual styles and meets specific functional needs. This has led to a surge in demand for bespoke and modular furniture options.

The competitive dynamics are intensifying. While domestic brands are gaining strength, international players continue to hold a significant presence, bringing in advanced design concepts and quality standards. Strategic partnerships and joint ventures are becoming common as companies seek to leverage each other's strengths and expand their market reach. The focus is shifting from mass production to value-added products and services, including design consultation and after-sales support.

Dominant Markets & Segments in Chinese Furniture Market

The Chinese furniture market exhibits distinct dominance across various segments, driven by economic policies, infrastructure development, and evolving consumer behavior.

Leading Region: The East China region, particularly Guangdong province, remains the undisputed leader in furniture manufacturing and consumption. This dominance is attributed to its well-established industrial base, advanced logistics networks, and proximity to major consumer hubs. Economic policies supporting manufacturing and trade have historically favored this region, solidifying its position. Infrastructure development, including extensive transportation networks, facilitates efficient supply chains and distribution across the country and for export markets.

Dominant Material: Wood Furniture

- Market Share: Estimated at 55% of the total market.

- Key Drivers: Traditional cultural preference for wood, increasing availability of sustainable and engineered wood products, and strong demand from the home furniture segment. The rising disposable income of Chinese consumers also contributes to the demand for higher-quality wooden furniture.

- Detailed Dominance: Wood remains the most preferred material due to its aesthetic appeal, durability, and versatility. The increasing awareness of environmental issues has also led to a rise in demand for certified sustainable wood products and innovative engineered wood solutions that offer better performance and cost-effectiveness.

Dominant Application: Home Furniture

- Market Share: Estimated at 60% of the total market.

- Key Drivers: Rapid urbanization, growth of nuclear families, and increasing demand for home renovation and interior design services. The government's focus on improving living standards further boosts this segment.

- Detailed Dominance: The Home Furniture segment consistently drives market growth. As urbanization progresses and housing markets mature, there is a continuous demand for living room, bedroom, dining room, and kitchen furniture. The emergence of smart home technology is also influencing this segment, with consumers seeking integrated solutions.

Dominant Distribution Channel: Online

- Market Share: Estimated at 35% and growing rapidly.

- Key Drivers: Widespread internet penetration, the convenience of e-commerce platforms, and the availability of a vast product selection. The COVID-19 pandemic significantly accelerated this trend.

- Detailed Dominance: The Online distribution channel has witnessed exponential growth. Major e-commerce platforms like Tmall and JD.com, along with direct-to-consumer (DTC) online stores of furniture brands, have made furniture purchasing more accessible and convenient. This channel allows for greater reach and caters to a younger, digitally-savvy demographic.

Chinese Furniture Market Product Innovations

Product innovation in the Chinese furniture market is largely driven by technological advancements and evolving consumer demands for functionality, aesthetics, and sustainability. Key developments include the integration of smart technologies, such as built-in charging ports, adjustable lighting, and voice-activated controls, particularly in home furniture. The use of advanced materials like sustainable composites, recycled plastics, and innovative metal alloys is gaining traction, offering enhanced durability and eco-friendliness. Modular and multi-functional furniture designs are prevalent, addressing space constraints in urban living. These innovations provide a significant competitive advantage by catering to niche markets and offering differentiated products.

Report Segmentation & Scope

This report segments the Chinese furniture market across various dimensions to provide a granular understanding of its structure and dynamics.

Material:

- Wood: Expected to hold a significant market share, driven by traditional preferences and sustainable sourcing.

- Metal: Growing due to demand for modern, minimalist designs in office and hospitality furniture.

- Plastic: Dominant in budget-friendly and outdoor furniture segments, with increasing use of recycled plastics.

- Other Materials: Encompasses glass, fabric, and composite materials, catering to specific aesthetic and functional needs.

Application:

- Home Furniture: The largest segment, driven by urbanization and rising disposable incomes.

- Office Furniture: Experiencing steady growth due to the expansion of commercial spaces and hybrid work models.

- Hospitality Furniture: Benefiting from the recovery and growth in the tourism and hospitality sectors.

- Other Furniture: Includes furniture for educational institutions, healthcare facilities, and public spaces.

Distribution Channel:

- Supermarkets & Hypermarkets: Limited share, typically for basic and utility furniture.

- Specialty Stores: Significant share, offering curated selections and personalized service.

- Online: Rapidly growing segment, providing wide reach and convenience.

- Others: Includes direct sales, contract manufacturing, and independent retailers.

Key Drivers of Chinese Furniture Market Growth

Several key drivers are propelling the growth of the Chinese furniture market. Economic growth and rising disposable incomes are fundamental, enabling increased consumer spending on home furnishings and upgrades. Urbanization continues to fuel demand for residential furniture, particularly in new housing developments. Technological advancements, including smart furniture integration and efficient manufacturing processes, are enhancing product offerings and consumer experience. Government initiatives aimed at promoting domestic consumption and improving living standards also play a crucial role. Furthermore, a growing emphasis on interior design and home aesthetics is driving demand for higher-quality and more diverse furniture options. The increasing adoption of sustainable practices and materials is also becoming a significant driver, appealing to an environmentally conscious consumer base.

Challenges in the Chinese Furniture Market Sector

Despite its robust growth, the Chinese furniture market faces several challenges. Intensifying competition from both domestic and international players leads to price pressures and necessitates continuous innovation. Rising raw material costs can impact profit margins and necessitate strategic sourcing. Supply chain disruptions, exacerbated by global events, can affect production and delivery timelines. Stringent environmental regulations require manufacturers to invest in sustainable practices and compliant materials, which can increase operational costs. Furthermore, counterfeiting and intellectual property infringement remain persistent issues, posing a threat to brand reputation and revenue. Adapting to rapidly changing consumer preferences and the demand for customization requires agility and significant R&D investment.

Leading Players in the Chinese Furniture Market Market

- Zhejiang Huaweimei Group Co Ltd

- Zhejiang Huafeng Furniture

- Honland Group Furniture

- Guangdong Landbond Furniture Group Co Ltd

- Qumei Furniture

- Guangzhou Holike Creative Home Co Ltd

- Huari Furniture

- Oppein Homes

- Kinwai Group China

- Chengdu Sunhoo Industry Co

- IKEA

- Interi Furniture

- HUAFENG FURNITURE GROUP CO LTD

- Red Apple Furniture

- Suofeiya

Key Developments in Chinese Furniture Market Sector

- 2022: Significant increase in e-commerce penetration for furniture sales, with online channels capturing an estimated 30% of the market share.

- 2023: Growing consumer demand for smart furniture, leading to increased product launches incorporating IoT capabilities.

- 2023: Enhanced focus on sustainable materials and eco-friendly manufacturing processes by major players, driven by consumer awareness and regulatory pressures.

- 2023: Rise in M&A activities as larger companies seek to consolidate market share and acquire innovative technologies.

- 2024: Expansion of the home renovation market, directly boosting demand for residential furniture.

- 2024: Introduction of new, cost-effective metal furniture designs targeting younger demographics and office spaces.

Strategic Chinese Furniture Market Market Outlook

The strategic outlook for the Chinese furniture market remains highly positive, driven by sustained economic development and evolving consumer lifestyles. The market is projected to continue its upward trajectory, with significant growth anticipated in segments like smart home furniture, customizable solutions, and eco-friendly products. Strategic opportunities lie in leveraging the online distribution channel for wider market reach and in developing innovative products that cater to the growing demand for personalized and sustainable living spaces. Companies that can effectively integrate technology, prioritize sustainability, and adapt to evolving consumer preferences will be best positioned for success. Strategic partnerships and a focus on value-added services beyond product manufacturing will be crucial for long-term competitive advantage. The continued expansion of the hospitality and office furniture segments also presents considerable growth potential.

Chinese Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic and Other Materials

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

- 2.4. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Others

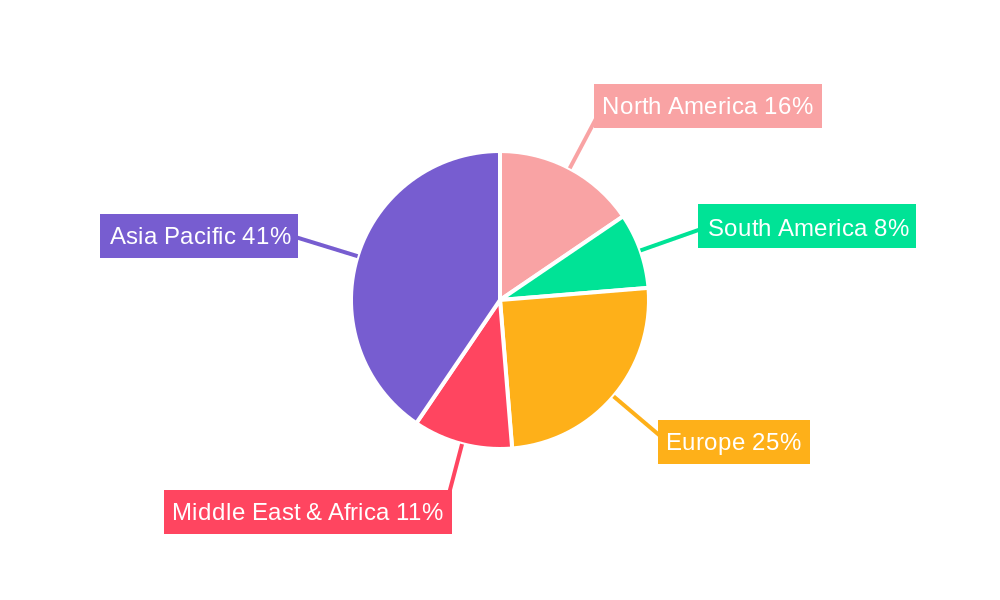

Chinese Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Furniture Market Regional Market Share

Geographic Coverage of Chinese Furniture Market

Chinese Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Improved Ventilation in GCC Countries

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Online Furniture Sales Are Flourishing in The Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic and Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.2.4. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Chinese Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Wood

- 6.1.2. Metal

- 6.1.3. Plastic and Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home Furniture

- 6.2.2. Office Furniture

- 6.2.3. Hospitality Furniture

- 6.2.4. Other Furniture

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America Chinese Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Wood

- 7.1.2. Metal

- 7.1.3. Plastic and Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home Furniture

- 7.2.2. Office Furniture

- 7.2.3. Hospitality Furniture

- 7.2.4. Other Furniture

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Chinese Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Wood

- 8.1.2. Metal

- 8.1.3. Plastic and Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home Furniture

- 8.2.2. Office Furniture

- 8.2.3. Hospitality Furniture

- 8.2.4. Other Furniture

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets & Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa Chinese Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Wood

- 9.1.2. Metal

- 9.1.3. Plastic and Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home Furniture

- 9.2.2. Office Furniture

- 9.2.3. Hospitality Furniture

- 9.2.4. Other Furniture

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets & Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific Chinese Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Wood

- 10.1.2. Metal

- 10.1.3. Plastic and Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home Furniture

- 10.2.2. Office Furniture

- 10.2.3. Hospitality Furniture

- 10.2.4. Other Furniture

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets & Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zhejiang Huaweimei Group Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhejiang Huafeng Furniture

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honland Group Furniture

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangdong Landbond Furniture Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qumei Furniture

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guangzhou Holike Creative Home Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Huari Furniture

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oppein Homes https

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kinwai Group China

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chengdu Sunhoo Industry Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IKEA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Interi Furniture

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 HUAFENG FURNITURE GROUP CO LTD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Red Apple Furniture

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Suofeiya

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Zhejiang Huaweimei Group Co Ltd

List of Figures

- Figure 1: Global Chinese Furniture Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Chinese Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Chinese Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Chinese Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Chinese Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Chinese Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Chinese Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Chinese Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Chinese Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Chinese Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 11: South America Chinese Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America Chinese Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 13: South America Chinese Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Chinese Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Chinese Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Chinese Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Chinese Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Chinese Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Chinese Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Chinese Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Chinese Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Chinese Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Chinese Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Chinese Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Chinese Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Chinese Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa Chinese Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa Chinese Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa Chinese Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa Chinese Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Chinese Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Chinese Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Chinese Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Chinese Furniture Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific Chinese Furniture Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific Chinese Furniture Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific Chinese Furniture Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Chinese Furniture Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Chinese Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Chinese Furniture Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Chinese Furniture Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chinese Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Chinese Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Chinese Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Chinese Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Chinese Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Chinese Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Chinese Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Chinese Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Chinese Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Chinese Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Chinese Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Chinese Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Chinese Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Chinese Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Chinese Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Chinese Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Chinese Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global Chinese Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Chinese Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Chinese Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Chinese Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global Chinese Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Chinese Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Chinese Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Chinese Furniture Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Furniture Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Chinese Furniture Market?

Key companies in the market include Zhejiang Huaweimei Group Co Ltd, Zhejiang Huafeng Furniture, Honland Group Furniture, Guangdong Landbond Furniture Group Co Ltd, Qumei Furniture, Guangzhou Holike Creative Home Co Ltd, Huari Furniture, Oppein Homes https, Kinwai Group China, Chengdu Sunhoo Industry Co, IKEA, Interi Furniture, HUAFENG FURNITURE GROUP CO LTD, Red Apple Furniture, Suofeiya.

3. What are the main segments of the Chinese Furniture Market?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Improved Ventilation in GCC Countries.

6. What are the notable trends driving market growth?

Online Furniture Sales Are Flourishing in The Country.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Furniture Market?

To stay informed about further developments, trends, and reports in the Chinese Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence