Key Insights

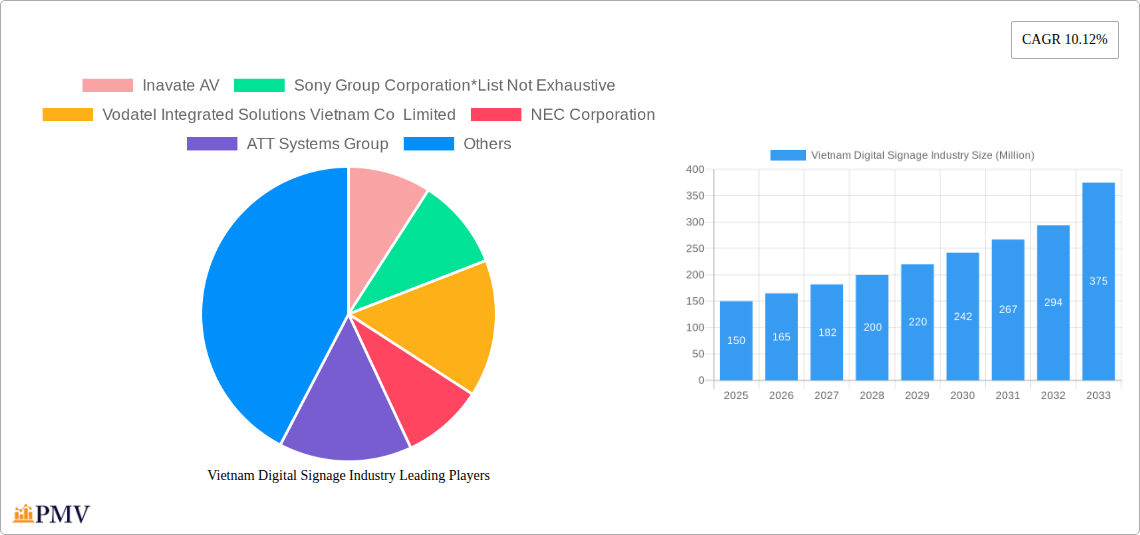

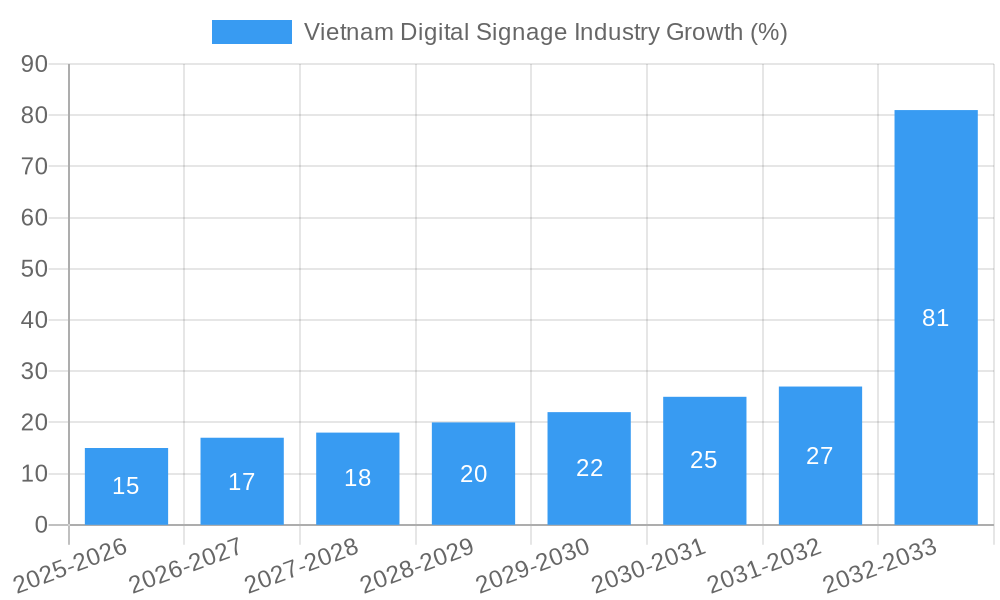

The Vietnam digital signage market, valued at approximately $150 million in 2025, is poised for robust growth, projected to reach approximately $375 million by 2033, exhibiting a compound annual growth rate (CAGR) of 10.12%. This expansion is fueled by several key drivers. Firstly, increasing urbanization and the burgeoning retail sector are creating a greater demand for dynamic and engaging visual communication. Secondly, technological advancements, particularly in LED and OLED display technologies, are offering higher resolution, improved brightness, and more energy-efficient solutions. This is complemented by the rising adoption of smart technologies, enabling interactive and data-driven signage experiences. Thirdly, government initiatives promoting digital transformation and smart city development are creating a favorable environment for market expansion. Furthermore, the growing adoption of digital signage across various applications, including infrastructure, industrial settings, and commercial spaces, is contributing significantly to this market growth. The market is segmented by display mode (LCD/Plasma, LEDs, Projection Screens, OLEDs, Others), solution type (Hardware, Software), and application (Infrastructure, Industrial, Commercial, Others). While challenges such as initial investment costs and the need for skilled professionals exist, the overall positive economic outlook and the increasing preference for efficient communication methods ensure sustained growth. Leading players like Inavate AV, Sony, and LG are capitalizing on these opportunities, but the market also presents opportunities for smaller, agile companies offering specialized solutions.

The competitive landscape is dynamic, with both international and domestic players vying for market share. The success of companies hinges on factors such as technological innovation, robust after-sales support, and a deep understanding of the local market needs. The focus is shifting towards integrated solutions that combine hardware, software, and content management systems to offer comprehensive digital signage experiences. The rising adoption of cloud-based platforms for content management is simplifying operations and reducing maintenance costs, further boosting market growth. Future growth will be significantly influenced by the integration of artificial intelligence (AI) and the Internet of Things (IoT) to deliver personalized and interactive experiences, thus further enhancing the market value proposition. The continued expansion of e-commerce and the increasing adoption of digital marketing strategies will further drive demand for effective digital signage solutions in Vietnam.

Vietnam Digital Signage Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Vietnam digital signage industry, covering market size, segmentation, competitive landscape, key drivers, challenges, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for businesses, investors, and stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic market. The total market size in 2025 is estimated at $XX Million.

Vietnam Digital Signage Industry Market Structure & Competitive Dynamics

The Vietnam digital signage market exhibits a moderately concentrated structure, with several major players vying for market share. Key players include Inavate AV, Sony Group Corporation, Vodatel Integrated Solutions Vietnam Co Limited, NEC Corporation, ATT Systems Group, Net & Com Integrated Telecom, Panasonic Corporation, Intel Corporation, and LG Corporation. However, the market also accommodates numerous smaller, specialized firms. Market share data for 2025 indicates that the top five players account for approximately 60% of the total market, indicating a competitive but not overly concentrated landscape.

Innovation in the ecosystem is driven by both international and domestic players, with a focus on developing advanced display technologies, software solutions, and integrated systems. The regulatory framework, while generally supportive of technological advancements, requires navigation for compliance. Product substitutes, such as traditional print media and outdoor advertising, continue to exist, but the advantages of targeted digital messaging and data analytics drive market growth. End-user trends are shifting towards interactive and experiential signage, demanding innovative solutions. M&A activity in the recent years has been moderate, with deal values ranging from $XX Million to $XX Million for smaller acquisitions, focusing on consolidation and technology acquisition.

Vietnam Digital Signage Industry Industry Trends & Insights

The Vietnam digital signage market is experiencing robust growth, driven by several key factors. The increasing adoption of digital technologies across various sectors, coupled with the government's push for digital transformation, is a major catalyst. The rising disposable incomes and increased urbanization are fueling demand for innovative advertising and information dissemination solutions in commercial spaces. Technological disruptions, such as the introduction of advanced display technologies (OLED, MicroLED) and AI-powered content management systems, are significantly impacting market dynamics. Consumer preferences are leaning towards interactive and engaging digital signage experiences. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be XX%, with market penetration exceeding XX% by 2033 across key segments. Competition remains fierce, with both established players and new entrants continuously striving for market share through product innovation and strategic partnerships.

Dominant Markets & Segments in Vietnam Digital Signage Industry

By Mode of Display: LCD/Plasma displays currently dominate the market, owing to their cost-effectiveness and maturity. However, LED displays are rapidly gaining traction due to their superior energy efficiency and visual appeal. OLED and other advanced display technologies are still niche segments but are expected to experience significant growth in the coming years.

By Solution Type: Hardware accounts for a larger market share compared to software, reflecting the significant investment required for display infrastructure. However, the software segment is expected to grow faster due to increasing demand for advanced content management and analytics capabilities.

By Application: The commercial sector, including retail, hospitality, and transportation, is currently the dominant application segment, driven by the rising need for engaging customer experiences and effective advertising. The infrastructure segment, particularly in public spaces and government institutions, is also experiencing significant growth, reflecting the government's efforts towards digital transformation. The industrial segment remains relatively smaller but is expected to gain traction with increasing automation and smart factory implementations.

Key drivers for each segment vary. Economic policies supporting infrastructure development and the growth of retail/commercial sectors directly fuel the market. The rise of smart cities and the government's digital transformation plans particularly bolster infrastructure and industrial applications. The commercial segment is fueled by the rise of digital marketing and the demand for enhanced customer experiences.

Vietnam Digital Signage Industry Product Innovations

Recent product innovations have centered on enhanced interactivity, improved energy efficiency, and seamless integration with existing IT infrastructure. The adoption of AI-powered content management systems and the integration of IoT devices are key trends shaping the market. New solutions are prioritizing flexibility, customization, and cost-effectiveness, making digital signage more accessible to a wider range of businesses. This focus on enhancing user experience while reducing costs aligns with the overall market needs and creates competitive advantages for firms.

Report Segmentation & Scope

This report segments the Vietnam digital signage market across several dimensions:

By Mode of Display: Liquid Crystal Display/Plasma, LEDs, Projection Screens, OLEDs, Other Modes of Display. Each segment's market size, growth projections, and competitive dynamics are analyzed.

By Solution Type: Hardware (displays, media players, mounting systems) and Software (content management systems, analytics platforms). Market size, growth rates and competitive landscape for each solution type are provided.

By Application: Infrastructure (transport hubs, government buildings), Industrial (factories, manufacturing plants), Commercial (retail, hospitality, entertainment), and Other Applications. Each segment's growth drivers, challenges, and market size projections are analyzed.

The report provides detailed market sizing and projections for each segment, offering valuable insights into growth potential and future market trends.

Key Drivers of Vietnam Digital Signage Industry Growth

The Vietnam digital signage industry's growth is spurred by several factors: Government initiatives promoting digital transformation, rapid urbanization leading to increased demand for informative and engaging public displays, and the expansion of retail and commercial sectors requiring innovative advertising solutions. Technological advancements such as the development of high-resolution displays, improved energy efficiency, and enhanced content management systems are also pivotal. Increasing disposable incomes are fueling consumer demand for better retail experiences and sophisticated displays.

Challenges in the Vietnam Digital Signage Industry Sector

Challenges include maintaining a stable supply chain amidst global uncertainties, addressing potential regulatory hurdles surrounding data privacy and advertising regulations, and managing the intense competition from established players and new entrants. High initial investment costs can also pose a barrier to entry for smaller businesses. The fluctuating prices of key components could also affect profitability.

Leading Players in the Vietnam Digital Signage Industry Market

- Inavate AV

- Sony Group Corporation

- Vodatel Integrated Solutions Vietnam Co Limited

- NEC Corporation

- ATT Systems Group

- Net & Com Integrated Telecom

- Panasonic Corporation

- Intel Corporation

- LG Corporation

Key Developments in Vietnam Digital Signage Industry Sector

- March 2020: Samsung Electronics commenced construction of a USD 220 Million R&D facility in Hanoi, showcasing Vietnam's growing importance as a tech hub.

- March 2022: NEC Corporation completed the modernization of Vietnam's national ID system, demonstrating the application of digital signage technology in government infrastructure projects.

- December 2022: Samsung Electronics opened its largest Southeast Asian R&D center in Hanoi, further solidifying Vietnam's position in the technology sector.

Strategic Vietnam Digital Signage Industry Market Outlook

The future outlook for the Vietnam digital signage market is extremely positive. Continued government investment in infrastructure and digital transformation, combined with rising consumer spending and the burgeoning retail and commercial sectors, will drive significant growth. Strategic opportunities lie in developing innovative, cost-effective solutions tailored to the specific needs of various industry segments, particularly leveraging emerging technologies like AI and IoT. The market is ripe for expansion into new applications, including smart cities and industrial automation.

Vietnam Digital Signage Industry Segmentation

-

1. Mode of Display

- 1.1. Liquid Crystal Display/Plasma

- 1.2. LEDs

- 1.3. Projection Screens

- 1.4. OLEDs

- 1.5. Other Modes of Display

-

2. Solution Type

- 2.1. Hardware

- 2.2. Software

-

3. Application

- 3.1. Infrastructure

- 3.2. Industrial

- 3.3. Commercial

- 3.4. Other Applications

Vietnam Digital Signage Industry Segmentation By Geography

- 1. Vietnam

Vietnam Digital Signage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in Displays; Contactless Interaction is Becoming Increasingly Popular

- 3.3. Market Restrains

- 3.3.1. Issues with Digital Signs that are Currently being Addressed in Terms of Security

- 3.4. Market Trends

- 3.4.1. OLED to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Display

- 5.1.1. Liquid Crystal Display/Plasma

- 5.1.2. LEDs

- 5.1.3. Projection Screens

- 5.1.4. OLEDs

- 5.1.5. Other Modes of Display

- 5.2. Market Analysis, Insights and Forecast - by Solution Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Infrastructure

- 5.3.2. Industrial

- 5.3.3. Commercial

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Mode of Display

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Inavate AV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sony Group Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vodatel Integrated Solutions Vietnam Co Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NEC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ATT Systems Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Net & Com Integrated Telecom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LG Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Inavate AV

List of Figures

- Figure 1: Vietnam Digital Signage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Digital Signage Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Digital Signage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Digital Signage Industry Revenue Million Forecast, by Mode of Display 2019 & 2032

- Table 3: Vietnam Digital Signage Industry Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 4: Vietnam Digital Signage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Vietnam Digital Signage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Digital Signage Industry Revenue Million Forecast, by Mode of Display 2019 & 2032

- Table 8: Vietnam Digital Signage Industry Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 9: Vietnam Digital Signage Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Vietnam Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Digital Signage Industry?

The projected CAGR is approximately 10.12%.

2. Which companies are prominent players in the Vietnam Digital Signage Industry?

Key companies in the market include Inavate AV, Sony Group Corporation*List Not Exhaustive, Vodatel Integrated Solutions Vietnam Co Limited, NEC Corporation, ATT Systems Group, Net & Com Integrated Telecom, Panasonic Corporation, Intel Corporation, LG Corporation.

3. What are the main segments of the Vietnam Digital Signage Industry?

The market segments include Mode of Display, Solution Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in Displays; Contactless Interaction is Becoming Increasingly Popular.

6. What are the notable trends driving market growth?

OLED to Show Significant Growth.

7. Are there any restraints impacting market growth?

Issues with Digital Signs that are Currently being Addressed in Terms of Security.

8. Can you provide examples of recent developments in the market?

December 2022 - On December 23, Samsung Electronics opened its largest research and development facility in Southeast Asia in Hanoi, signaling an increase in the significance of Vietnam as a center for research and development as well as manufacturing. In March 2020, Samsung Electronics started construction on the USD 220 million research and development facility in Hanoi, which the tech giant claimed would be the biggest R&D facility in Southeast Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Digital Signage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Digital Signage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Digital Signage Industry?

To stay informed about further developments, trends, and reports in the Vietnam Digital Signage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence