Key Insights

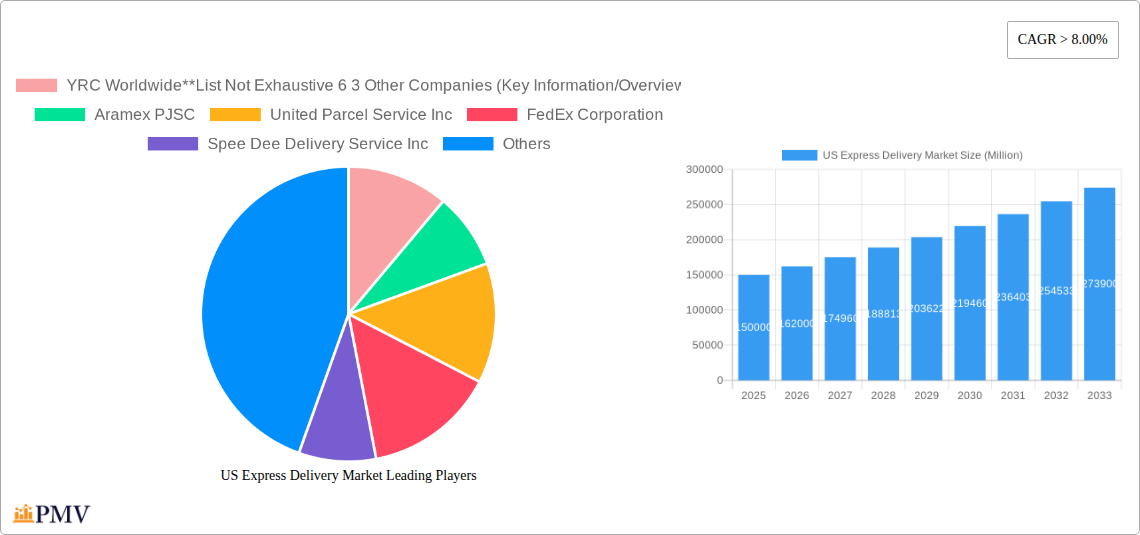

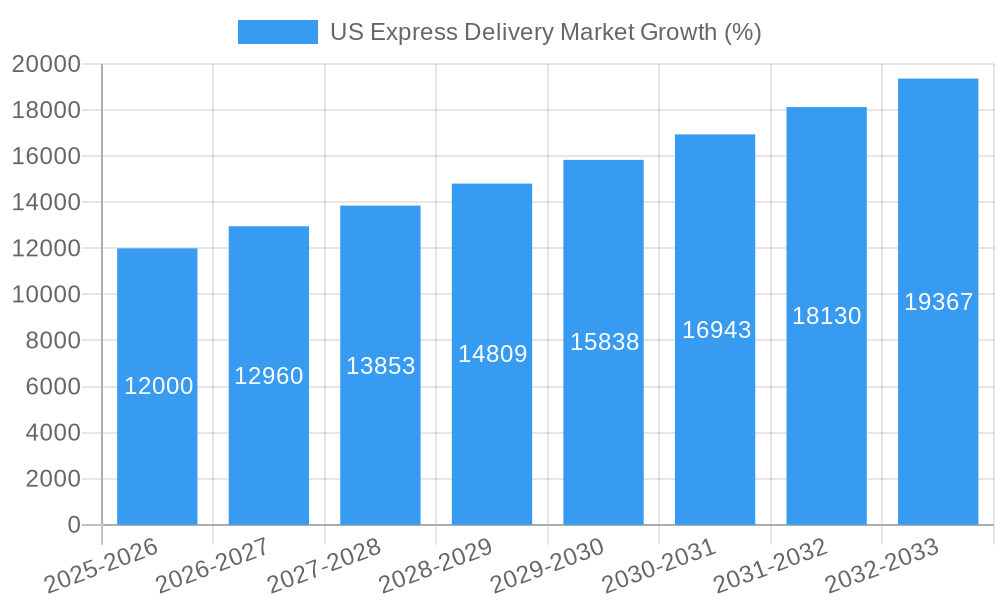

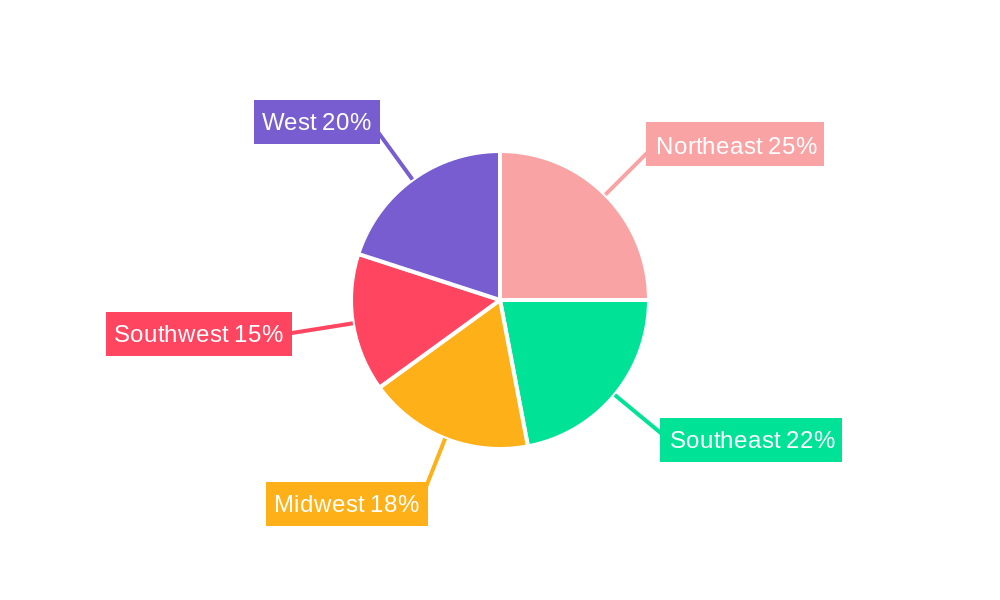

The US express delivery market, a dynamic sector fueled by e-commerce growth and the increasing demand for faster delivery options, is projected to experience robust expansion. The market, valued at approximately $150 billion in 2025 (estimated based on a plausible market size and provided CAGR), is anticipated to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% through 2033. This growth is primarily driven by several key factors. The surge in online shopping, particularly in the B2C segment, significantly contributes to heightened demand for swift and reliable delivery services. Furthermore, the expansion of e-commerce into previously underserved rural areas fuels this market expansion. The increasing adoption of advanced technologies, such as automated sorting systems and route optimization software, enhances efficiency and reduces delivery times, further boosting market growth. While regulatory hurdles and fluctuations in fuel prices present challenges, the overall market outlook remains positive, driven by ongoing technological advancements and the enduring preference for expedited shipping among consumers and businesses alike. The B2B segment, encompassing vital sectors like manufacturing, BFSI (Banking, Financial Services and Insurance), and wholesale trade, consistently contributes significantly to the market volume. Growth within the B2C segment, however, is expected to be a primary driver of overall market expansion over the forecast period. Geographical distribution shows a strong concentration in the densely populated coastal regions (Northeast, Southeast, and West), with substantial opportunities for growth in the Midwest and Southwest as e-commerce penetration increases in these areas.

The segmentation of the US express delivery market reveals considerable diversity. The B2B segment, with its focus on timely supply chain management, contributes significantly to market revenue. Conversely, the rapidly expanding B2C segment, fuelled by the rise of e-commerce, demonstrates exceptional growth potential. Geographically, the market displays a pronounced concentration in the coastal regions. However, robust growth is expected in the Midwest and Southwest, aligning with the expanding e-commerce penetration in these areas. Specific end-user segments like BFSI, with its stringent requirements for secure and prompt document delivery, and the dynamic retail and wholesale trade sectors, significantly influence the market’s trajectory. The leading players in the market, including established giants like UPS, FedEx, and DHL, and emerging companies, are continuously investing in infrastructure, technological upgrades, and efficient logistics solutions. This competitive landscape drives market innovation and reinforces the ongoing growth trend. This necessitates a strategic approach for companies aiming to capitalize on the numerous market opportunities presented by this rapidly evolving sector.

US Express Delivery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US express delivery market, covering market size, segmentation, competitive landscape, key trends, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for businesses operating in or seeking to enter this dynamic sector. The report utilizes data gathered through extensive primary and secondary research methods to provide actionable insights for strategic decision-making.

US Express Delivery Market Market Structure & Competitive Dynamics

The US express delivery market is characterized by a high level of concentration, with a few major players dominating the market share. However, a vibrant ecosystem of smaller companies and startups contribute to innovation and competitive pressure. The market structure is influenced by stringent regulatory frameworks governing transportation, safety, and environmental impact. Product substitutes, such as postal services and localized delivery networks, compete for market share, particularly in niche segments. End-user trends, particularly the rise of e-commerce and the increasing demand for faster delivery options, significantly impact market dynamics. Mergers and acquisitions (M&A) are common, reflecting the industry's consolidation trend.

- Market Concentration: The top five players command approximately xx% of the market share in 2025 (estimated).

- M&A Activity: The total value of M&A deals within the US express delivery market during the historical period (2019-2024) was approximately $xx Million. Examples include Forward Air Corporation's acquisition of Land Air Express in 2023 (USD 56.5 Million).

- Innovation Ecosystems: The market is witnessing increasing investment in technology, such as autonomous vehicles and drone delivery systems, which are expected to reshape future delivery operations.

- Regulatory Frameworks: Compliance with federal and state regulations related to transportation safety, environmental protection, and labor laws influences operational costs and strategies.

US Express Delivery Market Industry Trends & Insights

The US express delivery market is experiencing robust growth, driven primarily by the explosive growth of e-commerce. The increasing demand for faster and more reliable delivery services, coupled with technological advancements, fuels market expansion. Consumer preferences are shifting towards same-day and next-day delivery options, which put pressure on logistics providers to optimize their networks and invest in technology. Competitive dynamics are intensifying, with companies constantly seeking ways to improve efficiency, reduce costs, and enhance customer experience. The market is expected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration in rural areas remains relatively low, presenting significant untapped potential. The penetration of e-commerce continues to be a pivotal driver, pushing the demand for faster deliveries. The increasing preference for convenient delivery options such as scheduled deliveries and delivery lockers further influences market growth.

Dominant Markets & Segments in US Express Delivery Market

- By Business: The B2C segment dominates the market driven by the explosive growth of e-commerce. The B2B segment holds a significant share and is expected to experience steady growth fueled by business-to-business transactions.

- By Destination: Domestic deliveries constitute the largest share of the market, with international deliveries showing promising growth prospects driven by global trade expansion.

- By End User: The Wholesale and Retail Trade (E-commerce) sector is the largest end-user segment, followed by the Services sector (BFSI). The manufacturing, construction, utilities, and primary industries also contribute significantly.

The dominance of e-commerce in the B2C segment is primarily due to the substantial increase in online shopping. The growth of B2B is linked to the increased reliance on efficient supply chains and just-in-time delivery systems. Domestic deliveries benefit from established infrastructure and shorter delivery times. International deliveries are growing due to global supply chains and the growth of cross-border e-commerce. The significant share held by the Wholesale and Retail Trade (E-commerce) segment is self-explanatory, with BFSI showing consistent growth as financial institutions increasingly use express delivery for crucial documents and physical transfers.

US Express Delivery Market Product Innovations

Technological advancements are revolutionizing the express delivery industry. The integration of advanced tracking systems, route optimization software, and autonomous delivery vehicles enhances efficiency, reduces costs, and improves customer experience. Innovations in packaging materials and warehousing technologies also contribute to improved logistics and reduced environmental impact. These innovations provide companies with a significant competitive edge by enabling faster, more reliable, and cost-effective delivery services.

Report Segmentation & Scope

This report segments the US express delivery market across various parameters:

- By Business: B2B and B2C, providing detailed analysis of growth projections and competitive landscapes within each segment. The B2C segment is projected to experience a CAGR of xx% during the forecast period while the B2B segment is predicted to grow at a CAGR of xx%.

- By Destination: Domestic and International, outlining the market size and growth prospects for both segments. Domestic deliveries will account for xx Million in 2025, growing to xx Million by 2033 while international deliveries will be xx Million in 2025 and xx Million in 2033

- By End User: Services (BFSI), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction and Utilities, and Primary Industries, providing insights into industry-specific trends and demand drivers. The e-commerce segment dominates with a market size of xx Million in 2025.

Key Drivers of US Express Delivery Market Growth

Several factors contribute to the growth of the US express delivery market. Technological advancements, such as autonomous vehicles and drone delivery, offer significant potential for efficiency gains. The robust growth of e-commerce fuels the demand for faster and more reliable delivery services. Favorable economic conditions and government policies supporting infrastructure development further accelerate market expansion. Finally, increasing consumer expectations for convenience and speed in deliveries consistently push the market towards innovation and growth.

Challenges in the US Express Delivery Market Sector

The US express delivery market faces several challenges. Stringent regulatory compliance increases operational costs. Supply chain disruptions, such as fuel price volatility and driver shortages, can impact delivery reliability and costs. Intense competition from existing players and new entrants creates pressure on pricing and margins. For example, driver shortages are estimated to have negatively impacted delivery times by an average of xx% in 2024, resulting in increased customer complaints and potentially affecting revenue.

Leading Players in the US Express Delivery Market Market

- YRC Worldwide

- Aramex PJSC

- United Parcel Service Inc

- FedEx Corporation

- Spee Dee Delivery Service Inc

- SF Express (Group) Co Ltd

- OnTrac Inc

- Deutsche Post DHL Group

- Courier Express

- A-1 Express Delivery Service Inc

- Amazon (Atlantic International Express, A-1 Express Logistics, USA Couriers, Postmates, Deliv, Routific, Roadie, American Expediting, Koch Cos Inc)

Key Developments in US Express Delivery Market Sector

- January 2023: Forward Air Corporation acquired Land Air Express for USD 56.5 Million, expanding its national terminal footprint and strengthening its position in the expedited LTL market.

- September 2022: Uber Technologies partnered with Nuro to integrate autonomous delivery vehicles into its Uber Eats platform, potentially revolutionizing food delivery in the US.

Strategic US Express Delivery Market Market Outlook

The US express delivery market presents significant growth opportunities. Continued investment in technology, expansion into underserved markets, and strategic partnerships will be crucial for success. The increasing adoption of sustainable practices and the focus on improving last-mile delivery efficiency are key strategic areas for companies seeking to gain a competitive advantage. The market's future potential hinges on the ability of players to adapt to evolving consumer preferences and overcome challenges related to logistics, technology, and regulation.

US Express Delivery Market Segmentation

-

1. Business

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Manufacturing, Construction, and Utilities

- 3.4. Primary

US Express Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Express Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace

- 3.2.2 automotive

- 3.2.3 and pharmaceuticals.

- 3.3. Market Restrains

- 3.3.1 4.; The geopolitical situation in the Middle East can create security concerns for logistics operations

- 3.3.2 4.; Regulations and customs procedures can be complex and subject to change.

- 3.4. Market Trends

- 3.4.1. Increased E-commerce Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Manufacturing, Construction, and Utilities

- 5.3.4. Primary

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. North America US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Business

- 6.1.1. B2B (Business-to-Business)

- 6.1.2. B2C (Business-to-Consumer)

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Services

- 6.3.2. Wholesale and Retail Trade (E-commerce)

- 6.3.3. Manufacturing, Construction, and Utilities

- 6.3.4. Primary

- 6.1. Market Analysis, Insights and Forecast - by Business

- 7. South America US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Business

- 7.1.1. B2B (Business-to-Business)

- 7.1.2. B2C (Business-to-Consumer)

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Services

- 7.3.2. Wholesale and Retail Trade (E-commerce)

- 7.3.3. Manufacturing, Construction, and Utilities

- 7.3.4. Primary

- 7.1. Market Analysis, Insights and Forecast - by Business

- 8. Europe US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Business

- 8.1.1. B2B (Business-to-Business)

- 8.1.2. B2C (Business-to-Consumer)

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Services

- 8.3.2. Wholesale and Retail Trade (E-commerce)

- 8.3.3. Manufacturing, Construction, and Utilities

- 8.3.4. Primary

- 8.1. Market Analysis, Insights and Forecast - by Business

- 9. Middle East & Africa US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Business

- 9.1.1. B2B (Business-to-Business)

- 9.1.2. B2C (Business-to-Consumer)

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Services

- 9.3.2. Wholesale and Retail Trade (E-commerce)

- 9.3.3. Manufacturing, Construction, and Utilities

- 9.3.4. Primary

- 9.1. Market Analysis, Insights and Forecast - by Business

- 10. Asia Pacific US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Business

- 10.1.1. B2B (Business-to-Business)

- 10.1.2. B2C (Business-to-Consumer)

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Services

- 10.3.2. Wholesale and Retail Trade (E-commerce)

- 10.3.3. Manufacturing, Construction, and Utilities

- 10.3.4. Primary

- 10.1. Market Analysis, Insights and Forecast - by Business

- 11. Northeast US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Express Delivery Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 YRC Worldwide**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Aramex PJSC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 United Parcel Service Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 FedEx Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Spee Dee Delivery Service Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 SF Express (Group) Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 OnTrac Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Deutsche Post DHL Group

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Courier Express

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 A-1 Express Delivery Service Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 (Amazon Atlantic International Express A-1 Express Logistics USA Couriers Postmates Deliv Routific Roadie American Expediting Koch Cos Inc )

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 YRC Worldwide**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

List of Figures

- Figure 1: Global US Express Delivery Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Express Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Express Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Express Delivery Market Revenue (Million), by Business 2024 & 2032

- Figure 5: North America US Express Delivery Market Revenue Share (%), by Business 2024 & 2032

- Figure 6: North America US Express Delivery Market Revenue (Million), by Destination 2024 & 2032

- Figure 7: North America US Express Delivery Market Revenue Share (%), by Destination 2024 & 2032

- Figure 8: North America US Express Delivery Market Revenue (Million), by End User 2024 & 2032

- Figure 9: North America US Express Delivery Market Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America US Express Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America US Express Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America US Express Delivery Market Revenue (Million), by Business 2024 & 2032

- Figure 13: South America US Express Delivery Market Revenue Share (%), by Business 2024 & 2032

- Figure 14: South America US Express Delivery Market Revenue (Million), by Destination 2024 & 2032

- Figure 15: South America US Express Delivery Market Revenue Share (%), by Destination 2024 & 2032

- Figure 16: South America US Express Delivery Market Revenue (Million), by End User 2024 & 2032

- Figure 17: South America US Express Delivery Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: South America US Express Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America US Express Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe US Express Delivery Market Revenue (Million), by Business 2024 & 2032

- Figure 21: Europe US Express Delivery Market Revenue Share (%), by Business 2024 & 2032

- Figure 22: Europe US Express Delivery Market Revenue (Million), by Destination 2024 & 2032

- Figure 23: Europe US Express Delivery Market Revenue Share (%), by Destination 2024 & 2032

- Figure 24: Europe US Express Delivery Market Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe US Express Delivery Market Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe US Express Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe US Express Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa US Express Delivery Market Revenue (Million), by Business 2024 & 2032

- Figure 29: Middle East & Africa US Express Delivery Market Revenue Share (%), by Business 2024 & 2032

- Figure 30: Middle East & Africa US Express Delivery Market Revenue (Million), by Destination 2024 & 2032

- Figure 31: Middle East & Africa US Express Delivery Market Revenue Share (%), by Destination 2024 & 2032

- Figure 32: Middle East & Africa US Express Delivery Market Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East & Africa US Express Delivery Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East & Africa US Express Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa US Express Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific US Express Delivery Market Revenue (Million), by Business 2024 & 2032

- Figure 37: Asia Pacific US Express Delivery Market Revenue Share (%), by Business 2024 & 2032

- Figure 38: Asia Pacific US Express Delivery Market Revenue (Million), by Destination 2024 & 2032

- Figure 39: Asia Pacific US Express Delivery Market Revenue Share (%), by Destination 2024 & 2032

- Figure 40: Asia Pacific US Express Delivery Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Asia Pacific US Express Delivery Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Asia Pacific US Express Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific US Express Delivery Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Express Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 3: Global US Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global US Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global US Express Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global US Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 13: Global US Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 14: Global US Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Global US Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global US Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 20: Global US Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 21: Global US Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Global US Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global US Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 27: Global US Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 28: Global US Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global US Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global US Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 40: Global US Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 41: Global US Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 42: Global US Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global US Express Delivery Market Revenue Million Forecast, by Business 2019 & 2032

- Table 50: Global US Express Delivery Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 51: Global US Express Delivery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global US Express Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific US Express Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Express Delivery Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the US Express Delivery Market?

Key companies in the market include YRC Worldwide**List Not Exhaustive 6 3 Other Companies (Key Information/Overview), Aramex PJSC, United Parcel Service Inc, FedEx Corporation, Spee Dee Delivery Service Inc, SF Express (Group) Co Ltd, OnTrac Inc, Deutsche Post DHL Group, Courier Express, A-1 Express Delivery Service Inc, (Amazon Atlantic International Express A-1 Express Logistics USA Couriers Postmates Deliv Routific Roadie American Expediting Koch Cos Inc ).

3. What are the main segments of the US Express Delivery Market?

The market segments include Business, Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace. automotive. and pharmaceuticals..

6. What are the notable trends driving market growth?

Increased E-commerce Sales Driving the Market.

7. Are there any restraints impacting market growth?

4.; The geopolitical situation in the Middle East can create security concerns for logistics operations. 4.; Regulations and customs procedures can be complex and subject to change..

8. Can you provide examples of recent developments in the market?

January 2023: Forward Air Corporation, an asset-light provider of transportation services in the United States, Canada, and Mexico, has agreed to pay USD 56.5 million for full-service expedited LTL carrier Land Air Express. Forward Air currently offers expedited LTL services such as local pick-up and delivery, shipment consolidation/deconsolidation, warehousing, and customs brokerage. This acquisition will hasten the expansion of our national terminal footprint, particularly in the Midwest, and we think it will strategically position us to better fulfil customers' present and future demands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Express Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Express Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Express Delivery Market?

To stay informed about further developments, trends, and reports in the US Express Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence