Key Insights

The United Kingdom online travel market is projected to experience robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 10.5%. This expansion is fueled by increasing internet and smartphone penetration, a growing preference for convenient online booking, and the rising popularity of budget travel and unique experiences. The market, valued at $2 billion in the base year of 2025, is segmented into key areas including transportation, accommodation, and vacation packages. Online Travel Agencies (OTAs) and direct bookings via supplier websites and mobile applications dominate these segments. Technological advancements, personalized travel recommendations, and social media marketing are further propelling market success. The competitive landscape features major players such as Booking.com, Expedia Group, and TripAdvisor, alongside emerging niche providers.

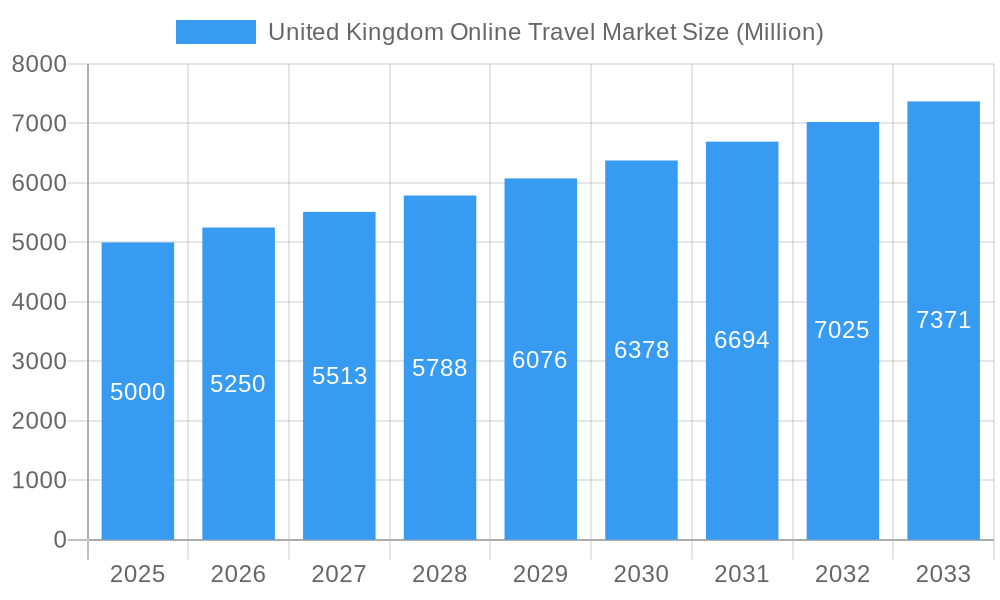

United Kingdom Online Travel Market Market Size (In Billion)

Despite strong growth trajectories, the market encounters challenges including economic fluctuations impacting consumer spending, geopolitical instability, and data privacy concerns. The growing demand for sustainable tourism also necessitates service adaptations. To maintain growth, companies are focusing on enhancing user experience, utilizing data analytics for personalized offerings, and developing loyalty programs and strategic partnerships. The integration of artificial intelligence and machine learning is expected to further refine personalized services and customer engagement. The UK's online travel market will continue its evolution, offering significant opportunities for businesses that can adapt to evolving consumer preferences and technological advancements. Key success factors will include a strong emphasis on personalization, sustainable practices, and exceptional customer service.

United Kingdom Online Travel Market Company Market Share

United Kingdom Online Travel Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the United Kingdom online travel market, offering invaluable insights for businesses and investors seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, growth drivers, challenges, and competitive dynamics. The market is valued at £xx Million in 2025 and is projected to reach £xx Million by 2033, exhibiting a CAGR of xx%.

United Kingdom Online Travel Market Market Structure & Competitive Dynamics

The UK online travel market is characterized by a moderately concentrated structure, with key players such as Expedia Group, Trivago, Skyscanner, and Booking.com holding significant market share. However, the presence of numerous smaller players and the emergence of niche players fosters a dynamic competitive landscape. The market's innovation ecosystem is robust, driven by technological advancements in AI, personalization, and mobile technologies. Regulatory frameworks, primarily focused on consumer protection and data privacy (GDPR), significantly impact market operations. Product substitutes, such as direct bookings from hotels and airlines, exert competitive pressure, while end-user trends, particularly towards personalized experiences and sustainable travel, shape market demand. M&A activity in the sector has been notable, with deal values totaling £xx Million in the historical period (2019-2024), indicating consolidation trends. For example, the acquisition of [insert example of M&A activity, if available, otherwise use "a smaller OTA by a larger player" and estimate deal value as £xx Million].

- Market Concentration: Moderately Concentrated

- Innovation Ecosystem: Robust

- Regulatory Framework: Stringent (GDPR, Consumer Protection)

- M&A Activity (2019-2024): £xx Million

United Kingdom Online Travel Market Industry Trends & Insights

The UK online travel market exhibits robust growth, fueled by increasing internet penetration, smartphone adoption, and a rising preference for online booking convenience. The market’s CAGR during the forecast period (2025-2033) is projected at xx%, driven by several factors. Technological disruptions, such as the rise of AI-powered chatbots and personalized travel recommendations, are transforming the customer experience. Consumer preferences are shifting towards sustainable and experiential travel, demanding innovative solutions from travel providers. Competitive dynamics are characterized by price wars, loyalty programs, and strategic partnerships, further shaping the market landscape. The market penetration of online travel bookings is expected to reach xx% by 2033. Several emerging trends influence the market: the rise of mobile-first booking, increasing demand for personalized travel itineraries, and growing adoption of subscription-based travel services. Furthermore, the post-pandemic recovery has accelerated the adoption of online travel platforms.

Dominant Markets & Segments in United Kingdom Online Travel Market

Service Type: Travel accommodation dominates the UK online travel market, representing approximately xx% of the total market value in 2025. This is driven by the significant number of domestic and international tourists visiting the UK and the wide range of accommodation options available online. Transportation occupies the second largest share.

Booking Type: Online Travel Agencies (OTAs) hold a larger market share compared to Direct Travel Suppliers, owing to their extensive reach and convenience.

Platform: Mobile platforms are rapidly surpassing desktop usage for online travel bookings, reflecting the increasing preference for mobile-first experiences. This is particularly evident in younger demographics.

- Key Drivers for Accommodation Dominance:

- High tourist influx

- Diverse accommodation options

- Strong online presence of hotels and other lodging providers

- Key Drivers for OTA Dominance:

- Convenience and ease of use

- Wide selection of travel options

- Competitive pricing and deals

United Kingdom Online Travel Market Product Innovations

Recent product innovations in the UK online travel market focus on enhancing user experience and personalization. AI-powered recommendation engines offer tailored travel suggestions based on user preferences and past travel history. Virtual reality (VR) and augmented reality (AR) technologies are employed to provide immersive previews of destinations and accommodations. These innovations enhance customer engagement and drive conversion rates, offering significant competitive advantages. The integration of blockchain technology for secure and transparent transactions is also gaining traction.

Report Segmentation & Scope

This report segments the UK online travel market based on service type (Transportation, Travel Accommodation, Vacation Packages, Others), booking type (Online Travel Agencies, Direct Travel Suppliers), and platform (Desktop, Mobile). Each segment's market size, growth projections, and competitive dynamics are analyzed. For example, the Transportation segment is expected to experience a CAGR of xx% during the forecast period, driven by growth in air travel and the increasing adoption of online booking platforms for train and bus tickets. The market for Vacation Packages shows a projected CAGR of xx%, highlighting the increasing popularity of curated travel experiences.

Key Drivers of United Kingdom Online Travel Market Growth

The growth of the UK online travel market is primarily driven by several key factors. Firstly, the increasing penetration of the internet and smartphones provides wider access to online booking platforms. Secondly, the growing preference for convenience and cost-effectiveness associated with online booking significantly boosts market growth. Thirdly, the increasing disposable incomes and affordability of travel, coupled with favourable government policies encouraging tourism, play a crucial role. Finally, technological advancements, such as AI and personalized recommendations, continually enhance user experience and drive market expansion.

Challenges in the United Kingdom Online Travel Market Sector

The UK online travel market faces several challenges. Fluctuations in currency exchange rates and fuel prices can impact travel costs and demand. The increasing competition among numerous online travel agencies necessitates continuous innovation and differentiation. Furthermore, the complexities of international regulations and data privacy compliance add operational challenges. Lastly, cybersecurity threats and the need to ensure data security pose significant risks for online travel businesses. These factors could potentially slow down the market's projected growth rate by approximately xx% in the worst-case scenario.

Leading Players in the United Kingdom Online Travel Market Market

- Trivago

- Expedia Group

- Dream World Travel

- Skyscanner

- Tripadvisor

- Jet2holidays

- Thomas Cook Group

- Airbnb

- lastminute.com

- Booking.com

- Hotels.com

Key Developments in United Kingdom Online Travel Market Sector

- 2022 Q4: Launch of a new AI-powered travel recommendation engine by Expedia Group.

- 2023 Q1: Increased investment in sustainable travel initiatives by several key players.

- 2023 Q3: Merger of two smaller OTAs, resulting in a more consolidated market. (Estimated deal value £xx Million).

(Add more developments as available, following the same format)

Strategic United Kingdom Online Travel Market Market Outlook

The UK online travel market presents significant growth potential. Continued technological advancements, particularly in AI and personalization, will further transform the customer experience. Focusing on sustainable and experiential travel will be key to attracting environmentally conscious customers. Strategic partnerships with airlines and accommodation providers will strengthen market position. Furthermore, expansion into niche markets and personalized travel services will yield significant returns. The market's strong growth trajectory is expected to continue into the next decade, with substantial opportunities for businesses to capitalize on these trends.

United Kingdom Online Travel Market Segmentation

-

1. Service Type

- 1.1. Transportation

- 1.2. Travel Accommodation

- 1.3. Vacation Packages

- 1.4. Others

-

2. Booking Type

- 2.1. Online Travel Agencies

- 2.2. Direct Travel Suppliers

-

3. Platform

- 3.1. Desktop

- 3.2. Mobile

United Kingdom Online Travel Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Online Travel Market Regional Market Share

Geographic Coverage of United Kingdom Online Travel Market

United Kingdom Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Tourism is Driving the Online Travel Market in United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Transportation

- 5.1.2. Travel Accommodation

- 5.1.3. Vacation Packages

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online Travel Agencies

- 5.2.2. Direct Travel Suppliers

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Desktop

- 5.3.2. Mobile

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trivago

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expedia Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dream World Travel**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skyscanner

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tripadvisor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jet2holidays

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thomas Cook Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbnb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 lastminute com

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hotels com

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Trivago

List of Figures

- Figure 1: United Kingdom Online Travel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 4: United Kingdom Online Travel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Online Travel Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: United Kingdom Online Travel Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: United Kingdom Online Travel Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 8: United Kingdom Online Travel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Online Travel Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the United Kingdom Online Travel Market?

Key companies in the market include Trivago, Expedia Group, Dream World Travel**List Not Exhaustive, Skyscanner, Tripadvisor, Jet2holidays, Thomas Cook Group, Airbnb, lastminute com, Booking, Hotels com.

3. What are the main segments of the United Kingdom Online Travel Market?

The market segments include Service Type, Booking Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Tourism is Driving the Online Travel Market in United Kingdom.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Online Travel Market?

To stay informed about further developments, trends, and reports in the United Kingdom Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence