Key Insights

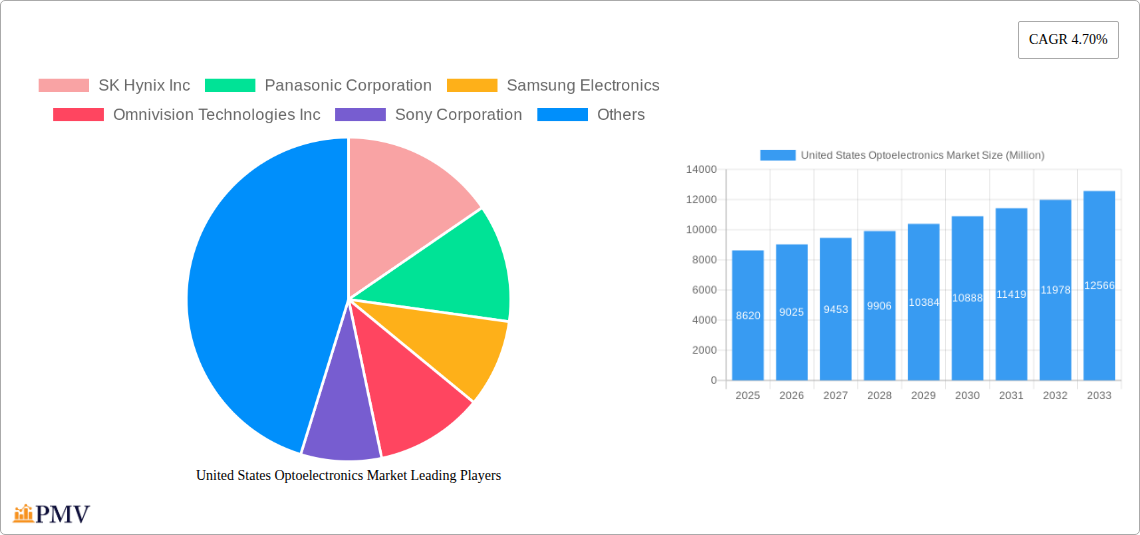

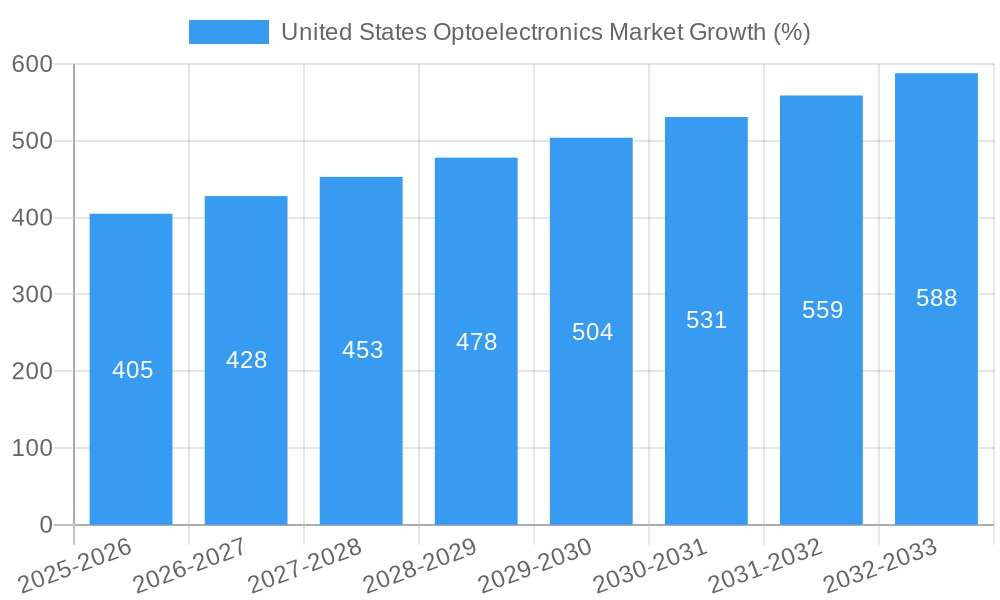

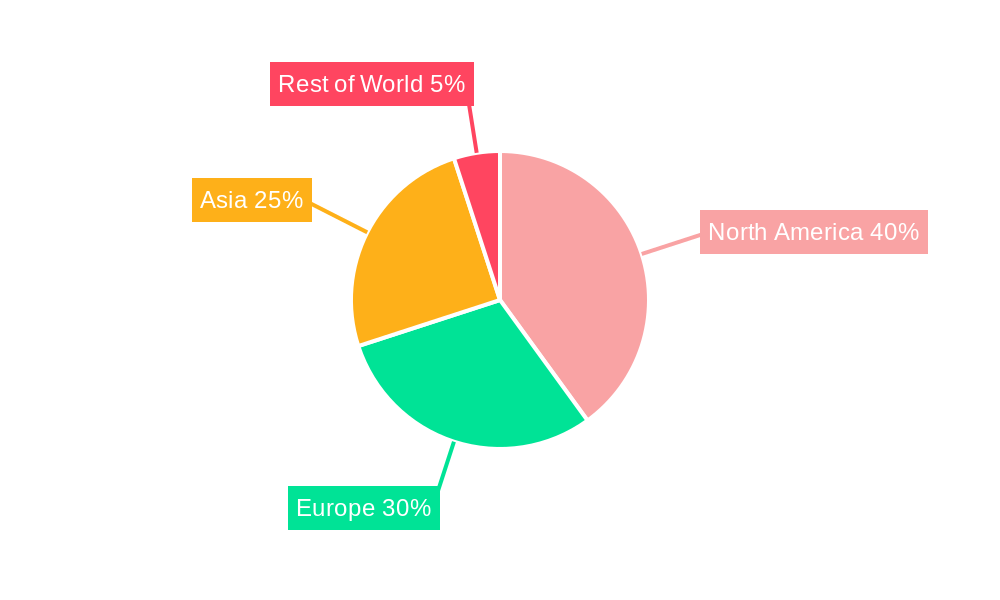

The United States optoelectronics market, valued at approximately $8.62 billion in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. A Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033 indicates a significant expansion, exceeding $12 billion by 2033. Key drivers include the burgeoning automotive industry's adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles, which heavily rely on optoelectronic sensors for navigation and object detection. Furthermore, the expanding telecommunications infrastructure, particularly the rollout of 5G networks, fuels demand for high-performance optical components. The consumer electronics sector, with its increasing integration of sophisticated displays and lighting solutions, further contributes to market growth. Growth is also spurred by advancements in medical imaging and biotechnology applications utilizing optoelectronic technologies for diagnostics and treatment. While challenges like supply chain disruptions and the price volatility of raw materials exist, the long-term outlook remains positive, fueled by continuous technological innovation and increasing integration of optoelectronics into everyday life.

This growth is expected to be uneven across segments. While the precise breakdown of segments isn't provided, we can infer that the automotive and telecommunications sectors are likely the largest contributors, followed by consumer electronics and medical applications. Companies like SK Hynix, Samsung Electronics, and Sony, along with numerous other players, are actively engaged in developing and supplying advanced optoelectronic components, fostering competition and driving innovation. The U.S. market's strong technological base and robust investment in research and development further solidify its position as a key player in this rapidly evolving field. Strategic partnerships, mergers, and acquisitions among industry players are expected to shape the competitive landscape during the forecast period. Understanding these dynamics is crucial for businesses operating within or seeking to enter the U.S. optoelectronics market.

United States Optoelectronics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States optoelectronics market, offering crucial insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's historical performance, current status, and future trajectory. The report encompasses detailed market segmentation, competitive analysis, and key growth drivers, providing actionable intelligence to navigate the dynamic landscape of the US optoelectronics sector. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States Optoelectronics Market Structure & Competitive Dynamics

The United States optoelectronics market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Key players include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Osram Licht AG, Koninklijke Philips N V, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Co Ltd (ROHM SEMICONDUCTOR), Mitsubishi Electric Corporation, Broadcom Inc, and Sharp Corporation. The market's competitive landscape is characterized by intense innovation, frequent product launches, and strategic mergers and acquisitions (M&A).

- Market Concentration: The top 5 players collectively hold an estimated xx% market share, indicating moderate concentration.

- Innovation Ecosystems: Strong R&D investments by major players and a vibrant ecosystem of startups contribute to continuous technological advancements.

- Regulatory Frameworks: Compliance with stringent industry regulations, such as those related to energy efficiency and safety, plays a crucial role in shaping market dynamics.

- Product Substitutes: The emergence of alternative technologies poses a challenge, impacting the market share of traditional optoelectronic components.

- End-User Trends: Increasing demand from automotive, consumer electronics, and industrial sectors drives market growth.

- M&A Activities: The past five years have witnessed several significant M&A deals, valued at an estimated xx Million in total, reshaping the competitive landscape. These deals often focus on acquiring specialized technologies or expanding market reach.

United States Optoelectronics Market Industry Trends & Insights

The US optoelectronics market is experiencing robust growth, driven by several key factors. Technological advancements, particularly in areas like miniaturization, higher efficiency, and improved performance, are fueling demand. The increasing adoption of optoelectronics in diverse applications, including automotive lighting, consumer electronics, and industrial automation, contributes significantly to market expansion. Consumer preferences for advanced features in electronic devices and the growing adoption of smart technologies further propel market growth. The market is also witnessing increased competition, with new players entering the market and existing players investing heavily in R&D to stay ahead of the curve. The CAGR for the forecast period is estimated at xx%, indicating a positive growth trajectory. Market penetration of advanced optoelectronic technologies in specific sectors, such as automotive lighting, is expected to reach xx% by 2033.

Dominant Markets & Segments in United States Optoelectronics Market

The automotive sector represents the largest segment within the US optoelectronics market, driven by the increasing demand for advanced driver-assistance systems (ADAS) and sophisticated lighting solutions. California and Texas are currently leading states in optoelectronics adoption due to robust automotive and technology industries.

- Key Drivers for Automotive Sector Dominance:

- Strong government regulations promoting vehicle safety and energy efficiency.

- Increasing adoption of ADAS features requiring advanced optoelectronic components.

- Robust automotive manufacturing base in several states.

- High consumer demand for vehicles with advanced features.

United States Optoelectronics Market Product Innovations

Recent years have witnessed significant innovation in optoelectronics, with a focus on developing smaller, more energy-efficient, and higher-performance components. New materials, improved manufacturing processes, and advanced packaging technologies are driving these advancements. The market is seeing a shift towards higher integration and the development of sophisticated optoelectronic systems. This is reflected in recent product launches like AMS Osram AG's SYNIOS P1515 side-looker LEDs and Marktech Optoelectronics' enhanced sharpness green and red dot LEDs, highlighting the focus on improved efficiency and specialized applications.

Report Segmentation & Scope

This report segments the US optoelectronics market based on various factors, including product type (LEDs, photodiodes, phototransistors, etc.), application (automotive, consumer electronics, industrial, etc.), and end-user (automotive manufacturers, electronics manufacturers, etc.). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. The report further explores regional variations in market trends and growth patterns across different states.

Key Drivers of United States Optoelectronics Market Growth

The growth of the US optoelectronics market is driven by several factors:

- Technological advancements: Continuous innovation in materials, manufacturing processes, and device design leads to improved performance, efficiency, and miniaturization of optoelectronic components.

- Increasing demand from diverse end-user industries: The automotive, consumer electronics, industrial automation, and healthcare sectors are driving significant demand.

- Government initiatives and regulations: Policies promoting energy efficiency and vehicle safety stimulate the adoption of advanced optoelectronic technologies.

Challenges in the United States Optoelectronics Market Sector

Despite the positive growth outlook, the US optoelectronics market faces several challenges:

- Supply chain disruptions: Global supply chain vulnerabilities can impact the availability and cost of raw materials and components.

- Intense competition: The market is characterized by strong competition, requiring continuous innovation and cost optimization to maintain market share.

- Regulatory compliance: Meeting stringent industry regulations can add to manufacturing costs and complexities.

Leading Players in the United States Optoelectronics Market Market

- SK Hynix Inc

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Osram Licht AG

- Koninklijke Philips N V

- Vishay Intertechnology Inc

- Texas Instruments Inc

- LITE-ON Technology Corporation

- Rohm Co Ltd (ROHM SEMICONDUCTOR)

- Mitsubishi Electric Corporation

- Broadcom Inc

- Sharp Corporation

Key Developments in United States Optoelectronics Market Sector

- January 2024: AMS Osram AG launched SYNIOS P1515 side-looker LEDs for automotive lighting, improving design efficiency and uniformity.

- December 2023: Marktech Optoelectronics released enhanced sharpness green and red dot LEDs for aiming applications, expanding its product line.

Strategic United States Optoelectronics Market Outlook

The US optoelectronics market is poised for continued growth, driven by technological innovation and increasing demand across various sectors. Strategic opportunities exist for companies focused on developing advanced, energy-efficient, and cost-effective optoelectronic components. The focus on sustainable technologies and the increasing adoption of smart technologies will further shape market dynamics in the coming years. Companies investing in R&D, expanding their product portfolios, and forging strategic partnerships are best positioned to capitalize on the market's future potential.

United States Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Others

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential and Commercial

- 2.7. Industrial

- 2.8. Others

United States Optoelectronics Market Segmentation By Geography

- 1. United States

United States Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market

- 3.4. Market Trends

- 3.4.1. The Image Sensors Segment Anticipated to Drive Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Optoelectronics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential and Commercial

- 5.2.7. Industrial

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SK Hynix Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panasonic Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omnivision Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sony Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Osram Licht AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vishay Intertechnology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LITE-ON Technology Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rohm Co Ltd (ROHM SEMICONDUCTOR)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mitsubishi Electric Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Broadcom Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sharp Corporatio

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 SK Hynix Inc

List of Figures

- Figure 1: United States Optoelectronics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Optoelectronics Market Share (%) by Company 2024

List of Tables

- Table 1: United States Optoelectronics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Optoelectronics Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Optoelectronics Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: United States Optoelectronics Market Volume Billion Forecast, by Device Type 2019 & 2032

- Table 5: United States Optoelectronics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: United States Optoelectronics Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: United States Optoelectronics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Optoelectronics Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Optoelectronics Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 10: United States Optoelectronics Market Volume Billion Forecast, by Device Type 2019 & 2032

- Table 11: United States Optoelectronics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: United States Optoelectronics Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: United States Optoelectronics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Optoelectronics Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Optoelectronics Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the United States Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Osram Licht AG, Koninklijke Philips N V, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Co Ltd (ROHM SEMICONDUCTOR), Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the United States Optoelectronics Market?

The market segments include Device Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market.

6. What are the notable trends driving market growth?

The Image Sensors Segment Anticipated to Drive Demand.

7. Are there any restraints impacting market growth?

Growing Demand for Smart Consumer Electronics and Next-Generation Technologies; Increasing Industrial Applications of the Technology; Expansion of the Li-Fi Market.

8. Can you provide examples of recent developments in the market?

January 2024 - AMS Osram AG introduced a line of low-power LEDs, named SYNIOS P1515 side lookers, designed to streamline design processes, enhance implementation, and facilitate the creation of uniform lighting in extended automotive light bars and rear lighting applications. As per the company, by opting for these side-looker LEDs over traditional top-looker ones, automakers can achieve a consistent appearance spanning the vehicle's width. Furthermore, utilizing the same LED count as a top looker setup, these side lookers allow for significantly slimmer and more straightforward optical assemblies in rear combination lamps and turn indicators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Optoelectronics Market?

To stay informed about further developments, trends, and reports in the United States Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence